Global Flux for Semiconductor Market Size, Share Report By Product Type (Lead-free Flux, Rosin Flux, Water-soluble Flux), By Application (Soldering, Surface Mount Technology, Repair), By End-User (Consumer Electronics, Automotive, Telecommunications, Others), By Technology (Lead-free Technology, Conventional Technology), By Distribution Channel (Online Sales, Offline Sales), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169520

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- Role of Generative AI

- Investment and Business Benefits

- China Market Size

- Product Type Analysis

- Application Analysis

- End-User Analysis

- Technology Analysis

- Distribution Channel Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

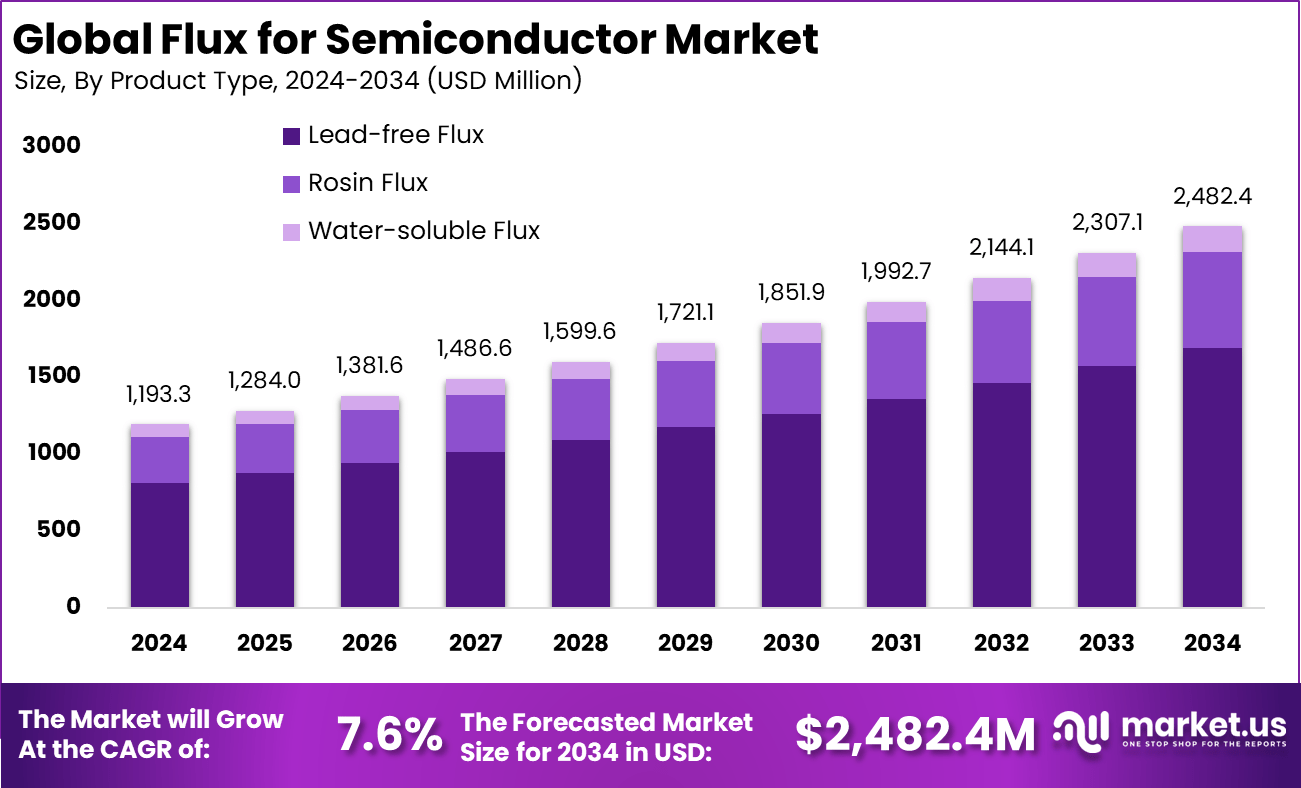

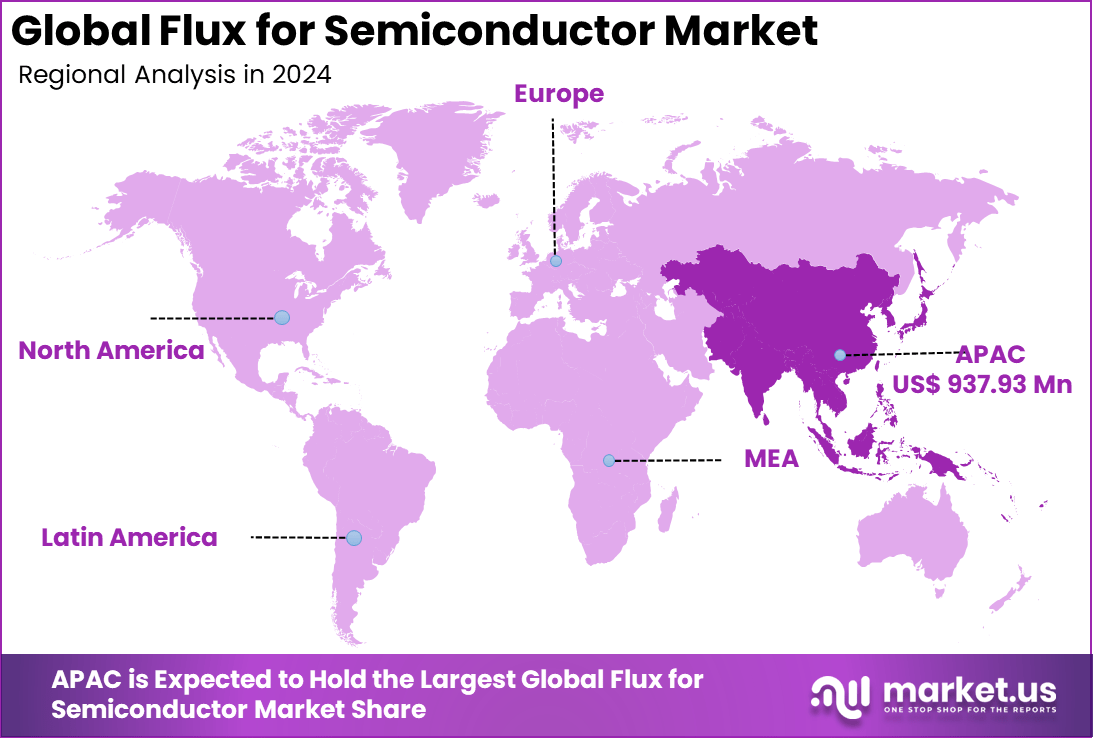

The Global Flux for Semiconductor Market size is expected to be worth around USD 2,482.4 million by 2034, from USD 1,193.3 million in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than 78.6% share, holding USD 937.93 million in revenue.

The flux for semiconductor market has expanded as chip manufacturing becomes more complex and highly sensitive to material quality and process stability. Growth reflects rising demand for advanced packaging, fine pitch soldering and defect free interconnections across wafer fabrication and assembly stages. Semiconductor flux plays a critical role in removing oxides, improving solder wetting and ensuring reliable electrical connections in micro level components.

