Global Garagekeepers Insurance Market Size, Share and Analysis Report By Coverage Type (Legal Liability, Direct Primary, Direct Excess), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Specialty Vehicles), By End-User (Automotive Repair Shops, Service Stations, Parking Garages, Car Washes, Dealerships, Others), By Distribution Channel (Direct, Brokers/Agents, Online), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177045

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Coverage Type Analysis

- Vehicle Type Analysis

- End-User Analysis

- Distribution Channel Analysis

- Regional Perspective

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

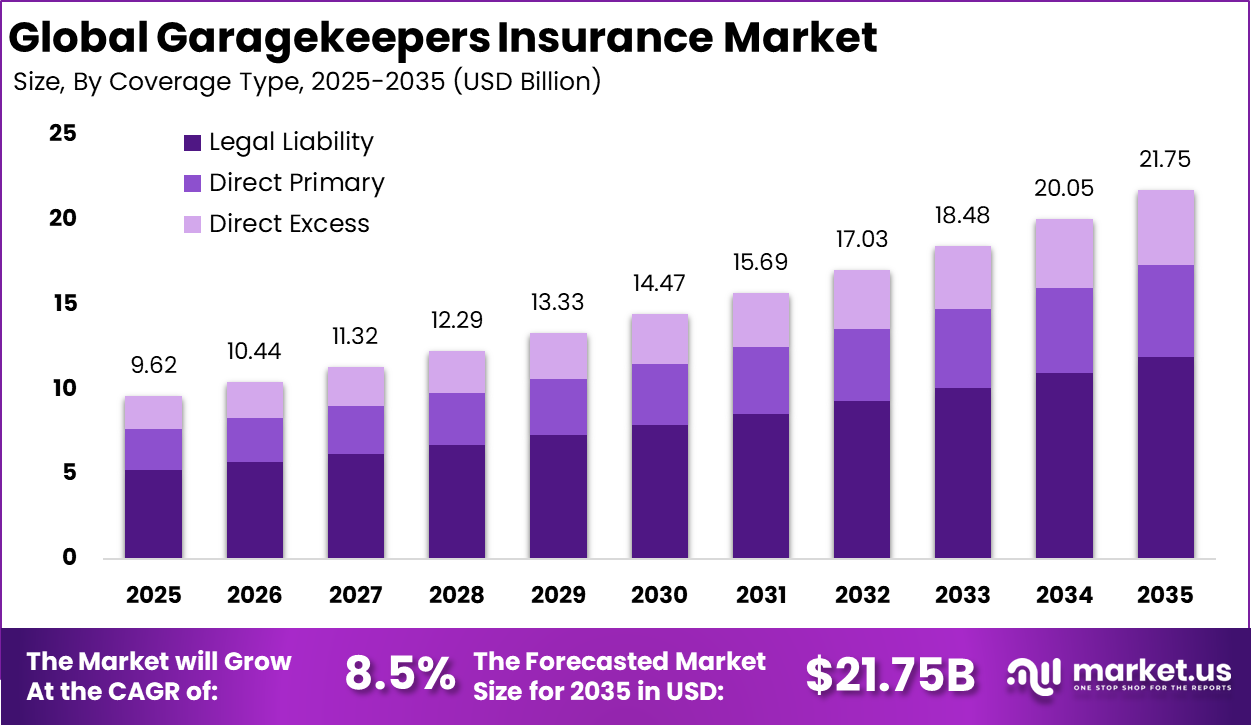

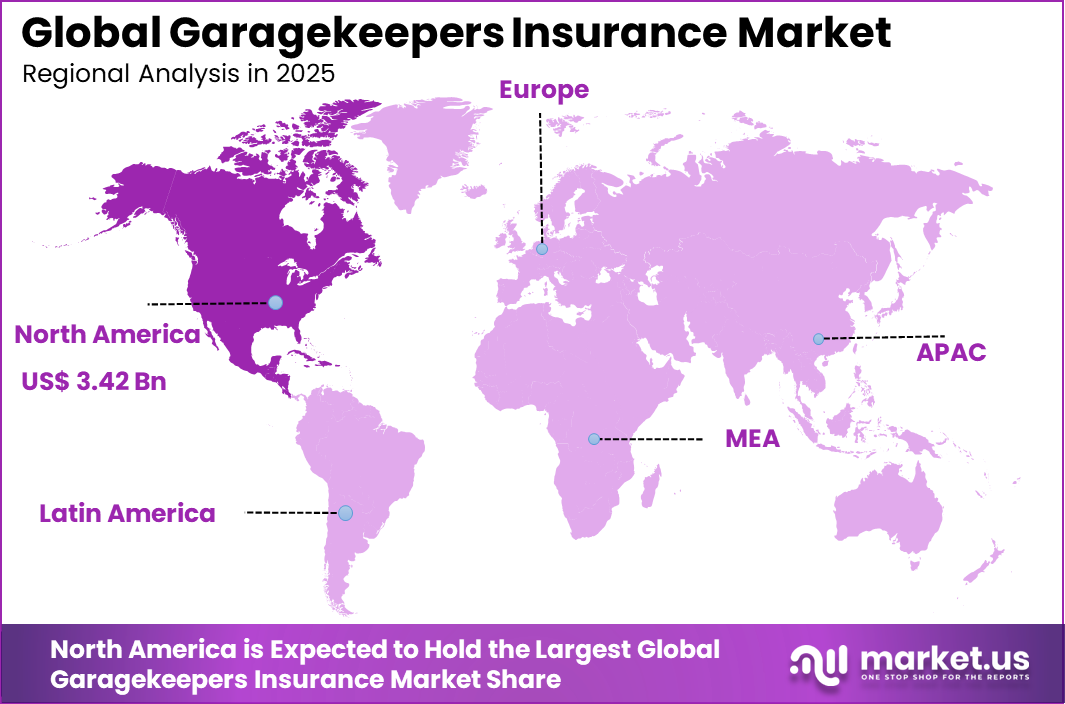

The Global Garagekeepers Insurance Market size is expected to be worth around USD 21.75 billion by 2035, from USD 9.62 billion in 2025, growing at a CAGR of 8.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 35.6% share, holding USD 3.42 billion in revenue.

The garagekeepers insurance market covers specialized insurance solutions designed to protect businesses that store, repair, service, or park customer vehicles. This includes auto repair shops, service centers, body shops, towing operators, and parking facilities that have temporary care, custody, or control of vehicles. The coverage addresses financial losses arising from damage, theft, vandalism, fire, or weather related incidents affecting customer vehicles while on business premises.

Key driver factors shaping this market include rising vehicle ownership, increasing complexity and value of modern vehicles, and growing legal accountability placed on service providers. As customer expectations around vehicle safety and service quality increase, garagekeepers insurance is viewed as an essential risk management tool rather than optional protection.

Based on data from industry survey, A typical garagekeepers insurance policy costs between USD 1,000 and USD 1,300 per year. Depending on coverage limits, location, and business size, some auto repair shops may pay as little as USD 800 or as much as USD 2,000 annually.

Bundling garagekeepers insurance with general liability and garage liability policies can lead to meaningful cost savings. Businesses that combine these coverages often reduce total insurance expenses by 18% to 26% compared to purchasing each policy separately.

For instance, in November 2025, Markel Corporation: Markel teamed up with Greenhouse Specialty Insurance to launch environmental risk solutions tailored for garage operations. The partnership expands specialty coverage, including garagekeepers liability for pollution incidents during repairs.

Key Takeaway

- In 2025, the Legal Liability segment led the Global Garagekeepers Insurance Market with a 54.7% share, driven by the need to cover third party vehicle damage risks.

- In 2025, Passenger Vehicles dominated the market by vehicle type, accounting for 58.8% of total coverage demand.

