Global FPV Racing Drone Market Size, Share, Growth Analysis By Type (Ready-to-Fly (RTF), Bind-and-Fly (BNF), Do-It-Yourself (DIY)), By Component (Frame, Flight Controller, FPV Camera, Video Transmitter, Others), By Distribution Channel (Online, Offline), By End-User (Individual, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166267

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- FPV System Analysis

- Drone Industry Adoption

- Emerging Trends

- US Market Size

- By Type

- By Component

- By Distribution Channel

- By End-User

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

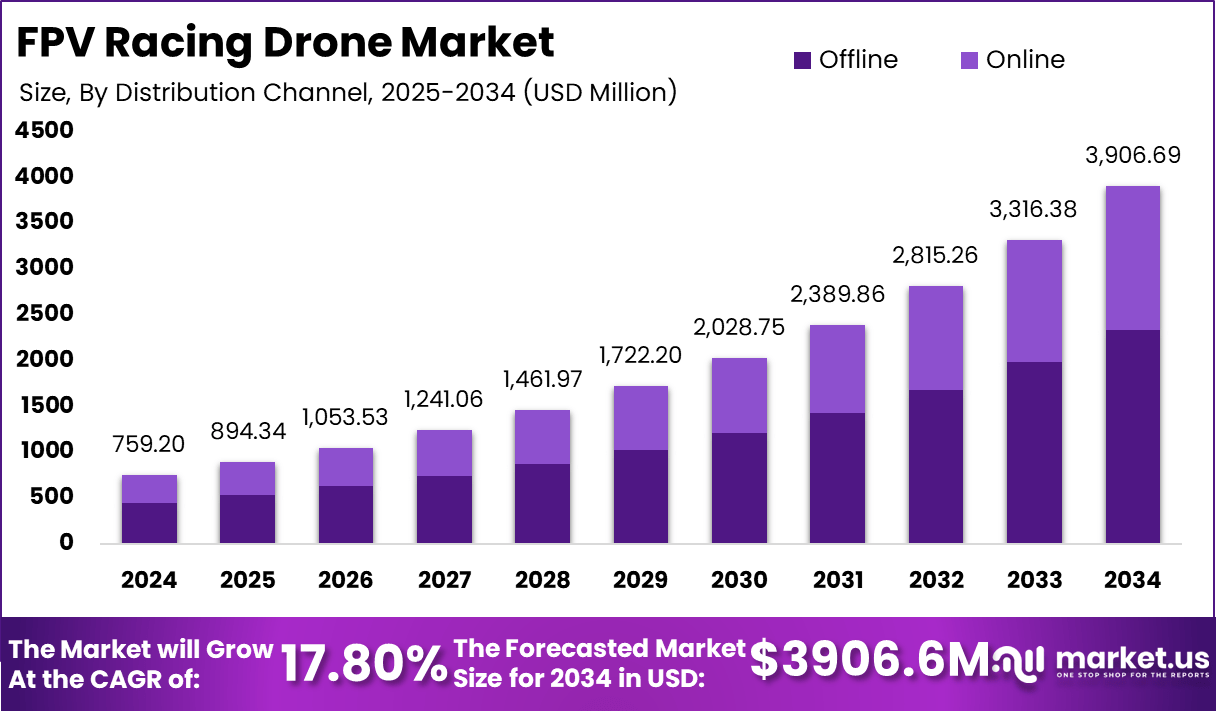

The FPV (First-Person View) Racing Drone Market is experiencing significant growth, driven by increasing popularity in drone racing sports and technological advancements in drone capabilities. In 2024, the market is valued at USD 759.2 million and is projected to grow at a robust CAGR of 17.80%, reaching an estimated USD 3906.6 million by 2034. This growth is attributed to the rising interest in FPV racing as both a recreational activity and a competitive sport, along with ongoing innovations in drone technology that enhance speed, maneuverability, and control.

