Global Flood Insurance Market Size, Share, Industry Analysis Report By Coverage Type (Building Coverage, Content Coverage, Combined Coverage), By Policy Provider (National Flood Insurance Program (NFIP), Private Flood Insurance), By Distribution Channel (Direct Sales, Agents and Brokers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162470

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Specific Country Statistics

- U.S. Market Size

- Emerging Trends

- Growth Factors

- Coverage Type Analysis

- Policy Provider Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

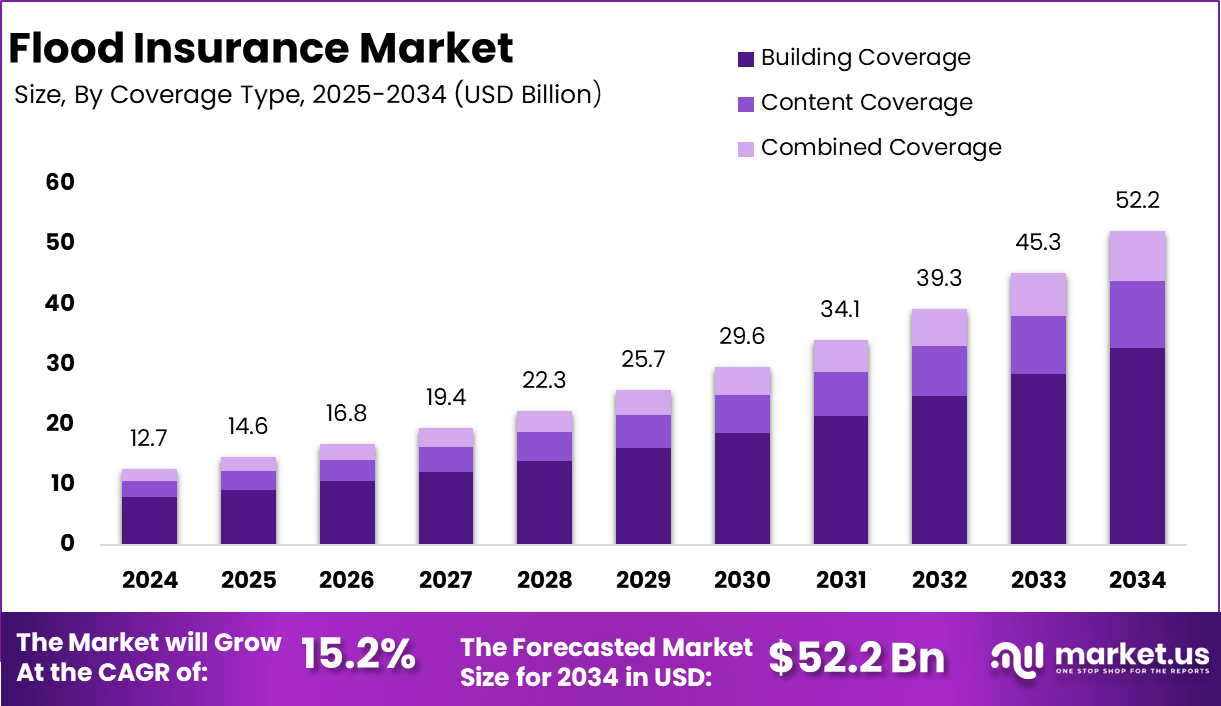

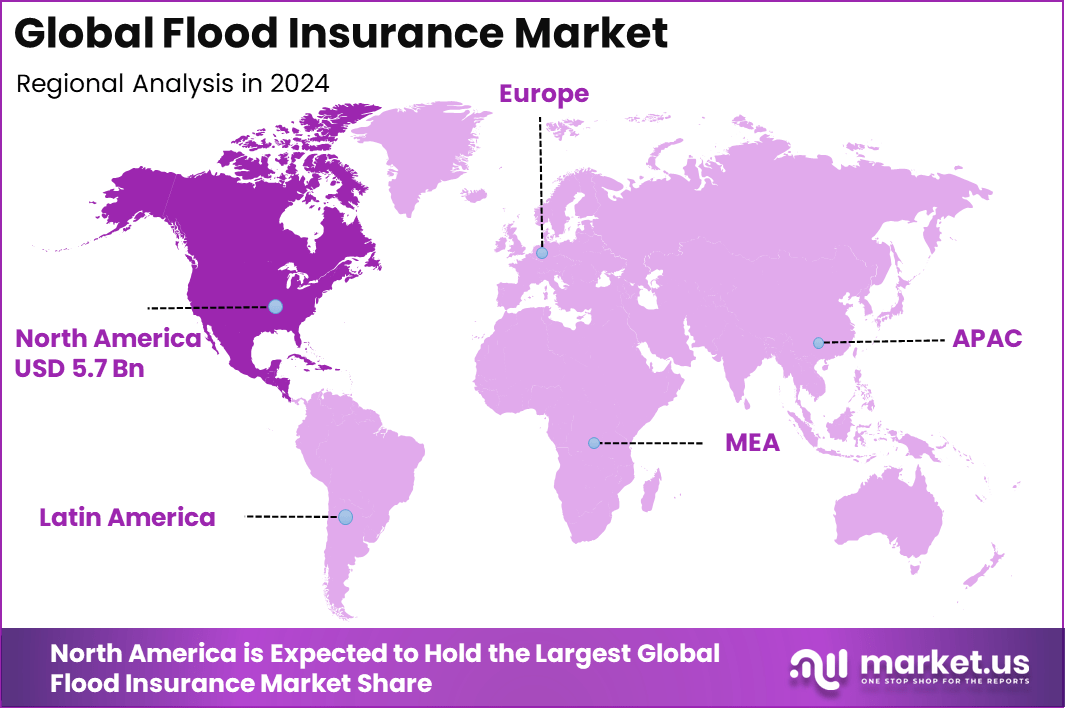

The Global Flood Insurance Market size is expected to be worth around USD 52.2 Billion by 2034, from USD 12.7 Billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.3% share, holding USD 5.7 Billion revenue.

The flood insurance market covers policies designed to protect homeowners, businesses and other property owners from the financial losses caused by flooding. Standard property insurance typically excludes flood damage, so specialised flood insurance is required to cover structural damage, contents loss, business interruption and other flood-related costs. For example, in the United States the National Flood Insurance Program (NFIP) handles a large portion of residential flood policies.

Top driving factors include the increased frequency of floods caused by environmental changes, expanding urban areas in flood-prone locations, and government requirements for insurance in vulnerable regions. In many places, regulations encourage or mandate flood insurance for properties near water bodies. Public education about flood risks also raises demand, as more people understand the potential financial impact of floods.

A rising trend in flood insurance, though adoption varies. For example, some countries have coverage rates above 70%, while others, especially low-income areas, have much lower uptake. High average flood damage costs, often tens of thousands of dollars per incident, motivate individuals to consider insurance. Government-backed programs and subsidies also boost policy purchases, though affordability remains a challenge for some.

Technologies like artificial intelligence and satellite monitoring are increasingly used to improve flood risk prediction and insurance services. These technologies provide faster and more precise flood forecasts, automate claim processes, and help insurers set fair prices. For instance, machine learning can reduce error rates in flood predictions by over 60%, and satellite data aids real-time monitoring. These innovations make flood insurance more efficient and accessible.

Key Takeaway

- The Content Coverage segment led with 62.8%, highlighting the increasing preference for policies that protect personal property and household contents.

- The National Flood Insurance Program (NFIP) accounted for 58.3%, reflecting its continued dominance in offering federally backed flood coverage.