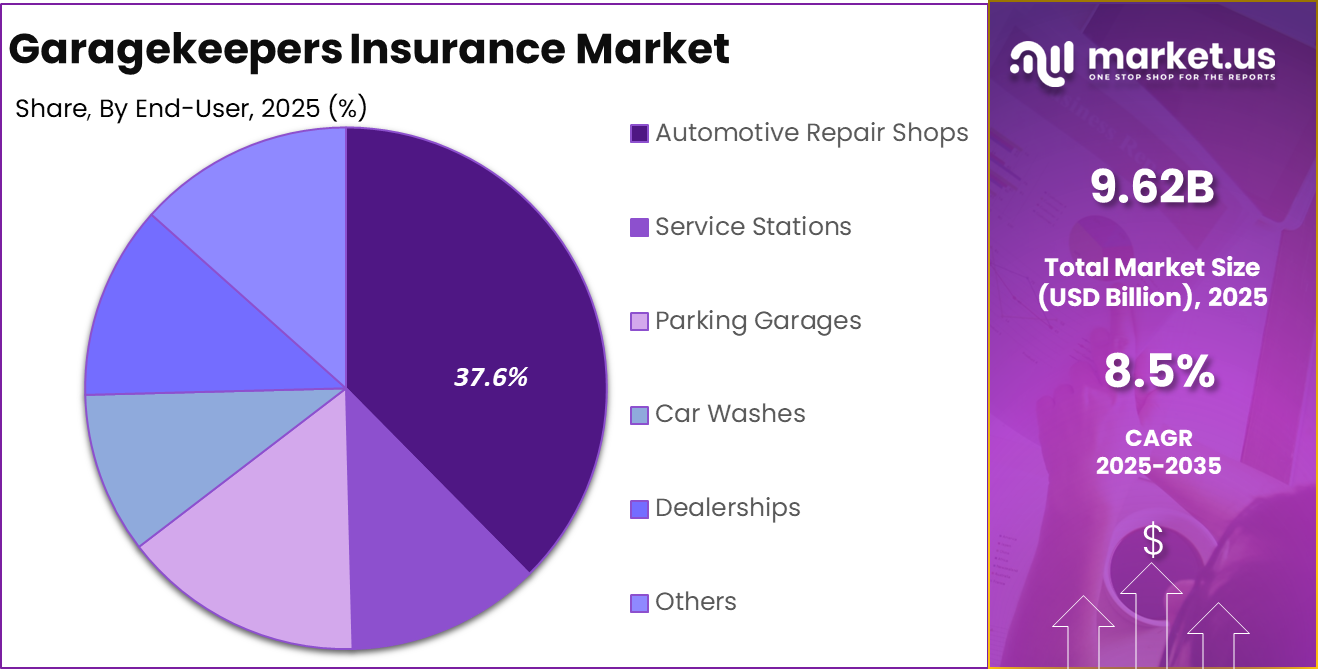

- In 2025, Automotive Repair Shops represented the largest end user group, holding a 37.6% market share.

- In 2025, the Direct distribution channel remained the leading sales route, capturing 46.7% of the global market.

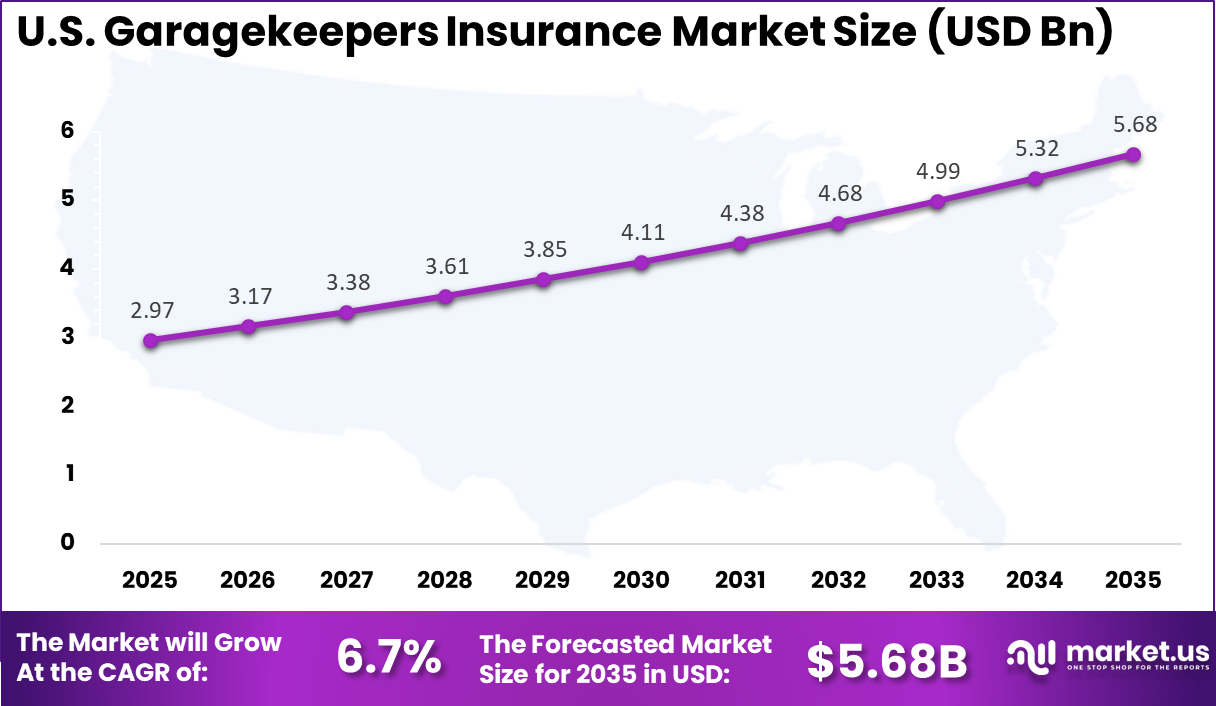

- In 2025, the US Garagekeepers Insurance Market was valued at USD 2.97 billion and recorded a CAGR of 6.7%, supported by a large automotive service base.

