Global Generator Sets Market Size, Share Report By Power Rating (≤50 KVA, >50 kVA - 125 KVA, 125 kVA - 200 KVA, 200 KVA - 330 KVA, >330 kVA - 750 KVA, >750 KVA), By Fuel (Diesel, Gas, Hybrid), By Application (Standby, Peak shaving, Prime/continuous), By End Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154769

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

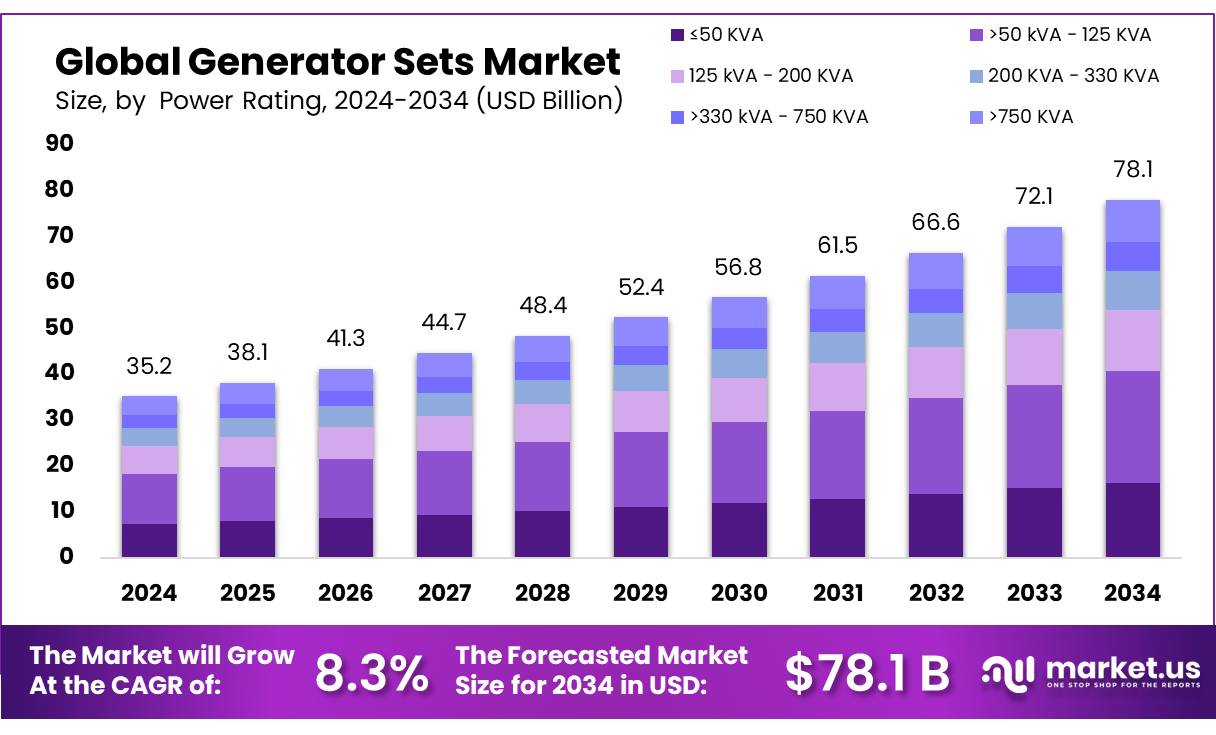

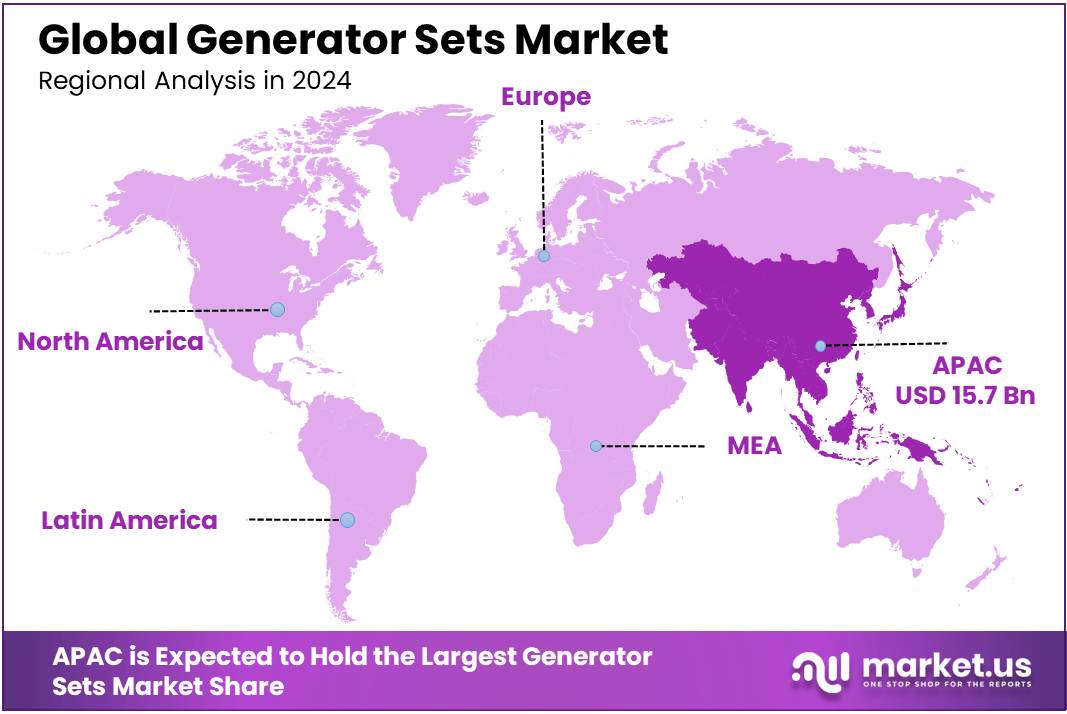

The Global Generator Sets Market size is expected to be worth around USD 78.1 Billion by 2034, from USD 35.2 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, Asia‑Pacific (APAC) held a dominant market position, capturing more than a 44.8% share, holding USD 15.76 Billion in revenue.

The generator sets industry constitutes equipment that provides backup, prime and emergency power via diesel, gas or hybrid engines. Industrial generator sets—typically rated above 10 kW—serve critical infrastructure across manufacturing, healthcare, telecommunications, and data centres.

The growth of generator sets is being driven by frequent grid disturbances and power outages, requiring reliable off‑grid or backup power solutions across residential, commercial, and industrial sectors. In India, industrial captive generation includes nearly 75 000 MW of diesel capacity (excluding sets below 100 kVA), used for emergency and industrial backup power as of FY 2023–24.

