Global Food Safety Testing Market By Type (Pathogens, Allergens, GMOs, Mycotoxin, and Other Types), By Technology, By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 31439

- Number of Pages: 241

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

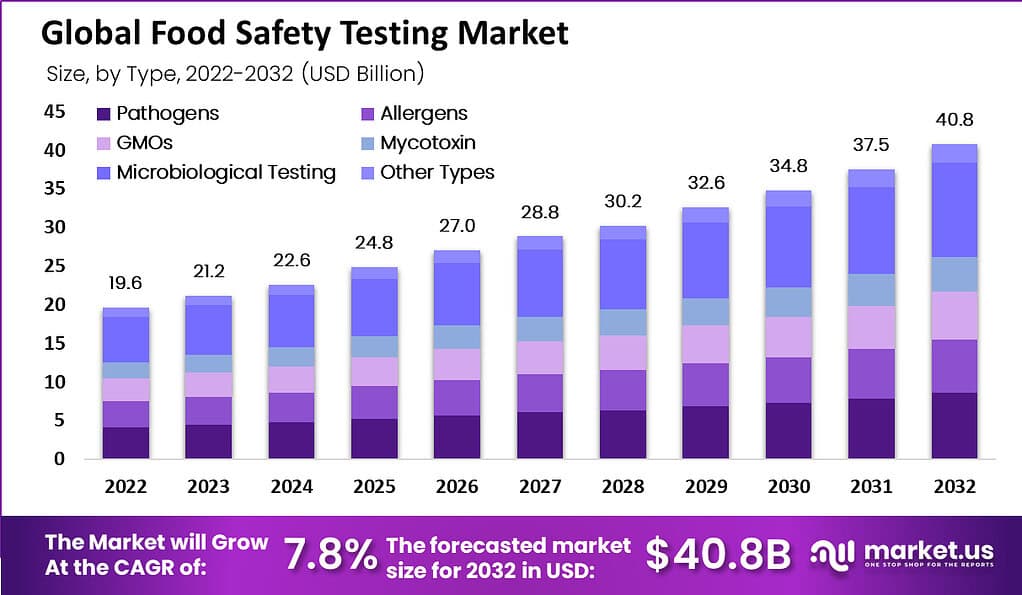

The Global Food Safety Testing Market was valued at USD 19.6 Billion, this market is estimated to register the highest CAGR of 7.8% and is expected to reach USD 40.8 Billion during the forecast period of 2023 to 2032.

The increasing demand for processed and packaged food in developing and developed countries, owing to factors such as shifting lifestyles and the increasing popularity of quick-service restaurants, is projected to drive the necessity for safety testing of edible stuff as well as the increasing demand for quality tests for unprocessed and processed meats is anticipated to drive the global food safety testing market.

The food safety testing market plays a crucial role in ensuring the safety and quality of the food we consume. With its capability to identify and eliminate harmful pathogens, contaminants, and toxins from food products, this segment is crucial in defending public health. With the rising public concern over food adulteration and foodborne illnesses, combined with advancements in testing technologies, the food safety testing market is anticipated to have significant growth.

Key Takeaways

- The Food Safety Testing Market is expected to grow at a CAGR of 7.8%.

- It is projected to reach a valuation of US$ 40.8 Billion by 2032.

- In 2022, the market was valued at USD 19.6 Billion.

- Microbiological testing held more than 30.0% of the revenue share in 2022.

