Global Gamma knife Market By Indications (Malignant Tumors, Benign Tumors, Vascular Disorders, Functional Disorders and Ocular Diseases) By Anatomy (Head, Neck, Other Body Parts) By End-Use (Hospitals, Clinics and Ambulatory Surgery Centers), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 55420

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

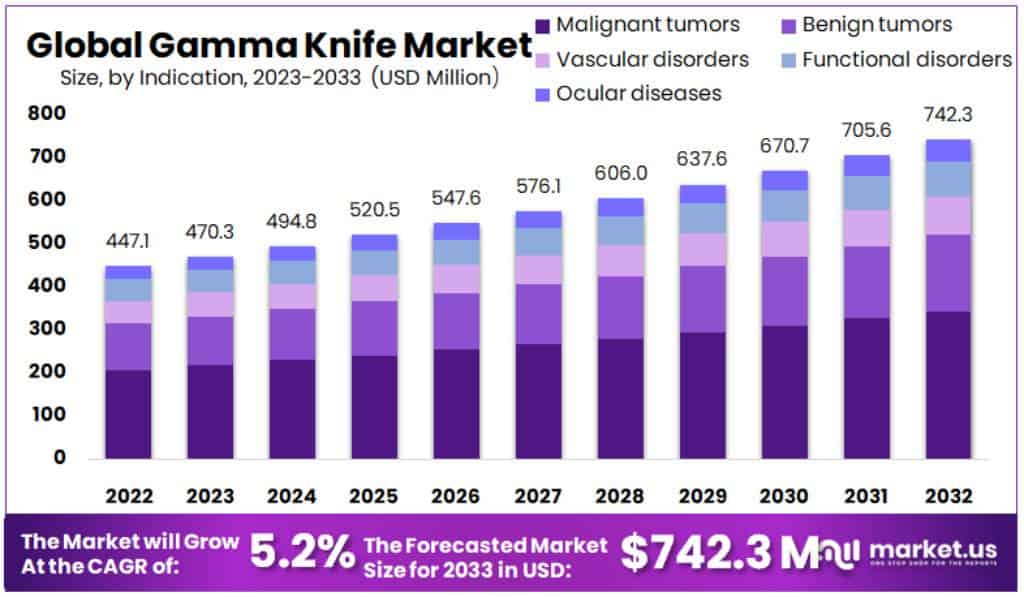

The Global Gamma Knife Market size is expected to be worth around USD 742.3 Million by 2033 from USD 470.3 Million in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Gamma Knife is a type of radiosurgery that uses very precise beams of gamma rays to treat areas of disease or growth, most often in the brain. Despite its name, it is not a knife and does not involve any incisions.

The Gamma Knife delivers a single, finely focused, high dose of radiation to its target while causing little or no damage to surrounding tissue. It is used to treat small to medium brain tumors, abnormal blood vessel formations, trigeminal neuralgia, and other neurological conditions.

The term Gamma Knife has nothing to do with a particular type of knife; instead, it is an intelligent system that acts as a minimal or non-invasive form of brain surgery. The accuracy level of the gamma knife program can be compared with the thickness of a piece of paper (about one-tenth of a millimeter).

This type of radiosurgery requires a shorter operation time, fewer side effects, and a shorter recovery time. More people are expected to choose the operation, which is also a factor affecting the growth of the global market. The high cost associated with gamma knife radiosurgery treatment, as well as the cost of necessary equipment and subsequent maintenance, may affect the adoption rate of gamma knife radiosurgery.

Key Takeaways

- The Gamma Knife market is expected to reach USD 742.3 Million by 2033.

- In 2023, the market was valued at USD 470.3 Million.

- The market is projected to grow at a CAGR of 5.2% from 2023 to 2033.

- Malignant tumors held a dominant market share of over 46.2% in 2023.

