Global Flow Chemistry Market Reactor Type(CSTR (Continuous stirred-tank reactor), Microreactor, Plug Flow Reactor, Microwave Systems, Others), By Purification Method( Crystallization, Distillation, Liquid-Liquid Extraction, Membrane Filtration, Others), Application(Pharmaceuticals, Academia & Research, Chemicals, Petrochemicals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 33902

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

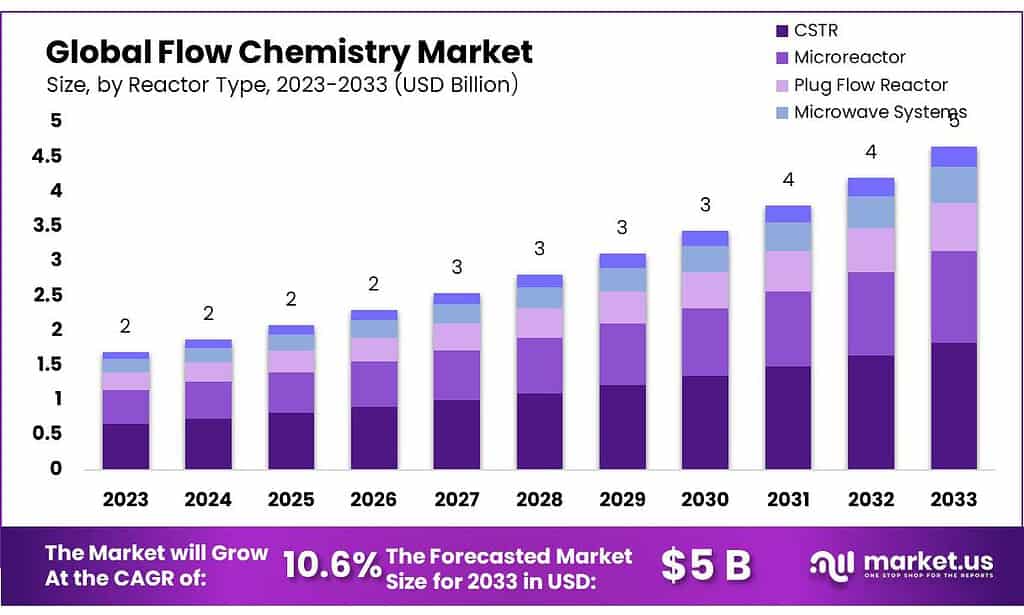

The Flow Chemistry Market size is expected to be worth around USD 4.6 billion by 2033, from USD 1.7 billion in 2023, growing at a CAGR of 10.6% during the forecast period from 2023 to 2033.

Industry growth has been fueled by increasing awareness about sustainable development and the growing pharmaceutical and chemical industry. The COVID-19 Pandemic caused an oil price crash, which led to a decrease in the feedstock cost advantage of chemical companies.

This led to a drop in demand for reactors within the chemical industry which is responsible for a large portion of the industry’s revenue. Additionally, the petrochemical, as well as pharmaceutical industries, felt these effects, which negatively impacted market growth.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Report Scope: The market is expected to grow to around USD 4.6 billion by 2033, from USD 1.7 billion in 2023, showcasing a CAGR of 10.6% during the forecast period from 2023 to 2033.

- Reactor Type Analysis: Continuous Stirred-Tank Reactors (CSTRs) dominated in 2023, holding over 39.2% market share due to their adaptability and consistency in conducting various chemical processes.