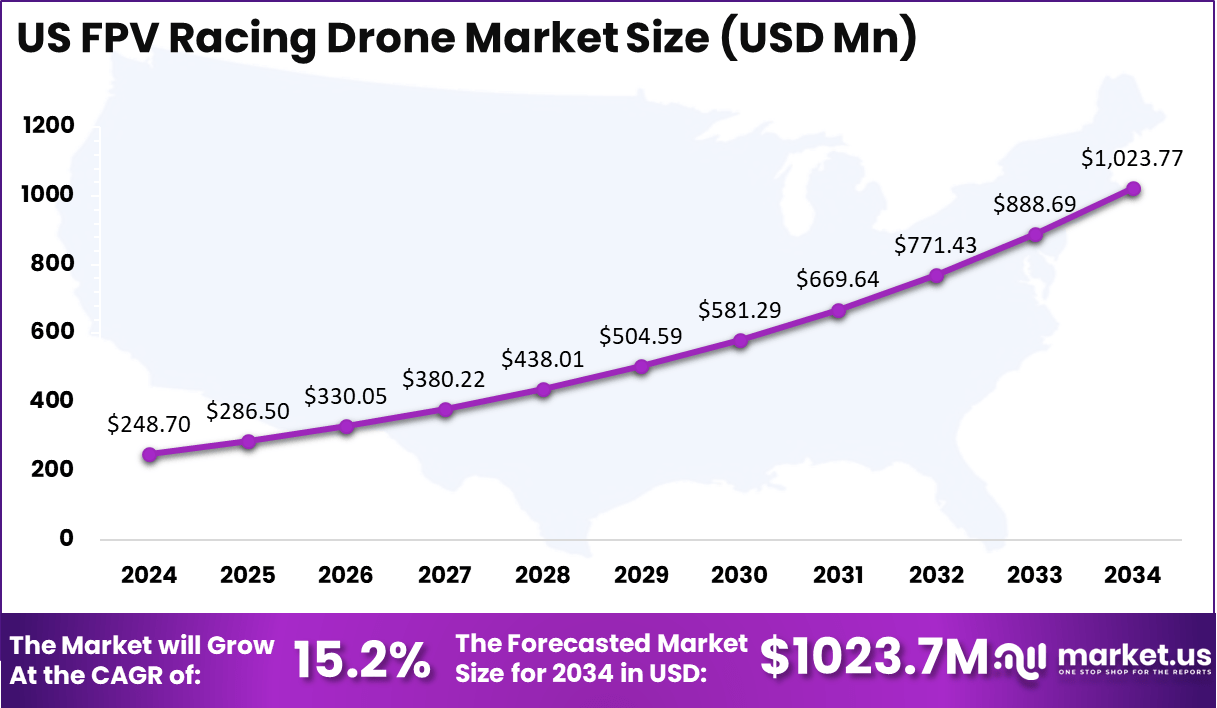

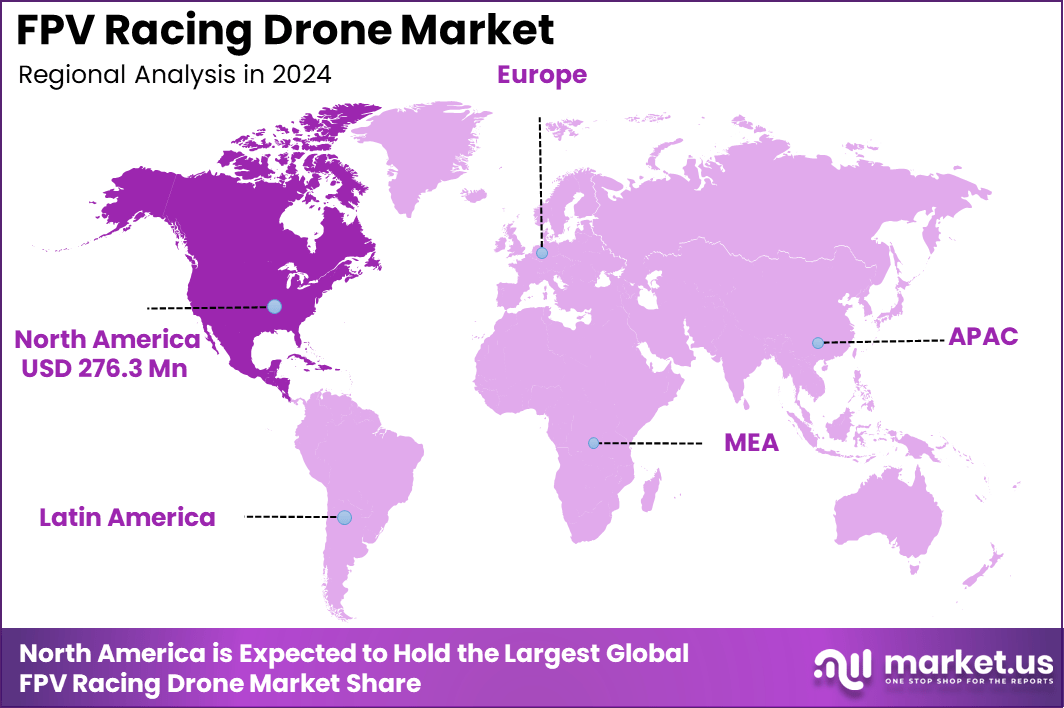

North America dominates the market with a 36.4% share in 2024, valued at USD 276.3 million. Within this region, the US leads, contributing USD 248.7 million to the overall market size. The US FPV racing drone market is expected to experience a healthy CAGR of 15.2%, reaching USD 1023.7 million by 2034.

This growth is supported by a growing number of drone enthusiasts, the rise of drone racing leagues, and a favorable regulatory environment for drone innovation and testing. As the market continues to evolve, the development of more advanced drones and the wider adoption of FPV racing are expected to drive sustained growth in the coming years.

FPV (First-Person View) Racing Drones have emerged as a dominant force in both the competitive drone racing sport and the broader recreational drone market. These drones offer a unique and immersive experience, where pilots wear goggles that provide a real-time view from the drone’s perspective, enhancing control and precision in racing. The ability to experience the flight from the drone’s point of view is a key differentiator that attracts enthusiasts and competitive racers alike.

In competitive settings, FPV racing has rapidly gained traction, with numerous events and leagues taking place globally. The demand for high-performance drones with advanced speed, agility, and stability has driven technological innovation in the FPV racing segment. These drones are equipped with specialized components such as high-definition cameras, powerful motors, and lightweight frames to optimize performance.

