Global Flight Tracking System Market Size, Share, Statistics Analysis Report By System (ADS-B, FANS, PFTS), By End-Use (General Aviation, Civil Aviation, Military Aircraft), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133066

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

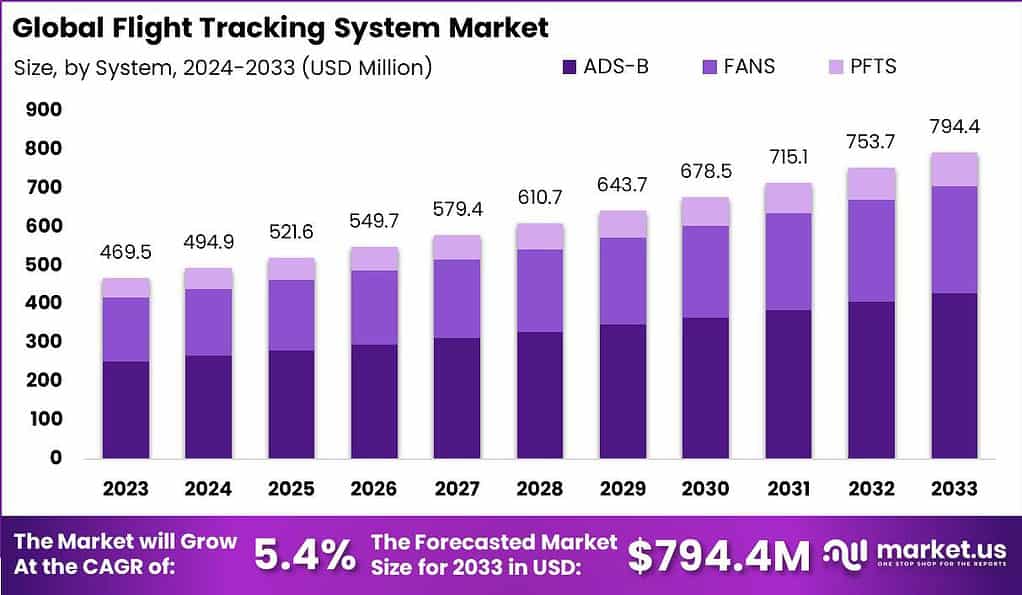

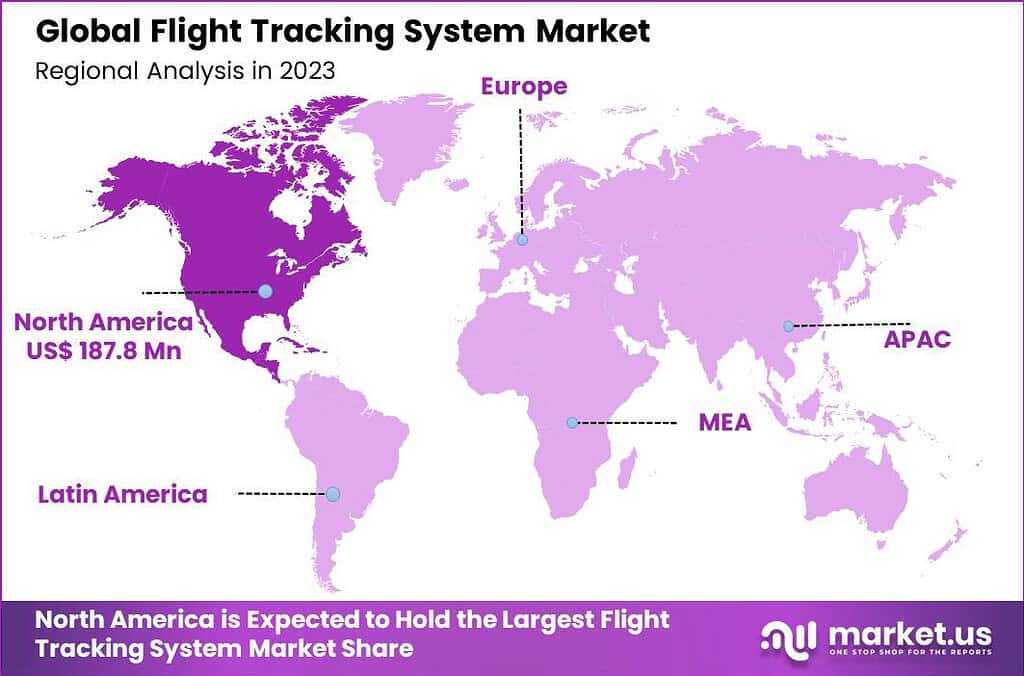

The Global Flight Tracking System Market size is expected to be worth around USD 794.4 Million By 2033, from USD 469.5 Million in 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033. In 2023, North America maintained a leading position in the Flight Tracking System Market, accounting for over 40% of the market share and generating around USD 187.8 million in revenue.

