Global Generative AI in Banking Market Based on Technology (Natural Language Processing, Deep Learning, Reinforcement Learning, Generative Adversarial Networks, Computer Vision, Predictive Analytics), By End-User (Retail Banking Customers, Small and Medium Enterprises, Investment Professionals, Compliance and Risk Management Teams, Operations and Process Optimization, Executives and Decision Makers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 119492

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

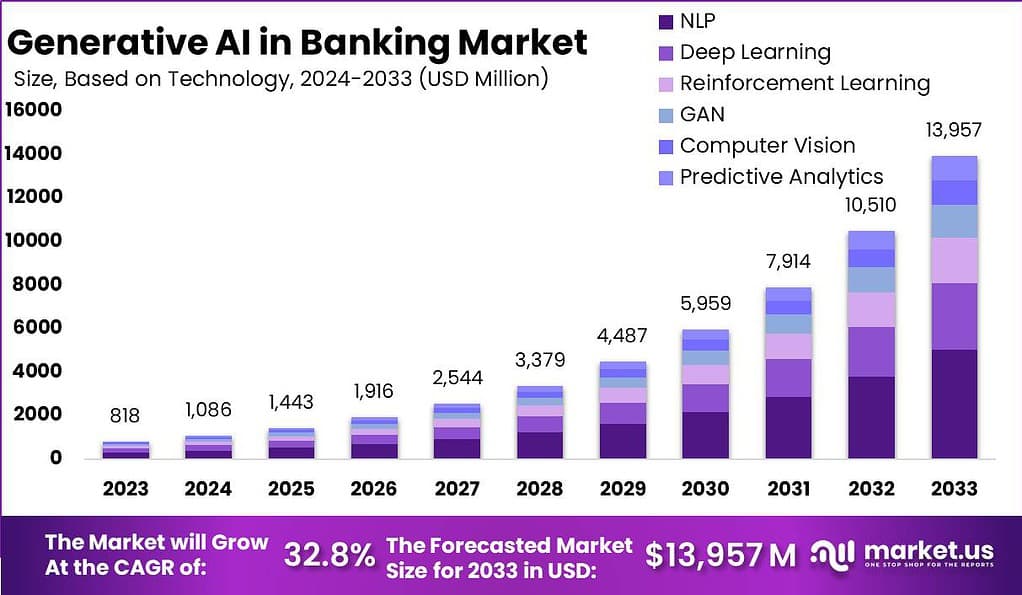

The Global Generative AI in Banking Market size is expected to be worth around USD 13,957 Million By 2033, from USD 818 Million in 2023, growing at a CAGR of 32.8% during the forecast period from 2024 to 2033.

Generative AI is transforming the banking industry by enabling more efficient processes, enhancing customer experiences, and offering new avenues for revenue generation. In the banking sector, this technology is primarily utilized for personalized customer service, risk assessment, fraud detection, and process automation. Generative AI models can analyze large volumes of data to predict customer behavior, personalize financial advice, and automate routine tasks, thereby increasing efficiency and reducing operational costs.

The market for generative AI in banking is experiencing significant growth, driven by the increasing demand for advanced analytical tools and the rising need for automation and personalized services. Financial institutions are investing heavily in AI technologies to stay competitive, enhance security measures, and meet the evolving expectations of digital-savvy customers.

The growth of this market can be attributed to the integration of AI with other technological advancements like blockchain and the Internet of Things (IoT), which further enhances its potential applications in banking. As banks continue to adopt these technologies, the market is expected to expand, offering substantial opportunities for technology providers and banking institutions alike.

Key players in the generative AI in banking market include established technology companies, specialized AI startups, and financial institutions themselves. These entities collaborate to develop innovative AI solutions that address specific banking challenges and deliver tangible business value. The market is characterized by intense competition, with continuous advancements in AI algorithms and models driving further innovation and differentiation.

The deployment of generative AI technologies is anticipated to yield significant economic benefits across various industries, with particular emphasis on the banking sector. The integration of these advanced technologies is projected to reduce costs by 9% and increase sales by the same margin, showcasing a balanced improvement in operational efficiency and revenue generation.

In the banking industry, the application of generative AI is expected to enhance productivity significantly. Estimates suggest an increase in productivity ranging from 2.8% to 4.7%, which could potentially add between $200 billion and $340 billion to the industry’s annual revenues. This substantial boost underscores the transformative potential of AI in reshaping financial services.