In recreational use, FPV racing drones offer thrill-seekers a way to experience the excitement of drone flying at high speeds through tight courses and obstacle-filled environments. The growth of drone racing leagues and online communities has also fueled the popularity of these drones, providing platforms for pilots to showcase their skills and connect with other enthusiasts.

With increasing technological advancements, including better battery life, enhanced video transmission, and more responsive controls, FPV drones are set to continue their growth trajectory, broadening their appeal across both competitive and recreational users.

In 2025, the FPV racing drone market saw several key developments. DJI released the Avata 2 drone, offering improvements like 4K video at 60fps and a maximum flight time of 23 minutes, making it popular among both beginners and advanced pilots. BetaFPV introduced the Air65 model, targeting micro drone enthusiasts, while Emax launched the Tinyhawk III Plus with enhanced stability features.

A major acquisition occurred when XTI Aerospace acquired Drone Nerds, a leading US drone distributor with annual sales exceeding $110 million in 2024, expanding XTI’s distribution capabilities nationwide. In funding, Neros closed a $75 million Series B round in November 2025, aiming to boost production capacity from 20,000 to 35,000 units annually and reduce reliance on external suppliers.

Adoption rates of digital FPV systems increased by 35% in 2025 compared to the previous year, driven by DJI’s O3 Air Unit and similar innovations. Drone racing leagues worldwide saw participation rise by 25%, partly due to lower entry costs and improved community engagement tools. These numbers highlight strong momentum in technology advancement, market consolidation, and financial investment, fueling FPV racing drones’ expanding footprint in both consumer and competitive markets.