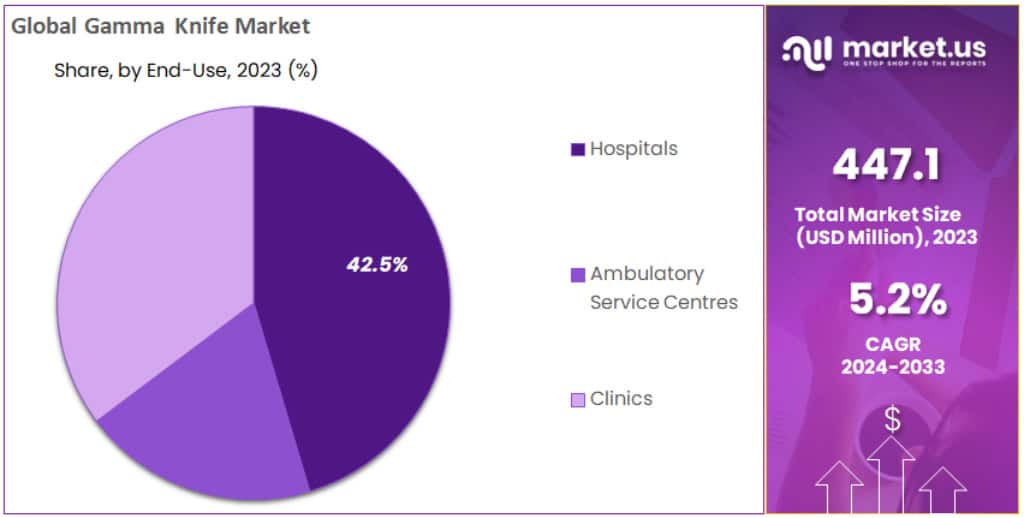

- Hospitals held over 43% of the market share in 2023.

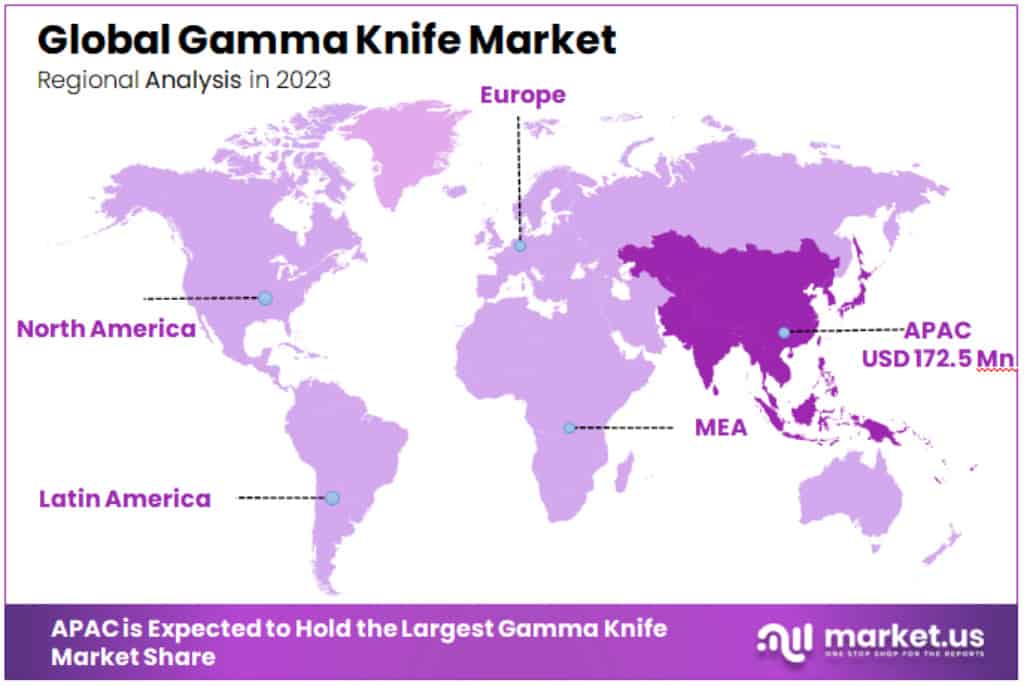

- Asia-Pacific (APAC) leads the market with a 38.5% share in 2023.

- India’s market is growing at a CAGR of 11.2% through 2033, driven by medical tourism and government efforts.

- China’s market is expected to expand at a CAGR of 10% through 2033, fueled by increased healthcare spending.

- Elekta AB dominates the market with a share of over 50%, followed by

- Varian Medical Systems Inc. with a share of approximately 30%.

Indications Analysis

In 2023, Malignant tumors held a dominant market position in the Gamma Knife market, capturing more than a 46.2% share. This segment’s growth is driven by the increasing prevalence of cancerous brain tumors and the need for precise, non-invasive treatment methods.

Benign tumors follow closely, benefiting from Gamma Knife’s ability to target non-cancerous growths with minimal side effects. This segment is growing as more patients seek alternatives to traditional surgery.

Vascular disorders, such as arteriovenous malformations, represent a significant portion of the market. Gamma Knife’s precision is crucial in treating these delicate brain conditions, driving its adoption in this segment.

Functional disorders, including conditions like trigeminal neuralgia, also contribute to market growth. Gamma Knife offers a painless treatment option, increasing its preference among patients and healthcare providers.

