Global Game Streaming Market Size, Share, Growth Analysis By Hardware (Mobile Devices, PCs, Laptops and TVs, Game Consoles, Hand-held/Cloud-only Devices), By Content Genre (Shooter and Battle Royale, Adventure and RPG, Strategy, Simulation, Puzzle and Casual, Sports and Racing, Sandbox/Creative), By Revenue Model (In-Game Advertising, Subscription, Donations and Virtual Gifts, Pay-Per-View/Event Passes, Merchandise and Affiliate Sales), By Streaming Platform Type (Web-based Platforms, Mobile Apps, Console-Integrated Streaming, Smart-TV/OTT Apps, Pure Cloud Gaming Services), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177286

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

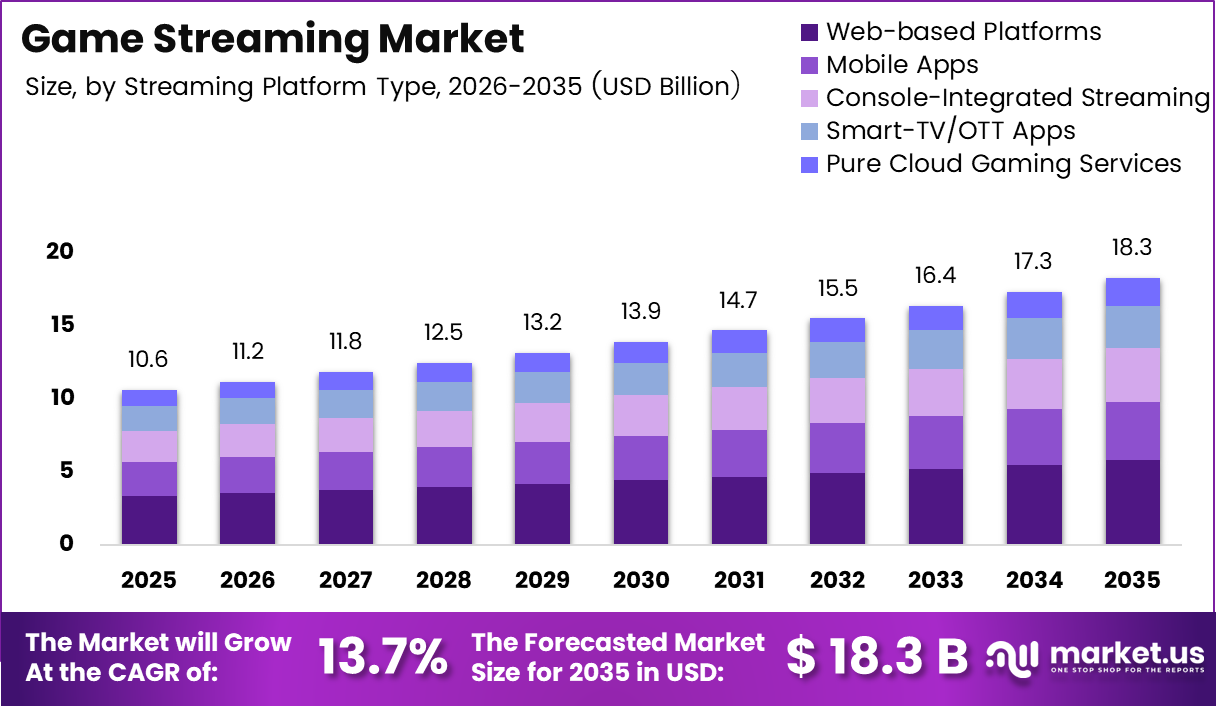

Global Game Streaming Market size is expected to be worth around USD 18.3 Billion by 2035 from USD 10.6 Billion in 2025, growing at a CAGR of 13.7% during the forecast period 2026 to 2035.

Game streaming represents the digital broadcasting of video game content through online platforms. Players and content creators share their gameplay experiences live or recorded with global audiences. This interactive entertainment medium combines gaming skills, personality-driven commentary, and community engagement across multiple devices and platforms.

The market encompasses various streaming technologies including cloud gaming services and traditional broadcast methods. Moreover, it integrates hardware devices, content genres, revenue models, and platform types. Therefore, the ecosystem supports diverse monetization strategies from advertising to subscriptions and virtual gifts.

Rising internet penetration and 5G network expansion drive seamless streaming experiences worldwide. Additionally, mobile gaming adoption enables on-the-go content consumption across smartphones and tablets. Consequently, platforms witness increased viewer engagement and longer watch times across demographic segments.