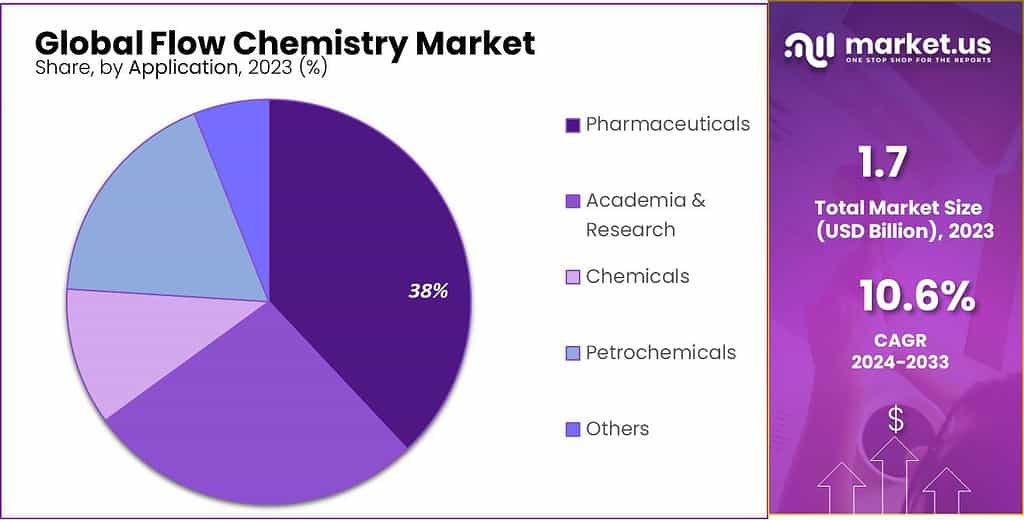

- Application Insights: Chemicals sector dominated the market (38.7%) followed by Pharmaceuticals (29.4%) and Petrochemicals (21.5%), showcasing diverse applications and acceptance of flow chemistry techniques.

- Drivers: Global pharmaceutical industry progress, particularly in emerging economies like China and India, is a significant driver. Continuous flow technology also reduces manufacturing stages, cutting costs significantly.

- Challenges: A limited supply of reagents and catalysts poses challenges. Disruptions during events like the COVID-19 pandemic caused global shortages, impacting the flow of chemistry applications.

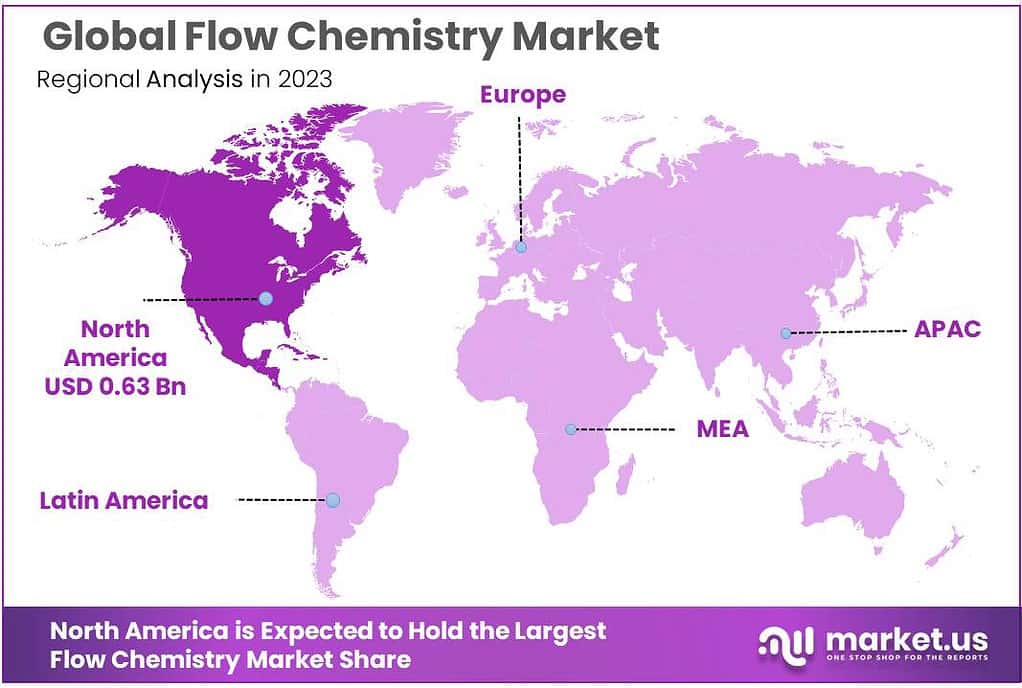

- Regional Analysis: North America held the largest market share (37.5%) in 2023, driven by pharmaceutical and chemical product demand, while APAC is expected to witness the highest CAGR of 11.9%.