The growth of the market can be attributed to shrinking chip geometries, rising complexity in packaging technologies and increasing demand for high performance electronic devices. As interconnect density increases, the need for precise soldering chemistry becomes more critical. The shift toward advanced packaging methods such as flip chip and wafer level packaging further drives demand for high purity and residue controlled flux materials.

The rising demand for flux in semiconductor manufacturing is driven by the increasing complexity of electronic products. Nearly seventy percent of assembly lines worldwide depend on flux to achieve consistent solder joints. As devices become smaller and pack more functions, soldering processes require highly effective cleaning agents to prevent oxidation. The continuous growth in semiconductor fab expansions and production volumes propels this demand further.

The market for flux in semiconductors is driven by the rapid growth in electronics manufacturing. Increasing demand for smaller, more complex semiconductor chips in devices like smartphones, electric vehicles, and 5G infrastructure requires advanced flux solutions. These flux materials help ensure strong, clean solder joints essential for high-performance chips. The shift toward advanced packaging methods like 3D packaging and hybrid bonding is increasing the need for reliable flux to control heat and residues, which is supporting steady market growth.

For instance, in October 2025, TSMC kicked off mass production of its 2nm chips using next-gen flux coatings for better soldering precision in high-density packaging. This move ramps up flux demand across AI and 5G apps, keeping Taiwan at the forefront of Asia-Pacific semi manufacturing, where clean, low-residue fluxes make all the difference in yields.

