Global Folic Acid Market Size, Share Analysis Report By Form (Tablets, Soft Gels, Lozenges, Others), By Purity Level (90% To 98%, 98% And Above, Below 90%), By Source (Vegetables, Fruits, Others), By Application (Pharmaceuticals, Food and Beverages, Nutraceuticals, Animal Feed, Others), By Distribution Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153594

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

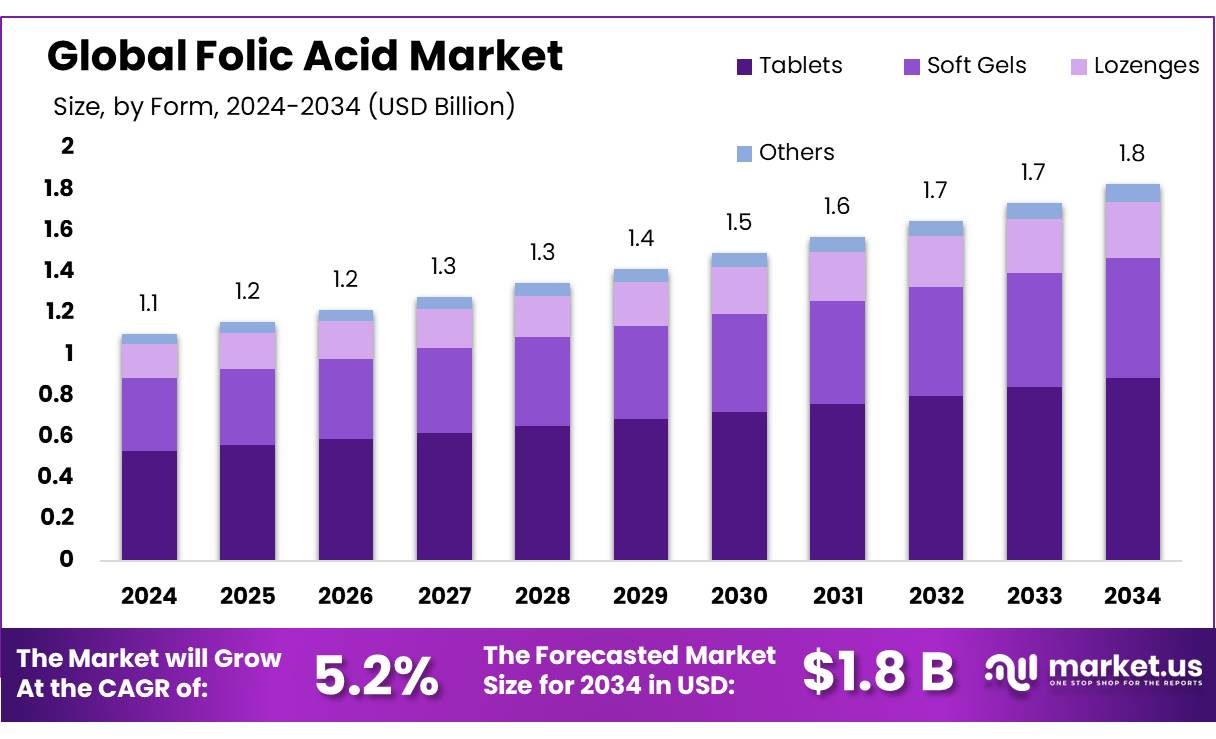

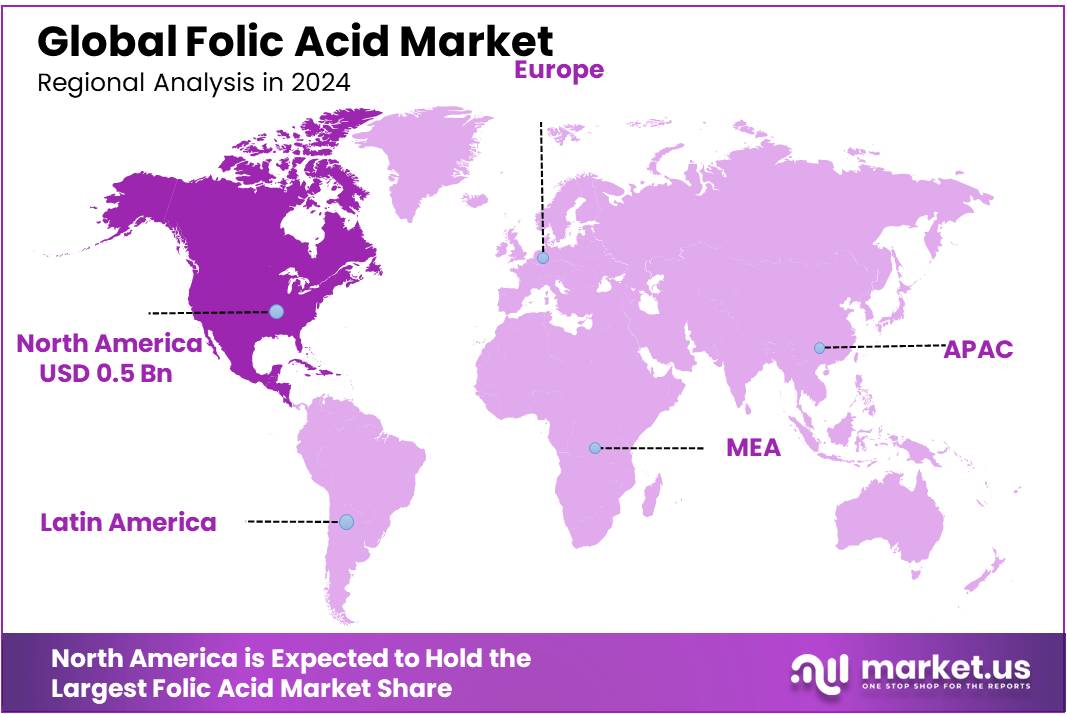

The Global Folic Acid Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.4% share, holding USD 0.5 Billion revenue.

Folic acid concentrates play a pivotal role in addressing micronutrient deficiencies, particularly in regions with high prevalence of neural tube defects (NTDs). Globally, over 70 countries have implemented mandatory fortification of staple foods with folic acid, significantly reducing the incidence of NTDs. In India, the Food Safety and Standards Authority (FSSAI) has set fortification standards for wheat flour, recommending the addition of 75–125 µg/kg of folic acid, aligning with World Health Organization guidelines.

The folic acid concentrates is influenced by government initiatives aimed at combating malnutrition. The Government of India has launched several programs, such as the Centrally Sponsored Pilot Scheme, distributing fortified rice with iron, folic acid, and vitamin B12 to address deficiencies among vulnerable populations. Additionally, the Public Distribution System (PDS) and the Mid-Day Meal Scheme (MDM) have incorporated fortified foods, including wheat flour and rice, to enhance nutritional intake.

The demand for folic acid concentrates is driven by the increasing awareness of their health benefits and the rising prevalence of NTDs. Studies indicate that proper folic acid intervention can prevent up to 90% of NTD cases. This has led to a surge in the adoption of fortification practices by food manufacturers and the expansion of fortified food programs by governments.

Government initiatives play a pivotal role in promoting folic acid fortification. In India, the Food Fortification Initiative (FFI) has been instrumental in advocating for the fortification of staple foods with essential micronutrients. For example, in Haryana, the government has fortified wheat flour with 130 mcg of folic acid per 100 grams, distributed through the Public Distribution System (PDS), Mid-Day Meal Scheme, and Integrated Child Development Services (ICDS). Such programs aim to reach vulnerable populations and reduce the prevalence of NTDs.

Key Takeaways

- Folic Acid Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 5.2%.

- Tablets held a dominant market position, capturing more than a 48.4% share in the folic acid market.

- 98% And Above held a dominant market position, capturing more than a 52.7% share in the folic acid market.

- Vegetables held a dominant market position, capturing more than a 44.9% share in the folic acid market.