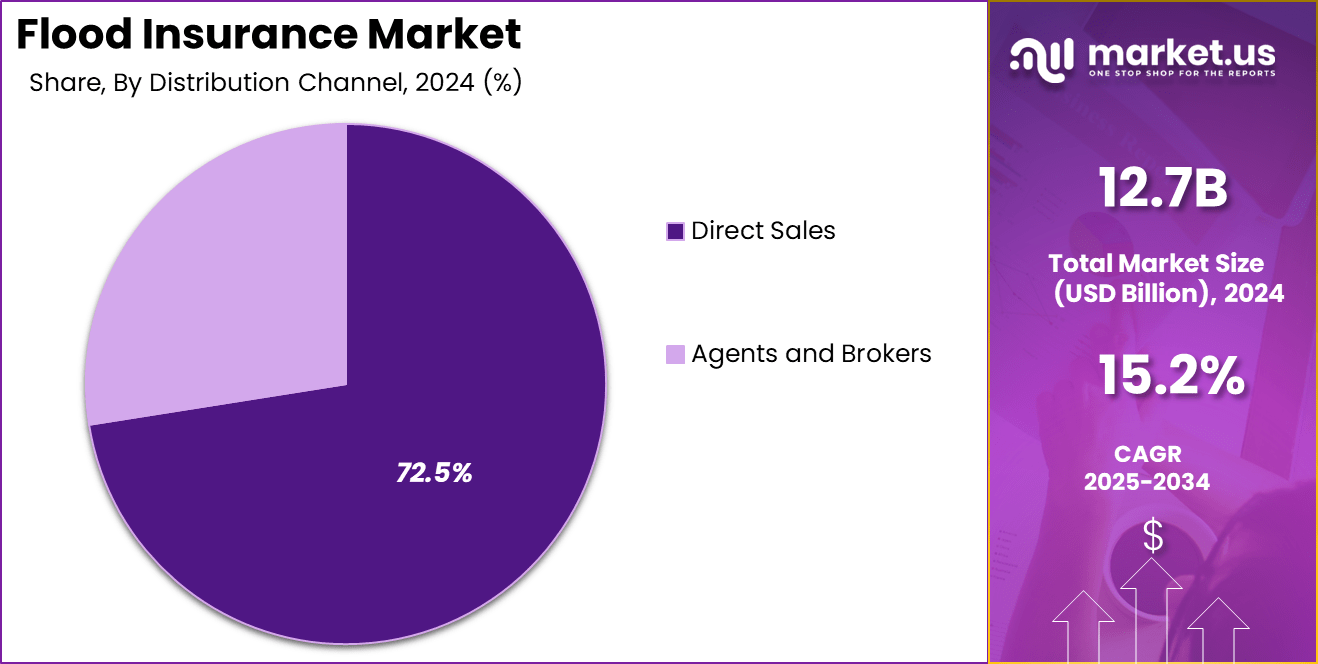

- Direct Sales channels captured 72.5%, indicating strong consumer preference for purchasing insurance directly from providers for better flexibility and transparency.

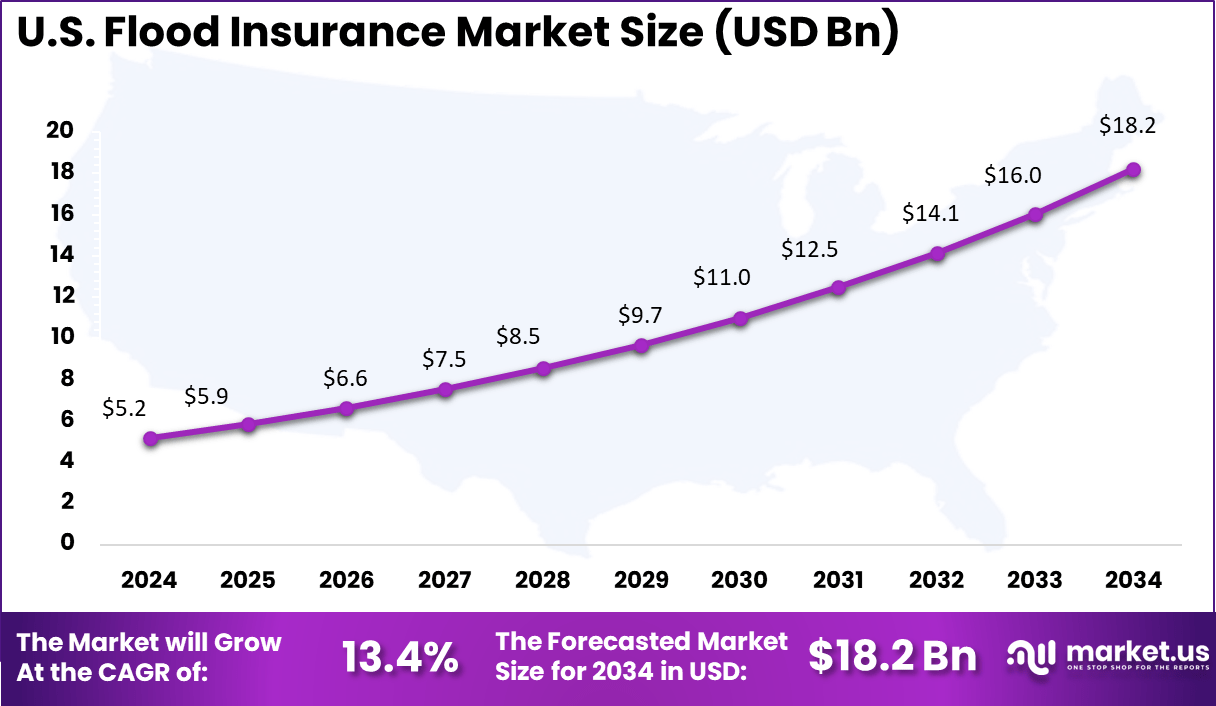

- The US Flood Insurance Market reached USD 5.2 Billion in 2024, expanding at a robust 13.4% CAGR, driven by rising flood incidents and heightened risk awareness.