Lastly, ocular diseases are an emerging segment. The technology’s ability to accurately target areas in the eye without invasive surgery is gaining attention, potentially expanding its market presence in the coming years.

End-Use Analysis

In 2023, Hospitals held a dominant market position in the Gamma Knife market, capturing more than a 43% share. This dominance is due to hospitals’ comprehensive care facilities and the ability to handle complex procedures, making them a primary choice for Gamma Knife treatments.

Clinics are also a key segment, attracting patients seeking specialized care in a more focused setting. Their market share is growing as they offer efficient and personalized Gamma Knife treatments, especially in urban areas.

Ambulatory Surgery Centers (ASCs) form a significant part of the market as well. Known for their convenience and cost-effectiveness, ASCs appeal to patients preferring outpatient care. Their role in the Gamma Knife market is expanding, driven by advancements in technology and patient-centric approaches.

Key Market Segments

Based on Indication

- Malignant tumors

- Benign tumors

- Vascular disorders

- Functional disorders

- Ocular diseases

- Other Indications

Based on Anatomy

- Head

- Neck

- Other Body Parts

Based on End-Use

- Hospital

- Clinics

- Ambulatory Surgery Centers

Drivers

- Non-Invasiveness and Minimal Side Effects: The Gamma Knife offers a non-surgical option with fewer risks and complications, attracting patients and doctors. Its targeted approach spares healthy brain tissue, leading to better recovery rates.

- Growing Awareness and Acceptance: Increased understanding of Gamma Knife surgery’s benefits among healthcare providers and patients boosts its use. Clinical evidence of its safety and effectiveness is strengthening this trend.

Challenges

- High Costs: The expense of acquiring and installing Gamma Knife systems is a major barrier. This high cost can deter healthcare facilities, particularly in less affluent areas, from adopting the technology.

- Limited Access and Awareness: In many regions, Gamma Knife centers are scarce. A lack of knowledge about the technology among patients and healthcare workers also hinders its use.

- Regulatory Hurdles: Gaining approvals for Gamma Knife systems can be complex and time-consuming, slowing market growth.

Opportunities

- Technological Advancements: Innovations in Gamma Knife technology, like improved imaging and treatment planning, are creating new market opportunities. Developing more compact systems could broaden the technology’s use.

Trends: - Technological Progress: There’s been a significant improvement in Gamma Knife technology, particularly in imaging integration and treatment planning. These advancements enhance precision and efficiency in treating neurological diseases.

- Fractionated Radiosurgery: Some Gamma Knife treatments are now spread over multiple sessions. This approach offers more treatment flexibility for larger or complex tumors.

Trend

- Rising Adoption of Non-Invasive Treatments: The increasing preference for non-invasive medical procedures has significantly driven the demand for Gamma Knife radiosurgery. According to a study by the World Health Organization (WHO) in 2023, the global market for non-invasive treatments grew by 12%, with Gamma Knife procedures being a major contributor due to their precision and minimal recovery time.

- Technological Advancements in Gamma Knife Systems: Technological innovations in Gamma Knife systems have enhanced their efficiency and accuracy, further propelling market growth. For instance, Elekta’s latest Gamma Knife Icon, launched in 2023, offers real-time imaging and precise targeting capabilities, which has led to a 15% increase in adoption rates among neurosurgeons globally, as reported by Elekta’s annual report.

Regional Analysis

In the Gamma Knife market, Asia-Pacific (APAC) is leading with a significant 38.5% share, amounting to USD 172.5 million in 2023. This dominance is attributed to the rising prevalence of neurological diseases, increased healthcare spending, and improved access to Gamma Knife surgeries in the region. These factors are forecasted to drive the growth of APAC’s Gamma Knife market in the coming years.

Additionally, North America, particularly the United States, is witnessing a growing adoption of Gamma Knife surgery systems, with various clinical studies exploring its applications in treating conditions like essential tremors, Parkinson’s, and glioblastoma. The expansion of Gamma Knife radiotherapy applications is anticipated to propel the market further.

In terms of country-specific insights, India and China are leading the charge. India, as a major medical tourism destination, is seeing its Gamma Knife market grow at a CAGR of 11.2% through 2033. The Indian government’s efforts to promote advanced medical technologies and enhance healthcare infrastructure significantly contribute to this growth. China’s market is expected to expand at a CAGR of 10% through 2033, driven by expanded health insurance coverage, increased government healthcare spending, and rising cancer incidence.