Key Takeaways

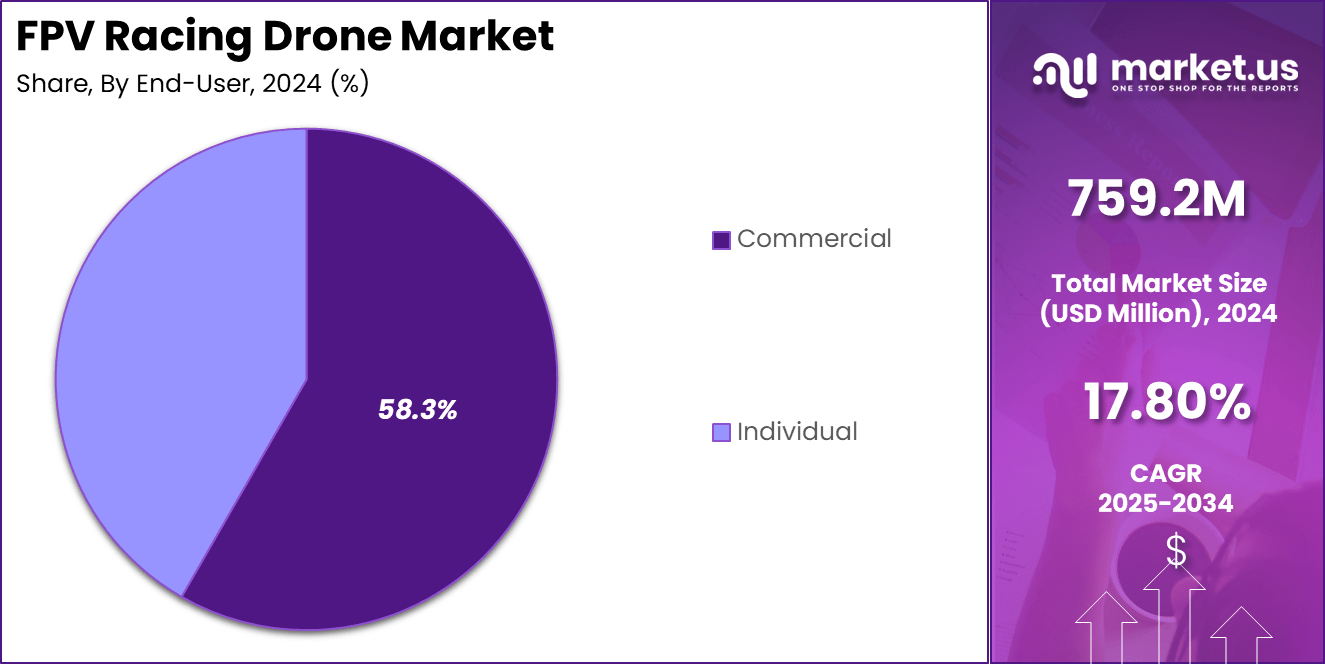

- The FPV Racing Drone Market in 2024 is valued at USD 759.2 million.

- The market is expected to grow at a CAGR of 17.80%, reaching USD 3906.6 million by 2034.

- North America holds a 36.4% market share in 2024, with a market size of USD 276.3 million.

- The US dominates the North American market with USD 248.7 million in 2024, projected to reach USD 1023.7 million by 2034, growing at a CAGR of 15.2%.

- Ready-to-Fly (RTF) drones account for 49.5% of the market by type.

- The FPV Camera segment leads the components category, representing 38.7% of the market.

- Offline distribution channels dominate, with 59.8% of market share.

- Commercial end-users hold a significant share of 58.3% in the market.

FPV System Analysis

The FPV system in racing drones functions as the pilot’s immersive ‘cockpit’, connecting the aircraft’s visual feed to the operator in real time and forming one of the most critical subsystems driving performance. Currently, the analog system segment dominates due to affordability and simplicity, while digital FPV systems — which provide higher resolution but slightly increased latency – are gaining adoption.

Within an FPV system, the camera is mounted rigidly ahead on the craft to transmit a live feed; this feed is encoded via the video transmitter (VTX) and relayed to the pilot’s goggles or monitor, with low latency being essential for high‑speed manoeuvres.

