Global G-Protein Coupled Receptors Market By Product Type (Cell Lines, Ligands, Detection Kits, and Cell Culture Reagents), By Application (Cancer Research, Respiratory Research, Inflammation Research, Cardiovascular Research, and Others), By Assay Type (cAMP Functional Assays, Trafficking Assays, Internalization Assays, Calcium Functional Assays, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151552

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

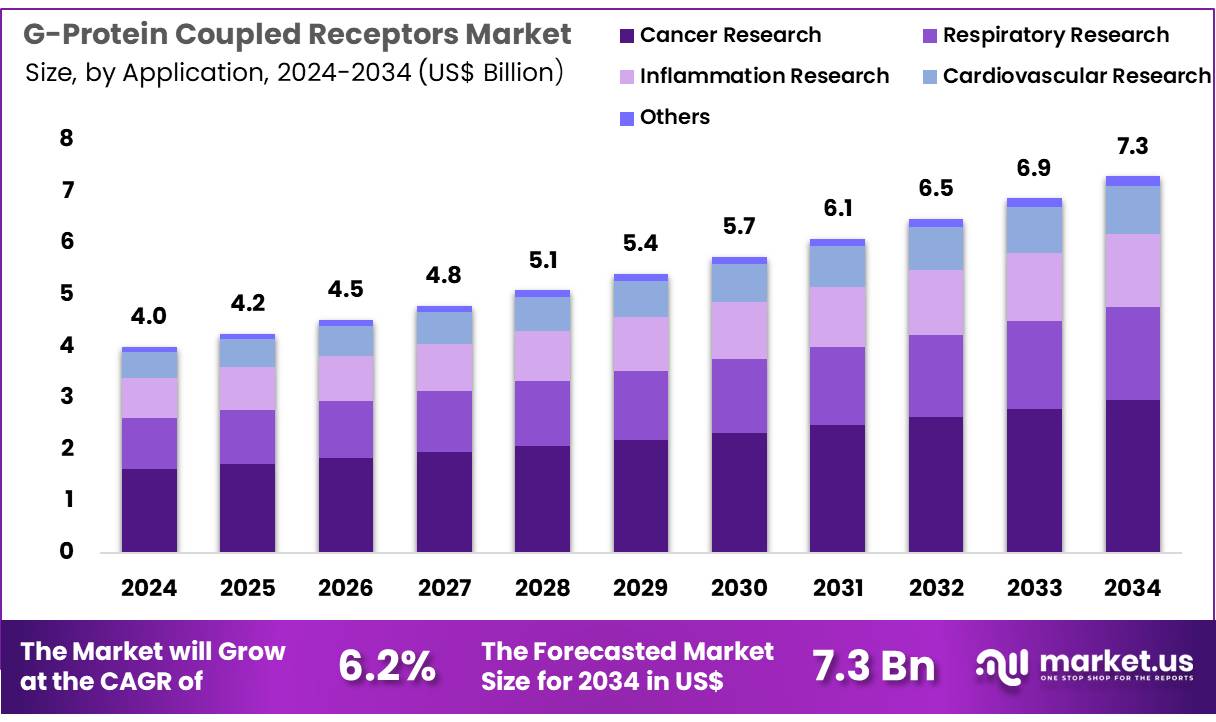

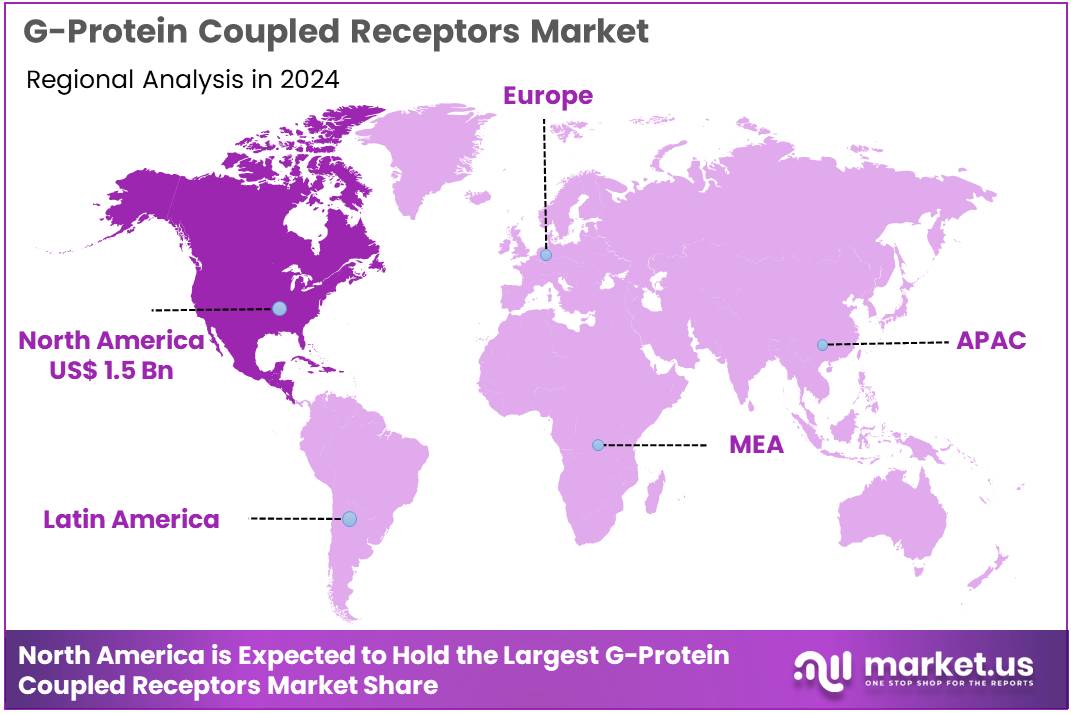

Global G-Protein Coupled Receptors Market size is expected to be worth around US$ 7.3 Billion by 2034 from US$ 4.0 Billion in 2024, growing at a CAGR of 6.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 1.5 Billion.

Increasing recognition of G-protein coupled receptors (GPCRs) as critical targets in drug discovery is driving significant growth in the GPCR market. These receptors play a pivotal role in a variety of physiological processes, including neurotransmission, immune responses, and endocrine regulation, making them key players in the treatment of a wide range of diseases such as neurological disorders, cardiovascular diseases, and cancers. GPCRs are implicated in numerous conditions, leading to a surge in research and development aimed at discovering novel therapies that target these receptors.

