Global Freight Railcar Parts Market Size, Share, Growth Analysis By Type (Box car, Autocar, Center beam, Covered hopper, Coil car, Flat car, Gondola, Open top hopper, Refrigerant boxcar, Tank cars, Others), By Component (Wheels axles and bearings, Gears, Side frames, Draft systems, Couplers & yokes, Airbrakes, Others), By Distribution Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169450

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

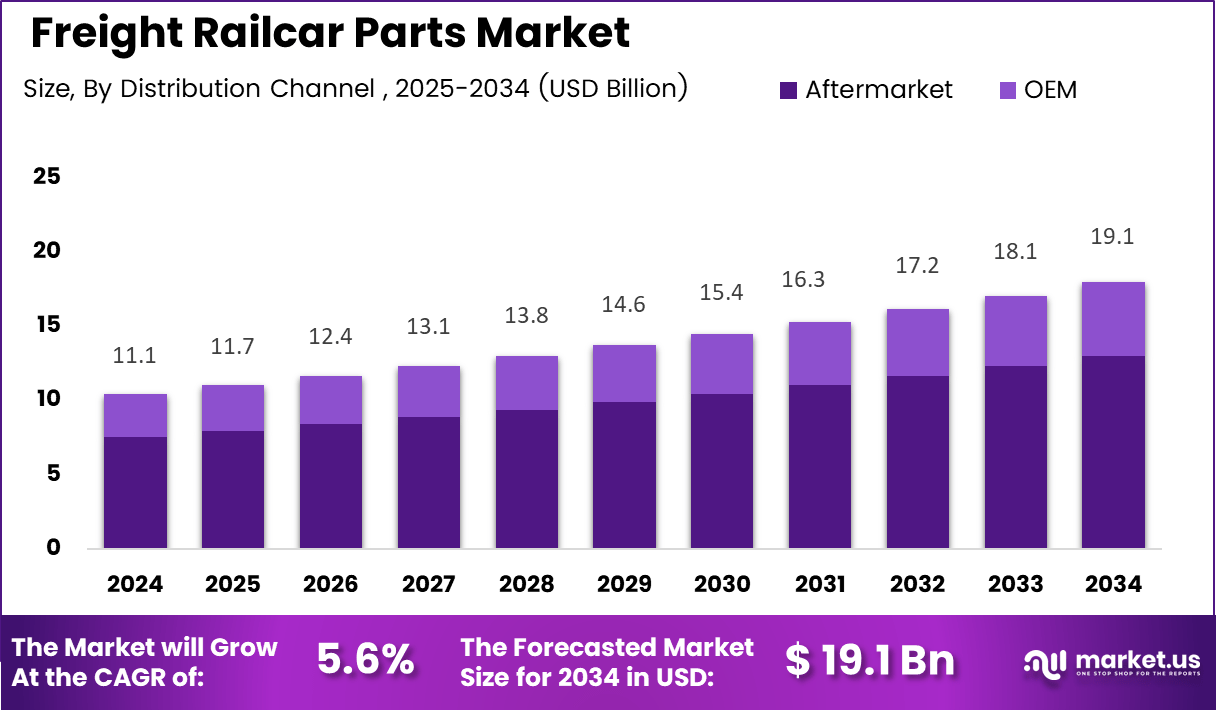

The Global Freight Railcar Parts Market size is expected to be worth around USD 19.1 billion by 2034, from USD 11.1 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Freight Railcar Parts Market represents a critical ecosystem supporting wheels, axles, bearings, couplers, draft gears, and braking assemblies essential for safe and efficient freight movement. It enables fleet longevity, operational reliability, and cost-effective maintenance as railroads prioritize sustainability, energy efficiency, and modernization. Growing freight volumes and infrastructure renewal continue to strengthen long-term industry relevance across global supply chains.

The market advances steadily as operators invest in durable forged components, lightweight assemblies, and corrosion-resistant materials to improve lifecycle performance. Additionally, rising demand for intermodal logistics encourages adoption of improved connector systems and high-capacity wheelsets. The sector also expands as digital inspection tools minimize downtime and ensure accurate part replacement cycles, boosting aftermarket opportunities.

The industry further evolves as governments increase spending on rail network upgrades, safety enhancements, and decarbonization programs. These investments encourage suppliers to innovate with smart sensor-enabled parts and energy-efficient braking modules. Meanwhile, tightening regulations on emissions and operational safety stimulate continuous redesign of critical subsystems to meet compliance, reliability, and environmental standards globally.

