Global Fondant Market Size, Share Analysis Report By Type (Rolled, Poured, Others), By Application (Ice Cakes, Cookies, Cupcakes, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162777

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

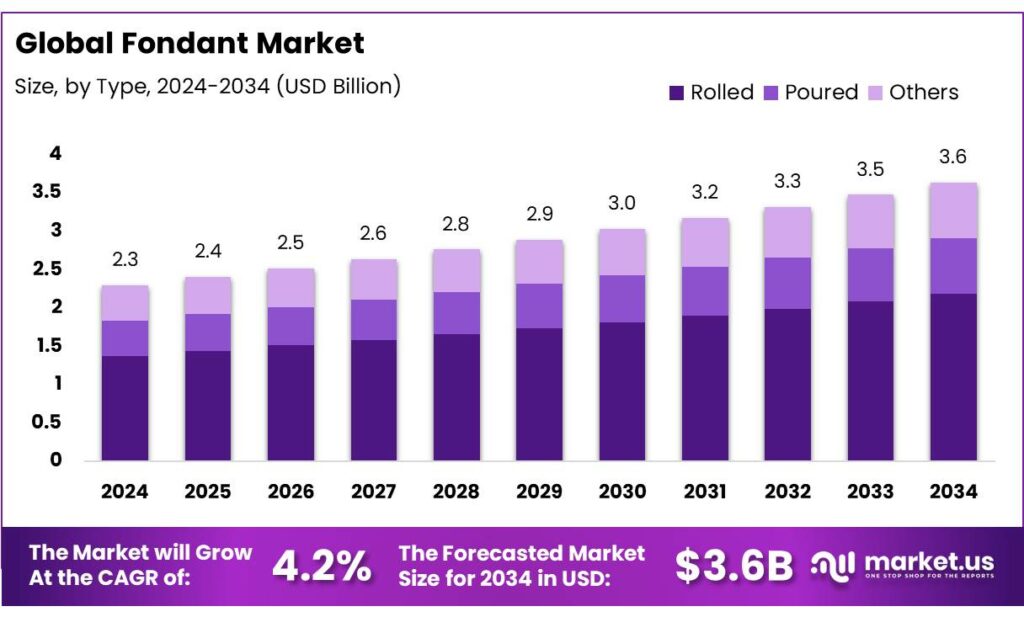

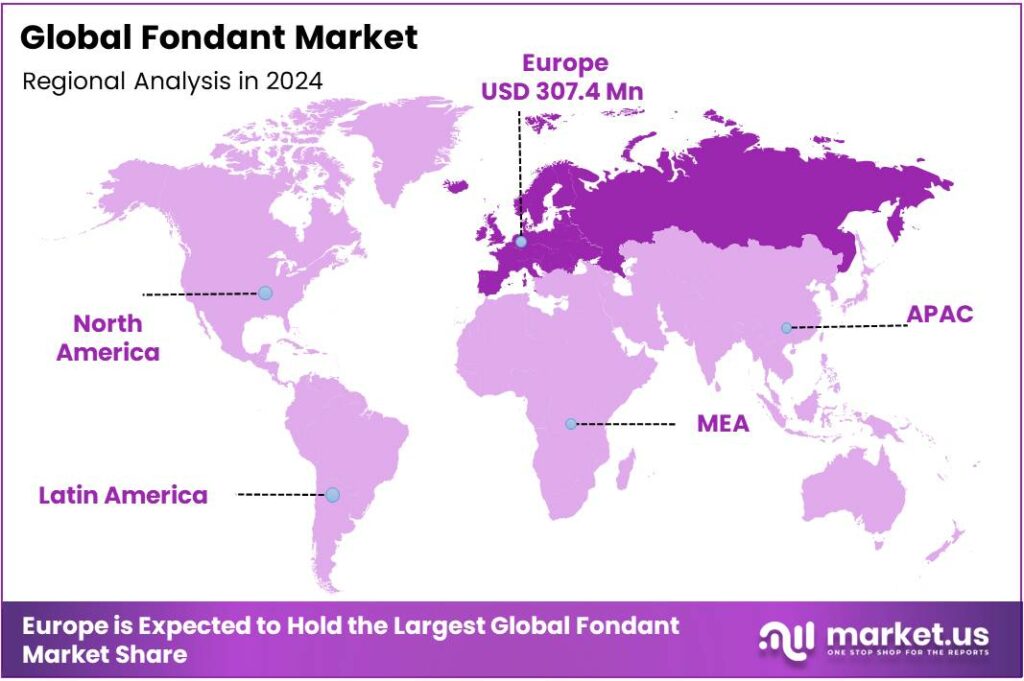

The Global Fondant Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024 European held a dominant market position, capturing more than a 37.2% share, holding USD 48.7 Million in revenue.

