Global Flexible Plastic Pouches Market By Material(Polyethylene, Polypropylene, Cast Polypropylene, Other Materials), By Type(Flat Pouches, Stand-up Pouches), By Application(Food & Beverages, Personal Care & Homecare, Healthcare, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 74480

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

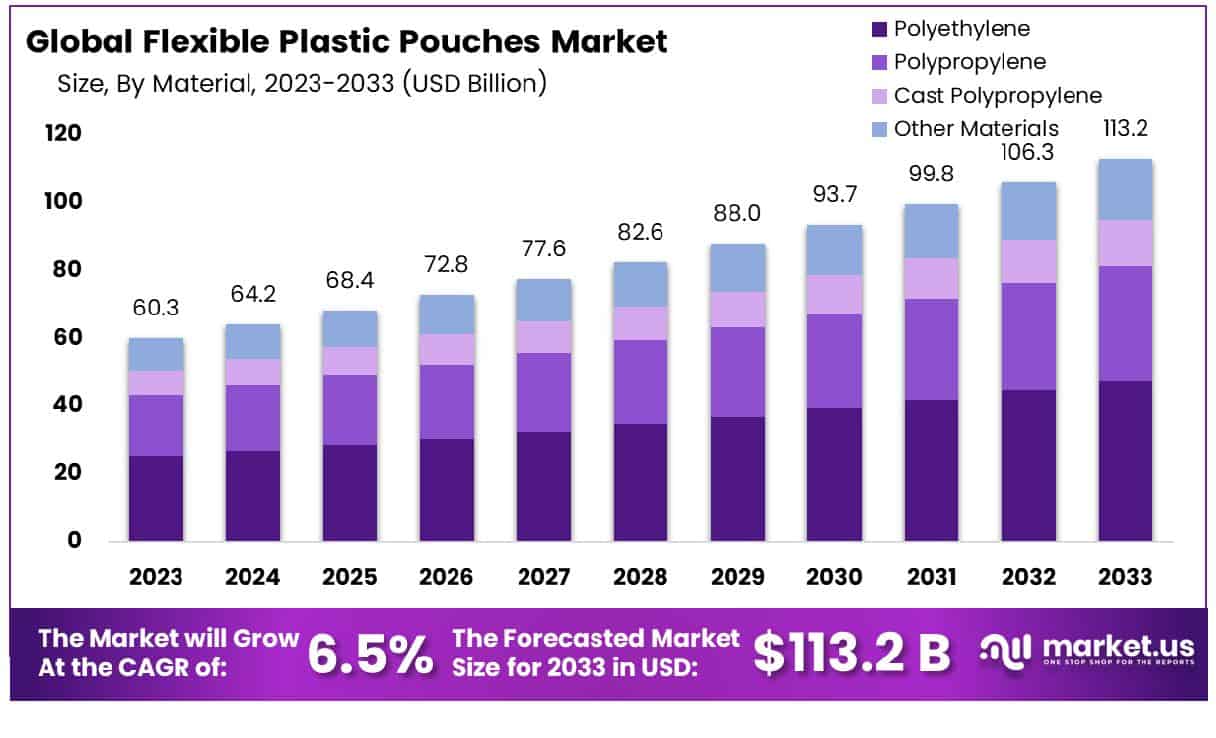

The Global Flexible Plastic Pouches Market size is expected to be worth around USD 113.2 Billion by 2033, From USD 60.3 Billion by 2023, growing at a CAGR of 6.50% during the forecast period from 2024 to 2033.

The Flexible Plastic Pouches Market refers to a rapidly evolving sector within the packaging industry, primarily focused on offering lightweight, cost-effective, and versatile packaging solutions. Characterized by their use of various flexible plastic materials, these pouches are designed to enhance product preservation, extend shelf life, and provide superior barrier protection against moisture, gases, and contaminants. This market caters to a diverse range of end-use industries including food & beverages, healthcare, personal care, and household products, among others.

