Germany Direct Selling Market Size, Share, Growth Analysis By Product (Health & Wellness, Cosmetics & Personal Care, Household Goods & Durables), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151667

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

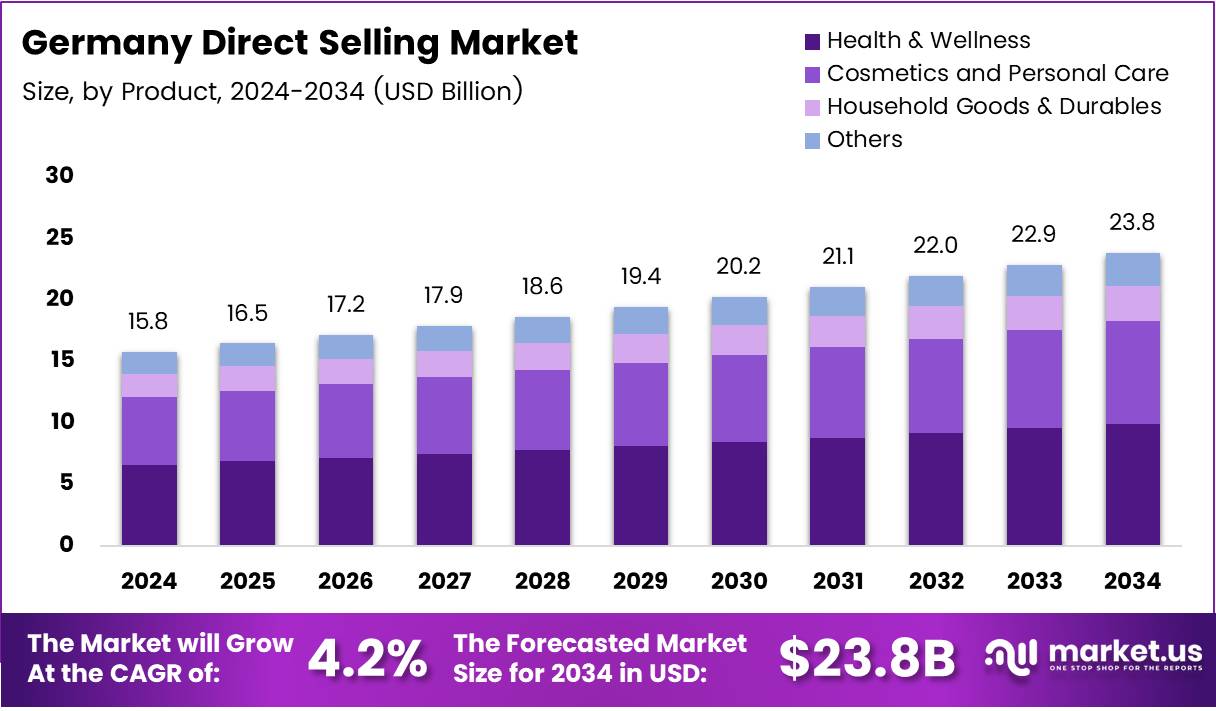

The Germany Direct Selling Market size is expected to be worth around USD 23.8 Billion by 2034, from USD 15.8 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

The Germany Direct Selling Market is a significant and expanding segment within the European retail landscape. As of recent reports, Germany accounts for 54.7% of retail sales in Europe, making it one of the largest direct sales markets in the continent, according to epixelmlm software. This highlights the robust consumer demand and established infrastructure supporting direct selling businesses across various sectors, including beauty, wellness, and home care.

The market has been steadily growing due to increasing consumer preferences for personalized services and flexible shopping experiences. Direct selling in Germany benefits from strong social networks and a highly developed digital landscape. According to ecommerce germany, by 2025, approximately 66.44% of Germany’s population will be active online shoppers, presenting an exciting opportunity for direct selling companies to reach an even larger consumer base through digital channels.

Government investment and regulations play a crucial role in the growth of the German direct selling market. The country has a well-defined regulatory framework that promotes transparency and consumer protection. This has helped build consumer trust, which is essential in direct selling businesses, especially when dealing with independent representatives. Government policies continue to support entrepreneurship, which has enabled many small businesses and individuals to thrive in the direct selling space.