At the national level, India’s National Electricity Plan (2023–27) mandates a transition away from new fossil‑fuel power plants (other than those under construction), aiming for non‑fossil fuel generation to contribute ~44.7 % of total electricity generation by 2029–30. This transition supports distributed backup generation via cleaner gas or hybrid gensets. Further, the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) achieved nearly 100 % village electrification by 2018, thereby raising demand for backup systems in rural areas vulnerable to grid instability during monsoon or remote operations.

Moreover, the newly launched ‘ADEETIE’ scheme (Assistance in Deploying Energy Efficient Technologies in Industries and Establishments) by the Union Ministry of Power, funded at ₹1,000 crore, offers interest subvention (₹875 crore) and capacity‑building support (₹50 crore) to MSMEs adopting energy‑efficient technologies, including modern genset systems. This scheme is expected to mobilise over ₹9,000 crore in investment, thereby stimulating demand for advanced, fuel‑efficient gensets in industrial clusters across states such as Andhra Pradesh, Telangana, Kerala, Karnataka, and Tamil Nadu.

Government initiatives under the National Action Plan on Climate Change, including the National Solar Mission, aim to reduce carbon intensity and promote renewable deployment, indirectly influencing generator usage by encouraging hybrid and lower-emission gensets. Similarly, the Make in India initiative supports local manufacturing and assembly of gensets, though the manufacturing share in GDP remains under 16 % as of 2023‑24.

Key Takeaways

- Generator Sets Market size is expected to be worth around USD 78.1 Billion by 2034, from USD 35.2 Billion in 2024, growing at a CAGR of 8.3%.