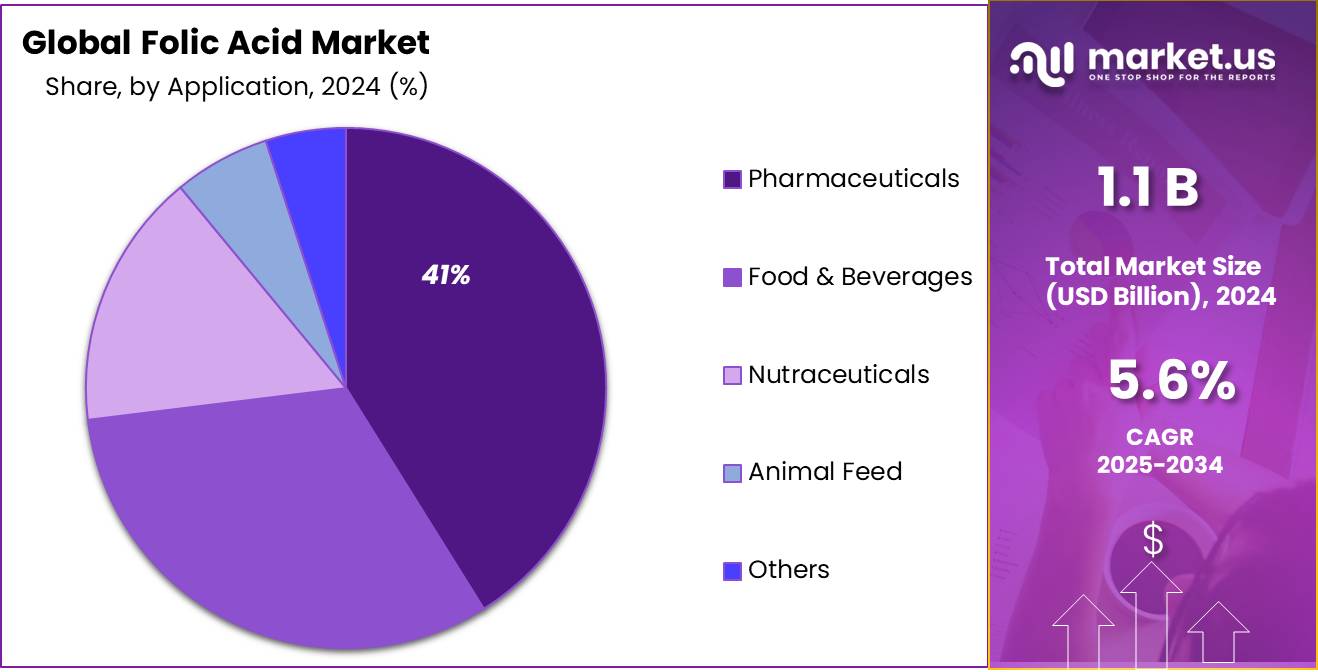

- Pharmaceuticals held a dominant market position, capturing more than a 41.2% share in the folic acid market.

- Offline held a dominant market position, capturing more than a 67.9% share in the folic acid market.

- North America stands as the dominant region in the global folic acid market, commanding a substantial share of 46.4% in 2024, equivalent to approximately USD 0.5 billion.

By Form Analysis

Tablets dominate with 48.4% due to ease of use and long shelf life.

In 2024, Tablets held a dominant market position, capturing more than a 48.4% share in the folic acid market by form. This strong presence is largely due to the convenience, portability, and stability that tablet formulations offer. Tablets are widely preferred in both prescription and over-the-counter folic acid products, especially among pregnant women and individuals managing anemia or vitamin deficiencies. Their longer shelf life compared to liquid or powder forms makes them ideal for bulk distribution in government health programs and retail pharmacies.

The growing awareness of prenatal health, particularly in developing nations, has also contributed to the strong demand for tablet-based folic acid. In 2025, this segment is expected to maintain its lead, supported by healthcare recommendations and global fortification programs that promote regular folic acid intake in an accessible form. Additionally, tablets are easier to standardize for dosage, helping healthcare providers ensure consistent nutrient delivery. The dominance of the tablet form reflects its alignment with consumer preference for simple, reliable supplementation solutions.

By Purity Level Analysis

98% And Above purity leads with 52.7% share for high-quality medical use.

In 2024, 98% And Above held a dominant market position, capturing more than a 52.7% share in the folic acid market by purity level. This segment’s leadership is mainly driven by its wide application in pharmaceutical formulations, where high purity is essential for safety, efficacy, and regulatory compliance. Medical-grade folic acid, particularly in prenatal vitamins and fortified food products, requires a minimum of 98% purity to meet global health standards.