- North America held a dominant 45.3% share of the global market, supported by advanced risk assessment frameworks and well-established insurance infrastructure.

Role of Generative AI

Generative AI is rapidly transforming the flood insurance sector by enabling far more accurate risk assessments and faster claims processing. In 2025, AI adoption among insurance companies has reached 91%, with AI-driven claims automation reducing processing time by up to 70%. This means flood insurance providers can now assess flood risks with significantly improved precision and speed, offering better service to policyholders.

Furthermore, AI-powered predictive analytics has increased fraud detection by 28%, ensuring that flood claims are more reliable and less prone to false claims, a vital factor for maintaining insurer trust. Generative AI also supports creating real-time flood monitoring systems, enabling granular assessment of flood risks for individual properties.

Satellite data integration and digital twin simulations extend forecast lead times to up to 30 days, dramatically enhancing early warning systems for flood insurance. This technology uplift is empowering insurers to price policies more fairly and tailor coverage, directly benefiting vulnerable communities with quicker claim settlements and more relevant protections.

Specific Country Statistics

Country Flood Insurance Coverage / Scheme Key Statistics (2024-2025) United States National Flood Insurance Program (NFIP) Only about 4% of homeowners have flood insurance; NFIP tracks claims and payouts United Kingdom Flood Re scheme Supported over 660,000 households with subsidized premiums in 2025 Japan Public and private coverage Approximately 75% of residential properties have flood coverage Australia Mandated coverage in Northern Territory Coverage increased by 20–25% since 2018 Germany Natural disaster insurance (includes flood) About 50% of homeowners covered Canada Expanded private market Approximately 40% of homeowners have access to flood coverage India Microinsurance products Coverage available for as little as $3 annually; pilot programs support crop loss compensation U.S. Market Size

In 2024, North America leads the global market with 45.3% share due to well-established insurance frameworks and frequent flood occurrences. The region’s growing urban population and coastal development have made flood insurance a critical financial safety net for both residential and commercial sectors. Enhanced awareness campaigns and data-driven risk modeling are helping boost policy adoption rates.

In the United States, the market size stands at around USD 5.16 billion, expanding at a strong 13.43% CAGR. This growth is supported by increasing private-sector participation complementing NFIP’s efforts and the introduction of flexible pricing models. The U.S. continues to invest in infrastructure analytics and early warning systems to help reduce claim volumes and severity. Together, these initiatives reinforce North America’s leadership in proactive disaster resilience and long-term climate adaptation.

Emerging Trends

One important trend in flood insurance is the rise of digital and AI-driven flood risk tools, which in 2025 improve spatial flood predictions by about 40% over traditional methods. This improvement enables insurers to deliver more precise coverage and better manage payout risks. Alongside this, there has been a significant shift towards pay-as-you-go and usage-based flood insurance models, especially in Europe, designed to broaden access to flood protection for lower-income policyholders.

Another emerging trend is the incorporation of climate change models into flood risk assessments, reflecting the escalating impact of extreme weather events worldwide. Insurers are increasingly integrating latest climate projections into underwriting models, responding to projections that flood risks could rise by over 60% by 2050 in some regions. This trend illustrates a growing move towards dynamic risk pricing and more flexible policies, tailored to evolving environmental conditions.

Growth Factors

Rising frequency and severity of flood events drive the strong demand growth in flood insurance. With expanding urbanization in flood-prone areas and increasing public awareness, more households and businesses seek coverage to protect against financial losses. In the US alone, over 1 million new flood insurance policies were purchased in 2025 following the 2023 storm season, highlighting how extreme weather acts as a direct growth catalyst.

