Generative AI in Oil and Gas Market Size, Share, Statistics Analysis Report By Function (Data Analysis and Interpretation, Predictive Modelling, Anomaly Detection, Decision Support, and Other Functions), By Application (Asset Maintenance, Drilling Optimization, Exploration and Production, Reservoir Modelling, Other Applications), By Deployment Mode (Cloud-based, On-premise), By End-User (Oil and Gas Companies, Drilling Contractors, Equipment Manufacturers, Service Providers, Consulting Firms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133501

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

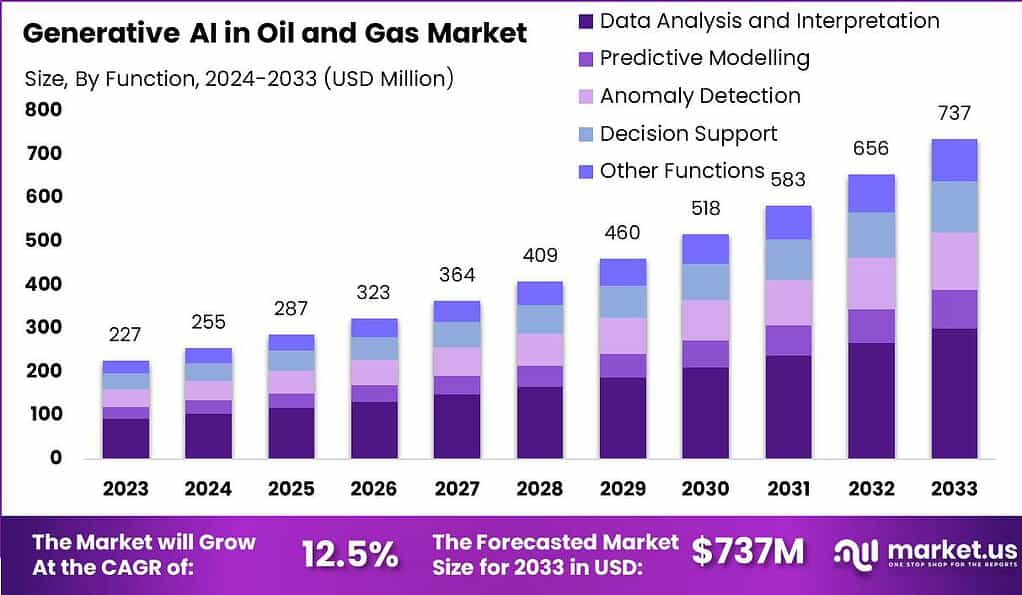

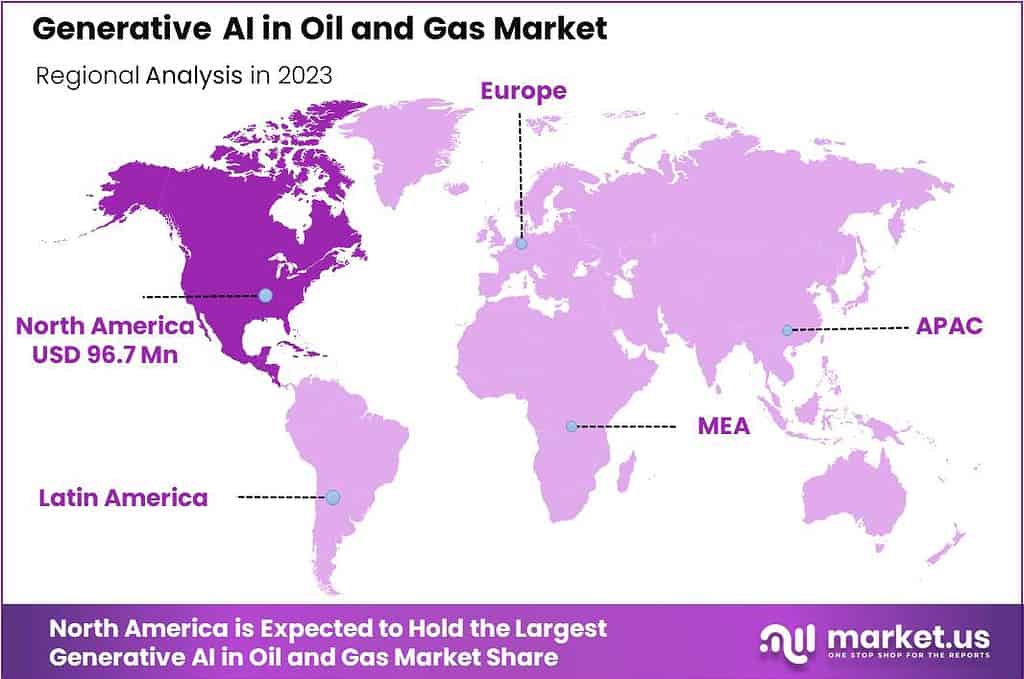

The Global Generative AI in Oil and Gas Market size is expected to be worth around USD 737 Million By 2033, from USD 227 billion in 2023, growing at a CAGR of 12.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 42.6% share, holding USD 96.7 Million revenue.

The generative AI market in the oil and gas industry is rapidly expanding, driven by the need for increased efficiency and reduced costs amidst challenging economic and environmental conditions. The technology’s ability to enhance predictive maintenance, optimize drilling and production processes, and improve safety and sustainability measures positions it as a critical tool for future growth. As companies strive to innovate and maintain competitive edges, the integration of generative AI into their operations is becoming increasingly prevalent.

Major driving factors for the adoption of generative AI in the oil and gas industry include the pursuit of operational excellence, cost reduction, and enhanced safety measures. Companies are leveraging this technology to refine exploration and production activities, anticipate maintenance needs, and optimize resource allocation. Moreover, generative AI assists in environmental monitoring and compliance, crucial for sustaining operations in sensitive ecological zones.