As the demand for precise and reliable supplementation grows—especially in maternal health programs—manufacturers continue to focus on high-purity grades to ensure product consistency and consumer trust. In 2025, this segment is expected to retain its lead, supported by stringent quality norms in the healthcare sector and increased production of high-purity APIs for export markets. The dominance of the 98% And Above category reflects the ongoing shift toward premium, clinically validated folic acid concentrates in both developed and emerging regions.

By Source Analysis

Vegetables dominate with 44.9% share due to rising natural health preferences.

In 2024, Vegetables held a dominant market position, capturing more than a 44.9% share in the folic acid market by source. This leadership reflects the growing consumer shift toward plant-based and naturally derived nutrients, especially in the food and nutraceutical sectors. Leafy greens like spinach, broccoli, and kale are rich sources of natural folate, making vegetable-derived folic acid a preferred option for clean-label and organic supplement formulations.

The segment’s strong performance is also supported by increasing demand from health-conscious consumers who are avoiding synthetic additives and choosing food-based vitamins. In 2025, the vegetable segment is expected to continue leading, driven by ongoing trends in sustainable sourcing and transparent labeling. Food producers and supplement brands are increasingly promoting vegetable-sourced folic acid to meet these expectations, reinforcing its place as a reliable and health-aligned option in the market.

By Application Analysis

Pharmaceuticals lead with 41.2% share due to strong demand in prenatal care and anemia treatment.

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 41.2% share in the folic acid market by application. This significant share is mainly due to the critical role folic acid plays in the prevention and treatment of folate deficiency, neural tube defects, and certain types of anemia. It is a standard component in prenatal supplements and is often prescribed during pregnancy to support fetal development and prevent birth defects.

The pharmaceutical sector also relies on folic acid for various therapeutic formulations, including multivitamin tablets and injectables used in hospitals and clinics. In 2025, the segment is projected to retain its leadership as healthcare providers continue to recommend folic acid supplements, especially for women of reproductive age. Government-backed health initiatives promoting maternal care and preventive nutrition are further boosting demand for pharmaceutical-grade folic acid. This continued reliance on folic acid in clinical applications underlines the segment’s strong and stable position in the overall market.

By Distribution Channel Analysis

Offline channels dominate with 67.9% share due to wider accessibility and trust.

In 2024, Offline held a dominant market position, capturing more than a 67.9% share in the folic acid market by distribution channel. This large share is mainly supported by the strong presence of pharmacies, hospitals, health clinics, and retail stores that continue to be the primary point of purchase for folic acid supplements. Consumers often prefer offline purchases due to face-to-face consultation, instant product availability, and trust in local pharmacy recommendations.

In addition, government health programs and hospital-based prenatal care heavily rely on offline distribution to provide folic acid tablets to expecting mothers and anemic patients. In 2025, offline distribution is expected to maintain its lead, supported by rural and semi-urban outreach programs where internet access is limited. The familiarity, reliability, and immediate access offered by offline channels continue to make them the preferred route for folic acid distribution in both developing and developed markets.

Key Market Segments

By Form

- Tablets

- Soft Gels

- Lozenges

- Others

By Purity Level

- 90% To 98%

- 98% And Above

- Below 90%

By Source

- Vegetables

- Fruits

- Others

By Application

- Pharmaceuticals

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Others

By Distribution Channel

- Offline

- Online

Emerging Trends

Global Expansion of Mandatory Folic Acid Fortification

A significant trend in the folic acid sector is the global shift towards mandatory fortification of staple foods like wheat and maize flour. As of 2023, 69 countries have implemented mandatory folic acid fortification, while 47 have voluntary programs, and 77 have no fortification policies. This widespread adoption is driven by compelling public health evidence linking folic acid intake to the prevention of neural tube defects (NTDs) in newborns.

- For instance, in nations with mandatory fortification, the average plasma folate levels are 36 nmol/L, compared to 21 nmol/L in countries with voluntary fortification and 17 nmol/L in those without any fortification. This increase in folate levels has been associated with a 25% to 50% reduction in NTD prevalence.

The World Health Organization (WHO) supports large-scale food fortification as a cost-effective strategy to combat micronutrient deficiencies. WHO recommends the fortification of staple foods with essential nutrients, including folic acid, to improve public health outcomes.

