Global Foot Orthotic Insoles Market By Material (Thermoplastic, Composite Carbon Fiber and Other Materials) By Application (Sports & Athletics, Personal Comfort and Medical) By Type (Pre-fabricated and Custom-made) By Distribution Channel (Drug Stores, Online Stores, Hospitals & Specialty Clinics and Others (Foot stores, Retail Shops)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 56747

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

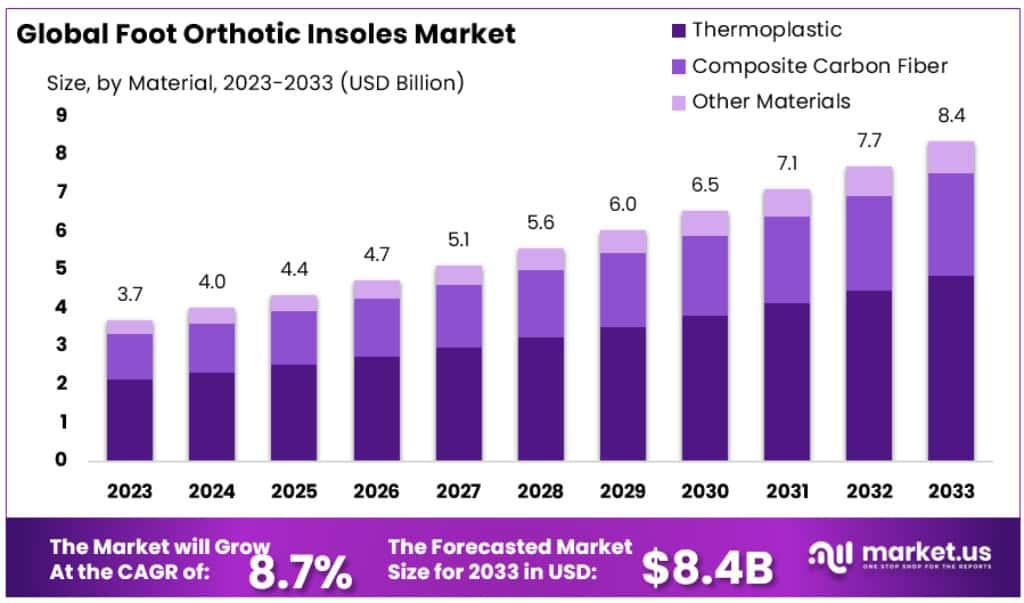

The Global Foot Orthotic Insoles Market size is expected to be worth around USD 8.4 billion by 2033, from USD 3.7 billion in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

Foot orthotic insoles, commonly known as orthotics, are specially designed shoe inserts that help support the feet and improve foot posture. They can be used to treat various foot conditions and provide extra padding and support.

The market is driven by factors such as increasing geriatric population and rising awareness about foot health, technological advancements in orthotic insoles, favorable reimbursement policies in developed countries and growing investments by key industry players and increased spending on research and development.

Key Takeaways

- Market Size: The market is valued at approximately USD 3.7 billion in 2023.

- Projected Market Size: It is expected to reach around USD 8.4 billion by 2033.

- Compound Annual Growth Rate: The market is growing at a CAGR of 8.7% from 2024 to 2033.

- Material Analysis: Thermoplastic materials are leading, with over 58% of the market share in 2023.

- Type Analysis: Custom-made foot orthotic insoles have a dominant position, holding more than a 53.2% market share in 2023.

- Distribution Channel Analysis: Hospitals and specialty clinics are the main distribution channels, capturing over 38.8% of the market in 2023.

