Global Gigacasting Presses Market Size, Share, Growth Analysis By Casting (Rear Underbody, Front Underbody, Battery Tray), By Customer Type (Automotive OEM, Tier-1/Foundry), By Alloy (High-Pressure Die-Casting (HPDC), Thixomolding), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175320

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

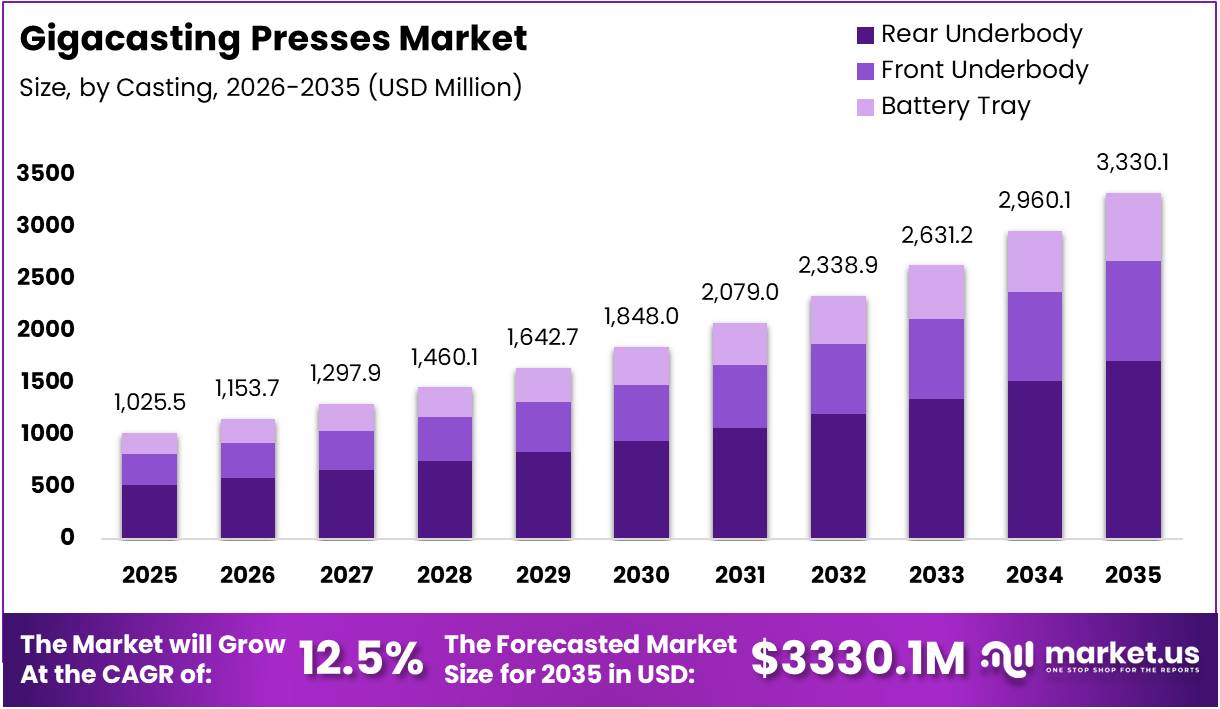

The Global Gigacasting Presses Market size is expected to be worth around USD 3330.1 Million by 2035, from USD 1025.5 Million in 2025, growing at a CAGR of 12.5% during the forecast period from 2026 to 2035.

The gigacasting presses market represents a transformative shift in automotive manufacturing technology. Essentially, gigacasting involves ultra-large die-casting machines that produce single-piece structural components, replacing dozens of individually stamped and welded parts. This innovative process streamlines production while enhancing vehicle structural integrity and cost efficiency across automotive assembly lines.

Transitioning to market dynamics, the gigacasting sector demonstrates robust expansion potential driven by electric vehicle proliferation. Automakers increasingly recognize gigacasting’s ability to simplify complex manufacturing workflows, reduce assembly time, and minimize production footprint. Consequently, industry stakeholders are accelerating investments in high-tonnage casting equipment, fundamentally reshaping traditional body-in-white manufacturing paradigms.

Furthermore, government policies worldwide are catalyzing market growth through substantial EV infrastructure investments and stringent emission regulations. These regulatory frameworks compel manufacturers to adopt lightweight, efficient production methodologies. Gigacasting technology directly addresses these mandates by enabling rapid production cycles while maintaining component quality, thereby aligning with global sustainability objectives and carbon neutrality targets.

