Global Gen-Z Shopping Avatars Market Size, Share and Analysis Report By Component (Avatar Creation & Customization Software, AI Styling & Recommendation Engines, Virtual Try-On & Integration Services), By Avatar Type (2D Stylized Avatars, 3D Hyper-realistic Avatars, Anime/Game-inspired Avatars), By Application (Virtual Fashion & Apparel Try-On, Cosmetics & Beauty Product Testing, Virtual Social Shopping & Hauls, Gaming & Metaverse Fashion, Others), By Platform (Social Media & Messaging Apps, Gaming & Metaverse Platforms, Branded Retail Apps & Websites, Standalone Avatar Apps, Others), By End-User (Individual Gen-Z Consumers, Fashion & Beauty Brands, Retail & E-commerce Platforms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172820

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

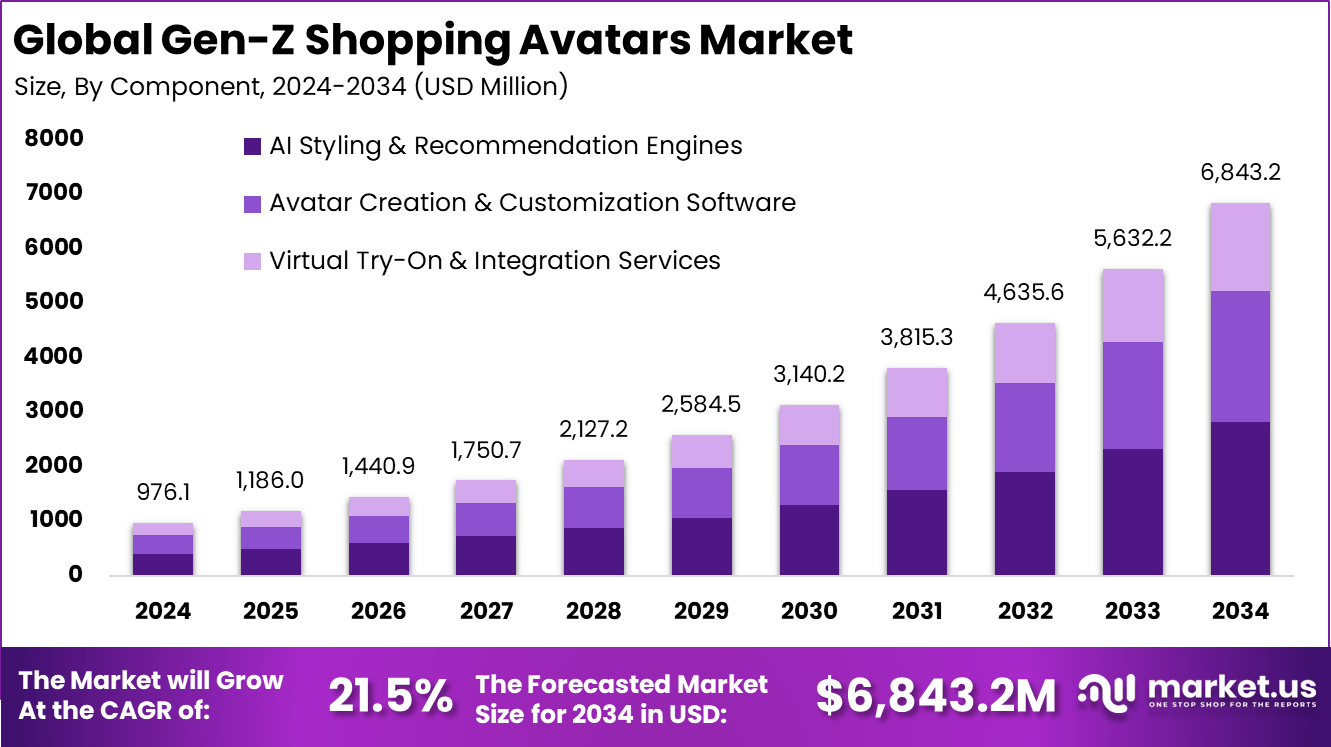

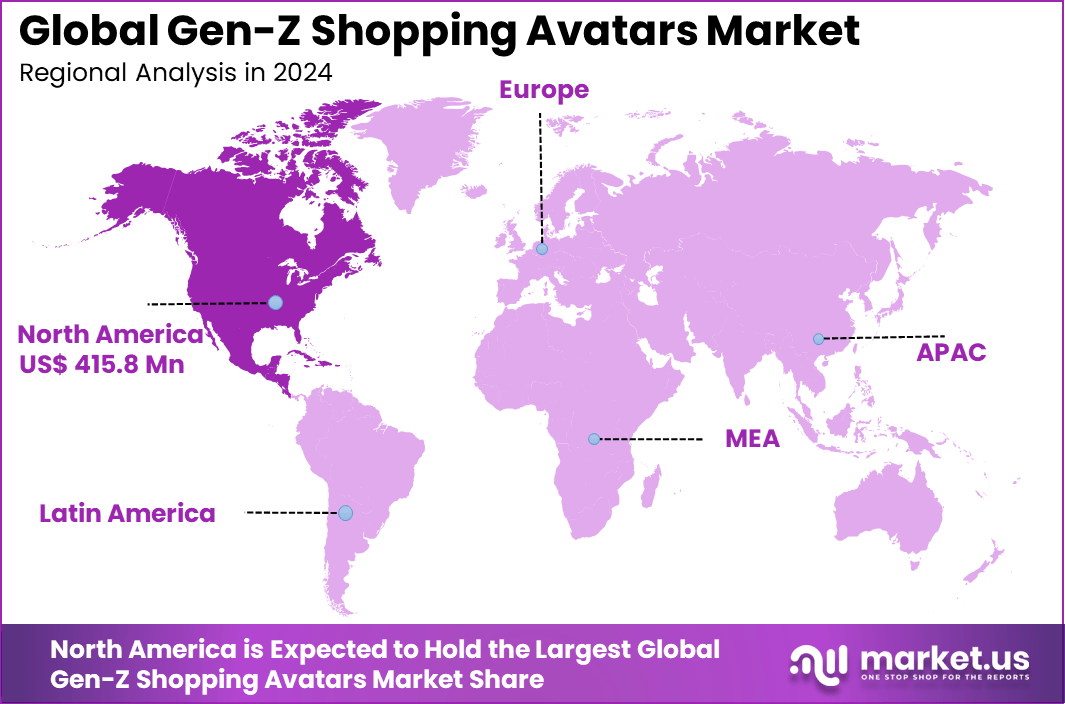

The Global Gen-Z Shopping Avatars Market size is expected to be worth around USD 6,843.2 Million By 2034, from USD 1,186 Million in 2025, growing at a CAGR of 21.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominan Market position, capturing more than a 42.6% share, holding USD 415.8 Million revenue.

The Gen Z Shopping Avatars market can be described as the use of digital avatars, virtual assistants, and AI based characters to guide product discovery, try on, and checkout across e commerce, social commerce, and immersive virtual spaces. These avatars are used as interactive shopping layers that simulate a stylist, store associate, or creator, while linking directly to product pages and payment flows. Strong alignment has been observed with Gen Z shopping habits because identity expression and social content are already central to how products are evaluated and shared.