Cloud gaming technology eliminates hardware limitations by processing games on remote servers. However, bandwidth requirements remain substantial with 1080p streaming needing 15-25 Mbps and 4K requiring 35-50+ Mbps. Furthermore, latency under 30ms ensures excellent gameplay while delays beyond 120ms create poor user experiences.

According to Connect Broadband, cloud gaming services deliver high visual quality with 1080p or 4K visuals and framerates reaching 60-120fps. Strategic partnerships between game publishers and streaming platforms accelerate exclusive content distribution. Therefore, the ecosystem benefits from enhanced content libraries and viewer retention strategies.

Government support for digital infrastructure and e-sports development strengthens market foundations globally. Additionally, emerging markets in Asia-Pacific and Latin America present significant growth potential. Consequently, platforms expand their regional presence through localized content and payment options.

Interactive streaming features and AI-powered recommendation systems enhance viewer engagement substantially. Moreover, short-form gaming content and highlight clips gain traction across social media platforms. Therefore, the market continues evolving with technological advancements and changing consumer preferences shaping future growth trajectories.

Key Takeaways

- Global Game Streaming Market valued at USD 10.6 Billion in 2025, projected to reach USD 18.3 Billion by 2035

- Market growing at CAGR of 13.7% during forecast period 2026-2035

- Mobile Devices segment dominates Hardware category with 34.9% market share

- Shooter and Battle Royale leads Content Genre segment capturing 36.4% share

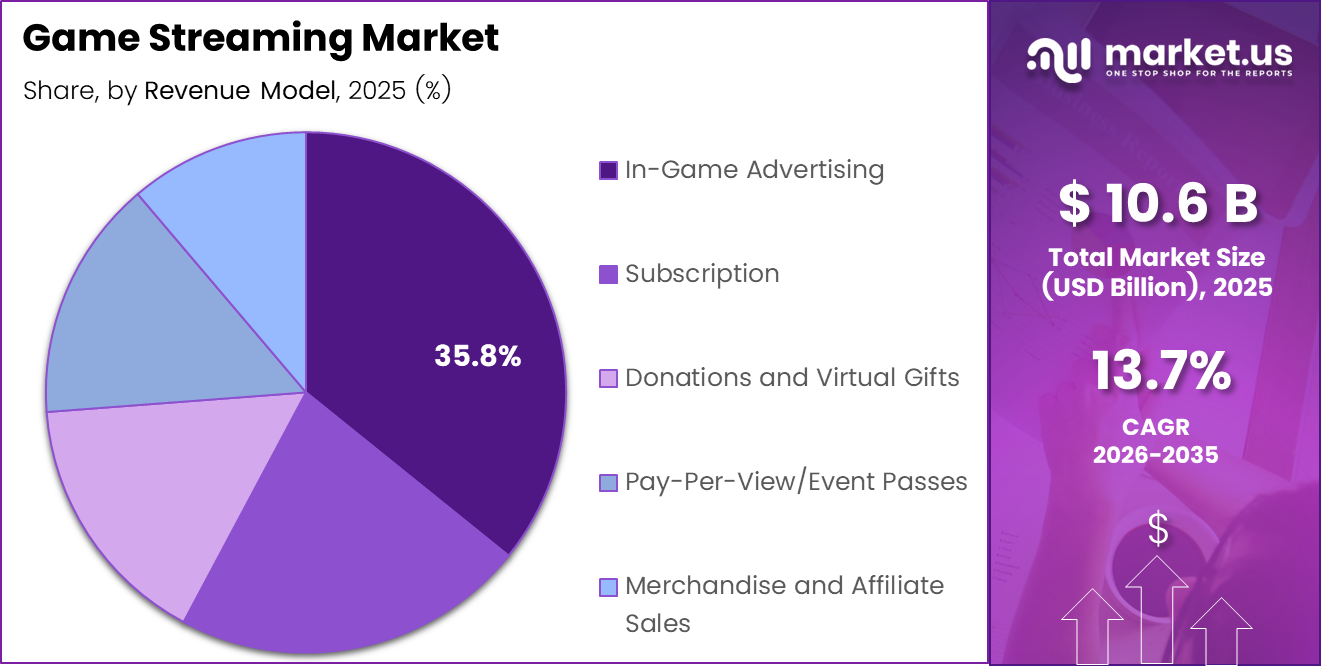

- In-Game Advertising holds 35.8% share in Revenue Model segment

- Web-based Platforms command 31.70% share in Streaming Platform Type segment

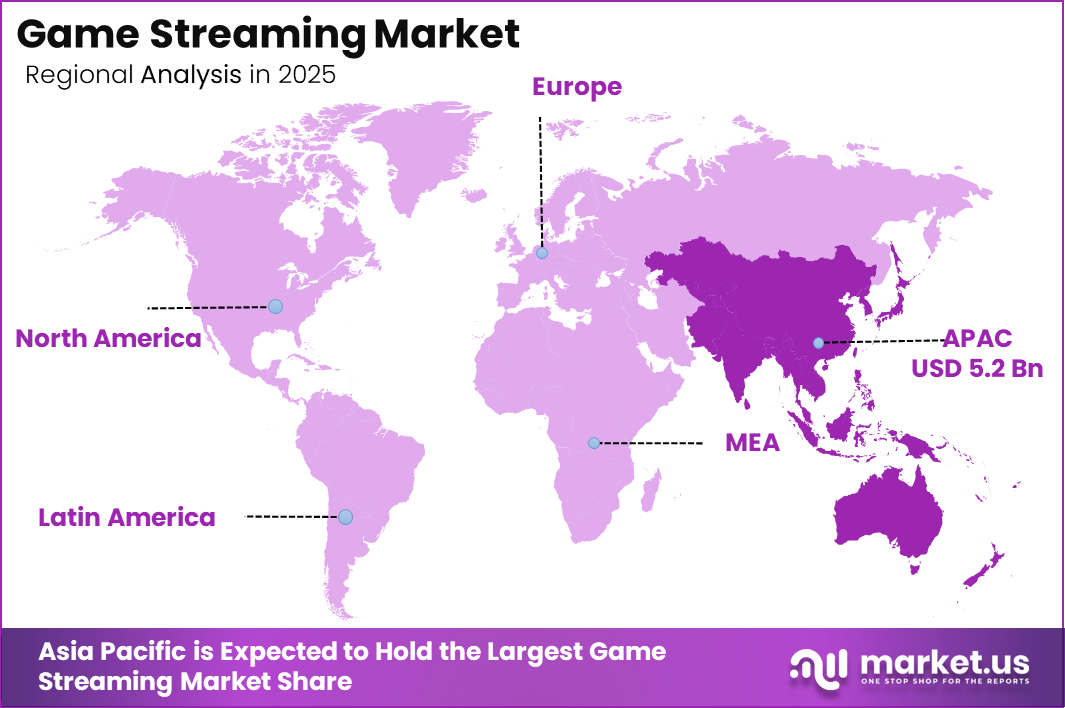

- Asia Pacific dominates regional market with 49.80% share valued at USD 5.2 Billion

