Global Functional Proteins Market Size, Share Analysis Report By Source (Animal Based, Plant Based, and Microbial Protein), By Form (Conventional and Organic), By Application (Food And Beverage, Nutraceuticals, Cosmetics And Personal Care, Animal Nutrition, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169561

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

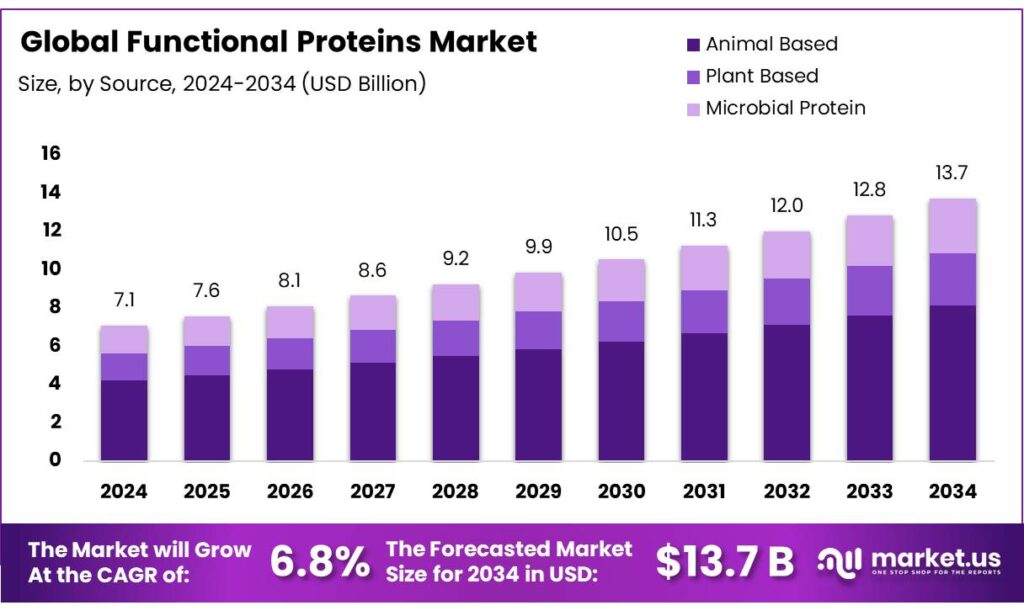

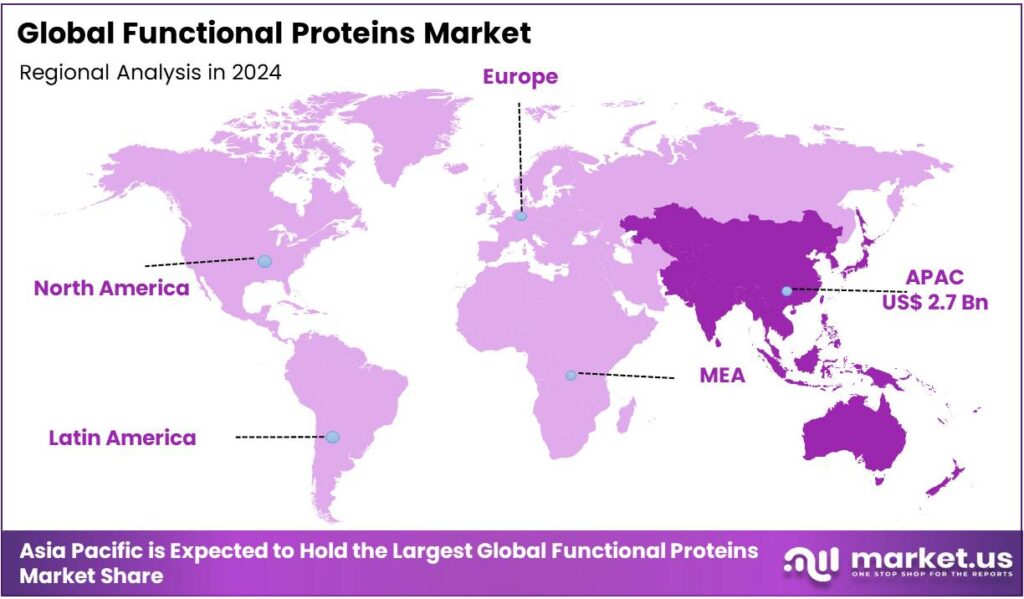

The Global Functional Proteins Market size is expected to be worth around USD 13.7 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.9% share, holding USD 2.7 Billion revenue.