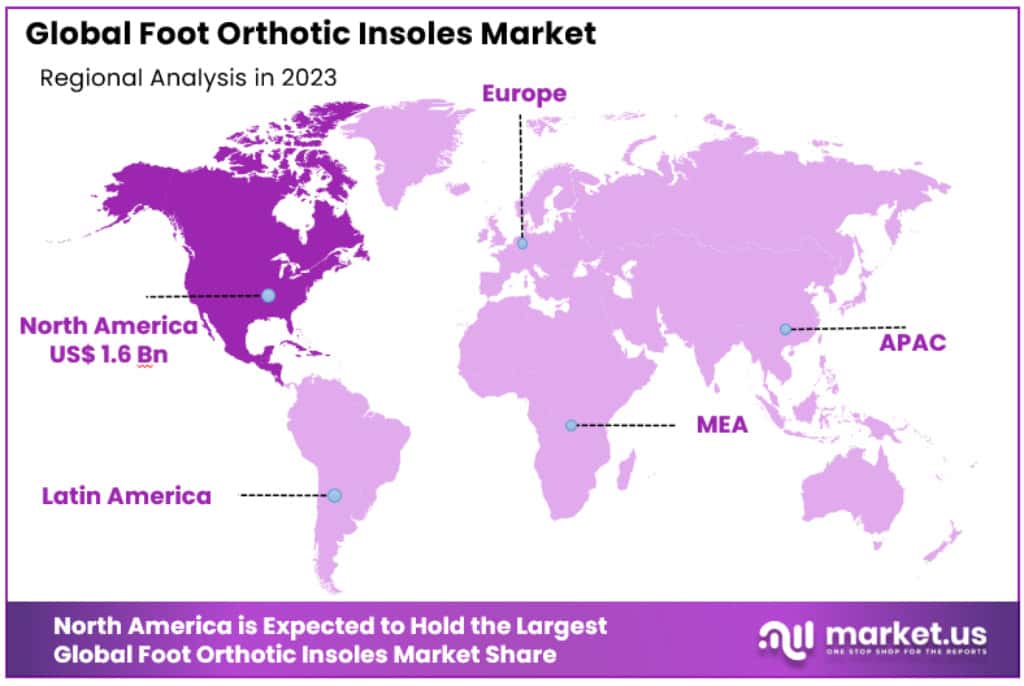

- Regional Analysis: North America is the leading region in the market, with a 42.9% share, equivalent to USD 1.6 billion.

Material Analysis

In 2023, thermoplastic held a dominant market position, capturing more than a 58% share in the foot orthotic insoles market. This dominance can be attributed to the material’s favorable properties such as flexibility, durability, and cost-effectiveness. Thermoplastic materials are easily moldable at high temperatures, making them ideal for custom orthotic solutions. Their ability to provide effective support and comfort to users with foot-related ailments has further propelled their demand.

Composite carbon fiber, another key material in this market, is gaining traction due to its lightweight nature and superior strength. Although it commands a smaller market share compared to thermoplastics, its usage is on the rise, particularly in sports and medical applications. The material’s rigidity and ability to provide firm support make it suitable for conditions requiring greater foot stabilization.

Other materials in the foot orthotic insoles market, such as gel, foam, and leather, collectively hold a significant portion of the market. These materials are valued for their comfort and versatility, catering to a wide range of consumer preferences. Their application varies from everyday use in casual footwear to specific medical requirements. As consumer awareness and technological advancements grow, the market for these materials is expected to see a steady increase.

Overall, the foot orthotic insoles market is characterized by a diverse range of materials, each catering to different needs and preferences. The market dynamics are influenced by factors such as technological innovations, consumer awareness, and healthcare trends, indicating a promising growth trajectory for the industry.

Application Analysis

Segmentation of the foot orthotic market for insoles is based on their application to medical, personal comfort, and sports. Due to rising rates of foot pain, diabetes, arthritis, and foot pain, the medical segment held the largest market share. This trend will likely continue throughout the forecast period.

The forecast period will see a lot of growth in the sports and athletics sector. Due to the growing opportunities in the industry, a greater number of people choose sports as a career. According to the National Health Statistics report in 2016, 213 million Americans (6 years old and older) participated in fitness and sports activities. The risk of injury increases with increased participation in recreational and sports activities. According to Stanford Children’s Health, more than 3.5 Million injuries are reported annually among children. According to the Canadian Institute of Health (CIH), 17.655 people were admitted to the hospital for sports-related injuries in 2016 and 2017.