Critical design factors for such systems include signal latency, transmission power, and channel density (which affect range and interference), image clarity and field of view (to help with rapid obstacle detection), and form‑factor/weight to minimise drag and improve agility. For example, higher output VTX power supports greater range but can introduce interference with other pilots.

From a usage perspective, the FPV system allows pilots to tackle complex racing circuits at high velocity by maintaining full immersion and situational awareness that traditional line‑of‑sight drones cannot provide. In commercial applications beyond racing, these systems enable inspection in confined spaces, immersive cinematography, and rapid response flights, where the live first‑person feed supports better operator judgment.

Drone Industry Adoption

The adoption of drones across industries is advancing strongly, with several key drivers and usage cases shaping the trajectory. In agriculture, precision‑farming applications using aerial imaging and spraying are increasingly leveraged to monitor crop health, optimise input usage, and boost yields; as noted, sectors such as agriculture, logistics, energy, and construction are adopting drones to improve efficiency and reduce costs.

In construction and infrastructure management, drones are being employed for site surveying, progress monitoring, and inspection tasks that previously required manned aircraft or on‑site labour, which reduces time and safety risk.

In logistics and delivery, several pilots and early commercial deployments illustrate the trend: drone delivery services promise faster fulfilment and access to hard‑to‑reach areas, with some estimates projecting rapid value growth in goods delivered by drones.

Regulatory developments and technological improvements—such as better sensors, data analytics, and autonomous capabilities—are complementing adoption by lowering barriers and enabling scalable deployment.

While uptake is strongest in developed markets, growth in emerging markets is also notable as local regulations ease and domestic manufacturing expands.

Overall, the ecosystem is moving from experimental pilots to more widespread operational use across multiple sectors, and this broad industry adoption is contributing to accelerating market growth for drone systems.

Emerging Trends

Emerging trends in the FPV racing drone market are shaping its growth and expanding its appeal. Advances in technology are driving performance improvements, with high-definition video transmission, AI-based flight control systems, and enhanced stabilization becoming increasingly common. These innovations are expected to enhance both competitive and recreational drone experiences.

Additionally, miniaturization and lightweight design are gaining traction, as manufacturers develop smaller, more agile drones that offer improved speed and maneuverability, making the sport more accessible. Battery technology improvements, such as higher energy density and faster charging times, are also playing a significant role in extending flight durations and enabling more dynamic racing formats.

The growth of organized racing leagues and event ecosystems is transforming FPV racing into a more structured, competitive sport with broader audience engagement. Furthermore, the adoption of real-time telemetry and data analytics is helping pilots optimize their performance, track conditions, and manage component wear.

Finally, immersive technologies like augmented reality (AR) and virtual reality (VR) are being explored to enhance both the pilot’s experience and the spectator’s engagement, making the sport more interactive and spectator-friendly. These trends collectively indicate that the FPV racing drone market is evolving not only in terms of hardware and technology but also in its ecosystem maturity, user experience, and competitive structure.

US Market Size

The US FPV racing drone market is currently valued at USD 248.7 million in 2024 and is expected to experience significant growth, reaching an estimated USD 1023.7 million by 2034. This growth reflects a robust compound annual growth rate (CAGR) of 15.2%. Several factors are driving the expansion of the market in the US, including increasing interest in drone racing as both a sport and a recreational activity.

The growing popularity of FPV racing leagues, as well as advancements in drone technology, are contributing to wider adoption among enthusiasts. The US also benefits from a favorable regulatory environment that supports the development and testing of drones, facilitating innovation and ensuring safer, more reliable products. Additionally, the presence of key drone manufacturers and a strong consumer electronics sector provides a solid foundation for market growth.

As the demand for more advanced, feature-rich drones continues to rise, particularly those with enhanced video transmission, stability, and speed capabilities, the US market is expected to capture a larger share of the global FPV racing drone market. The combination of technological advancements, increased consumer interest, and a well-developed competitive ecosystem positions the US as a leading market for FPV racing drones in the coming decade.