- Cloud gaming requires 15-25 Mbps for 1080p and 35-50+ Mbps for 4K streaming

Hardware Analysis

Mobile Devices dominates with 34.9% due to widespread smartphone adoption and portability.

Mobile Devices held a dominant market position in the Hardware segment of Market, with a 34.9% share. The unprecedented growth stems from enhanced mobile processing capabilities, affordable gaming smartphones, and expanding 5G networks enabling seamless streaming experiences across demographics.

PCs, Laptops and TVs maintained substantial presence in the Hardware segment of Market. Traditional computing platforms continue attracting dedicated gamers and content creators seeking superior graphics, multitasking capabilities, and immersive large-screen experiences for competitive gaming.

Game Consoles secured significant positioning in the Hardware segment of Market. Console ecosystems thrive through exclusive titles, integrated streaming functionalities, and loyal communities valuing optimized performance and seamless entertainment experiences.

Hand-held / Cloud-only Devices emerged in the Hardware segment of Market. Specialized portable devices and cloud-dedicated hardware attract niche audiences prioritizing mobility and subscription-based gaming without traditional installation requirements.

Content Genre Analysis

Shooter and Battle Royale dominates with 36.4% due to competitive multiplayer engagement and esports popularity.

Shooter and Battle Royale held a dominant market position in the Content Genre segment of Market, with a 36.4% share. This genre captivates millions through adrenaline-fueled competitive gameplay, regular content updates, professional e-sports ecosystems, and social connectivity driving sustained player engagement globally.

Adventure and RPG commanded considerable influence in the Content Genre segment of Market. Narrative-driven experiences attract players seeking immersive storytelling, character development, and expansive virtual worlds offering hundreds of gameplay hours and emotional investment.

