Global Generative AI for Semiconductor Design Market By Deployment Mode(Cloud-Based, On-Premise), By Industry Vertical(Consumer Electronics, Automotive, Telecommunications, Aerospace and Defense, Industrial Automation, Healthcare, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 125963

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

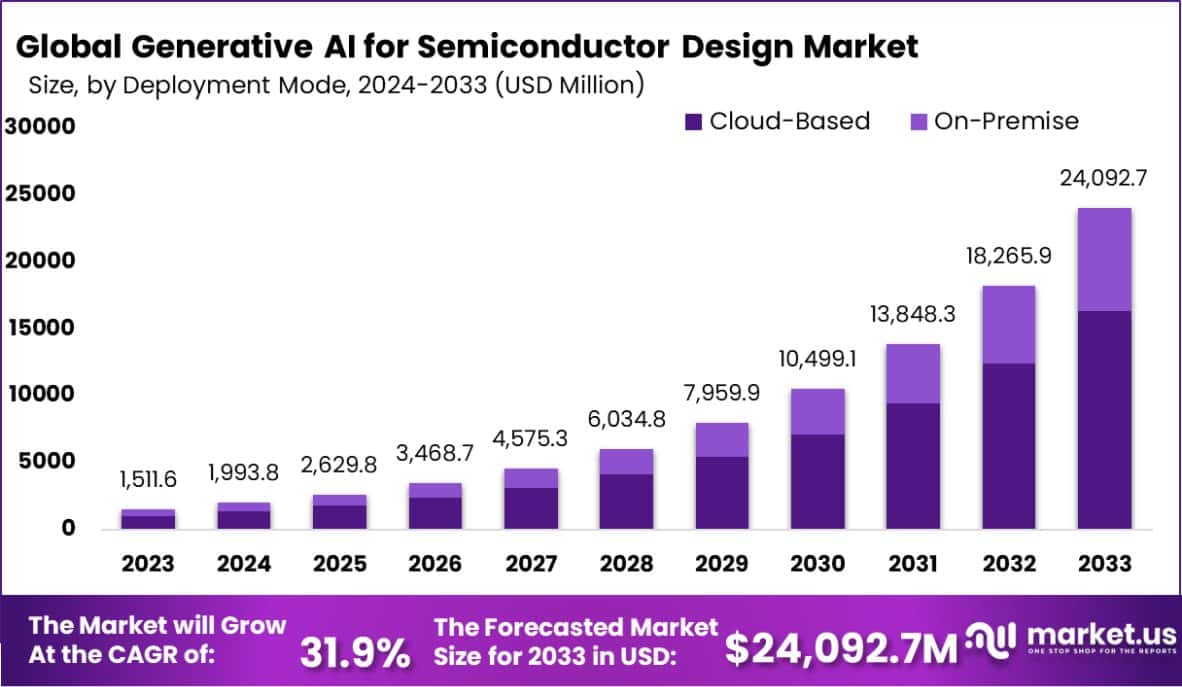

The Global Generative AI for Semiconductor Design Market size is expected to be worth around USD 24,092.7 Million By 2033, from USD 1,511.6 Million in 2023, growing at a CAGR of 31.9% during the forecast period from 2024 to 2033.

The Generative AI for Semiconductor Design Market encompasses advanced AI-driven solutions that enhance semiconductor design processes by optimizing chip architecture and expediting time-to-market. These technologies facilitate intricate design assessments and innovation, providing a crucial competitive edge in the rapidly evolving semiconductor industry.

Generative AI for Semiconductor Design refers to the integration of AI technologies to automate and optimize the semiconductor manufacturing process. This approach significantly reduces design complexities and speeds up development, providing a strategic advantage in the fast-paced tech industry.

The market for Generative AI in semiconductor design is poised for substantial growth, driven by increasing demand for more efficient and powerful chips. Opportunities abound as companies invest in AI to innovate and refine semiconductor technologies, ensuring their adaptability in emerging applications like IoT and autonomous vehicles.

The Generative AI for Semiconductor Design Market is currently experiencing an accelerated transformation, driven by significant technological advancements and industry needs. The complexity and cost of semiconductor design, especially at advanced nodes, have risen sharply. Developing a 5nm chip, for example, now demands approximately 864 engineer days, marking a considerable increase in labor and time investment.

Moreover, the financial outlay for chip design at these advanced nodes has escalated by 2-3 times over previous generations, placing considerable economic pressure on manufacturers. This uptick in costs and complexity underscores the critical need for innovative solutions like generative AI, which promises to streamline design processes and reduce time-to-market.