Innovations in recyclable and biodegradable plastic materials are further propelling the demand, as businesses and consumers increasingly prioritize sustainability. The market’s growth is driven by the continuous development of smart packaging technologies, consumer preferences for convenient and sustainable packaging options, and the global expansion of the retail sector. Executives and product managers in the aforementioned industries are strategically positioned to leverage these market insights for competitive advantage, aligning product development and marketing strategies with emerging consumer trends and regulatory requirements.

The packaging industry has witnessed a significant shift towards flexible plastic packaging, attributed to its adaptability, efficiency, and cost-effectiveness. This trend encapsulates the use of various plastic materials, including polyethylene, polypropylene, polystyrene, and polyvinyl chloride, to package a wide array of products ranging from food items to pharmaceuticals. The choice of packaging material is intricately linked to the specific requirements of the product being packaged, ensuring optimal preservation and distribution.

Flexible plastic packaging is increasingly favored for its ability to extend the shelf life of products, thereby enhancing distribution efficiency and minimizing losses. This method of packaging is considered the most practical and economical solution for preserving, distributing, and packaging an extensive range of products. The environmental footprint of packaging is also a critical consideration, with many flexible pouches designed to be reusable and more environmentally friendly compared to traditional alternatives such as glass, metal, and cardboard containers.

However, the proliferation of plastic packaging raises significant environmental concerns. Over 320 trillion tons of plastic were produced in 2016, a figure that is projected to double by 2034. Alarmingly, the world generates 381 million tonnes of plastic waste annually, a number also expected to double by 2034, with half of this waste attributed to single-use plastics. Since the inception of plastic production in 1950, over 9 billion metric tonnes have been manufactured, yet only approximately 6.5% of this has been recycled. This underscores the urgent need for sustainable practices within the packaging industry to mitigate the environmental impact of plastic waste.

Key Takeaways

- Market Growth: The market is witnessing substantial growth, with the market value expected to rise from US$ 60.3 billion in 2023 to US$ 113.2 billion in 2032, indicating a Compound Annual Growth Rate (CAGR) of 6.50%.

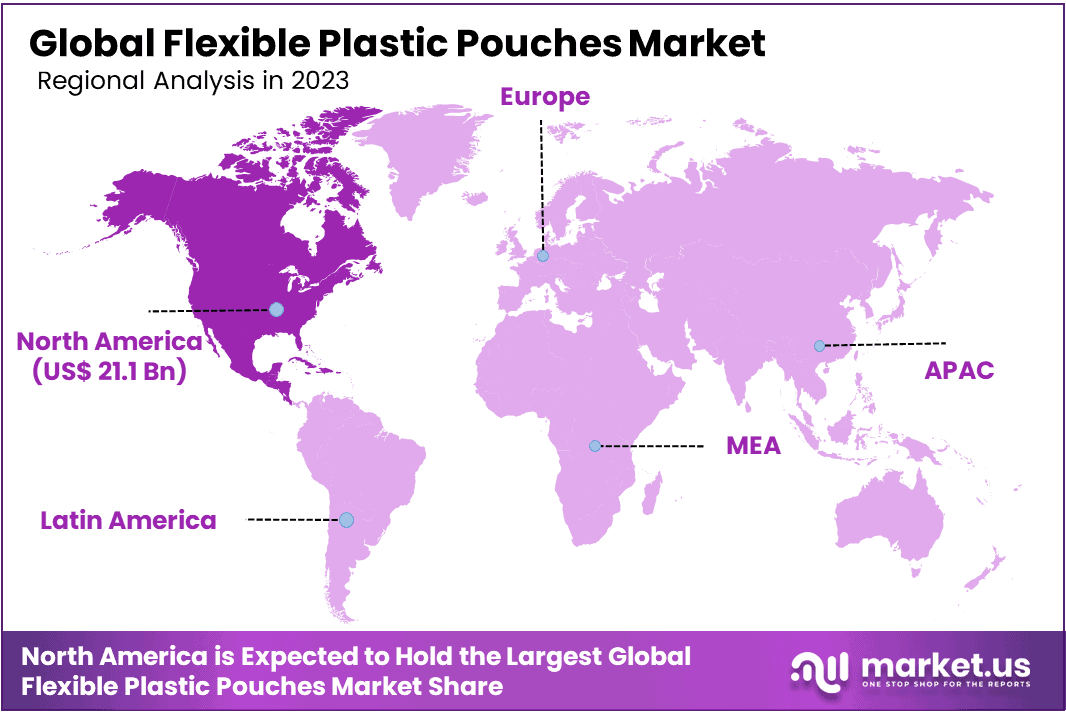

- Regional Dominance: North America emerges as the dominant region, holding 35% of the market share. This signifies a strong market presence and demand within the North American region.