Examining operational efficiency, typical giga press cycle times achieve approximately 80-90 seconds per casting, translating to 40-45 parts hourly. According to research, machines operating at full capacity deliver roughly 1,000 castings daily per unit. This throughput significantly outpaces conventional multi-component assembly processes, demonstrating clear productivity advantages for high-volume manufacturers.

Moreover, cost reduction metrics reveal compelling economic benefits. Research indicates approximately 40% reduction in rear underbody manufacturing costs for certain EV models like Tesla Model Y compared to traditional multi-part assembly approaches. This substantial cost optimization stems from eliminated welding processes, reduced material waste, and streamlined quality control procedures throughout the production chain.

Looking ahead, the gigacasting presses market presents exceptional opportunities as automotive manufacturers prioritize manufacturing efficiency and structural innovation. Advanced die-casting technologies, coupled with strategic capital deployment and favorable regulatory environments, position gigacasting as a cornerstone methodology for next-generation vehicle production, particularly within the rapidly expanding electric mobility sector.

Key Takeaways

- The Global Gigacasting Presses Market is expected to reach USD 3330.1 Million by 2035 from USD 1025.5 Million in 2025, growing at a CAGR of 12.5%.

- Rear Underbody dominates the By Casting segment with a 51.4% share in 2025.

- Automotive OEM leads the By Customer Type segment with a 69.3% share in 2025.

- High-Pressure Die-Casting (HPDC) holds 81.5% share in the By Alloy segment in 2025.

- North America leads the market with a 38.2% share, valued at USD 391.7 Million.

Casting Analysis

Rear Underbody dominates with 51.4% due to its structural complexity and integration advantages in electric vehicle platforms.

In 2025, Rear Underbody held a dominant market position in the By Casting Analysis segment of Gigacasting Presses Market, with a 51.4% share. This segment leads because rear underbody components require extensive structural integration, making them ideal for gigacasting technology. Electric vehicle manufacturers prefer gigacasting for rear sections as it consolidates multiple parts into single aluminum castings, reducing assembly time and costs while enhancing structural rigidity for battery electric vehicle architectures.

Front Underbody represents a growing application area as automotive manufacturers expand gigacasting adoption beyond rear implementations. Front sections present engineering challenges due to engine compartment requirements and crash management zones. However, the transition toward dedicated EV platforms accelerates front underbody gigacasting adoption, enabling symmetrical production processes and maximizing economies of scale.

Battery Tray applications demonstrate significant potential as electric vehicle production volumes escalate globally. Gigacast battery trays provide superior structural protection for battery packs while reducing vehicle weight through optimized material distribution. This application enables integrated cooling channels and mounting points, streamlining battery integration and enhancing manufacturing efficiency.