Social commerce and creator-led discovery are major drivers, because Gen Z often finds products through feeds, short videos, and community signals rather than traditional category browsing. When shopping starts in social environments, an avatar becomes a practical bridge between inspiration and purchase, by showing how items could look on a person and how they fit a style.

Demand for shopping avatars surges as Gen Z spends more time in virtual spaces. They buy digital clothes to fit online events and chats perfectly. 74% already own avatar outfits from games, craving that seamless digital self. It beats traditional shopping hassles like lines or unfit returns. Social proof from peers amps it up further. Younger users see avatars as core to their identity online. This steady pull ensures growing everyday use across apps and platforms.

For instance, in January 2025, Infinite Reality acquired Obsess, Inc., boosting metaverse shopping with 3D stores for 400+ brands like Ralph Lauren. Obsess’s self-service Ava builder lets brands craft immersive avatar experiences, driving Gen Z’s social commerce in VR and Roblox.

Key Takeaway

- AI styling and recommendation engines led components with a 41.3% share, reflecting strong demand for personalized fashion discovery and automated outfit suggestions.

- 2D stylized avatars dominated avatar types at 52.7%, favored for their ease of creation, lower processing needs, and strong appeal on social and mobile platforms.

- Virtual fashion and apparel try-on accounted for 48.6% of applications, driven by Gen Z preference for interactive and confidence-building shopping experiences.