The demand for generative AI in the oil and gas market is fueled by its potential to significantly improve data analysis capabilities, thereby enabling more informed decision-making and strategic planning. The technology’s ability to process and interpret vast datasets quickly helps companies adapt to fluctuating market conditions and optimize operational responses.

Market opportunities for generative AI in the oil and gas sector are abundant, with advancements in technology paving the way for innovative applications that promise to reshape industry standards. These include improved reservoir simulations, advanced drilling optimization, and enhanced safety protocols. As the industry continues to navigate economic and environmental challenges, these innovations provide critical solutions that drive growth and sustainability.

According to Market.us, The Global AI in Oil and Gas Market is projected to grow significantly over the next decade. By 2033, the market is expected to reach a value of USD 8.2 billion, up from USD 2.8 billion in 2023. This represents a steady compound annual growth rate (CAGR) of 11.3% between 2024 and 2033.

Technological advancements in generative AI, such as enhanced machine learning models and more sophisticated data analysis tools, are continuously expanding the boundaries of what can be achieved in the oil and gas industry. These developments not only increase the accuracy and efficiency of existing processes but also open new avenues for exploration and production optimization, ensuring the industry’s ability to adapt to future demands and challenges.

Key Takeaways

- The global market for generative AI in oil and gas is projected to grow significantly, reaching a value of USD 737 million by 2033, up from USD 227 million in 2023. This reflects a robust CAGR of 12.5% between 2024 and 2033.

- North America dominated the market in 2023, contributing over 42.6% of the total share. The region generated a revenue of approximately USD 96.7 million, showcasing its leadership in the adoption of advanced AI solutions.

- The Data Analysis and Interpretation segment led the market in 2023, accounting for more than 40.7% of the total market share. This reflects the rising demand for AI tools to process complex datasets in exploration and production activities.