The market benefits from advancements in technologies such as high-throughput screening and molecular biology, enabling the identification of new drug candidates targeting specific GPCR subtypes. Rising investments in drug discovery, especially for conditions with high unmet medical needs, present ample opportunities for growth in this market.

In August 2022, Sosei Group Corporation entered into a collaboration with AbbVie to explore and develop novel small molecules targeting GPCRs linked to neurological diseases. Sosei will lead the research and development efforts through initial IND-enabling studies, with AbbVie holding exclusive options to license up to three programs and assuming responsibility for further clinical development. This collaboration underscores the increasing focus on GPCR-targeted therapies and highlights the opportunities for innovative solutions in treating complex diseases. As more therapies targeting GPCRs reach clinical trials and eventually commercialization, the market is poised for continued expansion.

Key Takeaways

- In 2024, the market for G-protein coupled receptors generated a revenue of US$ 4.0 Billion, with a CAGR of 6.2%, and is expected to reach US$ 7.3 Billion by the year 2034.

- The product type segment is divided into cell lines, ligands, detection kits, and cell culture reagents, with cell lines taking the lead in 2024 with a market share of 43.2%.

- Considering application, the market is divided into cancer research, respiratory research, inflammation research, cardiovascular research, and others. Among these, cancer research held a significant share of 40.6%.