A Flight Tracking System is a technological solution that enables the real-time monitoring of aircraft positions, movements, and related data throughout their journeys. Utilizing a combination of satellite navigation, radar, and communication systems, these platforms provide accurate information on an aircraft’s location, altitude, speed, and trajectory.

The flight tracking system market is increasingly crucial due to the growing need for real-time data in aviation. As air traffic continues to rise, the demand for robust flight tracking solutions that can provide comprehensive coverage and precise tracking, even in remote areas, is escalating. This market benefits significantly from the integration of advanced technologies like ADS-B and satellite tracking, which help fill coverage gaps left by traditional radar systems.

The primary driving factor behind the expansion of the flight tracking system market is the increasing emphasis on safety and regulatory compliance. Aviation authorities worldwide, including the International Civil Aviation Organization (ICAO), have been implementing stringent standards that require airlines to equip with sophisticated tracking systems. This regulatory push is in response to past aviation disasters, compelling airlines to upgrade their tracking capabilities to ensure better management of flight operations and enhance safety measures.

There is a significant demand in the flight tracking system market driven by the aviation industry’s need to enhance the overall safety and efficiency of flight operations. The demand is further fueled by the need for airlines to provide up-to-date flight information to passengers and to improve the coordination of operations, especially in response to emergency situations. The ability to track aircraft in real-time over any part of the world, including remote and oceanic regions, has become a critical requirement for many operators.

The flight tracking system market presents numerous opportunities, particularly in technological innovation and expansion into new regions. As the global aviation network grows and more regions adopt modern air traffic management practices, there is potential for the development and deployment of more advanced tracking technologies. Companies that can offer comprehensive solutions that integrate seamlessly with existing avionics and offer real-time data access are particularly well-positioned to capitalize on these opportunities.

Technological advancements in the flight tracking system sector focus on enhancing data accuracy and speed, with real-time processing and communication capabilities. Innovations such as satellite-based ADS-B and multi-source data integration allow for minute-by-minute tracking of aircraft anywhere in the globe. Future enhancements are likely to include improved bandwidth management, which could lower costs and enhance the functionality of tracking systems, allowing for more detailed and frequent updates and broader adoption across the aviation industry.

According to RadarBox, approximately 156,613 flights are tracked daily on average, marking a notable 8% decrease compared to the previous year. Within this total, 10,855 business flights are monitored each day, reflecting the steady demand for corporate travel despite the overall decline. Cargo flights account for an average of 3,942 flights daily, underscoring the vital role of air freight in global supply chains. At any given moment, about 10,412 flights are airborne worldwide, highlighting the dynamic nature of air traffic across continents.

Key Takeaways

- The Global Flight Tracking System Market size is projected to reach USD 794.4 million by 2033, up from USD 469.5 million in 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

- In 2023, the ADS-B (Automatic Dependent Surveillance-Broadcast) segment dominated the market, holding over 54% of the share within the Flight Tracking System Market.

