Global Food Delivery App Market Size and Forecast Industry Analysis Report By Service (Restaurant, Cloud Kitchens), By Business Model (Aggregator Model, Restaurant-Owned Model), By Payment Type (Cash on Delivery, Digital Payments), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159339

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

- Food Delivery App Market size

- Key Insight Summary

- Food Delivery App Statistics

- Market Overview

- Role of Generative AI

- Investment and Business Benefits

- Top Food Delivery Apps

- US Market Size

- By Service

- By Business Model

- By Payment Type

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Food Delivery App Market size

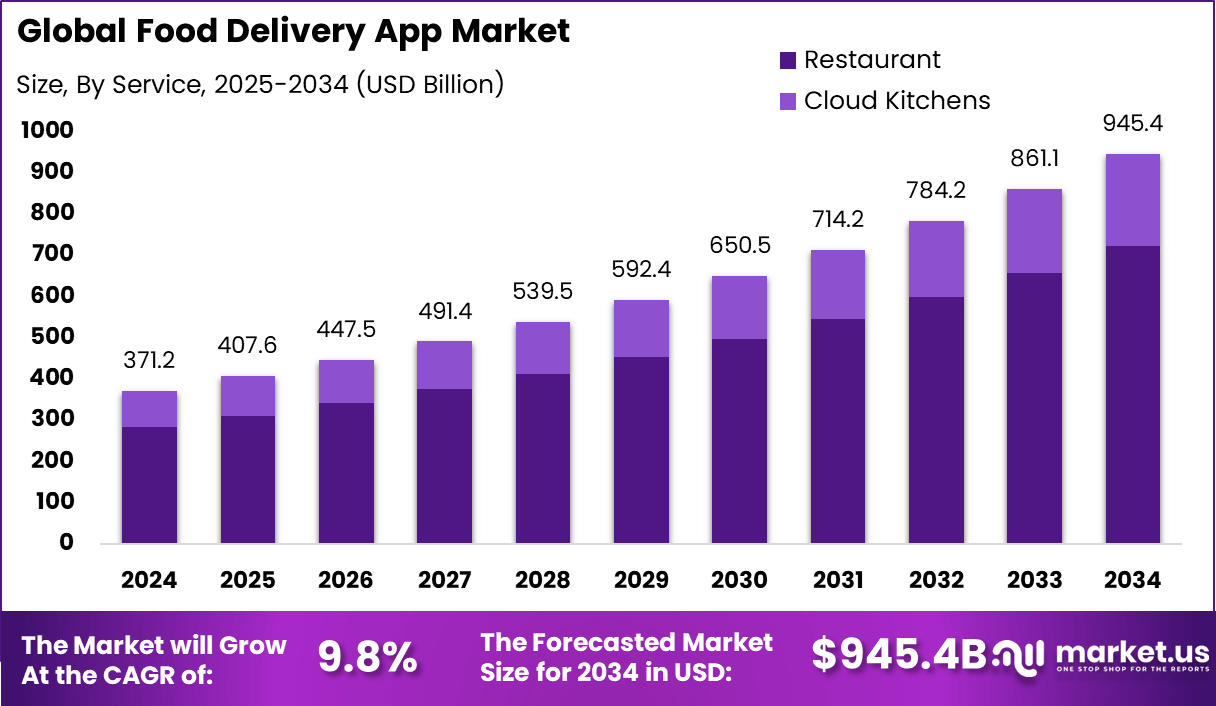

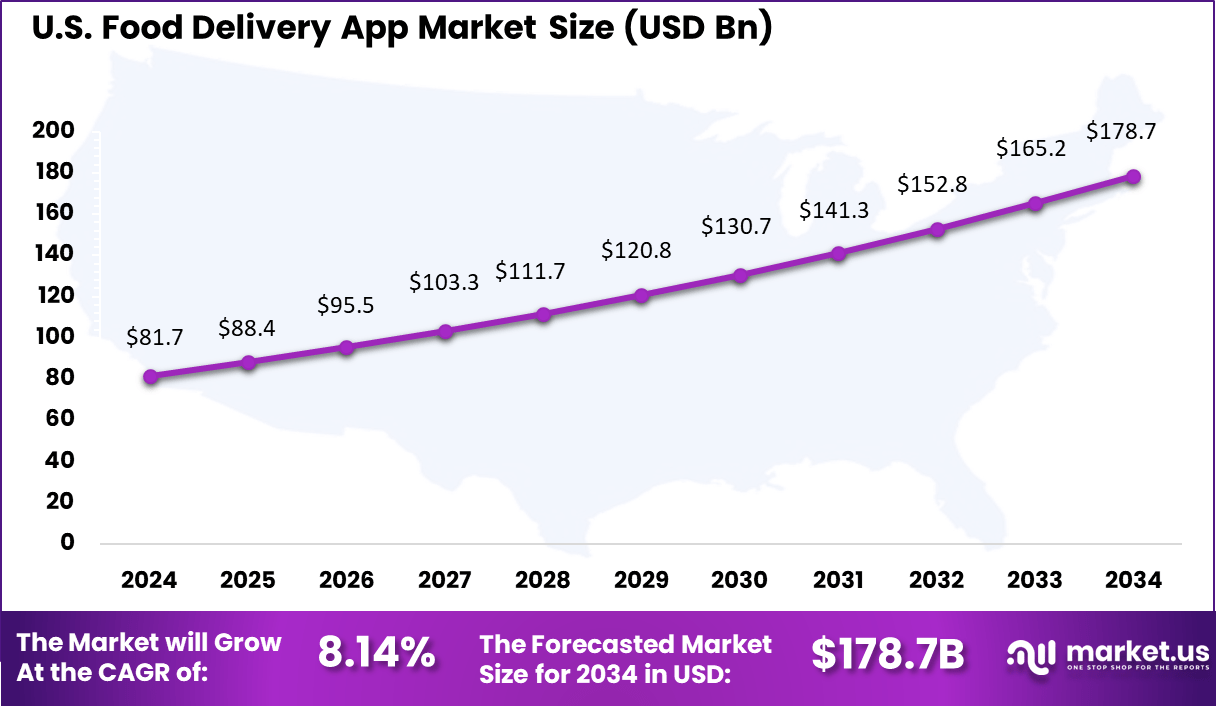

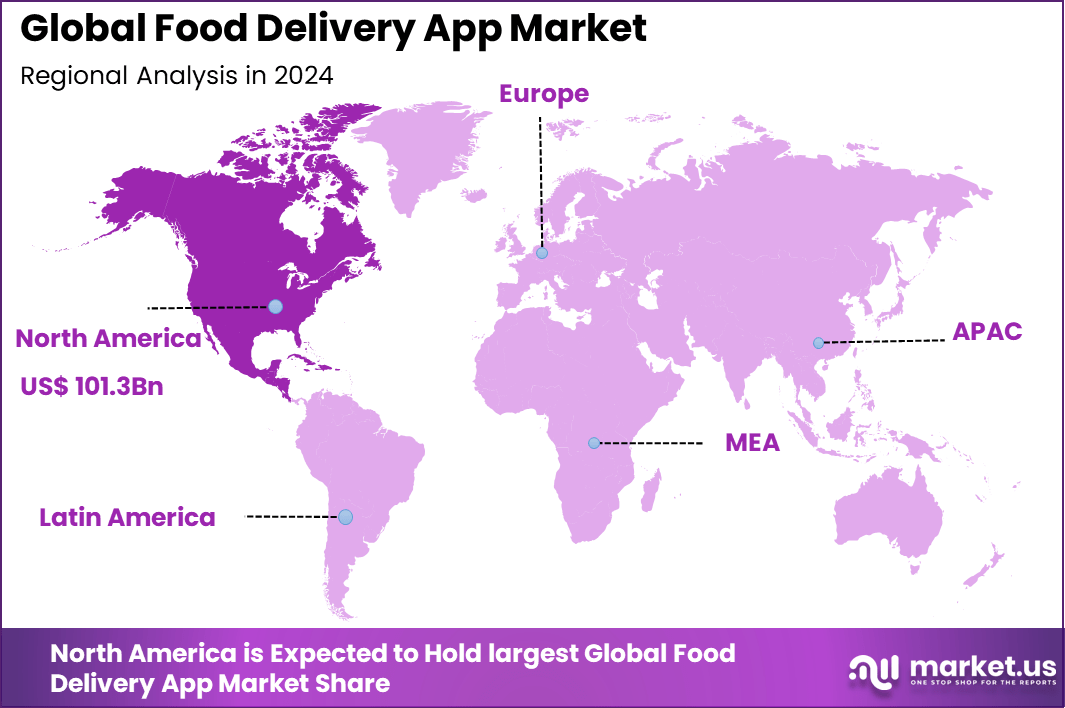

The Global Food Delivery App Market size is expected to be worth around USD 945.4 Billion By 2034, from USD 371.2 billion in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 27.3% share, holding USD 101.3 Billion revenue.