- Segmentation Insights:

- By Material: Polyethylene holds the majority share at 42%, indicating a preference for this material type in the production of flexible plastic pouches.

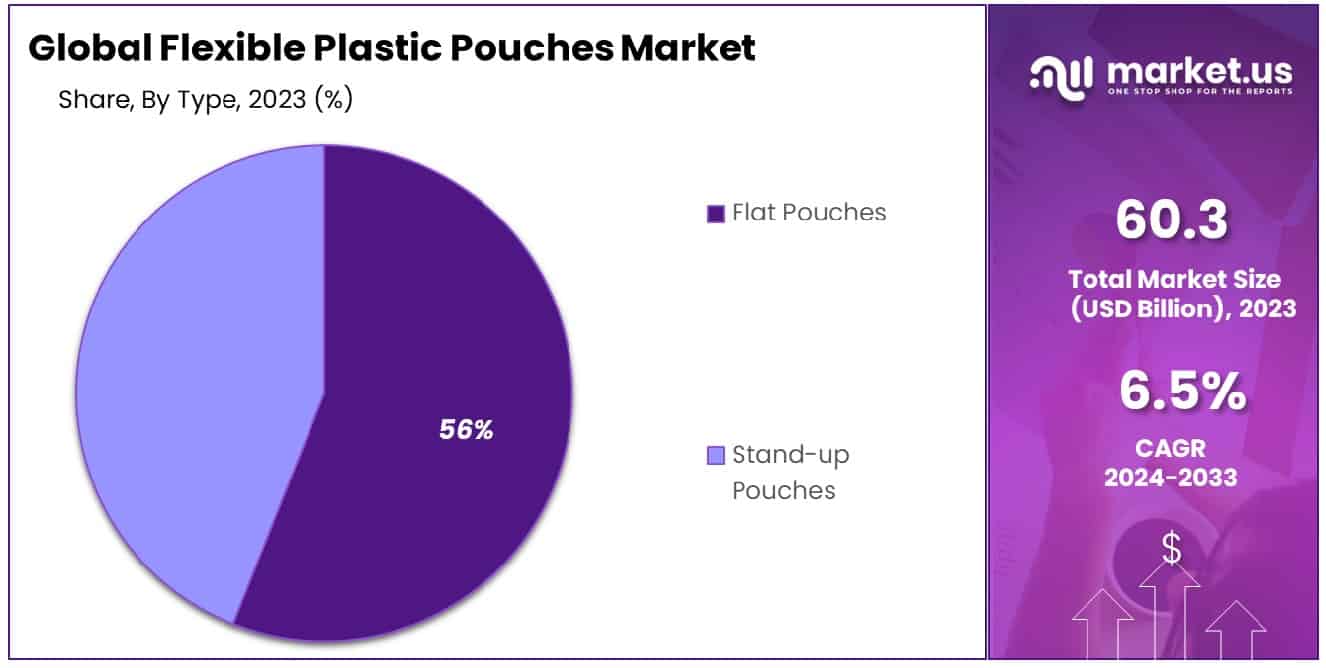

- By Type: Flat pouches constitute a significant portion of the market at 56%, showcasing their popularity and widespread use among consumers.

- By Application: Healthcare emerges as a dominant application sector, capturing 38% of the market demand. This indicates a substantial utilization of flexible plastic pouches within the healthcare industry.

- Market Dynamics: The Flexible Plastic Pouches Market displays a dynamic landscape shaped by several key market dynamics and an intricate industry analysis. This demand fosters the innovation and development of flexible plastic pouches that cater to varied lifestyles. Simultaneously, advancements in manufacturing techniques and materials play a pivotal role, in enhancing product durability, sustainability, and functional attributes.