- Social media and messaging apps captured 58.4% of platform usage, highlighting the role of social commerce and conversational shopping in Gen Z buying behavior.

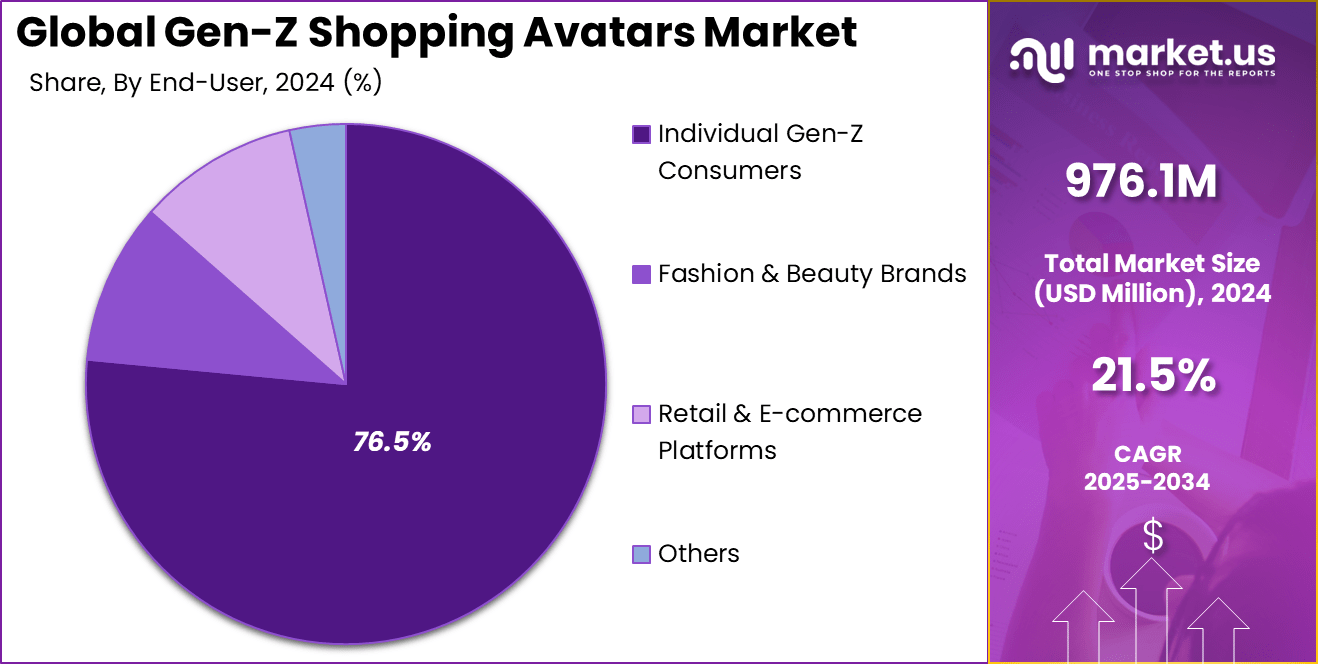

- Individual Gen Z consumers represented 76.5% of end users, underlining direct-to-consumer adoption and high engagement among digital-native shoppers.

- North America held 42.6% of the global market, supported by advanced digital retail ecosystems and high social media penetration.

