Global 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) Market Size, Share, And Enhanced Productivity By Purity Level (Upto 98%,Above 98%), By Application (Pharmaceutical Intermediates, Chemical Research, Agrochemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170218

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

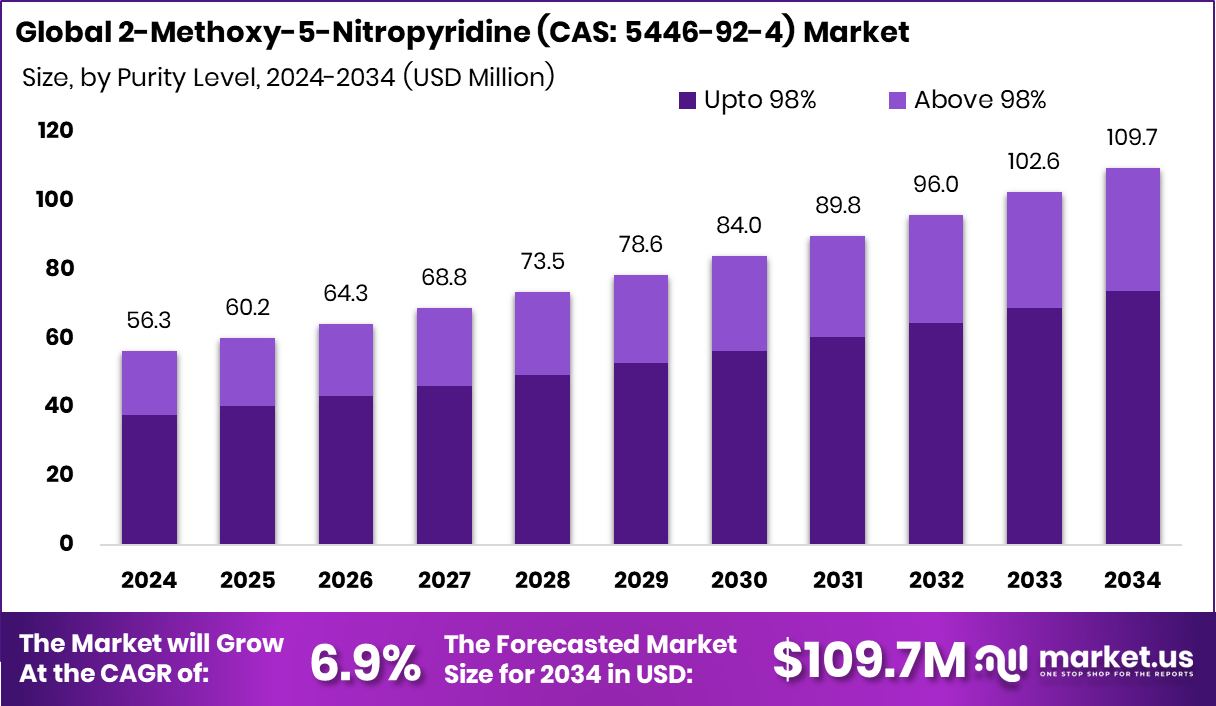

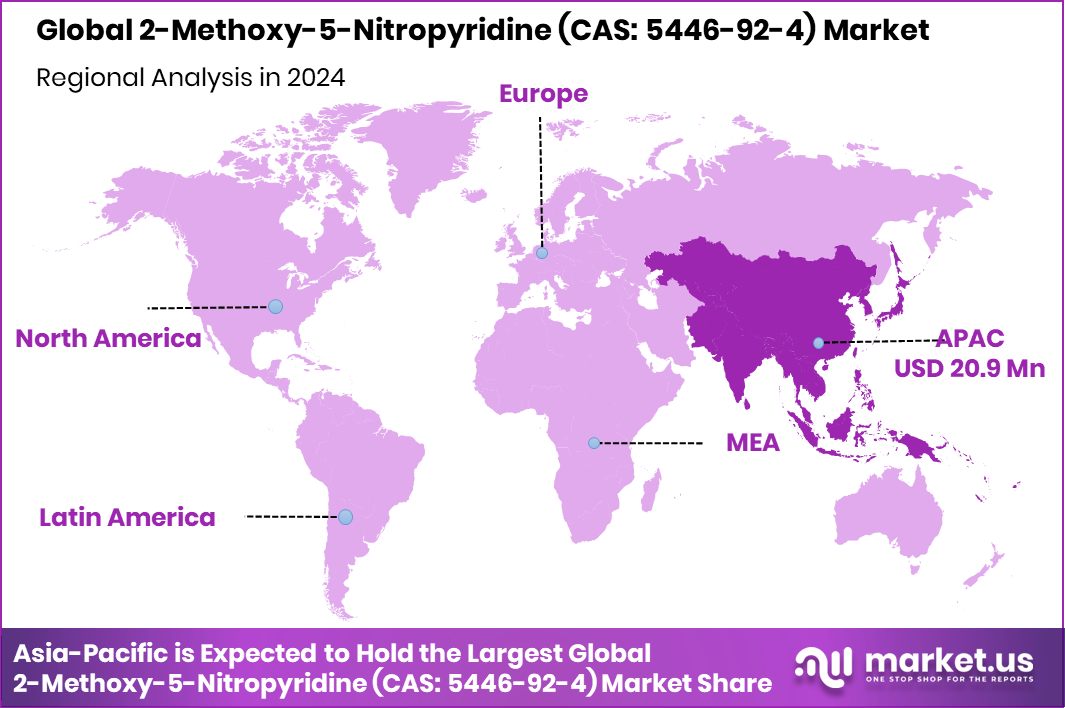

The Global 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) Market is expected to be worth around USD 109.7 million by 2034, up from USD 56.3 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia-Pacific accounted for 37.20% of the market, generating USD 20.9 Mn in total revenue.

2-Methoxy-5-Nitropyridine is a speciality heterocyclic compound used mainly as a chemical building block. It plays an important role in synthesising agrochemical and pharmaceutical intermediates, where precise molecular structure and reaction reliability are essential. Its value lies in enabling downstream formulations rather than direct end-use consumption.

The market represents demand for this compound across intermediate manufacturing chains, especially agrochemicals. Growth is closely linked to crop-protection output, export activity, and speciality chemical capacity expansion. India’s agrochemical market reached about ₹69,000 crores in FY2024, with exports contributing 51% of value, creating a strong pull for intermediates like this compound.

Market growth is driven by capacity expansion and capital restructuring in agrochemicals. Arbuda Agrochemicals filing an NSE Emerge IPO for 64 lakh shares to repay ₹120 crore debt and build a new ALP line reflects renewed production focus. Insecticides India targeting ₹200 crore business in Madhya Pradesh further supports intermediate demand.

India becoming the 3rd largest agrochemical exporter globally, with exports of $3.3 billion in FY2025, strengthens sustained demand. Even events like a DII selling a 2.97% stake highlight active capital movement rather than weakening fundamentals.