Strategy maintained dedicated following in the Content Genre segment of Market. Tactical gameplay appealing to intellectually-engaged audiences emphasizes planning, resource management, and competitive multiplayer battles requiring strategic thinking and coordination.

Simulation captured niche audiences in the Content Genre segment of Market. Realistic experiences ranging from life simulation to vehicle operation attract players seeking authentic, skill-building virtual environments and creative expression opportunities.

Puzzle and Casual retained widespread appeal in the Content Genre segment of Market. Accessible gameplay mechanics attract diverse demographics including non-traditional gamers seeking stress-free entertainment during commutes and leisure moments.

Sports and Racing sustained competitive presence in the Content Genre segment of Market. Licensed franchises and realistic simulations engage sports enthusiasts and competitive racing fans seeking authentic athletic experiences and multiplayer tournaments.

Sandbox/Creative fostered innovative communities in the Content Genre segment of Market. User-generated content platforms empower creative expression, collaborative building, and limitless gameplay possibilities attracting younger demographics and content creators.

Revenue Model Analysis

In-Game Advertising dominates with 35.8% due to non-intrusive monetization and free-to-play accessibility.

In-Game Advertising held a dominant market position in the Revenue Model segment of Market, with a 35.8% share. Brands leverage native advertising placements, sponsored content, and targeted campaigns reaching engaged audiences while enabling free access, creating mutually beneficial ecosystems for developers and users.

Subscription established recurring revenue streams in the Revenue Model segment of Market. Monthly memberships offering premium content, exclusive features, ad-free experiences, and game libraries attract committed users valuing consistent quality and comprehensive access.

Donations and Virtual Gifts strengthened creator economies in the Revenue Model segment of Market. Viewer-supported monetization through tipping, virtual items, and fan contributions enables independent streamers and content creators to sustain professional careers.

Pay-Per-View/Event Passes monetized exclusive content in the Revenue Model segment of Market. Premium tournaments, exclusive live events, and special broadcasts generate revenue from dedicated fans seeking unique competitive gaming experiences.

Merchandise and Affiliate Sales diversified income sources in the Revenue Model segment of Market. Branded products, affiliate partnerships, and promotional collaborations enable creators and platforms to expand beyond digital revenues into physical goods.

Streaming Platform Type Analysis

Web-based Platforms dominates with 31.70% due to universal accessibility and device compatibility.

Web-based Platforms held a dominant market position in the Streaming Platform Type segment of Market, with a 31.70% share. Browser-based streaming eliminates download requirements, ensuring instant access across operating systems, devices, and locations, maximizing reach and convenience for casual viewers.

Mobile Apps captured smartphone-centric audiences in the Streaming Platform Type segment of Market. Dedicated applications optimize streaming quality, notification systems, and offline viewing capabilities, catering to on-the-go consumption patterns and mobile-first demographics.

Console-Integrated Streaming served gaming ecosystems in the Streaming Platform Type segment of Market. Native integration within PlayStation, Xbox, and Nintendo platforms enables seamless content discovery, gameplay sharing, and community engagement without device switching.

Smart-TV/OTT Apps expanded living room entertainment in the Streaming Platform Type segment of Market. Large-screen streaming applications attract household viewing, family-friendly content consumption, and premium viewing experiences rivaling traditional broadcasting.

Pure Cloud Gaming Services pioneered hardware-independent gaming in the Streaming Platform Type segment of Market. Subscription-based cloud platforms eliminate download requirements and hardware barriers, democratizing access to AAA gaming experiences through streaming technology.

Key Market Segments

By Hardware

- Mobile Devices

- PCs, Laptops and TVs

- Game Consoles

- Hand-held/Cloud-only Devices

By Content Genre

- Shooter and Battle Royale

- Adventure and RPG

- Strategy

- Simulation

- Puzzle and Casual

- Sports and Racing

- Sandbox/Creative

By Revenue Model

- In-Game Advertising

- Subscription

- Donations and Virtual Gifts

- Pay-Per-View/Event Passes

- Merchandise and Affiliate Sales

By Streaming Platform Type

- Web-based Platforms

- Mobile Apps

- Console-Integrated Streaming

- Smart-TV/OTT Apps

- Pure Cloud Gaming Services

Drivers

Rising Global Internet Penetration and 5G Network Expansion Enabling Seamless Cloud Gaming Experiences

Expanding broadband infrastructure and 5G deployment eliminate connectivity barriers for streaming consumption. High-speed networks support demanding bandwidth requirements for 4K resolution and 120fps gameplay. Moreover, reduced latency below 30ms ensures responsive cloud gaming experiences. Therefore, improved connectivity drives viewer growth across geographic markets.

