Global Freight and Logistics Market Size, Share, Growth Analysis By Shipping Type (Railways, Airways, Roadways, Waterways, Others), By Service (Transportation, Inventory Management, Packaging, Warehousing, Distribution, Customs Clearance, Others), By End User (Manufacturing, Agriculture, Construction, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168668

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

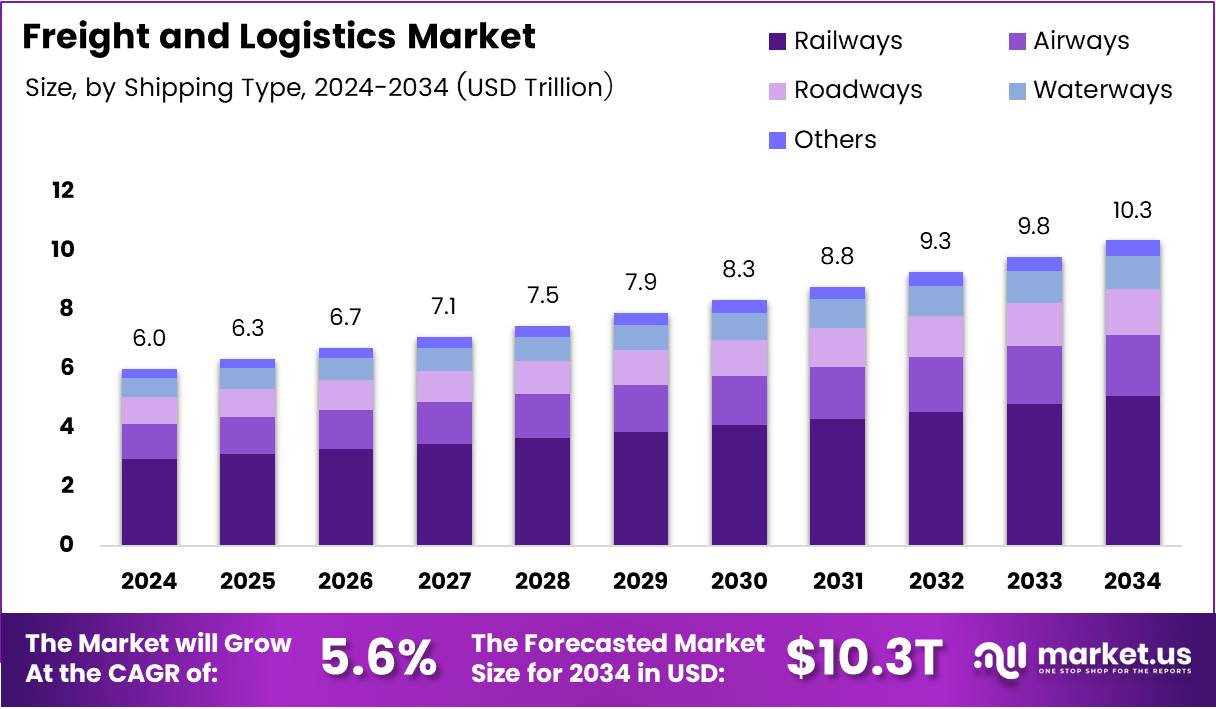

The Global Freight and Logistics Market size is expected to be worth around USD 10.3 Trillion by 2034, from USD 6.0 Trillion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The freight and logistics market represents a comprehensive ecosystem encompassing transportation, warehousing, distribution, and supply chain management services. This sector facilitates the movement of goods across global networks, connecting manufacturers with consumers through integrated multimodal solutions. Moreover, technological advancements are reshaping operational frameworks, enabling businesses to optimize delivery timelines and reduce costs systematically.

Currently, the market demonstrates robust expansion driven by cross-border e-commerce proliferation and digital transformation initiatives. Enterprises increasingly adopt automation technologies to enhance warehouse efficiency and streamline distribution processes. Consequently, stakeholders invest heavily in infrastructure modernization projects, creating competitive advantages through improved service delivery capabilities.