- In 2025, North America held a dominant regional position, accounting for more than 35.6% of the Global Garagekeepers Insurance Market.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising number of automotive repair shops and service centers +2.4% North America, Europe Short to medium term Increasing vehicle ownership and aging vehicle fleets +1.9% North America, Asia Pacific Medium term Higher liability exposure from customer vehicle damage and theft +1.7% Global Short term Growing regulatory and contractual insurance requirements +1.4% North America, Europe Medium term Expansion of dealership and fleet maintenance operations +1.1% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Premium sensitivity among small and independent garages -1.8% Global Short to medium term Limited insurance awareness in informal service markets -1.5% Asia Pacific, Latin America Medium term Perceived low risk among small operators -1.3% Emerging Markets Medium term Complexity of coverage terms and exclusions -1.1% Global Medium term Uneven enforcement of insurance requirements -0.9% Emerging Markets Long term Coverage Type Analysis

In 2025, Legal liability coverage accounts for 54.7% of overall adoption in the Garagekeepers Insurance Market. This dominance reflects the legal responsibility repair facilities hold for customer vehicles while they are in care, custody, or control. Damage, theft, or loss incidents expose businesses to direct financial claims.

The preference for legal liability coverage is reinforced by contractual and regulatory expectations. Many customers and fleet operators require proof of liability protection before handing over vehicles. As litigation risk increases, legal liability coverage continues to be treated as essential rather than optional.

For Instance, In January 2026, Progressive Insurance introduced updated garagekeepers’ legal liability options with coverage limits of up to USD 100,000 per location. The enhancement helps tow and repair shops better protect customer vehicles during storage or service, addressing rising claims linked to vandalism and collisions.

Vehicle Type Analysis

In 2025, Passenger vehicles represent 58.8% of total vehicle type coverage within the market. This leadership is driven by the high volume of privately owned cars serviced by repair shops, dealerships, and maintenance centers. Passenger vehicles account for the majority of daily repair and servicing activities.

The concentration of passenger vehicle coverage is also influenced by frequency of claims. Minor accidents, theft, and handling damage occur more often in high volume passenger vehicle operations. This sustains strong insurance demand for this vehicle category.

For instance, in October 2025, The Hartford enhanced its garagekeepers policies, focusing on passenger cars with direct primary coverage for test drives. Auto shops benefit from protection on sedans and SUVs left for routine fixes. This update cuts disputes over minor dings, speeding up repairs. Demand grows as more families rely on personal vehicles, pushing Hartford to tailor limits for common daily risks.

End-User Analysis

In 2025, Automotive repair shops account for 37.6% of total end user demand. These businesses routinely take possession of customer vehicles for diagnostics, repairs, and storage. Insurance coverage is critical to protect against financial loss arising from unexpected incidents.

Adoption among repair shops is driven by business continuity concerns and customer trust. Insured facilities are perceived as more reliable and professional. This perception supports consistent insurance uptake within this end user segment.

For Instance, in November 2025, Berkshire Hathaway GUARD expanded garagekeepers endorsements for repair shops, bundling liability up to $2 million. It covers tools and customer autos during work, ideal for busy garages. Shops save with discounts for safety certifications like ASE. This fits rising repair needs from older cars, helping end-users manage claims from employee errors smoothly.

Distribution Channel Analysis

In 2025, The Direct segment held a dominant market position, capturing a 46.7% share of the Global Garagekeepers Insurance Market. Garage owners seek simple and faster ways to buy insurance. Dealing directly with insurers allows clearer policy terms, quicker adjustments, and easier claim handling without relying on intermediaries. This suits small and mid sized garages that want control.

Digital tools further support this growth by making policy management more convenient. Online access to documents, renewals, and support reduces time spent on administration. These benefits encourage more garages to choose direct purchasing options.