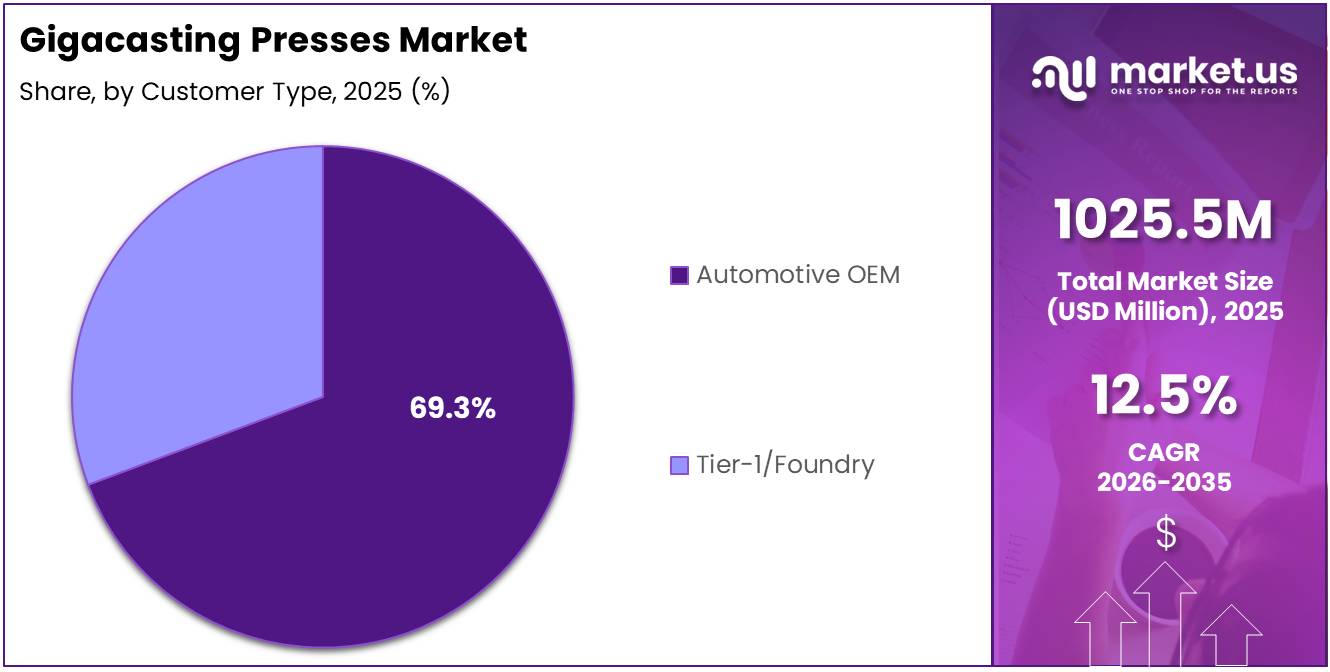

Customer Type Analysis

Automotive OEM dominates with 69.3% due to direct integration control and strategic production advantages.

In 2025, Automotive OEM held a dominant market position in the By Customer Type Analysis segment of Gigacasting Presses Market, with a 69.3% share. Original equipment manufacturers invest heavily in gigacasting technology to maintain competitive advantages in electric vehicle production. This vertical integration strategy allows OEMs to reduce capital expenditure, factory footprint, and production cycle times while protecting proprietary designs and maintaining quality standards.

Tier-1/Foundry participants serve as essential partners, providing specialized expertise and production capacity for automotive manufacturers pursuing asset-light strategies. These suppliers offer turnkey solutions, leveraging metallurgical knowledge to support multiple OEM clients. Foundries enable smaller manufacturers to access gigacasting benefits without substantial capital investments, creating flexible supply chain arrangements.

Alloy Analysis

High-Pressure Die-Casting (HPDC) dominates with 81.5% due to its proven scalability and material versatility.

In 2025, High-Pressure Die-Casting (HPDC) held a dominant market position in the By Alloy Analysis segment of Gigacasting Presses Market, with an 81.5% share. HPDC technology dominates because it delivers exceptional production speed, dimensional accuracy, and surface finish quality essential for large structural automotive components. The process accommodates various aluminum alloys engineered for gigacasting, enabling manufacturers to optimize material properties for strength and weight reduction.

Thixomolding represents an alternative technology offering distinct advantages in applications requiring superior mechanical properties and reduced porosity. This semi-solid processing technique produces parts with enhanced structural integrity and improved fatigue resistance. While holding smaller market share, thixomolding attracts interest for critical safety components where material performance justifies higher processing costs.

Key Market Segments

By Casting

- Rear Underbody

- Front Underbody

- Battery Tray

By Customer Type

- Automotive OEM

- Tier-1/Foundry

By Alloy

- High-Pressure Die-Casting (HPDC)

- Thixomolding

Drivers

OEM Shift Toward Large Structural Aluminum Castings Drives Market Expansion

Automakers are increasingly moving away from traditional multi-part vehicle construction methods. By adopting advanced gigacasting technology, manufacturers can efficiently produce large structural components in a single piece instead of assembling dozens of smaller parts. This fundamental shift is dramatically transforming how vehicles are designed and built.

The electric vehicle revolution is accelerating demand for gigacasting presses. EV manufacturers need lightweight yet strong body structures to maximize battery range and vehicle performance. Gigacasting delivers both benefits by creating rigid aluminum frames that reduce overall weight while maintaining structural integrity.

Production efficiency has become a critical priority for automotive plants worldwide. Gigacasting simplifies manufacturing by eliminating numerous welding and joining steps traditionally required in vehicle assembly. Fewer parts mean fewer suppliers, reduced inventory costs, and shorter production timelines. Assembly lines can operate faster with less complexity, directly improving factory productivity and profitability.

Restraints

Complex Tooling Design Limits Market Accessibility

Developing molds for gigacasting requires sophisticated engineering expertise and significant time investment. The dies used in these massive presses must withstand extreme pressure and temperature while producing precise, defect-free castings. This complexity extends development cycles considerably, often taking 12-18 months from design to production-ready tooling.

Creating these specialized dies demands advanced simulation software and iterative testing. Engineers must account for metal flow patterns, cooling rates, and dimensional accuracy across large surface areas. Any design flaws discovered during testing require costly modifications and additional development time.

The gigacasting equipment market faces significant supply constraints. Only a handful of manufacturers worldwide can produce ultra-large press systems capable of 6,000 tons or greater clamping force. This limited supplier base creates extended waiting periods for new equipment, sometimes exceeding two years. Manufacturers planning to adopt gigacasting must commit early and accept long procurement timelines.