Fondant covering sits at the intersection of sugar supply, energy-intensive confectionery processing, and tightening food-safety rules. Supply fundamentals are stable to slightly expansionary: the USDA projects 180.75 million metric tons of world sugar production in 2024/25, led by Brazil, India, and the EU—supportive for fondant’s primary input costs and availability.

In the U.S., policy and beet/cane harvest dynamics shape downstream pricing; the USDA’s latest outlook puts 2024/25 sugar supply at 14.716 million short tons, raw value with a 19.8% stocks-to-use ratio, indicating comfortable buffers for bakery and cake-decoration manufacturers.

On the cost side, fondant production is sensitive to power tariffs. The U.S. Energy Information Administration reports an average industrial electricity price of 8.13 cents/kWh in 2024, underscoring why energy efficiency and load management matter in sugar-confectionery lines using steam kettles and continuous mixers. In parallel, electricity price tables for August 2025 show continuing variation across regions, reinforcing the case for on-site generation or power-purchase strategies at multi-plant operators.

Regulation is reshaping formulations and labeling. The EU’s decision to ban titanium dioxide (E171) as a food additive—with a six-month phase-out window—accelerated a shift toward alternative whitening systems in icings and rolled fondant. Bakeries must also manage process contaminants: the EU’s Commission Regulation (EU) 2017/2158 sets mitigation measures and benchmark levels for acrylamide in bakery categories relevant to fondant-covered goods.

In the UK, “Natasha’s Law” allergen rules apply to prepacked-for-direct-sale items from 1 October 2021, elevating labeling diligence for fondant components such as colorants and glazing agents. In India, the FSSAI compendium codifies additive use and mandatory labeling, guiding fondant recipes and declarations for domestic and export packs.

Several forces are driving demand. First, resilient sugar availability supports competitive pricing for industrial fondant blocks and pre-rolled sheets, even amid weather variability. Second, retail bakery and celebration-cake channels benefit from stable U.S. sugar stocks, helping large chains and commissaries plan multi-month procurement. Third, energy-management investments pencil out as power remains a meaningful cost line at 8.13 cents/kWh for industrial users in 2024; heat-recovery on cookers and demand-response contracts can protect margins.

Key Takeaways

- Fondant Market size is expected to be worth around USD 3.6 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 4.2%.

- Rolled fondant held a dominant market position, capturing more than a 58.3% share of the global fondant market.

- Ice Cakes held a dominant market position, capturing more than a 49.4% share of the global fondant market.

- Europe held a dominant position in the global fondant market, capturing more than a 38.5% share, which accounted for an estimated market value of USD 307.4 million.

By Type Analysis

Rolled Fondant Dominates with 58.3% Market Share in 2024

In 2024, rolled fondant held a dominant market position, capturing more than a 58.3% share of the global fondant market. The dominance of rolled fondant is largely attributed to its smooth texture, pliability, and ease of application, which make it the preferred choice among professional bakers and confectionery manufacturers. It offers a polished finish and can be easily colored, flavored, or shaped, supporting creativity and precision in decorative cake production. The segment benefits from rising demand for customized and premium bakery products, especially in regions such as North America and Europe, where decorated cakes have become integral to celebrations and events.

The rolled fondant segment is expected to sustain its leading position, driven by the growing adoption of ready-to-use and pre-colored rolled fondant in commercial baking operations. The increasing number of specialty bakeries, coupled with consumer preference for visually appealing and artisanal desserts, continues to strengthen the segment’s growth momentum. Furthermore, food manufacturers are investing in improved formulations with enhanced elasticity and shelf stability, addressing humidity and storage challenges commonly faced by bakery operators. The segment’s growth is also reinforced by the expansion of the organized retail sector and e-commerce platforms, which have increased product accessibility to small and medium bakery businesses.