- GEF Council approved USD 668+ million in financing under its 9th replenishment, supporting chemical and environmental projects.

- Distil raised $7.7 million Series A, aiming for $25–30 million revenue, while Scimplify secured $9.5 million Series A, highlighting innovation-led growth in speciality chemicals.

Key Takeaways

- The Global 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) Market is expected to be worth around USD 109.7 million by 2034, up from USD 56.3 million in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In 2024, up to 98% purity dominated with a 67.2% share, driven by cost efficiency.

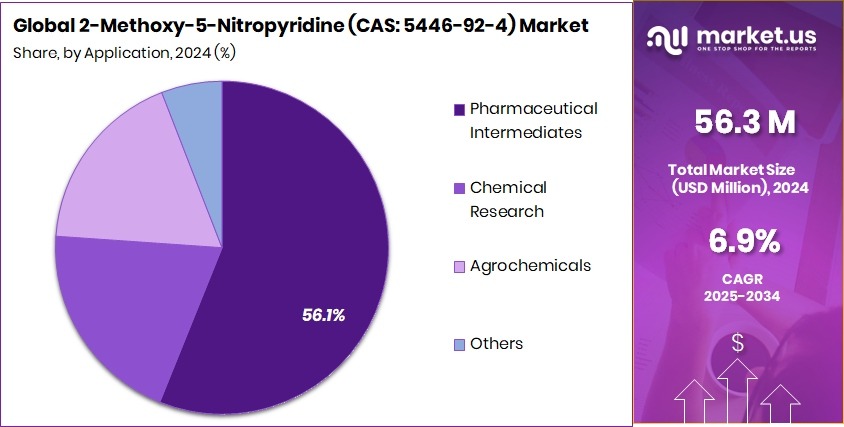

- Pharmaceutical intermediates led with a 56.1% share due to consistent drug synthesis demand.

- In the Asia-Pacific, the market reached USD 20.9 Mn, representing a 37.20% regional share.

By Purity Level Analysis

In 2024, upto 98% purity dominated the 2-Methoxy-5-Nitropyridine market globally consistently worldwide.

In 2024, Upto 98% held a dominant market position in the By Purity Level segment of the 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) market, with a 67.2% share. This dominance reflects strong buyer preference for high-purity material where consistency and chemical reliability are critical. Market participants increasingly prioritise purity benchmarks to ensure stable downstream performance and compliance with quality expectations.

The strong share of the up to 98% purity level also highlights its widespread acceptance across commercial transactions. Buyers favour this purity range due to its balance between performance suitability and procurement practicality. As a result, this segment continues to anchor overall demand patterns and sets the reference standard for quality-driven purchasing decisions within the market.