The Freight Railcar Parts landscape also benefits from growing opportunities in predictive maintenance, where AI-driven diagnostics enhance fleet planning and reduce operational disruptions. Additionally, refurbishment of aging fleets stimulates long-term demand for axles, bearings, and draft components. Emerging sustainable freight initiatives position rail as a preferred mode for reducing carbon intensity in large-scale logistics.

The safety improvement trends significantly support market confidence as accident and derailment rates continue to decline. According to industry sources, the train accident rate is down 43% since 2005 and 11% since 2023, while the Class I derailment rate is down 40% since 2005. Furthermore, mainline accident rates declined 43% since 2005, reinforcing the value of high-quality railcar components.

Additionally, industry data highlights that on-duty fatalities fell 27% since 2005, and grade-crossing collision rates dropped 25% compared to 2000. Public crossings decreased 12%, while gated crossings increased 42%, reflecting strong regulatory and safety investments. U.S. freight railroads also spent more than 18% of revenue on capital expenditures between 2014 and 2023, far above the 3% average of manufacturers, supporting sustained demand for critical railcar parts.

Environmental gains further accelerate adoption of advanced railcar components. Reports indicate that shifting 10% of freight from trucks to rail could cut greenhouse gases by 20 million tons annually, equal to removing 4.3 million cars or planting 300 million trees. Fuel-efficient locomotives and idle-reduction technologies, lowering idle time by 50%, reinforce the importance of modern, efficient freight railcar assemblies in meeting sustainability goals.

Key Takeaways

- The global Freight Railcar Parts Market reached USD 11.1 billion in 2024 and is projected to grow to USD 19.1 billion by 2034.

- The market expands at a steady CAGR of 5.6% from 2025 to 2034, driven by modernization and safety upgrades.

- Box car leads the By Type segment with a dominant share of 16.3%, supported by high utilization across freight categories.

- Wheels, axles, and bearings dominate the By Component segment with a strong 31.8% share due to high replacement frequency.

- OEM holds a significant 67.9% share in the distribution channel segment, reflecting strong reliance on factory-fitted components.

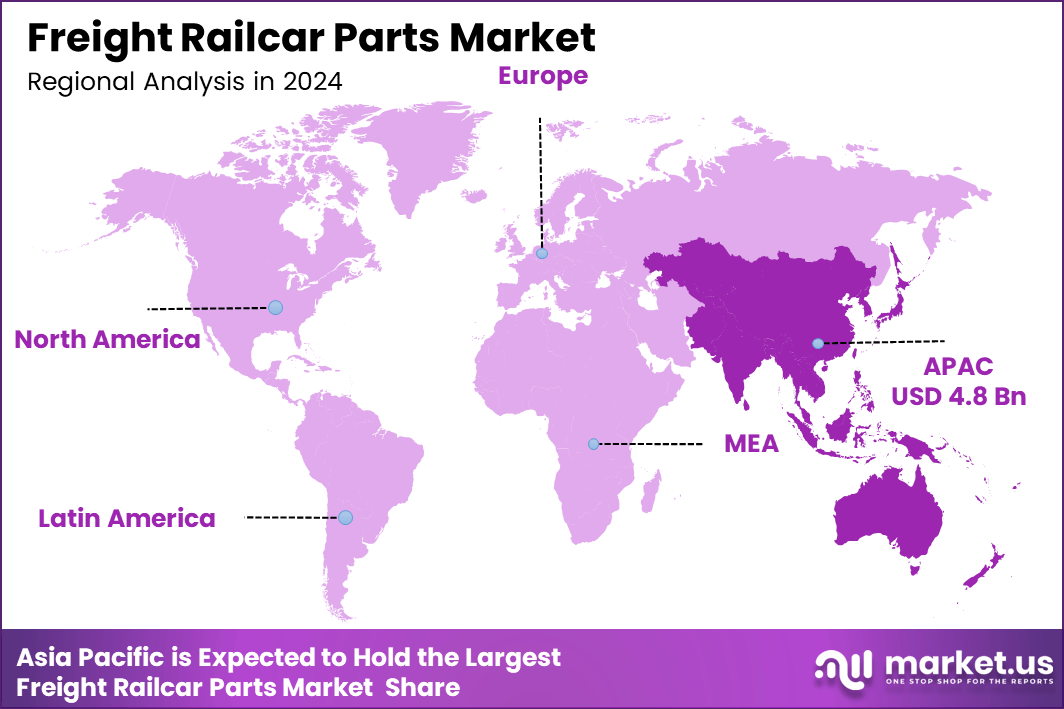

- Asia Pacific leads the global market with a commanding 43.8% share, valued at approximately USD 4.8 billion.

