Global Foley Catheter Market by Product Type (2-Way Foley Catheter, 3-Way Foley Catheter, and 4-Way Foley Catheter), By Material Type (Latex, Silicone, and Other), By Application Type (Surgery, Benign Prostatic Hyperplasia, Urinary Incontinence, and Others), By End-User Type (Hospitals, Long Term Care Centres, Specialty Clinics, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast; 2023-2032

- Published date: Nov 2023

- Report ID: 95680

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

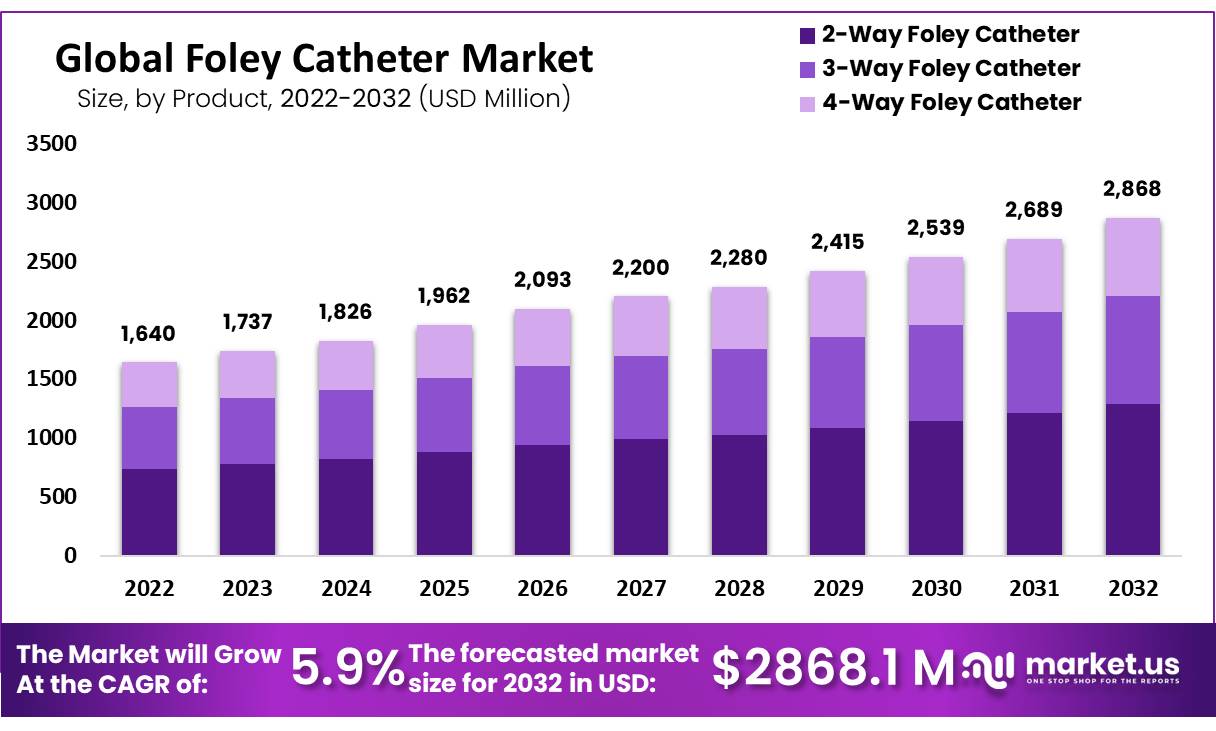

The Global Foley Catheter Market size is expected to be worth around USD 2868 Million by 2032 from USD 1,640 Million in 2022, growing at a CAGR of 5.9% during the forecast period from 2023 to 2032.

A Foley Catheter is a simple type of water balloon with a filler catheter. It removes urine from a bladder with an inserted soft rubber tube. Several times, the provider uses a catheter that is the smallest in size.

There are several sizes of Foley Catheters, which mainly depend on significant factors such as the geriatric population and a person’s situation when using a Foley Catheter. Urinary diseases will increase as the geriatric population increases. If the catheter is large, there is the possibility of irritation and difficulty in place. Also, if the Foley Catheter is tiny, it may create a leakage problem and kink.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The global foley catheter market is estimated to be valued at USD 2,868 million by 2032.

- The market is expected to exhibit a CAGR of 5.9% from 2023 to 2032.

- The Foley catheter market size was USD 1,640 million in 2022.

- By Product, the foley catheter market was dominated by the 2-way foley segment.