In the United Kingdom, the government announced in 2021 its intention to introduce mandatory folic acid fortification of non-whole wheat flour. This decision was based on declining folate levels observed in the population, particularly among females of reproductive age.

Drivers

Growing Awareness of Health Benefits Drives Demand for Folic Acid

The growing recognition of folic acid’s importance in preventing birth defects and promoting overall health has become a key driving factor in its widespread use. Folic acid, a crucial B-vitamin, is known to support cell growth and function, especially during pregnancy. Studies from the World Health Organization (WHO) have highlighted the benefits of folic acid supplementation in reducing the risk of neural tube defects (NTDs) like spina bifida in newborns. In fact, folic acid intake is recommended for all women of reproductive age, with 400 micrograms of folic acid suggested daily to help prevent these birth defects.

- In 2018, the Centers for Disease Control and Prevention (CDC) reported that over 3,000 pregnancies in the U.S. were affected by NTDs each year. This awareness has led to an increased adoption of folic acid supplements among women, particularly in the preconception phase.

Additionally, many countries have implemented mandatory folic acid fortification in foods such as flour, which has significantly improved the intake of this essential nutrient. According to a 2020 report by the Food and Agriculture Organization (FAO), fortifying staple foods with folic acid has been a successful strategy in countries like the U.S., Canada, and Chile, where NTD rates have seen a sharp decline after the introduction of mandatory fortification.

The demand for folic acid continues to rise, with food and beverage companies increasingly adding folic acid to fortified products, including cereals, bread, and beverages. The global market for folic acid, driven by its health benefits and government initiatives like food fortification policies, is expected to continue growing as awareness spreads about its vital role in disease prevention and overall health.

Restraints

Lack of Awareness and Insufficient Fortification Programs

One major restraint for the folic acid industry is the persistent lack of awareness about its importance, especially in certain regions. Despite the overwhelming evidence of its role in preventing neural tube defects in newborns, many individuals, particularly in developing countries, are not adequately informed about its benefits.

- According to the World Health Organization (WHO), approximately 300,000 babies are born with neural tube defects each year, and folic acid deficiency is a key contributing factor. In fact, a 2020 study by the Centers for Disease Control and Prevention (CDC) highlighted that about 1 in 3 women of reproductive age in the U.S. do not consume the recommended daily intake of folic acid, increasing the risk of pregnancy-related complications. This knowledge gap has hindered global efforts to reduce the prevalence of such defects.

In addition, the fortification programs that could address these deficiencies have been slow to expand in some regions. While countries like the United States and Canada have successfully implemented mandatory folic acid fortification in wheat flour, many low-income nations still lack similar programs.

According to the Global Alliance for Improved Nutrition (GAIN), countries with mandatory fortification programs have seen significant reductions in folic acid deficiency, yet only a small fraction of the world’s population benefits from these measures. In some developing nations, the challenge lies not only in the lack of awareness but also in the insufficient infrastructure to support large-scale fortification initiatives.

Opportunity

Expanding Mandatory Folic Acid Fortification Globally

A significant opportunity for the folic acid industry lies in the expansion of mandatory food fortification programs worldwide. Currently, approximately 80 countries have implemented mandatory folic acid fortification in staple foods like wheat flour. However, this initiative has not been universally adopted.

- In 2017, for instance, only 59 countries met the criteria for mandatory fortification of wheat and/or maize flour with folic acid, preventing about 50,270 out of 280,500 folic acid-preventable spina bifida and anencephaly (FAP SBA) births globally. This indicates that over 230,000 cases of FAP SBA could have been prevented if all countries had adopted such measures.

The World Health Organization (WHO) and other health organizations advocate for the mandatory fortification of staple foods with folic acid as a cost-effective public health strategy. For example, the United States and Canada have mandated folic acid fortification since the late 1990s, resulting in a significant reduction in neural tube defects. In Canada, the incidence of neural tube defects decreased by 46% following the implementation of mandatory fortification.

Expanding mandatory folic acid fortification globally presents a substantial growth opportunity for the industry. This expansion would not only increase the demand for folic acid but also contribute to the prevention of birth defects and improvement of public health outcomes worldwide. The potential benefits include reduced healthcare costs, improved quality of life for affected individuals, and progress toward achieving global health goals.