- North America continues to show consistent part replacement demand driven by safety regulations and digital inspection adoption.

- Europe’s focus on low-emission freight transport strengthens demand for advanced braking and coupling components.

- Latin America benefits from growth in mining and agriculture shipments, contributing to stable aftermarket demand.

- The U.S. market remains supported by federal infrastructure spending and expanding use of predictive maintenance technologies.

By Type Analysis

Box car dominates with 16.3% due to its versatility in transporting bulk commodities and general freight.

In 2024, Box car held a dominant market position in the By Type Analysis segment of the Freight Railcar Parts Market, with a 16.3% share. This category benefits from high utilization in agricultural, industrial, and consumer goods transport, driving consistent demand for replacement parts, structural components, and safety upgrades.

Autocar experienced steady adoption as fleets expanded their operational efficiency. These units support automated loading functions and improved cargo handling, encouraging procurement of modern braking assemblies, durable couplers, and upgraded chassis materials to extend service life.

Center beam railcars advanced due to rising construction sector shipments. Their specialized configuration for lumber transport increases the need for reinforced frames, precision bearings, and enhanced brake systems that support safe movement of heavy loads across long distances.

Covered hopper demand grew as grain, fertilizer, and chemical transportation increased. Operators focused on corrosion-resistant components, airflow systems, and optimized door mechanisms that reduce material loss and streamline loading efficiency. This drove recurring maintenance cycles for essential parts.

Coil car usage remained essential for steel industry transport. These railcars require high-strength cradles, robust suspension systems, and heat-resistant materials that ensure secure handling of rolled steel products while maintaining operational stability.

Flat car adoption progressed due to infrastructure supply movement. Their open-deck design necessitates periodic replacement of decking components, wheelsets, and tie-down fixtures to support heavy machinery, structural beams, and oversized freight securely.

Gondola cars remained important for scrap metal and bulk commodities. Frequent exposure to abrasive materials increased part fatigue, driving purchases of reinforced frames, improved bearings, and high-tensile structural components.

Open top hopper utilization expanded within mining and aggregates transport. Continuous loading cycles stimulated demand for durable discharge gates, heavy-duty brake assemblies, and structural reinforcements that improve lifecycle performance.

Refrigerant boxcar needs increased with temperature-sensitive logistics. These units require reliable insulation systems, compressor components, and specialized monitoring equipment, boosting the replacement part market.

Tank cars supported chemical and fuel transport. Safety-focused investments accelerated demand for pressure valves, protective housings, thermal coatings, and advanced coupling solutions.

Others included customized and region-specific railcars that rely on tailored components. Operators invested in modular upgrades, Automotive suspension systems, and part standardization to maintain compliance and operational reliability.