Additionally, sustainability considerations influence strategic decision-making as organizations transition toward eco-friendly fleet technologies. The integration of artificial intelligence and predictive analytics revolutionizes freight visibility, allowing real-time monitoring capabilities. Furthermore, regulatory frameworks evolve continuously, requiring adaptive compliance strategies across international operations.

Notably, labor market dynamics present ongoing challenges as driver shortages constrain capacity expansion efforts. Nevertheless, opportunities emerge through cold-chain logistics growth serving pharmaceutical and perishable goods sectors. According to research, in 2024 there were about 2.71 billion online shoppers worldwide, and in 2022 there were an estimated 8.2 billion cross-border e-commerce orders globally.

According to research, in the Netherlands, 52% of online shoppers buy from other countries. According to research, 77% of logistics leaders say real-time tracking is essential, but only 25% use real-time trackers now.

Key Takeaways

- Global Freight and Logistics Market valued at US$ 6.0 Trillion in 2024, projected to reach US$ 10.3 Trillion by 2034

- Market growing at CAGR of 5.6% during forecast period 2025 to 2034

- Railways segment dominates by shipping type with 53.9% market share

- Transportation service segment leads with 37.5% market share

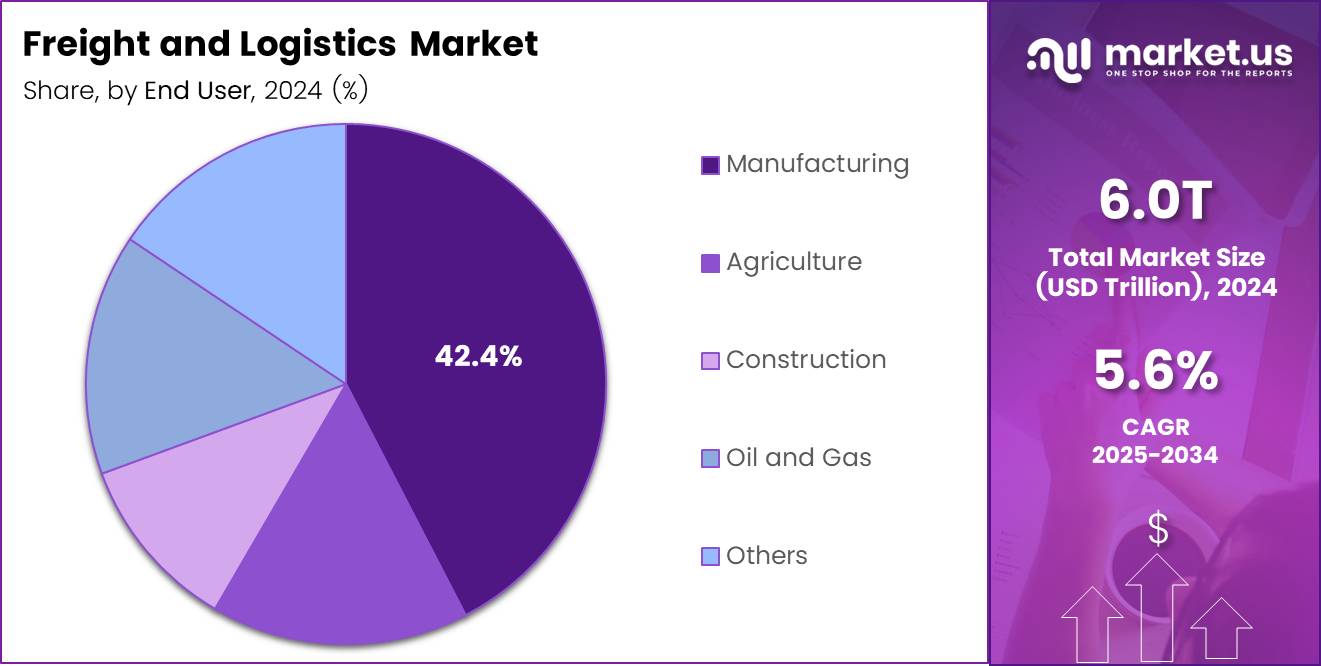

- Manufacturing end-user segment holds 42.4% market share

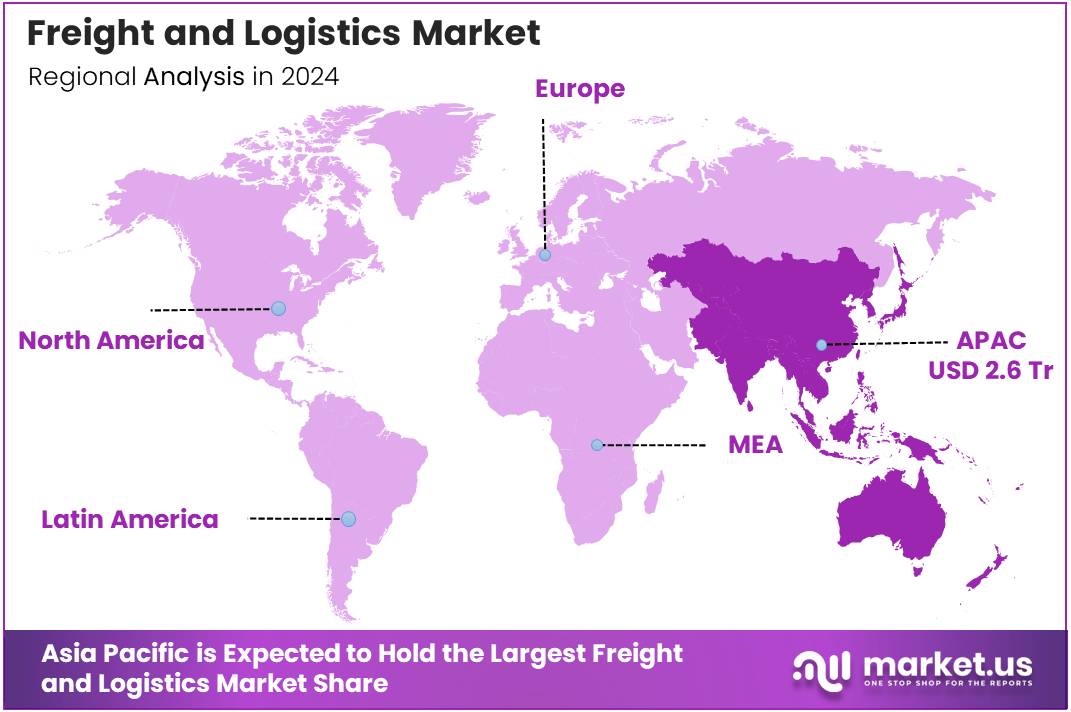

- Asia Pacific region dominates with 43.90% market share, valued at US$ 2.6 Trillion

By Shipping Type Analysis