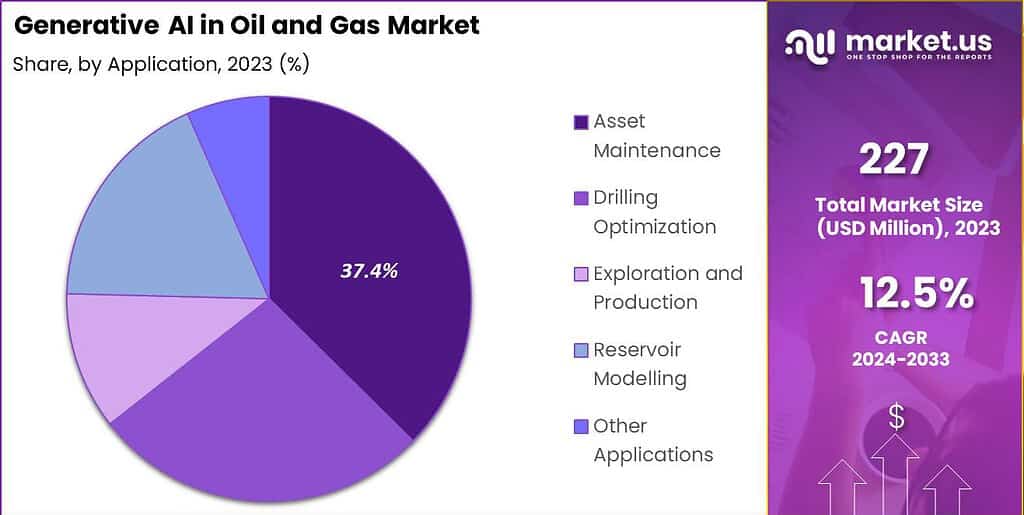

- The Asset Maintenance segment also held a strong position, capturing over 37.4% of the market share in 2023. Its growth is driven by the industry’s focus on minimizing equipment downtime and optimizing operational efficiency.

Function Insights

In 2023, the Data Analysis and Interpretation segment of the Generative AI in Oil and Gas Market held a dominant position, capturing over 40.7% of the market share. This substantial segment performance is fundamentally driven by the oil and gas industry’s increasing reliance on sophisticated data-driven decision-making processes.

As the industry contends with complex exploration, production activities, and a persistent need to minimize environmental impacts, the role of generative AI in enhancing operational efficiency has become critical. Data Analysis and Interpretation in the oil and gas sector involves utilizing generative AI to process and analyze vast arrays of data collected from various sources such as sensors, equipment logs, and seismic surveys.

The insights gained from this data are pivotal for identifying potential reservoirs, predicting rock formations, and assessing the viability of drilling sites. This segment’s growth is underpinned by the ability of AI to interpret geological data, which is often complex and voluminous, thereby allowing for more accurate predictions and better strategic planning.

Furthermore, the deployment of generative AI in this function supports a range of activities from optimizing asset maintenance to enhancing the reliability of drilling operations. Predictive analytics derived from generative AI models facilitate proactive maintenance strategies, thereby minimizing downtime and reducing the operational costs associated with unplanned outages.

This strategic application of AI not only streamlines operations but also extends the lifespan of critical infrastructure, making it a cornerstone of digital transformation strategies in the sector. Overall, the Data Analysis and Interpretation segment continues to expand its influence in the oil and gas industry, driven by technological advancements and an industry-wide shift towards more agile and data-centric operational frameworks.

Application Insights

In 2023, the Asset Maintenance segment held a dominant market position in the Generative AI in Oil and Gas Market, capturing more than a 37.4% share. This segment’s prominence is primarily attributed to its crucial role in enhancing operational efficiency and reliability within the oil and gas sector. As infrastructure ages and the cost of unplanned outages escalates, oil and gas companies are increasingly relying on AI-driven solutions to predict equipment failures and schedule preventive maintenance effectively.

The application of Generative AI in asset maintenance allows for the detailed analysis and interpretation of vast amounts of data from sensors and operational logs. This data-driven approach helps in predicting equipment failures before they occur, thereby enabling timely maintenance interventions that can prevent costly downtime and extend the equipment’s operational life.

Such predictive maintenance strategies are integral not only in reducing operational costs but also in optimizing asset performance and lifecycle management. Moreover, the increasing adoption of IoT devices and sensors in oil and gas operations offers a broader data pool from which actionable insights can be drawn.