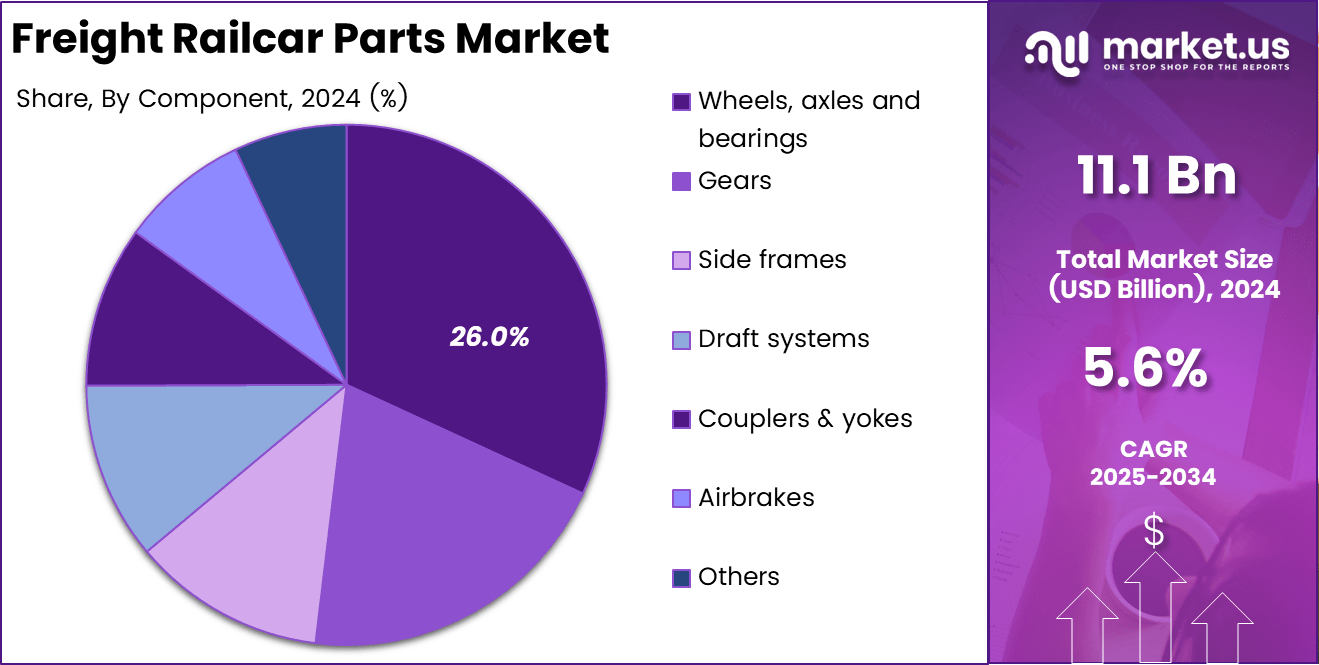

By Component Analysis

Wheels, axles and bearings dominate with 31.8% due to their essential role in safety and performance.

In 2024, Wheels, axles and bearings held a dominant market position in the By Component Analysis segment of the Freight Railcar Parts Market, with a 31.8% share. Their continuous exposure to high loads, friction, and vibration increases replacement frequency, making them the most critical component group for fleet reliability.

Gears observed stable demand as mechanical systems modernized. Enhanced drivetrain efficiency, torque management, and improved durability encouraged fleet operators to prioritize high-strength gear sets and precision-machined assemblies for smoother operation.

Side frames gained traction due to structural upgrades. These components support weight distribution and stability, prompting rail operators to invest in reinforced steel alloys, welded assemblies, and fatigue-resistant materials for improved safety performance.

Draft systems experienced higher adoption as coupling forces increased. Strong draft gears, yokes, followers, and cushioning units became essential for minimizing impact shocks, reducing cargo damage, and extending freight car longevity.

Couplers & yokes demand strengthened with rising regulatory focus on secure train connections. Manufacturers supplied advanced knuckle couplers, high-tensile yokes, and safety-compliant locking mechanisms to ensure operational integrity.

Airbrakes obtained steady demand from safety modernization programs. Fleet operators prioritized brake shoe replacements, valves, pistons, and pressure control systems to enhance emergency response efficiency and braking accuracy.

Others included smaller yet vital components such as ladders, doors, interior fittings, and monitoring devices. Operators favored durable and standardized parts that reduce downtime and support smoother inspections.

By Distribution Channel Analysis

OEM dominates with 67.9% driven by factory-installed components and long-term maintenance partnerships.

In 2024, OEM held a dominant market position in the By Distribution Channel Analysis segment of the Freight Railcar Parts Market, with a 67.9% share. OEM-supplied components ensure compliance with manufacturing standards, improved lifecycle performance, and seamless integration across critical systems.

Aftermarket maintained strong relevance as fleets aged and maintenance cycles intensified. Frequent part replacements, cost-effective alternatives, and accessible supply networks supported aftermarket demand across wheels, couplers, braking systems, and structural components.

Key Market Segments

By Type

- Box car

- Autocar

- Center beam

- Covered hopper

- Coil car

- Flat car

- Gondola

- Open top hopper

- Refrigerant boxcar

- Tank cars

- Others

By Component

- Wheels, axles and bearings

- Gears

- Side frames

- Draft systems

- Couplers & yokes

- Airbrakes

- Others

By Distribution Channel

- Aftermarket

- OEM

Drivers

Rising Demand for High-Axle-Load Railcars Drives Market Growth

The rising demand for high-axle-load railcars strengthens the need for durable wheels, couplers, and braking systems. Bulk commodities such as coal, grain, and minerals depend on heavier load movements, encouraging operators to upgrade parts that withstand higher stress levels. This trend increases replacement cycles and pushes manufacturers to enhance material strength and product reliability.