The utilization of machine learning and AI in investment banking is becoming increasingly prevalent. Currently, 63% of investment banks globally are employing machine learning techniques, while 60% are leveraging AI for predictive analysis. These technologies enable banks to forecast financial outcomes more accurately and manage risks more effectively.

According to research by Accenture, large language models (LLMs), a subset of AI technologies, could influence up to 90% of all working hours in the banking sector. This highlights the profound impact LLMs are expected to have on operational processes and employee productivity.

The financial value added by AI technologies to the banking industry could be as much as $1 trillion annually. This substantial figure illustrates the scale of opportunity AI presents for revenue generation and cost efficiency in global banking.

Furthermore, AI’s role in expanding loan accessibility is notable. Artificial intelligence systems have been shown to approve 27% more loan applicants while offering 16% lower interest rates compared to traditional methods. This increase in loan accessibility, combined with more favorable terms, can significantly enhance consumer satisfaction and financial inclusion.

Key Takeaways

- Generative AI in Banking Market is estimated to reach USD 13,957 Million by 2033, Riding on a Strong 32.8% CAGR throughout the forecast period.

- In 2023, the Natural Language Processing (NLP) segment held a dominant position in the generative AI banking market, capturing more than a 36% share.

- In 2023, the Retail Banking Customers segment held a dominant market position in the generative AI in banking market, capturing more than a 27% share.

- In 2023, North America held a dominant market position in the generative AI in banking sector, capturing more than a 36% share.

Based on Technology

In 2023, the Natural Language Processing (NLP) segment held a dominant position in the generative AI banking market, capturing more than a 36% share. This leading role can be attributed to NLP’s pivotal function in enhancing customer interactions and streamlining backend processes.

Banks utilize NLP technologies to interpret and understand human language in a way that allows for more intuitive and effective customer service solutions, such as chatbots and virtual assistants. These tools are capable of handling a wide array of customer queries, from basic account inquiries to complex loan applications, without human intervention, thereby improving service availability and customer satisfaction.

Furthermore, NLP is instrumental in analyzing unstructured data, such as customer feedback and social media communications, which can provide banks with valuable insights into customer needs and market trends. This capability supports more informed decision-making and strategic planning. The demand for NLP in banking is also driven by its ability to comply with regulatory requirements through the automated monitoring of communication for compliance purposes, significantly reducing the risk of penalties and reputational damage.

The dominance of the NLP segment is expected to continue as advancements in technology enhance its accuracy and functionalities. Banks are increasingly investing in AI to develop more sophisticated NLP systems that can offer deeper insights and more personalized banking experiences.

This trend is bolstered by the growing digitization of banking services and the global shift towards more dynamic, real-time customer service platforms. As NLP technology evolves, it remains at the forefront of generative AI applications in banking, promising substantial efficiency gains and customer engagement improvements.

Based on End-User

In 2023, the Retail Banking Customers segment held a dominant market position in the generative AI in banking market, capturing more than a 27% share. This segment’s leadership is largely due to the widespread adoption of generative AI technologies that significantly enhance the consumer banking experience.

Retail banking customers greatly benefit from personalized financial services and product offerings tailored to their specific needs, which are made possible by AI-driven data analysis and customer profiling. Generative AI facilitates a more engaging and responsive customer service environment.

It enables features such as AI-powered chatbots and virtual assistants that can handle a range of customer requests, from transaction inquiries to financial advice, around the clock. This not only improves customer satisfaction through enhanced accessibility and responsiveness but also reduces operational costs for banks by automating routine tasks.

Moreover, the increasing reliance on digital banking solutions by consumers calls for robust cybersecurity measures, where generative AI plays a crucial role. AI algorithms are employed to detect and prevent fraud, enhancing security for online transactions. As retail banking continues to evolve with technology, the integration of generative AI into this sector is expected to grow, driven by the demand for more sophisticated, secure, and customer-centric banking solutions.

Key Market Segments

Based on Technology

- Natural Language Processing

- Deep Learning

- Reinforcement Learning

- Generative Adversarial Networks

- Computer Vision

- Predictive Analytics

Based on End-User

- Retail Banking Customers

- Small and Medium Enterprises

- Investment Professionals

- Compliance and Risk Management Teams

- Operations and Process Optimization

- Executives and Decision Makers

Driver

Enhanced Customer Experience and Operational Efficiency

One significant driver for the adoption of generative AI in banking is the enhanced customer experience and operational efficiency it offers. Generative AI technologies, such as chatbots and personalized recommendation systems, provide customers with quick, tailored responses and advice. This not only improves customer satisfaction by minimizing wait times and offering 24/7 service but also allows banks to optimize their workforce, redirecting human efforts to more complex tasks and strategic initiatives.