The Food Delivery App Market refers to digital platforms that connect consumers with restaurants, cloud kitchens, and delivery partners for ordering meals through mobile devices or websites. These apps manage the ordering process, payment transactions, and logistics of delivering food to customers. The market includes aggregator apps, which list multiple restaurants, and restaurant-owned apps that manage direct deliveries.

The market is driven by rising smartphone and internet penetration, along with changing consumer lifestyles that prioritize convenience and speed. Growth in urbanization and disposable incomes has expanded the customer base for app-based food ordering. The expansion of cloud kitchens, partnerships with restaurants, and integration of multiple payment options further fuel market adoption. Seasonal promotions and loyalty programs also increase customer retention.

According to Business of Apps, China leads the global food delivery market, reaching a value of $40.2 billion in 2024. The industry as a whole is projected to expand significantly, with expectations that it will achieve a market size of $213 billion by 2030. At the company level, Uber Eats remains the most popular food delivery app worldwide, while Delivery Hero holds the largest collective user base.

In the United States, DoorDash dominates with over 65% market share, reflecting strong consumer preference and widespread adoption. In China, Meituan leads the market, followed closely by Ele.me, solidifying their positions as the country’s top platforms. In 2024, Uber Eats had the most downloads, followed by Meituan, highlighting rising competition as food delivery apps shape global consumer habits.

Key Insight Summary

- By service, restaurant-based delivery dominates with 76.4%, showing the strength of partnerships between apps and food outlets.

- By business model, the restaurant-owned model leads with 61.2%, reflecting the preference for direct-to-customer delivery systems over aggregator-led platforms.

