Global Gas Turbine Market By Type(Heavy-duty Gas Turbines, Industrial Gas Turbines, Aero Derivative Gas Turbines), By Capacity(Less than 40 MW, 40–120 MW, 120–300 MW, Above 300 MW), By Technology(Open Cycle, Combined Cycle), By End-Use(Power and Utilities Aviation, Oil & Gas, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 22290

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

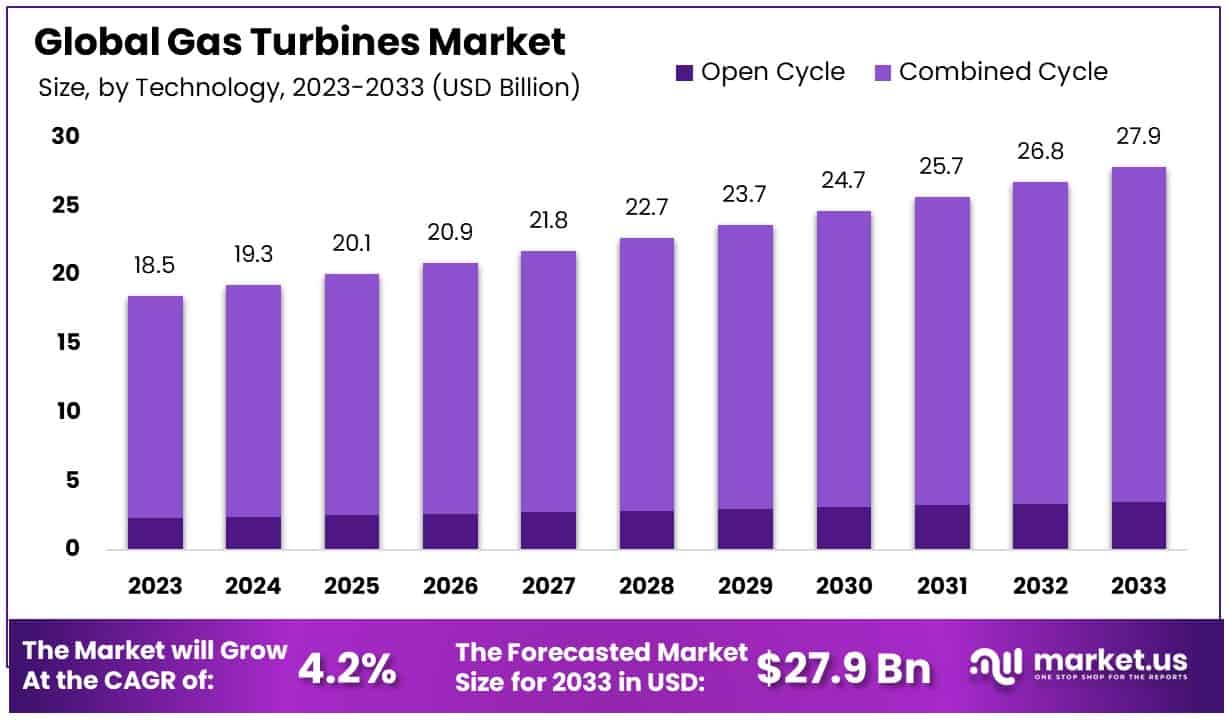

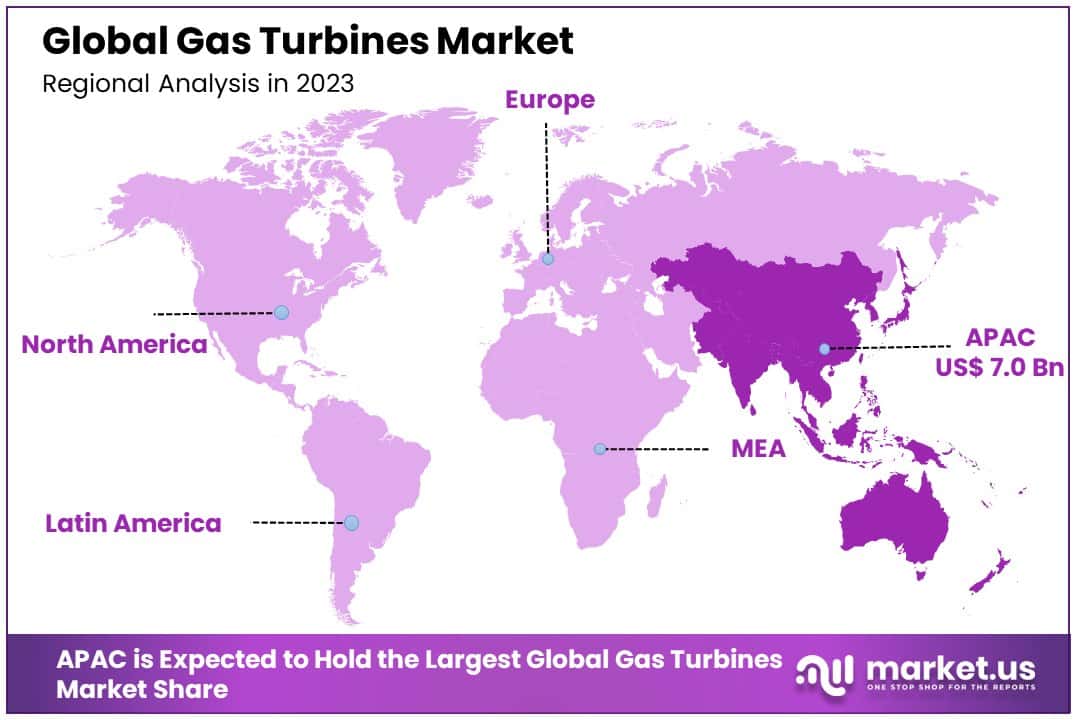

The Global Gas Turbine Market size is expected to be worth around USD 27.9 Billion by 2033, from USD 18.5 Billion in 2023, growing at a CAGR of 4.20% during the forecast period from 2024 to 2033. Asia Pacific dominated a 38.2% market share in 2023 and held USD 7.0 Billion in revenue from the Gas Turbine Market.

A gas turbine is a type of internal combustion engine that converts natural gas or other liquid fuels into mechanical energy. This energy then drives a generator to produce electrical power. Due to their efficiency and ability to use multiple fuels, gas turbines are widely used in various applications, including power generation, aircraft propulsion, and other industrial uses.

The gas turbine market refers to the economic environment encompassing the production, distribution, and sale of gas turbines across various industries. Factors influencing this market include technological advancements, increasing demand for electricity, and the shift towards renewable energy sources. This market is poised for growth, driven by the global increase in energy consumption and the need for efficient, low-emission technologies.

Growth in the gas turbine market is primarily driven by the escalating demand for electricity and greater efficiency in power generation. Opportunities in this sector are expanding with the rise of eco-friendly and flexible energy solutions, particularly in emerging markets.