Railways dominates with 53.9% due to its cost-effectiveness and high-capacity freight handling capabilities.

In 2024, Railways held a dominant market position in the By Shipping Type Analysis segment of Freight and Logistics Market, with a 53.9% share. Railway infrastructure provides unmatched efficiency for bulk cargo transportation across continental distances, offering competitive pricing structures. Consequently, industries prioritize rail networks for heavy machinery, raw materials, and containerized goods movement. Furthermore, ongoing modernization projects enhance speed and reliability standards systematically.

Airways shipping continues expanding rapidly, serving time-sensitive cargo requirements across global trade corridors. This segment caters primarily to high-value goods, perishables, and urgent shipments requiring expedited delivery solutions. Additionally, e-commerce growth drives demand for air freight services connecting international marketplaces efficiently.

Roadways maintain essential connectivity for last-mile delivery operations and regional distribution networks. Trucks provide flexible routing options, ensuring seamless door-to-door service capabilities. Moreover, technological integration enhances fleet management efficiency through GPS tracking and route optimization systems.

Waterways represent critical infrastructure for international trade, handling massive container volumes economically. Ocean freight dominates long-distance transportation, connecting manufacturing hubs with consumer markets worldwide. Meanwhile, Others segment includes pipeline transport and specialized handling solutions for unique cargo requirements.