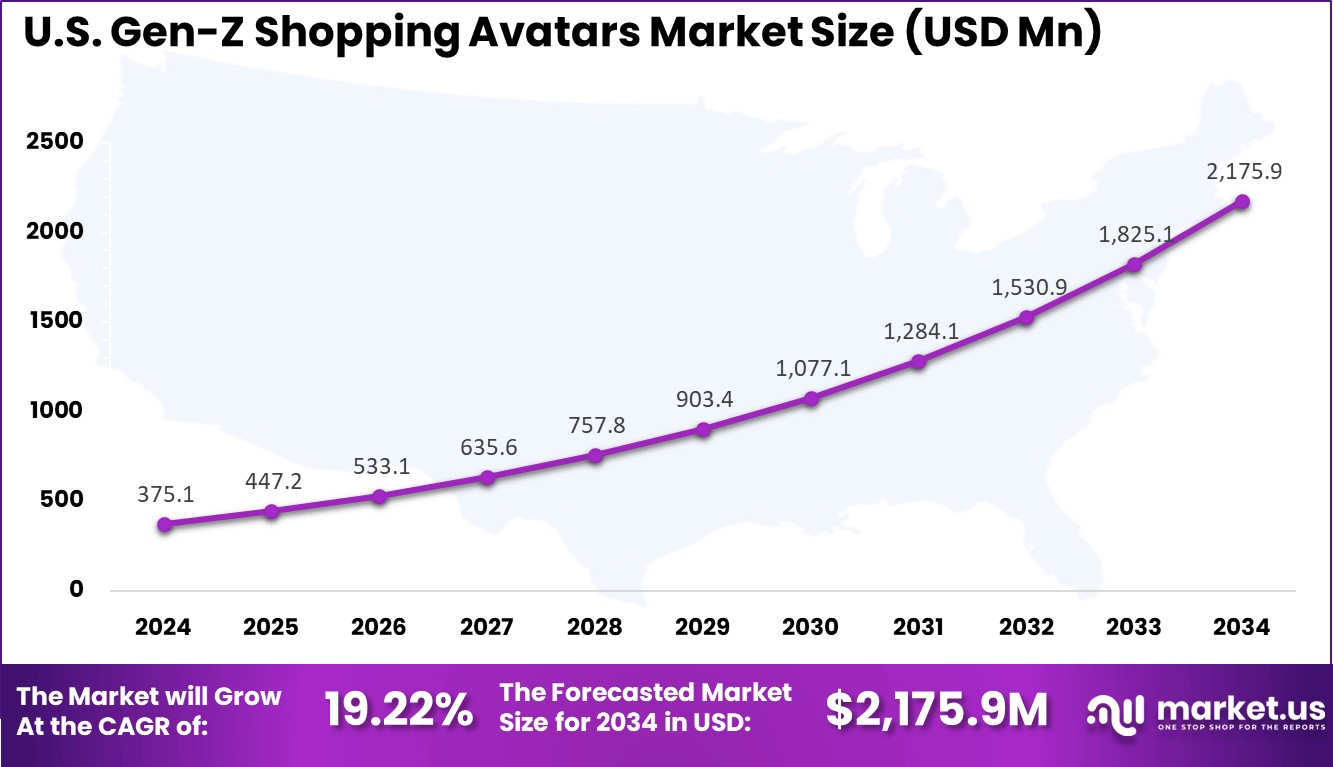

- The U.S. market reached USD 375.1 million in 2024 and is expanding at a 19.22% CAGR, driven by growth in virtual fashion, social shopping, and AI-powered personalization.

Quick Facts

Avatar Creation and Usage Trends

- More than 52% of Gen Z respondents report having created a virtual avatar, showing broad familiarity with digital self-representation.

- In the U.S., 85% of Gen Z users have created a Bitmoji avatar, with around 250 million people using Bitmoji daily.

- About 56% of Gen Z consumers prioritize styling their avatars over their physical appearance, highlighting the emotional and social value of digital identity.

- Avatars are increasingly treated as extensions of personal expression rather than simple gaming characters.

- Digital fashion strongly shapes offline behavior, with 84% of Gen Z and Gen Alpha consumers saying their real-world fashion choices are inspired by how they dress their avatars.

- This crossover effect is driving brands to align virtual collections with physical product lines.

- Over 60% of younger consumers purchase digital outfits for their avatars, reflecting willingness to spend on non-physical goods.

- In 2023 alone, users on Roblox bought 1.65 billion digital fashion items, underlining scale and monetization potential.

Spending Habits

- Around 52% of Gen Z users on avatar-driven platforms are willing to spend up to USD 10 per month on avatar styling and accessories.

- Brand Perception and Loyalty

- About 84% of Gen Z consumers report trying a brand in the physical world after first engaging with it through a virtual avatar experience.

- Brands emphasizing sustainability, inclusivity, and technology alignment are more likely to build long-term loyalty with this group.

- Gen Z males show higher likelihood than females to purchase digital clothing for avatars and often express interest in owning the same branded outfits in real life.

By Component

AI styling and recommendation engines account for 41.3%, showing their central role in shopping avatar platforms. These engines analyze user preferences, fashion trends, and browsing behavior to suggest outfits. Accurate recommendations improve relevance and personalization for Gen-Z users. Automated styling reduces the effort required to explore fashion options. This component enhances engagement and purchase confidence.

