Geomembrane Market Report By Type (High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), Polypropylene (PP), Others), By Manufacturing Method, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2024

- Report ID: 18568

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Geomembrane Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 13.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The geomembrane market refers to the industry focused on the production and distribution of very thin sheets of synthetic material, used primarily for lining or covering to prevent leaks or contamination.

These geomembranes are crafted from materials like polyethylene, polyvinyl chloride (PVC), and ethylene propylene diene monomer (EPDM), making them highly effective in environmental protection, water management, and construction projects. They serve a critical role in applications such as landfill liners, water reservoirs, canal linings, and mining operations.

In the geomembrane market, recent trends and analyses indicate a robust growth trajectory, driven by increasing environmental concerns and stringent government regulations on waste management.

The market is witnessing a significant upsurge in demand for high-quality, durable geomembranes, particularly in applications such as landfills, water conservation projects, and infrastructure development. This demand is further bolstered by the global push towards sustainable practices, where geomembranes play a pivotal role in preventing contamination and preserving natural resources.

Government regulations across various countries have become more rigorous, mandating the use of geomembranes in a range of environmental protection and infrastructure projects. This regulatory framework is a key driver for the market, compelling industries to adopt geomembrane solutions.

Additionally, countries like the United States, Germany, and China are at the forefront of market expansion, investing heavily in renewable energy projects and waste management systems that incorporate geomembrane technologies.

The market is also benefiting from technological advancements in geomembrane materials and manufacturing processes, leading to the development of more efficient and cost-effective products. These innovations are expanding the applications of geomembranes beyond traditional uses, opening new avenues for growth.

Key Takeaways

- The global geomembrane market is projected to reach USD 22.3 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034.

- High-Density Polyethylene (HDPE) holds the largest market share in the geomembrane sector at 31.7%.

- The extrusion manufacturing method dominates the geomembrane market with a 56.4% share.

- Mining is the leading application for geomembranes, representing 39.6% of the market.

- The Asia Pacific region leads the geomembrane market with a 33.4% share, driven by industrialization and infrastructure investment.

Driving Factors

Increasing Use in Waste Management Applications Drives Market Growth

The geomembrane market is experiencing a surge in demand, primarily fueled by the escalating volumes of municipal solid waste worldwide. As cities grow and consumer habits evolve, the generation of waste increases, necessitating more sophisticated waste management solutions. Geomembranes, with their exceptional impermeability, have become a cornerstone technology in landfill designs, serving as liners and covers to prevent groundwater contamination and hazardous leaks.

This application directly responds to global environmental regulations and public demand for sustainable waste management practices. Moreover, as nations intensify their efforts to mitigate pollution and adhere to international environmental standards, the adoption of geomembranes in waste management infrastructures is set to rise.

Mining Industry Growth Fuels Geomembrane Demand

The expansion of the mining industry, especially in emerging economies, presents significant opportunities for the geomembrane market. Geomembranes are integral to the mining process, utilized in heap leach pads, tailings ponds, and other critical applications to ensure environmental safety and operational efficiency.

For instance, the development of a new 300-acre copper mine tailings facility in Peru, leveraging geomembrane technology, underscores the material’s importance in modern mining operations. This trend is indicative of a broader industry shift towards sustainable practices, with geomembranes at the forefront of minimizing environmental impact. The steady growth of the mining sector, driven by the global demand for minerals and metals, directly translates to increased usage of geomembranes.

Water Conservation Efforts Propel Geomembrane Adoption

Water scarcity issues have prompted governments and industries to adopt rigorous water conservation measures, significantly impacting the geomembrane market. Geomembranes are crucial in the construction of irrigation canals, reservoirs, and dams, offering a reliable solution to minimize water loss through seepage.

Initiatives like the major irrigation canal project in Saudi Arabia, which incorporated polyethylene geomembranes to conserve water, exemplify the material’s role in addressing water scarcity. This trend is particularly pronounced in arid and semi-arid regions where water conservation is a priority for sustainable development. As global awareness and legislative frameworks around water conservation strengthen, the demand for geomembranes in water-related infrastructure is expected to grow.