Gas turbines’ versatility in fuel use and applications across different sectors, including industrial, aviation, and marine, bolsters the demand for them. Additionally, ongoing innovations aimed at reducing carbon footprints present significant market opportunities for developing and deploying advanced gas turbine technologies.

The gas turbine market is poised for transformative growth, driven by robust investments in clean energy technologies and significant strides toward decarbonization. According to the Department of Energy’s FY 2024 budget proposal, there is a planned allocation of $51.99 billion—an increase of 13.6% from the previous fiscal year—dedicated to advancing clean energy innovations, including the development and enhancement of gas turbines.

This substantial financial commitment underscores a strategic focus on clean energy solutions as pivotal to achieving broader energy policy goals. Furthermore, ongoing technological advancements are set to redefine the operational capabilities of gas turbines. Notably, Mitsubishi Power’s recent endeavors highlight a shift towards integrating hydrogen as a viable fuel source.

The company has successfully conducted stable combustion with a fuel mixture comprising 30% hydrogen and 70% natural gas. More ambitiously, there are plans to achieve 100% hydrogen combustion by 2030. This progression towards hydrogen utilization not only enhances the environmental footprint of gas turbines but also aligns with global carbon reduction mandates.

Key Takeaways

- The Global Gas Turbine Market size is expected to be worth around USD 27.9 Billion by 2033, from USD 18.5 Billion in 2023, growing at a CAGR of 4.20% during the forecast period from 2024 to 2033.

- In 2023, Heavy-duty Gas Turbines held a dominant market position in the by-type segment of the Gas Turbine Market, with a 52.4% share.

- In 2023, Above 300 MW held a dominant market position in the By Capacity segment of the Gas Turbine Market, with a 36.6% share.

- In 2023, Combined Cycle held a dominant market position in the By Technology segment of the Gas Turbine Market, with an 87.4% share.