A functional protein is a protein that performs a specific biological task, such as acting as an enzyme, a hormone, or a transporter. The functional proteins market has experienced significant growth, driven by increasing consumer awareness about health, fitness, and nutrition. As consumers embrace active lifestyles, there is a rising demand for protein-rich foods and supplements to support muscle recovery, performance, and overall wellness. Sports nutrition is a major contributor to the growth of the market, with athletes and fitness enthusiasts turning to protein bars, shakes, and powders to meet their dietary needs.

Similarly, the market is expanding beyond traditional sports nutrition, with protein-enriched foods such as cereals, snacks, and beverages gaining popularity among the consumer base. Furthermore, there is an increased adoption of plant-based proteins, such as pea, catering to the growing vegan and health-conscious demographic. Despite the challenges such as consumer skepticism regarding product efficacy and ingredient sourcing, the functional proteins market continues to evolve, benefiting from trends such as the rise of ready-to-drink beverages, increased focus on convenience, and the impact of lifestyle changes.

- The Recommended Dietary Allowance (RDA) for the quantity of protein needed daily for essential bodily functions in healthy adults is a minimum of 0.8 grams per kilogram of body weight, or 0.36 grams per pound.

Key Takeaways

- The global functional proteins market was valued at USD 7.1 billion in 2024.

- The global functional proteins market is projected to grow at a CAGR of 6.8% and is estimated to reach USD 13.7 billion by 2034.

- Based on the source, animal-based functional proteins dominated the market, with a substantial market share of around 59.4%.

- On the basis of forms, the market is dominated by conventional functional proteins, comprising 83.8% share of the total market.

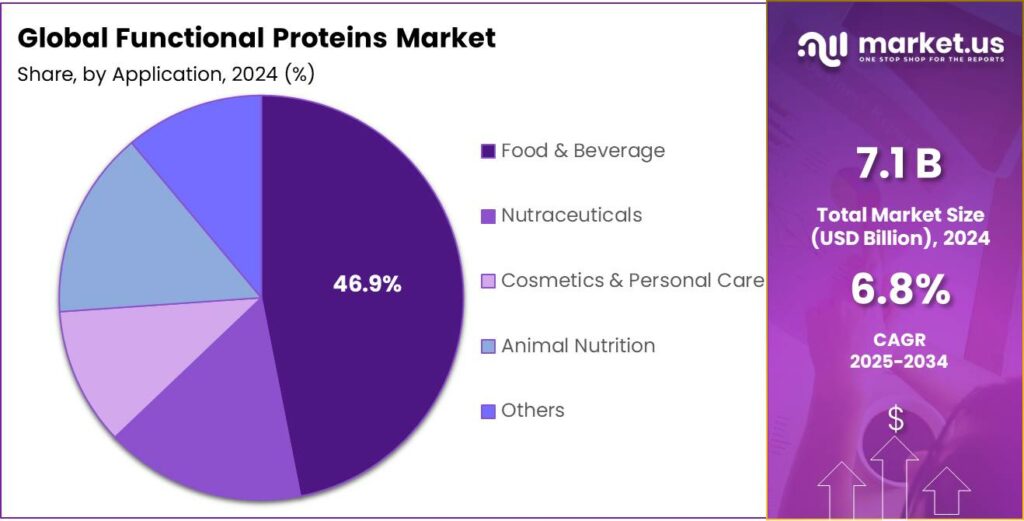

- Among the applications of the functional proteins, the food and beverage sector held a major share in the market, 46.9% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the functional proteins market, accounting for around 37.9% of the total global consumption.