Policy and regulatory mandates also contribute heavily to market expansion by requiring flood insurance in vulnerable zones and boosting investments in flood defense infrastructure. Public funding for mitigation efforts, such as the $1.2 billion FEMA flood mitigation grants in 2025, helps reduce risk and supports insurer confidence in expanding coverage. Combined with advanced flood risk analytics improving underwriting, these factors collectively reinforce the flood insurance market’s momentum.

Coverage Type Analysis

In 2024, Content coverage accounts for about 62.8% of the global flood insurance market. This form of coverage protects personal belongings, furnishings, and assets inside residential and commercial properties. The rising frequency of extreme weather events has prompted homeowners and small businesses to prioritize safeguarding valuables from flood-related losses.

As urban flooding grows more common due to inadequate drainage and climate variability, the demand for comprehensive content protection has notably increased. Insurers are expanding product flexibility by offering tailored coverage options for renters and property owners. Digital policy management and automated claims processing are also making these packages more accessible.

With governments encouraging private participation and awareness of flood risk rising, the focus on protecting household and business contents has shifted from being optional to essential. This steady adoption reflects a growing understanding of how financial resilience begins with protecting possessions most vulnerable to flood damage.

Policy Provider Analysis

In 2024, The National Flood Insurance Program (NFIP) retains around 58.3% of the market share, maintaining its dominant position in the U.S. flood insurance landscape. Administered by the Federal Emergency Management Agency (FEMA), NFIP has become a critical mechanism for ensuring flood coverage availability in high-risk areas.

It bridges the gap between government risk management and private-sector participation by providing standardized policy options and predictable pricing structures. Recently, enhancements in flood risk mapping and digital underwriting have strengthened NFIP’s reach and effectiveness. The program’s collaboration with private insurers under a reinsurance model has also improved capital security and coverage limits.

These developments have built resilience into the national flood insurance framework while sustaining consumer trust. As flood zones continue expanding with changing rainfall patterns, NFIP’s central role in enabling affordable and accessible protection will likely persist.

Distribution Channel Analysis

In 2024, Direct sales dominate with 72.5% of the flood insurance market, reflecting a shift toward digital and self-service purchasing. Consumers prefer direct channels for transparency, faster policy issuance, and real-time claim tracking. The widespread use of online platforms by insurers has reduced dependency on intermediaries, accelerating policy adoption among first-time buyers and small enterprises.

The convenience of online distribution, coupled with simplified premium calculation tools, has created a more user-centered insurance experience. Many insurers are integrating predictive analytics and flood-risk visualization tools into their digital platforms to help clients understand exposure levels before purchasing coverage. This combination of technology and accessibility continues to make direct sales the strongest growth avenue in flood insurance distribution.

Key Market Segments

By Coverage Type

- Building Coverage

- Content Coverage

- Combined Coverage

By Policy Provider

- National Flood Insurance Program (NFIP)

- Private Flood Insurance

By Distribution Channel

- Direct Sales

- Agents and Brokers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Climate Change Increasing Flood Risks

Climate change is driving more frequent and severe flooding events, raising awareness of flood risks and creating a stronger demand for flood insurance. With heavy rainfall, storms, and rising sea levels becoming more common, both homeowners and businesses are increasingly motivated to seek protection against flood damage. This growing urgency pushes insurers to expand coverage options and improve risk assessment capabilities.

The shift in weather patterns also encourages innovation in how insurers evaluate flood risks, such as using advanced data analytics and remote sensing technologies. These tools allow insurers to offer more precise coverage, helping communities better prepare for and recover from flood events.

Restraint Analysis

Affordability Challenges Limit Coverage Uptake

High premiums for flood insurance policies pose a significant barrier to wider adoption, especially in high-risk areas. Many property owners find the cost of coverage prohibitive, particularly those in lower-income groups, leading to fewer people purchasing flood insurance. This affordability issue leaves large populations financially vulnerable when flooding occurs.

The rising costs are partly driven by insurers needing to factor in increased flood risks and losses linked to climate change. As a result, many potential customers opt to remain uninsured, which increases the social and economic burden on governments and relief organizations following flood disasters.

Opportunity Analysis

Technology Enhances Accessibility and Efficiency

Technology is playing a key role in expanding the flood insurance market by making it easier and more efficient for customers to obtain and manage policies. Digital platforms simplify the buying process and provide real-time access to flood risk information, which helps consumers make better decisions about coverage.

Moreover, advancements such as AI-driven risk modeling and automated claims processing enable insurers to assess risk more accurately and respond faster to claims. This improved customer experience helps attract a wider base of clients, including those who previously found the process complex or inaccessible.

