Global Food Grade Salt Market Size, Share, And Enhanced Productivity By Grade (High Purity Salt, Industrial Salt, Pickling Salt, Table Salt), By Salt Type (Sodium Chloride, Potassium Chloride, Calcium Chloride, Magnesium Chloride), By Application (Dairy Products, Bakery Products, Meat Products, Food Processing, Pharmaceuticals), By Distribution Channel (Direct Sales, Distributors, Retail Stores, Online Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176281

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

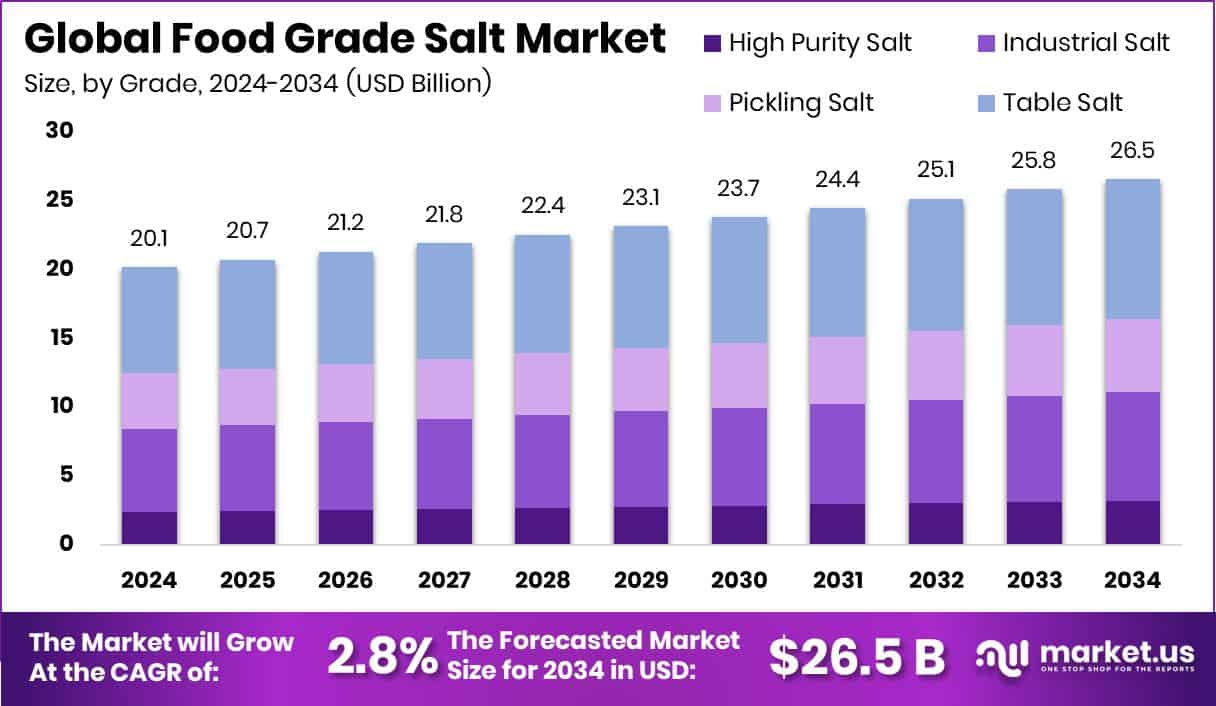

The Global Food Grade Salt Market is expected to be worth around USD 26.5 billion by 2034, up from USD 20.1 billion in 2024, and is projected to grow at a CAGR of 2.8% from 2025 to 2034. Food Grade Salt demand in Asia Pacific hits 48.5% and USD 9.7 Bn.

The Food Grade Salt Market consists of salts processed to meet purity and safety standards for human consumption. Food-grade salt is refined to remove impurities and ensure consistent texture, taste, and mineral balance, making it suitable for cooking, preservation, fermentation, and food manufacturing. It supports essential functions such as flavor enhancement, moisture control, and microbial stability across dairy, bakery, meat, and packaged food applications. The Food Grade Salt Market represents the global demand, supply, and distribution of high-purity salt varieties—including high-purity salt, table salt, pickling salt, sodium chloride, potassium chloride, and magnesium chloride—used across food processing, household use, pharmaceuticals, and industrial blending.