- Market Players: Notable companies like CEM Corporation, Syrris Ltd., and Corning Incorporated, among others, are investing heavily in R&D, alliances, and technology to optimize production processes.

Reactor Type Analysis

In 2023, Continuous Stirred-Tank Reactor CSTR held a dominant position, capturing over 39.2% of the market share. CSTRs are versatile and widely used for continuous chemical reactions. They feature a well-stirred tank where reactants are continuously added, mixed, and then withdrawn as the reaction proceeds. Their adaptability makes them favorable for various chemical processes due to their consistent and controlled reaction conditions.

Other Reactor Types are Beyond CSTRs, the market comprises various other reactor types. These include Wet Chemical, Direct, Indirect, and specialized reactors, each designed for specific applications or reactions. These reactors offer unique advantages and functionalities, catering to specialized needs within the field of flow chemistry.

The dominance of CSTRs underscores their efficiency and versatility in conducting continuous chemical reactions, offering control and reliability. Meanwhile, other reactor types contribute to the market by catering to specific chemical processes and applications, providing a diverse array of options for conducting flow chemistry-based reactions.

By Purification Method

In 2023, Powder emerged as a leader in the Flow Chemistry market’s purification methods, holding a dominant position. Capturing a significant market share, the powder purification method is preferred for its versatility and ease of use in various chemical processes, ensuring efficient and reliable purification within the field of flow chemistry.

Pellets and Liquid forms, while contributing to the market, held smaller shares. Pellets offer controlled-release capabilities and specific shapes for targeted applications, while Liquid purification is utilized in specialized cases where liquid dispersion is preferred.

The prominence of Powder in the market underlines its widespread application and effectiveness in purification processes within flow chemistry, showcasing its versatility across different chemical reactions and industries.

Application Analysis

In 2023, the Flow Chemistry market was predominantly led by the Chemicals sector, securing over 38.7% of the market share. Flow chemistry found extensive use in chemical industries for synthesizing various compounds, enhancing efficiency, and streamlining production processes.

Following closely, Pharmaceuticals held a significant share of about 29.4%. Flow chemistry techniques were increasingly adopted in pharmaceutical manufacturing for precise synthesis and improved efficiency in drug development. Petrochemicals accounted for a notable portion, approximately 21.5% of the market. Flow chemistry methods were utilized in this sector for refining and synthesizing various petrochemical products.

Academia and research, along with other sectors, contributed to the remaining market share. Flow chemistry’s adoption in academia and research showcased its growing significance in advancing scientific discoveries and innovations across various fields.

The dominance of Chemicals in the Flow Chemistry market highlights its widespread application and acceptance, while Pharmaceuticals and Petrochemicals, among others, underscore the diverse applications of flow chemistry techniques across different sectors, driving advancements and efficiencies in various industries.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Reactor Type

- CSTR (Continuous stirred-tank reactor)

- Microreactor

- Plug Flow Reactor

- Microwave Systems

- Others

By Purification Method

- Crystallization

- Distillation

- Liquid-Liquid Extraction

- Membrane Filtration

- Others

Application

- Pharmaceuticals

- Academia & Research

- Chemicals

- Petrochemicals

- Others

Drivers

Driver of Global Pharmaceutical Industry Progress The global pharmaceutical industry is driven by advances in medicine and bioscience, fuelling rapid expansion.

Additionally, Asia-Pacific consumer health awareness – particularly among developing nations such as China and India – and increasing disposable income should drive pharmaceutical sector growth during this projection period. Over the past decade, United States, United Kingdom and Europe dominated the pharmaceutical market; however, now they face serious competition from emerging economies such as Brazil, India and China.