Generative AI leverages this data to enhance the precision of predictive analytics, making it a valuable tool for asset managers seeking to implement robust maintenance protocols. As a result, the Asset Maintenance segment is seen as a critical component in the digital transformation strategies of oil and gas companies, driving further investment and innovation in this area.

This strategic emphasis on advanced AI applications reflects the sector’s broader push towards maximizing efficiency and reliability, as companies look to technology to navigate the operational complexities of the modern energy landscape.

Deployment Mode Insights

In 2023, the Cloud-based segment held a dominant market position in the Generative AI in Oil and Gas Market, capturing more than a 70.3% share. This commanding presence underscores the pivotal role cloud computing has come to play in the sector, primarily due to its scalability, flexibility, and efficiency in handling large datasets required for AI operations.

The cloud-based deployment of generative AI tools allows companies to leverage advanced data analytics and machine learning capabilities without significant upfront investment in physical infrastructure. The attractiveness of the cloud-based model is further enhanced by its ability to facilitate remote access to AI applications and data, which is particularly advantageous for oil and gas companies with geographically dispersed operations.

This model supports real-time data processing and decision-making, crucial for optimizing drilling and production processes. Additionally, the cloud environment fosters collaborative efforts among different teams or companies by providing common platforms for sharing insights and operational strategies.

Moreover, the ongoing shift towards digital transformation in the oil and gas industry propels the adoption of cloud-based AI solutions. Companies are keen to reduce operational costs and enhance efficiency, driving them towards technologies that offer cost-effective, scalable, and flexible solutions. The cloud-based AI deployment not only aligns with these goals but also supports the industry’s push towards more sustainable practices by reducing the carbon footprint associated with physical data centers.

Overall, the cloud-based segment’s dominance in the Generative AI market is a clear indicator of the oil and gas industry’s commitment to embracing digital technologies that enhance operational efficiency, reduce costs, and drive innovation. This trend is expected to continue as more companies recognize the strategic value of cloud platforms in harnessing the power of AI.

End-User Insights

In 2023, the Oil and Gas Companies segment held a dominant market position in the Generative AI in Oil and Gas Market, capturing more than a 44.7% share. This leading position can be attributed to the significant investments oil and gas companies have made in digital transformation initiatives, aiming to leverage AI for enhanced decision-making and operational efficiencies.

The deployment of Generative AI technologies by these companies is primarily driven by the need to optimize exploration and production processes, improve safety standards, and reduce environmental impacts. Oil and gas companies are increasingly reliant on AI to process and interpret the vast data generated from their operations, including seismic data, drilling logs, and production metrics.

Generative AI assists in extracting valuable insights from this data, enabling companies to make informed decisions about where to drill, how to increase output, and ways to extend the life of existing wells. Additionally, AI technologies are used for predictive maintenance of equipment, helping to avoid costly downtime and extend the service life of critical infrastructure.

Moreover, the push towards sustainability and reduced carbon footprints has made AI an invaluable tool for oil and gas companies. AI-driven analytics help in monitoring and reducing emissions and optimizing energy use, which is crucial as the industry faces increasing regulatory pressures to operate more sustainably.

Overall, the significant market share held by oil and gas companies in the Generative AI space underscores their pivotal role in advancing the application of AI technologies within the industry. As these companies continue to focus on innovation and efficiency, their investment in AI is expected to grow, further cementing their leadership in this market segment.

Key Market Segments

By Function

- Data Analysis and Interpretation

- Predictive Modelling

- Anomaly Detection

- Decision Support

- Other Functions

By Application

- Asset Maintenance

- Drilling Optimization

- Exploration and Production

- Reservoir Modelling

- Other Applications

By Deployment Mode

- Cloud-based

- On-premise

By End-User

- Oil and Gas Companies

- Drilling Contractors

- Equipment Manufacturers

- Service Providers

- Consulting Firms

Driver

Enhancing Operational Efficiency and Decision-Making

The integration of Generative AI in the oil and gas industry significantly enhances operational efficiency and the decision-making process. By employing advanced machine learning algorithms, Generative AI facilitates the analysis of massive datasets, enabling predictive maintenance, optimizing drilling operations, and improving safety measures.