Another factor driving product demand is the rise in geriatrics, who are more susceptible to orthotic disorders. According to the U.S. Census Bureau in 2015, the number 65 and older increased by 1.6 million.

Type Analysis

In 2023, custom-made foot orthotic insoles held a dominant market position, capturing more than a 53.2% share. This segment’s leadership stems from the increasing demand for personalized healthcare solutions. Custom-made insoles are tailored to individual foot contours and specific medical needs, offering superior comfort and effectiveness. Their popularity is particularly high among patients with specific foot conditions and athletes seeking performance enhancement.

Conversely, the pre-fabricated segment, while smaller, remains significant in the market. These insoles are readily available and offer a convenient, cost-effective solution for general foot support and comfort. They are widely used for everyday wear and by individuals seeking immediate relief from minor foot discomfort. The versatility and accessibility of pre-fabricated insoles make them a popular choice in various consumer segments.

The market dynamics of foot orthotic insoles are influenced by factors like technological advancements in customization, growing awareness of foot health, and an increasing prevalence of foot-related ailments. As such, both custom-made and pre-fabricated insoles are expected to see continued demand, with custom-made insoles leading due to their tailored approach and effectiveness in addressing specific foot conditions.

Distribution Channel Analysis

In 2023, hospitals & specialty clinics held a dominant market position in the foot orthotic insoles market, capturing more than a 38.8% share. This prominence is attributed to the professional and personalized services they offer, along with direct recommendations from healthcare professionals. Patients seeking specialized care for foot-related issues tend to prefer these settings for their reliability and access to expert advice.

Drug stores, another key distribution channel, also play a vital role in the market. They offer the convenience of immediate purchase and a wide range of over-the-counter options for consumers. Their market share is significant, especially for those seeking quick relief for common foot discomforts without the need for customization.

Online stores are rapidly gaining market share, thanks to the convenience and broad range of options they offer. Their growth is fueled by the increasing trend of e-commerce and the ease of comparing products and prices online. They are particularly appealing to tech-savvy consumers and those with limited access to physical stores.

Other distribution channels like foot stores and retail shops collectively hold a noteworthy portion of the market. These outlets cater to a diverse consumer base, offering a variety of insoles for different needs, from everyday comfort to specific medical requirements. As consumer awareness and retail expansion continue, these channels are poised for steady growth.

The foot orthotic insoles market is diversified across various distribution channels, each addressing different consumer needs and preferences. The market dynamics are shaped by factors such as consumer behavior, accessibility, and the growing emphasis on foot health, indicating a dynamic and evolving landscape for this industry.

Key Market Segments

Material

- Thermoplastic

- Composite Carbon Fiber

- Other Materials

Application

- Sports & Athletics

- Personal Comfort

- Medical

Type

- Pre-fabricated

- Custom-made

Distribution Channel

- Drug Stores

- Online Stores

- Hospitals & Specialty Clinics

- Others (Foot stores, Retail Shops)

Drivers

- Rising Prevalence of Chronic Foot Conditions: A significant driver for the market is the increasing number of people suffering from foot-related medical conditions like arthritis, plantar fasciitis, bursitis, and diabetic foot ulcers. Over 30% of the population experiences foot pain, leading to a higher demand for orthotic insoles. Specifically, the global incidence of diabetic foot ulcers ranged between 9.1 and 26.1 million cases in 2021, highlighting the urgent need for effective foot care solutions.

- Technological Advancements: The market is also being propelled forward by technological innovations. The introduction of advanced 3D printing techniques, for example, has revolutionized the production of custom-foot orthotics, increasing both their effectiveness and accessibility. This technology allows for the production of insoles with complex geometries, tailored to individual needs.