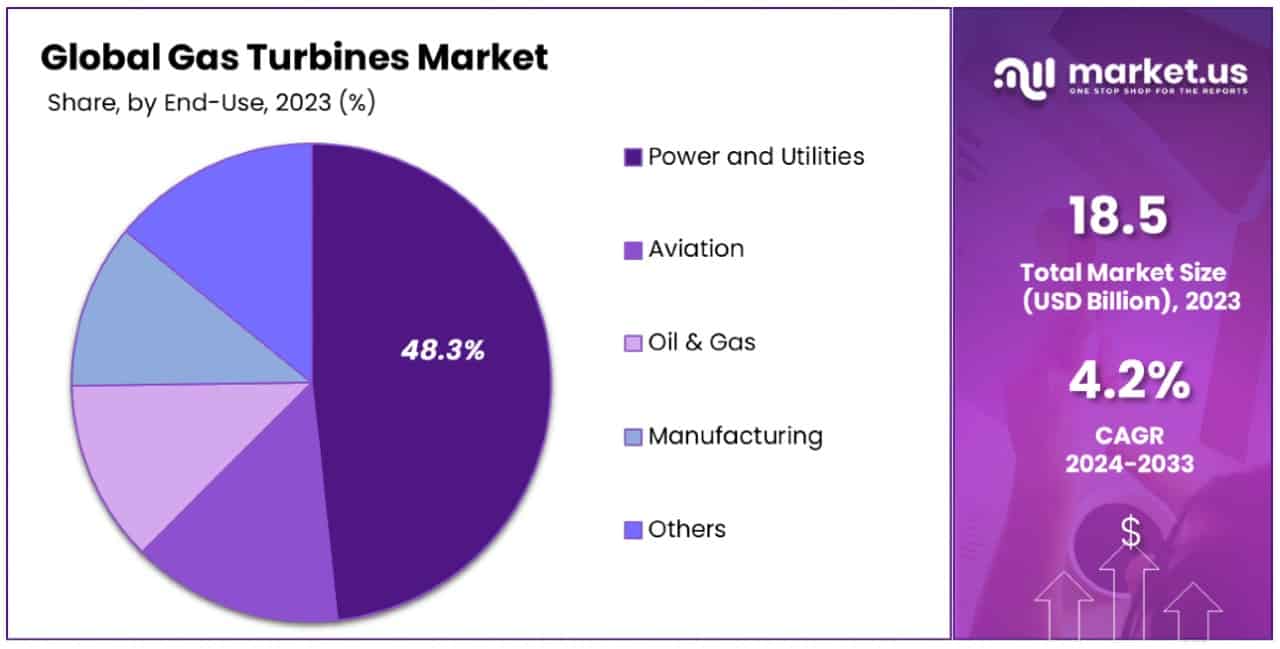

- In 2023, Power and Utilities Aviation held a dominant market position in the end-use segment of the Gas Turbine Market, with a 48.3% share.

- Asia Pacific dominated a 38.2% market share in 2023 and held USD 7.0 Billion in revenue from the Gas Turbine Market.

By Type Analysis

In 2023, Heavy-duty Gas Turbines held a dominant market position in the “By Type” segment of the Gas Turbine Market, with a 52.4% share. This category outperformed other segments, including Industrial Gas Turbines and Aero Derivative Gas Turbines, primarily due to its extensive application in large power plants and utilities which demand high capacity and efficiency. These turbines are favored for their durability and ability to operate continuously under high-load conditions, making them indispensable in modern energy generation.

Industrial Gas Turbines, with their compact size and lower power generation capacity, catered to a different market segment, focusing on mid-sized industrial applications. They are particularly valued in regions where operational flexibility and quick start-up are required.

Meanwhile, Aero Derivative Gas Turbines, which are modified from jet engines to serve energy generation and mechanical drive applications, are noted for their lighter weight and higher efficiency. These turbines are preferred in applications requiring rapid load changes and short start-up times, such as in emergency power generation and the oil and gas industry.

The varied applications and distinct advantages of each type highlight the diverse needs and technological advancements within the Gas Turbine Market, reflecting a robust demand spectrum across multiple industrial sectors.

By Capacity Analysis

In 2023, Above 300 MW held a dominant market position in the “By Capacity” segment of the Gas Turbine Market, with a 36.6% share. This segment, which includes turbines with capacities exceeding 300 MW, is primarily utilized in large-scale utility projects due to their high power output and efficiency levels. These turbines are pivotal in meeting the demands of large metropolitan areas and industrial operations, reinforcing their leading status within the market.