Emerging economies such as these have undergone dramatic transformations to their healthcare infrastructures over the last several years; therefore requiring tailored approaches tailored specifically to each market cluster within BRICMT economies such as Brazil Russia India China Turkey Mexico as well as second-tier nations across Southeast Asia and Africa based on local circumstances and differences. Continuous flow technology also reduces manufacturing stages to reduce manufacturing costs significantly.

Restraints

Competition from emerging technologies The development of the flow chemistry market may be hindered by competition from alternative technologies that appear on the market.

Standard batch-wise methods, microwave-assisted chemistry and ultrasound-assisted chemistry are just a few technologies utilized for chemical synthesis. Comparing these technologies with flow chemistry, each has its set of advantages and disadvantages; some may even be better suited for particular uses.

Conventional batch-wise methods commonly employed by the chemical industry could be chosen when only small amounts of a certain chemical need to be manufactured. On the other hand, microwave and ultrasound-assisted chemistry may be better suited to certain reactions due to faster reaction times and higher yields. Microwave chemistry, another competing technology, allows quick heating and energy transfer in chemical reactions. Although microwave chemistry provides the advantages of speed, its use may only apply to certain types of reactions and may not offer as much control and selectivity as flow chemistry.

Opportunities

An increase in biodiesel manufacturing flow chemistry demand The rising demand for chemicals to meet various end-use applications boosts new capital investments within the chemical industry. With the planned establishment of new chemical facilities, production capacity for chemicals should increase significantly. Significant factors contributing to the global chemical industry’s expansion include government initiatives and investments, stringent environmental regulations, high fragmentation in industry segments and growing specialty chemical demand.

Major chemical industry players are constantly expanding their production facilities in order to meet the rising demand for chemicals across various applications. Chemical manufacturers across the world rely heavily on continuous flow chemistry technology, with multiple sectors like fertilizer and food & beverage needing bulk chemicals for bulk processing. Since flow chemistry makes bulk processing economical and simple, numerous chemical companies adopt it worldwide.

Challenges

Challenges in Flow Chemistry

One of the challenges associated with flow chemistry could be its limited supply of reagents and catalysts. As opposed to batch processing, flow chemistry offers many benefits compared to this approach, including increased safety, efficiency, and scalability. This field of chemical synthesis is experiencing exponential growth.

Reliable and superior-quality reagents and catalysts are vital to its success; otherwise it would never work. Recent events in the flow chemistry industry have caused great disruption due to numerous instances of reagent and catalyst shortages. For instance, the COVID-19 pandemic of 2020 caused global shortages for chemicals and laboratory supplies such as reagents and catalysts critical for flow chemistry applications such as COVID.

Regional Analysis

North America was the dominant market and held over 37.5% of the global revenue for 2023. The industry’s growth is due to an increase in pharmaceutical and chemical products as well as investments in flow chemistry research and development, particularly in continuous processes.

The highest CAGR for the APAC region, 11.9%, is expected over the forecast period. A rise in government spending on pharmaceutical production due to the increase in demand for generic drugs, combined with the promising outlook of the chemical and petrochemical sectors, will likely boost industry growth in the region. The pharmaceutical business in Europe is concentrating on medical R&D by upholding, sustaining, and expanding a strong regulatory and incentive framework that supports innovation. Drug production can be done economically using flow chemistry. Because of this, it is more well-liked by European pharmaceutical producers.

The country’s oil production is expected to rise and the investment in Brazil’s pharmaceutical sector will have a positive impact on the industry. The industry’s growth is also expected to be supported by an increased focus on biotechnology, and the rising use of green production processes.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Innovations in technology that use flow chemistry are driving the competitive market. Market players are investing heavily in R&D and developing tools to optimize the production process and increase the yield of the product. Manufacturers are forming alliances with end-users to help them apply flow chemistry in response to the increasing demand for specialty and fine chemicals all over the globe.