Restraining Factors

High Installation Costs Restrain Market Growth

The geomembrane market faces significant challenges from the high costs associated with their installation. This process is not just about laying down the material; it requires skilled labor, specialized machinery, and, often, extensive site preparation to ensure the geomembrane performs as intended.

Such expenses can be prohibitive, particularly for projects in developing countries where budgets are tight and cost-effectiveness is a priority. This financial barrier limits the adoption of geomembranes, as potential users may seek cheaper alternatives despite the lower performance and environmental efficacy.

Complex Regulatory Policies Hamper Market Expansion

The geomembrane market’s expansion is further inhibited by complex regulatory policies and the cumbersome permit processes prevalent in some regions. Navigating these regulatory landscapes requires significant time and resources, making it a daunting task for companies.

For instance, in the United States, securing Environmental Protection Agency (EPA) approvals for geomembrane-lined landfills can extend beyond a year, delaying project timelines and inflating costs. Such regulatory hurdles not only slow down market growth by deterring potential new entrants but also create uncertainties for ongoing and planned projects.

Type Analysis

HDPE Leads with 31.8% Share, Driven by Durability and Chemical Resistance

In the geomembrane market, High-Density Polyethylene (HDPE) emerges as the dominant sub-segment, commanding a 31.8% market share. This predominance is attributed to HDPE’s superior attributes, including high chemical resistance, durability, and flexibility, making it suitable for a wide range of applications from landfill liners to chemical containment areas.

HDPE’s strength and resistance to environmental stress crack are highly valued in applications requiring long-term reliability under harsh conditions, contributing to its leading position in the market.

Other types, including Low-Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), Polypropylene (PP), and others, also play crucial roles in the market. LDPE is appreciated for its flexibility and is often used in applications where geomembrane shaping around complex designs is required.

PVC, known for its cost-effectiveness and ease of installation, is a preferred choice for decorative pond liners and secondary containment. EPDM stands out for its excellent elasticity, making it ideal for projects requiring material with high elongation before breaking. Polypropylene, on the other hand, is recognized for its thermal stability and resistance to chemical erosion, suitable for high-temperature applications.

Manufacturing Method Analysis

Geomembrane Manufacturing Methods – Extrusion Dominates with 56.6% Market Share, Known for Efficiency and Durability

Extrusion holds the largest market share in the manufacturing method segment at 56.6%. This technique’s popularity stems from its efficiency in producing geomembranes with consistent thickness and high quality, crucial for ensuring the reliability and durability of geomembrane applications.

Extrusion allows for the production of wide sheets that can cover large areas with fewer seams, reducing the potential for leaks and failures.

Calendering and other manufacturing methods also contribute to the market, each with its unique advantages. Calendering, for instance, is favored for creating geomembranes with specific textures or patterns, enhancing their aesthetic appeal or functionality in certain applications. Other methods, including coating and laminating, offer solutions for adding additional layers to geomembranes, improving their properties for specific uses.