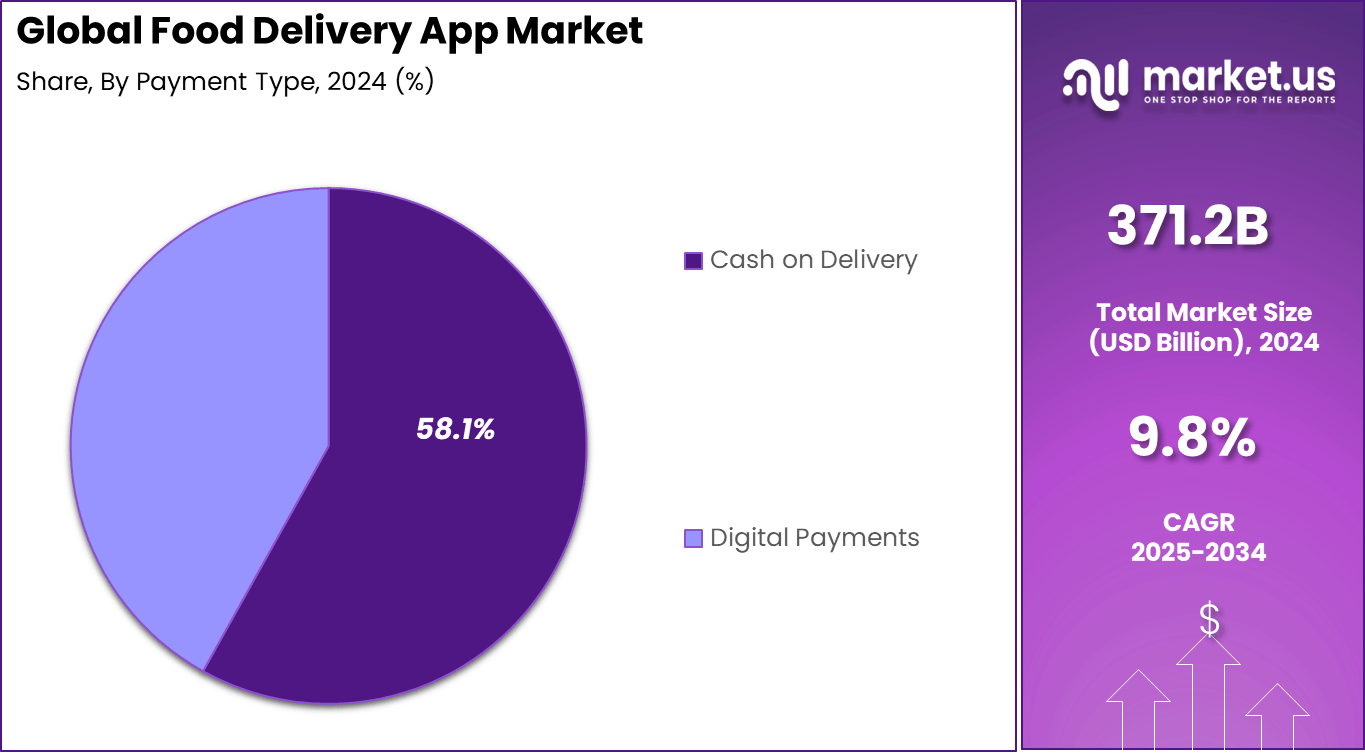

- By payment type, cash on delivery remains the most used option at 58.1%, underlining the continued reliance on traditional payment methods despite the growth of digital wallets.

- Regionally, North America accounted for 27.3% of the market, with the U.S. leading at revenues of USD 81.07 billion, supported by a CAGR of 8.14%.

Food Delivery App Statistics

- 60% of restaurant operators report higher sales after offering delivery services, confirming delivery as a strong revenue driver.

- Among millennials, 59% of restaurant orders are for takeout or delivery, highlighting their clear preference for convenience.

- The online food ordering sector is projected to reach USD 200 billion by 2025, reflecting strong long-term industry momentum.

- In the U.S., average annual food consumption per person reached 537.5 kg in 2022, underscoring high overall demand in the food market.

- Consumers spend more on digital orders, with online ordering growing nearly 3x faster than traditional in-store dining.

- Online orders now contribute to about 40% of total restaurant sales, marking a significant share of revenue streams.

- Since the pandemic, 55% of diners have primarily eaten at home, showing a major shift in dining habits.

- 68% of consumers were more likely to order takeout in 2021 compared to pre-pandemic, indicating sustained behavioral change.

- Nearly 75% of consumers place food orders through mobile phones, confirming the importance of mobile-friendly platforms.

Market Overview

Demand is highest in metropolitan areas with dense populations and busy lifestyles. Younger consumers, working professionals, and students represent the largest customer segments. The demand for quick service, contactless delivery, and access to a wide variety of cuisines is shaping growth. Suburban and semi-urban areas are also seeing increased adoption as delivery networks expand beyond major cities.

Food delivery apps are increasingly integrating artificial intelligence and data analytics to personalize recommendations, optimize delivery routes, and forecast demand. Real time GPS tracking enhances transparency and customer trust. Digital wallets and contactless payment systems improve transaction security. Integration of chatbots and voice ordering provides additional convenience.