The Less than 40 MW segment serves small-scale industrial and residential applications, offering solutions where space and lower power outputs are significant considerations. Meanwhile, the 40–120 MW and 120–300 MW segments cater to intermediate needs, balancing efficiency and adaptability. These turbines are commonly employed in medium-sized power plants and as reliable backup power sources in various industries.

The segmentation by capacity underscores the diverse application spectrum of gas turbines, illustrating a strategic alignment with varying power needs across different sectors. The robust performance and versatility of the Above 300 MW turbines underscore their critical role in supporting substantial energy infrastructure projects globally, a key factor driving their market dominance.

By Technology Analysis

In 2023, Combined Cycle held a dominant market position in the “By Technology” segment of the Gas Turbine Market, with an 87.4% share. This technology, which integrates both gas and steam turbines to generate electricity, significantly enhances efficiency by utilizing the waste heat from gas turbines to produce additional power through a steam turbine. This dual-phase operation not only increases power output but also reduces carbon emissions, aligning with global sustainability goals and regulations.

The Open Cycle technology, though less efficient than its counterpart, is valued for its lower initial capital cost and faster start-up times. It continues to be relevant in applications requiring quick power supply without the prolonged duration of operation, such as in peak load power plants and remote area energy generation where simplicity and cost-effectiveness are prioritized.

The overwhelming preference for Combined Cycle technology is reflective of the market’s shift towards more energy-efficient and environmentally friendly solutions. This segment’s dominance is bolstered by ongoing advancements in technology that enhance the operational efficiency and environmental performance of combined cycle plants, thereby supporting their expansive adoption across the globe in large-scale power generation projects.

By End-Use Analysis

In 2023, Power and Utilities Aviation held a dominant market position in the “By End-Use” segment of the Gas Turbine Market, with a 48.3% share. This segment primarily utilizes gas turbines for the generation of electricity in power plants and for various applications in the aviation sector, where reliable and efficient power is crucial. The substantial share underscores the critical role of gas turbines in supporting the infrastructural backbone of the power generation and aviation industries.

The Oil & Gas sector, another significant user of gas turbines, employs these systems for power generation and mechanical drives in exploration and pipeline applications. This sector appreciates the turbines’ robust performance in harsh and remote environments.

Similarly, the Manufacturing sector relies on gas turbines to meet its need for consistent and reliable power supply, especially in energy-intensive processes. The segment’s preference for gas turbines stems from their operational efficiency and ability to scale with production demands.

The “Others” category includes various smaller-scale applications across different sectors that benefit from the adaptability and energy efficiency of gas turbines. Each end-use segment reflects specific needs and operational dynamics, with Power and Utilities Aviation leading due to its expansive and essential applications in critical infrastructure projects.

Key Market Segments

By Type

- Heavy-duty Gas Turbines

- Industrial Gas Turbines

- Aero Derivative Gas Turbines

By Capacity

- Less than 40 MW

- 40–120 MW

- 120–300 MW

- Above 300 MW

By Technology

- Open Cycle

- Combined Cycle

By End-Use

- Power and Utility Aviation

- Oil & Gas

- Manufacturing

- Others

Drivers

Key Drivers of Gas Turbine Demand

The Gas Turbine Market is primarily driven by the increasing demand for energy-efficient power generation solutions. As global energy consumption rises, industries and utilities are seeking more efficient technologies to meet their power needs while reducing environmental impact.

Gas turbines are at the forefront of this shift because they can convert natural gas into electricity more efficiently than traditional coal-powered plants, and with fewer emissions. Additionally, the flexibility of gas turbines to be used in combined cycle plants—which pair gas and steam turbines to produce even more electricity from the same fuel—makes them even more attractive in light of tightening environmental regulations.

This adaptability, combined with advancements in technology that enhance performance and reduce operational costs, is propelling the widespread adoption of gas turbines across various sectors, including power and utilities, oil and gas, and manufacturing.

Restraint

Challenges Limiting Gas Turbine Growth

One major restraint in the Gas Turbine Market is the high initial cost associated with deploying these systems. Gas turbines require significant investment not only in terms of the machinery itself but also in infrastructure and maintenance.

This financial burden can deter potential adopters, particularly in regions with limited capital resources or those that are heavily invested in existing, less costly power generation methods. Furthermore, the global shift towards renewable energy sources like smart solar and wind, which are becoming increasingly cost-competitive, poses a significant challenge.

