Global 2-Ethylhexyl Acrylate Market Size, Share, And Business Benefit By Purity (Greaytewr Than Equal To 99%, Less Than 99%), By Application (Adhesives and Sealants, Paints and Coatings, Plastics, Textiles, Others), By End-Use (Construction, Automotive, Packaging, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161901

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

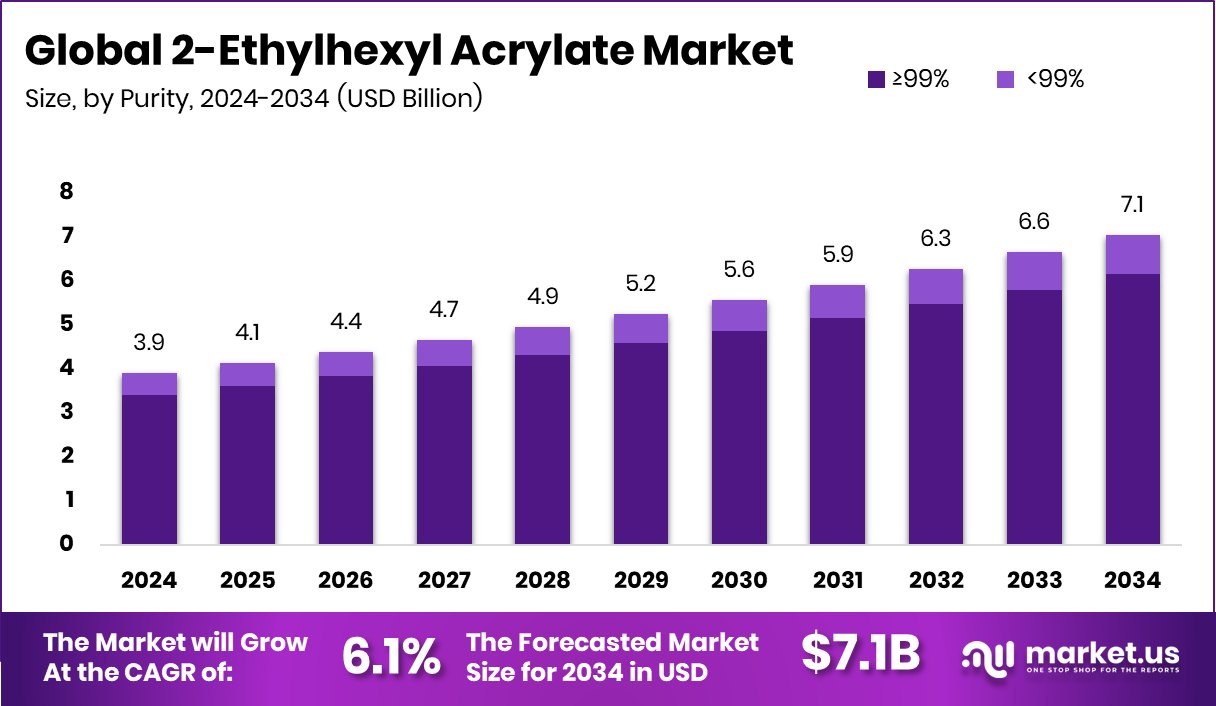

The Global 2-Ethylhexyl Acrylate Market is expected to be worth around USD 7.1 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Rising construction, coatings, and adhesive demand fueled Asia Pacific’s 47.80% share worth USD 1.8 Bn.

2-Ethylhexyl acrylate is a versatile monomer used in the manufacture of acrylic polymers, adhesives, coatings, and sealants. Its flexibility, weather resistance, and ability to copolymerize with other monomers make it valuable in paints, pressure-sensitive adhesives, and waterborne systems.

The growth of the construction, automotive, and packaging sectors is pushing demand for advanced coatings and adhesives. Regulatory preference for low-VOC and high-performance materials further boosts the adoption of acrylate-based systems. The shift toward durable, lightweight materials also supports its usage.

Demand is rising from markets needing weather-resistant, durable coatings — such as architectural paints, wood coatings, and durable sealants. The expansion of infrastructure and renovation in emerging economies especially fuels growth. In adhesives, demand in flexible packaging, tapes, and labels is contributing steadily.