Consumers adopt food delivery apps for convenience, variety, and time savings. Restaurants adopt them to expand reach, boost sales, and reduce reliance on dine-in traffic. Delivery partners benefit from flexible income opportunities. For many small and mid-sized restaurants, apps provide visibility and customer access that would otherwise require costly marketing.

Role of Generative AI

Aspect Description Personalized Meal Planning Generative AI designs meal plans based on dietary needs and user preferences Custom Recommendations AI suggests dishes tailored to individual health goals Real-time Route Optimization AI optimizes delivery routes to reduce delivery time Increased User Engagement Personalization drives higher order frequency and customer satisfaction Automation of Customer Interaction AI handles chat and voice ordering, improving convenience Investment and Business Benefits

Investment opportunities abound in areas like AI development, autonomous delivery systems, sustainable packaging, and personalized user experience platforms. Investors can tap into growth by supporting innovations that address fast delivery and customization. The shift to subscription meal services offers steady revenue streams, while new markets with rising internet penetration present expansion possibilities.

Green logistics and low-cost delivery models also attract capital focused on long-term sustainability and competitive advantage. Business benefits of food delivery apps include increased market reach, access to detailed consumer data for better marketing, and improved operational control.

Restaurants and delivery platforms enhance customer engagement and retention through personalization and loyalty programs. Apps can scale efficiently, cross-sell, and gather feedback for continuous improvement. Transparency with real-time tracking builds customer trust, and automation boosts profitability by optimizing resource use.

Top Food Delivery Apps

Food Delivery App Description Uber Eats One of the most global food delivery apps, operating across six continents Just Eat A leading food delivery brand in the UK, with strong presence in Europe and Australia DoorDash The top food delivery app in the US and an early mover in the platform-to-consumer model Deliveroo Started the platform-to-consumer trend in the UK, now active in 13 countries Grubhub Among the first US delivery aggregators, with a strong user base in New York City Postmates Part of Uber Eats since 2019, handling around 5% of US deliveries Takeaway.com A key player in Europe, dominating online delivery in Germany, the Netherlands, and Belgium Delivery Hero Operates through subsidiaries, managing food delivery platforms in over 40 countries Ele.me A Chinese app owned by Alibaba, ranked second in the national market Meituan China’s largest food delivery service by revenue and volume, serving more than 600 million users Rappi A fast-growing delivery app in South America, present in nine countries iFood Brazil’s most popular platform, handling over 70% of the country’s food orders Zomato India’s leading delivery app, which expanded further after acquiring Uber Eats India in 2020 US Market Size

The United States plays a leading role within the region. The market there has been expanding at a 8.14% CAGR, supported by high consumer willingness to spend on premium food delivery services and subscription models. Rapid adoption of digital payments, combined with wide restaurant networks and expansion into smaller cities, continues to support growth momentum.

In 2024, North America accounted for 27.3% of the food delivery app market. The region has significant adoption due to its strong digital infrastructure, high smartphone penetration, and changing consumer lifestyles. Growing demand for convenience-based dining and increasing popularity of online food ordering across urban centers continue to strengthen adoption.

By Service

In 2024, Restaurant-to-consumer delivery captured a leading 76.4% share in the food delivery app market. This dominance comes from the growing demand for convenience, where users prefer to get their meals directly from restaurants instead of relying solely on aggregator platforms. Established restaurant chains often invest in their own apps or collaborate with delivery partners to ensure wider reach and control over customer experiences.

This preference also reflects consumer trust in restaurant-linked apps, as they often provide better offers, loyalty programs, and more transparency around quality. By focusing on direct engagement, restaurants maintain customer retention while reducing dependency on third-party commission-based services.

By Business Model

In 2024, The restaurant-owned model accounted for 61.2% of the total market. Many restaurants now prefer to build and maintain their own delivery infrastructure, as it allows them to retain higher margins and manage customer relationships more effectively. Direct control through branded apps also ensures better visibility over order flows and personalized offerings to returning customers.

