Global Gable Top Packaging Market Size, Share, Growth Analysis By Material Type (Paper, Plastic, Aluminium, Others), By Cap Type (Screw Caps, Flip Caps, Others), By Application (Food & Beverages, Personal Care Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156310

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

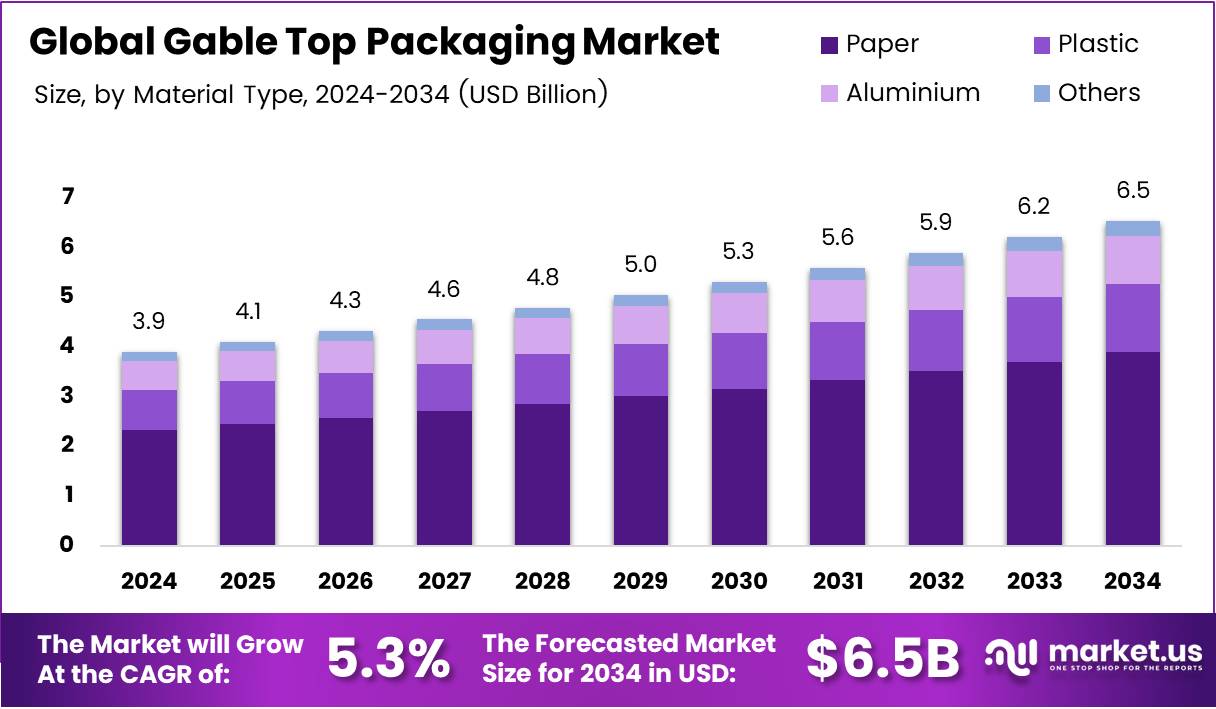

The Global Gable Top Packaging Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Gable Top Packaging market is defined by cartons with foldable tops, widely used for beverages, dairy, and liquid food products. These cartons combine convenience with sustainability, offering renewable paperboard solutions that meet rising consumer demand for eco-friendly packaging. The market aligns with growing food safety regulations and modern retail distribution systems.

The Gable Top Packaging industry is positioned for stable expansion due to rising urban consumption trends. With consumers increasingly valuing recyclable and lightweight packaging formats, gable top cartons deliver strong utility. Their adaptability across dairy, juice, and plant-based beverages further strengthens the category’s competitive relevance in packaging innovation.

Growth is expected as major producers invest in advanced carton designs with enhanced barrier properties. Manufacturers are integrating renewable raw materials to meet sustainability targets, while also developing innovative closures for consumer convenience. Strategic investments in capacity expansion and regional manufacturing hubs are anticipated to support rising demand and reduce logistics costs.