This technology aids in forecasting equipment failures before they occur, which minimizes downtime and reduces maintenance costs, leading to an overall increase in productivity and profitability. The ability to generate predictive models from historical data and sensor readings allows for better resource management and strategic planning.

Restraint

High Implementation Costs and Complexity

Despite its benefits, the implementation of Generative AI in the oil and gas industry is hampered by high costs and complexity. The development and deployment of AI technologies require substantial investment in infrastructure, specialized hardware, and software, as well as the need for highly skilled personnel to manage and maintain these systems.

Additionally, the integration of AI into existing workflows can be challenging, requiring significant changes to legacy systems and processes. These factors contribute to the hesitation among some stakeholders to fully embrace Generative AI technologies, thereby restraining its widespread adoption.

Opportunity

Exploration and Production Optimization

Generative AI presents significant opportunities in the exploration and production domains of the oil and gas sector. By analyzing geological and geophysical data, AI algorithms can identify patterns and trends that suggest the presence of oil and gas deposits.

This capability allows companies to make more informed decisions about where to drill, optimizing exploration budgets and reducing financial risks associated with dry wells. Additionally, Generative AI enhances reservoir simulations, improves drilling parameter optimization, and offers more accurate production forecasting, which together enhance operational efficiencies and economic returns.

Challenge

Slow Adoption and Cultural Resistance

One of the main challenges facing the adoption of Generative AI in the oil and gas industry is cultural resistance and the slow pace of technological uptake. The oil and gas sector is traditionally conservative, and the shift towards AI-driven technologies often meets with skepticism from a workforce accustomed to conventional methods.

Furthermore, the complexity of AI solutions can lead to misunderstandings and reluctance among employees to adopt new tools. Ensuring sufficient training and demonstrating clear value from AI investments are crucial steps needed to overcome these barriers and fully leverage the potential of Generative AI in the sector.

Growth Factors

Generative AI plays a pivotal role in enhancing operational efficiency within the oil and gas industry. Through its advanced machine learning capabilities, Generative AI facilitates significant improvements in various operational processes. By analyzing vast amounts of data, this technology helps predict equipment maintenance needs, thereby minimizing downtime and reducing costs.

It also enables better resource management and strategic planning by generating predictive models that help anticipate future scenarios and outcomes. The push for sustainability is also a significant growth factor, as Generative AI aids in environmental management and compliance, making operations not only more efficient but also environmentally friendlier.

The continual evolution of AI technology fuels its adoption in oil and gas. Innovations in AI, particularly in Generative AI, have opened new doors for exploration and production optimization. Generative AI’s ability to process and interpret complex geological data allows for more accurate predictions of reservoir behavior and optimization of drilling operations. These technological advancements are critical as they provide companies with the tools to navigate the complexities of resource extraction and management more effectively.

Emerging Trends

A notable trend is the integration of Generative AI in managing and optimizing renewable energy sources within the oil and gas sectors. Generative AI’s predictive capabilities are being used to forecast and enhance the efficiency of renewable energy production, such as wind and solar power. This not only supports operational efficiency but also aligns with global sustainability goals by facilitating smoother integration of renewable resources into the energy mix.

The trend towards more sophisticated predictive maintenance models is gaining momentum. Generative AI is at the forefront of this trend, utilizing extensive data analysis to predict equipment failures and maintenance needs before they occur. This proactive approach in maintenance not only prevents costly downtimes but also extends the lifecycle of critical infrastructure, thereby saving costs and enhancing safety across operations.

Business Benefits

One of the primary benefits of implementing Generative AI in the oil and gas industry is significant cost savings. By automating complex processes and optimizing production and maintenance schedules, companies can reduce operational costs dramatically. These efficiencies translate into enhanced profitability as less money is spent on maintenance, and downtime is reduced, ensuring continuous production and revenue generation.

Generative AI significantly enhances safety measures within the oil and gas industry. By predicting potential failures and identifying risks before they pose real threats, this technology helps in establishing a safer working environment. Moreover, the ability to simulate various operational scenarios enables companies to prepare better for emergencies, thereby managing risks more effectively and ensuring compliance with safety regulations.