- Increased Research and Development Activities: The market is further driven by enhanced R&D efforts, particularly in recycling materials like thermoplastics, to reduce environmental impact. These initiatives are not only eco-friendly but also align with various environmental policies and regulations.

Restraints

- High Costs and Limited Penetration in Emerging Markets: The market’s growth is hindered by the high costs of custom orthotic insoles, which can range from USD 400 to USD 600. Additionally, in lower-middle-income countries (LMIC), there’s limited market penetration due to funding shortages and weak supply channels. This limitation in accessibility and affordability significantly restrains market expansion in these regions.

- Challenges with Research and Development: High costs associated with R&D capabilities also pose a challenge, particularly in developing and underdeveloped economies where there’s a lack of awareness and adoption of these products.

Opportunities

- Strategic Market Initiatives by Key Players: As the demand for foot orthotic insoles rises, major players in the market are engaging in strategic initiatives like mergers and acquisitions. These efforts aim to expand business portfolios and enter new markets, leveraging innovative technologies and offering personalized customer support. Such strategic moves are creating significant opportunities for market growth.

Market Trends

- Growth in Sports and Athletics Segment: The sports and athletics segment is witnessing substantial growth, driven by the increasing prevalence of foot ailments among athletes and sports enthusiasts. With the rising number of people participating in sports worldwide, the demand for orthotic insoles that prevent injury and enhance performance is escalating.

- Increased Burden of Diabetes: The growing prevalence of diabetes globally is leading to more cases of diabetic foot problems, further boosting the demand for diabetic insoles. These insoles play a critical role in preventing foot tissue damage and supporting healthy blood circulation.

Challenges

- Alternative Therapies and Awareness Issues: The presence of alternative therapies and a general lack of awareness in some regions present ongoing challenges to the market’s growth. The need for increased education and awareness about the benefits of foot orthotic insoles is essential for market expansion.

Regional Analysis

North America

In 2023, North America continues to lead the global market, holding a commanding 42.9% share, equivalent to USD 1.6 billion. This dominance is primarily due to the rapid adoption of advanced manufacturing technologies like 3D printing for creating customized orthotic insoles. The region’s market benefits significantly from a growing number of podiatric procedures and an increasing number of podiatrists and orthotists. The United States plays a pivotal role in this regional market, supported by a robust healthcare infrastructure, high purchasing power, and a significant adoption rate of foot orthotic insoles.

Europe

Europe stands as the second-largest market, driven by favorable reimbursement policies and concerted government efforts to raise awareness about foot care. The United Kingdom, for example, invested over USD 36.2 million in orthotic products and services between 2015 and 2016. Such investments are expected to continue, fueling the market’s growth in Europe.

Asia Pacific

The Asia Pacific region is set for remarkable growth during the forecast period, largely due to its increasing elderly population. This demographic shift is a key driver for the adoption of orthotic insoles in the region. Additionally, the rising prevalence of chronic diseases like diabetes and musculoskeletal disorders contributes to the market growth here.

Rest of the World

While holding a smaller share compared to other regions, the rest of the world is anticipated to witness significant growth. This is attributed to improvements in healthcare spending and rising awareness about foot health in developing countries.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

There are many small and large companies in the industry. This market is highly competitive and is dominated mainly by Superfeet Worldwide Inc., Hanger; Algeo Ltd., Amfit Inc., Bauerfeind AG, and Dr. Scholl’s.

These players are involved in many strategic initiatives, including new product launches, technological advances, mergers, and acquisitions to increase market penetration. The next big thing in this market is 3D-printed orthotics. In order to develop customized orthotic products, industry players invest in R&D. In June 2017, Stratasys Direct Manufacturing and Peacocks Medical Group collaborated to develop 3D printed orthotics. Aetrex purchased 3D-printed orthotics pioneer SOLS Systems in February 2017 with the aim of improving its 3D product range.

Key Market Players

- Reckitt Benckiser Group PLC

- Hanger Inc.