Opportunities exist in the expanding plant-based beverage segment, where sustainable packaging solutions are prioritized. Governments are promoting circular economy initiatives, pushing industries to adopt recyclable formats. Favorable policies encouraging reduced plastic consumption, along with incentives for renewable packaging materials, are shaping a supportive business environment for carton packaging players globally.

Regulations around packaging waste and recycling efficiency are also shaping market dynamics. In regions such as North America and Europe, compliance with recycling standards has become mandatory. This regulatory push fosters adoption of carton-based packaging and positions gable top cartons as a sustainable alternative to plastic bottles and other rigid packaging formats.

According to the Carton Council, more than 78 million U.S. households—over 62%—now have access to curbside carton recycling programs. This reflects strong infrastructure backing for gable top packaging adoption. Furthermore, the U.S. Environmental Protection Agency reported that nearly 33 million tons of cardboard was recycled in 2023, with a recycling rate of 71–76%. These statistics highlight how recycling frameworks are fueling growth opportunities within this packaging segment.

Key Takeaways

- The Global Gable Top Packaging Market is projected to reach USD 6.5 Billion by 2034, up from USD 3.9 Billion in 2024, growing at a CAGR of 5.3%.

- In 2024, Paper dominated the material type segment with a 59.5% share, driven by recyclability and eco-friendly demand.

- Screw Caps led the cap type segment with a 67.3% share in 2024, supported by convenience and reusability.

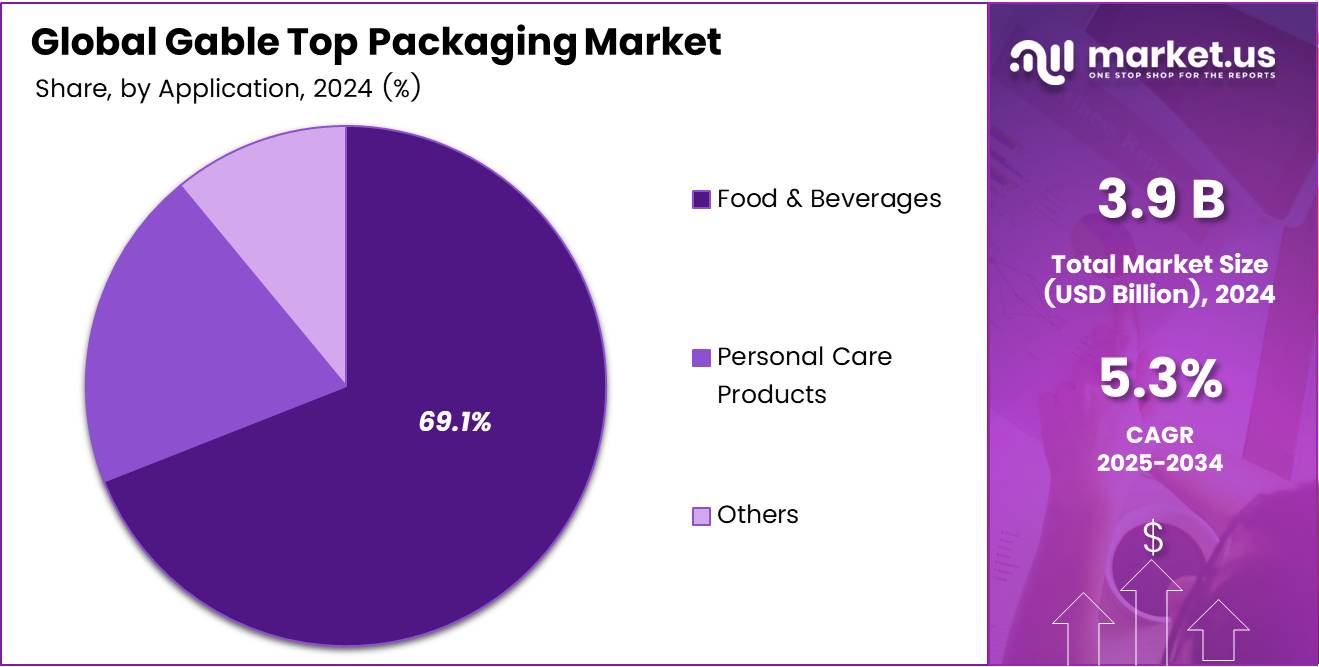

- The Food & Beverages application segment held a dominant 69.1% share in 2024, boosted by high adoption in milk, juices, and liquid consumables.