Application Analysis

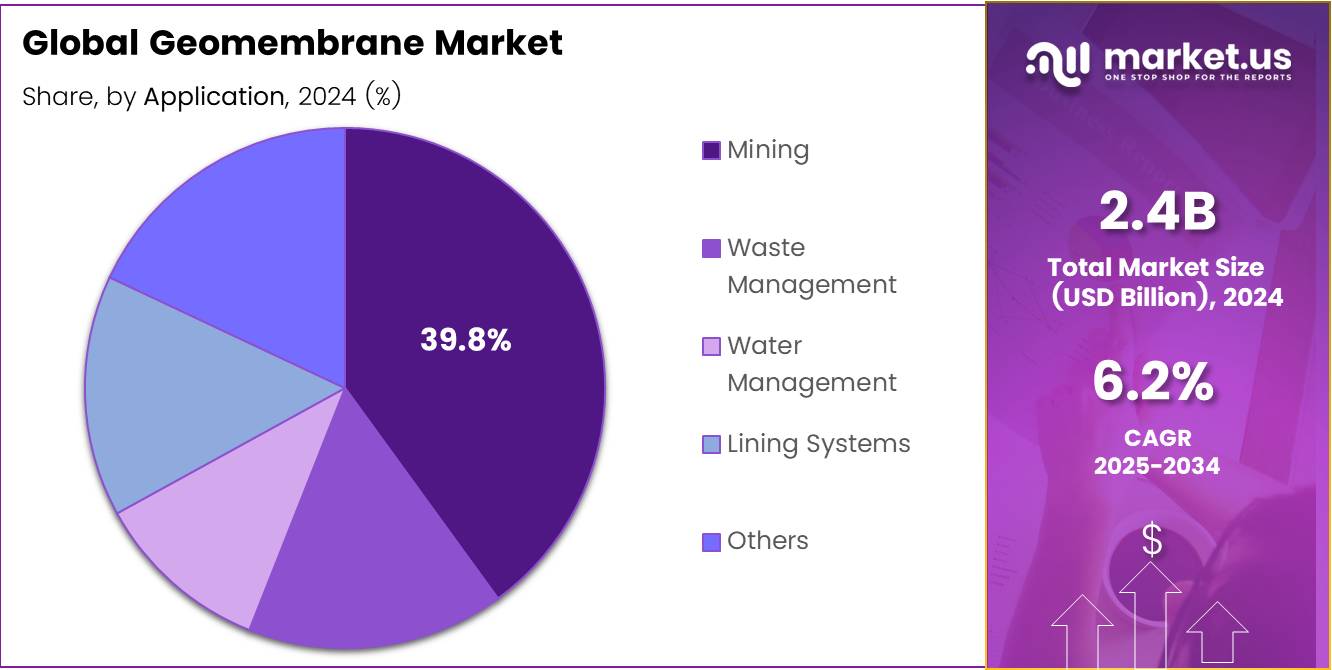

Geomembrane Applications – Mining Leads with 39.8% Market Share, Essential for Environmental Protection

Mining is the leading application for geomembranes, accounting for 39.8% of the market. The demand in this segment is driven by the critical need for effective solutions in managing mine tailings and heap leach pads. Geomembranes are essential in preventing harmful chemicals used in the mining process from contaminating the surrounding environment, ensuring compliance with environmental regulations and safeguarding local ecosystems.

The waste management segment follows closely, where geomembranes are indispensable in creating secure landfill liners and covers that prevent leachate from contaminating groundwater. Water management is another significant application, with geomembranes used in reservoirs, canals, and dams to prevent water loss and contamination.

Lining systems, including pond liners and floating covers, utilize geomembranes for their impermeability and resistance to various environmental factors. The “others” category encompasses a range of applications, highlighting the versatility of geomembranes in addressing diverse containment and protection needs across industries.

Key Market Segments

By Type

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polyvinyl Chloride (PVC)

- Ethylene Propylene Diene Monomer (EPDM)

- Polypropylene (PP)

- Others

By Manufacturing Method

- Extrusion

- Calendering

- Others

By Application

- Mining

- Waste Management

- Water Management

- Lining Systems

- Others

Growth Opportunities

Innovations in Polymer Blends Offer Growth Opportunity

The development of innovative polymer blends is a significant growth driver in the geomembrane market. Investments in research and development have led to the creation of new materials that boast enhanced temperature resistance, chemical compatibility, and lifespan. Such advancements make geomembranes more adaptable to harsh environmental conditions, which are common in industries like mining, oil, and gas.

A notable example includes the new HDPE-polypropylene blend developed by Agru America, which has broadened the scope of geomembrane applications, particularly in landfills. These innovations not only improve the performance of geomembranes but also increase their appeal across a wider range of applications, from hazardous waste containment to aggressive chemical environments.

Promotion of Geosynthetics in Road Construction Opens Market Possibilities

The promotion of geosynthetics, including geomembranes, in road construction emerges as a lucrative growth avenue. Currently, the use of geomembranes in paved roads and bridges is limited, primarily due to the absence of comprehensive long-term performance data.

However, forming partnerships with transportation agencies to conduct extensive field trials can significantly change this landscape. Demonstrating the viability of geomembranes in enhancing the durability and lifespan of road infrastructure can pave the way for their increased adoption. Such initiatives not only provide concrete evidence of the benefits of geomembranes in road construction but also open up a vast, untapped market segment.