Regional Analysis

In 2023, North America held a dominant market position in the generative AI sector within the oil and gas industry, capturing more than a 42.6% share. This region accounted for USD 96.7 million in revenue, underpinned by several key factors. The significant market share can primarily be attributed to the robust technological infrastructure and the early adoption of AI technologies by the oil and gas sector in this region.

North American companies have been pioneers in integrating AI to optimize drilling operations, predictive maintenance, and production planning, which has driven substantial market growth. Moreover, the presence of major AI technology developers and oil and gas giants in the United States and Canada has propelled regional advancements.

These entities have heavily invested in research and development to harness the potential of generative AI for enhancing operational efficiencies and reducing environmental impacts. The collaborative efforts between technology providers and oil and gas companies have fostered innovation, leading to the development of tailored AI solutions that meet the specific needs of the industry.

The regulatory and investment climate in North America also supports the proliferation of AI technologies in the energy sector. Governments in the region have implemented policies that encourage digital transformation in oil and gas operations, aiming to maintain competitiveness and compliance with environmental standards. Financial incentives, such as grants and tax benefits, for technology upgrades have further stimulated the adoption of generative AI solutions.

Furthermore, the drive towards digitalization in North American oil and gas operations is amplified by the need to enhance safety standards and operational reliability. The application of generative AI not only streamlines processes but also plays a critical role in risk assessment and management, predicting equipment failures before they occur. This proactive approach to maintenance and operation significantly reduces downtime and operational costs, reinforcing North America’s leading position in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of generative AI within the oil and gas sector, several key players have made significant strides through strategic acquisitions, innovative product launches, and impactful mergers.Top Key Players Covered

- Quantifind

- OpenAI

- Accenture

- DataRobot

- SAS

- IBM

- Microsoft

- Adobe

- NVIDIA

- Intel

Recent Developments

- SLB and NVIDIA Collaboration (September 2024): SLB (formerly Schlumberger) expanded its partnership with NVIDIA to develop generative AI solutions tailored for the energy sector. This collaboration aims to accelerate the deployment of AI models across SLB’s platforms, including the Delfi™ digital platform and Lumi™ data and AI platform, utilizing NVIDIA’s NeMo™ framework.

- Microsoft’s AI Initiatives in Oil and Gas (September 2024): Microsoft has been actively promoting its generative AI technologies to oil and gas companies. The company offers AI solutions designed to optimize exploration and production processes, thereby enhancing operational efficiency within the sector.

- Saudi Aramco’s Generative AI Model (March 2024): Saudi Aramco introduced its first generative AI model, Aramco Metabrain AI, at the LEAP tech conference in Riyadh. This model, trained on extensive company data, is designed to analyze drilling plans, geological data, and historical drilling metrics to recommend optimal well options.

- Abu Dhabi’s AIQ Ownership Restructuring (May 2024): Presight AI Holding acquired a 51% majority stake in AIQ, a joint venture between Abu Dhabi National Oil Company (ADNOC) and G42. This strategic move aims to leverage AI and machine learning to optimize processes and enhance profitability in the oil and gas industry.

Report Scope

Report Features Description Market Value (2023) USD 227.0 Mn Forecast Revenue (2033) USD 737 Mn CAGR (2024-2033) 12.5% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Data Analysis and Interpretation, Predictive Modelling, Anomaly Detection, Decision Support, and Other Functions), By Application (Asset Maintenance, Drilling Optimization, Exploration and Production, Reservoir Modelling, Other Applications), By Deployment Mode (Cloud-based, On-premise), By End-User (Oil and Gas Companies, Drilling Contractors, Equipment Manufacturers, Service Providers, Consulting Firms) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Quantifind, OpenAI, Accenture, DataRobot, SAS, IBM, Microsoft, Adobe, NVIDIA, Intel,Google Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Generative AI in Oil and Gas MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Oil and Gas MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Quantifind

- OpenAI

- Accenture

- DataRobot

- SAS

- IBM

- Microsoft

- Adobe

- NVIDIA

- Intel