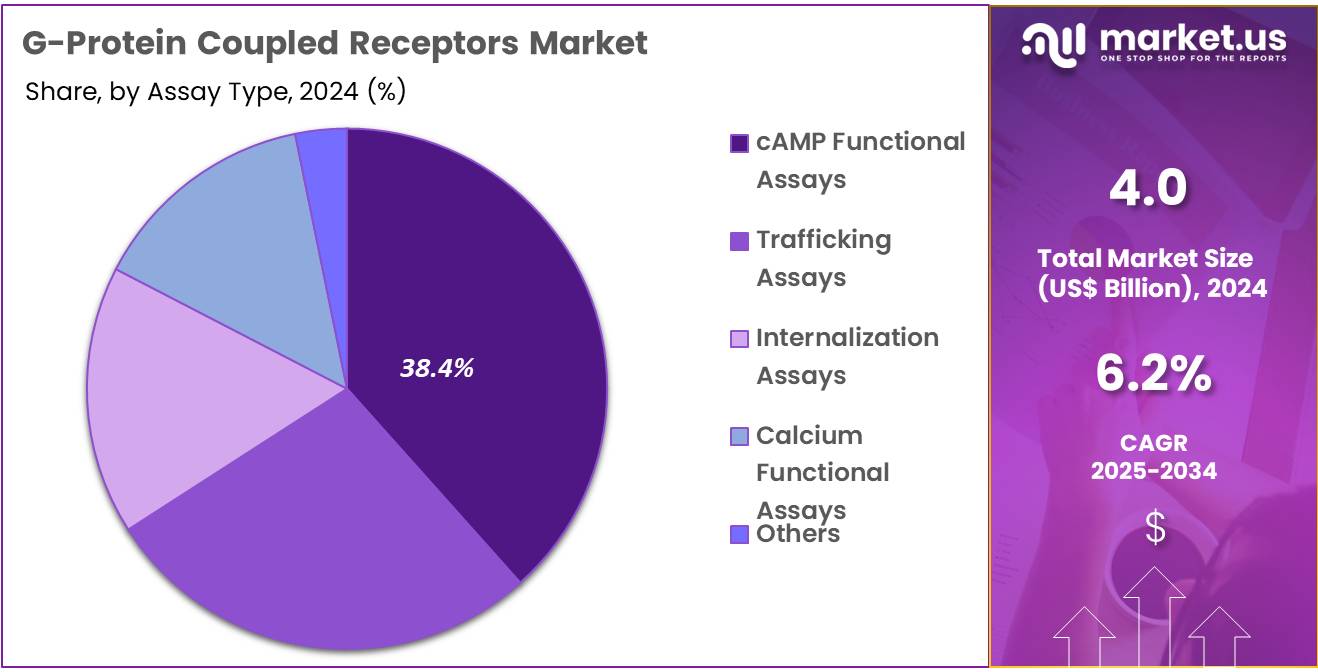

- Furthermore, concerning the assay type segment, the market is segregated into cAMP functional assays, trafficking assays, internalization assays, calcium functional assays, and others. The cAMP functional assays sector stands out as the dominant player, holding the largest revenue share of 38.4% in the G-protein coupled receptors market.

- North America led the market by securing a market share of 37.9%.

Product Type Analysis

Cell lines are expected to be the dominant product type in the GPCR market, comprising 43.2% of the market share. The demand for high-quality, reliable cell lines is anticipated to grow as they play a critical role in GPCR research, particularly in drug discovery and testing. Researchers and pharmaceutical companies rely heavily on GPCR-expressing cell lines to study receptor function and develop targeted therapies.

The increasing adoption of GPCRs in various therapeutic areas, including cancer, neurological disorders, and cardiovascular diseases, is projected to drive the growth of this segment. Furthermore, advancements in gene editing and the development of more efficient cell line models are expected to enhance their application in drug discovery, making cell lines an indispensable tool in the GPCR market.

Application Analysis

Cancer research is expected to remain the largest application in the GPCR market, holding 40.6% of the share. The increasing focus on cancer immunotherapy, personalized medicine, and targeted therapies has led to a significant rise in the demand for GPCRs in cancer research. GPCRs are involved in key cellular processes such as cell growth, survival, and migration, making them valuable targets for cancer therapies.