Key Takeaway

- The lead-free flux segment dominated with a 68.2% share in 2024, reflecting strong regulatory push toward environmentally safer semiconductor manufacturing materials.

- Surface mount technology accounted for 56.5%, showing its central role in high-volume, compact electronic assembly.

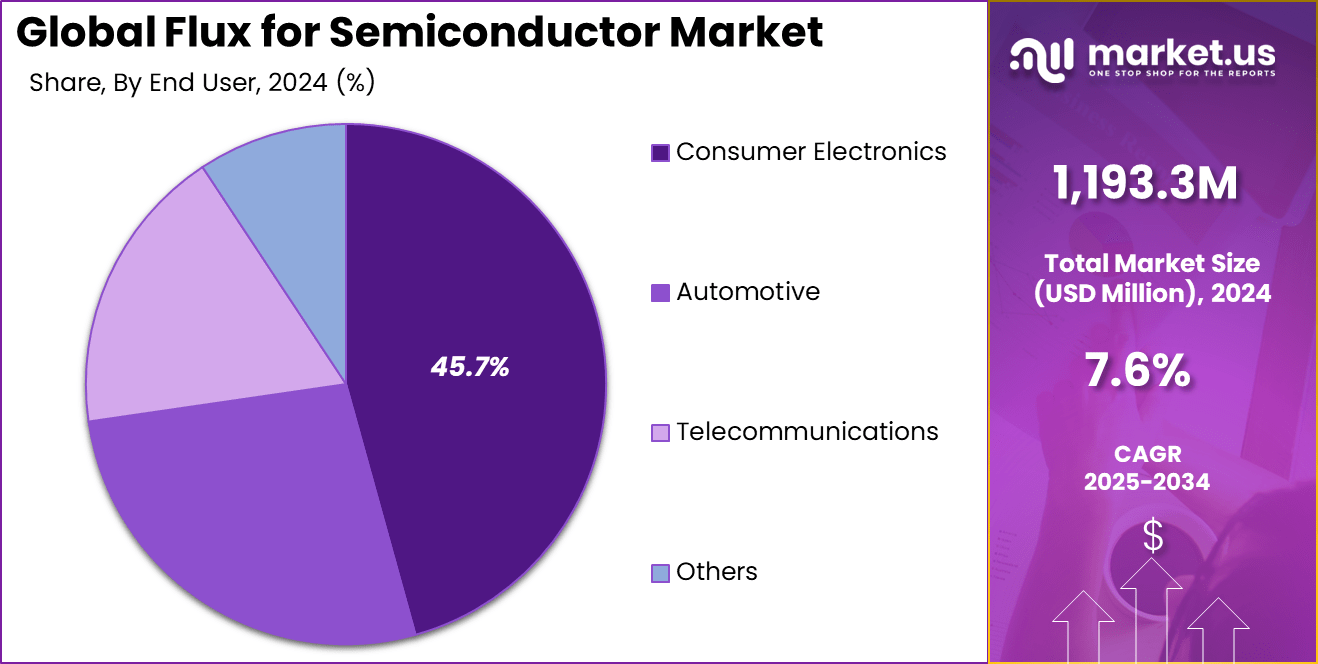

- Consumer electronics captured 45.7%, driven by continuous demand for smartphones, wearables, and home electronics.

- Lead-free technology held 72.3%, confirming the industry-wide shift away from hazardous soldering materials.

- Offline sales represented 94.5%, indicating that most flux purchases still move through direct supplier and distributor networks.