For Instance, in December 2025, Travelers Insurance boosted direct online tools for garagekeepers’ quotes, simplifying buys for small shops. Owners get instant coverage for legal liability without agents. This channel thrives on digital speed, cutting costs amid high vehicle volumes. Travelers’ app tracks policies, drawing more direct sales as managers seek hassle-free setups.

Regional Perspective

North America holds a leading position in the Garagekeepers Insurance Market, accounting for 35.6% of total activity. The region benefits from a large automotive service industry, high vehicle ownership rates, and strong insurance penetration. Liability protection is widely embedded in repair shop operations.

Regulatory requirements and customer expectations further encourage insurance adoption. Businesses prioritize coverage to manage legal and financial exposure. These factors support North America’s strong regional position.

For instance, in May 2025, Allstate Insurance completed placement of its 2025-2026 catastrophe reinsurance program, lifting the tower to $9.5 billion to protect against major losses in property lines, including garage operations. This enhanced reinsurance capacity strengthens Allstate’s ability to underwrite garagekeepers policies amid increasing catastrophe risks.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 2.97 Bn and a growth rate of 6.7% CAGR. Growth is supported by sustained demand for vehicle maintenance services and rising repair costs. Insurance coverage remains a standard operational requirement for repair facilities.

Adoption in the U.S. is influenced by litigation risk and regulatory oversight. Repair shops increasingly rely on garagekeepers insurance to protect assets and maintain customer confidence. These dynamics collectively support steady growth in the U.S. market segment.

For instance, in May 2025, Chubb Limited partnered with Zurich and National Indemnity to launch a $100 million excess casualty facility for large companies, complementing core garagekeepers’ offerings. The facility addresses escalating claims in auto service sectors, solidifying Chubb’s leadership position.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Commercial auto insurance providers High Medium North America, Europe Stable and recurring premium growth Specialized garage and dealership insurers High Medium North America Strong niche positioning Digital insurance platforms Medium Medium North America, Europe Growth via online policy distribution Private equity firms Medium Medium North America, Europe Consolidation of niche insurance portfolios Venture capital investors Low to Medium High North America Selective interest in insurtech tools Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Digital policy issuance and online quoting platforms +2.1% Faster onboarding of garages North America, Europe Short term Automated risk assessment using claims and location data +1.8% Improved pricing accuracy North America Medium term Mobile-first claims reporting tools +1.5% Faster claim resolution Global Medium term Integration with garage management software +1.2% Policy retention and bundling North America Medium to long term Data analytics for theft and damage risk profiling +1.0% Loss prevention Global Long term Emerging Trends Analysis

An emerging trend in the garagekeepers insurance market is increased emphasis on risk prevention and loss control. Insurers are encouraging better vehicle tracking, secure storage practices, and digital condition reporting. These measures reduce claim frequency and support more accurate underwriting. Preventive risk management is gaining importance.

Another trend is closer integration between garage operations software and insurance processes. Digital work orders, vehicle intake documentation, and incident reporting improve transparency and claims efficiency. Technology enabled workflows support faster resolution and improved trust between insurers and policyholders.

Growth Factors Analysis

One of the key growth factors for the garagekeepers insurance market is the continued expansion of the automotive service industry. Rising vehicle populations and longer vehicle ownership cycles increase demand for repair and maintenance services. More vehicles under temporary custody directly increase insurance demand. This structural trend supports sustained growth.

Another growth factor is increasing reliance on third party vehicle service providers. As consumers outsource more vehicle care activities, liability exposure shifts to service operators. Insurance becomes critical for protecting both customers and businesses. This shift reinforces the long term relevance of garagekeepers insurance.

Opportunity Analysis

A major opportunity in the garagekeepers insurance market lies in tailored and modular policy design. Coverage options that align with specific business models allow operators to select appropriate limits and protections. Customization improves affordability and relevance, encouraging broader adoption. Flexible policy structures support diverse service environments.

Another opportunity is increased awareness of risk transfer benefits among vehicle service businesses. Education initiatives that highlight real loss scenarios and liability exposure can improve insurance uptake. As operators recognize insurance as a business continuity tool, demand for comprehensive coverage strengthens. This awareness driven shift supports market expansion.

Challenge Analysis

A significant challenge for the garagekeepers insurance market is managing claim disputes related to responsibility and cause of damage. Determining whether damage occurred under the garage’s control can be complex. Disputes may arise if documentation or vehicle condition records are insufficient. Clear procedures and documentation standards are essential to reduce friction.