- Industry Analysis: These industry leaders play a pivotal role in meeting diverse packaging needs across sectors, steering the market toward sustained growth and innovation. As market dynamics evolve and consumer preferences continue to evolve, the Flexible Plastic Pouches Market remains primed for further expansion, adaptation, and continued innovation to meet the evolving demands of a dynamic consumer base and regulatory landscape.

Driving Factors

Rising Demand for Convenient Packaging Solutions

The flexible plastic pouches market is experiencing significant growth, primarily driven by the increasing consumer demand for convenient and lightweight packaging options. This trend is particularly evident in the food and beverage industry, where the need for extended shelf life, coupled with the convenience of resealable and easy-to-use packaging, is paramount. Flexible plastic pouches, with their ability to provide superior protection against moisture, oxygen, and contaminants, have emerged as an ideal solution for on-the-go consumption and portion control, further fuelling their adoption across various sectors.

According to the Associated Chambers of Commerce and Industry of India (ASSOCHAM), packaged food yearly spending in India increased by 22.5% annually from 2010 to 2015. Surging westernization levels, as well as an increase in the shelf life, and a preference for convenience foods, all contribute to a surge in the demand for packaged food pouches.

Sustainability Initiatives and Material Innovations

Another pivotal driver for the expansion of the flexible plastic pouches market is the escalating emphasis on sustainability and environmental consciousness among consumers and manufacturers alike. The industry is witnessing a shift towards the use of bio-based polymers and recycling-friendly materials in pouch manufacturing, aimed at reducing the environmental footprint of packaging waste. Innovations in material science have enabled the development of more recyclable and biodegradable pouch options, aligning with global sustainability goals. This shift not only caters to the regulatory pressures and consumer preferences for eco-friendly packaging solutions but also opens up new market opportunities for sustainable product offerings.

Restraining Factors

Environmental Regulations and Sustainability Concerns

The growth of the flexible plastic pouches market is significantly hampered by stringent environmental regulations and increasing sustainability concerns. Governments worldwide are implementing strict regulations aimed at reducing plastic waste, compelling manufacturers to seek environmentally friendly alternatives. The push for sustainability is influencing consumer preferences, with a growing demand for biodegradable and recyclable packaging solutions. This shift poses a challenge to the flexible plastic pouches sector, as the industry strives to balance cost-effectiveness with eco-friendly practices. The need for innovation in sustainable packaging materials and processes is becoming crucial, as companies navigate the complex landscape of regulatory compliance and consumer expectations.

Competitive Pressure from Alternative Packaging Solutions

Another major restraint facing the flexible plastic pouches market is the intense competition from alternative packaging options, such as rigid containers, glass jars, and paper-based packaging. These alternatives offer distinct advantages in terms of sustainability, durability, and consumer perception. Rigid packaging, for example, often provides better protection for certain products and is perceived by consumers as being more sustainable due to its recyclability. The versatility and aesthetic appeal of glass and paper-based packaging further intensify the competitive landscape. As a result, manufacturers of flexible plastic pouches must innovate and improve their products’ functionality, sustainability, and cost-efficiency to maintain market share and attract environmentally conscious consumers.

Material Analysis

Polyethylene Holds A 42% Market Share In Its Material Category.

In 2023, Polyethylene held a dominant market position in the material segment of the Flexible Plastic Pouches Market, capturing more than a 42% share. This segment encompasses various materials including Polyethylene, Polypropylene, Cast Polypropylene, and Other Materials. The preeminence of Polyethylene in this sector can be attributed to its superior properties, such as flexibility, durability, and moisture resistance, making it highly sought after for packaging applications across numerous industries.

Polypropylene followed, benefiting from its thermal resistance and strength, which are critical for products requiring sterilization and high-temperature processing. Cast Polypropylene, known for its clarity and heat-sealability, also carved out a significant niche, appealing particularly to markets prioritizing product visibility and packaging integrity.