Growth Factors

Expansion Beyond Automotive Sectors Creates New Market Potential

Commercial vehicle manufacturers are exploring gigacasting for trucks and buses. These larger vehicles can benefit significantly from single-piece structural components that reduce weight and improve durability. The technology’s ability to create complex geometries makes it attractive for specialty vehicle applications beyond passenger cars.

New electric vehicle startups present substantial opportunities for gigacasting press manufacturers. These companies are building manufacturing facilities from scratch without legacy production constraints. They can design entire factories around gigacasting technology, making them ideal customers for advanced press systems. Many emerging EV brands view gigacasting as a competitive advantage in production efficiency.

Established die casting facilities represent an underserved market segment. Many existing plants can retrofit or upgrade their equipment to incorporate gigacasting capabilities. This retrofit potential allows traditional manufacturers to modernize without building entirely new facilities. Press manufacturers offering modular upgrade solutions can tap into this installed base, creating recurring revenue streams while helping conventional producers remain competitive in an evolving automotive landscape.

Emerging Trends

Ultra-Large Single-Casting Capabilities Shape Industry Direction

Manufacturers are pushing boundaries with increasingly larger single-piece castings. What began with rear underbody sections has evolved to include entire vehicle floors and structural frames. This trend toward maximum part consolidation is redefining vehicle architecture possibilities and setting new benchmarks for press capacity requirements.

Artificial intelligence integration is transforming gigacasting operations. Modern press systems incorporate AI-powered sensors that monitor metal temperature, injection pressure, and cooling patterns in real-time. Predictive maintenance algorithms analyze equipment performance data to prevent breakdowns before they occur. These smart manufacturing capabilities reduce downtime and improve casting quality consistency.

Collaboration between equipment makers and automakers is intensifying. Press manufacturers are forming strategic alliances with major vehicle producers to co-develop next-generation gigacasting solutions. These partnerships allow equipment suppliers to understand specific automotive requirements while giving manufacturers early access to emerging technologies.

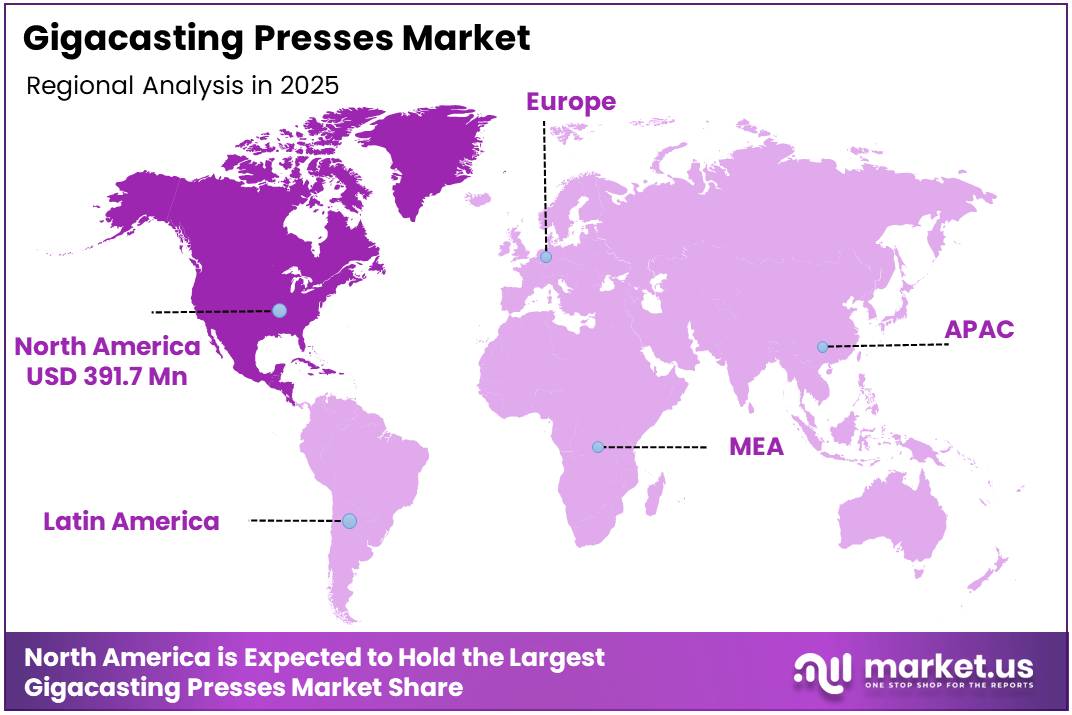

Regional Analysis

North America Dominates the Gigacasting Presses Market with a Market Share of 38.2%, Valued at USD 391.7 Million

North America leads the gigacasting presses market with a commanding share of 38.2%, valued at USD 391.7 million. The region’s dominance stems from advanced automotive manufacturing infrastructure and rapid electric vehicle adoption by major manufacturers. Strong R&D capabilities, supportive government policies, and increasing focus on lightweighting solutions drive market growth across the region.