- >50 kVA – 125 kVA held a dominant market position, capturing more than a 31.2% share.

- Diesel held a dominant market position, capturing more than a 73.4% share in the generator sets market.

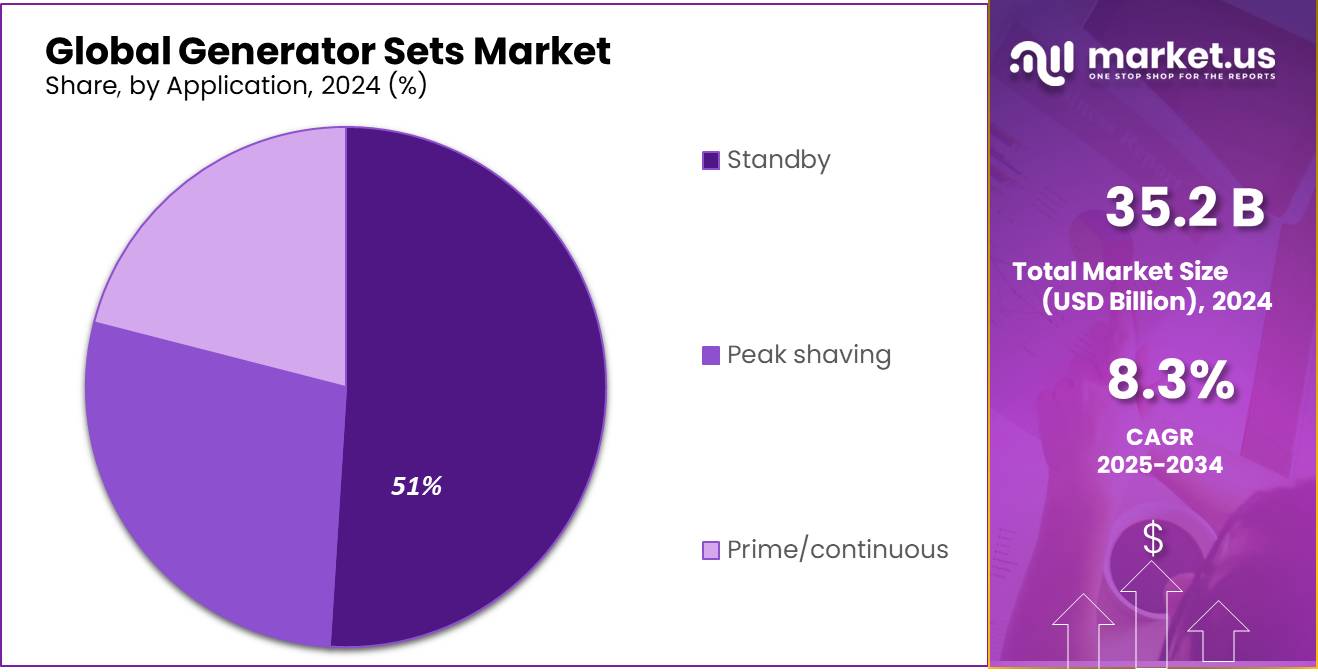

- Standby held a dominant market position, capturing more than a 51.8% share in the generator sets market.

- Commercial held a dominant market position, capturing more than a 54.7% share in the generator sets market.

- Asia‑Pacific (APAC) region sustained its position as the dominant market for generator sets, accounting for 44.8% of global revenue and generating an estimated USD 15.76 billion.

By Power Rating Analysis

Generator Sets Rated >50 kVA – 125 kVA lead with 31.2% due to strong industrial demand

In 2024, >50 kVA – 125 kVA held a dominant market position, capturing more than a 31.2% share. This power range continued to be the preferred choice for medium-sized industries, construction sites, commercial buildings, and small manufacturing units, where a stable and moderate power supply is essential. These gensets offer a balance between performance and cost, making them ideal for users who require dependable backup without the high expense of larger units. Their wide adoption in sectors with frequent power interruptions—especially in developing regions—has supported this segment’s strong standing.

