GCC Warehousing And Distribution Logistics Market Size, Share, Growth Analysis By Warehouse Type (General Warehousing and Storage, Refrigerated Warehousing and Storage), By Ownership (Private Warehouses, Public Warehouses), By End-User (E-commerce & Retail, Food & Beverage, Pharma & Healthcare, Automotive, Manufacturing & Engineering Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170642

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

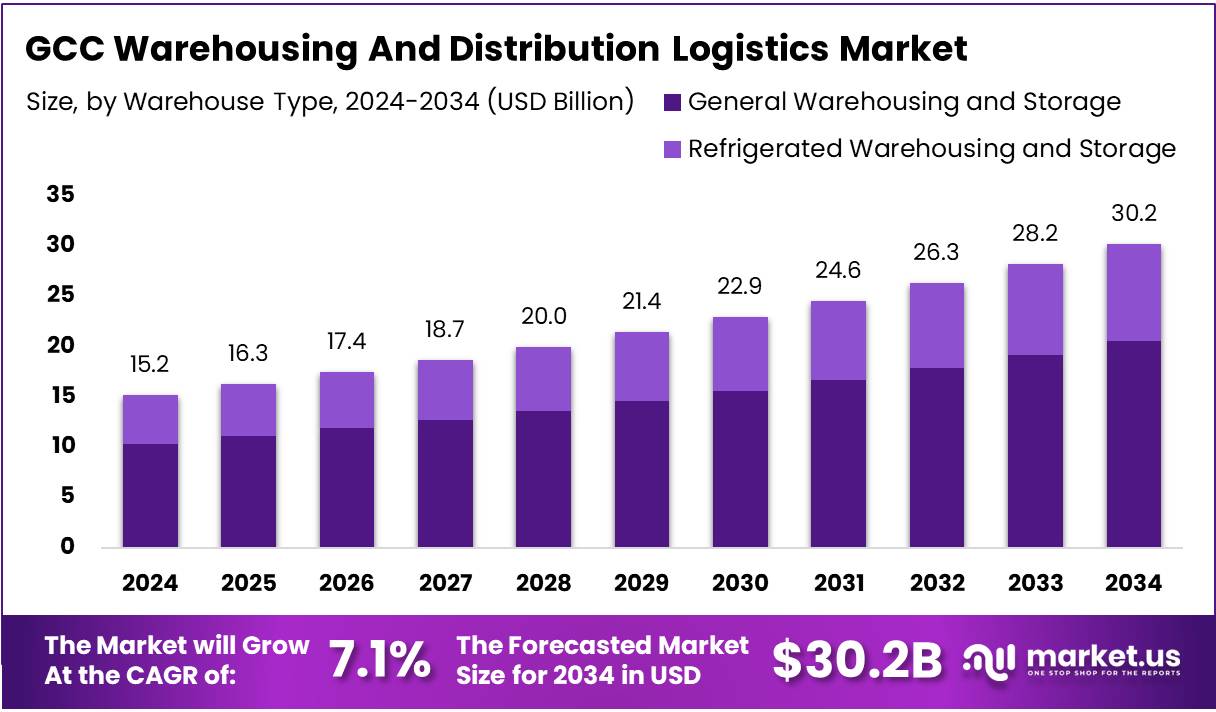

The GCC Warehousing And Distribution Logistics Market size is expected to be worth around USD 30.2 Billion by 2034, from USD 15.2 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The GCC Warehousing and Distribution Logistics Market refers to organized storage, handling, and movement of goods across Gulf economies. It enables efficient import, export, and domestic distribution activities. This market supports trade flows, inventory management, and last-mile distribution, forming a critical backbone for regional supply chains and commercial operations.

GCC Warehousing and Distribution Logistics focuses on operational execution, including storage optimization, order fulfillment, and transport coordination.This segment is evolving toward integrated logistics solutions. Businesses increasingly demand centralized warehousing, faster turnaround times, and technology-enabled distribution to support growing trade and consumption volumes.

From a market perspective, steady growth is supported by economic diversification initiatives and expanding non-oil sectors. Governments are strengthening logistics ecosystems to attract investment and improve trade competitiveness. As a result, warehouse capacity expansion and distribution network optimization are becoming strategic priorities across the GCC region.