Additionally, AI-driven analytics help banks understand customer behaviors and preferences in depth, enabling them to offer more relevant products and improve customer retention rates. This dual benefit of customer service improvement and operational cost reduction makes generative AI a compelling investment for banks.

Restraint

High Implementation Costs and Complexity

The high costs and complexity associated with implementing generative AI technologies pose a significant restraint in the banking sector. Developing or integrating sophisticated AI systems requires substantial initial investment in terms of technology, infrastructure, and skilled personnel. The complexity of AI technology also necessitates ongoing maintenance and updates, which adds to the operational costs.

Additionally, banks often face challenges in integrating new AI systems with their existing IT infrastructure, which can be time-consuming and disruptive to current operations. These factors can deter especially smaller banks or those in developing regions from adopting advanced AI solutions, thus slowing down the market growth.

Opportunity

Increasing Digitalization of Banking Services

The increasing digitalization of banking services presents a major opportunity for the expansion of generative AI in the industry. As customers increasingly prefer online and mobile banking solutions, banks are pushed to enhance their digital offerings.

Generative AI can play a pivotal role in this transformation by providing advanced features like predictive analytics for personalized financial advice, automated customer service portals, and real-time fraud detection. The growing acceptance of digital banking across demographics provides a ripe environment for integrating AI solutions, offering banks the chance to innovate and stay competitive in a rapidly changing market.

Challenge

Data Privacy and Security Concerns

Data privacy and security remain significant challenges in the deployment of generative AI in banking. Banks collect and process vast amounts of sensitive personal and financial information, making them prime targets for cyberattacks. The use of AI, while beneficial for analyzing and utilizing this data, also raises concerns about the potential for data breaches and privacy violations.

Ensuring the security of AI systems and maintaining customer trust is paramount. Banks must adhere to stringent regulatory requirements regarding data protection, which can complicate the implementation of AI solutions. Balancing innovation with security is a critical challenge that banks must navigate as they expand their use of generative AI technologies.

Growth Factors

- Advancements in AI and Machine Learning: Continuous improvements in AI technologies, including machine learning and deep learning, are enhancing the capabilities of generative AI, making it more accurate, efficient, and adaptable to complex banking functions.

- Rising Demand for Personalized Banking Services: As customer expectations evolve, there is a significant push towards personalized banking experiences. Generative AI facilitates this by analyzing customer data to offer tailored advice, product recommendations, and risk assessments.

- Operational Cost Reduction: AI technologies help banks reduce operational costs by automating routine tasks such as customer service, transaction processing, and compliance checks, allowing human resources to focus on higher-value activities.

- Enhanced Cybersecurity Measures: Generative AI improves fraud detection and cybersecurity, crucial for maintaining trust and safety in digital banking. AI algorithms can identify patterns that indicate fraudulent activity more efficiently than traditional methods.

- Regulatory Compliance: Generative AI aids banks in complying with evolving regulatory requirements by automating data management and reporting processes, ensuring accuracy and timeliness in compliance-related tasks.

Emerging Trends

- AI-Powered Digital Assistants: The integration of sophisticated AI-powered digital assistants in banking apps and websites to provide real-time, interactive customer support and financial advice is becoming increasingly common.

- Blockchain Integration: Combining generative AI with blockchain technology to enhance security and transparency in transactions, particularly in areas like identity verification and smart contracts.

- Voice-Activated Banking: The rise of voice-activated banking services powered by AI, allowing customers to perform banking tasks through voice commands, which improves accessibility and user experience.

- Ethical AI Adoption: There is a growing focus on ethical AI, which involves developing AI systems that make fair and unbiased decisions, particularly in loan approvals and risk assessments.

- AI in Regulatory Technology (RegTech): The use of AI to streamline and improve regulatory processes in banking is expanding, helping institutions manage their regulatory compliance through efficient data processing and management.

Regional Analysis

In 2023, North America held a dominant market position in the generative AI in banking sector, capturing more than a 36% share. This prominence is largely due to the region’s advanced technological infrastructure and the early adoption of innovative AI solutions by its financial institutions.

North American banks are pioneers in integrating AI into their operations, driven by a competitive market environment that favors efficiency and innovation. The presence of major AI technology providers and substantial investments in research and development further support the widespread adoption and advancement of generative AI technologies in this region.