Innovation in sustainable and bio-based versions offers opportunities for new entrants. For example, Ecoat secures €21 million to reinvent the future of paint—sustainably. Also, Nature Coatings Secures $2.45m in Funding Led by The 22 Fund and Regeneration. VC shows investor interest in greener coatings. In specialty chemicals more broadly, Distil’s $7.7M in Series A funding points to capital flowing into next-gen chem solutions.

On the industrial front, moves like BASF’s initiation of the sale of its coatings business at about a $6.8 billion valuation suggest consolidation and reallocation of resources in the coatings domain. Regional growth is also underpinned by capital flows—for instance, Asian Paints, Dixon Tech & 3 other stocks in which mutual funds acquired shares worth up to ₹10,093 Cr, hinting at investors’ confidence in related sectors. On a smaller scale, the Boldon painting firm is set to create new jobs thanks to a £50,000 grant, showing grass-roots support and potential regional expansion.

Key Takeaways

- The Global 2-Ethylhexyl Acrylate Market is expected to be worth around USD 7.1 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- In 2024, ≥99% purity dominated the 2-Ethylhexyl Acrylate Market, capturing 87.3% share.

- Adhesives and sealants led the 2-ethylhexyl acrylate market, accounting for 39.7% share in 2024.

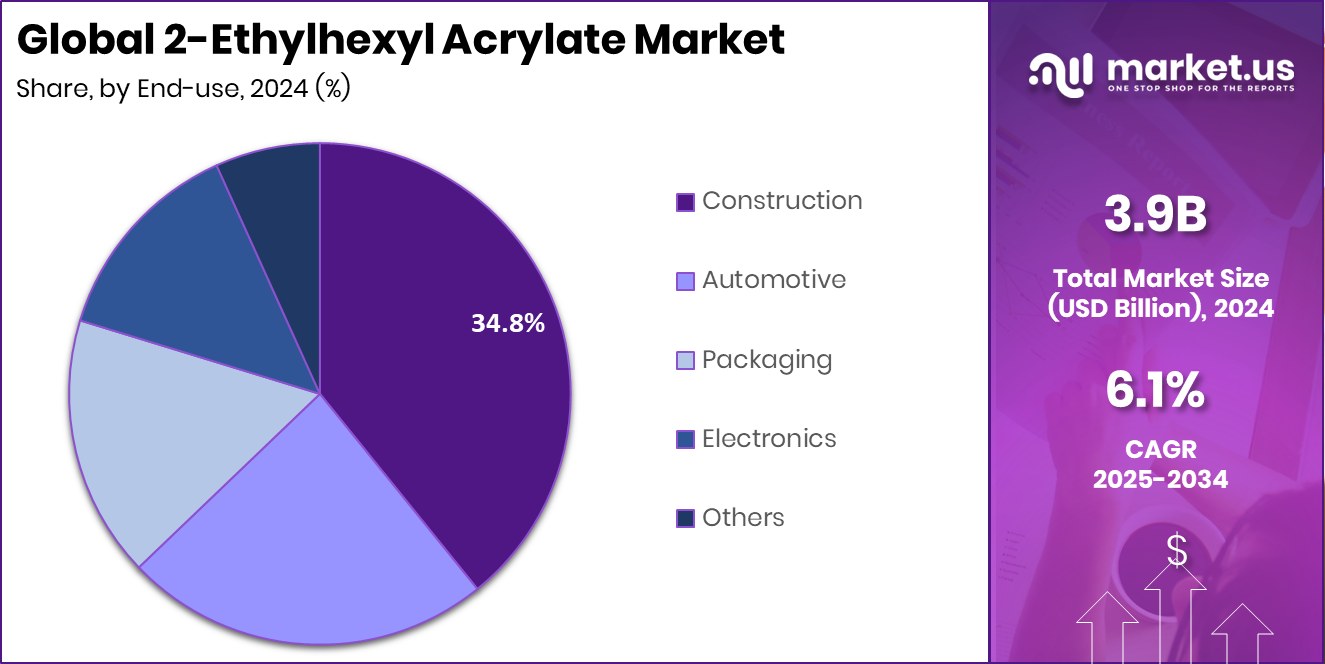

- Construction remained the key end-use in the 2-Ethylhexyl Acrylate Market, holding a 34.8% share.