Another challenge is adapting coverage to changing vehicle technology. Electric vehicles and connected cars introduce new risks related to batteries, charging systems, and software components. Insurers must continuously update policy terms and underwriting models to reflect these evolving exposures. Keeping coverage aligned with technology change remains an ongoing challenge.

Key Market Segments

By Coverage Type

- Legal Liability

- Direct Primary

- Direct Excess

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Specialty Vehicles

By End-User

- Automotive Repair Shops

- Service Stations

- Parking Garages

- Car Washes

- Dealerships

- Others

By Distribution Channel

- Direct

- Brokers/Agents

- Online

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Large national insurers such as Progressive Insurance, Allstate Insurance, and State Farm play a major role in the garagekeepers insurance market. Their policies typically cover customer vehicle damage, theft, vandalism, and liability risks. Strong agent networks and digital quoting tools support broad adoption among small and mid-sized repair shops. Nationwide Mutual Insurance Company and Liberty Mutual Insurance strengthen market reach through bundled commercial auto solutions.

Commercial and specialty insurers such as Travelers Insurance, The Hartford, and Chubb Limited focus on tailored coverage for dealerships and service centers. Zurich Insurance Group and AXA XL address complex and high-value garage operations. GEICO supports smaller operators through simplified policy options. These players emphasize claims efficiency, underwriting accuracy, and regulatory compliance.

Specialty and regional insurers such as Berkshire Hathaway GUARD Insurance Companies, Markel Corporation, and CNA Financial Corporation serve niche garage risks. AmTrust Financial Services, ICW Group, and Tokio Marine Group expand coverage options. Munich Re supports risk capacity. Other insurers increase competition and customization across the market.

Top Key Players in the Market

- Progressive Insurance

- Allstate Insurance

- State Farm

- Nationwide Mutual Insurance Company

- Liberty Mutual Insurance

- Travelers Insurance

- GEICO

- The Hartford

- Zurich Insurance Group

- Chubb Limited

- AXA XL

- Berkshire Hathaway (Berkshire Hathaway GUARD Insurance Companies)

- American Family Insurance

- Farmers Insurance Group

- Markel Corporation

- CNA Financial Corporation

- AmTrust Financial Services

- ICW Group

- Tokio Marine Group

- Munich Re (Munich Re Specialty Insurance)

- Others

Recent Developments

- In May 2025, Allstate Insurance boosted its catastrophe reinsurance tower to $9.5 billion for 2025-2026, providing solid backing for property and garage operations coverage. This move helps Allstate confidently underwrite garagekeepers’ policies for auto service businesses facing weather-related risks.

- In October 2025, The Hartford enhanced its garagekeepers offerings with new digital tools for faster claims processing, helping shops manage risks from customer vehicles more efficiently. This innovation keeps them competitive in the evolving market.

Report Scope

Report Features Description Market Value (2025) USD 9.6 Billion Forecast Revenue (2035) USD 21.7 Billion CAGR(2025-2035) 8.5% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Legal Liability, Direct Primary, Direct Excess), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Specialty Vehicles), By End-User (Automotive Repair Shops, Service Stations, Parking Garages, Car Washes, Dealerships, Others), By Distribution Channel (Direct, Brokers/Agents, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Progressive Insurance, Allstate Insurance, State Farm, Nationwide Mutual Insurance Company, Liberty Mutual Insurance, Travelers Insurance, GEICO, The Hartford, Zurich Insurance Group, Chubb Limited, AXA XL, Berkshire Hathaway (Berkshire Hathaway GUARD Insurance Companies), American Family Insurance, Farmers Insurance Group, Markel Corporation, CNA Financial Corporation, AmTrust Financial Services, ICW Group, Tokio Marine Group, Munich Re (Munich Re Specialty Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Garagekeepers Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Garagekeepers Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Progressive Insurance

- Allstate Insurance

- State Farm

- Nationwide Mutual Insurance Company

- Liberty Mutual Insurance

- Travelers Insurance

- GEICO

- The Hartford

- Zurich Insurance Group

- Chubb Limited

- AXA XL

- Berkshire Hathaway (Berkshire Hathaway GUARD Insurance Companies)

- American Family Insurance

- Farmers Insurance Group

- Markel Corporation

- CNA Financial Corporation

- AmTrust Financial Services

- ICW Group

- Tokio Marine Group

- Munich Re (Munich Re Specialty Insurance)

- Others