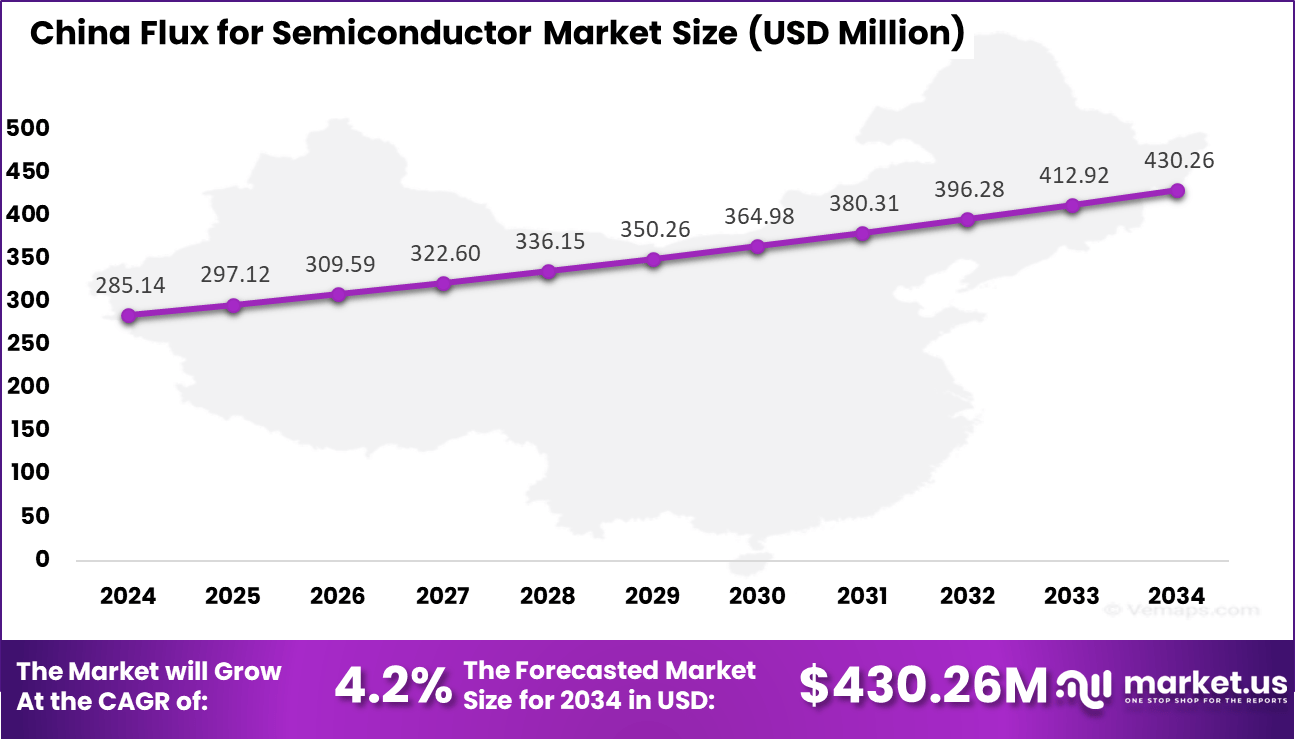

- China’s market reached USD 285.14 million in 2024 with a steady 4.2% CAGR, supported by large-scale electronics manufacturing capacity.

- Asia Pacific dominated globally with over 78.6% share, driven by dense semiconductor fabrication and assembly ecosystems across the region.

Quick Market Facts

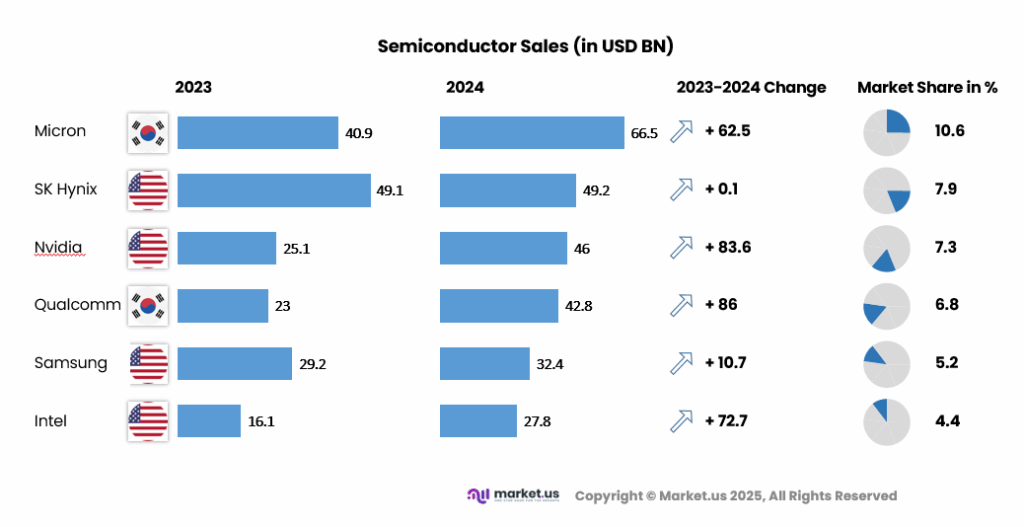

According to the Semiconductor Industry Association, global semiconductor sales reached USD 208.4 billion in the third quarter of 2025, showing a 15.8% rise compared with Q2. September 2025 sales were USD 69.5 billion, which is 25.1% higher than the USD 55.5 billion recorded in September 2024 and 7.0% above August 2025, based on World Semiconductor Trade Statistics using a three month moving average.