In this dynamic landscape, NVIDIA has established a dominant position, holding a 92% share in the data center GPU segment, vital for powering generative AI applications. Additionally, the alliance between OpenAI and Microsoft commands a 69% stake in the foundational models and platforms market, emphasizing their significant influence in shaping the future of AI-driven design technologies.

Key Takeaways

- The Global Generative AI for Semiconductor Design Market size is expected to be worth around USD 24,092.7 Million By 2033, from USD 1,511.6 Million in 2023, growing at a CAGR of 31.9% during the forecast period from 2024 to 2033.

- In 2023, On-Premise held a dominant market position in the Deployment Mode segment of Generative AI for Semiconductor Design Market, capturing more than a 58.9% share.

- In 2023, Consumer Electronics held a dominant market position in the Industry Vertical segment of Generative AI for Semiconductor Design Market, capturing more than a 34.5% share.

- Asia-Pacific dominated a 38.1% market share in 2023 and held USD 575.9 Million in revenue from the Generative AI for Semiconductor Design Market.

Deployment Mode Analysis

In 2023, On-Premise held a dominant market position in the Deployment Mode segment of the Generative AI for Semiconductor Design Market, capturing more than a 58.9% share. This preference for on-premise solutions can be attributed to their robust security features and the control they offer over sensitive data, which is paramount in the semiconductor industry.

On-premise systems ensure that critical intellectual property and proprietary design processes remain within the physical confines of the company, a non-negotiable requirement for many industry leaders concerned with data breaches and industrial espionage.

Conversely, the Cloud-Based segment also showed promising growth, driven by its scalability and the reduced need for upfront capital investment. Cloud solutions offer semiconductor companies the flexibility to leverage vast computational resources on demand, which is crucial for running complex AI algorithms and handling large datasets inherent in generative AI applications.

As cloud security technologies continue to advance, it is anticipated that this segment will increase its market share, especially among startups and mid-size enterprises looking to minimize costs and enhance collaborative opportunities in semiconductor design. Together, these trends underline a dynamic competitive landscape, where the integration of on-premise and cloud-based solutions will likely shape future strategies in the market.

Industry Vertical Analysis

In 2023, Consumer Electronics held a dominant market position in the Industry Vertical segment of the Generative AI for Semiconductor Design Market, capturing more than a 34.5% share. This significant market penetration is driven by the relentless demand for smarter, more efficient consumer devices, which require advanced semiconductor chips that enhance processing capabilities and power management.

Generative AI plays a pivotal role in meeting these requirements by enabling more rapid and innovative chip designs, significantly reducing time-to-market for new consumer electronics products.

Other key segments such as Automotive, Telecommunications, Aerospace and Defense, Industrial Automation, and Healthcare also benefit from generative AI technologies. The Automotive sector, for example, utilizes these innovations to develop chips that support advanced driver-assistance systems (ADAS) and electric vehicle functionalities. The telecommunications industry leverages generative AI to optimize designs for 5G technology components, enhancing performance and efficiency.

Despite these advancements, the Aerospace and Defense segment follows closely, where high reliability and precision are paramount. Similarly, the Industrial Automation and Healthcare sectors are increasingly adopting generative AI to manage complex designs required for robotics and medical devices, respectively. As these industries continue to evolve, the role of generative AI in semiconductor design becomes increasingly critical, pointing towards broader adoption across various verticals.

Key Market Segments

Deployment Mode

- Cloud-Based

- On-Premise

Industry Vertical

- Consumer Electronics

- Automotive

- Telecommunications

- Aerospace and Defense

- Industrial Automation

- Healthcare

- Other Industry Verticals

Drivers

Generative AI Boosts Chip Design

Generative AI is revolutionizing the semiconductor design market by significantly accelerating the development process and reducing associated costs. As chip designs become increasingly complex due to technological advancements, the need for efficient, error-free, and rapid production cycles is more critical than ever.

Generative AI addresses these challenges by automating and optimizing design tasks that traditionally require extensive human input and time. This AI-driven approach enables designers to quickly explore a broader array of design alternatives, improving performance, power efficiency, and chip area utilization.

Moreover, as the cost and time required to develop chips at advanced nodes continue to rise, the economic benefits provided by generative AI become even more compelling. This technological shift not only speeds up the design process but also enhances the overall quality and innovation of semiconductor products, making generative AI a key driver in the industry’s future growth.

Restraint

Challenges Limiting AI Design Adoption

Despite the promising advancements, the Generative AI for Semiconductor Design Market faces significant restraints, particularly the high initial costs and complexity of AI implementation. Integrating generative AI into existing semiconductor design frameworks requires substantial upfront investment in both hardware and software.

Additionally, the complexity of AI models and the need for specialized expertise can pose barriers for companies, especially smaller firms and those new to AI. These factors can slow down the adoption rate, as organizations may hesitate to commit significant resources without clear, immediate returns.