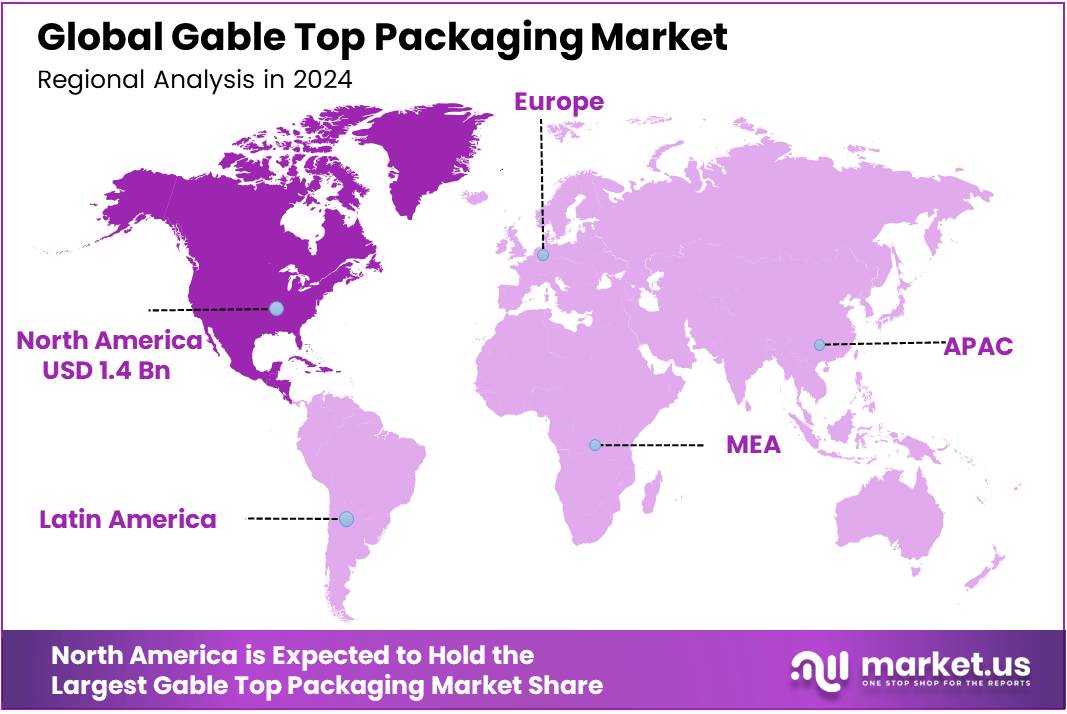

- North America was the leading regional market with a 37.8% share, valued at USD 1.4 Billion, anchored by dairy and premium juice categories.

Material Type Analysis

Paper dominates with 59.5% due to its eco-friendliness and strong adoption in sustainable packaging.

In 2024, Paper held a dominant market position in By Material Type Analysis segment of Gable Top Packaging Market, with a 59.5% share. Its dominance is driven by the rising preference for recyclable and biodegradable solutions, particularly in food and beverage applications where sustainable packaging remains a top priority.

Plastic accounted for a notable portion of the segment, supported by its flexibility, durability, and low production cost. The material continues to find applications in regions with high demand for lightweight packaging formats, particularly in single-serve and on-the-go consumption.

Aluminium gained attention as a protective material ensuring extended shelf life and preservation of sensitive products. Its use remains strong in premium categories where maintaining product integrity is essential, especially for dairy and specialty beverages.

Others, including composite and hybrid material innovations, contributed a smaller share. These formats are emerging in niche applications, appealing to companies experimenting with packaging differentiation, improved aesthetics, and performance benefits beyond traditional solutions.