The market presents significant growth opportunities, particularly with the increasing adoption of e-commerce and digital technologies. As more German consumers embrace online shopping, direct selling companies can leverage digital tools to enhance their reach and engagement. This shift is not just limited to traditional products but also spans services, where personalized experiences can be offered more effectively.

Moreover, the rise of social selling and influencer marketing in Germany provides a unique opportunity for direct selling companies to innovate their sales strategies. With a significant number of the population now engaging with social media and online platforms, brands can tap into a new wave of digital entrepreneurs, making the direct selling industry in Germany even more dynamic.

Key Takeaways

- Germany Direct Selling Market size is expected to reach USD 23.8 Billion by 2034, growing at a CAGR of 4.2% from 2025 to 2034.

- Health & Wellness holds a dominant market position in the By Product Analysis segment in 2024, driven by the growing demand for preventive healthcare and wellness solutions.

- The market growth is fueled by the increased demand for personalized products, particularly in skincare and fashion.

- Digital tools such as CRM systems and data analytics are creating growth opportunities for direct selling businesses in Germany.

- The rise of subscription-based direct selling models is a key trend, fostering customer loyalty and ensuring consistent revenue streams.

Product Analysis

Health & Wellness leads with a dominant share in 2024, capturing the largest portion of Germany’s Direct Selling Market.

In 2024, Health & Wellness held a dominant market position in the By Product Analysis segment of Germany Direct Selling Market. This strong performance was largely driven by increasing consumer focus on preventive healthcare, nutritional supplements, and holistic wellness solutions. As lifestyle diseases rise and health awareness grows, direct selling of wellness products has gained significant traction, especially among Germany’s aging population and health-conscious millennials.

Cosmetics and Personal Care followed closely, benefiting from consumer interest in self-care and natural beauty. This category continues to thrive as demand for organic and sustainable personal care items rises. Germany’s preference for clean-label cosmetics and the influence of social media-driven beauty trends further fuel growth in this segment.

Household Goods & Durables showing consistent demand within the market. The direct selling of cleaning agents, kitchen tools, and home appliances remains popular among consumers seeking trusted, demonstrable solutions for everyday use.

Others category encompassing niche products and emerging trends. Though smaller in comparison, it reflects a growing appetite for innovative and lifestyle-enhancing items delivered through trusted seller networks.

Key Market Segments

By Product

- Health & Wellness

- Cosmetics & Personal Care

- Household Goods & Durables

Drivers

Increased Consumer Preference for Personalized Products Drives Market Growth

The German direct selling market is experiencing significant growth due to increased consumer demand for personalized products. Customers are seeking unique, tailor-made goods that cater to their individual needs. This shift is driving direct selling companies to offer more customizable products, allowing them to stand out in a competitive market. Personalized offerings, such as skincare and fashion, are becoming increasingly popular, helping companies build stronger relationships with their clients.

Additionally, the rise of online direct selling platforms has made it easier for consumers to access personalized products. The convenience of shopping from home and receiving personalized recommendations has contributed to this trend. As more businesses adapt to this demand, the market for direct selling is expected to continue expanding.

Restraints

Stringent Regulatory Frameworks and Compliance Challenges Restrain Market Growth

The direct selling market in Germany faces some challenges due to strict regulatory frameworks. These regulations aim to protect consumers from fraudulent practices, but they can also be burdensome for businesses operating in the direct selling space. Companies must navigate a complex web of laws and compliance requirements, which can result in increased operational costs and slowdowns in market entry.

Negative perceptions surrounding direct selling models also create a challenge. Some consumers remain skeptical about the legitimacy of direct selling, associating it with pyramid schemes or high-pressure sales tactics. Additionally, awareness about direct selling remains limited in smaller regions, making it harder for companies to expand their presence outside major urban centers.

Growth Factors

Adoption of Advanced Digital Tools and Sustainable Products Drives Market Expansion

One of the key growth opportunities for the German direct selling market lies in the adoption of advanced digital tools for sales and marketing. The integration of digital platforms, customer relationship management (CRM) systems, and data analytics is allowing direct sellers to engage with customers more effectively and make data-driven decisions.