By Application Analysis

Pharmaceutical intermediates led applications in 2024, capturing 56.1% of total market demand.

In 2024, Pharmaceutical Intermediates held a dominant market position in the By Application segment of the 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) market, with a 56.1% share. This leading position underscores the compound’s established role within pharmaceutical value chains, where precise chemical properties and dependable sourcing are essential for intermediate synthesis.

The sizeable share reflects sustained utilisation in pharmaceutical production workflows, driven by consistent demand and long-standing application relevance. Market activity in this segment remains shaped by quality-focused procurement and stable usage volumes. As pharmaceutical intermediates continue to command more than half of total application demand, this segment remains the primary driver influencing market structure and application-based consumption trends.

Key Market Segments

By Purity Level

- Upto 98%

- Above 98%

By Application

- Pharmaceutical Intermediates

- Chemical Research

- Agrochemicals

- Others

Driving Factors

Rising Investment Strengthens Speciality Agrochemical Intermediate Demand

A key driving factor for the 2-Methoxy-5-Nitropyridine market is growing investment momentum in speciality chemicals and agrochemical manufacturing. Increased capital support is helping companies expand technical ingredient production, improve process efficiency, and stabilise supply chains. This directly supports higher demand for niche intermediates used in complex synthesis routes. As agrochemical producers focus on performance-driven formulations, dependable intermediates like 2-Methoxy-5-Nitropyridine gain stronger importance across production planning.

- Scimplify secured $5 million in a funding round led by Omnivore, supporting the scale-up of speciality chemical sourcing and synthesis platforms.

- GSP Crop Science received Rs 95 cr from Oman India Fund, strengthening its capabilities in manufacturing pesticide formulations and technical ingredients.

Market sentiment also reflects confidence in chemical manufacturing growth, highlighted by a chemical stock rising 77% in 2025, signalling a positive outlook for intermediates supporting agrochemical value chains. This investment-led confidence continues to drive steady demand expansion.

Restraining Factors

Capital Concentration And Cost Pressures Limit Market Expansion

A major restraining factor for the 2-Methoxy-5-Nitropyridine market is rising cost pressure caused by capital concentration and shifting investment priorities within agrochemical and life-science ecosystems. While funding inflows support innovation, they also raise expectations around margins, scale, and speed, which smaller intermediate suppliers often struggle to meet. This imbalance can slow capacity additions and tighten the availability of niche compounds.

As capital increasingly favours large platforms and integrated players, specialised intermediates face procurement delays and stricter pricing negotiations, limiting flexible market growth.

Recent funding activity reflects this challenge. Large investments channel resources toward broader technology or formulation platforms rather than individual intermediates, indirectly constraining production focus. Market volatility also increases when institutional investments influence valuation sensitivity and short-term performance expectations.

- Kotak arm invested Rs 375 crore in Cropnosys, increasing competitive intensity and cost benchmarks

- Pivot Bio raised $430m in a Series D round, shifting capital attention toward alternative agricultural solutions

Additionally, a ₹147 Cr institutional stake acquisition highlights capital-driven market fluctuations affecting supply planning.

Growth Opportunity

Expanding Agrochemical And Pharma Intermediate Manufacturing Demand

A key growth opportunity for the 2-Methoxy-5-Nitropyridine market is the rising investment in agrochemical and pharmaceutical intermediate manufacturing. Companies are scaling production and improving process efficiency to support growing formulation pipelines, which increases demand for reliable speciality intermediates.

Capital inflows are being directed toward strengthening manufacturing capacity, quality systems, and supply stability, creating favourable conditions for sustained usage of compounds like 2-Methoxy-5-Nitropyridine. This shift reflects a long-term focus on self-reliant chemical supply chains and value-added intermediate production rather than dependence on imports.

Funding activity clearly supports this opportunity. IFC invested Rs 300 cr in Crystal Crop Protection, reinforcing agrochemical manufacturing strength and upstream intermediate demand. At the same time, global capital interest is growing, with private equity firms preparing a $3–4 billion investment push into intermediate pharma companies, signalling confidence in speciality molecules. Additional momentum comes from Agrofy raising $30m in a Yara-led Series C round to expand agri-linked services and Berlin-based DUDE CHEM securing €6.5 million to boost chemical-pharmaceutical production in Europe.

Latest Trends

Rising Investment-Driven Expansion of Specialty Chemical Intermediates

The 2-Methoxy-5-Nitropyridine market is seeing a clear trend toward investment-led expansion across agrochemical and speciality chemical value chains. Companies are focusing on improving synthesis efficiency, scale, and reliability of intermediates that support advanced crop-protection and life-science applications. This shift reflects growing confidence in speciality intermediates as long-term growth drivers rather than short-cycle commodities. Strategic capital is increasingly used to strengthen R&D depth, process optimisation, and global supply reach, ensuring stable availability of critical molecules used in complex formulations.