Cap Type Analysis

Screw Caps dominate with 67.3% owing to their ease of use and strong preference across beverage applications.

In 2024, Screw Caps held a dominant market position in By Cap Type Analysis segment of Gable Top Packaging Market, with a 67.3% share. Their success stems from convenience, reusability, and widespread adoption in dairy and juice packaging, where resealability plays a crucial role.

Flip Caps held a smaller but noteworthy position, particularly appealing in ready-to-drink and kids’ packaging. Their easy dispensing functionality makes them suitable for on-the-go consumption, although higher production costs limit broader adoption compared to screw variants.

Others, including custom closures and push-fit caps, represented a modest share of the segment. These formats are gradually emerging, targeted at premium packaging lines or brand-specific innovations designed to improve differentiation and consumer experience.

Application Analysis

Food & Beverages dominate with 69.1% due to their extensive consumption and packaging sustainability focus.

In 2024, Food & Beverages held a dominant market position in By Application Analysis segment of Gable Top Packaging Market, with a 69.1% share. This dominance is attributed to widespread usage in milk, juices, and other liquid consumables where freshness, safety, and eco-friendly packaging drive adoption.

Personal Care Products accounted for a smaller yet steadily growing portion of demand. Brands in cosmetics and toiletries are adopting gable top formats for premium appeal, though the segment remains niche compared to food and beverage applications.

Others contributed a limited share, including household and specialty products where packaging differentiation is explored. These segments highlight the adaptability of gable top cartons in non-traditional markets but remain secondary in overall adoption trends.

Key Market Segments

By Material Type

- Paper

- Plastic

- Aluminium

- Others

By Cap Type

- Screw Caps

- Flip Caps

- Others

By Application

- Food & Beverages

- Personal Care Products

- Others

Drivers

Rising Demand for Sustainable Carton-Based Packaging in the Dairy Sector

The demand for gable top packaging is gaining momentum as dairy companies prioritize sustainable carton-based formats. Consumers are increasingly aware of environmental impacts, leading to higher preference for recyclable and renewable paperboard cartons. This shift is driving steady adoption in milk, yogurt drinks, and cream packaging across developed and developing markets.

Urbanization is further contributing to the rise of gable top cartons, especially through the growing demand for single-serve dairy and beverage products. With more consumers living in cities and leading fast-paced lifestyles, small and portable packaging formats are becoming essential. Gable top cartons are well-suited for convenience-driven buyers, offering easy handling and spill-proof use.

Premium beverage categories such as fresh juices and plant-based milk alternatives are also turning toward gable top packaging. The natural appearance and eco-friendly perception of cartons appeal strongly to health-conscious and sustainability-driven consumers. This positioning gives dairy and beverage brands a competitive edge, boosting market expansion in the premium segment.

Overall, the rising focus on sustainability, combined with urban consumption patterns and premium product adoption, is reinforcing the growth of gable top packaging in the dairy and beverage industry. As companies continue investing in eco-friendly packaging solutions, gable top cartons are expected to secure a stronger market presence in the years ahead.

Restraints

Competition from Alternative Packaging Formats such as PET Bottles and Pouches

The gable top packaging market faces competitive pressure from alternative formats such as PET bottles and flexible pouches. These alternatives are lightweight, durable, and often cost-effective, making them highly attractive for beverage manufacturers aiming to reduce logistics and packaging costs.

Another key restraint is the limited recyclability of gable top cartons in regions without advanced waste management infrastructure. While the material is largely recyclable, the lack of proper collection and separation systems restricts its recovery rate, especially in emerging economies. This reduces overall adoption and impacts sustainability claims.

Fluctuating raw material prices also pose challenges for manufacturers. Paperboard, coatings, and other inputs are subject to global supply variations and inflationary pressures. Rising production costs can lead to narrower profit margins for packaging companies, making it harder for smaller players to compete with alternative formats.

Taken together, the growing competition, infrastructure limitations, and volatile costs are restraining faster adoption of gable top cartons globally. Unless addressed through innovation and investment, these challenges could limit the market’s ability to expand at its full potential.