Source Analysis

Animal-based Functional Proteins are a Prominent Segment in the Market.

The functional proteins market is segmented based on source into animal-based, plant-based based and microbial protein. The animal-based functional proteins dominated the market, comprising around 59.4% of the market share, due to several key factors related to their nutritional profile and functionality. Animal proteins, such as those derived from whey, casein, and egg whites, contain all nine essential amino acids in proportions that the human body readily absorbs and utilizes for muscle growth, repair, and overall bodily functions.

Additionally, these proteins tend to have superior bioavailability as they are more efficiently digested and incorporated by the body. In contrast, many plant-based proteins, while rich in nutrients, may lack one or more essential amino acids or have lower digestibility, requiring consumers to combine various plant sources to achieve a complete protein profile. Moreover, animal proteins are often perceived to provide more consistent and reliable results in terms of performance, making them more commonly utilized in specialized applications such as sports nutrition.

Form Analysis

Conventional Functional Proteins Dominated the Market.

On the basis of forms, the functional proteins market is segmented into conventional and organic. The conventional functional proteins dominated the market, with a substantial market share of 83.8%, due to several practical and economic considerations. Conventional farming and production methods typically offer higher yields at lower costs, making them more accessible for large-scale manufacturing. Conventional practices often focus on maximizing efficiency and minimizing production time, which aligns well with the high-demand nature of functional proteins, particularly in industries such as sports nutrition and pharmaceuticals.

Additionally, organic farming, while increasingly popular for its environmental and health benefits, often involves more stringent practices, such as the use of natural feed and slower growth cycles, which can lead to higher costs and lower production efficiency. The conventional protein production remains the dominant method, as it meets the demand for affordability, scalability, and consistency in product quality.

Application Analysis

The Food and Beverage Sector Held a Major Share of the Functional Proteins Market.

Based on the applications of functional proteins, the market is divided into food & beverage, nutraceuticals, cosmetics & personal care, animal nutrition, and others. The food and beverage sector dominated the market, with a market share of 46.9%. Functional proteins are predominantly utilized in the food and beverage sector due to their direct role in enhancing the nutritional value and functional properties of everyday consumables. As consumers become more health-conscious, there is an increasing demand for food products that offer additional health benefits, such as muscle recovery, satiety, and immune support, which functional proteins can provide.

The food and beverage industry is highly receptive to innovations that improve product formulations, making it an ideal platform for incorporating functional proteins. While other industries, such as nutraceuticals, cosmetics, and animal nutrition, use functional proteins, the food sector stands out as it directly addresses widespread consumer needs for health-focused, everyday solutions. Furthermore, food products are consumed by a much broader consumer base, making functional proteins a practical choice for mass-market applications.

Key Market Segments

By Source

- Animal Based

- Dairy

- Whey

- Casein

- Others

- Egg

- Meat Based

- Others

- Dairy

- Plant Based

- Wheat

- Maize

- Rice

- Soy

- Pea

- Oats

- Others

- Microbial Protein

By Form

- Conventional

- Organic

By Application

- Physical Treatment

- Biological Treatment

- Thermal Treatment

- Recycling & Reuse

- Others

Drivers

Growing Demand for Sports Nutrition Drives the Functional Proteins Market.

The growing demand for sports nutrition has significantly boosted the functional proteins market. As athletes and fitness enthusiasts increasingly focus on muscle recovery, endurance, and overall performance, functional proteins have gained prominence due to their role in providing essential amino acids and supporting muscle repair. Examples of functional proteins include whey protein, soy protein, and casein, which are commonly found in protein bars, shakes, and other supplements.