By Type

The FPV racing drone market is categorized by different types, with Ready-to-Fly (RTF) drones commanding the largest share at 49.5%. RTF drones are pre-assembled and come with all the necessary components, including the drone, transmitter, and FPV equipment, making them the ideal choice for both beginners and experienced pilots who prefer convenience. These drones are designed for immediate use, offering a hassle-free experience for users who want to dive straight into racing without the need for extensive assembly or setup.

Bind-and-Fly (BNF) drones follow closely behind, offering a more customizable experience. BNF drones come pre-assembled but require the user to bind the drone to their own transmitter, which provides flexibility for pilots who already have their preferred equipment. This category appeals to those with more experience who want to fine-tune their drone settings or use existing gear for enhanced performance.

Do-It-Yourself (DIY) drones make up a smaller portion of the market but cater to the most advanced and technical enthusiasts. DIY drones require users to assemble all components, from the frame to the electronics, offering full control over the build. This type of drone appeals to those who value customization and want to maximize performance through individual component choices. The growing popularity of RTF and BNF options reflects a shift toward user-friendly experiences, with DIY drones maintaining a strong presence among expert pilots.

By Component

In the FPV racing drone market, the FPV Camera holds the largest share of 38.7% among the key components. The camera is a critical element in FPV drones, as it provides the live feed that pilots see through their goggles or monitors, allowing them to navigate the drone in real-time. High-quality FPV cameras are essential for ensuring clear, stable visuals, especially at high speeds and in complex racing environments. As technology advances, cameras with higher resolutions, improved low-light performance, and enhanced image stabilization are becoming more common, further driving the demand for FPV cameras.

The frame is another important component, providing the structural foundation for the drone. Frames are typically made from lightweight materials such as carbon fiber to ensure durability while minimizing weight, which is crucial for enhancing the drone’s speed and agility. The flight controller is the brain of the drone, managing the drone’s stability and response to pilot inputs. It processes data from sensors and adjusts the drone’s motors to maintain control during flight.

The video transmitter (VTX) is another key component, responsible for transmitting the live video feed from the FPV camera to the pilot’s goggles or monitor. Other components, such as antennas and batteries, also play essential roles in the drone’s overall performance. Together, these components create a seamless and high-performance system for competitive FPV racing.

By Distribution Channel

In the FPV racing drone market, the offline distribution channel dominates with a significant 59.8% share, reflecting a preference for traditional retail and physical stores for purchasing these high-tech devices. Offline channels include brick-and-mortar hobby shops, specialized drone retailers, and large electronics stores, where consumers can physically examine the drones, receive expert advice, and often test the products before purchasing.

The hands-on experience and immediate availability of products are key advantages that drive consumer preference for offline shopping, particularly among those who may need personalized assistance in selecting components or configuring their drone.

Offline retail also provides a sense of trust and reliability, as customers can interact directly with knowledgeable staff and ensure the quality of the product. Additionally, hobbyists often benefit from post-purchase services like drone repair, upgrades, or consultations available at physical stores.

On the other hand, the online distribution channel is growing rapidly, offering convenience and a broader range of options for consumers. Online retailers, e-commerce platforms, and specialized drone websites allow customers to shop from anywhere and access a wider selection of drones, components, and accessories. Although the online market share is smaller compared to offline, it is expected to continue growing as more consumers embrace the ease and variety of online shopping.

By End-User

In the FPV racing drone market, commercial end-users dominate with a significant share of 58.3%, highlighting the growing use of these drones in various professional applications. Commercial use of FPV drones extends beyond the competitive racing scene, with industries adopting these drones for tasks such as aerial cinematography, surveying, mapping, and inspections.

FPV drones are increasingly used by film production companies for dynamic, immersive shots, as their high-speed capabilities and maneuverability allow for creative angles and detailed aerial footage in challenging environments. In addition, commercial entities in sectors like construction and agriculture are utilizing FPV drones for site surveys, crop monitoring, and infrastructure inspections, benefiting from the high-quality real-time video feeds and the ability to navigate hard-to-reach locations.

On the other hand, individual users make up the remaining share of the market. These enthusiasts primarily use FPV drones for recreational racing, flying, and hobbyist activities. Individual pilots are often passionate about customizing their drones and participating in local or competitive FPV racing events.