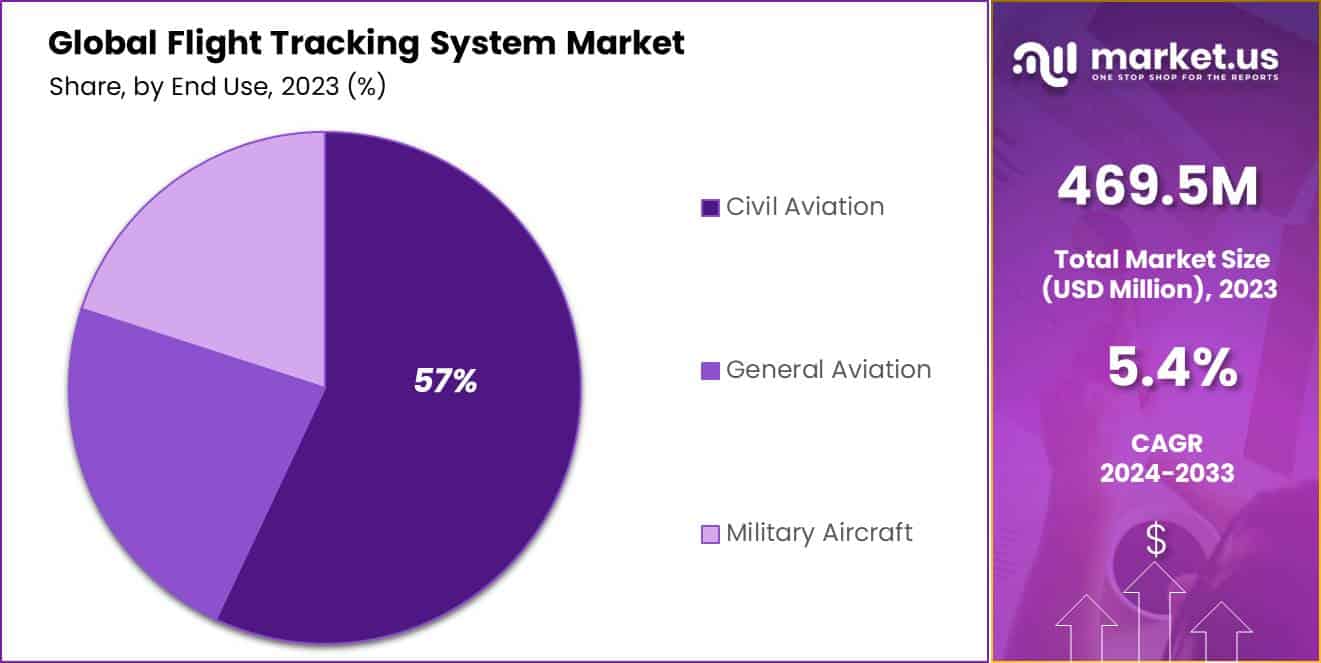

- The Civil Aviation segment also held a dominant market position in 2023, capturing more than 57% of the market share. This dominance can be attributed to the strict regulatory requirements and safety standards imposed on commercial airlines.

- North America led the Flight Tracking System Market in 2023, holding more than 40% of the market share, with a revenue of approximately USD 187.8 million.

System Analysis

In 2023, the ADS-B (Automatic Dependent Surveillance-Broadcast) segment maintained a dominant position within the flight tracking system market, holding a significant share of over 54%. This prominence can be attributed to its widespread implementation and technological superiority, which offers precise real-time tracking and positioning of aircraft. The system enhances aviation safety and operational efficiency, contributing to its leading status in the market.

The ADS-B system functions by having aircraft transmit their GPS-derived location data to air traffic control and other nearby aircraft, facilitating enhanced situational awareness. This capability is not only mandated in numerous regions but also integrates seamlessly with existing air traffic management systems, increasing its adoption rate. The effectiveness of ADS-B in improving airspace utilization and reducing the risk of mid-air collisions has been recognized by regulatory bodies, further bolstering its market share.

Moreover, the adoption of ADS-B is propelled by its compatibility with future technological advancements and potential integration with emerging technologies such as AI and machine learning. These technologies promise to refine predictive capabilities in air traffic management, thereby opening new avenues for market growth. The global expansion in air traffic and passenger volumes continues to drive the demand for reliable flight tracking systems, positioning ADS-B as a critical component in modern aviation infrastructure.

This segment’s robust position is supported by ongoing innovations and enhancements, which aim to maintain its relevance and efficacy in addressing the evolving demands of air traffic management and safety regulations. As the aviation industry continues to focus on enhancing operational efficiencies and safety, the ADS-B segment is expected to sustain its market dominance

End-Use Analysis

In 2023, the civil aviation segment held a dominant market position in the flight tracking system market, capturing more than a 57% share. This substantial market share is primarily driven by the high volume of flights operated by commercial airlines compared to general and military aviation. The expansive and increasing global air traffic demands robust flight tracking systems to ensure operational efficiency and enhance passenger safety, significantly contributing to the segment’s dominance.

The rise in global passenger traffic has been a key driver for the civil aviation segment. As air travel becomes more accessible and frequent, the reliance on sophisticated flight tracking technologies grows to manage the dense traffic and maintain safety standards. The civil aviation market’s needs are also evolving, pushing for advancements in real-time tracking and comprehensive surveillance to mitigate risks and improve the management of flight operations.