Growth Factors

Integration of Smart Packaging Solutions with QR Codes and NFC Tags

Smart packaging is emerging as a key growth avenue for the gable top packaging market. The use of QR codes and NFC tags on cartons allows brands to enhance consumer engagement by offering traceability, authenticity checks, and interactive experiences directly from the package.

Expansion into emerging markets also presents major opportunities. Rising disposable incomes and increasing demand for packaged food and beverages are creating favorable conditions for gable top packaging adoption. Countries in Asia, Latin America, and Africa are witnessing higher consumption of milk, juice, and convenience beverages, strengthening the need for innovative carton packaging.

Another promising development lies in biodegradable and fully recyclable barrier coatings. Innovations in water-based and plant-derived coatings are enabling gable top cartons to achieve better shelf life while aligning with global sustainability goals. This progress addresses environmental concerns and improves the attractiveness of cartons compared to alternatives.

As companies leverage smart technologies, expand geographically, and adopt greener materials, gable top packaging is poised for long-term growth. These opportunities position the market as a central player in the evolving packaging landscape.

Emerging Trends

Shift Toward Eco-Friendly and Lightweight Gable Top Cartons

The packaging industry is witnessing a strong trend toward eco-friendly and lightweight solutions, with gable top cartons at the forefront. Their renewable paper-based composition makes them increasingly favored by environmentally conscious consumers and brands striving to reduce their carbon footprint.

Another trend shaping the market is the growing use of gable top cartons in ready-to-drink coffee and flavored water packaging. These beverages demand portable, attractive, and sustainable formats, and gable top cartons provide a balance of convenience and premium appeal.

Resealable caps are also becoming a preferred feature in gable top packaging, enhancing consumer convenience. The ability to easily open and close cartons appeals to modern buyers seeking functionality and waste reduction, particularly in multi-serve beverage categories.

Finally, digital printing technologies are transforming gable top packaging into a powerful branding tool. High-quality graphics, personalization, and short-run printing options allow companies to stand out on crowded shelves and cater to targeted consumer groups.

These trends collectively highlight the adaptability of gable top packaging in meeting evolving consumer expectations. As sustainability, convenience, and customization remain top priorities, these factors are expected to drive ongoing adoption in the global market.

Regional Analysis

North America Dominates the Gable Top Packaging Market with a Market Share of 37.8%, Valued at USD 1.4 Billion

North America emerged as the leading regional market, anchored by mature dairy and premium juice categories across retail and foodservice. Strong cold-chain logistics and retailer private-label expansion continue to support format standardization and shelf presence. Emphasis on recyclability and paper-based packaging aligns with brand sustainability roadmaps, reinforcing scale advantages. North America accounts for 37.8% share, valued at USD 1.4 Billion, reflecting robust end-use penetration and stable pricing dynamics.

Europe Gable Top Packaging Market Trends

Europe demonstrates steady demand led by chilled dairy, plant-based beverages, and premium juices in Northern and Western markets. Circular economy policies and retailer packaging targets sustain carton adoption, with closures and barrier enhancements improving usability. Cross-border private-label activity supports co-packing networks and short runs. Despite input-cost volatility, supplier innovation in coatings and fiber efficiency is anticipated to protect margins.

Asia Pacific Gable Top Packaging Market Trends

Asia Pacific is projected to post above-average growth as urbanization, convenience retail, and school milk programs expand format familiarity. Rising adoption in ready-to-drink teas, functional juices, and plant-based milks widens end-use breadth. Local converting capacity and regional sourcing strategies improve lead times and cost positions. Value-engineered caps and lightweight paperboards are expected to accelerate penetration in price-sensitive markets.

Middle East & Africa Gable Top Packaging Market Trends

In the Middle East & Africa, modernization of retail and quick-service channels is enhancing visibility for chilled dairy and nectar-based beverages. Investment in regional dairies and filling lines supports shorter supply chains and fresher offerings. Climate considerations and portability favor carton formats for on-the-go consumption. Recycling infrastructure remains uneven, yet pilot initiatives and stakeholder partnerships are anticipated to improve recovery rates over time.