While commercial users currently represent the larger segment, the individual consumer base continues to grow as the sport gains popularity and as the accessibility of FPV drones increases. With the expanding applications and rising interest, the commercial sector is likely to maintain its dominance while the individual market segment continues to contribute to overall growth.

Key Market Segments

By Type

- Ready-to-Fly (RTF)

- Bind-and-Fly (BNF)

- Do-It-Yourself (DIY)

By Component

- Frame

- Flight Controller

- FPV Camera

- Video Transmitter

- Others

By Distribution Channel

- Online

- Offline

By End-User

- Individual

- Commercial

Regional Analysis

North America holds a dominant share of 36.4% in the global FPV racing drone market, with a market size of USD 276.3 million in 2024. This region is expected to maintain its leadership due to several key factors, including a strong base of drone enthusiasts, rapid technological advancements, and the growing popularity of drone racing as both a sport and a hobby.

The US, in particular, is a significant contributor to North America’s market share, benefiting from favorable regulations that support drone innovation, testing, and recreational use. The presence of major drone manufacturers and a well-established retail infrastructure further strengthens the market in this region.

In addition to recreational use, North America has witnessed a surge in commercial applications of FPV drones, especially in industries such as filmmaking, agriculture, construction, and infrastructure inspection. These industries increasingly rely on FPV drones for high-speed, high-definition aerial footage, real-time data collection, and precision work in challenging environments.

The region’s market growth is also supported by the rise of organized drone racing leagues and events, which continue to gain popularity and attract large audiences. As drone technology continues to improve, with advancements in video transmission, battery life, and camera resolution, North America’s FPV racing drone market is poised for continued expansion in the coming years.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The FPV racing drone market is driven by technological advancements in drone components, including enhanced FPV cameras, high-speed processors, and improved flight controllers. These innovations enable better performance, greater stability, and more immersive experiences for pilots, which is attracting more enthusiasts to the sport.

The growing popularity of drone racing leagues and organized events is another key driver, as these platforms provide exposure and support for the sport. Additionally, rising demand for drones in commercial applications, such as aerial cinematography, infrastructure inspections, and agriculture, is contributing to market growth.

The increasing affordability and availability of FPV drones, coupled with a growing base of skilled pilots, are further fueling demand. Government support for drone technology, coupled with relaxed regulations in certain regions, also plays a role in the market’s expansion, fostering innovation and development.

Restraint Factors

Despite its growth, the FPV racing drone market faces several challenges. One of the primary restraints is the high cost of advanced FPV racing drones, especially for professional-grade models, which may limit adoption among casual users or newcomers. Furthermore, the technical complexity of assembling and tuning DIY drones can deter less experienced individuals from entering the market.

Regulatory restrictions, such as no-fly zones and airspace regulations, also pose significant challenges for drone operators. These constraints impact the freedom of drone use, particularly in commercial applications.

Additionally, technical limitations such as battery life and signal interference continue to hinder optimal performance during extended racing events, requiring ongoing innovation to address these issues. The lack of standardization in drone components and formats also adds to operational complexities.

Growth Opportunities

The FPV racing drone market presents several growth opportunities, particularly in the commercial sector. The demand for high-quality aerial footage in industries such as filmmaking and advertising is increasing, with FPV drones offering unique, dynamic shots that traditional aerial methods cannot replicate.

Additionally, drones are increasingly being used for surveying, inspections, and agriculture, where their ability to provide real-time data and imagery is invaluable. The expanding popularity of drone racing leagues globally offers an opportunity for both increased engagement and commercialization of the sport.

As technology advances, there are opportunities for further developments in battery life, lightweight materials, and camera resolution, which can drive both performance and affordability. The emergence of virtual and augmented reality (VR/AR) applications in FPV racing also presents a growth avenue, enhancing both the pilot’s experience and spectator engagement. Finally, the growth of e-commerce and online platforms offers new distribution channels for drones.

Trending Factors

Several emerging trends are shaping the FPV racing drone market. One key trend is the growing integration of artificial intelligence (AI) and machine learning into drone systems, which helps optimize flight performance, stabilize video feeds, and provide real-time data analysis during races.