Growing smartphone adoption in emerging markets creates massive mobile streaming audiences. Affordable devices with capable processors enable quality viewing experiences. Additionally, data plan improvements reduce consumption costs for viewers. Consequently, mobile-first platforms experience accelerated user acquisition.

Strategic partnerships between game publishers and streaming platforms accelerate exclusive content distribution. Developers recognize streaming’s marketing value for title launches and community building. Furthermore, integrated streaming features within games simplify content creation workflows. Therefore, collaborative ecosystems strengthen market foundations and viewer engagement rates.

Restraints

High Bandwidth Requirements and Network Latency Issues Affecting User Experience Quality

Cloud gaming demands substantial internet speeds with 1080p requiring 15-25 Mbps and 4K needing 35-50+ Mbps. Insufficient bandwidth creates buffering, quality degradation, and viewer frustration. Moreover, inconsistent connections disrupt live broadcasts and competitive gameplay. Therefore, infrastructure limitations restrict market penetration in underserved regions.

Latency beyond 60ms introduces noticeable delays affecting gameplay responsiveness and viewer enjoyment. Network instability causes stream interruptions and audio-video synchronization problems. Additionally, peak usage times strain network capacity creating degraded experiences. Consequently, technical barriers prevent seamless adoption among potential users.

Intense competition among platforms and individual streamers creates monetization challenges. Oversaturated markets make viewer acquisition increasingly difficult and expensive. Furthermore, algorithm changes impact content discoverability and revenue stability. Therefore, sustainable income generation remains challenging for emerging creators and smaller platforms.

Growth Factors

Expansion of Cloud Gaming Services and Subscription-Based Streaming Models

Cloud gaming eliminates hardware barriers by processing games on remote servers with enterprise-grade specifications. Subscription services offer unlimited game libraries for fixed monthly fees. Moreover, instant play capabilities remove download wait times and storage constraints. Therefore, cloud models democratize access to premium gaming experiences.

Virtual reality and augmented reality integration creates immersive streaming experiences beyond traditional formats. VR broadcasts enable viewers to experience gameplay from player perspectives. Additionally, AR overlays enhance live streams with interactive elements and information layers. Consequently, emerging technologies differentiate platforms and attract tech-savvy audiences.

Rising infrastructure investments improve streaming quality through enhanced server networks and content delivery systems. Advanced encoding technologies reduce bandwidth requirements while maintaining visual fidelity. Furthermore, creator tool development simplifies production workflows and elevates content quality. Therefore, technical improvements support professional-grade streaming from diverse creator backgrounds.

Emerging Trends

Surge in Interactive Streaming Features Including Real-Time Viewer Engagement and Co-Streaming

Interactive elements transform passive viewing into participatory experiences through polls, predictions, and gameplay decisions. Real-time chat integration enables direct creator-viewer communication during broadcasts. Moreover, co-streaming features allow multiple creators to broadcast simultaneously from different perspectives. Therefore, engagement innovations strengthen community bonds and extend watch times.

Artificial intelligence systems automate content moderation protecting communities from harmful behavior and spam. Machine learning algorithms deliver personalized content recommendations based on viewing history and preferences. Additionally, AI-powered highlights automatically generate shareable clips from lengthy streams. Consequently, intelligent systems enhance both platform safety and content discoverability.

Short-form gaming content gains prominence across social media platforms through highlights and memorable moments. Vertical video formats optimize mobile consumption and social sharing. Furthermore, clip-based discovery introduces new audiences to full streams and creators. Therefore, multi-format strategies expand reach beyond traditional long-form broadcasting approaches.

Regional Analysis

Asia Pacific Dominates the Game Streaming Market with a Market Share of 49.80%, Valued at USD 5.2 Billion

Asia Pacific leads global game streaming adoption with 49.80% market share valued at USD 5.2 Billion. Massive gaming populations in China, Japan, and South Korea drive viewership growth. Moreover, mobile-first consumption patterns align with regional smartphone penetration. Therefore, Asia Pacific remains the dominant force shaping market evolution and platform strategies.