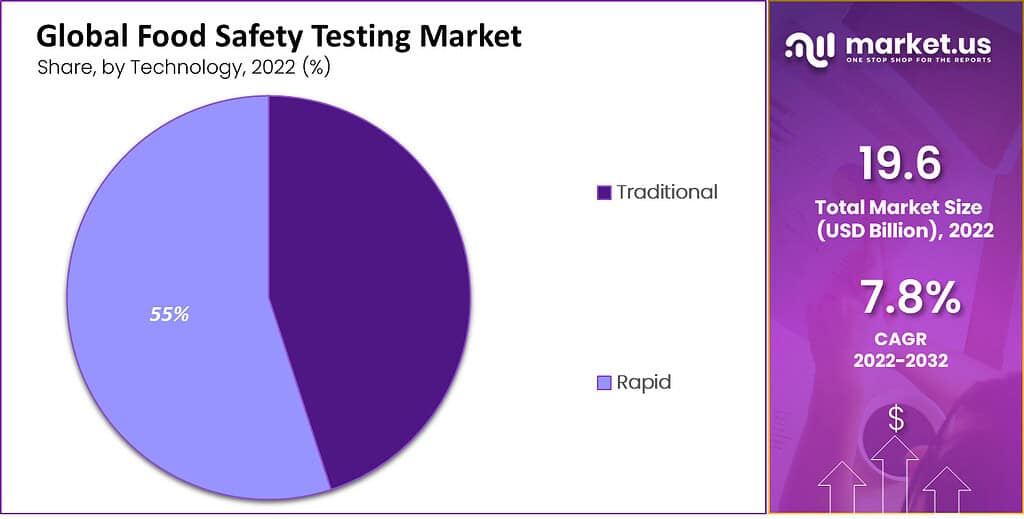

- Rapid technology had the highest revenue share of almost 55.0% in 2022.

- The meat, poultry & seafood sector led the market in 2022 with a market share of about 30.0%.

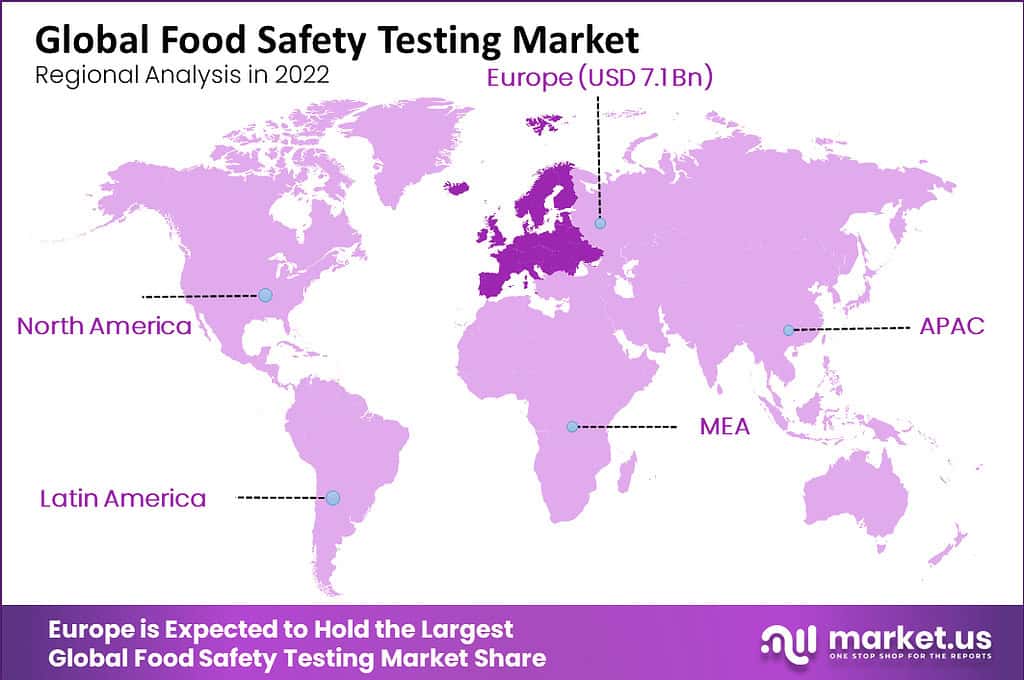

- Europe held a revenue share of approximately 36% in 2022.

- Asia Pacific is anticipated to grow at a significant rate.

- Factors affecting market growth include consumer awareness, growing demand for clean and healthy food, and government regulations.

- Asia Pacific is expected to witness the fastest-growing demand.

- Key players in the market include BIOTECON Diagnostics GmbH, FoodChain ID Group, Inc., SGS SA, and others.

Driving Factors

Increase in the Number of Food-Poisoning Illness Cases

The rising cases of food illness in society globally are expected to drive the global food safety testing market. Consuming contaminated, spoiled, or deteriorated food items with various microorganisms, such as fungi, bacteria, viruses, parasites, and others, is the main cause of food poisoning illness.

In addition, other contaminants such as heavy metals, mycotoxins, and chemicals are also leading the market growth. The rising cases significantly increase the demand for food testing kits, equipment, and systems across the region.

Increase in Consumer Awareness Regarding Food Safety

With the rising number of food-related illness cases and food poisoning issues, more consumers are becoming aware of the importance of eating safe and healthy food. This leads to a higher demand for good quality and safe food among individuals, generating demand for food safety testing equipment.