By Fuel Analysis

Diesel Generator Sets lead with 73.4% share due to strong reliability and easy availability

In 2024, Diesel held a dominant market position, capturing more than a 73.4% share in the generator sets market. This high share is mainly due to diesel’s long-standing reputation for reliability, efficiency, and suitability for heavy-duty operations. Diesel generators are widely used across construction sites, factories, hospitals, and telecom towers because they provide stable power for longer durations. Their fuel is easily available in most regions, and the engines require less maintenance compared to other types, making them a practical choice for both urban and remote areas.

By Application Analysis

Standby Generator Sets dominate with 51.8% share as power backup needs rise

In 2024, Standby held a dominant market position, capturing more than a 51.8% share in the generator sets market. These systems are mainly used as backup power sources and are widely installed in hospitals, data centers, commercial buildings, and residential complexes to prevent disruption during power outages. Their ability to switch on automatically when the main grid fails makes them a reliable and convenient solution. With increasing concerns about grid stability and more frequent weather-related blackouts, the demand for standby generators remained strong in 2024.

By End Use Analysis

Commercial Sector leads with 54.7% share as businesses secure power reliability

In 2024, Commercial held a dominant market position, capturing more than a 54.7% share in the generator sets market. This high share reflects the growing need for uninterrupted power across hotels, shopping malls, office buildings, telecom towers, and healthcare facilities. Businesses in the commercial sector rely heavily on consistent power to maintain daily operations, avoid service disruptions, and ensure customer satisfaction. With rising urban development and an increase in commercial real estate projects, the demand for generator sets has grown steadily.

Key Market Segments

By Power Rating

- ≤50 KVA

- >50 kVA – 125 KVA

- 125 kVA – 200 KVA

- 200 KVA – 330 KVA

- >330 kVA – 750 KVA

- >750 KVA

By Fuel

- Diesel

- Gas

- Hybrid

By Application

- Standby

- Peak shaving

- Prime/continuous

By End Use

- Residential

- Commercial

- Telecom

- Data Centers

- Educational institutions

- Government Centers

- Hospitality

- Retail Sales

- Real Estate

- Commercial complex

- Infrastructure

- Others

- Industrial

- Oil & gas

- Manufacturing

- Construction

- Electric utilities

- Mining

- Transportation & logistics

- Others

Emerging Trends

Government Initiatives Accelerating Hybrid Generator Set Adoption

In recent years, India has witnessed a significant shift towards hybrid generator sets, driven by a combination of government policies, environmental concerns, and technological advancements. Hybrid gensets, which integrate traditional diesel engines with renewable energy sources like solar or wind, offer a sustainable solution to the country’s growing power demands.

The Indian government’s commitment to renewable energy is evident through initiatives such as the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme. Launched in 2019, PM-KUSUM aims to promote the use of solar energy in the agricultural sector by providing subsidies for the installation of solar pumps and grid-connected solar power systems.

This initiative not only supports farmers but also encourages the adoption of hybrid systems that combine solar power with traditional gensets, ensuring a reliable power supply for irrigation and other agricultural activities. The government has allocated ₹34,422 crore (approximately USD 4.6 billion) for the scheme, targeting the installation of 34,800 MW of solar capacity by 2026.

Furthermore, the Atmanirbhar Bharat campaign emphasizes self-reliance in manufacturing, encouraging domestic production of hybrid gensets. This policy shift has led to increased investments in research and development, resulting in the creation of more efficient and cost-effective hybrid systems. Local manufacturers are now producing gensets that meet stringent emission norms, aligning with global sustainability standards.

The adoption of hybrid gensets is also supported by the country’s growing renewable energy infrastructure. As of 2025, India has an installed solar capacity of 116.24 GW, with plans to reach 500 GW of non-fossil fuel capacity by 2030. This expansion provides a robust foundation for integrating renewable energy sources into hybrid genset systems, enhancing their efficiency and reducing dependency on fossil fuels.

Drivers

Government Initiatives Driving Growth in India’s Generator Sets Market

One of the cornerstone initiatives is the National Infrastructure Pipeline (NIP), which envisions an investment of approximately USD 1.4 trillion across over 7,400 projects by 2025. This ambitious plan encompasses sectors such as transportation, energy, and urban development, all of which necessitate a reliable power supply. Consequently, the demand for gensets has surged, as they are integral to maintaining uninterrupted power in these critical infrastructure projects.