By Service Analysis

Transportation dominates with 37.5% driven by fundamental demand for goods movement across supply chains.

In 2024, Transportation held a dominant market position in the By Service Analysis segment of Freight and Logistics Market, with a 37.5% share. This service category encompasses comprehensive carrier operations across multiple transport modes, ensuring efficient cargo movement. Businesses depend heavily on reliable transportation networks to maintain supply chain continuity and meet delivery commitments consistently.

Inventory Management services gain prominence as enterprises seek optimization strategies to balance stock levels effectively. Advanced technologies enable real-time visibility into inventory positions, reducing carrying costs while preventing stockouts. Consequently, third-party providers offer sophisticated management systems supporting demand forecasting accuracy.

Packaging services ensure product protection throughout transit journeys, minimizing damage risks and maintaining quality standards. Specialized packaging solutions address fragile goods, hazardous materials, and temperature-sensitive products systematically. Additionally, sustainable packaging alternatives emerge responding to environmental regulations.

Warehousing provides strategic storage facilities supporting distribution networks and enabling efficient order fulfillment processes. Distribution services coordinate product flow from manufacturing sites to retail destinations seamlessly. Customs Clearance handles regulatory compliance, documentation processing, and border crossing procedures efficiently. Others segment includes value-added services such as assembly, labeling, and quality inspection operations.

By End User Analysis

Manufacturing dominates with 42.4% reflecting extensive supply chain complexity and raw material logistics requirements.

In 2024, Manufacturing held a dominant market position in the By End User Analysis segment of Freight and Logistics Market, with a 42.4% share. Industrial operations require sophisticated logistics networks managing inbound raw materials and outbound finished goods simultaneously. Consequently, manufacturers partner with specialized providers offering integrated solutions supporting production schedules reliably.

Agriculture sector depends on logistics infrastructure for perishable commodities distribution, requiring temperature-controlled transportation capabilities. Seasonal fluctuations create dynamic demand patterns necessitating flexible capacity management strategies. Moreover, export-oriented agricultural businesses rely heavily on efficient supply chain coordination.

Construction industry generates substantial freight volumes transporting building materials, equipment, and prefabricated components to project sites. Timely delivery proves critical for maintaining construction timelines and controlling project costs effectively. Additionally, specialized handling equipment supports oversized and heavy cargo movement requirements.

Oil and Gas sector maintains complex logistics operations managing exploration equipment, pipeline materials, and petroleum product distribution networks. Remote location challenges require innovative transportation solutions ensuring operational continuity. Others segment encompasses retail, technology, pharmaceutical, and consumer goods industries with diverse logistics needs.

Key Market Segments

By Shipping Type

- Railways

- Airways

- Roadways

- Waterways

- Others

By Service

- Transportation

- Inventory Management

- Packaging

- Warehousing

- Distribution

- Customs Clearance

- Others

By End User

- Manufacturing

- Agriculture

- Construction

- Oil and Gas

- Others

Drivers

Rapid Expansion of Cross-Border E-Commerce Fulfillment Networks Drives Market Growth

Online retail proliferation creates unprecedented demand for international shipping services connecting global marketplaces efficiently. Consequently, logistics providers expand fulfillment center networks strategically positioned near consumer populations. Digital platforms enable seamless cross-border transactions, requiring sophisticated customs clearance and last-mile delivery capabilities systematically.

Furthermore, consumer expectations for rapid delivery timelines push innovation in distribution network design. Enterprises invest heavily in technology infrastructure supporting real-time order tracking and flexible delivery options. Additionally, emerging markets demonstrate accelerated e-commerce adoption rates, creating substantial growth opportunities across developing regions continuously.

Moreover, automation technologies enhance warehouse productivity through robotic picking systems and automated sorting equipment. Data-driven supply chain optimization improves route planning efficiency while reducing transportation costs effectively. Investment in multimodal transport infrastructure modernization strengthens connectivity between production centers and consumption markets systematically.