The growing recognition of GPCRs as promising targets for anti-cancer drugs is anticipated to fuel the expansion of this segment. Moreover, the continuous advancements in GPCR-targeted drug discovery and the rising investment in oncology research will likely further propel the growth of cancer research within the GPCR market.

Assay Type Analysis

cAMP functional assays are projected to be the dominant assay type in the GPCR market, with a share of 38.4%. These assays are crucial for studying GPCR signaling, as cAMP is a key secondary messenger involved in various GPCR-mediated pathways. The demand for cAMP assays is expected to increase due to their widespread use in drug screening, receptor characterization, and signal transduction studies.

The growing interest in developing drugs that modulate GPCR signaling to treat various diseases, including neurological disorders, cardiovascular diseases, and cancers, will drive the demand for cAMP functional assays. Additionally, improvements in assay sensitivity and automation are anticipated to make cAMP assays more efficient, further contributing to the growth of this segment. The increasing use of GPCRs in precision medicine is likely to solidify the importance of cAMP assays in research and drug development.

Key Market Segments

By Product Type

- Cell Lines

- Ligands

- Detection Kits

- Cell Culture Reagents

By Application

- Cancer Research

- Respiratory Research

- Inflammation Research

- Cardiovascular Research

- Others

By Assay Type

- cAMP Functional Assays

- Trafficking Assays

- Internalization Assays

- Calcium Functional Assays

- Others

Drivers

High Therapeutic Potential and Broad Disease Involvement is Driving the Market

The immense therapeutic potential of G-protein coupled receptors (GPCRs) and their involvement in a vast array of physiological processes and disease states are primary drivers for the GPCR market. GPCRs represent the largest family of cell surface receptors and are targets for over one-third of all currently approved drugs, addressing conditions ranging from cardiovascular diseases, central nervous system disorders, and metabolic diseases to inflammatory conditions and cancer.

The National Institutes of Health (NIH) continues to heavily fund research into GPCRs due to their critical role in human health; the NIH RePORTER database shows thousands of active grants related to GPCRs in 2023-2024, emphasizing their importance as drug targets. This widespread relevance makes GPCRs a highly attractive area for pharmaceutical research and drug development, fueling continuous investment and innovation in the market.

Restraints

Challenges in Drug Specificity and Off-Target Effects are Restraining the Market

The G-protein coupled receptors market faces significant restraint due to the challenges associated with achieving high drug specificity and minimizing off-target effects when developing GPCR-targeted therapeutics. The structural similarity among different GPCR subtypes and the phenomenon of receptor promiscuity can lead to drugs binding to unintended receptors, resulting in adverse side effects and limiting their therapeutic window.

For instance, a 2024 review published in Trends in Pharmacological Sciences highlighted that selectivity remains a major hurdle in GPCR drug discovery, as closely related receptors often share binding pockets. This complexity necessitates extensive lead optimization and rigorous preclinical and clinical testing, increasing the cost and time required for drug development and sometimes leading to drug attrition, thereby impeding the market’s growth.

Opportunities

Advancements in Structural Biology and AI-Driven Drug Discovery Create Growth Opportunities

Ongoing advancements in structural biology techniques, such as cryo-electron microscopy (cryo-EM) and X-ray crystallography, coupled with the increasing application of artificial intelligence (AI) in drug discovery, present significant growth opportunities in the G-protein coupled receptors market. These technologies are enabling researchers to determine the precise three-dimensional structures of GPCRs, including their active and inactive states and interactions with ligands and G-proteins.