The expansion of cross-border freight corridors improves long-haul connectivity and increases the utilization of railcars across international routes. As rail distances grow, wear and tear accelerates, raising demand for standardized components that support smoother interchange operations. This creates steady opportunities for suppliers offering globally compliant wheels, axles, and air brake systems.

Modernization of rail fleets accelerates as operators adopt lightweight and corrosion-resistant components. Aluminum, composite alloys, and advanced coatings help reduce fuel consumption and maintenance needs. These upgrades encourage continuous procurement of innovative parts that extend railcar lifespan and improve asset performance across diverse climates.

Automated rail inspection systems enhance part monitoring accuracy, enabling earlier identification of faults in bearings, brake shoes, and couplers. With improved detection, replacement intervals become more frequent and predictable. This shift increases demand for high-quality components designed to support automated maintenance workflows and digital inspection ecosystems.

Restraints

High Cost of Advanced Braking and Coupling Systems Restrains Market Expansion

The high cost of advanced braking and coupling systems limits adoption among smaller rail operators. Modern technologies deliver stronger safety performance but require significant upfront investment, slowing broader market penetration. Many mid- and small-scale fleets continue relying on legacy parts due to budget constraints and long replacement cycles.

Delays in rail infrastructure upgrades restrict progress toward parts standardization. Variations in track conditions, axle configurations, and loading rules across regions hinder the adoption of universal components. This fragmentation increases production complexity and limits operators’ ability to streamline procurement, thereby slowing modernization efforts across aging rail networks.

Growth Factors

Adoption of Predictive Maintenance Platforms Creates Strong Market Opportunities

The adoption of predictive maintenance platforms supports strong demand for smart, sensor-embedded parts. Real-time monitoring of wheels, axles, and bearings helps operators reduce unplanned downtime and optimize part usage. This evolution opens new opportunities for suppliers developing digital-ready components designed for data-driven maintenance.

Rising refurbishment of aging railcars expands aftermarket opportunities. Many fleets approaching end-of-life cycles opt for rebuild programs rather than full replacement, accelerating demand for wheels, brake systems, couplers, and structural components. This shift allows manufacturers to serve a growing upgrade market with cost-effective part solutions. Development of hybrid and energy-efficient rail models increases the need for redesigned parts architectures.

Lightweight components, thermal-efficient braking materials, and optimized suspension systems become essential for supporting fuel reduction goals. These innovations create long-term opportunities for suppliers that specialize in advanced materials and energy-efficient rail technologies.

Emerging Trends

Increasing Shift Toward Composite Materials Shapes Market Trends

The rising shift toward composite materials drives weight reduction and fuel efficiency across freight railcars. Composites offer strong resistance to corrosion and fatigue, making them ideal for doors, side panels, and structural frames. This trend motivates manufacturers to diversify material engineering capabilities and replace conventional steel components.

The rapid integration of telematics-enabled wheelsets and bearing monitoring solutions transforms part usage patterns. Real-time tracking improves asset visibility and safety, enabling operators to detect early failures and streamline maintenance schedules. This technology trend encourages increasing adoption of digitally equipped components designed for condition-based maintenance strategies.

Regional Analysis

Asia Pacific Freight Railcar Parts Market Dominates with a 43.8% Share, Valued at USD 4.8 Billion

Asia Pacific holds a dominant position in the Freight Railcar Parts Market, capturing a strong 43.8% regional share supported by rising mineral exports, rapid industrialization, and expanding cross-border freight corridors. The market value reached nearly USD 4.8 billion as governments across China, India, and Southeast Asia accelerate investments in high-axle-load wagons and modern rail infrastructure. The shift toward lightweight, corrosion-resistant components and stricter fleet modernization programs continues to strengthen APAC’s leadership.

North America Freight Railcar Parts Market Trends

North America shows steady growth driven by ongoing rail network upgrades, adoption of automated inspection systems, and higher demand for durable components supporting bulk commodity transport. Major freight operators in the US and Canada continue prioritizing fleet optimization and asset reliability. Regulatory focus on safety and preventive maintenance practices reinforces consistent aftermarket demand across the region.