Trending Factors

Recycled Resins and Green Manufacturing Processes Are Trending Factors

The geomembrane market is witnessing a significant shift towards sustainability, marked by the emergence of recycled resins and green manufacturing processes. This trend reflects the growing global focus on environmental sustainability and the demand for eco-friendly materials.

Manufacturers are increasingly incorporating recycled materials into their geomembrane products and adopting greener production methods to reduce carbon footprints. This move not only aligns with regulatory pressures and consumer expectations but also opens up new market opportunities by appealing to environmentally conscious clients.

Composite Geomembranes with Multiple Polymer Layers Are Trending Factors

The rising adoption of composite geomembranes, which feature multiple polymer layers, is another trending factor in the geomembrane market. These advanced materials offer enhanced performance characteristics, including improved mechanical strength, chemical resistance, and durability.

The layered structure allows for the customization of geomembranes to suit specific project requirements, making them more versatile and effective in a broader range of applications. This trend towards composite geomembranes is driven by the continuous push for more efficient and reliable environmental protection solutions in sectors such as waste management, mining, and water conservation.

Regional Analysis

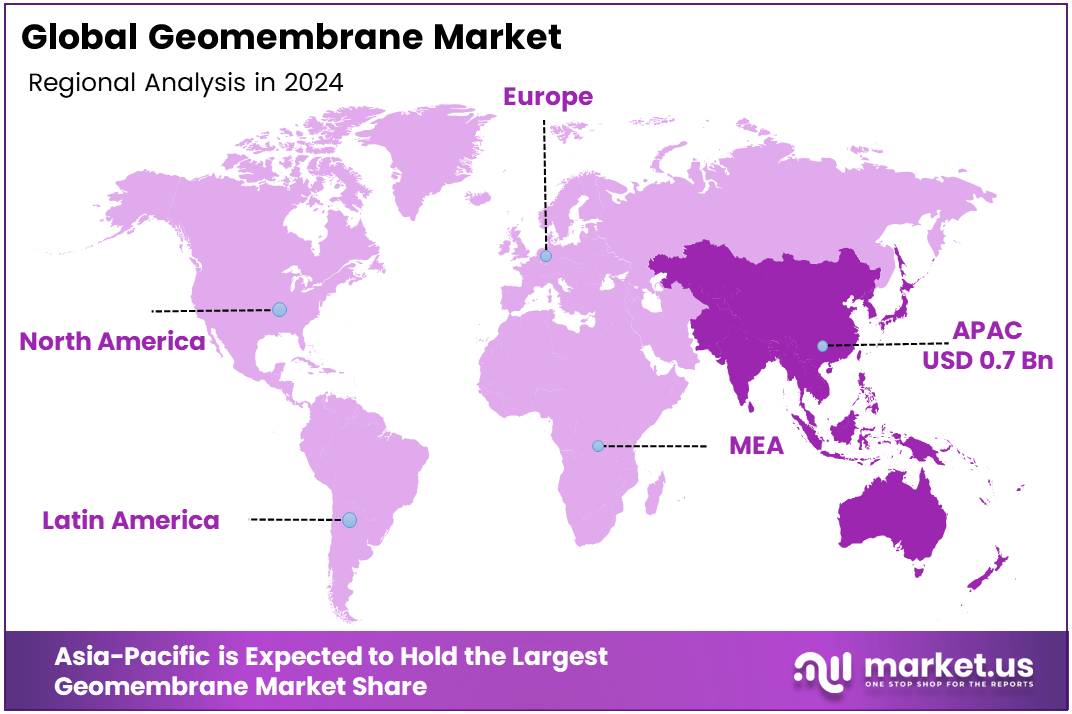

Asia Pacific Dominates with 33.4% Market Share

Asia Pacific (APAC) leads the geomembrane market with a commanding 33.4% share, driven by rapid industrialization and urbanization. The region’s significant investment in infrastructure development, particularly in waste management, water conservation projects, and mining activities, fuels the demand for geomembranes.

Countries like China and India, experiencing robust economic growth, are the primary contributors to this demand. Their efforts to adhere to environmental regulations and promote sustainable practices further amplify the need for geomembranes, making APAC a hotspot for market growth.

APAC’s market dominance is also influenced by its dynamic market characteristics, including a vast construction sector, increasing environmental awareness, and government initiatives promoting the use of sustainable materials.