Growing demand is influenced by rising processed food consumption, evolving ingredient standards, and the expansion of dairy, bakery, and meat product manufacturing. Recent investments also strengthen innovation, such as Nordic Salt Cycle raising €3.5M, Saltworks receiving $5M, and Thorizon securing €10 million, all contributing to advanced salt technologies. Increasing demand is also supported by expanding industrial capacity, backed by $150M debt approvals and EBRD’s KZT 5.5 billion lending to a regional producer.

Opportunities arise as companies explore cleaner formulations, low-sodium blends, and functional salts needed across food categories. Projects like Atlas Salt targeting 10% of North America’s de-icing market also show wider industry movement, indirectly supporting salt processing capabilities that contribute to food-grade supply stability.

Key Takeaways

- The Global Food Grade Salt Market is expected to be worth around USD 26.5 billion by 2034, up from USD 20.1 billion in 2024, and is projected to grow at a CAGR of 2.8% from 2025 to 2034.

- The Food Grade Salt Market sees Table Salt leading with 38.4% due to widespread global consumption.

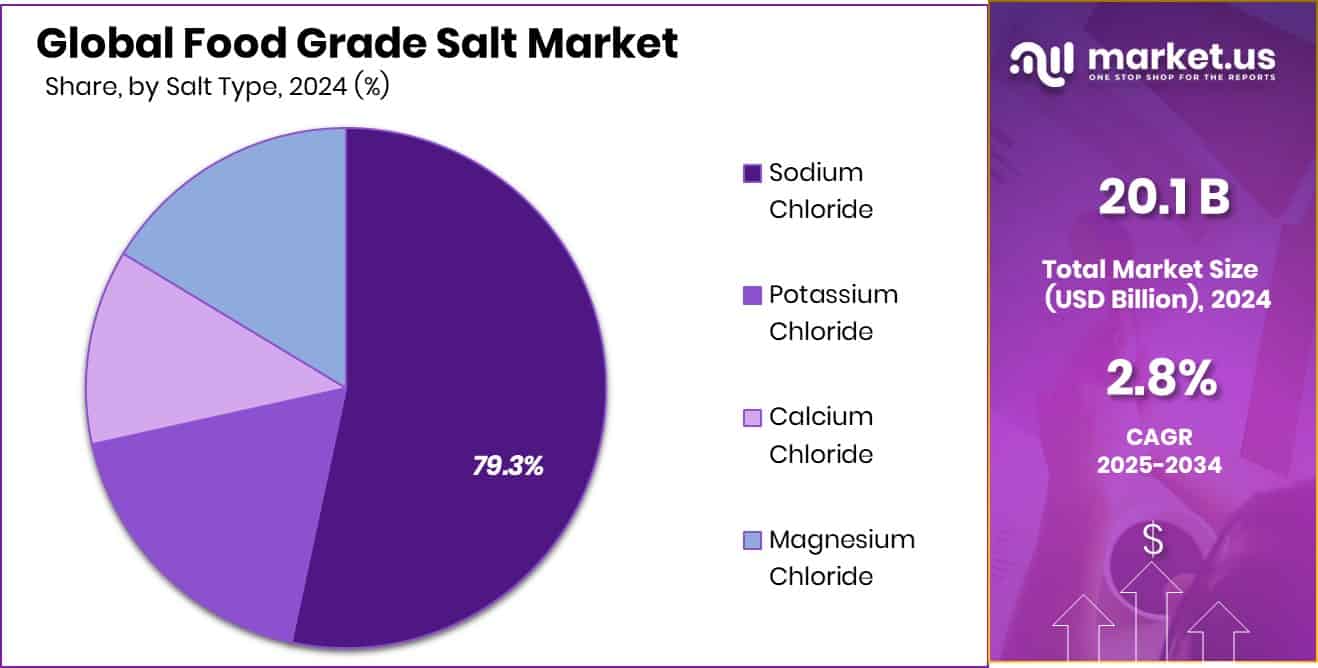

- Sodium Chloride dominates the Food Grade Salt Market with 79.3%, driven by extensive food industry applications.

- Food Processing remains the key application in the food-grade salt market, contributing a strong 53.2% share.