The growing cases of food-related diseases have caused consumers to bring about vital changes in their lifestyles and diets, making them more concerned about food safety.

Restraining Factors

Lack of Infrastructure Facilities for Food Testing

The growing number of food contamination litigation, product recalls, food poisoning incidents, and increasing consumer awareness have led to the growing demands for facilities for food safety over the region. However, the absence of infrastructural facilities in food testing laboratories is obstructing the growth of the global food safety testing market.

In order to gain precise results for food tests, good hygienic conditions should be maintained in the laboratories. Still, the laboratories are not well advanced in terms of safe water, infrastructure, modern technologies for quality assurance, staff training, packaging operation, and standard sanitizing processes.

In addition, implementing microbiological controls in a GMP or HACCP program is essentially an outside question because of inadequate or insufficient plant conditions.

Type Analysis

Based on type, the microbiological testing segment developed as a leading segment in 2022 and anticipated 30% of the market share. The segment is anticipated to increase momentum as it helps to identify microorganisms in edible products with the help of biological, chemical, biochemical, and molecular methods, providing highly precise results regarding their configuration.

The genetically modified organism (GMO) testing segment is anticipated to observe the fastest-growing CAGR over the forecast period, principally driven by growing awareness among consumers about harmful GMOs in edible products. In addition, growth in the manufacturing of GMO edible products is projected to drive the requirement for safety checks to certify optimum food quality.

Technology Analysis

On the basis of technology, the rapid technology sector is projected to lead the largest share of the food safety testing market in 2022. The major share of this segment is due to factors like multi-functional testing in less time, increasing incidences of foodborne diseases & viruses, flexible testing in end-user industries, microbiological pollutants related to insufficient storage conditions, and unsanitary food management practices.

In addition, this segment is also projected to grow at the fastest growth rate during the forecast period, primarily due to its capability to test an extensive range of pollutants in comparison with traditional technologies. Polymerase Chain Reaction (PCR) (a subtype of rapid technology) based segment is expected to have a significant share in the food safety testing market share during the forecast period.

PCR is. Real-time polymerase chain reaction is an affordable and quick quantitative technique that helps identify unintentional and intentional food contaminations brought on by biological pollutants by measuring the amount of particular DNA segments present in samples.

Application Analysis

On the basis of application, the poultry, meat, & seafood products segment dominated the global food safety testing market share by over 30% in 2022. Growing consumption of meat products over the globe and chances of diseases in red meats are projected to drive the meat, poultry & seafood segment growth over the forecast period.

Processed food appeared as the second-largest segment in 2022. It is anticipated to record considerable gains due to the rising demand for packaged products such as snacks, frozen meals, cake mixes, and convenient ready-to-eat products.

Moreover, the longer shelf life of processed products leads to the implementation of rigid regulations related to such products. The Dairy & dairy products segment is projected to record a high growth rate in the market across the forecast period on account of some occasions of impurity during the manufacturing process. Moreover, the demand for safety tests conducted for the segment is projected to rise on account of strict regulations in place regarding standard milk configuration.

Key Market Segments

Based on Type

- Pathogens

- Allergens

- GMOs

- Mycotoxin

- Microbiological Testing

- Other Types

Based on Technology

- Traditional

- Rapid

- Polymerase Chain Reaction

- DNA Sequencing/NGS

- Other Technologies

Based on Application

- Meat, Poultry, & Seafood

- Dairy Products

- Processed Food

- Fruits & Vegetables

- Beverages

- Other Applications

Growth Opportunity

Growing Demand and Popularity for Clean-Label Food

Clean-labeled food products contain various food ingredients that are less processed and most natural. Consumers are choosing clean and healthy food options to live healthier lifestyles, therefore growing the demand for food safety testing.

Consumers are getting more motivated towards clean-labeled food, free from preservatives and additives, to continue a positive lifestyle. Also, the awareness about promoting a supportable environment by using clean-label products is increasing the market’s growth during the forecast period.

The growing demand for clean-label food products and the demand for food safety testing is also growing as producers offer clean products to confirm to consumers that the food products are free from harmful mycotoxins, pathogens, chemicals, and chemicals heavy metals.

Latest Trends

Growing Strictness of Food Safety Regulations and Policies

The global food safety testing market is mainly driven by the growing strictness of food safety regulations and policies implemented by the governments of several countries.