In addition, the restaurant-owned model reduces dependency on aggregator platforms that charge commissions for every order. For consumers, this model often translates into cost-effective meal options, exclusive deals, and faster customer service, making it increasingly popular, especially among loyal patrons.

By Payment Type

In 2024, Cash on delivery led the market with 58.1% share. While digital payments are rising, many users in both emerging and developed markets still prefer the reliability of paying after the order is delivered. This option builds trust, particularly with first-time users or in regions where digital payment adoption is still maturing.

The dominance of cash-based transactions also underlines the need for flexibility in food delivery platforms. Offering multiple payment methods, including cash, ensures wider accessibility and helps attract customers who remain hesitant to adopt online payment solutions despite rapid growth in mobile-based wallets and cards.

Emerging Trends

Emerging trends in food delivery apps reflect a shift towards automation, personalization, and sustainability. Autonomous delivery using AI-powered drones and robots is being tested in major cities to speed up last-mile delivery.

Augmented reality menus are enabling customers to visualize food items in 3D before ordering, which enhances order confidence. Cloud kitchens and ghost kitchens continue to grow, optimizing delivery efficiency without traditional restaurant footprints. Personalized health and wellness meal recommendations, integrated with wearable devices, are another rising trend supporting user-specific dietary needs.

Growth Factors

Several growth factors drive the uptake of food delivery apps today. Increasing smartphone penetration and internet accessibility create a wider user base. Urbanization and changing consumer lifestyles that prioritize convenience and variety also contribute strongly.

Expanding partnerships with local eateries and cloud kitchen networks enhance food diversity on platforms. AI and machine learning help with demand forecasting and inventory management, reducing waste and improving service reliability, which further supports growth. The industry’s ability to personalize experience and optimize logistics is crucial for retaining users and encouraging repeat orders.

Key Market Segments

By Service

- Restaurant

- Cloud Kitchens

By Business Model

- Aggregator Model

- Restaurant-Owned Model

By Payment Type

- Cash on Delivery

- Digital Payments

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand for Convenient Food Access

The food delivery app market is primarily driven by the growing demand for convenient and time-saving meal options. Urban consumers increasingly prefer apps that enable quick access to a wide variety of cuisines without the need to cook or dine out. This lifestyle shift is particularly pronounced in dual-income households where time constraints make food delivery a practical solution.

For instance, busy professionals and working parents often rely on food delivery apps to ensure meals are available with minimal effort. This demand fuels the expansion of partnerships between delivery platforms and restaurants, which aim to meet consumer expectations for fast and reliable service.

Furthermore, smartphone penetration and improved internet connectivity globally have made these apps accessible to a larger audience. The ease of placing orders from mobile devices coupled with real-time tracking features enhances the user experience and encourages frequent use. As a result, more users are adopting food delivery apps as a regular part of their dining habits, boosting the market’s growth substantially.

Restraint Analysis

High Operational Costs Impact Profitability

A significant restraint for food delivery apps is the high operational cost associated with last-mile delivery logistics. Managing a fleet of drivers, ensuring timely deliveries, and handling order inaccuracies require substantial investment, which challenges the profitability of these platforms.

For example, costs related to driver wages, fuel, maintenance, and technology infrastructure add up quickly. Many delivery services operate with razor-thin margins or even losses, especially when heavy discounts or promotions are offered to attract users. These financial pressures make scaling a delivery app business more difficult.

Additionally, regulatory requirements around worker rights and benefits for delivery personnel are evolving, increasing legal compliance costs. This includes expenses related to insurance, minimum wage laws, and safety standards that companies must incorporate. Such increased expenditure limits the ability to reduce service fees or increase driver pay without impacting overall earnings.

Opportunity Analysis

Expansion in Emerging Markets

The food delivery app industry has a major growth opportunity in emerging markets, where increasing urbanization, rising incomes, and expanding smartphone use are creating new consumer bases. Markets in Asia Pacific, Latin America, and parts of Africa show strong potential as these regions witness changing lifestyles that favor convenience-oriented services.