North America Game Streaming Market Trends

North America maintains strong market presence through established streaming platforms and esports infrastructure. High-speed internet availability supports 4K streaming and cloud gaming adoption. Additionally, mature monetization ecosystems enable creator professionalization and brand partnerships. Consequently, the region leads in per-user revenue generation and premium content production.

Europe Game Streaming Market Trends

Europe demonstrates diverse gaming cultures with strong regional platform preferences and language localization. Regulatory frameworks shape advertising practices and data privacy standards. Moreover, esports investments and tournament hosting strengthen viewer engagement. Therefore, European markets balance growth with consumer protection priorities.

Latin America Game Streaming Market Trends

Latin America experiences rapid mobile gaming adoption driving streaming consumption growth. Improving internet infrastructure expands accessible markets across major urban centers. Additionally, localized content and payment options reduce adoption barriers. Consequently, the region presents significant expansion opportunities for international platforms.

Middle East & Africa Game Streaming Market Trends

Middle East and Africa markets develop through increasing smartphone penetration and youth demographic engagement. Gaming investments and esports initiatives accelerate infrastructure development. Furthermore, cultural content preferences drive demand for localized streaming experiences. Therefore, emerging opportunities attract platform expansion and creator ecosystem development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Alphabet Inc. dominates game streaming through YouTube Gaming integration with massive user base and advertising infrastructure. The platform leverages existing content creator ecosystems and recommendation algorithms. Moreover, Google Stadia represents cloud gaming investments despite market challenges. Therefore, Alphabet maintains strategic positioning across multiple streaming segments and monetization approaches.

Amazon.com Inc. operates Twitch as the leading dedicated game streaming platform globally. Extensive features support professional creators through subscriptions, bits, and advertising revenue. Additionally, Amazon Prime integration drives cross-platform user engagement and exclusive benefits. Consequently, the company controls significant market share in live streaming and creator economy development.

Meta Platforms Inc. pursues game streaming through Facebook Gaming and social media integration strategies. Platform connectivity enables seamless content sharing and community building across existing networks. Moreover, investments in virtual reality position Meta for immersive streaming futures. Therefore, the company leverages social graph advantages for viewer acquisition and retention.

Apple Inc. influences game streaming through App Store distribution and Apple Arcade subscription service. Hardware ecosystem integration delivers optimized streaming experiences across iPhones, iPads, and Apple TVs. Additionally, privacy-focused positioning differentiates platform policies from competitors. Consequently, Apple shapes mobile streaming standards through platform control and developer relationships.

Key players

- Alphabet Inc.

- Amazon.com Inc.

- Meta Platforms Inc.

- Apple Inc.

- Genvid Holdings Inc.

- GosuGamers

- Huya

- NVIDIA Corp.

- Parsec Cloud Inc.

- Sony Group Corp.

Recent Developments

- December 2024 – Streamplay Studio completed acquisition of North American indie gaming leader Noodlecake Studios, expanding content portfolio and development capabilities. This strategic move strengthens independent gaming content distribution and creator partnerships across streaming platforms.

- February 2026 – Genius Sports entered definitive agreement to acquire Legend, creating digital sports and gaming media powerhouse. The merger combines sports data analytics with gaming content delivery, expanding integrated streaming and betting experiences.

Report Scope

Report Features Description Market Value (2025) USD 10.6 Billion Forecast Revenue (2035) USD 18.3 Billion CAGR (2026-2035) 13.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Hardware (Mobile Devices, PCs, Laptops and TVs, Game Consoles, Hand-held/Cloud-only Devices), By Content Genre (Shooter and Battle Royale, Adventure and RPG, Strategy, Simulation, Puzzle and Casual, Sports and Racing, Sandbox/Creative), By Revenue Model (In-Game Advertising, Subscription, Donations and Virtual Gifts, Pay-Per-View/Event Passes, Merchandise and Affiliate Sales), By Streaming Platform Type (Web-based Platforms, Mobile Apps, Console-Integrated Streaming, Smart-TV/OTT Apps, Pure Cloud Gaming Services) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alphabet Inc., Amazon.com Inc., Meta Platforms Inc., Apple Inc., Genvid Holdings Inc., GosuGamers, Huya, NVIDIA Corp., Parsec Cloud Inc., Sony Group Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alphabet Inc.

- Amazon.com Inc.

- Meta Platforms Inc.

- Apple Inc.

- Genvid Holdings Inc.

- GosuGamers

- Huya

- NVIDIA Corp.

- Parsec Cloud Inc.

- Sony Group Corp.