Additionally, the trend toward miniaturization continues to dominate, with smaller, more agile drones becoming popular for racing and recreational flying. Another notable trend is the increasing use of digital FPV systems, which offer higher video resolution and lower latency, making them more appealing for professional-grade racing and commercial applications.

The rise of immersive technologies like virtual reality (VR) and augmented reality (AR) is also influencing the market, as they are being used to enhance both the pilot’s experience and the spectator’s view of the races. Finally, organized drone racing leagues are gaining popularity, driving spectator engagement and commercial investment in the sport.

Competitive Analysis

The competitive landscape of the FPV racing drone market is marked by a diverse mix of global players striving for differentiation through technology, product breadth, and market presence. Key players such as DJI (China), Fat Shark (USA), BetaFPV (China), and TBS Team BlackSheep (Germany) feature prominently in recent reports.

DJI leverages its broad consumer drone leadership to capture adjacent FPV racing segments, enabling cross‑customer acquisition and economies of scale. Fat Shark has strong brand equity in FPV goggles and racing accessories, strengthening its ecosystem control.

BetaFPV and TBS are more niche‑oriented but focus intensively on racing‑specific innovations, catering to enthusiasts and competitive pilots. This multi‑tier competition creates a layered market structure where mass‑market players address RTF (Ready‑to‑Fly) offerings, while specialist brands dominate BNF (Bind‑and‑Fly) and DIY (Do‑It‑Yourself) segments.

Emerging entrants and component‑specialists (e.g., camera/transmitter system providers) are intensifying rivalry by introducing feature upgrades (e.g., higher resolution FPV cameras, lower‑latency video transmission). Profit margins are under pressure as end‑users expect more performance at lower cost, intensifying price competition.

Partnerships between drone manufacturers and racing leagues are becoming strategic mechanisms to drive product visibility and adoption. Overall, the competitive environment is fragmented yet tilted toward brand‑strong incumbents, with innovation and channel strength as key differentiators.

Top Key Players in the Market

- BETAFPV

- Radiomaster

- MEPS

- EMAX

- iFlight

- GEPRC

- Fat Shark

- RunCam

- SpeedyBee

- CaddxFPV

- FIVE33

- Team BlackSheep (TBS)

- HGLRC

- Foxeer

- Axisflying

- RCinpower

- Others

Recent Developments

- October 1, 2025: DJI announced the expected launch of its “Neo 2 FPV” drone in November 2025, marking a major refresh in its racing drone product line ahead of the holiday season.

- November 5, 2025: During the Indo‑Pacific Endeavour 2025 at Kuantan Airbase, the Royal Australian Air Force showcased its drone-racing team flying FPV drones at speeds in excess of 200 km/h, engaging local visitors in STEM outreach activities related to FPV performance and drone technology.

- October 16, 2025: Researchers introduced “SkyDreamer”, the first end-to-end vision-based autonomous FPV drone racing policy capable of onboard execution, reaching high speeds and tight manoeuvres without external assistance.

Report Scope

Report Features Description Market Value (2024) USD 759.2 Million Forecast Revenue (2034) USD 3906.6 Million CAGR(2025-2034) 17.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Ready-to-Fly (RTF), Bind-and-Fly (BNF), Do-It-Yourself (DIY)), By Component (Frame, Flight Controller, FPV Camera, Video Transmitter, Others), By Distribution Channel (Online, Offline), By End-User (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BETAFPV, Radiomaster, MEPS, EMAX, iFlight, GEPRC, Fat Shark, RunCam, SpeedyBee, CaddxFPV, FIVE33, Team BlackSheep (TBS), HGLRC, Foxeer, Axisflying, RCinpower, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BETAFPV

- Radiomaster

- MEPS

- EMAX

- iFlight

- GEPRC

- Fat Shark

- RunCam

- SpeedyBee

- CaddxFPV

- FIVE33

- Team BlackSheep (TBS)

- HGLRC

- Foxeer

- Axisflying

- RCinpower

- Others