The region’s diverse climate conditions, ranging from arid to tropical, necessitate the use of geomembranes in various applications, from water reservoirs in drought-prone areas to landfill liners in urban centers. This versatility in application underscores the geomembrane’s critical role in the region’s environmental and infrastructure projects.

North America, particularly driven by the United States, holds a significant portion of the geomembrane market, attributed to advanced environmental regulations and a strong focus on infrastructure and waste management practices. The region’s emphasis on sustainable development, coupled with stringent regulatory frameworks, propels the adoption of geomembranes across various applications, including waste management and water conservation.

Europe’s market share in the geomembrane sector is characterized by a strong emphasis on sustainability and environmental protection, underpinned by strict EU regulations. The region’s commitment to reducing carbon emissions and managing industrial waste effectively has led to increased use of geomembranes in landfill and water management projects. Countries like Germany, France, and the UK are at the forefront, integrating geomembranes into environmental protection schemes.

The Middle East & Africa (MEA) region, while holding a smaller share of the global geomembrane market, presents significant growth potential. Driven by water scarcity issues and the need for effective waste management solutions, countries in this region are increasingly turning to geomembrane technologies. Infrastructure development projects, particularly in Gulf Cooperation Council (GCC) countries, are expected to boost demand.

Latin America’s geomembrane market is primarily driven by its extensive mining activities, especially in countries like Chile, Peru, and Brazil. The need for effective solutions to manage mining waste and prevent environmental contamination has led to increased adoption of geomembranes. Additionally, growing awareness of waste management and environmental protection in the region supports the market’s expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the geomembrane market, key players such as Solmax International Inc., Raven Industries, AGRU, Carlisle Construction Materials LLC, and others play pivotal roles in shaping industry dynamics and driving innovation.

These companies have established strong market positions through extensive product portfolios, global distribution networks, and a focus on technological advancements. Solmax, for example, stands out for its wide range of high-quality geomembranes suitable for various applications, underpinning its strategic positioning as a leader in environmental solutions.

Raven Industries and AGRU are renowned for their commitment to research and development, leading to the creation of durable and versatile geomembrane products. Carlisle and Atarfil emphasize sustainability and efficiency in their manufacturing processes, aligning with global trends towards green construction materials.

Collectively, these key players influence market trends through strategic expansions, mergers, and acquisitions, enhancing their global reach and impact on the geomembrane industry. Their efforts in innovation, sustainability, and market penetration set the standard for excellence and drive the market forward, addressing the evolving needs of diverse industries such as waste management, mining, and water conservation.

Market Key Players

- Solmax International Inc.

- Raven Industries

- AGRU

- Carlisle Construction Materials LLC

- Atarfil

- PLASTIKA KRITIS S.A.

- JUTA Ltd.

- Maccaferri Bridgestone Americas, Inc.

- Anhui Huifeng New Synthetic Materials Co. Ltd

- Carlisle SynTec Systems

- Officine Maccaferri Spa

Recent Developments

- On Nov 2023, Bridgestone Americas has expanded its MasterCore mining tire line, which provides mine sites with customized tire performance. The MasterCore tires are currently being used in select mines, and a full launch to customers worldwide with additional patterns and sizes will begin soon.

- Solmax Geosynthetics, a Canadian company that supplies geosynthetic drainage geocomposites, has developed a reflective membrane called Geolux to increase the albedo of the surface below photovoltaic (PV) power plants.