Role of Generative AI

Generative AI speeds up chip design in the semiconductor field. It handles floor planning and checks for errors on its own. 33% of leaders view it as the main tool to raise worker output. This tech also lowers defects during production runs. It looks at data from sensors to improve quality checks. Digital twins offer live views to spot and fix problems right away. These steps make the whole process smoother and more reliable for teams on the ground.

Workers in factories gain from real-time insights that cut waste. Generative AI pulls patterns from huge data sets to guide fixes. This keeps production lines running steadily without big stops. Design teams test more ideas faster with automated scenarios. Quality stays high as issues get caught early. Overall, it helps staff focus on key tasks instead of routine ones. The result is better chips made quicker each day.

Investment and Business Benefits

Investment opportunities in the semiconductor flux sector focus on developing environmentally friendly materials and specialty flux variants for emerging chip types such as AI processors. The trend towards reshoring semiconductor manufacturing drives demand for local flux suppliers to shorten the supply chain.

As fabs adopt newer nodes and packaging methods, flux formulations must evolve, creating openings for innovation and capital investment. Investors find these developments attractive due to the steady need for flux in manufacturing and the growing complexity of chips that raise flux requirements. Investment flows naturally follow expanding semiconductor production and technical advancements in flux chemistry.

Businesses that integrate advanced fluxes in semiconductor production benefit from improved yields, which can increase by up to twenty percent through better solder joint quality. Reducing defects means less rework and lower manufacturing costs over time. Reliable solder bonds enhance device reliability, reducing field failures and warranty claims. Increased process consistency also lowers machine downtime and boosts throughput.

China Market Size

The market for Flux for Semiconductor within China is growing tremendously and is currently valued at USD 937.93 million, the market has a projected CAGR of 78.6%. The market is experiencing rapid growth driven by several key factors. Increasing semiconductor manufacturing activities within the country are fueling demand for high-quality flux to ensure efficient soldering and reliable assembly processes.

Stricter environmental regulations are accelerating the adoption of lead-free and eco-friendly flux products. Additionally, China’s focus on advanced technologies such as 5G, AI, and IoT boosts semiconductor production, further pushing flux consumption. Strong government support and local manufacturing investments also contribute to this robust growth trajectory in the market.

In 2024, Asia Pacific held a dominant market position in the Global Flux for Semiconductor Market, capturing more than 78.6% share, holding USD 937.93 million in revenue. This leadership is primarily due to the region’s extensive semiconductor manufacturing ecosystem, especially in countries like China, South Korea, and Taiwan.

Robust electronics manufacturing, large-scale chip production facilities, and growing demand for consumer electronics drive flux consumption. Supportive government policies and investments in advanced semiconductor technologies also fuel market growth. The focus on lead-free and eco-friendly fluxes aligns with stringent environmental regulations, boosting sustainable manufacturing practices in the Asia Pacific.

For instance, in September 2025, Samsung Electronics ramped up 2nm GAA process production in South Korea, leveraging advanced semiconductor fluxes for enhanced yield in AI server memory like HBM3E and GDDR7. This positions Samsung at the forefront of Asia-Pacific’s flux-intensive manufacturing hubs, meeting global AI chip needs.

Product Type Analysis

In 2024, The Lead-free Flux segment held a dominant market position, capturing a 68.2% share of the Global Flux for Semiconductor Market. Its popularity stems from its compliance with environmental regulations limiting hazardous substances like lead. This flux type offers cleaner soldering compared to traditional formulas, reducing residues and defects during semiconductor assembly.

As electronic devices continue to shrink and gain complexity, lead-free flux becomes essential to meet stringent quality requirements while supporting eco-friendly manufacturing processes. The shift towards lead-free flux reflects broader industry trends emphasizing safety and sustainability. Manufacturers increasingly prefer this product type to avoid environmental hazards and ensure compatibility with modern soldering processes.

For Instance, in November 2025, Intel advanced its lead-free soldering in flip chip processes for next-gen chips. The company focused on cleaner joints to meet environmental rules. This move supports high-volume production without lead residues. It aligns with flux needs for reliable semiconductor assembly.