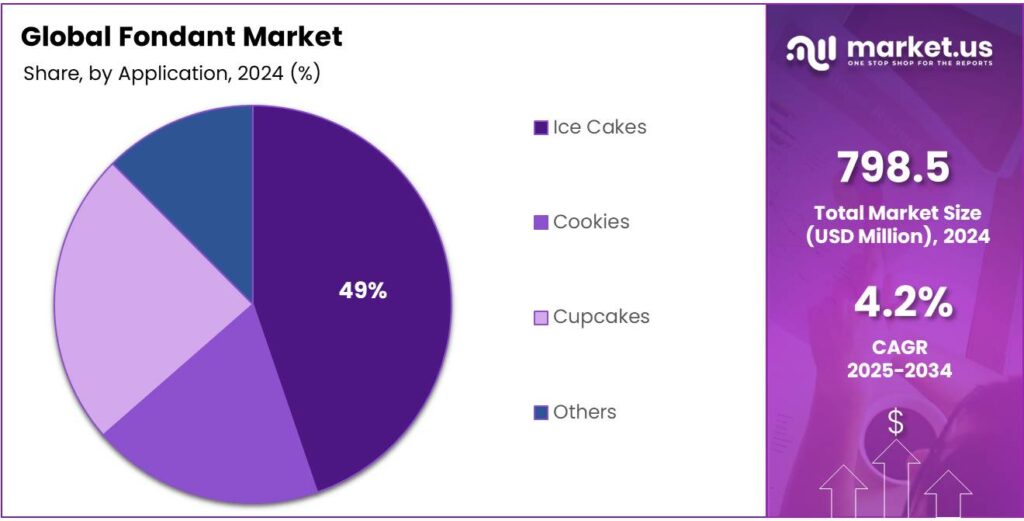

By Application Analysis

Ice Cakes Lead the Market with 49.4% Share in 2024

In 2024, Ice Cakes held a dominant market position, capturing more than a 49.4% share of the global fondant market. This strong performance was driven by the growing popularity of decorative and themed cakes for birthdays, weddings, and festive occasions. Ice cakes, which rely heavily on fondant for smooth finishes and artistic designs, have become a symbol of premium bakery craftsmanship. The segment benefited from an increasing consumer preference for personalized and visually appealing desserts, particularly in urban markets where customization and presentation strongly influence purchase decisions.

The demand for fondant used in ice cakes is expected to continue rising, supported by the expanding global bakery sector and the steady increase in celebration-based cake consumption. Advancements in fondant quality, including improved elasticity and longer shelf life, are encouraging large-scale adoption by commercial bakeries and confectionery producers. The rising trend of social media sharing of aesthetically designed cakes is also contributing to market visibility and demand for professionally finished ice cakes.

Key Market Segments

By Type

- Rolled

- Poured

- Others

By Application

- Ice Cakes

- Cookies

- Cupcakes

- Others

Emerging Trends

Social-media inspired decorative fondant and visual cake trends

One of the strongest recent trends in the fondant space is the rapid rise of visually stunning, shareable cakes—driven by social media and digital aesthetic demands. Research from Dawn Foods shows that 60% of consumers say social media influences their purchase of sweet bakery items. This means that for cakes finished with traditional materials like fondant, the look and “Instagram-mood” are now a major part of the appeal, not just the taste.

At the same time, bakery trends point to a clear shift towards crafting novelty shapes, bold textures and hybrid dessert formats. According to the Innova Market Insights “Bakery Trends 2025” overview, 43% of consumers are actively looking for creative and indulgent flavor or format experiences in sweet bakery goods. For fondant-based cakes, this translates into more elaborate sculpting, multi‐layered toppers, thematic colours and customized designs that extend beyond standard white smooth finishes.

Another striking point: in sweet goods and cake applications, there has been a 22% growth in launches with digestive/gut-health claims in the past year. While that statistic isn’t specific to fondant itself, it serves as a contextual backdrop: even highly decorative cakes are being asked to carry an extra “health-friendly” layer of messaging or functional ingredient. For fondant manufacturers and cake decorators, that means innovating on smoother textures, thinner layers, alternative sweeteners or functional additives while maintaining visual appeal.

From a production and supply-side perspective, colour innovations are also becoming more critical. According to a trend insight from EXBERRY covering bakery, confectionery and dairy: “Natural food colours” are a top category for 2025 and include bakery décor-applications. For fondant production, this means ingredient systems must support vibrant, pastel, or unusual colours without relying on synthetic pigments, aligning with consumer expectations for “clean-label” looks that photograph well and reflect modern aesthetics.