These renewable technologies offer lower operational costs and benefit from strong regulatory support and incentives, making them more attractive to investors and governments aiming for sustainable energy solutions. As a result, the economic and policy-driven preference for renewables is a key obstacle to the broader adoption of gas turbines.

Opportunities

Expanding Opportunities in Gas Turbines

The Gas Turbine Market is witnessing expanding opportunities due to the growing emphasis on reducing carbon emissions and increasing energy efficiency. As countries and industries strive to meet international climate targets, gas turbines are becoming a preferred choice for new power plants because they emit less carbon compared to traditional coal-fired plants.

Moreover, the ongoing development of high-efficiency, low-emission (HELE) gas turbine technologies is opening new markets, particularly in regions with stringent environmental regulations. Additionally, the rising demand for reliable power supply in emerging economies and the replacement of aging power generation infrastructure in developed countries provide significant growth prospects for gas turbines.

These turbines are also well-suited to complement renewable energy sources by providing stable power during periods when solar or wind are not available, thereby supporting a balanced, sustainable energy mix.

Challenges

Navigating Gas Turbine Market Challenges

The Gas Turbine Market faces several challenges that could hinder its growth. The fluctuating prices and availability of natural gas, which is the primary fuel for most gas turbines, pose a significant risk to operational stability and cost-effectiveness.

These fluctuations can deter investment in gas turbine projects, as potential developers may worry about the long-term viability and profitability of their operations. Additionally, the rapid advancement in renewable energy technologies, such as solar and wind, which benefit from decreasing costs and increased governmental support, is intensifying competition in the power generation sector.

This shift toward renewables is diverting attention and resources away from gas turbines, especially in markets aiming for a low-carbon future. Furthermore, regulatory and market uncertainty, including changing policies on emissions and subsidies for alternative energies, complicates strategic planning for companies in the gas turbine space.

Growth Factors

Driving Growth in Gas Turbines

Significant growth factors for the Gas Turbine Market include the global push for more efficient and environmentally friendly power generation methods. As governments around the world implement stricter emissions regulations to combat climate change, the demand for gas turbines is increasing because they produce energy more cleanly than traditional coal-fired power plants.

Additionally, the versatility of gas turbines in combined cycle applications, which greatly enhance efficiency by using waste heat to generate additional power, makes them highly attractive in both mature and emerging markets. This is particularly relevant as countries seek to modernize aging infrastructure and build capacity to support economic growth.

The ability of gas turbines to quickly ramp up and down also makes them an ideal complement to intermittent renewable energy sources, helping to stabilize grids as solar and wind power fluctuate, further boosting their adoption in integrated energy systems.

Emerging Trends

Trends Shaping Gas Turbine Future

Emerging trends in the Gas Turbine Market are heavily influenced by technological advancements and environmental considerations. One key trend is the development of more efficient and flexible gas turbines that can start quickly and adjust output to better integrate with renewable energy sources.

This flexibility is crucial for maintaining grid stability as the share of intermittent renewable energies like wind and solar increases. Additionally, there is a growing focus on developing gas turbines that can operate on a mix of hydrogen and natural gas, paving the way for a transition to greener fuels. This hydrogen capability is particularly promising, as it aligns with global decarbonization goals and the push towards hydrogen economies.

Moreover, digitalization and predictive maintenance technologies are being increasingly adopted, enhancing operational efficiency and reducing downtime by anticipating maintenance needs before breakdowns occur, further positioning gas turbines as a competitive option in the evolving energy landscape.

Regional Analysis

The global gas turbine market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each presenting distinct market dynamics and opportunities. Asia Pacific is the dominant region, commanding a substantial 38.2% market share with a valuation of USD 7.0 billion. This dominance is driven by rapid industrialization, increasing energy consumption, and significant investments in infrastructure development across major economies such as China and India.

In North America, the market is bolstered by stringent environmental regulations and aging power plant upgrades, which stimulate the adoption of advanced, efficient gas turbine technologies. Europe’s market benefits from a strong regulatory framework supporting energy efficiency and emission reductions, with a significant push towards incorporating renewable energy sources that complement the deployment of gas turbines.

The Middle East & Africa region is witnessing a growth in demand, fueled by the energy needs of its expanding industrial sectors and the availability of natural gas resources. In contrast, Latin America, though smaller in market size, is experiencing gradual growth due to modernization efforts in its energy infrastructure and increasing industrial energy efficiency requirements.