Application Analysis

In 2024, the Surface Mount Technology (SMT) segment held a dominant market position, capturing a 56.5% share of the Global Flux for Semiconductor Market. SMT involves placing tiny components directly onto the surface of circuit boards, which demands precise soldering techniques supported by effective flux. The role of flux here is to clean metal surfaces, prevent oxidation, and improve solder flow to ensure strong, reliable joints in miniature and high-density assemblies prevalent in modern electronics.

The growing demand for compact and lightweight consumer devices fuels the expansion of SMT in semiconductor manufacturing. Flux optimized for SMT must deliver high performance in fast-paced automated environments. Industries prioritize SMT flux for its ability to maintain minimal residues and support efficient production without compromising product integrity or throughput.

For instance, in July 2025, Texas Instruments expanded SMT capabilities in new US fabs with an over $60 billion investment. The firm emphasized precise flux use for surface mount in analog chips. Production ramps target compact device demands. This boosts efficiency in SMT soldering lines.

End-User Analysis

In 2024, The Consumer Electronics segment held a dominant market position, capturing a 45.7% share of the Global Flux for Semiconductor Market. The sector’s fast innovation cycle and demand for feature-rich, portable devices drive extensive use of advanced flux. Reliable flux materials are critical in ensuring defect-free soldering for components in smartphones, tablets, and wearable gadgets, where precision and durability directly impact product experience and lifespan.

With consumer electronics evolving rapidly, manufacturers emphasize flux that supports mass production without quality loss. The dependency on semiconductor flux in this end market reflects ongoing trends toward miniaturization, multifunctionality, and energy efficiency. Proper flux application is key to meeting these complex technical demands at scale while minimizing manufacturing costs.

For Instance, in September 2025, Micron raised forecasts due to AI-driven memory demand in consumer gadgets. High-bandwidth chips rely on flux for solid SMT bonds in electronics. The company supplies key parts for phones and wearables. This sustains flux use in end-user markets.

Technology Analysis

In 2024, the Lead-free Technology segment held a dominant market position, capturing a 72.3% share of the Global Flux for Semiconductor Market. This reflects a widespread industry move to replace traditional lead soldering with environmentally safer alternatives. Lead-free flux is formulated to handle higher soldering temperatures and maintain cleanliness during the soldering process, ensuring components adhere effectively without compromising on quality or safety.

This technology phase aligns with global regulations driving cleaner production standards in electronics manufacturing. Lead-free flux supports these efforts by enabling manufacturers to meet environmental guidelines while delivering high-performance semiconductor devices. The trend highlights a focus on sustainability alongside advanced technical capabilities in flux design.

For Instance, in April 2025, Intel shared its foundry roadmap with lead-free tech at the forefront. Partners adopt these methods for advanced packaging without lead. The focus cuts defects in high-heat soldering. It drives wider lead-free flux adoption industry-wide.

Distribution Channel Analysis

In 2024, The Offline Sales segment held a dominant market position, capturing a 94.5% share of the Global Flux for Semiconductor Market. Many semiconductor manufacturers favor direct purchasing through local distributors or suppliers to secure continuous and reliable flux delivery. This channel allows firms to maintain inventory buffers and rapidly address production needs, essential in high-volume manufacturing environments.

Despite growth in online platforms, offline sales remain preferred due to established supply chain relationships, immediate product availability, and trusted quality assurance. Manufacturers value the ability to negotiate terms and receive technical support directly, which online channels may not consistently offer, ensuring smooth and uninterrupted semiconductor production.

For Instance, in January 2025, Samsung saw stock gains from AI chip wins via established offline channels. Direct supplier ties ensure flux supply for massive fabs. The company prioritizes local deals for steady materials. This keeps offline sales vital for production scale.

Emerging Trends

A major emerging trend in the flux for semiconductor market is the shift toward low-residue and no-clean flux formulations. As semiconductor devices become smaller and more complex, manufacturers require flux solutions that leave minimal surface contamination after soldering. This reduces the need for post-cleaning processes and improves overall production efficiency.

Another visible trend is the growing use of flux in advanced packaging technologies such as flip-chip, ball grid array, and wafer-level packaging. These packaging methods demand high thermal stability and precise wetting performance from flux materials. As chip integration density increases, demand for specialized flux formulations continues to rise.