- By Material, the latex and silicone segments held substantial stakes over the forecast period.

- In 2022, the urinary incontinence segment dominated the Foley catheter market.

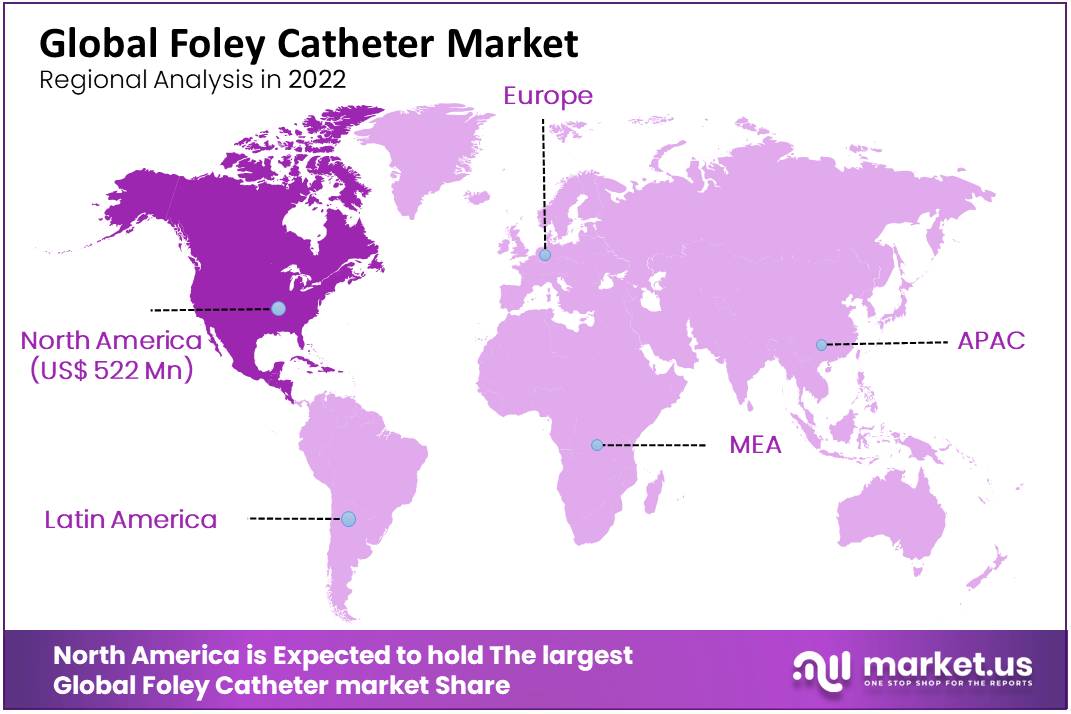

- North America dominated the market with a 31.8% revenue share in 2022.

- Europe held a 29.7% revenue share in 2022.

- Asia Pacific is the fastest-growing region in the global Foley catheter market.

- According to WHO data, 12.0%-16.0% of adults in acute hospitals in the United States use Foley catheters.

- The Urological Society of India has published guidelines to raise awareness about urinary problems in India.

- The Korean Incontinence Society is raising awareness in South Korea.

- The Foley catheter market is also expected to grow as proactive treatment for urological disorders transitions to preventive care.

By Product Type Analysis

2-Way Foley Catheter Segment Dominated Largest Market Share In Product Type Owing To Its Low Cost Compared To Others

Based on product type, the global Foley catheter market is segmented into 2-way Foley catheter, 3-way Foley catheter, and 4-way Foley catheter. Among these products, the 2-way segment dominated the Foley catheter market in 2022 because of its low cost compared to others.

There is wide acceptance of Foley catheters based on short and long-term catheterization. Also, there is a high CAGR in 3-way Foley catheters due to an extra lumen at the installation time and less bladder irrigation during urological surgeries. Hence, 3-way Foley has shown a high growth rate in the Foley catheter market.

Four-way Foley has to offer moderate CAGR in the forecast period as the growth of 4-way is low compared to other catheter-type markets.

By Material

Silicone Segment Dominated with the Largest Market Share, Owing To its Rigidity, Longer Shelf Life, and Biocompatibility

Based on material type, the most significant in the global Foley Catheters market shares are latex and silicone, the most accepted choice, with substantial stakes in the forecast period.

Among these materials, silicone is preferred due to rigidity, longer shelf life, and biocompatibility, which is expected to increase silicone demand during the forecasting period. For the short term, latex catheterization is chosen due to its minimal cost and flexibility.