Opportunities are emerging from rising consumer demand, cross-border trade, and regional manufacturing growth. As inventory flows increase, companies are focusing on warehouse location efficiency and throughput performance. Consequently, demand is rising for scalable facilities near ports, industrial clusters, and major urban consumption centers.

Government investment continues to accelerate infrastructure development across ports, logistics corridors, and free zones. Regulatory frameworks increasingly favor digitized customs processes and streamlined cargo handling. These improvements are reducing clearance times and encouraging private participation in warehousing and distribution logistics activities throughout the region.

Regulations related to storage standards, safety compliance, and traceability are also shaping market evolution. Food security programs and healthcare supply requirements are driving adoption of specialized warehousing formats. As a result, operators are upgrading facilities to meet temperature control, quality assurance, and operational transparency expectations.

From an infrastructure standpoint, GCC ports include more than 25 major seaports supporting regional and international trade flows. Leading ports handle over 4 million TEUs, while eight medium-volume ports manage between 500,000 and 4 million TEUs, directly stimulating warehouse throughput and inland distribution demand.

Additionally, GCC commercial fleets account for approximately 54.2% of total Arab shipping capacity by tonnage. This strong maritime presence enhances regional connectivity, supports re-export activities, and reinforces the long-term importance of the GCC Warehousing and Distribution Logistics Market within global supply chains.

Key Takeaways

- The GCC Warehousing And Distribution Logistics Market is projected to grow from USD 15.2 Billion in 2024 to USD 30.2 Billion by 2034, at a CAGR of 7.1%.

- In 2024, General Warehousing and Storage dominated the By Warehouse Type segment with a 69.2% share in the GCC region.

- Private Warehouses led the By Ownership segment in 2024 with a 67.9% market share across GCC countries.