The ‘Other Materials’ category, comprising a mix of alternative polymers and innovative composites, addressed specific needs not met by the more common materials, underscoring the market’s adaptability and responsiveness to evolving consumer demands and environmental considerations. This diversified material portfolio underscores the Flexible Plastic Pouches Market’s dynamic nature, driven by technological advancements, sustainability concerns, and shifting consumer preferences.

Type Analysis

Flat Pouches Command A 56% Market Share Within Their Type.

In 2023, within the type segment of the Flexible Plastic Pouches Market, Flat Pouches and Stand-up Pouches emerged as key categories. Flat Pouches held a dominant market position, capturing more than a 56% share. This substantial market share can be attributed to the cost-effectiveness, lightweight nature, and ease of transportation offered by Flat Pouches, making them a preferred choice for manufacturers and consumers alike. In contrast, Stand-up Pouches, while offering the advantage of better visibility on retail shelves and enhanced convenience for users, accounted for a lesser share of the market.

The preference for Flat Pouches underscores the market’s inclination toward packaging solutions that combine economic viability with functional efficiency. Despite the smaller share, Stand-up Pouches continue to gain traction, driven by consumer demand for user-friendly packaging and the ongoing innovation by manufacturers to enhance pouch functionality. This dynamic indicates a competitive landscape within the Flexible Plastic Pouches Market, where product innovation and consumer preferences play pivotal roles in shaping market trends. The sustained growth of Flat Pouches, coupled with the emerging preference for Stand-up Pouches, highlights the diverse needs and opportunities within this segment, offering insights into potential areas for innovation and growth.

Application Analysis

In 2023, the Flexible Plastic Pouches Market was segmented into various applications, with Healthcare, Food & Beverages, Personal Care & Homecare, and Other Applications being the primary segments. Healthcare held a dominant market position, capturing more than a 38% share. This significant market share can be attributed to the increasing demand for flexible packaging solutions in the pharmaceutical and medical sectors, driven by factors such as the need for durable, lightweight, and barrier-protected packaging to ensure product integrity and extend shelf life.

The Food & Beverages segment also showcased a substantial share, benefiting from the rising consumer preference for convenient, on-the-go packaging options that offer enhanced freshness and are easy to use. Personal Care & Homecare followed, leveraging the growing consumer awareness towards personal hygiene and the demand for cost-effective, aesthetically pleasing packaging solutions. Other Applications encompassed a diverse range of markets, including industrial and consumer goods, which are gradually embracing flexible plastic pouches for their versatility and sustainability advantages.

The growth of the Flexible Plastic Pouches Market in the Healthcare segment, in particular, underscores the critical role of advanced packaging solutions in meeting the stringent standards of the medical industry, while also catering to the evolving needs of food safety, consumer convenience, and environmental sustainability across other segments.

Key Market Segments

By Material

- Polyethylene

- Polypropylene

- Cast Polypropylene

- Other Materials (PVC, EVOH, and Polyamide)

By Type

- Flat Pouches

- Stand-up Pouches

By Application

- Food & Beverages

- Personal Care & Homecare

- Healthcare

- Other Applications (Oil and lubricants, Auto Glass Wipes, Agricultural Products, Lawn and Garden Products, and Paints)

Growth Opportunities

Expansion into Emerging Markets

The global flexible plastic pouches market is poised for significant growth, driven by the expansion into emerging markets. These regions, characterized by rising disposable incomes and the burgeoning retail sector, present fertile ground for the adoption of flexible packaging solutions. The convenience, durability, and cost-effectiveness of flexible plastic pouches align with the consumption patterns and preferences observed in these markets. Furthermore, the ongoing shift towards modern retail formats, such as supermarkets and online shopping platforms, amplifies the demand for flexible packaging solutions that cater to consumer convenience and extended shelf life requirements. The growth potential in emerging markets can be attributed to the integration of advanced packaging technologies, enabling the development of innovative pouch designs that offer enhanced functionality and appeal to a wider consumer base.