Restraints

Volatile Global Trade Policies and Persistent Labor Shortages Constrain Market Expansion

International trade uncertainties stemming from fluctuating tariff policies create planning challenges for logistics operators. Regulatory changes impose unexpected cost burdens, disrupting established supply chain configurations and profitability margins. Consequently, businesses face difficulties maintaining competitive pricing structures amid unpredictable policy environments continuously.

Additionally, driver shortages represent critical constraints limiting capacity expansion across trucking and delivery sectors. Labor market tightness drives wage inflation, increasing operational expenses while compromising service reliability standards. Furthermore, stringent licensing requirements and challenging working conditions deter new workforce entrants systematically.

Moreover, aging driver demographics exacerbate shortage concerns as retirement rates accelerate without adequate replacement pipelines. Training program investments prove insufficient addressing immediate capacity needs across regional markets. These labor constraints particularly impact last-mile delivery operations requiring extensive driver networks supporting urban distribution systems.

Growth Factors

Deployment of AI-Enhanced Freight Visibility Solutions Accelerates Market Innovation

Artificial intelligence applications revolutionize predictive analytics capabilities, enabling proactive disruption management and dynamic route optimization. Machine learning algorithms process vast datasets identifying efficiency improvement opportunities across complex supply chain networks. Consequently, stakeholders achieve superior visibility into shipment status, enhancing customer service responsiveness systematically.

Green logistics initiatives gain momentum as organizations prioritize sustainability objectives through low-emission fleet technologies. Electric vehicle adoption accelerates supported by charging infrastructure investments and regulatory incentives favoring environmental compliance. Additionally, alternative fuel solutions including hydrogen and biodiesel emerge reducing carbon footprint significantly.

Cold-chain logistics expansion serves growing pharmaceutical and food retail sectors requiring temperature-controlled transportation capabilities. Blockchain integration enhances freight documentation security while streamlining compliance procedures across international borders. These technological advancements collectively create substantial opportunities for market participants embracing digital transformation strategies.

Emerging Trends

Surge in Last-Mile Micro-Fulfillment and Digital Freight Marketplace Adoption

Urban delivery hubs proliferate addressing last-mile challenges through strategically positioned micro-fulfillment centers near consumer populations. These facilities enable rapid order processing and same-day delivery capabilities meeting escalating customer expectations consistently. Consequently, retailers and logistics providers collaborate developing innovative distribution models optimizing urban logistics efficiency.

Digital freight marketplaces transform traditional brokerage operations through automated load matching and transparent pricing mechanisms. Platform-based solutions connect shippers directly with carriers, reducing intermediary costs while improving capacity utilization rates. Furthermore, autonomous and semi-autonomous freight transport trials advance, promising enhanced safety and operational efficiency.

IoT-enabled telematics systems become standard across fleet operations, providing comprehensive vehicle monitoring and predictive maintenance capabilities. Real-time data collection supports performance optimization while reducing downtime through proactive service interventions. These emerging trends collectively reshape competitive dynamics within freight and logistics markets globally.

Regional Analysis

Asia Pacific Dominates the Freight and Logistics Market with a Market Share of 43.90%, Valued at USD 2.6 Trillion

Asia Pacific commands the largest market position driven by manufacturing concentration and robust e-commerce growth trajectories. The region benefits from extensive infrastructure investments supporting multimodal transportation networks connecting production hubs efficiently. Moreover, China, India, and Southeast Asian nations demonstrate accelerated logistics modernization initiatives. The region’s market share stands at 43.90%, with valuation reaching USD 2.6 Trillion, reflecting sustained economic expansion and trade volume increases.

North America Freight and Logistics Market Trends

North America maintains sophisticated logistics infrastructure characterized by advanced technology adoption and integrated supply chain management systems. The region leads in automation implementation across warehousing and distribution operations. Additionally, nearshoring strategies drive cross-border freight volumes between United States, Canada, and Mexico continuously.