This atomic-level understanding facilitates rational drug design, allowing for the development of more selective and potent GPCR modulators. A 2024 article in Nature showcased how cryo-EM is accelerating GPCR drug discovery by providing unprecedented structural insights. The integration of AI and machine learning further enhances the ability to screen vast chemical libraries and predict drug-receptor interactions, accelerating the identification of novel therapeutic candidates and expanding the druggable GPCR landscape.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the G-protein coupled receptors market, primarily through their impact on global pharmaceutical research and development (R&D) budgets, venture capital investments in biotech, and overall healthcare expenditure. Periods of robust economic growth often correlate with increased R&D spending by major pharmaceutical companies and greater availability of venture capital for startups exploring novel drug targets. This favorable economic climate supports the high-risk, high-reward nature of discovering and developing new GPCR-targeted drugs.

The International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) reported in their 2024 “Facts and Figures” that global pharmaceutical R&D spending continued to grow, reaching significant levels, reflecting sustained investment. Conversely, economic downturns or high inflation can lead to tighter R&D budgets, reduced investment in early-stage research, and increased scrutiny of drug pricing, potentially slowing the pace of innovation in the GPCR field.

Geopolitical factors, such as international scientific collaborations, intellectual property protections, and the stability of global supply chains for specialized reagents, research tools, and outsourcing services, also play a crucial role. Disruptions caused by geopolitical tensions, as observed in 2024 with various trade and logistics issues, can increase costs and delay research projects. However, the fundamental and pervasive role of GPCRs in human physiology ensures a consistent strategic focus on this target class, providing resilience against broader economic and political volatility.

Current US tariff policies can directly impact the G-protein coupled receptors market by altering the cost of imported specialized reagents, antibodies, high-throughput screening equipment, and advanced laboratory instruments used in GPCR research and drug discovery. The complex nature of drug development means reliance on a global supply chain for these specialized tools and components. The US Census Bureau reported that US imports of laboratory analytical instruments and parts, crucial for GPCR research, totaled US$18.6 billion in 2023, indicating the vast scope of potential tariff impacts.

Any new tariffs on these imports could directly increase the operational costs for US-based pharmaceutical companies and academic research institutions. This could translate to higher prices for research tools, potentially slowing down discovery efforts or increasing the cost of bringing new GPCR-targeted drugs to market.

Conversely, these tariff policies can act as an incentive for companies to invest in expanding or establishing domestic manufacturing capabilities for critical research reagents and equipment within the US. This strategic shift towards localized production could lead to a more secure and resilient supply chain for GPCR research and drug development in the long term, reducing dependence on potentially volatile international sources and enhancing national scientific leadership, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increased Focus on Allosteric Modulators and Biased Agonism is a Recent Trend

A prominent recent trend in the G-protein coupled receptors market is the increased focus on developing allosteric modulators and biased agonists. Rather than directly binding to the orthosteric site where natural ligands bind, allosteric modulators bind to distinct sites on the receptor, allowing for more fine-tuned control of GPCR activity and potentially greater selectivity and fewer off-target effects.

Biased agonism, where a ligand preferentially activates one signaling pathway over others, offers another avenue for improved efficacy and safety profiles. A January 2025 review in Pharmacological Reviews discussed the clinical impact of GPCR allosteric modulators and biased agonists, noting their potential to revolutionize drug development. This shift in drug design paradigms aims to create more sophisticated and safer GPCR-targeted therapies, addressing the limitations of traditional orthosteric ligands.

Regional Analysis

North America is leading the G-Protein Coupled Receptors Market

North America dominated the market with the highest revenue share of 37.9% owing to sustained investment in biomedical research, the continuous approval of new drugs targeting these receptors, and their widespread relevance across numerous therapeutic areas. The National Institutes of Health (NIH) consistently provides substantial funding for fundamental research, including studies focused on GPCRs, which underpins the discovery of new drug candidates.

In 2023 alone, the US Food and Drug Administration (FDA) approved several drugs that act on GPCRs, such as Veozah (fezolinetant) for menopause-related vasomotor symptoms, an NK3 receptor antagonist, and Talvey (talquetamab-tgvs) for multiple myeloma, which targets GPRC5D. These approvals highlight the ongoing success in translating GPCR research into clinical treatments. Major pharmaceutical companies, whose portfolios heavily feature GPCR-targeting drugs across diverse conditions like cardiovascular diseases, central nervous system disorders, and metabolic ailments, have also demonstrated strong financial performance.