This can be attributed to the rising occurrence of poor hygiene in the food production process. The rising cases of food pollution and adulteration resulting in potential health threats to consumers is resulting in a higher interest in severe testing.

The growing demand for fast foods due to busy lifestyles and changing dietary habits of the commonalities leading to an increase in the number of food manufacturing and processing facilities is driving the market demand during the forecast period.

Regional Analysis

On the basis of regional analysis, Europe is anticipated for the largest market share of 36% in 2022. The food & beverage industry is a key contributor to Europe’s economy. The industry upholds the characteristics of a strong, stable health sector.

The growing focus of product manufacturers is to maintain the food product’s safety which is projected to propel the market growth during the forecast period.

Asia Pacific region’s food safety testing market is anticipated to witness the fastest growing demand due to the massive growth of food sectors in developing economies, united with rising requirements to establish strict regulations regarding food safety to challenge various contamination issues and food scandals. Many governments in the region are focusing on protective measures to control the epidemics of foodborne diseases.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key players focus on premium quality and healthy food items. These players focus deeply on innovative products over their research and development facilities. Major vendors are providing high-quality and processed food items to upsurge the shelf-life of food by emerging advanced technologies and food testing devices.

The strategies adopted by these market players are partnerships, acquisitions, collaborations, and mergers. They are raising food testing service sales over numerous distribution channels to enlarge market size.

Top Key Players

- BIOTECON Diagnostics GmbH

- FoodChain ID Group, Inc

- AsureQuality Limited

- Intertek Group plc

- SGS SA

- NEOGEN Corporation

- Bio-Rad Laboratories

- Bureau Veritas SA.

- Eurofins Scientific SE

- Mérieux NutriSciences

- Other Key Players

Recent Developments

- July 2022: SGS introduced a new food analysis laboratory in Mexico. The new Naucalpan laboratory will take care of the Mexican food industry, supporting organizations with quality control and regulatory compliance.

- May 2022: Bureau Veritas, a provider of laboratory testing, inspection, and certification services, announced the opening of its third US microbiology laboratory, based in Reno, Nevada. The facility planned to conduct rapid pathogen testing and microbiology indicator analyses for the agro-food sector.

Report Scope

Report Features Description Market Value (2022) USD 19.6 Bn Forecast Revenue (2032) USD 40.8 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Pathogens, Allergens, GMOs, Microbiological Testing, Chemical & Nutritional, and Other Types, By Technology – Traditional, Rapid, Polymerase Chain Reaction, DNA Sequencing/NGS, and Other Technologies, Applications – Meat, Poultry & Seafood, Dairy Products, Processed Food, Fruits & Vegetables, Beverages, and Other Applications. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BIOTECON Diagnostics GmbH, FoodChain ID Group, Inc, AsureQuality Limited, Intertek Group plc, SGS SA, NEOGEN Corporation, Bio-Rad Laboratories, Bureau Veritas SA., Eurofins Scientific SE, Mérieux NutriSciences, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Food Safety Testing Market is expected to grow at?The Food Safety Testing Market is expected to grow at a CAGR of 7.8% (2023-2032).

What is the size of the Food Safety Testing Market in 2023?The Food Safety Testing Market size is USD 19.6 billion in 2023.

Which region is more appealing for vendors employed in the Food Safety Testing Market?Europe is anticipated for the largest market share of 36% in 2022.

Name the key business areas for the Food Safety Testing Market.The US, Canada, China, India, Brazil, South Africa, Singapore, Indonesia, Portugal, etc., are leading key areas of operation for the Food Safety Testing Market.

List the segments encompassed in this report on the Food Safety Testing Market?Market.US has segmented the Food Safety Testing Market by geography (North America, Europe, APAC, South America, And Middle East and South Africa). The market has been segmented Based on Type Pathogens, Allergens, GMOs, Mycotoxin, Microbiological Testing, and Other Types. Based on Technology Traditional and Rapid.Based on Application Meat, Poultry, & Seafood, Dairy Products, Processed Food, Fruits & Vegetables, Beverages, and Other Applications.

-

-

- BIOTECON Diagnostics GmbH

- FoodChain ID Group, Inc

- AsureQuality Limited

- Intertek Group plc

- SGS SA

- NEOGEN Corporation

- Bio-Rad Laboratories

- Bureau Veritas SA.

- Eurofins Scientific SE

- Mérieux NutriSciences

- Other Key Players