Environmental compliance is also shaping product development trends. Manufacturers are increasingly adopting halogen-free and low-VOC flux solutions to meet stricter environmental and workplace safety regulations. This shift is influencing both product innovation and material selection across fabrication plants.

Growth Factors

Rising global demand for semiconductors across consumer electronics, automotive, industrial automation, and data centers is a key growth factor for the flux market. Every stage of semiconductor assembly requires consistent soldering performance, which directly supports steady demand for high-quality flux materials.

The expansion of advanced node manufacturing and high-performance chip production is also supporting market growth. As circuits become more compact and operate at higher speeds, precise solder bonding becomes more critical. This increases dependence on reliable flux solutions that ensure strong interconnections and defect-free assembly.

The rapid growth of electric vehicles, 5G infrastructure, and artificial intelligence hardware is further strengthening demand for semiconductor components. Since flux is essential in chip assembly and packaging, growth in these end-use sectors directly supports continued expansion of the flux for semiconductor market.

Key Market Segments

By Product Type

- Lead-free Flux

- Rosin Flux

- Water-soluble Flux

By Application

- Soldering

- Surface Mount Technology

- Repair

By End-User

- Consumer Electronics

- Automotive

- Telecommunications

- Others

By Technology

- Lead-free Technology

- Conventional Technology

By Distribution Channel

- Online Sales

- Offline Sales

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand from Electronics Boom

The growing electronics manufacturing industry is driving strong demand for semiconductor flux. As devices become smaller and more complex, manufacturers need advanced flux that supports precise soldering in chips used across smartphones, automotive electronics, and communication equipment. This steady increase in production and innovation across the electronics sector continues to push flux consumption higher.

Advanced packaging techniques such as 3D ICs require high-performance flux capable of ensuring clean, durable solder joints. The trend toward miniaturization leaves no room for defects, making flux a critical part of the process. At the same time, the global move toward electric vehicles adds to requirements for reliable circuitry, further sustaining the demand from electronics and automotive manufacturers.

For instance, in December 2025, TSMC plans to build 12 new wafer and packaging plants in Taiwan for 2nm chips. Surge in orders from phones and EVs drives the need for better flux materials. Advanced CoWoS tech demands low-residue flux to handle heat cycles. Production ramps target full 2nm use by Q4. This boosts flux buys across the supply chain.

Restraint

Raw Material Price Swings

Flux producers face major challenges due to frequent fluctuations in raw material prices. Key ingredients, including petrochemical-based resins, often vary in availability and cost based on supply disruptions and global market uncertainties. These swings make it difficult for manufacturers to maintain stable pricing structures and profit margins, limiting capacity expansion and slowing new development efforts.

Environmental and safety regulations place additional pressure on producers to modify formulations. Compliance with restrictions on hazardous materials requires investment in new, cleaner chemistry that can affect production costs and consistency. Small and mid-sized players, in particular, struggle to adjust to these changes while maintaining product performance, which constrains overall market growth.

For instance, in August 2025, Samsung faces raw material hikes from petrochemical shortages for flux in packaging. Delays hit SoP tech trials on large panels due to cost swings. Foundry output slips 5% amid global supply tensions. Shift to safer formulas adds extra spend under RoHS rules. Buyers push back on price rises, slowing deals.

Opportunities

Push for Eco-Friendly Flux

The growing shift toward environmentally friendly flux formulations is unlocking fresh business opportunities. As global industries prioritize sustainability, manufacturers are moving rapidly toward lead-free and low-residue variants that align with evolving environmental standards. Expanding sectors such as renewable energy and solar manufacturing also create new use cases for reliable, eco-conscious flux materials.

Government incentives supporting semiconductor self-sufficiency are further boosting local production, creating direct opportunities for flux suppliers. Collaboration with large chip producers and expansion into high-growth markets such as electric mobility and connected devices give manufacturers room to strengthen supply chains and capture emerging demand segments.

For instance, in July 2025, Texas Instruments taps U.S. CHIPS funding for seven new fabs in Texas and Utah. $60 billion plan calls for green flux in 300mm wafer lines. EV chip surge opens doors for halogen-free products. Local supply deals promise steady volumes. Output hits hundreds of millions of chips daily with compliant materials.

Challenges

High R&D Costs for New Tech

Developing flux solutions suited for next-generation semiconductor designs demands significant investment in research and testing. Formulations must perform well under high thermal and mechanical stress while leaving minimal residue, which takes time and resources to perfect. The rapid pace of technological upgrades means that older products can become outdated quickly, putting pressure on smaller firms to innovate faster.