Regional Insights

North America: Dominant Leader in the Folic Acid Market

North America stands as the dominant region in the global folic acid market, commanding a substantial share of 46.4% in 2024, equivalent to approximately USD 0.5 billion in market value. This commanding position is primarily attributed to stringent regulatory frameworks, widespread public health initiatives, and a high level of consumer awareness regarding the benefits of folic acid supplementation.

In the United States, the Food and Drug Administration (FDA) has mandated the fortification of enriched grain products with folic acid since 1996. This policy has been instrumental in reducing the incidence of neural tube defects, with studies indicating a significant decline in such birth defects following the implementation of mandatory fortification. Similarly, Canada introduced mandatory fortification in 1998, leading to a 46% reduction in neural tube defects, underscoring the effectiveness of such public health policies.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DSM N.V., a global leader in nutrition and health, manufactures folic acid products widely used in the food, beverage, and pharmaceutical industries. DSM offers high-quality folic acid solutions that support healthy pregnancies and prevent birth defects. The company emphasizes innovation, with a focus on sustainability and enhancing bioavailability. DSM is well-regarded for its advanced research in the field of nutrition and its commitment to improving public health through the fortification of food products with essential vitamins.

Hebei Jiheng Group Pharmacy Co. Ltd. is a prominent producer of active pharmaceutical ingredients (APIs), including folic acid. The company is known for its high-quality manufacturing of vitamin-based products, providing folic acid for use in dietary supplements and food products. Hebei Jiheng emphasizes quality control, with a strong commitment to ensuring product safety and regulatory compliance. They cater to the growing demand for folic acid across Asia and other emerging markets.

BASF SE is a leading global chemical company, known for its diverse portfolio in the folic acid market. The company produces high-quality folic acid ingredients for use in food fortification, dietary supplements, and pharmaceuticals. BASF is committed to sustainable practices, offering innovative solutions that cater to the growing demand for folic acid, especially in regions where deficiency-related birth defects are prevalent. Their research and development activities focus on enhancing product efficacy and safety.

Top Key Players Outlook

- BASF SE

- Changzhou Niutang Chemical Plant Co. Ltd.

- DSM N.V.

- Hebei Jiheng Group Pharmacy Co Ltd.

- Jiangxi Tianxin Pharmaceutical Co. Ltd.

- Jiheng Pharmaceutical

- Medicamen Biotech ltd

- Nantong Changhai Food Additive

- Shandong Xinfa Pharmaceutical Co., Ltd.

- Tyson Foods

Recent Industry Developments

In 2024, DSM N.V., operating now under DSM Firmenich, remained a key global supplier of high‑quality folic acid and its bioavailable forms. Its Swiss vitamin B9 facility at Sisseln produces pharma‑grade folic acid in a wide range of pack sizes—from 0.05 kg up to 570 kg—to meet diverse needs, from clinical use to industrial food fortification.

In December 2024, BASF announced the sale of its Food and Health Performance Ingredients business, including the production site in Illertissen, Germany, to Louis Dreyfus Company, as part of its strategic portfolio optimization.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 1.8 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Tablets, Soft Gels, Lozenges, Others), By Purity Level (90% To 98%, 98% And Above, Below 90%), By Source (Vegetables, Fruits, Others), By Application (Pharmaceuticals, Food and Beverages, Nutraceuticals, Animal Feed, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Changzhou Niutang Chemical Plant Co. Ltd., DSM N.V., Hebei Jiheng Group Pharmacy Co Ltd., Jiangxi Tianxin Pharmaceutical Co. Ltd., Jiheng Pharmaceutical, Medicamen Biotech ltd, Nantong Changhai Food Additive, Shandong Xinfa Pharmaceutical Co., Ltd., Tyson Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Changzhou Niutang Chemical Plant Co. Ltd.

- DSM N.V.

- Hebei Jiheng Group Pharmacy Co Ltd.

- Jiangxi Tianxin Pharmaceutical Co. Ltd.

- Jiheng Pharmaceutical

- Medicamen Biotech ltd

- Nantong Changhai Food Additive

- Shandong Xinfa Pharmaceutical Co., Ltd.

- Tyson Foods