Collectively, these regional markets contribute to the robust positioning of the gas turbine industry on the global stage, with Asia Pacific leading the way in market share and growth potential, underpinned by aggressive expansion in energy capacity and technological adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global gas turbine market, key players such as Siemens, General Electric (GE), and Wärtsilä have established strong positions through strategic innovation and market adaptation. Each company brings distinct capabilities and strategies to the forefront of the industry, influencing market dynamics and future growth trajectories.

Siemens has consistently demonstrated leadership in the high-efficiency gas turbine segment. The company’s focus on developing advanced technologies that improve power generation efficiency and reduce emissions is pivotal.

iemens gas turbines are renowned for their reliability and performance, which makes them a preferred choice in both developed and emerging markets. Their strategic partnerships and robust R&D capabilities allow them to stay ahead of the technology curve, adapting quickly to regulatory changes and market demands.

General Electric remains a formidable competitor, leveraging its broad portfolio of gas turbines designed for a wide range of commercial and industrial applications. GE’s emphasis on innovation is evident in their development of HA gas turbines, which are among the most efficient in the world.

GE’s commitment to expanding its footprint in renewable energy and its investments in integrating digital technologies into its offerings enhances its competitive edge, driving further penetration into global markets.

Wärtsilä, while smaller compared to Siemens and GE, differentiates itself with its flexible power solutions that are capable of running on various fuels, including natural gas and biogas. This flexibility is critical for regions with fluctuating power demands or transitioning fuel sources.

Wärtsilä’s strategic focus on sustainability and its advanced combustion technology cater to a niche yet growing segment of the market looking for versatile and eco-friendly solutions.

Top Key Players in the Market

- Siemens

- General Electric

- Wärtsilä

- Mitsubishi Heavy Industries Ltd

- Opra Turbines

- Kawasaki Heavy Industries, Ltd.

- Solar Turbines Incorporated

- Bharat Heavy Electricals Limited (BHEL) Harbin Electric Corporation Co., Ltd.

- MAN Energy Solutions

- VERICOR

- UEC Saturn

- Zorya-Mashproekt

- Baker Hughes Company

- Capstone Green Energy Corporation

- Ansaldo Energia

- Nanjing Turbine & Electric Machinery

Recent Developments

- In January 2024, Solar Turbines Incorporated expanded its service range by opening a new maintenance facility in Dubai. This strategic move aims to enhance support for their Middle Eastern clients, thereby improving service response times and operational efficiency.

- In June 2023, Kawasaki Heavy Industries unveiled in June 2023 their latest gas turbine model, which boosts output efficiency by 3%. This turbine supports diverse fuels, including hydrogen blends, aligning with global shifts towards sustainable energy sources.

- In March 2023, Opra Turbines launched a new version of its OP16 gas turbine, enhancing efficiency by 2%. This model is designed for small to mid-sized industrial applications, improving operational flexibility and lowering emissions.

Report Scope

Report Features Description Market Value (2023) USD 18.5 Billion Forecast Revenue (2033) USD 27.9 Billion CAGR (2024-2033) 4.20% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Heavy-duty Gas Turbines, Industrial Gas Turbines, Aero Derivative Gas Turbines), By Capacity(Less than 40 MW, 40–120 MW, 120–300 MW, Above 300 MW), By Technology(Open Cycle, Combined Cycle), By End-Use(Power and Utilities Aviation, Oil & Gas, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens, General Electric, Wärtsilä, Mitsubishi Heavy Industries Ltd, Opra Turbines, Kawasaki Heavy Industries, Ltd., Solar Turbines Incorporated, Bharat Heavy Electricals Limited (BHEL) Harbin Electric Corporation Co., Ltd., MAN Energy Solutions, VERICOR, UEC Saturn, Zorya-Mashproekt, Baker Hughes Company, Capstone Green Energy Corporation, Ansaldo Energia, Nanjing Turbine & Electric Machinery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens

- General Electric

- Wärtsilä

- Mitsubishi Heavy Industries Ltd

- Opra Turbines

- Kawasaki Heavy Industries, Ltd.

- Solar Turbines Incorporated

- Bharat Heavy Electricals Limited (BHEL) Harbin Electric Corporation Co., Ltd.

- MAN Energy Solutions

- VERICOR

- UEC Saturn

- Zorya-Mashproekt

- Baker Hughes Company

- Capstone Green Energy Corporation

- Ansaldo Energia

- Nanjing Turbine & Electric Machinery