Teflon, hydrogel, and new soft materials product launches have fewer infection chances and reduce potential urethral irritation in patients with a latex Foley catheter. Hence, latex likely leads to market growth demand worldwide.

By Application

The Urinary Incontinence Segment Dominated the Largest Market Share In Application Type Owing To Its Low Cost Compared To Others

Based on application type, the global Foley Catheters market is segmented into surgery, benign prostatic hyperplasia, urinary incontinence, and others due to the increase in chronic and urological diseases each year.

Among these applications, urinary incontinence accounted for the largest revenue share in the Foley catheter market in 2022.

Urinary incontinence problem is a significant problem for many patients in the Foley catheter market. This factor is expected to boost the growth of the target market.

By End-User

The hospital Segment Dominated The Largest Market Share In End-User Type Owing To Its Increased Number Of Patients With Urological Disorders.

Based on end-user type, the global Foley Catheters market is segmented into hospitals, long-term care facilities, specialty clinics, and others.

Among these end-users, hospitals have a significant share in the forecast period due to the increased number of patients with urological disorders.

In the US market research market, 15 to 25% of hospitalized patients use urinary catheters, which drives the overall growth.

Key Market Segments

By Product Type

- 2-Way Foley Catheter

- 3-Way Foley Catheter

- 4-Way Foley Catheter

By Material Type

- Latex

- Silicone

- Other

By Application Type

- Surgery

- Benign Prostatic Hyperplasia

- Urinary Incontinence

- Others

By End-User Type

- Hospitals

- Long-Term Care Facilities

- Specialty Clinics

- Others

Drivers

The Elderly Population and Obese Population Are the Primary Customers

The boost in demand for urinary catheters is because these catheters are used highly in the geriatric population, so there is an increase in nursing home patients, which increases the prevalence of disease rates.

Also, obesity in Europe and North America is growing, so there is an increase in the demand for urinary catheters in the forecast period.

Restraints

Catheterization It Is a Painful Process

The catheterization process is painful, so patients try to avoid its use. Poor lubrication can form friction in the patient and may cause bleeding with infection.

Special care is needed to be taken at the time of UTI or CAUTI, resulting in non-invasive or invasive treatment in place for current incontinence. Hence, these disadvantages can limit the urinary catheter market.

Opportunities

Low Entry Barriers in The Market

New economies are showing high market growth because of low barriers, increased patient population, healthcare spending, and improved healthcare technology & infrastructure.

Flexible Regulation Policies

In this market, regulation policies are flexible. With this, market key players are trying to acquire future emerging markets such as India, South Korea, etc. For instance, B. Braun, a major market key player, has established new production facilities in Penang and Zambia.

Challenges

Problems Like Catheter-Based Infections and Sepsis

Even if there is an increase in quality of life due to Foley catheters, catheter-based infections are also increasing, which blocks the use of Foley catheters on a large scale. A report by NHSN shows a 75% of conditions due to urinary tract are in hospitals due to catheters.

New systems creation for catheters can cause a 6% increase in bacteriuria in the urinary tract. More than 40% of hospital-acquired infections are by urinary catheters due to improper usage.

CDC has issued an advisory for people’s healthcare with new correct guidelines and advising how to remove catheters when there is no need.

Fluctuating Prices in Different Regions

There are fluctuating prices for Foley Catheters as Catheters are valued at different prices in different regions. Also, fluctuating prices are due to raw materials and exports of a Foley Catheter; due to this, units of Foley Catheters are being valued differently worldwide. These also affect most revenue due to regulatory barriers in bulk sales worldwide.

Regional Analysis

North America Dominates The Global Foley Catheter Market, Owing To The Increasing Healthcare Sector

North America accounted most significant revenue share in the Global Foley Catheter Market, with 31.8%. The dominance of the increasing healthcare sector in the US and high-spending areas is vital to help reduce the urinary tract infection ratio.

A recent survey in this region showed that a urinary tract infection contributes to 12.9% of the healthcare sector. Hence, continuous spending on treatment and disease in hospitals continues to increase and will increase overall Foley catheter sales. Even though there is a small portion of patients, there is a continuous increase in market share.

Hence, North America will remain the biggest market share holder. The European catheter market is nearly the same as North America but still the second most in the market share. Due to government support, it is acquiring a market to develop a nation in the world within the catheterization market.