For instance, Eli Lilly’s revenue for the full year 2024 increased to US$45 billion, with significant contributions from drugs in cardiometabolic health, an area rich with GPCR targets. Similarly, Pfizer reported US$63.6 billion in total revenues for the full year 2024, with its Specialty Care segment and oncology portfolio including medicines acting on these receptors, reinforcing their commercial impact.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investments in drug discovery and development, a rising burden of chronic diseases, and evolving healthcare infrastructure. Governments in countries like China are significantly increasing public research funding in biotechnology, which includes drug discovery platforms relevant to GPCRs; for instance, public research funding in biotech is likely to have exceeded CNY 20 billion (approximately US$2.6 billion) in 2023.

Japan, through entities like the Japan Agency for Medical Research and Development (AMED), maintains a robust budget for medical research and development, supporting early-stage drug discovery projects that frequently involve GPCR targets. The “Health at a Glance: Asia/Pacific 2024” report by the OECD and WHO indicates increasing healthcare expenditure across the region, suggesting greater capacity for adopting new and innovative therapies.

Furthermore, major pharmaceutical companies are observing strong growth in the Asia Pacific for drugs in therapeutic areas where these receptors are key targets; Novartis, for example, noted strong performance in Q4 2024 for its cardiovascular and oncology therapies, with significant demand from markets including China and Japan. This expanding research landscape and commercial interest are anticipated to drive the development and adoption of new therapeutics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the G-protein coupled receptors (GPCRs) market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting GPCRs. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in drug discovery processes. Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices.

Additionally, players aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for GPCR-targeted solutions.

Thermo Fisher Scientific Inc., headquartered in Waltham, Massachusetts, is a prominent player in the GPCR market. The company offers a comprehensive range of products and services, including reagents, cell culture media, and analytical instruments, to support GPCR research and drug discovery.

Thermo Fisher emphasizes innovation and quality, providing solutions that enable researchers to advance their understanding of GPCR biology and develop effective therapies. With a global presence and a commitment to customer support, Thermo Fisher plays a crucial role in advancing the field of GPCR research and its applications in medicine.

Top Key Players

- WuXi AppTec

- Superluminal Medicines

- QIAGEN

- Promega Corporation

- Merck KGaA

- Isogenica

- Eurofins Scientific

- Abcam plc

Recent Developments

- In January 2025, Isogenica and Cube Biotech announced a partnership aimed at advancing GPCR-targeted therapeutics. By combining Cube Biotech’s expertise in GPCR stabilization with Isogenica’s synthetic VHH libraries, the collaboration seeks to improve the efficiency of antibody discovery for complex GPCR targets.

- In September 2024, Superluminal Medicines, a biotechnology firm based in Boston, successfully closed a USD 120 million Series A funding round. The round was led by RA Capital Management and included investments from Insight Partners, NVentures (NVIDIA’s venture arm), and others. This funding will help advance Superluminal’s lead therapeutic program and expand its pipeline focused on GPCR targets.

Report Scope

Report Features Description Market Value (2024) US$ 4.0 Billion Forecast Revenue (2034) US$ 7.3 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cell Lines, Ligands, Detection Kits, and Cell Culture Reagents), By Application (Cancer Research, Respiratory Research, Inflammation Research, Cardiovascular Research, and Others), By Assay Type (cAMP Functional Assays, Trafficking Assays, Internalization Assays, Calcium Functional Assays, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WuXi AppTec, Superluminal Medicines, QIAGEN, Promega Corporation, Merck KGaA, Isogenica , Eurofins Scientific, Abcam plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  G-Protein Coupled Receptors MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

G-Protein Coupled Receptors MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WuXi AppTec

- Superluminal Medicines

- QIAGEN

- Promega Corporation

- Merck KGaA

- Isogenica

- Eurofins Scientific

- Abcam plc