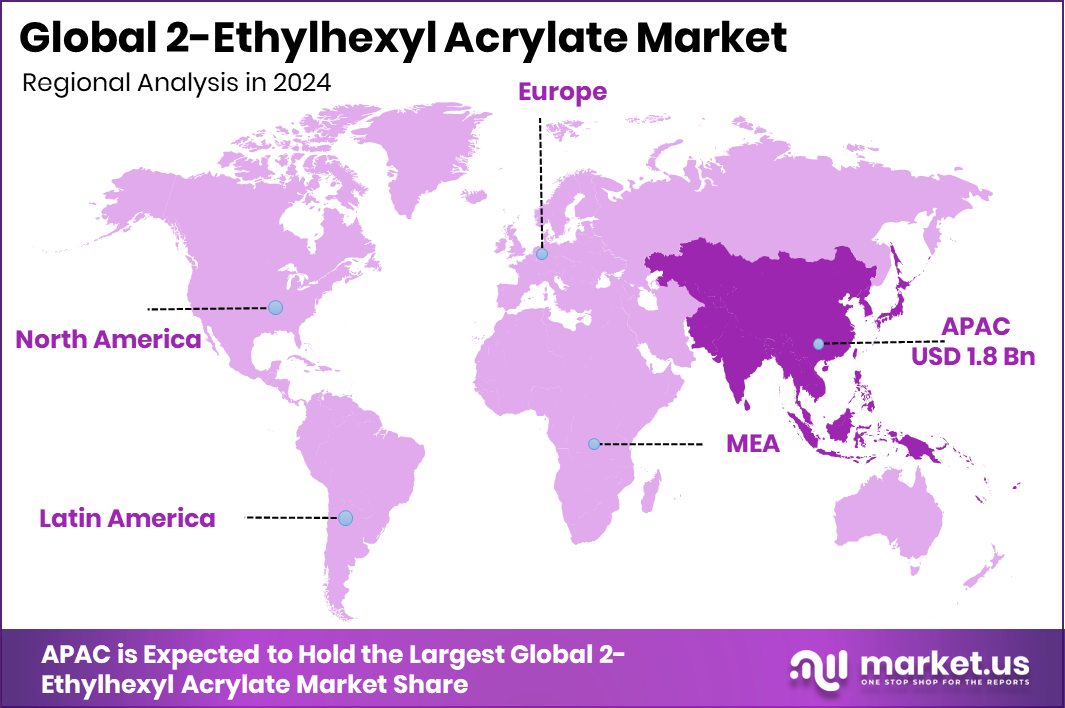

- The 2-Ethylhexyl Acrylate Market in the Asia Pacific reached USD 1.8 billion in 2024.

By Purity Analysis

In 2024, the 2-Ethylhexyl Acrylate Market’s ≥99% purity segment dominated, capturing 87.3% share due to its superior performance and consistency in industrial formulations.

In 2024, ≥99% held a dominant market position in the By Purity segment of the 2-Ethylhexyl Acrylate Market, capturing a 87.3% share. This high-purity grade is widely preferred in coatings, adhesives, and sealant applications due to its excellent polymerization stability and consistent performance. Industries increasingly rely on ≥99% pure 2-Ethylhexyl Acrylate to achieve better transparency, flexibility, and weather resistance in end products.

The segment’s dominance reflects growing demand for precision-grade monomers in modern paint formulations and advanced adhesive systems. Its superior purity ensures reduced impurities during polymer synthesis, making it a key choice for manufacturers focused on efficiency, product quality, and compliance with evolving environmental standards in high-performance chemical applications.

By Application Analysis

Adhesives and Sealants held a leading 39.7% share in the 2-Ethylhexyl Acrylate Market, driven by expanding construction and automotive bonding applications.

In 2024, Adhesives and Sealants held a dominant market position in the By Application segment of the 2-Ethylhexyl Acrylate Market, capturing a 39.7% share. The strong demand was driven by the growing use of flexible and durable bonding materials across construction, packaging, and automotive industries. 2-Ethylhexyl Acrylate provides excellent elasticity, adhesion, and weather resistance, making it ideal for pressure-sensitive adhesives, caulks, and sealants.