This trend is also reflected in the rise of plant-based protein sources like pea and hemp, catering to vegan and vegetarian athletes. With consumers becoming more health-conscious and seeking products that align with their fitness goals, functional proteins have become a staple in dietary regimens. As more professional athletes and influencers endorse these products, their adoption across a wider demographic, from casual gym-goers to seasoned athletes, continues to drive market growth.

Restraints

Consumer Skepticism Might Pose a Challenge to the Functional Proteins Market.

Despite the growing demand for functional proteins, consumer skepticism remains a significant challenge for the market. Many consumers are cautious about the effectiveness and safety of protein supplements, particularly in the context of long-term use. Concerns about artificial additives, allergens, and the sourcing of ingredients have led some consumers to doubt the quality of products. For instance, according to a consumer report, tests of 23 products popular in the United States found that more than two-thirds of them contain more lead in a single serving than the recommended safe amount to have in a day.

Similarly, while plant-based proteins are gaining popularity, there are studies about their incomplete amino acid profile compared to animal-based proteins. This skepticism is compounded by misleading marketing claims and a lack of transparency regarding sourcing and manufacturing practices. Some consumers may opt for whole foods such as chicken, beans, and legumes instead of processed protein supplements, highlighting the importance of building trust through education, transparency, and clear labeling.

Opportunity

The Mainstreaming of Protein-Enriched Foods Beyond Sports Nutrition Creates Opportunities in the Functional Proteins Market.

The popularity of protein-enriched foods has expanded well beyond sports nutrition, creating new opportunities in the functional proteins market. Consumers are increasingly incorporating protein into everyday foods, driven by the growing awareness of its role in muscle maintenance, weight management, and overall health. Products such as protein-infused snacks, ready-to-drink beverages, and protein-fortified cereals and bread have entered mainstream markets. For instance, brands such as Quest and Premier Protein offer high-protein bars and shakes, while companies such as Chobani and Oikos have introduced milk and yogurt with added protein.

Additionally, plant-based proteins, such as those derived from peas, quinoa, and almonds, are gaining traction in mainstream food categories due to their appeal to both health-conscious consumers and consumers following vegan or vegetarian diets. In 2024, veganism showed continued growth, with 25 million people participating in Veganuary, many reporting lasting dietary changes, 81% reducing intake significantly. As consumers continue to seek more convenient and nutritious options, the demand for functional proteins across food categories is expected to grow considerably.

Trends

Shift Towards Ready-to-Drink Functional Beverages.

The shift towards ready-to-drink (RTD) functional beverages is a significant trend in the functional proteins market. Consumers are increasingly seeking convenient, on-the-go options that provide nutrition and hydration, making RTD functional protein drinks a popular choice. These beverages combine the benefits of protein with added nutrients such as electrolytes, vitamins, and minerals, catering to busy lifestyles.

For instance, in June 2025, BioSteel, a Canadian sports nutrition brand known for its no-compromise approach to hydration, launched its first ready-to-drink (RTD) protein beverage. This trend is particularly prevalent among fitness enthusiasts, athletes, and health-conscious individuals who prefer a quick and effective post-workout recovery solution. Additionally, RTD options are expanding into other segments, including plant-based protein drinks from brands such as Silk and Ripple, catering to the growing demand for dairy-free and vegan-friendly beverages. The convenience and functionality of these drinks are key drivers behind their popularity.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Functional Proteins Market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions significantly impact the functional proteins market, influencing supply chains, ingredient sourcing, and consumer sentiment. Trade disruptions, tariffs, and sanctions have hindered the flow of raw materials such as whey, soy, and pea protein, essential for producing functional protein supplements. For instance, due to tensions between major agricultural exporters such as the U.S. and China, it has led to shortages and price hikes of key protein ingredients, impacting the availability and affordability of end products. Similarly, the ongoing conflict in Ukraine has disrupted supply chains across Europe, affecting protein production in the region.