Complementing the NIP is the PM Gati Shakti initiative, a mega project valued at USD 1.2 trillion, designed to provide multimodal connectivity to all economic zones in India . This initiative aims to boost manufacturing and logistics, sectors that are heavily reliant on consistent power supply. As industries expand and logistics hubs proliferate, the need for dependable backup power solutions, such as gensets, becomes increasingly vital.

Additionally, the Atmanirbhar Bharat campaign emphasizes self-reliance in manufacturing, encouraging domestic production and reducing dependency on imports. This policy shift has spurred local manufacturers to innovate and produce gensets that meet stringent emission norms, thereby aligning with global sustainability standards.

Furthermore, the government’s focus on rural electrification and renewable energy integration has opened new avenues for genset applications. Programs like the PM KUSUM Scheme, which aims to install solar-powered pumps in rural areas, are promoting hybrid genset solutions that combine solar energy with traditional power sources. Such integrations not only provide reliable power to off-grid areas but also contribute to environmental sustainability.

Restraints

Transition to Stricter Emission Standards Challenges Generator Set Manufacturers

The Indian generator sets (gensets) industry is currently navigating a significant challenge due to the implementation of the Central Pollution Control Board (CPCB) IV+ emission standards, which came into effect in July 2023 for gensets up to 800 kW. These stringent regulations mandate a substantial reduction in harmful emissions, aiming for a 90% decrease in particulate matter (PM) and nitrogen oxides (NOx) compared to previous standards.

While these measures are commendable from an environmental perspective, they pose considerable hurdles for manufacturers. The transition necessitates substantial investments in research and development to redesign engines and integrate advanced emission control technologies. This shift not only increases production costs but also extends the time required for product development and certification processes. For instance, industry leaders like Cummins India have reported a 9.2% rise in expenses, primarily attributed to a 16.8% surge in raw material costs, even as they strive to meet the new emission standards.

Moreover, the stringent emission norms have led to a market realignment. Products that do not comply with the CPCB IV+ standards are being phased out, compelling manufacturers to either upgrade existing models or introduce new compliant variants. This transition period may result in supply shortages or delays, affecting industries that rely heavily on gensets for uninterrupted power supply.

Additionally, the increased operational costs associated with meeting these new standards could lead to higher prices for end-users. This price hike may impact sectors with tight budgets, such as small and medium enterprises (SMEs) and rural businesses, potentially hindering their growth and operational efficiency.

Opportunity

Government Initiatives Fueling Growth in Generator Sets Industry

The Indian government’s strategic initiatives are significantly propelling the growth of the generator sets (gensets) industry, particularly in rural and agricultural sectors. Programs like the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) are pivotal in this transformation. Launched in 2019, PM-KUSUM aims to solarize agricultural operations, thereby reducing dependence on diesel and enhancing income for farmers.

The scheme’s components include setting up decentralized solar power plants, installing standalone solar pumps, and solarizing existing grid-connected pumps. The government has committed a substantial financial outlay of ₹34,422 crore (approximately USD 4.6 billion) to achieve a solar capacity addition of 34,800 MW by March 2026.

Under Component B of PM-KUSUM, the government provides a 60% subsidy for the installation of standalone solar pumps up to 7.5 HP, with the remaining 40% to be borne by the farmer, often facilitated through bank financing . This initiative not only promotes the adoption of renewable energy but also alleviates the financial burden on farmers, encouraging them to transition from conventional diesel pumps to solar-powered alternatives.

The impact of these initiatives is evident in states like Rajasthan, which has achieved a significant milestone by installing over 1,000 MW of solar power capacity under the PM-KUSUM schemes. This development has enabled 1.7 lakh farmers to access daytime electricity, thereby enhancing efficiency and reducing the challenges of irrigating at night.

Additionally, the PM Surya Ghar Muft Bijli Yojana, launched in 2024, aims to empower 1 crore households with rooftop solar installations, providing them with 300 units of free electricity every month. The scheme offers subsidies ranging from ₹30,000 to ₹78,000, depending on the household’s average monthly power consumption. This initiative not only promotes clean energy but also reduces the financial burden on rural households, indirectly benefiting the genset market by encouraging the adoption of solar solutions.