Europe Gigacasting Presses Market Trends

Europe holds a substantial market position, driven by stringent environmental regulations and aggressive electric vehicle transition targets. The region’s automotive manufacturers are increasingly adopting gigacasting technology to achieve weight reduction and production efficiency, particularly in Germany, France, and the United Kingdom, supported by strong sustainability initiatives.

Asia Pacific Gigacasting Presses Market Trends

Asia Pacific exhibits rapid market growth due to expanding automotive production capacity and rising electric vehicle manufacturing in China, Japan, and South Korea. The region benefits from cost-effective manufacturing ecosystems, government incentives for EV adoption, and increasing investments by domestic and international automotive players in advanced casting technologies.

Middle East and Africa Gigacasting Presses Market Trends

The Middle East and Africa region shows emerging potential with gradual automotive sector modernization and growing interest in advanced manufacturing technologies. Market growth is supported by economic diversification initiatives, infrastructure development projects, and increasing collaboration with global automotive manufacturers seeking to establish regional production capabilities.

Latin America Gigacasting Presses Market Trends

Latin America represents a developing market with modest adoption of gigacasting presses, primarily concentrated in Brazil and Mexico. The region’s growth is driven by expanding automotive manufacturing operations, foreign direct investments, and the gradual shift toward electric vehicle production as manufacturers seek to optimize costs and improve production efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Gigacasting Presses Company Insights

IDRA Group maintains its leadership position in the gigacasting presses market through its continuous innovation in large-tonnage die-casting machines specifically designed for automotive structural components. The Italian manufacturer’s Giga Press series, with clamping forces exceeding 6,000 tons, has become the industry benchmark for producing single-piece vehicle underbodies and structural elements.

Bühler Carat has established itself as a formidable competitor by leveraging its extensive expertise in die-casting solutions and vacuum technology. The company’s focus on precision engineering and energy-efficient gigacasting systems appeals to automotive manufacturers seeking to optimize production costs while maintaining stringent quality standards.

LK Machinery continues to gain traction in the Asian markets through competitive pricing strategies and localized technical support services. The Hong Kong-based manufacturer offers gigacasting solutions that balance performance with cost-effectiveness, making large-scale structural casting accessible to mid-tier automotive manufacturers.

UBE Machinery distinguishes itself through proprietary hydraulic technology and robust machine construction that ensures long-term operational reliability. The Japanese manufacturer’s gigacasting presses incorporate advanced mold protection systems and real-time monitoring capabilities, minimizing downtime and maximizing production efficiency for high-volume automotive applications.

Top Key Players in the Market

- IDRA Group

- Bühler Carat

- LK Machinery

- UBE Machinery

- Yizumi

- Haitian

- Others

Recent Developments

- In October 2025, Linamar announced its plan to acquire Aludyne’s North American casting assets, aiming to expand its automotive components manufacturing footprint and enhance its production capabilities in the region.

- In July 2025, Nemak declared a definitive agreement to acquire the automotive business of GF Casting Solutions, a division of Georg Fischer, for approximately $336 million, strengthening its position in lightweight aluminum casting solutions.

- In May 2025, Falcon Lakeside officially joined the ArtiFlex Family of Companies, enhancing the group’s expertise and capacity in high-pressure die casting and broadening its industrial casting portfolio.

- In February 2025, the GAC Group in China broke ground on a new gigacasting foundry facility with an investment exceeding ¥1.2 billion (~$138 million), with production phases scheduled for 2026, focused on high-volume structural components using gigacasting technology.

Report Scope

Report Features Description Market Value (2025) USD 1025.5 Million Forecast Revenue (2035) USD 3330.1 Million CAGR (2026-2035) 12.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Casting (Rear Underbody, Front Underbody, Battery Tray), By Customer Type (Automotive OEM, Tier-1/Foundry), By Alloy (High-Pressure Die-Casting (HPDC), Thixomolding) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape IDRA Group, Bühler Carat, LK Machinery, UBE Machinery, Yizumi, Haitian, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IDRA Group

- Bühler Carat

- LK Machinery

- UBE Machinery

- Yizumi

- Haitian

- Others