Its ability to maintain performance under extreme conditions has increased its preference in structural and industrial bonding solutions. The rising trend toward eco-friendly, low-VOC adhesive formulations has also supported its usage, reflecting a shift toward sustainable materials that balance performance efficiency with environmental compliance.

By End-Use Analysis

The Construction sector accounted for a 34.8% share in the 2-Ethylhexyl Acrylate Market, supported by infrastructure projects and durable coating demand.

In 2024, Construction held a dominant market position in the By End-Use segment of the 2-Ethylhexyl Acrylate Market, capturing a 34.8% share. The segment’s leadership was supported by the increasing demand for high-performance coatings, sealants, and adhesives used in residential, commercial, and infrastructure projects. 2-Ethylhexyl Acrylate is widely applied in waterproofing, flooring, and architectural coatings due to its flexibility, strong adhesion, and weather durability.

The growth of construction and renovation activities, particularly in developing economies, continues to drive the consumption of acrylate-based materials. Its ability to enhance bonding strength and maintain elasticity under varying environmental conditions makes it a preferred component in modern construction chemicals and performance-based architectural applications.

Key Market Segments

By Purity

- ≥99%

- <99%

By Application

- Adhesives and Sealants

- Paints and Coatings

- Plastics

- Textiles

- Others

By End-Use

- Construction

- Automotive

- Packaging

- Electronics

- Others

Driving Factors

Rising Investments and Expansion in the Coatings Industry

One of the major driving factors for the 2-Ethylhexyl Acrylate Market is the rapid expansion and heavy investment in the global coatings and resins industry. The growing use of high-performance, durable, and eco-friendly coatings in construction, automotive, and industrial applications is fueling demand for 2-Ethylhexyl Acrylate as a key raw material. Recent financial movements highlight this momentum — Nippon Paint announced plans to buy coatings and resins maker AOC for US$2.3 billion, reinforcing its commitment to growth and product innovation.

Similarly, BASF is reportedly selling its coatings business at a $6.8 billion valuation, indicating significant restructuring and capital reallocation in the sector. These major transactions reflect strong investor confidence and continued industrial development supporting market growth.

Restraining Factors

High Production Costs and Limited R&D Funding

A major restraining factor for the 2-Ethylhexyl Acrylate Market is the high production and operational costs associated with raw materials and processing technologies. Manufacturers face challenges due to fluctuating prices of feedstocks like acrylic acid and 2-ethylhexanol, which directly affect profitability. Moreover, strict environmental regulations increase compliance costs for producers handling volatile organic compounds.

Limited access to affordable funding for research and innovation further slows technological advancement. For example, Houston biotech VC firm’s portfolio companies secured $5.3 million in federal funding, which highlights how such grants remain concentrated in life sciences rather than specialty chemical innovation. The uneven distribution of financial support makes it harder for smaller players in the chemical sector to scale sustainable production efficiently.

Growth Opportunity

Expanding Green Coatings and Marine Applications Worldwide

A key growth opportunity for the 2-Ethylhexyl Acrylate Market lies in the expansion of sustainable coatings and marine applications across global markets. The increasing demand for low-VOC, durable, and eco-friendly coatings has encouraged investment in innovative surface solutions. A notable example is the Dartmouth startup that raised $10 million to take its marine paint global, showcasing growing commercial interest in advanced, environment-friendly coatings where 2-Ethylhexyl Acrylate plays a vital role.

Additionally, DuPont’s sale of its car paint unit to Carlyle for $4.9 billion signals restructuring and reinvestment opportunities within the coatings value chain, paving the way for next-generation formulations. These developments indicate rising focus on sustainable chemistry, improved adhesion technologies, and broader industrial use in green marine and automotive sectors.

Latest Trends

AI-Driven Innovation Shapes Coatings Chemistry Trends

One of the latest trends in the 2-Ethylhexyl Acrylate Market is the increasing use of artificial intelligence and data science to accelerate material development and optimize formulations. The move toward smarter R&D helps developers create better-performing adhesives, coatings, and sealants more quickly and cost-effectively. An example is Albert Invent raising $7.5 million to accelerate laboratory science using AI, highlighting how funding is flowing into tech-driven materials research.

Leveraging AI can reduce trial-and-error, predict polymer behavior, and enhance process efficiency. When combined with 2-Ethylhexyl Acrylate’s versatility, this trend could lead to faster innovation cycles, tailor-made chemistries, and more sustainable product development paths in coatings and adhesive markets.