Recent funding and acquisition activity highlight this direction. Investments are supporting higher-quality output, better process control, and closer alignment with downstream requirements, which directly benefits demand for niche intermediates like 2-Methoxy-5-Nitropyridine. The trend also shows stronger integration between chemical manufacturing and life-science innovation, reducing supply risks and improving turnaround times.

- Kotak Mahindra invested Rs 375 Cr in Cropnosys, strengthening agrochemical innovation and intermediate demand

- Avendus Fund led a Rs 300 Cr investment in Aragen Life Sciences, supporting advanced chemistry platforms

Additional momentum comes from Vive Crop Protection’s $11.2 million CAD Series C extension and China’s Bide and partner funds acquiring Combi-Blocks for USD 215 million, reinforcing global confidence in speciality chemical intermediates.

Regional Analysis

Asia-Pacific leads the 2-Methoxy-5-Nitropyridine market with a 37.20% share valued at USD 20.9 Mn.

Asia-Pacific emerged as the dominating region in the 2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) market, accounting for 37.20% of the total market share and generating USD 20.9 Mn in revenue. This leadership position reflects the region’s strong concentration of chemical manufacturing activity and consistent demand for speciality intermediates, which together support higher consumption volumes. Asia-Pacific’s performance sets the overall pace of the market and acts as the primary reference point for regional demand distribution.

In comparison, North America represents a steady and mature market environment, characterised by established procurement practices and stable utilisation patterns, contributing to balanced regional demand. Europe follows with a structured market landscape, supported by long-standing industrial usage and regulated supply chains that maintain consistent consumption levels.

The Middle East & Africa region shows a smaller yet developing market presence, shaped by the gradual expansion of chemical processing activities and increasing regional participation. Latin America also contributes to the overall market through moderate demand, supported by localised production and import-based supply.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Biosynth Carbosynth continues to be viewed as a reliability-focused supplier in the 2-Methoxy-5-Nitropyridine market in 2024. The company’s strength lies in its consistent product quality and ability to serve research and industrial customers with repeatable specifications. Its broad catalogue approach allows buyers to source niche pyridine derivatives alongside related compounds, simplifying procurement. From an analyst perspective, Biosynth Carbosynth benefits from long-term customer relationships that prioritise quality assurance and technical confidence over short-term pricing dynamics.

Apollo Scientific holds a solid position by catering strongly to laboratory-scale and development-stage demand. In 2024, the company is recognised for its responsive supply model and focus on speciality chemicals used in synthesis and formulation work. Analysts note that Apollo Scientific’s emphasis on technical documentation and product transparency supports trust among scientific users. This positioning helps the company remain relevant in applications where precise chemical attributes are critical.

Fluorochem Ltd. is regarded as a specialist supplier with a clear focus on fine and speciality chemicals. Its presence in the 2-Methoxy-5-Nitropyridine space is supported by controlled production standards and attention to purity requirements. From a market viewpoint, Fluorochem benefits from serving customers who value dependable sourcing and consistent batch quality.

Top Key Players in the Market

- Biosynth Carbosynth

- Apollo Scientific

- Fluorochem Ltd.

- Jubilant Ingrevia

- Glentham

- Accela ChemBio Inc

- Jay finechem

- Others

Recent Developments

- In July 2025, Apollo Scientific entered into a share purchase agreement where Titan Technology (Shanghai Titan Scientific) agreed to acquire 100% of Apollo Scientific from Central Glass Co., Ltd. This step is aimed at supporting future investment and innovation in Apollo Scientific’s research chemical business, strengthening its global presence and product capabilities.

- In October 2024, Biosynth Carbosynth opened a cutting-edge facility called Biosynth Biological Technology in the Lifebay technology park in Suzhou, China. This development strengthens its production and service capabilities for biological and chemical supply, aiding regional customers with improved operations and faster delivery of speciality materials. This new site underlines expansion into enhanced manufacturing support.

Report Scope

Report Features Description Market Value (2024) USD 56.3 Million Forecast Revenue (2034) USD 109.7 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity Level (Upto 98%,Above 98%), By Application (Pharmaceutical Intermediates, Chemical Research, Agrochemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Biosynth Carbosynth, Apollo Scientific, Fluorochem Ltd., Jubilant Ingrevia, Glentham, Accela ChemBio Inc, Jay finechem, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

2-Methoxy-5-Nitropyridine (CAS: 5446-92-4) MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Biosynth Carbosynth

- Apollo Scientific

- Fluorochem Ltd.

- Jubilant Ingrevia

- Glentham

- Accela ChemBio Inc

- Jay finechem

- Others