- Direct Sales hold 37.9% in the Food Grade Salt Market, supported by efficient supply and procurement networks.

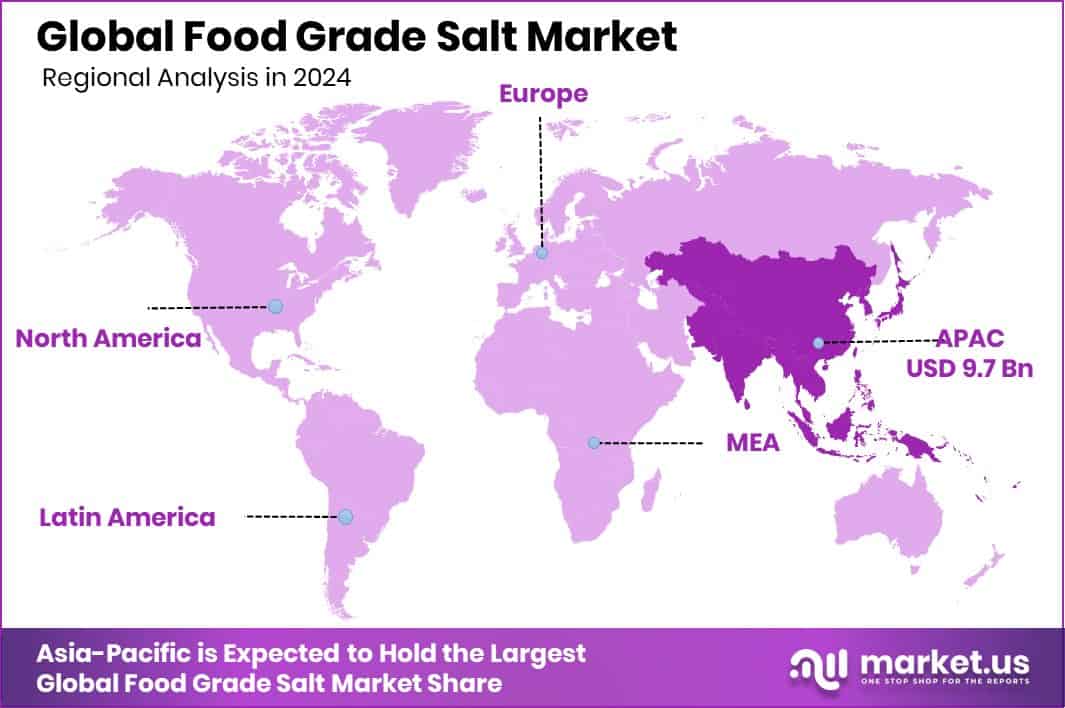

- In the Asia Pacific, the market holds a 48.5% share valued at USD 9.7 Bn.

By Grade Analysis

Food Grade Salt Market shows Table Salt leading with a strong 38.4% share.

In 2024, the Food Grade Salt Market continued gaining steady momentum as consumers and industries relied on salt for everyday culinary and processing needs. Table salt held a prominent position with a 38.4% share, driven by its broad household use, ease of availability, and continued adoption across packaged foods. Many food brands reformulated their products to meet cleaner-label expectations, supporting consistent demand for refined table salt.

Expansion of processed food consumption in urban regions, combined with rising home-cooking trends, reinforced the segment’s strength. Producers also focused on improving purity levels and granule consistency, helping table salt remain a preferred option across domestic kitchens, bakeries, and mass-market food manufacturers.

By Salt Type Analysis

In the Food Grade Salt Market, Sodium Chloride dominates significantly with 79.3% globally.

In 2024, sodium chloride remained the backbone of the Food Grade Salt Market, securing an impressive 79.3% share thanks to its universal role in flavoring, preservation, and fermentation processes. Its dominance reflects decades of industrial dependence on standard salt for seasoning blends, sauces, snacks, and packaged meals. Food companies emphasized maintaining stable salt quality to ensure texture and flavor uniformity across high-volume production lines.

The segment benefited further from the rising output of processed convenience foods in both emerging and mature markets. Despite growing interest in specialty salts, sodium chloride maintained its lead due to its cost-effectiveness, long shelf life, and unmatched versatility across diverse food manufacturing applications.