Sustainability-Driven Innovations

Sustainability-driven innovations represent another significant growth opportunity for the flexible plastic pouches market in 2023. The escalating environmental concerns and stringent regulatory frameworks are compelling manufacturers to explore eco-friendly alternatives. Biodegradable and recyclable materials are being increasingly adopted in pouch manufacturing, reducing the environmental footprint and appealing to the eco-conscious consumer. Moreover, advancements in material science have facilitated the creation of lighter, yet durable, packaging solutions, optimizing material use and logistics efficiency. These innovations not only address environmental challenges but also align with consumer preferences for sustainable packaging options. The market’s responsiveness to sustainability trends is indicative of its capacity for adaptation and growth, positioning flexible plastic pouches as a key player in the future of environmentally responsible packaging solutions.

Latest Trends

Smart Packaging Technologies

Integration of smart technologies into flexible plastic pouches is emerging as a key trend, enhancing product functionality and consumer engagement. Smart pouches equipped with QR codes, NFC tags, and RFID technology enable brands to offer augmented reality experiences, track products through the supply chain, and provide consumers with detailed product information. This trend is propelled by the growing need for brand differentiation and the increasing importance of transparent product narratives. Smart packaging solutions are not only enhancing consumer experience but also playing a crucial role in anti-counterfeiting measures.

High-Barrier Packaging Materials

The demand for high-barrier packaging materials in the flexible plastic pouches market is escalating, driven by the need to extend shelf life and ensure product safety for food, pharmaceuticals, and cosmetic products. High-barrier pouches offer superior protection against moisture, oxygen, and contaminants, thereby maintaining the quality and freshness of the contents. Innovations in material science and layering technologies are enabling the development of thinner, yet more effective barrier materials. This trend reflects the industry’s response to consumer demands for longer-lasting and safer products, highlighting a significant growth opportunity for manufacturers specializing in high-barrier solutions.

Regional Analysis

In the Flexible Plastic Pouches Market, North America holds a dominant position, accounting for 35% of the global market share.

The global market for flexible plastic pouches is witnessing a significant transformation, driven by evolving consumer preferences, technological advancements, and sustainability concerns. In North America, the market is characterized by a robust demand for convenient, lightweight packaging solutions, accounting for approximately 35% of the global market share. This dominance can be attributed to the region’s advanced food and beverage industry, where flexible plastic pouches are increasingly favored for their cost-effectiveness and reduced environmental footprint. North America’s commitment to sustainability and innovation has spurred the development of recyclable and biodegradable pouch solutions, further solidifying its market position.

Europe follows closely, with a strong emphasis on regulatory compliance and environmental sustainability. The European market is propelled by stringent EU regulations concerning packaging waste and recycling targets. These regulations have encouraged the adoption of eco-friendly packaging alternatives, driving the market growth for flexible plastic pouches. The region’s focus on circular economy principles has led to increased investment in sustainable packaging technologies, enhancing its market share.

The Asia Pacific region presents the most promising growth opportunities, fueled by rapid urbanization, increasing disposable incomes, and the expanding retail sector. Countries such as China and India are at the forefront, with their burgeoning consumer goods industries demanding innovative packaging solutions. The region’s market is characterized by a high demand for flexible packaging in the food, pharmaceutical, and personal care sectors, making it a critical area for expansion and innovation.

Meanwhile, the Middle East & Africa, and Latin America regions are experiencing steady growth, driven by economic development and increasing consumer awareness about sustainable packaging. These regions show a growing preference for flexible plastic pouches due to their benefits of extended shelf life and portability, coupled with a rising focus on environmental sustainability.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Italy

- Spain

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASIAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global flexible plastic pouches market has witnessed significant contributions from key players, including Berry Global Inc., Mondi, Huhtamaki Flexible Packaging, Sealed Air, Sonoco Products Company, Smurfit Kappa, Amcor plc, Goglio SpA, Constantia Flexibles, ProAmpac, and other pivotal entities. These organizations have been instrumental in driving the market’s growth, primarily through innovative product offerings, strategic partnerships, and a strong focus on sustainability and customer-centric solutions.