The government is giving 2 billion euros for national services for the health department. Hence, they formed effective catheters with fewer side effects. Individuals need to continuously replace catheters to remove the chance of death and to reduce further healthcare costs.

Asia Pacific will be a prominent player in the market share. Many new growing urinary diseases in the Asia Pacific market share are increasing. Rising awareness among people, a high chance of getting hospital infections, and higher spending on medical hygiene also increased in the market such as china, japan, India, and others.

People in Asia Pacific are more vulnerable due to urinary disorders using Foley catheters because the large population is aged above 60 age. In upcoming years, China will have the most geriatric people, directly increasing the catheter demand.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Global manufacturers are speeding up the production process with cost-effective solutions. Integer Holdings Corporation has expanded its business in Galway, Ireland, with a new manufacturing plant and new medical device inventions.

To maintain the demand for various applications leading players are getting a higher quality product through acquisitions and mergers.

Key Market Players

- Sterimed Group.

- Boston Scientific Corporation

- Foley Temp Sensor

- Angiplast Pvt Ltd

- Dickinson and Company

- HEMC (Hospital Equipment Manufacturing Company)

- Cardinal Health

- GWS Surgicals LLP

- BACTIGUARD AB

- Medtronic

- Ribble International Limited

- Bard (BD)

- Hollister Incorporated

- Braun

- VOGT Medical

- Advin Health Care

- AdvaCare Pharma

- Teleflex Incorporated

- Teleflex inc.

- Coloplast ltd

- Convatec Group plc

- Medtronic Plc

- braun melsungen ag

- Other Key Players

Recent Market Developments

- Teleflex incorporated treated with the UroLift System’s Minimal Invasive surgeries to reach 400,000 Patients in Dec 2022.

- Braun Melsungen ag officially expanded its new branch in Vietnam on 10 Jan 2022.

Report Scope

Report Features Description Market Value (2022) USD 1,640 Million Forecast Revenue (2032) USD 2,868 Million CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (2-Way Foley Catheter, 3-Way Foley Catheter, and 4-Way Foley Catheter), By Material Type (Latex, Silicone, and Other), By Application Type (Surgery, Benign Prostatic Hyperplasia, Urinary Incontinence, and Others), By End-User Type (Hospitals, Long Term Care Centres, Specialty Clinics, and Others) Regional Analysis North America – US, Canada, Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic; Eastern Europe – Russia, Poland, The Czech Republic, Greece; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates; Competitive Landscape Sterimed Group., Boston scientific corporation, B. Braun Melsungen AG, Foley Tempsensor, Angiplast Pvt Ltd, Dickinson and Company, HEMC, Cardinal Health, GWS Surgicals LLP, BACTIGUARD AB, Medtronic, Ribbel International Limited, C. R. Bard (BD), Hollister Incorporated, Coloplast ltd, Convatec Group plc, Medtronic Plc, B. braun melsungen ag, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the foley catheter market growth?The global foley catheter market is expected to grow at a compound annual growth rate of 8.20% from 2023 to 2032 to reach USD 3.08 million by 2032.

Who are the key players in the foley catheters market?Prominent key players operating in the foley catheters market include Sterimed Group. Boston Scientific Corporation Foley Temp Sensor Angiplast Pvt Ltd Dickinson and Company HEMC (Hospital Equipment Manufacturing Company) Cardinal Health GWS Surgicals LLP BACTIGUARD AB Medtronic Ribble International Limited Bard (BD) Hollister Incorporated Braun VOGT Medical Advin Health Care AdvaCare Pharma Teleflex Incorporated Teleflex inc. Coloplast ltd Convatec Group plc Medtronic Plc braun melsungen ag Other Key Players

What segments are covered in the Foley Catheter Market Report?The Global Foley Catheter Market is segmented based on Product Type, Material Type, Application Type, End-User Type.

-

-

- Sterimed Group.

- Boston Scientific Corporation

- Foley Temp Sensor

- Angiplast Pvt Ltd

- Dickinson and Company

- HEMC (Hospital Equipment Manufacturing Company)

- Cardinal Health

- GWS Surgicals LLP

- BACTIGUARD AB

- Medtronic

- Ribble International Limited

- Bard (BD)

- Hollister Incorporated

- Braun

- VOGT Medical

- Advin Health Care

- AdvaCare Pharma

- Teleflex Incorporated

- Teleflex inc.

- Coloplast ltd

- Convatec Group plc

- Medtronic Plc

- braun melsungen ag

- Other Key Players