Furthermore, concerns about data security and intellectual property protection when using cloud-based AI solutions also deter some companies from fully embracing these technologies. These challenges highlight the need for more streamlined, cost-effective AI solutions and enhanced security measures to broaden the adoption of generative AI in semiconductor design.

Opportunities

Expanding AI in Chip Manufacturing

The Generative AI for Semiconductor Design Market offers significant opportunities for growth and innovation, particularly as demand for advanced electronics continues to surge. The increasing complexity of devices such as smartphones, IoT gadgets, and autonomous vehicles necessitates more sophisticated semiconductor chips, creating a substantial market for AI-enhanced design solutions.

These technologies enable faster, more efficient development cycles and the possibility to explore new, innovative chip architectures that were previously unfeasible due to design constraints or cost limitations. Additionally, the push towards miniaturization and energy efficiency in electronics further amplifies the need for precise, AI-driven design tools.

As industries continue to evolve towards more automated and intelligent systems, the integration of generative AI in semiconductor design not only meets these critical demands but also opens up new avenues for technological advancements and market leadership.

Challenges

Navigating AI Design Complexity

One of the significant challenges in the Generative AI for Semiconductor Design Market is managing the sophistication and integration of AI technologies. As semiconductor designs become more complex, integrating AI requires seamless compatibility with existing design processes, which often involves significant overhauls of legacy systems.

The steep learning curve associated with these AI tools can also deter adoption, especially among firms with limited technical expertise. Furthermore, the reliability and predictability of AI-generated designs remain concerns, as any errors could lead to costly recalls or failures in critical applications.

Additionally, regulatory and ethical considerations around the use of AI in industrial design processes complicate its widespread adoption, requiring companies to navigate a maze of compliance issues while striving to innovate. Addressing these challenges demands ongoing development in AI robustness, user-friendly interfaces, and regulatory frameworks to fully harness AI’s potential in semiconductor design.

Growth Factors

- Rapid technological advancements: Continuous innovations in AI technology are enabling more complex and efficient semiconductor designs, driving industry growth.

- Increasing complexity of electronic devices: As devices become smarter and more feature-rich, the demand for advanced chip designs escalates, pushing the boundaries of traditional design methodologies.

- Demand for reduced time-to-market: Generative AI significantly cuts down design and testing time, allowing companies to accelerate product development cycles and respond quickly to market changes.

- Scalability of AI solutions: AI’s scalability makes it possible to expand design capabilities without proportional increases in cost or resource allocation, making it a cost-effective solution for growing firms.

- Global expansion of semiconductor markets: As emerging markets increase their technological capabilities, the demand for semiconductors rises, providing a larger market for AI-enhanced design tools.

- Integration with existing CAD tools: Generative AI integrates seamlessly with current computer-aided design (CAD) systems, enhancing their capabilities and improving user adoption across the semiconductor industry.

Emerging Trends

- Collaboration between AI and human designers: Increasingly, AI tools are being designed to complement human expertise, allowing for more intuitive design interfaces and collaborative workflows that enhance productivity and creativity.

- Customizable AI solutions: As different semiconductor firms have varied requirements, customizable AI solutions are becoming more prevalent, offering tailored functionalities that match specific design needs and industry standards.

- Integration with cloud computing: The integration of cloud computing with generative AI allows for unparalleled scalability and accessibility, enabling companies to handle complex computations and large data sets more efficiently.

- Advancements in machine learning algorithms: New developments in machine learning algorithms are enabling more precise and efficient simulations and testing, reducing the time and cost associated with semiconductor design.

- Focus on sustainability: Generative AI is being leveraged to create more energy-efficient chip designs, contributing to the global push towards sustainability by reducing the overall environmental impact of semiconductor manufacturing.

- Regulatory compliance automation: AI is increasingly being used to automate compliance with international standards and regulations, ensuring that new designs meet necessary safety and quality benchmarks without extensive manual oversight.

Regional Analysis

The Generative AI for Semiconductor Design Market is experiencing dynamic growth across various global regions, each contributing uniquely to the industry’s expansion. Asia-Pacific is the market leader, holding a dominant share of 38.1%, equivalent to USD 575.9 million. This region’s dominance is primarily due to its robust electronics manufacturing sector and significant investments in technological advancements. The presence of major semiconductor manufacturing hubs in countries like South Korea, Taiwan, and China fuels the demand for advanced AI-driven design tools to maintain a competitive edge.

In North America, the market is driven by the presence of leading technology companies and substantial investments in R&D activities. The region’s focus on innovative technologies and early adoption of AI solutions contribute to its strong market position. Europe follows closely, with a keen emphasis on integrating AI into manufacturing to enhance design efficiency and reduce operational costs.