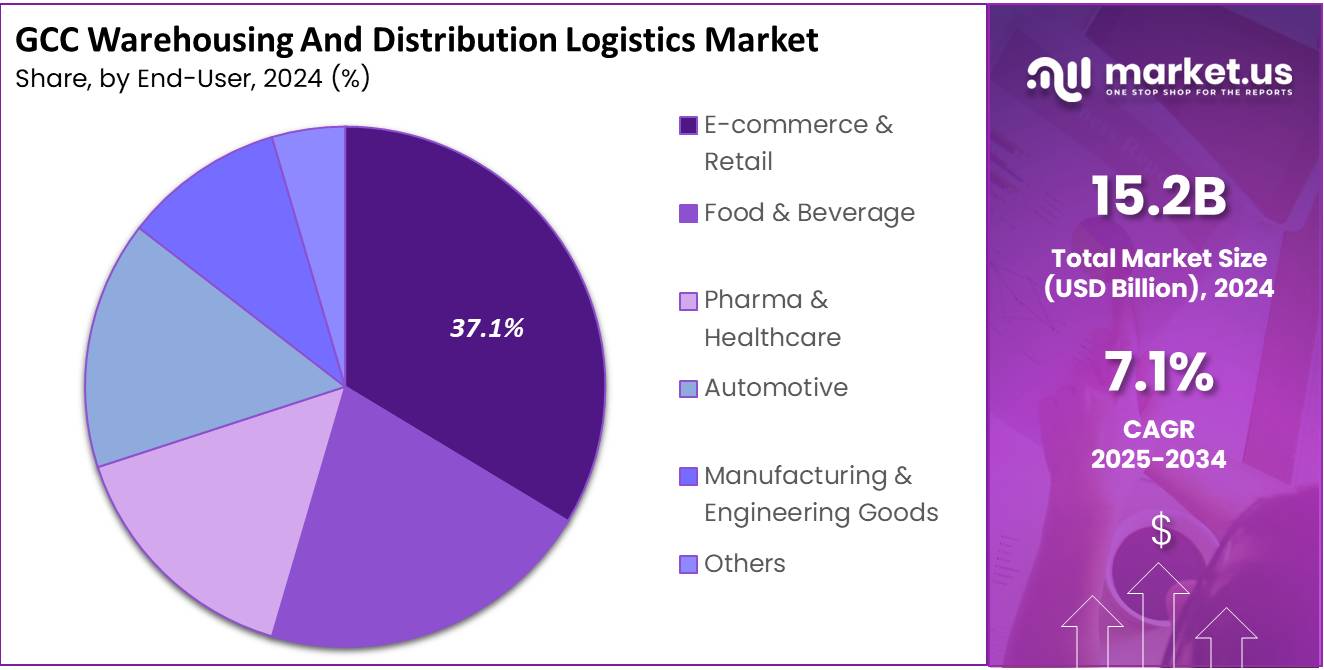

- E-commerce & Retail held the top position in the By End-User segment with a 37.1% share in 2024.

By Warehouse Type Analysis

General Warehousing and Storage dominates with 69.2% due to its flexibility in storing diverse goods and cost-effective solutions.

In 2024, General Warehousing and Storage held a dominant market position in the By Warehouse Type Analysis segment of GCC Warehousing And Distribution Logistics Market, with a 69.2% share. It caters to multiple sectors including e-commerce, manufacturing, and retail. The flexibility to store various goods, ease of inventory management, and operational efficiency continue to drive its adoption. Logistics providers prefer this model for scalable storage solutions across the GCC region.

Refrigerated Warehousing and Storage offers climate-controlled solutions for temperature-sensitive products such as food and pharmaceuticals. Growing demand for fresh and perishable goods drives investment in advanced refrigeration technology. Compliance with food safety and pharma standards further enhances its importance. Although smaller in share, it is critical for industries that require secure, temperature-monitored environments, ensuring product quality and reducing spoilage.

By Ownership Analysis

Private Warehouses dominates with 67.9% due to their control over inventory, security, and operational efficiency.

In 2024, Private Warehouses held a dominant market position in the By Ownership Analysis segment of GCC Warehousing And Distribution Logistics Market, with a 67.9% share. Companies prefer private facilities for exclusive access, security, and seamless integration with supply chain management systems. High e-commerce growth and retail expansion support the adoption of private warehouses, offering reliable storage and enhanced operational flexibility for large-scale businesses across the region.

Public Warehouses provide shared storage solutions for SMEs, seasonal inventory, and businesses entering new markets. Flexible pay-as-you-use models reduce upfront investment and offer scalability. These facilities support companies that do not require dedicated warehouses while maintaining supply chain efficiency. Public warehouses are increasingly attractive for businesses exploring cost-effective storage and distribution options in the GCC logistics ecosystem.

By End-User Analysis

E-commerce & Retail dominates with 37.1% due to rapid online shopping growth and high delivery expectations.

In 2024, E-commerce & Retail held a dominant market position in the By End-User Analysis segment of GCC Warehousing And Distribution Logistics Market, with a 37.1% share. Rising online shopping and same-day delivery expectations drive the need for modern warehouse facilities. Technology-enabled inventory management, automated picking, and proximity to urban centers strengthen operational efficiency and customer satisfaction, making this sub-segment highly strategic for logistics providers.

Food & Beverage warehouses focus on maintaining quality and compliance through cold-chain and climate-controlled storage. Growing consumer demand for fresh products drives investment in refrigeration and temperature monitoring solutions. Efficient storage and distribution practices ensure freshness and minimize wastage. This sub-segment is expanding steadily, supporting retailers, restaurants, and suppliers with reliable food logistics solutions.

Pharma & Healthcare warehouses specialize in temperature-sensitive and secure storage of medicines and healthcare products. Regulatory compliance and product traceability are essential. Rising healthcare demand and pharmaceutical distribution across the GCC support growth. Warehouses ensure timely delivery, reduce risks, and maintain the integrity of sensitive products.

Automotive warehouses store spare parts, components, and vehicles. Timely distribution and organized inventory management are critical. Growth in automotive production, including electric vehicles, increases demand. Advanced warehousing solutions improve operational efficiency and ensure on-time delivery to dealerships and service centers.