Europe Freight and Logistics Market Trends

Europe demonstrates strong emphasis on sustainability compliance and green logistics initiatives across transportation sectors. The region’s interconnected rail networks facilitate efficient cross-border freight movement supporting single market operations. Furthermore, digital freight platforms gain traction improving transparency and operational efficiency systematically.

Middle East and Africa Freight and Logistics Market Trends

Middle East positions as strategic logistics hub connecting Asia, Europe, and Africa through world-class port facilities and aviation infrastructure. The region benefits from substantial investments in free trade zones and logistics parks. Africa demonstrates emerging opportunities driven by infrastructure development and increasing trade integration initiatives.

Latin America Freight and Logistics Market Trends

Latin America experiences gradual logistics modernization addressing infrastructure gaps and regulatory complexities across diverse markets. E-commerce expansion drives demand for improved distribution networks and last-mile delivery capabilities. Additionally, regional trade agreements facilitate cross-border operations supporting economic integration objectives progressively.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Freight and Logistics Company Insights

A.P. Moller-Maersk maintains global leadership in container shipping and integrated logistics services, offering comprehensive supply chain solutions across maritime and inland transport networks. The company leverages advanced digital platforms enhancing visibility and operational efficiency for international trade clients.

DHL Group operates extensive logistics infrastructure spanning express delivery, freight forwarding, and supply chain management services globally. The organization demonstrates strong commitment toward sustainability initiatives while expanding healthcare and life sciences logistics capabilities systematically.

C.H. Robinson provides technology-enabled freight brokerage and third-party logistics solutions connecting shippers with extensive carrier networks. The company’s digital platform facilitates transparent pricing and real-time shipment tracking across multimodal transportation options.

DP World operates major port terminals and logistics facilities worldwide, serving as critical infrastructure connecting global trade routes. The organization invests heavily in automation technologies and smart port solutions enhancing cargo handling efficiency continuously.

These industry leaders collectively shape competitive dynamics through innovation investments, strategic acquisitions, and service portfolio expansions. Companies prioritize technology integration, sustainability commitments, and customer-centric solutions addressing evolving market requirements. Furthermore, digital transformation initiatives enable enhanced operational performance while supporting complex supply chain coordination needs effectively.

Top Key Players in the Market

- A.P. Moller-Maersk

- Allcargo Logistics

- Americold

- Aramex

- C.H. Robinson

- CJ Logistics Corporation

- CTS Logistics Group

- Culina Group

- DACHSER

- DHL Group

- DP World

Recent Developments

- In Sep 2024, DSV wins €14.3 billion acquisition of DB Schenker in a move to elevate global logistics reach and capabilities. This strategic transaction significantly expands DSV’s operational footprint across international markets while strengthening its competitive positioning within integrated logistics services.

- In April 2025, TIBA acquired Total Freight Worldwide to strengthen its air-freight capabilities between Latin America, Europe and Asia. The acquisition enhances TIBA’s service offerings connecting key trade corridors while expanding customer access to specialized air cargo solutions.

- In April 2025, DHL Group committed to invest €2 billion over the next five years to expand its logistics services in the life-sciences and healthcare sector. This substantial investment demonstrates strategic focus on high-growth segments requiring specialized temperature-controlled transportation and regulatory compliance expertise.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Trillion Forecast Revenue (2034) USD 10.3 Trillion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Shipping Type (Railways, Airways, Roadways, Waterways, Others), By Service (Transportation, Inventory Management, Packaging, Warehousing, Distribution, Customs Clearance, Others), By End User (Manufacturing, Agriculture, Construction, Oil and Gas, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape A.P. Moller-Maersk, Allcargo Logistics, Americold, Aramex, C.H. Robinson, CJ Logistics Corporation, CTS Logistics Group, Culina Group, DACHSER, DHL Group, DP World Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Freight and Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Freight and Logistics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- A.P. Moller-Maersk

- Allcargo Logistics

- Americold

- Aramex

- C.H. Robinson

- CJ Logistics Corporation

- CTS Logistics Group

- Culina Group

- DACHSER

- DHL Group

- DP World