Challenge Analysis

Risk Assessment and Pricing Complexity

Assessing flood risk accurately is a major challenge due to the complex and changing nature of factors such as topography, climate variability, and urban development. Traditional methods often fall short in capturing the full scope of flood risk, which can lead to pricing inaccuracies and coverage gaps.

As climate change alters flood patterns, insurers must continually update their models and data inputs, requiring significant investment in research and collaboration with scientific and governmental bodies. Balancing the need for accurate pricing with the goal of maintaining affordable insurance remains a delicate and ongoing challenge for the industry.

Key Players Analysis

The Flood Insurance Market is led by major insurers and underwriting specialists such as Neptune Flood, Nationwide Mutual Insurance Company, Chubb Group, and Assurant, Inc. These companies provide both residential and commercial flood coverage supported by advanced risk modeling and satellite-based flood mapping. Their expertise in underwriting, claims processing, and reinsurance partnerships strengthens their ability to offer customized flood protection products across high-risk regions.

Regional and independent brokerage firms including Pyron Group Insurance, Advisory Insurance Brokers Limited, Sutcliffe Insurance Brokers Limited, Reliant Assurance Brokers LLC, and JMG Insurance Corp. play a vital role in distributing flood insurance products. They focus on localized risk assessment, community outreach, and policy customization to improve coverage accessibility, particularly in flood-prone and underserved markets.

Emerging and specialized players such as FloodFlash Limited, Insurance America LLC, Prizm Solutions Ltd, Hylant Group, Inc., Main Street America Insurance, Pioneer Life (Philippines), and CLIMBS Life & General Insurance Co-op, along with other key participants, are leveraging parametric insurance models and digital underwriting tools. Their focus on rapid claims settlement, IoT-based flood detection, and data-driven pricing continues to modernize the flood insurance landscape and enhance financial resilience against climate-related disasters.

Top Key Players in the Market

- Neptune Flood

- Pyron Group Insurance

- Advisory Insurance Brokers Limited

- FloodFlash Limited

- Insurance America LLC

- Sutcliffe Insurance Brokers Limited

- Nationwide Mutual Insurance Company

- Prizm Solutions Ltd

- Chubb Group

- Hylant Group, Inc.

- Reliant Assurance Brokers LLC

- JMG Insurance Corp

- Main Street America Insurance

- Assurant, Inc.

- The Hartford

- Others

Recent Developments

- October 2025, Neptune Flood went public on the New York Stock Exchange with an IPO raising over 18 million shares priced at $20 each, trading initially at $22.50 per share. This launch came during a U.S. government shutdown that halted the National Flood Insurance Program (NFIP) from processing new policies, giving Neptune an opportunity to attract customers seeking flood insurance amid delays in government-backed coverage.

- May 2025, NormanMax Insurance Holdings acquired FloodFlash, a parametric flood insurance technology company known for sensor-enabled flood coverage. This acquisition integrates FloodFlash’s cutting-edge sensor technology into NormanMax’s parametric insurance platform, aiming to deliver rapid, scalable flood coverage across the U.S., U.K., and other markets.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Bn Forecast Revenue (2034) USD 52.2 Bn CAGR(2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Building Coverage, Content Coverage, Combined Coverage), By Policy Provider (National Flood Insurance Program (NFIP), Private Flood Insurance), By Distribution Channel (Direct Sales, Agents and Brokers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Neptune Flood, Pyron Group Insurance, Advisory Insurance Brokers Limited, FloodFlash Limited, Insurance America LLC, Sutcliffe Insurance Brokers Limited, Nationwide Mutual Insurance Company, Prizm Solutions Ltd, Chubb Group, Hylant Group Inc., Reliant Assurance Brokers LLC, JMG Insurance Corp, Main Street America Insurance, Assurant Inc., The Hartford, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Neptune Flood

- Pyron Group Insurance

- Advisory Insurance Brokers Limited

- FloodFlash Limited

- Insurance America LLC

- Sutcliffe Insurance Brokers Limited

- Nationwide Mutual Insurance Company

- Prizm Solutions Ltd

- Chubb Group

- Hylant Group, Inc.

- Reliant Assurance Brokers LLC

- JMG Insurance Corp

- Main Street America Insurance

- Assurant, Inc.

- The Hartford

- Others