Regional Analysis

In 2024, the Asia Pacific held a 47.80% share, reflecting strong industrial growth.

In the Asia Pacific region, the sector is especially robust, with the region commanding a 47.80 % share and generating USD 1.8 billion in revenue, making it the dominating region in the market. Growth here is underpinned by booming infrastructure, expanding automotive and coatings industries, and escalating consumption across developing economies.

In North America, demand is supported by mature construction, renovation, and manufacturing sectors that seek high-performance adhesives and coatings. The region prioritizes innovation, stringent environmental standards, and specialty applications. Europe benefits from strong automotive, industrial, and architectural coatings markets, where regulatory drivers encourage low-VOC formulations and ensure consistent uptake of high-quality monomers like 2-Ethylhexyl Acrylate.

In Latin America, growing urbanization, rising infrastructure development, and increased access to modern adhesives and paint technologies fuel gradual uptake. Meanwhile, the Middle East & Africa show potential, particularly in construction, oil & gas, and infrastructure growth, albeit moderated by variable economic conditions and dependence on import-driven supply chains.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the case of BASF SE, the company is undergoing a strategic transformation in its coatings and surface treatment portfolio. Recent moves include initiating the sale of its coatings business at a valuation of around US$6.8 billion. This divestment signals a pivot toward refocusing capital and resources on core chemical segments, potentially reducing its direct exposure in monomer and coating value chains tied to 2-Ethylhexyl Acrylate. While BASF may continue supplying or licensing technologies, its structural reorganization may open space for more agile specialty chemical players to expand in the 2-EHA space.

For Arkema S.A., the firm already maintains a strong foothold in acrylic monomers and related downstream materials. Its product listings show that 2-Ethylhexylacrylate is part of its acrylics portfolio, with high purity grades and global availability. This positions Arkema to leverage synergies across adhesives, coatings, and specialty applications. Its integrated offerings and established customer network give it an advantage in meeting demand for high-performance monomers and tailored formulations in emerging and mature markets alike.

The Dow Chemical Company plays a critical role as a major chemical supplier with broad capabilities in acrylics. Dow supplies 2-Ethylhexyl Acrylate as part of its acrylic monomer portfolio, capitalizing on existing infrastructure, scale, and R&D. Its strengths in scale manufacturing, global distribution, and ability to co-develop customized grades allow Dow to support large industrial users demanding consistency, reliability, and economies of scale. In summary, Dow is likely to remain a backbone supplier and innovation driver in the 2-EHA ecos

Top Key Players in the Market

- BASF SE

- Arkema S.A.

- The Dow Chemical Company

- Nippon Shokubai Co., Ltd.

- LG Chem Ltd.

- Evonik Industries AG

- Shanghai Huayi Acrylic Acid Co., Ltd.

- Mitsubishi Chemical Corporation

- KH Neochem Co., Ltd.

- SIBUR Holding

Recent Developments

- In October 2025, BASF agreed to sell a majority stake in its coatings business (including automotive OEM, refinish coatings, and surface treatments) to Carlyle and Qatar Investment Authority in a transaction valued at €7.7 billion. BASF will retain a 40 % equity interest.

- In December 2024, Arkema finalized the acquisition of Dow’s flexible packaging laminating adhesives business, expanding its adhesives portfolio and integrating laminating solutions.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (≥99%, <99%), By Application (Adhesives and Sealants, Paints and Coatings, Plastics, Textiles, Others), By End-Use (Construction, Automotive, Packaging, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Arkema S.A., The Dow Chemical Company, Nippon Shokubai Co., Ltd., LG Chem Ltd., Evonik Industries AG, Shanghai Huayi Acrylic Acid Co., Ltd., Mitsubishi Chemical Corporation, KH Neochem Co., Ltd., SIBUR Holding Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2-Ethylhexyl Acrylate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

2-Ethylhexyl Acrylate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Arkema S.A.

- The Dow Chemical Company

- Nippon Shokubai Co., Ltd.

- LG Chem Ltd.

- Evonik Industries AG

- Shanghai Huayi Acrylic Acid Co., Ltd.

- Mitsubishi Chemical Corporation

- KH Neochem Co., Ltd.

- SIBUR Holding