By Application Analysis

Food Grade Salt Market highlights Food Processing applications holding a major 53.2% share.

In 2024, food processing continued to anchor the Food Grade Salt Market, representing a strong 53.2% share as manufacturers relied heavily on salt for preservation, flavor enhancement, curing, and functional properties. The shift toward ready-to-eat snacks, frozen meals, and bakery items supported consistent industrial demand. Salt’s ability to regulate moisture, improve dough handling, and stabilize formulations kept it indispensable for large-scale production.

Companies also focused on meeting regulatory requirements related to sodium limits while maintaining product quality. This balance encouraged investments in controlled-sodium formulations and improved blending technologies. With the global rise of packaged foods and cross-border trade, the food processing segment maintained its central role in shaping market volume.

By Distribution Channel Analysis

Direct Sales channels capture 37.9% in the expanding food-grade salt market today.

In 2024, direct sales accounted for a notable 37.9% share of the Food Grade Salt Market, supported by strong relationships between manufacturers and bulk buyers such as food processors, bakery chains, seasoning producers, and wholesalers. This channel offered cost benefits, consistent supply, and customized order volumes, making it a preferred route for large-scale users.

Many suppliers expanded their direct distribution networks to maintain stable delivery timelines and quality assurance. Industrial buyers increasingly valued direct contracts for predictable pricing and uninterrupted availability, especially during logistics fluctuations. As food companies streamlined procurement strategies, direct sales strengthened their position by offering reliability, transparency, and tailored service across high-demand segments of the market.

Key Market Segments

By Grade

- High Purity Salt

- Industrial Salt

- Pickling Salt

- Table Salt

By Salt Type

- Sodium Chloride

- Potassium Chloride

- Calcium Chloride

- Magnesium Chloride

By Application

- Dairy Products

- Bakery Products

- Meat Products

- Food Processing

- Pharmaceuticals

By Distribution Channel

- Direct Sales

- Distributors

- Retail Stores

- Online Platforms

- Others

Driving Factors

Rising usage in global food processing

The Food Grade Salt Market continues to expand, supported strongly by rising usage in global food processing, where salt remains essential for preservation, flavor stability, curing, and texture optimization. Demand increases as packaged foods, bakery lines, dairy formulations, and meat processing rely on consistent food-grade salt quality. This growing industrial consumption aligns with broader chemical and ingredient innovations, including large-scale investments such as Concrete Chemicals receiving €350 million funding for Germany’s largest industrial-scale e-SAF plant.

Although the project focuses on sustainable fuels, such developments indirectly support chemical processing infrastructure that benefits high-purity salt supply and downstream applications. Overall, expanding processed food production keeps the market’s driving factors firmly rooted in industrial growth.

Restraining Factors

Supply fluctuations affecting refined salt availability

Despite steady demand, the Food Grade Salt Market faces supply-related constraints, especially where weather-dependent production and transportation affect refined salt availability. Seasonal disruptions, tightening logistics, and fluctuations in raw brine or mined salt output can limit timely supply for food processors that require strict purity levels. These challenges coincide with major industrial shifts, including Germany granting €46 million for a sodium-chloride solid-state battery factory, which increases competition for high-grade sodium chloride used in advanced manufacturing.

As more industries incorporate purified salt into next-generation technologies, it can pressure availability for food applications. These overlapping demands create a restraint that manufacturers navigate through strategic sourcing and improved processing efficiencies.

Growth Opportunity

Expanding applications across fortified food categories

Growth opportunities in the Food Grade Salt Market emerge from expanding applications across fortified and value-added food categories, including functional dairy, enhanced bakery mixes, nutritional snacks, and emerging low-sodium blends. As food producers reformulate for health-focused consumers, salt with controlled mineral content and improved solubility becomes more relevant.

A recent supply stabilization, such as Sodium chloride (Biomed) nebulising solution 7%, 90 ml: supply issue resolved, reflects improved reliability in high-purity salt availability that can also support food-related applications. As refined salt production and distribution become more consistent, manufacturers gain opportunities to innovate with fortified salts, enriched formulations, and specialized mixes tuned for modern dietary demands.