Meanwhile, the Middle East & Africa, and Latin America are emerging as potential growth areas. These regions are gradually embracing digital transformation in manufacturing processes, including semiconductor design. Although their market shares are currently smaller, increasing technological adoption and industrial modernization are expected to accelerate growth in these regions over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Generative AI for Semiconductor Design Market is significantly shaped by the contributions of key players like Synopsys, Inc., Cadence Design Systems, Inc., and Google LLC. Each of these companies brings distinct strengths and strategic initiatives that drive innovation and market growth.

Synopsys, Inc. is a frontrunner, leveraging its extensive experience in electronic design automation to integrate generative AI into its offerings. The company’s AI-enhanced tools are pivotal in simplifying complex semiconductor design processes, making them faster and more efficient. This leadership in innovation not only solidifies Synopsys’s market position but also sets industry standards for AI applications in semiconductor design.

Cadence Design Systems, Inc. is another major contender, known for its comprehensive suite of software tools that synergize well with generative AI technologies. Cadence’s commitment to continuous improvement and customer-centric solutions enables it to adapt swiftly to evolving market demands, thus maintaining its competitive edge.

Google LLC, although traditionally not a semiconductor company, impacts the market through its cutting-edge AI and machine learning platforms. Google’s advancements in AI algorithms offer significant potential for enhancing semiconductor design, particularly in optimizing chip performance and reducing energy consumption. This involvement pushes the boundaries of what generative AI can achieve in semiconductor design, influencing broader market dynamics.

Top Key Players in the Market

- Synopsys, Inc.

- Cadence Design Systems, Inc.

- Google LLC

- Siemens AG

- Amazon Web Services, Inc.

- Other Key Players

Recent Developments

- In August 2023, AWS launched a new cloud-based service specifically tailored for generative AI applications in semiconductor design. This innovative platform is designed to reduce the time and cost associated with chip development, directly addressing industry bottlenecks.

- In July 2023, Cadence announced a major update to their software suite, introducing advanced generative AI features that further automate and optimize semiconductor design processes. This update follows a $200 million investment in R&D, reflecting their commitment to maintaining a technological edge in the market.

- In June 2023, Siemens AG enhanced its semiconductor design capabilities by acquiring a startup specializing in AI-driven chip layout optimization. This move, costing approximately $350 million, strategically boosts their existing technology portfolio.

Report Scope

Report Features Description Market Value (2023) USD 1,511.6 Million Forecast Revenue (2033) USD 24,092.7 Million CAGR (2024-2033) 31.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Deployment Mode(Cloud-Based, On-Premise), Industry Vertical(Consumer Electronics, Automotive, Telecommunications, Aerospace and Defense, Industrial Automation, Healthcare, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Synopsys, Inc., Cadence Design Systems, Inc., Google LLC, Siemens AG, Amazon Web Services, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI for Semiconductor Design Market?The Generative AI for Semiconductor Design Market encompasses advanced AI-driven solutions that enhance semiconductor design processes by optimizing chip architecture and expediting time-to-market. These technologies facilitate intricate design assessments and innovation, providing a crucial competitive edge in the rapidly evolving semiconductor industry.

How big is Generative AI for Semiconductor Design Market?The Global Generative AI for Semiconductor Design Market size is expected to be worth around USD 24,092.7 Million By 2033, from USD 1,511.6 Million in 2023, growing at a CAGR of 31.9% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Generative AI for Semiconductor Design Market?Generative AI is transforming semiconductor design by automating tasks, speeding up development, and reducing costs. It enables more efficient and innovative chip designs, addressing the increasing complexity and economic demands of modern semiconductor production.

What are the emerging trends and advancements in the Generative AI for Semiconductor Design Market?Generative AI is transforming semiconductor design by enhancing human collaboration, offering customizable solutions, and integrating cloud computing for efficiency. It's advancing machine learning, promoting sustainability, and automating regulatory compliance, significantly optimizing the design process.

What are the major challenges and opportunities in the Generative AI for Semiconductor Design Market?The Generative AI for Semiconductor Design Market is driven by the need for sophisticated chip designs for advanced electronics, offering opportunities for enhanced efficiency and innovation. However, the complexity of integrating AI, steep learning curves, and regulatory challenges pose significant obstacles to its widespread adoption.

Who are the leading players in the Generative AI for Semiconductor Design Market?Synopsys, Inc., Cadence Design Systems, Inc., Google LLC, Siemens AG, Amazon Web Services, Inc., Other Key Players

Generative AI for Semiconductor Design MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI for Semiconductor Design MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Synopsys, Inc.

- Cadence Design Systems, Inc.

- Google LLC

- Siemens AG

- Amazon Web Services, Inc.

- Other Key Players