Increasingly strict environmental standards on emissions and waste management deepen the challenge. Achieving the right balance between high performance and regulatory compliance requires advanced technology and continuous R&D efforts. This situation gives a competitive advantage to large, established companies with the technical expertise and capital to sustain long-term innovation in flux development.

For instance, in January 2025, Micron struggles with R&D costs for flux in NCF-TCB bonding on memory chips. Advanced nodes need residue-free types, but tests overrun budgets. Tech shifts to 2nm risk old stock waste. Smaller fabs lag big rivals in compliance upgrades. Yield issues persist from emission controls.

Key Players Analysis

Intel, Samsung Electronics, and TSMC lead the flux for semiconductor market through large-scale fabrication operations and advanced packaging ecosystems. Their demand for high-purity soldering and cleaning flux is driven by dense interconnects, fine-pitch components, and advanced node manufacturing. These companies focus on process stability, low-residue performance, and high thermal reliability. Rising production of AI chips, memory devices, and advanced logic continues to support steady flux consumption.

Qualcomm, NVIDIA, Texas Instruments, Micron Technology, Broadcom, SK Hynix, and AMD strengthen market demand through high-volume chip design and memory production. Their packaging workflows require flux with consistent wetting behavior and low ionic contamination. These companies prioritize joint reliability, high yield rates, and compatibility with lead-free processes. Growth in data centers, automotive electronics, and high-performance computing continues to drive usage.

Infineon Technologies, Analog Devices, GlobalFoundries, Renesas Electronics, STMicroelectronics, and others expand the market through power electronics, automotive semiconductors, and mixed-signal devices. Their applications require flux that supports high-temperature stability and long-term electrical reliability. These players focus on clean processing and defect reduction. Rising adoption of EVs, industrial automation, and smart power systems continues to reinforce demand for advanced semiconductor-grade flux.

Top Key Players in the Market

- Intel Corporation

- Samsung Electronics

- TSMC (Taiwan Semiconductor Manufacturing Company)

- Qualcomm Inc.

- NVIDIA Corporation

- Texas Instruments

- Micron Technology

- Broadcom Inc.

- SK Hynix

- AMD (Advanced Micro Devices)

- Infineon Technologies

- Analog Devices

- GlobalFoundries

- Renesas Electronics Corporation

- STMicroelectronics

- Others

Recent Developments

- In October 2025, TSMC kicked off mass production of its 2nm chips using next-gen flux coatings for better soldering precision in high-density packaging. This move ramps up flux demand across AI and 5G apps, keeping Taiwan at the forefront of Asia-Pacific semi manufacturing, where clean, low-residue fluxes make all the difference in yields.

- In September 2025, SK Hynix wrapped quality checks on 12-layer HBM4 samples for NVIDIA, leaning on advanced flux tech for reliable TSV bonding in stacked memory. South Korea’s push here locks in strong flux usage for AI servers, showing how these materials handle the heat in next-gen memory stacks.

Report Scope

Report Features Description Market Value (2024) USD 1,193.3 Mn Forecast Revenue (2034) USD 2,482.4 Mn CAGR(2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Lead-free Flux, Rosin Flux, Water-soluble Flux), By Application (Soldering, Surface Mount Technology, Repair), By End-User (Consumer Electronics, Automotive, Telecommunications, Others), By Technology (Lead-free Technology, Conventional Technology), By Distribution Channel (Online Sales, Offline Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Samsung Electronics, TSMC (Taiwan Semiconductor Manufacturing Company), Qualcomm Inc., NVIDIA Corporation, Texas Instruments, Micron Technology, Broadcom Inc., SK Hynix, AMD (Advanced Micro Devices), Infineon Technologies, Analog Devices, GlobalFoundries, Renesas Electronics Corporation, STMicroelectronics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flux for Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Flux for Semiconductor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Samsung Electronics

- TSMC (Taiwan Semiconductor Manufacturing Company)

- Qualcomm Inc.

- NVIDIA Corporation

- Texas Instruments

- Micron Technology

- Broadcom Inc.

- SK Hynix

- AMD (Advanced Micro Devices)

- Infineon Technologies

- Analog Devices

- GlobalFoundries

- Renesas Electronics Corporation

- STMicroelectronics

- Others