Latest Trends

Rapid shift toward clean-label salt formulations

One of the most visible trends in the Food Grade Salt Market is the strong shift toward clean-label formulations, where consumers prefer minimally processed salt types with transparent sourcing and balanced mineral compositions. Food brands increasingly target simple ingredient lists, pushing demand for salts free from additives and aligned with natural product standards. This movement parallels broader sustainability-driven investments, including Co-reactive, securing €6.5 million in seed funding for CO₂-negative construction materials technology, demonstrating industry-wide interest in cleaner and lower-impact processes.

As cleaner production methods gain traction, salt producers are encouraged to adopt improved refining, brining, and energy-efficient technologies, reinforcing the market’s trend toward purity-focused and environmentally conscious salt solutions.

Regional Analysis

Asia Pacific leads the Food Grade Salt Market with 48.5%, reaching USD 9.7 Bn.

In 2024, Asia Pacific dominated the Food Grade Salt Market, holding a 48.5% share valued at USD 9.7 Bn, driven by the region’s strong food processing base and expanding packaged food consumption. Rising urban demand in China, India, Japan, and Southeast Asia supported stable volume growth, particularly in household and industrial salt applications.

North America showed steady uptake, supported by established food manufacturing operations and continued reliance on high-purity salt for bakery, snacks, and ready-meal segments. Europe maintained consistent demand as regulatory focus on product quality and clean-label formulations reinforced the need for standardized food-grade salt across processing facilities.

The Middle East & Africa region experienced gradual expansion, supported by growing food import dependency and increased adoption of refined salt in the bakery and confectionery industries. Latin America continued to strengthen its presence with rising consumption in processed foods and seasoning categories, particularly across Brazil and Mexico, where manufacturers utilized food-grade salt for preservation and flavor stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Incorporated remained influential through its broad product range and strong distribution presence, enabling the company to meet rising demand from bakery, snacks, and processed food categories. Its ability to maintain quality uniformity across large production volumes supported long-term partnerships with major food processors.

Meanwhile, K+S AG sustained its market relevance by offering refined salt suited for applications requiring strict purity and functional performance. The company’s experience in salt production allowed it to adapt to evolving formulation needs across Europe and other key regions. Its well-structured supply network helped meet stable demand from major food industries.

Compass Minerals also contributed meaningfully to market growth through refined salt solutions used in everyday food manufacturing. Its steady production output and focus on meeting food-grade standards positioned the company as a dependable supplier. Collectively, these companies shaped market consistency, supported continuous industrial consumption, and maintained dependable salt quality across global food processing applications.

Top Key Players in the Market

- Cargill Incorporated

- K+S AG

- Compass Minerals

- Morton Salt

- Tata Chemicals

- Rio Tinto

- Salinen Austria AG

- China National Salt Industry Corporation

Recent Developments

- In December 2025, Tata Chemicals International (a fully owned subsidiary of Tata Chemicals) signed an agreement to acquire 100% stake in Novabay Pte. Ltd. for about €25 million. This move strengthens Tata Chemicals’ portfolio by adding premium-grade sodium bicarbonate, which supports food, pharmaceutical, and other industrial uses. This acquisition enhances the company’s offerings in higher-value chemical segments and aligns with its growth strategy.

- In September 2025, Morton Salt completed an agreement to transfer ownership of its Great Inagua, Bahamas, salt facility to Lusca Group. While Morton is no longer the owner, it signed a long-term supply contract to continue sourcing salt from the operation, helping ensure continuity in its supply chain.

Report Scope

Report Features Description Market Value (2024) USD 20.1 Billion Forecast Revenue (2034) USD 26.5 Billion CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (High Purity Salt, Industrial Salt, Pickling Salt, Table Salt), By Salt Type (Sodium Chloride, Potassium Chloride, Calcium Chloride, Magnesium Chloride), By Application (Dairy Products, Bakery Products, Meat Products, Food Processing, Pharmaceuticals), By Distribution Channel (Direct Sales, Distributors, Retail Stores, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Incorporated, K+S AG, Compass Minerals, Morton Salt, Tata Chemicals, Rio Tinto, Salinen Austria AG, China National Salt Industry Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Grade Salt MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Food Grade Salt MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill Incorporated

- K+S AG

- Compass Minerals

- Morton Salt

- Tata Chemicals

- Rio Tinto

- Salinen Austria AG

- China National Salt Industry Corporation