Another growth driver is the increasing consumer interest in eco-friendly and sustainable products. Consumers are becoming more conscious of the environmental impact of their purchases and are seeking out brands that align with their values. This trend is creating new opportunities for direct selling companies to offer green products and differentiate themselves in the marketplace.

Additionally, the demand for health and wellness products is on the rise. Consumers are becoming more health-conscious, which has led to increased sales of supplements, fitness equipment, and wellness-focused services. Direct selling businesses can tap into this growing market by offering relevant products tailored to health-conscious consumers.

Emerging Trends

Subscription-Based Models and AI Integration Shape Market Trends

The German direct selling market is currently being shaped by several trends that are changing the way businesses interact with consumers. One of the most notable trends is the shift towards subscription-based direct selling models. These models provide customers with regular deliveries of products, creating a consistent revenue stream for businesses and enhancing customer loyalty.

Another key trend is the integration of artificial intelligence (AI) and automation into sales processes. AI tools are being used to streamline sales, personalize marketing efforts, and improve customer service. Automation is helping businesses scale their operations while maintaining efficiency.

Lastly, there is a growing focus on multi-level marketing (MLM) innovations. MLM strategies are being refined to create more sustainable and effective business models, allowing companies to recruit more representatives and increase their customer base through referrals and word-of-mouth marketing. These trends are likely to continue influencing the German direct selling market.

Key Germany Direct Selling Company Insights

The Germany Direct Selling Market in 2024 reflects a dynamic landscape shaped by strong consumer engagement, evolving wellness trends, and digital transformation.

Amway Corporation continues to be a dominant force in the market, leveraging its well-established reputation in health and wellness products. Its robust distribution network and personalized customer engagement strategies have supported steady growth in Germany.

Herbalife Ltd maintains its position through a strong portfolio of nutrition and weight management products. The company’s focus on independent distributor training and digital platforms has helped it retain relevance in an increasingly competitive environment.

Natura & Co. Holding SA has seen a growing presence in the German market by aligning with consumer demand for sustainable and ethically sourced beauty products. Its purpose-driven branding strategy resonates well with younger demographics, boosting its market penetration.

Friedrich Vorwerk Group SE, while primarily known for its engineering and infrastructure services, plays a unique role in the direct selling space through its energy-related home solutions. Its niche approach sets it apart, although it operates within a more specialized segment of the market.

The remaining players, including Nu Skin Enterprises Inc., Tupperware Brands Corp, and Oriflame, contribute significantly but face varying degrees of market saturation and shifting consumer preferences.

As digital tools and e-commerce integration become more essential, companies that can blend traditional relationship-based selling with innovative technologies are better positioned to lead in the evolving German direct selling market. The year 2024 is expected to further test the adaptability and innovation of these industry leaders.

Top Key Players in the Market

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame

Recent Developments

- In November 2024, the Vorwerk Group accelerated its global growth by expanding its direct sales operations into new international markets.

The initiative reflects Vorwerk’s commitment to personalized customer engagement and strengthening its global presence. - In August 2024, VARO Energy announced the divestment of its German subsidiary, VARO Energy Direct GmbH, to Hoyer SE.

The transaction supports VARO’s strategic focus on energy transition and strengthens Hoyer’s position in the fuel distribution market in Germany. - In January 2025, KARL STORZ expanded its direct sales capabilities by acquiring a Swiss medical distribution company.

This move enhances its regional market access and aligns with its long-term growth strategy in Europe.

Report Scope

Report Features Description Market Value (2024) USD 15.8 Billion Forecast Revenue (2034) USD 23.8 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Health & Wellness, Cosmetics & Personal Care, Household Goods & Durables) Competitive Landscape Amway Corporation, Herbalife Ltd, Natura &Co Holding SA, Friedrich Vorwerk Group SE, Nu Skin Enterprises Inc, Tupperware Brands Corp, Oriflame Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Germany Direct Selling MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Germany Direct Selling MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amway Corporation

- Herbalife Ltd

- Natura &Co Holding SA

- Friedrich Vorwerk Group SE

- Nu Skin Enterprises Inc

- Tupperware Brands Corp

- Oriflame