Adoption of AI styling engines is driven by demand for personalized digital experiences. Gen-Z users expect quick and relevant fashion suggestions. These engines continuously learn from interactions to improve accuracy. Integration with product catalogs supports real-time recommendations. This sustains strong component demand.

For Instance, in December 2025, Genies, Inc. launched Smart Avatars, AI-powered characters that learn user styles and suggest outfits in real time. These avatars pull from photos and prompts to create personalized looks, dressing like the user across games and apps. Gen Z users love how it evolves with their tastes, making shopping feel intuitive and fun.

By Avatar Type

2D stylized avatars hold 52.7%, making them the most used avatar format. These avatars are lightweight and easy to render across platforms. Stylized designs appeal to Gen-Z preferences for expressive visuals. They are compatible with mobile devices and social apps. This supports widespread usage.

The dominance of 2D avatars is driven by accessibility and ease of customization. Users can quickly create and modify their avatars. Lower processing requirements improve performance on smartphones. Brands prefer 2D formats for faster deployment. This keeps adoption high.

For instance, in December 2025, Bitmoji updated its 2D avatar creator with fresh stylized options for Gen Z customization. Users tweak cartoonish looks for social shares, tying into Snapchat’s daily interactions. The simple designs load fast on mobiles, perfect for quick profile swaps and fun expressions.

By Application

Virtual fashion and apparel try-on represent 48.6%, making them the leading application. Users test clothing styles on avatars before purchasing. This reduces uncertainty around fit and appearance. Visual previews increase confidence in buying decisions. Try-on features improve overall shopping experience.

Growth in this application is driven by online fashion adoption. Gen-Z shoppers prefer interactive shopping tools. Virtual try-on helps reduce returns and indecision. Retailers benefit from higher conversion rates. This supports continued expansion.

For Instance, in October 2025, Perfect Corp. enhanced its AI Clothes Try-On with AR overlays for avatars. Shoppers see realistic fabric drapes on digital bodies, testing full outfits in motion. Gen Z shares these previews socially, cutting returns with accurate fits for diverse shapes.

By Platform

Social media and messaging apps account for 58.4%, highlighting their importance as delivery platforms. Gen-Z users spend significant time on these platforms daily. Shopping avatars integrate seamlessly into chats and feeds. This enables discovery and sharing of fashion content. Convenience drives engagement.

The preference for these platforms is driven by social interaction. Users enjoy sharing avatar looks with peers. Messaging apps support quick feedback and recommendations. Brands leverage social channels for reach. This platform dominance continues.

For Instance, in December 2025, Zepeto introduced cross-platform fashion converters for social sharing. Avatars dressed in virtual clothes move seamlessly to Instagram and TikTok feeds. Gen Z engages through stories and lives, blending shopping with daily chats effortlessly.

By End User

Individual Gen-Z consumers hold 76.5%, showing they are the primary users. This group values personalization, speed, and visual interaction. Shopping avatars align with their digital habits. Individual users explore styles independently. Ease of use supports frequent engagement.

Adoption among Gen-Z is driven by comfort with digital identities. Avatars allow self-expression without physical constraints. Users enjoy experimenting with looks virtually. Integration with social platforms increases appeal. This sustains strong demand.

For Instance, in September 2025, Genies, Inc. empowered individual users with AI avatars for personal gaming. Creators build evolving digital twins that reflect moods and styles uniquely. Gen Z treats them as extensions of identity, fueling solo customization hours.

By Region

North America accounts for 42.6%, supported by high social media usage and digital shopping adoption. The region shows strong interest in interactive retail technologies. Brands invest in avatar-based engagement tools. Mobile infrastructure supports seamless experiences. Market activity remains high.

For instance, in November 2025, Bitmoji partnered with Prada and Miu Miu to launch 34 virtual garments, including the Gen-Z favorite Small Galleria bag and Wander bag for Snapchat avatars. Users can unlock these affordable digital luxury items across profiles, stickers, Snap Maps, and AR lenses, enhancing personalized shopping experiences.

The United States reached USD 375.1 Million with a CAGR of 19.22%, reflecting solid growth. Expansion is driven by Gen-Z spending and social commerce trends. Retailers focus on immersive shopping formats. Technology adoption continues to rise. Market momentum remains positive.