Moreover, the regulatory landscape in North America, particularly in the United States and Canada, has evolved to support the safe and effective use of AI in banking. Regulatory bodies have been proactive in establishing guidelines that encourage the ethical use of AI while ensuring customer data protection and privacy. This regulatory support has helped mitigate risks associated with AI deployment, fostering trust and stability in the adoption of new technologies.

Additionally, the increasing demand for personalized banking services among North American consumers has driven banks to invest in AI to enhance customer experience. This includes the use of AI for personal financial management, customized product offerings, and real-time customer support, all of which contribute to North America’s leading position in the generative AI banking market. As technology continues to evolve and customer expectations grow, the region is expected to maintain its lead, driven by ongoing innovation and a supportive ecosystem for AI development in banking.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The generative AI in banking market is characterized by the presence of several key players that drive innovation and competition. Prominent companies like IBM, Microsoft, and Google dominate due to their extensive technological capabilities, comprehensive AI solutions, and strong global presence. These companies offer a range of AI tools and platforms that assist banks in automating operations, enhancing customer service, and improving security. IBM’s Watson, for example, has been widely adopted for its powerful natural language processing abilities that help in customer interaction and personalized banking services.

Another significant player is Salesforce, which integrates AI into its customer relationship management (CRM) solutions to provide banks with enhanced customer insights and predictive analytics. Similarly, Palantir Technologies offers advanced data analytics solutions that help financial institutions in fraud detection and risk management. These tools are essential for banks looking to leverage big data for strategic decision-making and maintaining compliance with regulatory standards

Top Key Players in the Market

- OpenAI

- IBM

- Microsoft

- Salesforce

- Amazon Web Services

- Traditional Banking Institutions

- Other Key Players

Recent Developments

- Microsoft and OpenAI: In 2023, Microsoft enhanced its Azure OpenAI Service by integrating GPT-4, offering advanced AI models that can better support banking operations such as content generation and data summarization. This update emphasizes security and privacy, which are crucial in the banking sector.

- In March 2024, Goldman Sachs launched a new AI-driven tool designed to optimize asset allocation for wealth management clients. This tool uses generative AI to create customized investment strategies based on individual risk profiles and financial goals, marking a significant advancement in personalized financial planning services.

- Deloitte: On April 13, 2023, Deloitte launched a new Generative AI practice aimed at helping clients harness the power of disruptive AI technologies to enhance productivity and accelerate business innovation. This practice integrates deep industry experience, skilled AI engineers, and strategic partnerships to facilitate the adoption and implementation of generative AI solutions.

- Finastra: In early 2024, Finastra underscored the transformative potential of generative AI in banking. The company has been focusing on how generative AI can drive innovation and efficiency within financial services, helping banks to reimagine their products and services through enhanced digital capabilities.

Report Scope

Report Features Description Market Value (2023) USD 818 Mn Forecast Revenue (2033) USD 13,957 Mn CAGR (2024-2033) 32.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Technology (Natural Language Processing, Deep Learning, Reinforcement Learning, Generative Adversarial Networks, Computer Vision, Predictive Analytics), By End-User (Retail Banking Customers, Small and Medium Enterprises, Investment Professionals, Compliance and Risk Management Teams, Operations and Process Optimization, Executives and Decision Makers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OpenAI, Google, IBM, Microsoft, Salesforce, Amazon Web Services, Traditional Banking Institutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI in banking?Generative AI refers to AI systems that can produce new content, such as images, text, or even entire datasets, based on the patterns and examples it has been trained on. In the banking sector, Generative AI is used to create synthetic data, generate personalized content for customers, improve fraud detection algorithms, and streamline various processes.

How big is Generative AI in Banking Market?The Global Generative AI in Banking Market size is expected to be worth around USD 13,957 Million By 2033, from USD 818 Million in 2023, growing at a CAGR of 32.8% during the forecast period from 2024 to 2033.

Which companies are leading in the development of Generative AI in Banking?OpenAI, Google, IBM, Microsoft, Salesforce, Amazon Web Services, Traditional Banking Institutions, Other Key Players

Which region has the biggest share in Generative AI in Banking Market?In 2023, North America held a dominant market position in the generative AI in banking sector, capturing more than a 36% share.

What are the challenges associated with implementing Generative AI in banking?Challenges include ensuring data privacy and security when generating synthetic data, mitigating the risk of biased or inaccurate outputs, integrating Generative AI systems with existing banking infrastructure, and addressing regulatory compliance requirements.

Generative AI in Banking MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Banking MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- OpenAI

- IBM

- Microsoft

- Salesforce

- Amazon Web Services

- Traditional Banking Institutions

- Other Key Players