Latin America Gable Top Packaging Market Trends

Latin America registers consistent uptake in UHT and chilled milk, complemented by flavored dairy and value-added juices. Brand and private-label players are emphasizing convenience through reclosable caps and ergonomic designs to drive repeat use. Currency fluctuations and input-cost swings influence format mix, but retailer assortment resets are expected to support stable shelf space. Localized converting and logistics optimization remain priorities for cost control.

U.S. Gable Top Packaging Market Trends

Within the U.S., demand is supported by premium dairy, specialty juices, and expanding plant-based beverage portfolios. Retailers prioritize recyclable paper-based formats, while brands invest in cap functionality and barrier upgrades to extend freshness. Foodservice recovery and convenience channels bolster single-serve momentum. Sustainability claims, shelf impact, and private-label innovation are anticipated to remain the key purchase drivers across categories.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Gable Top Packaging Company Insights

In 2024, the global gable top packaging market continued to reflect the strategic influence of key packaging manufacturers driving innovation, sustainability, and product diversification. These companies played a pivotal role in shaping packaging adoption across dairy, beverages, and plant-based product categories.

Parksons Packaging Ltd. reinforced its strong presence in Asia by expanding its eco-friendly carton offerings. The company focused on lightweight, recyclable packaging, catering to increasing consumer demand for sustainable solutions in fast-growing urban markets. Its strategic investments supported both domestic and international clients with premium carton-based formats.

Carton Service Inc. leveraged its expertise in custom packaging solutions with a strong emphasis on food and beverage sectors. The company focused on expanding capacity for short-run, high-quality gable top cartons to meet rising demand for personalized and flexible packaging formats in the North American market.

Evergreen Packaging Inc. maintained its leadership through sustainable carton development, integrating renewable materials and responsible forestry practices. With strong ties to the dairy industry, the company advanced innovation in single-serve and family-size cartons, reinforcing its positioning as a key supplier to beverage brands across global markets.

UNITED CAPS LUXEMBOURG S.A strengthened its position in closures for gable top cartons by expanding its product line with innovative, tamper-evident solutions. Its focus on precision-engineered caps complemented the growth of liquid packaging, particularly in premium juice and plant-based milk categories, where consumer convenience and safety remain critical drivers.

Top Key Players in the Market

- Parksons Packaging Ltd.

- Carton Service Inc.

- Evergreen Packaging Inc.

- UNITED CAPS LUXEMBOURG S.A

- Tetra Pak, International S.A.

- Elopak Inc.

- Silgan Plastic Closure Solutions

- Closure Systems International, Inc.

Recent Developments

- In March 2025, Saica Group announced a second major investment in the USA, committing more than $110 million. The expansion reflects the company’s strategy to strengthen its footprint in North America and enhance its sustainable packaging operations.

- In July 2025, SIG revealed plans to expand its state-of-the-art carton packaging plant in Querétaro, Mexico. The investment is expected to boost production capacity, support growing regional demand, and reinforce the company’s commitment to advanced packaging solutions.

- In June 2025, Green Bay Packaging invested more than $1 billion in its Morrilton, Arkansas facility. This substantial project is aimed at expanding operations, integrating sustainable practices, and ensuring long-term growth in corrugated packaging production.

- In December 2024, Carton Pack acquired Clifton Packaging Group to strengthen its flexible packaging portfolio. The acquisition enhances product offerings, broadens market reach, and accelerates innovation within the global packaging industry.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paper, Plastic, Aluminium, Others), By Cap Type (Screw Caps, Flip Caps, Others), By Application (Food & Beverages, Personal Care Products, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Parksons Packaging Ltd., Carton Service Inc., Evergreen Packaging Inc., UNITED CAPS LUXEMBOURG S.A, Tetra Pak, International S.A., Elopak Inc., Silgan Plastic Closure Solutions, Closure Systems International, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Parksons Packaging Ltd.

- Carton Service Inc.

- Evergreen Packaging Inc.

- UNITED CAPS LUXEMBOURG S.A

- Tetra Pak, International S.A.

- Elopak Inc.

- Silgan Plastic Closure Solutions

- Closure Systems International, Inc.