For instance, in August 2025, Genies, Inc. advanced U.S. dominance in Gen-Z shopping avatars by launching AI companions and avatar autogeneration tools, enabling personalized 3D avatars from photos for immersive shopping and gaming. Their Unity integration empowers creators with game-ready avatars, blending AI intelligence with visual presence for emotional connections in virtual commerce.

Emerging Trend Analysis

The Gen-Z Shopping Avatars Market is being shaped by the rising use of immersive digital identities that allow younger consumers to explore products in virtual environments. These avatars act as personalized digital representations of shoppers that interact with online storefronts, try on products virtually, and participate in gamified shopping experiences.

This trend reflects a broader shift toward experiential retail where engagement and interaction influence purchase decisions. As virtual spaces such as metaverse platforms grow in popularity among Gen-Z users, shopping avatars are becoming a core part of digital commerce experiences. Another emerging trend is the integration of social commerce features with shopping avatars, enabling users to engage with peers, influencers, and brands in collaborative virtual settings.

Gen-Z consumers value social discovery and peer validation, and avatars facilitate shared shopping journeys through co-browsing, real-time recommendations, and community-driven styling sessions. These interactive features extend beyond traditional e-commerce by blending social interaction with purchasing pathways. This trend underscores the importance of community and content-rich engagement in Gen-Z shopping behavior.

Driver Analysis

A key driver of market growth is the strong preference among Generation Z for personalized and interactive digital experiences that go beyond static online catalogs. Gen-Z users are digital natives who expect technology to adapt to their preferences and styles.

Shopping avatars enable dynamic personalization, where virtual try-ons, custom looks, and real-time feedback align with individual tastes. This capability enhances satisfaction and increases conversion rates as shoppers feel more connected to the experience.

Another driver is the rapid adoption of mobile and immersive platforms that support avatar-based interaction, including augmented reality (AR), virtual reality (VR), and 3D visualization tools. These technologies provide the technical foundation for realistic avatar engagement, allowing users to virtually test products in lifelike scenarios.

Restraint Analysis

One restraint on the market is the challenge of ensuring seamless integration between avatar systems and existing e-commerce platforms. Many retailers operate legacy online systems that lack support for 3D visualization or real-time avatar rendering.

Integrating advanced avatar technology often requires significant development effort, middleware, and backend customization. These technical barriers can delay adoption, especially for smaller retailers with limited resources. Another restraint stems from privacy and data protection concerns related to the collection of personal preferences and user interaction data required to tailor avatar experiences.

Gen-Z consumers are generally attuned to data use policies and expect transparency and control over their information. Retailers and platform providers must navigate complex data governance and consent frameworks to avoid erosion of trust. These privacy requirements add compliance overhead and may slow market expansion.

Opportunity Analysis

A significant opportunity exists in offering cross-brand avatar ecosystems that allow users to carry their digital identity and style preferences across multiple retail platforms. Such interoperable avatar standards can simplify onboarding, enhance user loyalty, and increase lifetime value as consumers reuse their digital personas across fashion, beauty, and lifestyle brands.

Ecosystem-wide identity solutions are positioned to deepen engagement and support sustained growth. Another opportunity lies in developing avatar-based analytics that provide retailers with actionable insight into Gen-Z shopping behavior.

By analyzing how avatars interact with virtual products, brands can refine merchandising strategies, optimize product offerings, and tailor promotional content. This data-driven personalization supports enhanced profitability while aligning brand experiences with consumer expectations. As retailers seek competitive differentiation, analytics-enhanced avatar solutions are expected to gain traction.

Challenge Analysis

A major challenge for the market is maintaining accessibility and inclusivity in avatar design and representation. Gen-Z spans diverse cultural backgrounds, body types, and identity expressions, and avatar systems must reflect this diversity to meaningfully resonate with users.

Failure to offer inclusive representation can alienate segments of the target audience and reduce adoption. Designing flexible, inclusive avatar frameworks is both a creative and technical challenge. Another challenge lies in managing the cost of developing and maintaining high-fidelity avatar environments that meet user expectations for realism and responsiveness.

Advanced graphics, real-time rendering, and AI-enabled personalization require substantial computing resources and ongoing optimization. Retailers and platform providers must balance investment in quality with affordability to ensure sustainable delivery of immersive shopping experiences.