For instance, countries like India and China are experiencing rapid adoption of food delivery apps fueled by large young populations and digital literacy enhancements. These markets remain relatively underserved compared to developed regions, leaving room for new entrants and local adaptations.

Moreover, there is an opportunity to diversify service offerings beyond restaurant meals. Expanding into grocery delivery, meal kits, and catering services can drive additional revenue streams. Platforms can also leverage AI and data analytics to personalize recommendations, optimize logistics, and improve customer retention.

Challenge Analysis

Intense Competition and Customer Retention

One of the key challenges for food delivery apps is maintaining customer loyalty amid fierce competition. The market is crowded with many similar services competing on price, delivery speed, and restaurant selection. For example, users often switch between apps based on discounts or availability, making it hard to build a stable customer base.

This churn forces platforms to invest heavily in marketing and promotions, which can erode profitability. Keeping users engaged with unique features or loyalty programs requires continuous innovation and technological upgrades. Another challenge is managing user expectations around delivery times and service quality.

Delays, incorrect orders, or poor communication can quickly damage brand reputation and drive users away to competitors. Handling fluctuating demand, especially during peak hours or adverse weather, adds complexity to logistics. Balancing growth while ensuring operational efficiency and customer satisfaction remains difficult in such a highly competitive environment.

Competitive Analysis

In the food delivery app market, Uber Technologies (Uber Eats), DoorDash, Deliveroo, and Delivery Hero are global leaders. Their dominance is supported by extensive restaurant partnerships, strong logistics networks, and user-friendly mobile platforms. These companies focus on fast delivery, wide menu options, and competitive pricing, making them the preferred choice for millions of customers worldwide.

Other significant players such as Just Eat, Zomato, Swiggy, and Rappi strengthen the market with strong regional presence. Just Eat dominates in Europe, while Zomato and Swiggy lead in India with deep market penetration and localized offerings. Rappi has built a strong footprint in Latin America by diversifying into on-demand delivery beyond food.

Additional contributors including Delivery.com, Yelp, and Amazon expand the market with unique value propositions. Amazon leverages its e-commerce infrastructure to integrate food delivery into its wider ecosystem, while Yelp connects users through reviews and delivery services. Delivery.com focuses on local partnerships and tailored services for U.S. markets.

Top Key Players in the Market

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc.

- Others

Recent Developments

- September 2024: DoorDash launched a new suite of digital business tools called the DoorDash Commerce Platform. This platform offers merchants five core solutions including branded mobile apps, AI-based phone ordering, online ordering, tableside order & pay with QR codes, and dedicated customer support. This move aims to help retailers manage their businesses more independently and boost sales through direct channels.

- July-August 2024: Delivery Hero announced a strategic merger of its European and Asian operations by combining subsidiaries Foodora, Yemeksepeti, and Foodpanda to improve efficiency and reduce costs. The consolidation affected fewer than 200 employees and was designed to strengthen growth and operational synergies across 70 countries.

- February 2025: Just Eat Takeaway agreed to be acquired by Prosus in a €4.1 billion all-cash deal, representing a 22% premium on recent share prices. By year-end 2025, Just Eat is expected to delist from public markets and focus on leveraging Prosus’s financial strength and AI capabilities for growth, after experiencing revenue decline and significant net losses in recent years.

Report Scope

Report Features Description Market Value (2024) USD 371.2 Bn Forecast Revenue (2034) USD 945.4 Bn CAGR(2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service (Restaurant, Cloud Kitchens), By Business Model (Aggregator Model, Restaurant-Owned Model), By Payment Type (Cash on Delivery, Digital Payments) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Deliveroo PLC, DoorDash Inc., Delivery Hero Group, Just Eat Limited, Uber Technologies Inc., Swiggy, Zomato, Delivery.com LLC, Yelp Inc., Amazon.com Inc., Rappi Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc.

- Others