Manufacturing & Engineering Goods warehouses handle raw materials and industrial products. Efficient storage and material handling support manufacturing processes. Expansion of industrial hubs and supply chain networks increases demand for these facilities. Proper warehousing ensures timely production cycles and smooth operations.

Others include electronics, textiles, and chemicals. These diverse sectors require either specialized or general storage. Though smaller in share, they create opportunities for niche logistics providers. Tailored solutions enhance operational efficiency and meet unique industry requirements across the GCC.

Key Market Segments

By Warehouse Type

- General Warehousing and Storage

- Refrigerated Warehousing and Storage

By Ownership

- Private Warehouses

- Public Warehouses

By End-User

- E-commerce & Retail

- Food & Beverage

- Pharma & Healthcare

- Automotive

- Manufacturing & Engineering Goods

- Others

Drivers

Expansion of Port and Airport Infrastructure Boosts GCC Warehousing and Distribution Logistics

The GCC region is witnessing significant growth in port and airport cargo infrastructure. Expansion projects at major seaports and airports are increasing handling capacity, which allows warehouses to process larger volumes of goods efficiently. This development is attracting more logistics operators and investors to the market.

Rising consumer imports in GCC countries are also driving demand for warehousing services. As more goods enter the region, warehouses need to manage higher throughput volumes. This trend is particularly evident in e-commerce, retail, and FMCG sectors, where fast and reliable storage and distribution are crucial.

The GCC’s strategic location between Asia, Europe, and Africa strengthens its role as a regional distribution hub. Companies are using the region as a gateway for MEA trade flows, making warehousing and distribution logistics critical for smooth operations. Efficient warehouses reduce transit times and support timely deliveries.

Overall, the combination of improved port and airport facilities, growing import volumes, and the region’s strategic positioning is fueling the GCC warehousing and logistics market. Investors and service providers are increasingly expanding capacities and adopting advanced technologies to meet rising demand efficiently.

Restraints

Zoning and Operational Challenges Constrain GCC Warehousing and Distribution Logistics

One of the main restraints in the GCC warehousing market is strict zoning regulations and land-use restrictions. These rules limit the development of large-scale warehouses in core logistics corridors, making it difficult for companies to expand in key areas. As a result, logistics operators may face higher costs or operational inefficiencies when relocating or building new facilities.

Another challenge is the volatility in energy and utility costs. Warehouses, especially those handling high-volume storage or temperature-controlled goods, consume significant electricity and water. Sudden increases in utility prices can directly affect operating costs, reducing profit margins for logistics providers and impacting overall market growth.

These restraints also influence investment decisions. Companies may hesitate to invest in large facilities if regulatory approvals are uncertain or utility costs remain unpredictable. This can slow down the modernization and expansion of warehouse networks in the region.

Growth Factors

Rising Demand for Contract Warehousing from Regional and International Manufacturers

The GCC warehousing and distribution logistics market is seeing growth due to rising demand for contract warehousing. Regional and international manufacturers are increasingly outsourcing storage and inventory management to reduce operational costs and focus on core business activities. This trend creates steady opportunities for warehouse operators.

Another growth driver is the expansion of re-export and transshipment activities in the region. High-volume trade movements require efficient distribution centers capable of handling fast turnover. Warehouses near ports and free zones are especially benefiting, supporting faster goods movement and reducing lead times for global shipments.

Third-party logistics (3PL) services are gaining popularity among mid-sized enterprises. Many businesses prefer outsourcing logistics functions such as transportation, inventory management, and order fulfillment. This adoption allows companies to scale operations flexibly while reducing capital investment in infrastructure.

Additionally, technological advancements in warehouse management systems and automation are enhancing service efficiency. Businesses leveraging smart warehousing solutions can manage inventory accurately and respond to market demands quickly.

Emerging Trends

Adoption of High-Bay Warehousing to Maximize Storage Density in Land-Constrained Markets

The GCC warehousing and distribution logistics market is witnessing a trend toward high-bay warehousing. Companies are adopting vertical storage solutions to maximize space in regions where land is limited and expensive. This approach allows businesses to store more goods efficiently without expanding their footprint.