Key Market Segments

By Component

- Avatar Creation & Customization Software

- AI Styling & Recommendation Engines

- Virtual Try-On & Integration Services

By Avatar Type

- 2D Stylized Avatars

- 3D Hyper-realistic Avatars

- Anime/Game-inspired Avatars

By Application

- Virtual Fashion & Apparel Try-On

- Cosmetics & Beauty Product Testing

- Virtual Social Shopping & Hauls

- Gaming & Metaverse Fashion

- Others

By Platform

- Social Media & Messaging Apps

- Gaming & Metaverse Platforms

- Branded Retail Apps & Websites

- Standalone Avatar Apps

- Others

By End-User

- Individual Gen-Z Consumers

- Fashion & Beauty Brands

- Retail & E-commerce Platforms

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Zepeto, Genies, Inc., and Bitmoji lead the Gen-Z shopping avatars market by enabling highly personalized digital identities for social commerce and virtual try-ons. Their platforms allow users to customize avatars and engage with brands across social media, gaming, and metaverse environments. These companies focus on self expression, social sharing, and brand collaborations.

Ready Player Me, Daz 3D, Inc., Loom.ai, and Soul Machines, Ltd. strengthen the market with realistic avatar creation, 3D modeling, and AI driven digital humans. Their solutions support cross platform avatar use and interactive shopping assistants. These providers emphasize realism, interoperability, and scalable avatar engines. Growing adoption of virtual stores and digital fashion supports wider use.

The Fabricant, Obsess, Inc., Perfect Corp., Memomi, and Vertebrae, Inc. expand the landscape with avatar based virtual try on, digital apparel, and immersive retail experiences. Their offerings help brands improve engagement and conversion among younger consumers. These companies focus on fashion tech integration and visual commerce. Increasing overlap between gaming, social media, and shopping continues to drive steady market growth.

Top Key Players in the Market

- Zepeto

- Genies, Inc.

- Ready Player Me

- Daz 3D, Inc.

- Bitmoji

- Loom.ai

- Replica Studios

- Soul Machines, Ltd.

- The Fabricant

- Obsess, Inc.

- Zeekit

- Vue.ai

- Perfect Corp.

- Memomi

- Vertebrae, Inc.

- Others

Recent Developments

- In May 2025, Zepeto partnered with Walmart to launch the first physical product sales on its platform, letting Gen Z users buy real-world items directly through their avatars. This bridges virtual fashion try-ons with actual commerce, tapping into Zepeto’s 1.7 billion avatar customizations and weekly 7-item purchases per user.

- In August 2025, Genies, Inc. rolled out its visual layer for LLMs with Unity, creating smart avatars for gaming and social apps. These customizable characters now support UGC fashion and real-time shopping interactions, solidifying U.S. leadership in persistent Gen Z digital identities.

Report Scope

Report Features Description Market Value (2025) USD 976.1 Mn Forecast Revenue (2035) USD 6,843.2 Mn CAGR(2025-2035) 21.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Avatar Creation & Customization Software, AI Styling & Recommendation Engines, Virtual Try-On & Integration Services), By Avatar Type (2D Stylized Avatars, 3D Hyper-realistic Avatars, Anime/Game-inspired Avatars), By Application (Virtual Fashion & Apparel Try-On, Cosmetics & Beauty Product Testing, Virtual Social Shopping & Hauls, Gaming & Metaverse Fashion, Others), By Platform (Social Media & Messaging Apps, Gaming & Metaverse Platforms, Branded Retail Apps & Websites, Standalone Avatar Apps, Others), By End-User (Individual Gen-Z Consumers, Fashion & Beauty Brands, Retail & E-commerce Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zepeto, Genies, Inc., Ready Player Me, Daz 3D, Inc., Bitmoji, Loom.ai, Replica Studios, Soul Machines, Ltd., The Fabricant, Obsess, Inc., Zeekit, Vue.ai, Perfect Corp., Memomi, Vertebrae, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gen-Z Shopping Avatars MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Gen-Z Shopping Avatars MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Zepeto

- Genies, Inc.

- Ready Player Me

- Daz 3D, Inc.

- Bitmoji

- Loom.ai

- Replica Studios

- Soul Machines, Ltd.

- The Fabricant

- Obsess, Inc.

- Zeekit

- Vue.ai

- Perfect Corp.

- Memomi

- Vertebrae, Inc.

- Others