Looking at Europe, Germany’s Gamma Knife market is projected to grow at a 4.1% CAGR through 2033, fueled by its well-developed healthcare infrastructure and rising incidence of brain tumors and neurological disorders. Similarly, Japan’s market, growing at a ~7.5% CAGR, benefits from continuous technological advancements and collaborative efforts between technology providers and healthcare institutions.

Overall, the Gamma Knife market is experiencing robust growth across various regions, driven by technological advancements, growing awareness of its benefits, and expanding applications in treating neurological disorders and cancers.

Key Regions

- North America

- The US

- Canada

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Mexico

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global gamma knife market is dominated by a few key players, with Elekta AB holding a significant share of the market. Other major players include Varian Medical Systems Inc, Solera Health Company, Zhuhai Hokai Medical Instruments Co Ltd, Masep Medical Science & Technology Development (Shenzhen) Co. Ltd., Huiheng Group, and Akesis Inc. These companies offer a variety of gamma knife systems, each with its own unique features and capabilities.

Elekta AB is the leading provider of gamma knife systems, with a market share of over 50%. The company’s flagship product, the Leksell Gamma Knife Icon, is considered the gold standard for gamma knife radiosurgery. Elekta AB has a strong track record of innovation and is well-positioned to continue to lead the market in the years to come.

Varian Medical Systems Inc is another major player in the gamma knife market, with a market share of approximately 30%. The company’s Edge radiosurgery system is a popular choice for hospitals and clinics that are looking for a cost-effective and versatile gamma knife solution. Varian Medical Systems Inc is also a leading provider of linear accelerators for radiotherapy, which gives the company a competitive advantage in the gamma knife market.

Market Key Players

- Elekta AB

- Varian Medical Systems Inc.

- Solera Health Company

- Zhuhai Hokai Medical Instruments Co Ltd.

- Masep Medical Science & Technology Development (Shenzhen) Co. Ltd.

- Huiheng Group

- Akesis Inc.

- Other Key Players

Recent Developments

- Elekta AB: In June 2024, Elekta AB launched the Elekta Unity Gamma Knife, integrating advanced MR imaging with precise radiosurgery. This new product aims to offer unprecedented real-time tumor tracking and treatment accuracy, enhancing outcomes in brain cancer therapies.

- Varian Medical Systems Inc.: In May 2024, Varian Medical Systems Inc. introduced the Varian Edge Gamma Knife, a next-generation system designed for streamlined operation and enhanced patient comfort. This launch reflects Varian’s ongoing commitment to technological innovation in oncology.

- Solera Health Company: In April 2024, Solera Health Company announced the acquisition of a technology firm specializing in artificial intelligence for healthcare, aiming to integrate AI with their Gamma Knife services to improve treatment planning and patient outcomes.

- Zhuhai Hokai Medical Instruments Co., Ltd.: In March 2024, Zhuhai Hokai Medical Instruments Co., Ltd. announced a strategic merger with a regional competitor, aiming to expand its market reach and enhance its R&D capabilities in the Gamma Knife technology sector.

- Masep Medical Science & Technology Development (Shenzhen) Co. Ltd.: In February 2024, Masep Infini, an innovative model of the Gamma Knife developed by Masep Medical, was launched, featuring enhanced automation and improved radiation precision, aimed at reducing treatment times and increasing throughput.

- Huiheng Group: In January 2024, Huiheng Group launched the Huiheng Gamma Knife Prime, which incorporates advanced dose optimization technology to minimize radiation exposure to healthy tissues while maximizing the impact on malignant targets. This development is part of Huiheng’s initiative to improve safety and efficacy in radiosurgical procedures.

Report Scope

Report Features Description Market Value (2023) USD 470.3 Million Forecast Revenue (2033) USD 742.3 Million CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Indications (Malignant Tumors, Benign Tumors, Vascular Disorders, Functional Disorders and Ocular Diseases) By Anatomy (Head, Neck, Other Body Parts) By End-Use (Hospitals, Clinics and Ambulatory Surgery Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Elekta AB, Varian Medical Systems Inc, Solera Health Company, Zhuhai Hokai Medical Instruments Co Ltd, Masep Medical Science & Technology Development (Shenzhen) Co. Ltd., Huiheng Group, Akesis Inc. and other Key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Elekta AB

- Varian Medical Systems Inc.

- Solera Health Company

- Zhuhai Hokai Medical Instruments Co Ltd.

- Masep Medical Science & Technology Development (Shenzhen) Co. Ltd.

- Huiheng Group

- Akesis Inc.

- Other Key Players