The region expansion effort is expected to be a key role, as North American and European producers are looking at the Asia Pacific for potential destinations. CEM acquired Intavis Bioanalytical Instruments Assets, which was then able to assume global sales, service, and support for the instrumentation division.

Key Market Players

- Am Technology

- CEM Corporation

- Milestone Srl

- Biotage AB

- Syrris Ltd.

- Vapourtec Ltd.

- ThalesNano Inc.

- Hel Group

- Uniqsis Ltd.

- Chemtrix BV

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

- Cambridge Reactor Design Ltd.

- PDC Machines Inc.

- Parr Instrument Company

Recent development

In July 2023, H.E.L Group announced a collaboration with IIT Kanpur to leverage sustainable energy driven by the institute. The objective of this initiative was to create new testing labs for conducting research in new chemistry development, battery storage, and thermal characteristics study.

In June 2023, ACI Sciences strengthened its strategic partnership with Vapourtec. With the help of this transaction, ACI Sciences planned to serve as the official distributor of Vapourtec in Southeast Asia. By deploying Vapourtec’s groundbreaking continuous flow chemistry systems, scientists can leverage the productivity and precision of experiments while reducing waste and minimizing costs.

In June 2023, H.E.L Group expanded its BioXplorer product range with the launch of two new automated parallel bioreactors: BioXplorer 400XL and BioXplorer 400P. These bioreactors are idyllic for cell line/strain screening, small-scale process development, and various research, screening, and optimization investigations in bioprocessing and flow chemistry.

In March 2023, Uniqsis unveiled the Solstice multi-position batch photoreactor, which can achieve up to 12 small-scale reactions parallelly. After determining the optimal conditions through parallel reactions, researchers can transition to a continuous flow reactor, such as the Borealis Flow photoreactor, to scale up the process and attain higher throughput.

In March 2023, Corning Incorporated and NARD Institute, Ltd. announced the commencement of an Advanced-Flow reactor application-qualified lab in NARD’s facility in Japan.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Bn Forecast Revenue (2033) USD 4.6 Bn CAGR (2024-2033) 10.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Reactor Type(CSTR (Continuous stirred-tank reactor), Microreactor, Plug Flow Reactor, Microwave Systems, Others), By Purification Method( Crystallization, Distillation, Liquid-Liquid Extraction, Membrane Filtration, Others), Application(Pharmaceuticals, Academia & Research, Chemicals, Petrochemicals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Am Technology, CEM Corporation, Milestone Srl, Biotage AB, Syrris Ltd., Vapourtec Ltd., ThalesNano Inc., Hel Group, Uniqsis Ltd., Chemtrix BV, Ehrfeld Mikrotechnik BTS, Future Chemistry Holding BV, Corning Incorporated, Cambridge Reactor Design Ltd., PDC Machines Inc., Parr Instrument Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is flow chemistry?Flow chemistry is a technique where chemical reactions occur in a continuous flow of reagents through a reactor, as opposed to batch processing. It allows precise control over reaction conditions and offers various advantages in terms of efficiency and scalability.

What trends are shaping the future of the flow chemistry market?- Automation and AI: Integration of automation and artificial intelligence for process optimization.

- Customization: Tailoring flow systems for specific reactions and applications.

- Sustainable Practices: Focus on greener chemistry and sustainable manufacturing processes.

How does flow chemistry differ from traditional batch processing?- Continuous Flow: Reagents are continuously pumped through the reactor, allowing for precise control over reaction parameters.

- Efficiency: Reduced reaction times and improved heat transfer lead to higher yields and purities.

- Safety: Safer handling of hazardous materials due to smaller quantities in the system at any given time.

-

-

- Am Technology

- CEM Corporation

- Milestone Srl

- Biotage AB

- Syrris Ltd.

- Vapourtec Ltd.

- ThalesNano Inc.

- Hel Group

- Uniqsis Ltd.

- Chemtrix BV

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

- Cambridge Reactor Design Ltd.

- PDC Machines Inc.

- Parr Instrument Company