Berry Global Inc. and Amcor plc, in particular, have led the market with their advanced material science capabilities and global reach, enabling them to offer a wide range of flexible packaging solutions that cater to diverse industries. Their commitment to sustainability, evident in their investments in recyclable and biodegradable materials, aligns with the increasing consumer demand for environmentally friendly packaging.

Mondi and Huhtamaki Flexible Packaging have distinguished themselves through their focus on customized packaging solutions, leveraging their expertise in material technology and design to meet specific customer needs. This approach has not only enhanced their competitive positioning but also driven the adoption of flexible plastic pouches in new market segments.

Sealed Air and Sonoco Products Company have focused on innovation in barrier technologies and product preservation, enhancing the shelf life and integrity of packaged goods. This has been particularly relevant in the food and beverage sector, where these advancements contribute significantly to reducing food waste.

Smurfit Kappa and Constantia Flexibles have capitalized on their strong presence in the European market, expanding their offerings to cater to the growing demand for sustainable and flexible packaging solutions. Their efforts in integrating digital printing technologies have also allowed for greater customization and efficiency in production processes.

Goglio SpA and ProAmpac have played crucial roles in advancing the flexible plastic pouches market through their focus on packaging automation and smart packaging solutions, thereby improving operational efficiencies for their clients.

Market Key Players

- Berry Global Inc.

- Mondi

- Huhtamaki Flexible Packaging

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa

- Amcor plc

- Goglio SpA

- Constantia Flexibles

- ProAmpac

Recent Developments

- In August 2020, Sealed Air Corp. announced that it had inked a collaboration deal with Plastic Energy, a leader in innovative recycling technologies. Additionally, Plastic Energy Global, the parent business of Plastic Energy, has received an equity investment from Sealed Air.

- In July 2020, Mondi invested in its flexible packaging operations in Aramil and Pereslavl, Russia, to provide clients with greater flexibility and a broader portfolio, which includes sustainable packaging solutions.

- In May 2020, Berry Global Inc. announced that it would collaborate with long-time customer Mondelçz International to deliver Philadelphia, the world’s most popular cream cheese, in packaging made from recycled plastic.

Report Scope

Report Features Description Market Value (2023) USD 60.3 Billion Forecast Revenue (2033) USD 113.2 Billion CAGR (2024-2033) 6.50% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material(Polyethylene, Polypropylene, Cast Polypropylene, Other Materials), By Type(Flat Pouches, Stand-up Pouches), By Application(Food & Beverages, Personal Care & Homecare, Healthcare, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Berry Global Inc., Mondi, Huhtamaki Flexible Packaging, Sealed Air, Sonoco Products Company, Smurfit Kappa, Amcor plc, Goglio SpA, Constantia Flexibles, ProAmpac, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Flexible Plastic Pouches Market in 2023?The Flexible Plastic Pouches Market size is SD 60.3 Billion in 2023.

What is the projected CAGR at which the Flexible Plastic Pouches Market is expected to grow at?The Flexible Plastic Pouches Market is expected to grow at a CAGR of 6.50% (2024-2033).

List the segments encompassed in this report on the Flexible Plastic Pouches Market?Market.US has segmented the Flexible Plastic Pouches Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Material(Polyethylene, Polypropylene, Cast Polypropylene, Other Materials), By Type(Flat Pouches, Stand-up Pouches), By Application(Food & Beverages, Personal Care & Homecare, Healthcare, Other Applications)

List the key industry players of the Flexible Plastic Pouches Market?Berry Global Inc., Mondi, Huhtamaki Flexible Packaging, Sealed Air, Sonoco Products Company, Smurfit Kappa, Amcor plc, Goglio SpA, Constantia Flexibles, ProAmpac, Other Key Players

Name the key areas of business for Flexible Plastic Pouches Market?The US, Canada, Mexico, are leading key areas of operation for Flexible Plastic Pouches Market.

Flexible Plastic Pouches MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Flexible Plastic Pouches MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Berry Global Inc.

- Mondi

- Huhtamaki Flexible Packaging

- Sealed Air

- Sonoco Products Company

- Smurfit Kappa

- Amcor plc

- Goglio SpA

- Constantia Flexibles

- ProAmpac