Europe Freight Railcar Parts Market Trends

Europe benefits from strong policy support for low-emission freight transport, prompting rail operators to invest in modernized rolling stock and advanced braking and coupling systems. The region’s shift toward intermodal logistics strengthens requirements for high-performance parts across cross-border routes. Continued innovation in lightweight materials further supports market expansion.

Middle East and Africa Freight Railcar Parts Market Trends

Middle East and Africa experience rising demand fueled by new freight rail development corridors across GCC nations and resource-rich African economies. Investments in long-haul cargo lines and modernization of legacy fleets drive consistent need for wheels, axles, and structural components. Growing trade connectivity initiatives also encourage wider adoption of standardized railcar technologies.

Latin America Freight Railcar Parts Market Trends

Latin America shows gradual expansion supported by mining output recovery, agricultural export growth, and renewed government interest in freight rail efficiency. Infrastructure upgrades in Brazil, Mexico, and Chile improve fleet performance expectations, boosting demand for reliable railcar parts. Increasing private sector participation in logistics networks supports long-term modernization spending.

U.S. Freight Railcar Parts Market Trends

The US market progresses with strong emphasis on operational safety, digital inspection technologies, and lifecycle cost optimization for rail assets. Upgrades to bulk commodity railcars and higher adoption of predictive maintenance tools enhance replacement cycles. Federal infrastructure programs and freight demand stability reinforce the country’s steady market outlook.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Freight Railcar Parts Company Insights

Leading players demonstrate diverse strategies focused on material innovation, lifecycle extension, and global service capabilities to support rising freight volumes and increasing cross-border operations.

Johnson & Johnson maintains a disciplined approach to engineered materials and industrial components that indirectly support maintenance ecosystems for freight operators. The company emphasizes product durability and standardized performance, reinforcing efficiency improvements across heavy-duty applications as rail systems adopt more advanced inspection and replacement cycles.

Procter & Gamble leverages its global supply expertise and large-scale manufacturing discipline to improve operational logistics within rail freight environments. Its focus on sustainable material science, packaging efficiency, and cost-optimized production contributes to operational models that support high-volume part distribution in freight maintenance networks.

Unilever integrates advanced procurement, sustainability frameworks, and optimized transport models that influence broader freight rail part distribution patterns. Its strong sustainability mandates encourage cleaner, energy-efficient logistics, supporting industry transitions toward lightweight components and reduced emissions across regional freight corridors.

Kimberly-Clark Corporation applies process excellence and high-throughput manufacturing capabilities that resonate with rail maintenance operations seeking predictable supply and standardized components. Its operational reliability and global distribution strength align with the freight sector’s increasing dependency on stable part availability and long-term fleet performance planning.

Top Key Players in the Market

- Wabtec Corporation

- ABB Ltd.

- Alstom SA

- Bombardier Transportation

- CIMC Group Limited

- Faiveley Transport

- GATX Corporation

- General Electric Company

- Greenbrier Companies

- Knorr-Bremse AG

Recent Developments

- In Dec 22, 2025, FreightCar America, Inc., a diversified manufacturer and supplier of railroad freight cars, railcar parts, and components, completed the acquisition of Carly Railcar Components, LLC (CRC).The acquisition of the family owned leading distributor strengthens FreightCar America’s railcar components portfolio and enhances aftermarket distribution capabilities.

Report Scope

Report Features Description Market Value (2024) USD 11.1 billion Forecast Revenue (2034) USD 19.1 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Box car, Autocar, Center beam, Covered hopper, Coil car, Flat car, Gondola, Open top hopper, Refrigerant boxcar, Tank cars, Others), By Component (Wheels axles and bearings, Gears, Side frames, Draft systems, Couplers & yokes, Airbrakes, Others), By Distribution Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Wabtec Corporation, ABB Ltd., Alstom SA, Bombardier Transportation, CIMC Group Limited, Faiveley Transport, GATX Corporation, General Electric Company, Greenbrier Companies, Knorr-Bremse AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Freight Railcar Parts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Freight Railcar Parts MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wabtec Corporation

- ABB Ltd.

- Alstom SA

- Bombardier Transportation

- CIMC Group Limited

- Faiveley Transport

- GATX Corporation

- General Electric Company

- Greenbrier Companies

- Knorr-Bremse AG