- Ottobock SE & Co. KGaA

- Össur hf

- Algeo Limited

- Bauerfeind AG

- Groupe Gorge

- Colfax Corporation

- Superfeet Worldwide Inc

- Materialise NV

- Blatchford Group Limited

Recent Developments

- November 2023: Upstep launches first AI-powered technology system for customized insoles: Upstep, a foot orthotic insole company, introduced the first artificial intelligence (AI)-powered technology system of its kind, which enables a 50% reduction in the time it takes to manufacture customized insoles.

- October 2023: Foot Levelers introduces InMotion+ custom orthotic: Foot Levelers, a provider of hand-crafted custom orthotics, introduced their most advanced custom orthotic, InMotion+. The meticulously crafted and rigorously tested orthotic incorporates premium performance, stability, and comfort features.

- September 2023: Powerstep announces new partnership with Orthofeet: Powerstep, a leading provider of over-the-counter foot orthotics, announced a new partnership with Orthofeet, a manufacturer of diabetic footwear. The partnership will expand Powerstep’s reach into the diabetic footwear market and provide additional solutions for people with foot pain.

- August 2023: Aetrex expands into Asia with new distribution agreement: Aetrex Worldwide, Inc., a provider of custom-made foot orthotics, announced a new distribution agreement with Orthopaedic International Asia Limited (OIAL), a leading provider of orthopedic products in Asia. The agreement will expand Aetrex’s reach into the Asian market and provide additional support for people with foot pain.

- July 2023: FootBalance acquires Orthotic Shop: FootBalance, a provider of custom-made foot orthotics, announced the acquisition of Orthotic Shop, a leading online retailer of foot orthotics. The acquisition will expand FootBalance’s product offerings and reach a wider audience of consumers.

- June 2023: Superfeet introduces new line of orthotic insoles for plantar fasciitis: Superfeet, a manufacturer of orthotic insoles, introduced a new line of insoles specifically designed for plantar fasciitis, a common cause of heel pain. The new line of insoles features a combination of arch support and cushioning to help relieve pain and improve foot function.

Report Scope

Report Features Description Market Value (2023) USD 3.7 Billion Forecast Revenue (2033) USD 8.4 Billion CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2017-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Thermoplastic, Composite Carbon Fiber and Other Materials) By Application (Sports & Athletics, Personal Comfort and Medical) By Type (Pre-fabricated and Custom-made) By Distribution Channel (Drug Stores, Online Stores, Hospitals & Specialty Clinics and Others (Foot stores, Retail Shops)) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Reckitt Benckiser Group PLC, Hanger Inc, Ottobock SE & Co. KGaA, Össur hf, Algeo Limited, Bauerfeind AG, Groupe Gorge, Colfax Corporation, Superfeet Worldwide Inc, Materialise NV and Blatchford Group Limited and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the foot orthotic insoles market size in 2023?The foot orthotic insoles market size is USD 3.7 billion in 2023.

Q: What is the CAGR for the foot orthotic insoles market?The foot orthotic insoles market is expected to grow at a CAGR of 8.7% during 2023-2033.

Q: What are the segments covered in the foot orthotic insoles report?Market.US has segmented the Global foot orthotic insoles Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material (Thermoplastic, Composite Carbon Fiber and Other Materials) By Application (Sports & Athletics, Personal Comfort and Medical) By Type (Pre-fabricated and Custom-made) By Distribution Channel (Drug Stores, Online Stores, Hospitals & Specialty Clinics and Others (Foot stores, Retail Shops))

Foot Orthotic Insoles MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Foot Orthotic Insoles MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Reckitt Benckiser Group PLC

- Hanger Inc.

- Ottobock SE & Co. KGaA

- Össur hf

- Algeo Limited

- Bauerfeind AG

- Groupe Gorge

- Colfax Corporation

- Superfeet Worldwide Inc

- Materialise NV

- Blatchford Group Limited