Drivers

Celebration-led bakery demand and eating-out rebound

A clear driver for fondant is the simple fact that people are celebrating more, and they’re buying cakes rather than baking them. In the United States, total food spending climbed to $2.58 trillion in 2024, with the strongest push coming from food-away-from-home. Eating-out spend rose from $1.45 trillion in 2023 to $1.52 trillion in 2024, underscoring how consumers are returning to retail bakeries and dessert occasions where fondant is a staple finish for premium cakes.

Holidays and life events are pulling that demand forward. Valentine’s Day alone was expected to reach a record $27.5 billion in 2025, according to the National Retail Federation—spend that reliably includes cakes, cupcakes, and confectionery gifts that favor shelf-stable icings and fondant decorations. Even the average per-person outlay rose to $188.81, pointing to a continued appetite for “showpiece” desserts.

Policy and regulation also help by giving bakers clarity. India’s food regulator codifies standards and permitted additives for sweets and confectionery, including labeling and sweetener rules. Clear, nationally enforced specifications reduce compliance risk for industrial fondant makers and allow small bakeries to source confidently, which in turn supports wider usage across festivals and weddings.

At the supply side, ingredient availability supports this momentum. The OECD-FAO outlook projects global sugar consumption to grow about 1.2% annually, reaching roughly 202 million tonnes by 2034—a steady medium-term base for sugar-rich applications like fondant and rolled icings. This projection is anchored in rising populations and incomes, particularly in Asia, which also aligns with growing celebration and gifting cultures in urban centers.

- In the U.S. alone, the baking industry employs ~800,000 people and generates over $186 billion in total economic impact, indicating a robust network of plants, distributors, and retail bakeries capable of scaling decorated-cake output quickly for peak seasons. A mature bakery backbone makes it easier for chains and independents to add fondant-finished SKUs without long lead times.

Restraints

Sugar scrutiny and additive rules squeeze fondant

One strong restraint on fondant is the steady tightening of sugar and additive rules across big markets. Health agencies are asking people to cut sugar, and that changes how retailers, caterers, and parents shop. The World Health Organization recommends keeping “free sugars” below 10% of daily energy, and says going below 5% (≈ 25 g/day) brings extra benefits. Those simple numbers sit on public campaigns, school guidance, and procurement checklists—and they make very sweet decorations like fondant an easy target for reduction or removal.

In the United States, the FDA now requires an “Added Sugars” line on pack with a Daily Value of 50 g/day. This single figure lets buyers and menu planners spot high-sugar toppings at a glance, nudging bakers toward thinner coatings, smaller portions, or buttercream/ganache swaps where possible. The U.K. went further by asking industry to cut sugar in key categories that children eat, aiming for a 20% reduction from 2015 baselines. Cakes and biscuits—where fondant is common—sit squarely in scope, so supermarket buyers often push suppliers to reformulate or redesign celebration lines.

In India, many fondant recipes rely on shortening or specialty fats for pliability and sheen. The food regulator has capped industrial trans fat at ≤ 2% in all oils and fats since 2022, forcing reformulation and raising costs for some bakery fat systems. The public-health goal is right, but the switch can complicate texture and handling for small shops.

In the European Union, the ban on titanium dioxide (E171) as a food additive removed a popular whitening pigment used in bright white fondant and pastes. Manufacturers have had to hunt for alternatives, which can dull whiteness or raise ingredient bills, and older recipes cannot be sold without change. The ban has been in force since early 2022 under Regulation (EU) 2022/63.

Price swings add day-to-day pressure. Fondant is sugar-dense, so when sugar moves, margins move. FAO data show the global Food Price Index has been volatile; in February 2025 the FAO noted a 6.6% monthly rise in sugar prices on expected tighter supply—exactly the kind of jump that squeezes decorators and pushes buyers to cheaper finishes. Even when the overall basket eases, the month-to-month swings make bakeries cautious about committing to sugar-heavy SKUs for long seasonal runs.

Opportunity

Occasion-led demand through tourism, e-commerce, and micro-bakery formalization

A big growth opening for fondant is the mix of more celebrations, more travel, and easier online cake buying. As people go out more, they order decorated cakes for moments that happen outside the home—birthdays in restaurants, weddings at resorts, and corporate events. In the United States, total food spending reached $2.58 trillion in 2024, and eating-out took a record 58.9% share—strong signals that dessert occasions are happening in foodservice settings where fondant-finished cakes shine.