Furthermore, geopolitical instability has led to consumer uncertainty, causing a shift in purchasing behavior. In countries facing economic or political turmoil, discretionary spending on non-essential items such as protein supplements has declined. In contrast, geopolitical tensions create opportunities for local production and alternative sourcing, with countries looking to reduce dependence on imports. The geopolitical factors add a layer of unpredictability, making it more challenging to outsource the raw materials or end products.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Functional Proteins Market.

In 2024, the Asia Pacific dominated the global functional proteins market, holding about 37.9% of the total global consumption. The region has emerged as a dominant region in the global functional proteins market, driven by a combination of health-conscious consumers, a growing middle class, and an increasing interest in fitness and wellness. In countries such as China, India, and Japan, protein consumption has seen a steady rise as customers become more aware of its role in improving health and preventing lifestyle-related diseases.

Traditional protein sources such as soy, tofu, and fish are commonly consumed in the region; however, there is an increasing adoption of Western protein products such as protein bars, shakes, and supplements. This shift is particularly noticeable among young adults and athletes. Additionally, the region’s growing interest in plant-based diets has spurred the demand for plant-based protein alternatives, such as pea protein and brown rice protein, further expanding the market. The Asia Pacific region’s rapid urbanization and rising disposable incomes continue to fuel the demand for functional proteins.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis:

Companies in the functional proteins market employ several strategies to boost sales and gain a competitive edge. The companies focus on product innovation, with brands developing new flavors, formulations, and specialized products, such as plant-based or allergen-free protein options, to cater to a broader audience. Additionally, the players emphasize strategic partnerships and endorsements, with companies collaborating with athletes or fitness influencers to build brand credibility and reach target consumers more effectively.

Furthermore, the companies try to expand distribution channels, including online platforms and retail partnerships, ensuring wider accessibility. Furthermore, the companies focus on transparency and sustainability, highlighting clean-label ingredients and ethical sourcing practices to attract health-conscious and environmentally aware consumers. Moreover, many major players focus on personalized nutrition offerings and ready-to-drink formats that enhance convenience, meeting the demands of busy, on-the-go lifestyles.

The Major Players in The Industry

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- DSM-Firmenich

- FrieslandCampina Ingredients

- Fonterra Co-operative Group Limited

- Glanbia plc

- Kerry Group plc

- Alver World SA

- Roquette Frères S.A.

- Secil

- Corbion

- Agthia Group

- Lallemand Inc.

- AngelYeast Co., Ltd.

- Arla Foods Ingredients Group P/S

- Abbott Nutrition

- Amway Corporation (Nutrilite)

- Other Key Players

Key Development

- In August 2025, ADM announced plans to streamline and strengthen its global soy protein production network, enhancing efficiency by capitalizing on operational leverage and excellence at its soy protein facility in Illinois, as well as other facilities spanning its global network.

- In October 2025, Cargill announced that develop a multi-source protein toolkit combining plant-based, fermentation-derived, and hybrid solutions to meet flexitarian demand.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Bn Forecast Revenue (2034) USD 13.7 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Animal Based, Plant Based, and Microbial Protein), By Form (Conventional and Organic), By Application (Food & Beverage, Nutraceuticals, Cosmetics & Personal Care, Animal Nutrition, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill, DSM-Firmenich, FrieslandCampina Ingredients, Fonterra Co-operative Group Limited, Glanbia plc, Kerry Group plc, Alver World SA, Roquette Frères S.A., Secil, Corbion, Agthia Group, Lallemand Inc., AngelYeast Co., Ltd., Arla Foods Ingredients Group P/S, Abbott Nutrition, Amway Corporation (Nutrilite), and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- DSM-Firmenich

- FrieslandCampina Ingredients

- Fonterra Co-operative Group Limited

- Glanbia plc

- Kerry Group plc

- Alver World SA

- Roquette Frères S.A.

- Secil

- Corbion

- Agthia Group

- Lallemand Inc.

- AngelYeast Co., Ltd.

- Arla Foods Ingredients Group P/S

- Abbott Nutrition

- Amway Corporation (Nutrilite)

- Other Key Players