Furthermore, the ongoing expansion of international and domestic flight routes has necessitated the adoption of advanced tracking systems. These systems are crucial for optimizing flight paths, reducing delays, and providing accurate flight information to passengers and airport authorities. The increase in demand for these systems within civil aviation is also propelled by stringent regulatory requirements that mandate the use of sophisticated tracking technologies to ensure aircraft are monitored continuously throughout their journeys.

Key Market Segments

By System

- ADS-B

- FANS

- PFTS

By End-Use

- General Aviation

- Civil Aviation

- Military Aircraft

Driver

Regulatory Pressure and Enhanced Safety Requirements

One of the key drivers behind the growth of the Flight Tracking System market is the increasing regulatory pressure and the heightened focus on aviation safety.

Aviation authorities around the world, including the International Civil Aviation Organization (ICAO) and various regional regulatory bodies, have introduced stricter safety mandates. One of the most notable regulations is the requirement for continuous flight tracking, particularly in areas with limited radar coverage, like oceans or remote regions.

This regulation, which came into effect for international flights, mandates that airlines must be able to track aircraft in real-time, no matter where they are in the world. The goal is to increase situational awareness for both pilots and air traffic controllers, enabling quick action in the event of an emergency.

Restraint

High Cost of Implementation and Operational Challenges

One significant restraint in the widespread adoption of flight tracking systems is the high cost of implementation and maintenance. The investment required to install and operate these systems is substantial, making it a significant barrier for smaller airlines and operators, particularly in developing regions.

The upfront costs include purchasing and installing hardware such as GPS units, satellite communication systems, and necessary data transmission technology. For existing fleets, retrofitting older aircraft to support modern tracking systems can add further costs. Additionally, ongoing operational expenses, such as paying for satellite connectivity, software updates, and system maintenance, are recurring costs that airlines must factor into their budgets.

Opportunity

Integration of AI and Predictive Analytics

The integration of Artificial Intelligence (AI) and predictive analytics into flight tracking systems presents a promising opportunity for the aviation industry. By leveraging AI-driven solutions, airlines and aviation authorities can go beyond mere tracking to derive actionable insights from vast amounts of flight data.

Predictive analytics enables the forecasting of potential flight delays, optimizing route planning, and enhancing fuel efficiency, which results in cost savings and improved customer experiences. This intelligent analysis of data can also predict weather patterns and airspace congestion, allowing for more proactive decision-making by pilots and air traffic controllers.

AI-powered flight tracking systems have the capability to detect anomalies in flight behavior or unexpected deviations from planned routes. Such systems can automatically alert ground control and provide recommendations for corrective actions, thereby improving the safety and reliability of air travel.

Challenge

Cross-Border Compatibility

Given that aviation is a global industry, flight tracking systems must adhere to a complex array of regulations and standards set forth by international aviation bodies and national authorities. Different countries have varying requirements for data collection, usage, and transmission, making it challenging for airlines to ensure compliance on international routes. Harmonizing these regulations to allow seamless tracking across borders remains a significant obstacle for the industry.

Moreover, compliance with data protection and privacy laws adds further challenges. Many jurisdictions enforce strict controls on how flight data is stored and shared, and the aviation industry must navigate these rules carefully. Adhering to these regulations often entails implementing extensive data security measures, which can be both costly and time-consuming.

Latest Trends

Flight tracking systems have evolved significantly, embracing new technologies to enhance safety, efficiency, and passenger experience. A notable trend is the integration of Artificial Intelligence (AI) and machine learning into these systems. AI enables predictive analytics, allowing airlines to anticipate potential disruptions by analyzing historical flight data and current conditions.

Another advancement is the use of Augmented Reality (AR) overlays in flight tracking. AR provides real-time visualizations of flight paths and air traffic, assisting pilots and air traffic controllers in making informed decisions. This technology enhances situational awareness, contributing to safer skies.

Data visualization tools have become more sophisticated, offering intuitive interfaces that present complex flight data in easily understandable formats. These tools aid in efficient decision-making and improve communication among aviation stakeholders.

Business Benefits

Implementing advanced flight tracking systems offers numerous advantages for aviation businesses. One significant benefit is the enhancement of operational efficiency. Real-time tracking allows airlines to monitor flight progress accurately, enabling timely adjustments to flight paths and schedules. This adaptability leads to reduced fuel consumption and cost savings.