Another emerging trend is the integration of IoT-enabled asset tracking. Advanced sensors and connected devices provide real-time visibility of inventory and fleet movements. This technology helps logistics operators reduce errors, optimize routes, and improve overall supply chain efficiency.

Sustainable warehouse designs are also gaining traction across the GCC. Energy-efficient lighting, solar panels, and smart HVAC systems are being incorporated to reduce operational costs and environmental impact. Companies are increasingly aligning with green logistics practices to meet regulatory standards and sustainability goals.

The combination of high-bay warehousing, IoT tracking, and eco-friendly designs is shaping modern warehousing strategies. These factors enable businesses to improve storage efficiency, enhance operational transparency, and reduce carbon footprints.

Key GCC Warehousing And Distribution Logistics Company Insights

In 2024, Al-Futtaim Logistics maintained a strong presence in the GCC market, focusing on expanding its warehouse infrastructure and modern storage solutions. Its integrated supply chain services enabled faster distribution and improved inventory management for retail and industrial clients. Investments in technology also enhanced visibility across multiple locations.

Kuehne + Nagel continued to leverage its global logistics expertise, particularly in freight forwarding and contract logistics. The company emphasized digitalization, including advanced warehouse management systems and real-time tracking. These initiatives improved operational efficiency and flexibility, helping clients optimize their supply chains across sectors like e-commerce and manufacturing.

Ceva Logistics strengthened its position by offering specialized solutions for automotive, healthcare, and industrial goods. Its focus on automation and IoT-enabled warehouse operations enhanced delivery efficiency and reduced errors. By combining customized services with technology-driven processes, Ceva effectively addressed the growing complexity of regional supply chains.

DB Schenker Logistics expanded its footprint through warehouse optimization and sustainable infrastructure investments. Integrated distribution networks and technology-enabled inventory management allowed faster deliveries while reducing costs. Its focus on energy-efficient operations and high-volume storage solutions positioned DB Schenker as a preferred partner for e-commerce and industrial distribution in the GCC.

Top Key Players in the Market

- Al-Futtaim Logistics

- Kuehne + Nagel

- Ceva Logistics

- DB Schenker Logistics

- DHL Group

- Barq Express

- UPS [UPS]

- GWC (Gulf Warehousing Company)

- Global Shipping and Logistics

- Integrated National Logistics

Recent Developments

- In September 2024, DP World completed the acquisition of Cargo Services Far East Ltd, aiming to enhance its comprehensive retail and fashion logistics services. This strategic move strengthens its global supply chain capabilities and market presence.

- In March 2025, Abu Dhabi’s ADQ took a majority stake in logistics firm Aramex, aiming to expand its influence in the regional logistics sector. The investment supports long-term growth and operational efficiency across the Middle East.

- In December 2024, CMA CGM signed an MoU with Saudi authorities to advance port and logistics projects, marking a key step in national infrastructure growth. This initiative supports future terminal operations and hinterland logistics and warehousing expansion in KSA.

- In June 2025, DHL Group announced plans to invest more than EUR 500 million in fast-growing Middle East markets, focusing on modernizing facilities and expanding service networks. The investment targets enhanced efficiency and regional market capture.

Report Scope

Report Features Description Market Value (2024) USD 15.2 Billion Forecast Revenue (2034) USD 30.2 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Warehouse Type (General Warehousing and Storage, Refrigerated Warehousing and Storage), By Ownership (Private Warehouses, Public Warehouses), By End-User (E-commerce & Retail, Food & Beverage, Pharma & Healthcare, Automotive, Manufacturing & Engineering Goods, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Al-Futtaim Logistics, Kuehne + Nagel, Ceva Logistics, DB Schenker Logistics, DHL Group, Barq Express, UPS [UPS], GWC (Gulf Warehousing Company), Global Shipping and Logistics, Integrated National Logistics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  GCC Warehousing And Distribution Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

GCC Warehousing And Distribution Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Al-Futtaim Logistics

- Kuehne + Nagel

- Ceva Logistics

- DB Schenker Logistics

- DHL Group

- Barq Express

- UPS [UPS]

- GWC (Gulf Warehousing Company)

- Global Shipping and Logistics

- Integrated National Logistics