Regional Insights

Asia‑Pacific dominates with 44.8% share, generating approximately USD 15.76 billion in 2024

In 2024, the Asia‑Pacific (APAC) region sustained its position as the dominant market for generator sets, accounting for 44.8% of global revenue and generating an estimated USD 15.76 billion in sales. This substantial regional share reflects increasingly frequent power interruptions, rapid industrial expansion, and aggressive infrastructure development across key economies such as China, India, Japan, and Southeast Asia.

The regional landscape is characterized by high demand in commercial hubs, manufacturing zones, healthcare facilities, and digital infrastructure centers, which all rely on reliable backup power. In particular, industrial and telecommunications sectors depend heavily on gensets due to inconsistent grid reliability. National initiatives such as India’s smart cities, China’s urban development expansion, and Southeast Asian infrastructure programs have collectively pushed genset adoption across medium- and high‑power capacities.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Atlas Copco AB is a major global player in the generator sets market, known for its portable and stationary power solutions. The company offers diesel and gas-powered gensets tailored for industrial, construction, and mining sectors. In 2024, Atlas Copco focused on compact and fuel-efficient models to meet emission regulations and off-grid applications. With its strong presence across Asia, Europe, and Africa, the company continues to expand through innovative energy-efficient technologies and strategic service partnerships to meet rising global power demands.

Caterpillar Inc. holds a strong position in the global generator sets market, offering a wide portfolio of diesel and gas-powered gensets ranging from 7.5 kVA to over 10,000 kVA. Its generator systems are widely used in commercial, industrial, and data center applications. In 2024, Caterpillar emphasized high-efficiency engines with lower emissions and digital remote monitoring features. The company leverages its vast dealer network and after-sales support to strengthen its global footprint, especially in power-deficit and rapidly industrializing regions.

General Electric (GE) plays a vital role in the high-capacity segment of the generator sets market, offering diesel and gas turbine gensets for critical infrastructure, oil & gas, and power generation industries. In 2024, GE focused on enhancing efficiency and digital control features for better system integration. Its global presence and experience in grid stability and power solutions make GE a key provider in utility-scale and mission-critical installations, supporting energy reliability and resilience across multiple global regions.

Top Key Players Outlook

- Atlas Copco AB

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- General Electric

- Briggs and Stratton Corporation

- AKSA Power Generation

- Cooper Corporation

- Kohler Co.

- MTU Onsite Energy

- Mitsubishi Heavy Industries Ltd

- Doosan Corporation

- Wartsila Corporation

- Honda Siel Power Products Ltd.

Recent Industry Developments

Atlas Copco AB is a well‑established supplier in the generator sets sector, operating through its Power Technique division that produces portable and industrial generators for global customers. In 2024, Atlas Copco reported total revenues of MSEK 176 771, up 2 % from MSEK 172 664 in 2023.

In 2024, Caterpillar Inc. recorded total revenues of USD 64.8 billion, with its Energy & Transportation segment—which includes generator sets—accounting for USD 28 billion, representing approximately 44 % of its machinery-related sales.

Report Scope

Report Features Description Market Value (2024) USD 35.2 Bn Forecast Revenue (2034) USD 78.1 Bn CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Rating (≤50 KVA, >50 kVA – 125 KVA, 125 kVA – 200 KVA, 200 KVA – 330 KVA, >330 kVA – 750 KVA, >750 KVA), By Fuel (Diesel, Gas, Hybrid), By Application (Standby, Peak shaving, Prime/continuous), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Copco AB, Caterpillar Inc., Cummins Inc., Generac Holdings Inc., General Electric, Briggs and Stratton Corporation, AKSA Power Generation, Cooper Corporation, Kohler Co., MTU Onsite Energy, Mitsubishi Heavy Industries Ltd, Doosan Corporation, Wartsila Corporation, Honda Siel Power Products Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Copco AB

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- General Electric

- Briggs and Stratton Corporation

- AKSA Power Generation

- Cooper Corporation

- Kohler Co.

- MTU Onsite Energy

- Mitsubishi Heavy Industries Ltd

- Doosan Corporation

- Wartsila Corporation

- Honda Siel Power Products Ltd.