Travel magnifies this. Resorts, hotels, cruise lines, and destination bakeries run on pre-orders for birthdays and anniversaries. Global tourism regained momentum in 2024 and kept rising in 2025. The UN World Tourism Organization reported +5% international arrivals in the first half of 2025 vs. 2024, putting volumes about 4% above pre-pandemic levels—more gatherings away from home, and more premium cakes that travel well and photograph beautifully.

- According to the U.S. Census Bureau, Q2-2025 retail e-commerce sales were $292.9 billion, accounting for 16.3% of total retail. This isn’t just electronics; bakeries and grocery chains increasingly route cake orders through web and app journeys, enabling on-demand personalization (names, themes, edible prints) that pair naturally with fondant’s smooth finish.

Policy is also creating room for small operators to scale. India’s centrally sponsored PMFME scheme is built for micro food processors, including neighborhood bakeries that rely on fondant for eye-catching finishes. The program targets 2,00,000 units with credit-linked support and an outlay of ₹10,000 crore (2020–2025); it offers 50% branding/marketing grants to groups and structured assistance to individual units. By August 2025, the government reported 1,44,517 micro food processing enterprises supported—thousands of real kitchens gaining equipment, packaging, and compliance capacity to sell decorated cakes confidently.

Regional Insights

Europe Leads the Global Fondant Market with 38.5% Share Valued at USD 307.4 Million

In 2024, Europe held a dominant position in the global fondant market, capturing more than a 38.5% share, which accounted for an estimated market value of USD 307.4 million. The region’s strong presence is primarily driven by its established bakery and confectionery culture, where decorative cakes, pastries, and desserts form an integral part of both retail and artisanal bakery offerings. Countries such as the United Kingdom, France, Germany, and Italy serve as key centers for fondant production and consumption, supported by advanced baking industries, premium product innovation, and a high level of consumer spending on indulgent and aesthetic bakery goods.

- According to data from the European Association of Bakery, the bakery industry in Europe contributes significantly to the continent’s food manufacturing output, employing over 2.8 million people across more than 190,000 businesses, providing a robust industrial base for fondant applications. Growing consumer interest in premium-quality desserts and the expansion of patisserie chains across Western and Northern Europe continue to propel demand.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Duff Goldman, known for his Charm City Cakes brand, has expanded into fondant manufacturing with vibrant, easy-to-use decorative pastes favored by professional and home bakers. His fondant products are praised for elasticity, smooth texture, and bright color options that simplify sculpting and cake covering. Sold through major U.S. retailers and online platforms, Duff’s range emphasizes creativity and accessibility, aligning with the trend of social-media-inspired cake artistry and accessible professional-quality baking materials for everyday consumers.

Satin Ice is one of the most recognized fondant brands globally, supplying premium rolled fondant to bakeries in over 60 countries. Its portfolio includes classic vanilla, chocolate, and tropical flavors, as well as vegan and gluten-free variants. Satin Ice focuses on consistent texture, easy kneading, and professional finish for competition-grade cakes. The company also partners with culinary schools and sponsors cake design contests, promoting innovation in edible artistry and supporting the global cake-decorating community.

Fat Daddio’s, based in the United States, supplies professional baking tools and decorative materials, including high-performance fondant and baking pans. Its fondant line is formulated for durability, smooth coverage, and neutral flavor, ideal for precision cake artistry. The company emphasizes food-safe manufacturing and sustainable production, appealing to both commercial and artisan bakers. Fat Daddio’s leverages its established reputation in bakeware to provide reliable fondant solutions compatible with professional temperature and texture demands in global kitchens.

Top Key Players Outlook

- Duff Goldman

- Satin Ice

- FondX

- Saracino

- Fat Daddio’s

- Wilton

- Bakels Pettinice

Recent Industry Developments

In 2024, Wilton reported estimated annual revenue of US $3.6 billion, with a revenue per employee of around US $480,000, reflecting a workforce of roughly 7,500 staff.

In 2024, Satin Ice remained a global fondant specialist focused on professional finishes and high throughput: the company highlights production capacity of 40+ million lbs/year, running from a ~100,000 sq ft facility, and supplying 500+ customers across 30+ countries via its corporate platform; its brand site also cites distribution in 60+ countries, underscoring broad retail and decorator reach.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 3.6 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rolled, Poured, Others), By Application (Ice Cakes, Cookies, Cupcakes, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Duff Goldman, Satin Ice, FondX, Saracino, Fat Daddio’s, Wilton, Bakels Pettinice Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Duff Goldman

- Satin Ice

- FondX

- Saracino

- Fat Daddio’s

- Wilton

- Bakels Pettinice