Safety is another critical area where flight tracking systems make a substantial impact. Continuous monitoring of aircraft positions and conditions enables prompt responses to any anomalies, thereby reducing the risk of accidents. In distress situations, precise location data facilitates quicker search and rescue operations, potentially saving lives.

Moreover, the data collected through these systems can be analyzed to identify trends and areas for improvement. Airlines can optimize routes, enhance fuel efficiency, and improve overall service quality based on insights gained from flight data.

Regional Analysis

In 2023, North America held a dominant market position in the Flight Tracking System Market, capturing more than a 40% share and generating revenue of approximately USD 187.8 million. This leading stance can be attributed to several factors that underscore the region’s robust aviation infrastructure and stringent safety regulations.

The prominence of North America in this market primarily stems from the high volume of air traffic and the presence of major airline companies in the region, which necessitate advanced tracking systems to ensure operational efficiency and safety. The U.S., in particular, has one of the busiest airspaces in the world, with both domestic and international flights requiring rigorous monitoring and tracking.

Also, regulatory bodies such as the Federal Aviation Administration (FAA) have been instrumental in mandating the use of sophisticated tracking technologies like ADS-B. These regulations, aimed at enhancing navigational safety and efficiency, have driven the rapid adoption of flight tracking systems across the continent.

North America is a hub for technological innovation, with many leading companies in the flight tracking system market based here. This proximity to innovation accelerates the adoption of new technologies in the region’s aviation sector. The ongoing investments in research and development in flight tracking technologies by these companies further reinforce North America’s leading position in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The flight tracking system market features several key players, each contributing uniquely to the industry’s growth and innovation.

Airbus SAS (NAVBLUE) stands out as a leading innovator in the flight tracking system market. NAVBLUE, a subsidiary of Airbus, offers a range of flight operations solutions that integrate seamlessly with existing airline systems to enhance operational efficiency and safety.

ACR Electronics, Inc. specializes in creating safety and survival technologies for both aviation and marine industries. ACR’s commitment to high-quality products has earned them strong reputation among smaller and general aviation operators , highlighting their role in enhancing safety across various aviation sectors.

Aireon has revolutionized the flight tracking system market by introducing space-based ADS-B technology. This innovation allows for real-time tracking of aircraft across the globe, including over oceans and remote areas where ground-based systems have limitations.

Top Key Players in the Market

- Airbus SAS (NAVBLUE)

- ACR Electronics Inc.

- Aireon

- AirNav Systems LLC

- Blue Sky Network

- FLYHT Aerospace Solutions Ltd.

- Garmin Ltd.

- Honeywell International Inc.

- Raytheon Technologies Corporation

- SITA

- IBM Corporation

- Spider Tracks Limited

- Sabre

- Lufthansa Systems

- Other Key Players

Recent Developments

- In April 2023, Lufthansa Systems launched Lido Flight 4D, an advanced flight planning solution designed to optimize flight routes and improve operational efficiency.

- In March 2023, FLYHT introduced the AFIRS Edge, an advanced flight data recorder and real-time data streaming device aimed at improving flight tracking and operational efficiency.

- In August 2024, Qantas upgraded its mobile app to include an Inbound Flight Tracking feature. This allows passengers to monitor the status of the aircraft scheduled for their flight, enhancing the customer experience.

Report Scope

Report Features Description Market Value (2023) USD 469.5 Mn Forecast Revenue (2033) USD 794.4 Mn CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By System (ADS-B, FANS, PFTS), By End-Use (General Aviation, Civil Aviation, Military Aircraft) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airbus SAS (NAVBLUE), ACR Electronics Inc., Aireon, AirNav Systems LLC, Blue Sky Network, FLYHT Aerospace Solutions Ltd., Garmin Ltd., Honeywell International Inc., Raytheon Technologies Corporation, SITA, IBM Corporation, Spider Tracks Limited, Sabre, Lufthansa Systems, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flight Tracking System MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Flight Tracking System MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Airbus SAS (NAVBLUE)

- ACR Electronics Inc.

- Aireon

- AirNav Systems LLC

- Blue Sky Network

- FLYHT Aerospace Solutions Ltd.

- Garmin Ltd.

- Honeywell International Inc.

- Raytheon Technologies Corporation

- SITA

- IBM Corporation

- Spider Tracks Limited

- Sabre

- Lufthansa Systems

- Other Key Players