Report Scope

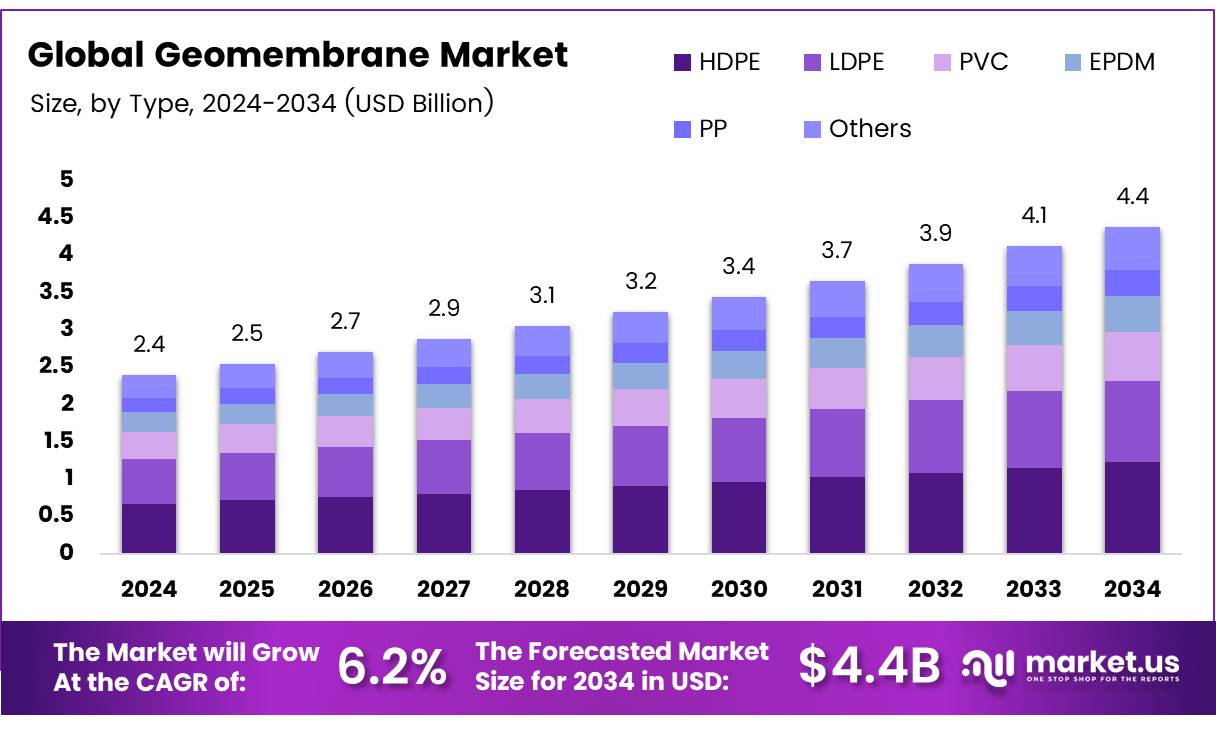

Report Features Description Market Value (2023) USD 2.3 Billion Forecast Revenue (2033) USD 4.2 Billion CAGR (2024-2033) 6.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), Polypropylene (PP), Others), By Manufacturing Method (Extrusion, Calendering, Others), By Application (Mining, Waste Management, Water Management, Lining Systems, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Solmax International Inc., Raven Industries, AGRU, Carlisle Construction Materials LLC, Atarfil, PLASTIKA KRITIS S.A., JUTA Ltd., Maccaferri Bridgestone Americas, Inc., Anhui Huifeng New Synthetic Materials Co. Ltd, Carlisle SynTec Systems, Officine Maccaferri Spa Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size and growth rate of the geomembrane market?The geomembrane market was valued at USD 2.3 Billion in 2023 and is expected to reach USD 4.2 Billion in 2033, with a compound annual growth rate (CAGR) of 6.20%.

What are the key drivers of growth in the geomembrane market?Increasing environmental concerns, stringent government regulations on waste management, technological advancements, and the global push towards sustainable practices are key drivers of growth in the geomembrane market.

Which type of geomembrane holds the largest segment share, and why?High-Density Polyethylene (HDPE) holds the largest segment share at 31.7%, attributed to its superior attributes such as high chemical resistance, durability, and flexibility, making it suitable for a wide range of applications.

What are some emerging trends in the geomembrane market?Emerging trends include the use of recycled resins and green manufacturing processes, as well as the adoption of composite geomembranes with multiple polymer layers for enhanced performance characteristics.

-

-

- Solmax International Inc.

- Raven Industries

- AGRU

- Carlisle Construction Materials LLC

- Atarfil

- PLASTIKA KRITIS S.A.

- JUTA Ltd.

- Maccaferri Bridgestone Americas, Inc.

- Anhui Huifeng New Synthetic Materials Co. Ltd

- Carlisle SynTec Systems

- Officine Maccaferri Spa