Global Flavor Emulsion Market Size, Share and Report Analysis By Type of Flavor (Fruit Flavors, Dairy Flavors, Savory Flavors, Others), By Nature (Organic, Conventional), By Application (Bakery and confectionery, Dairy products, Sauces and dressings, Beverages, Nutraceuticals., Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175699

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

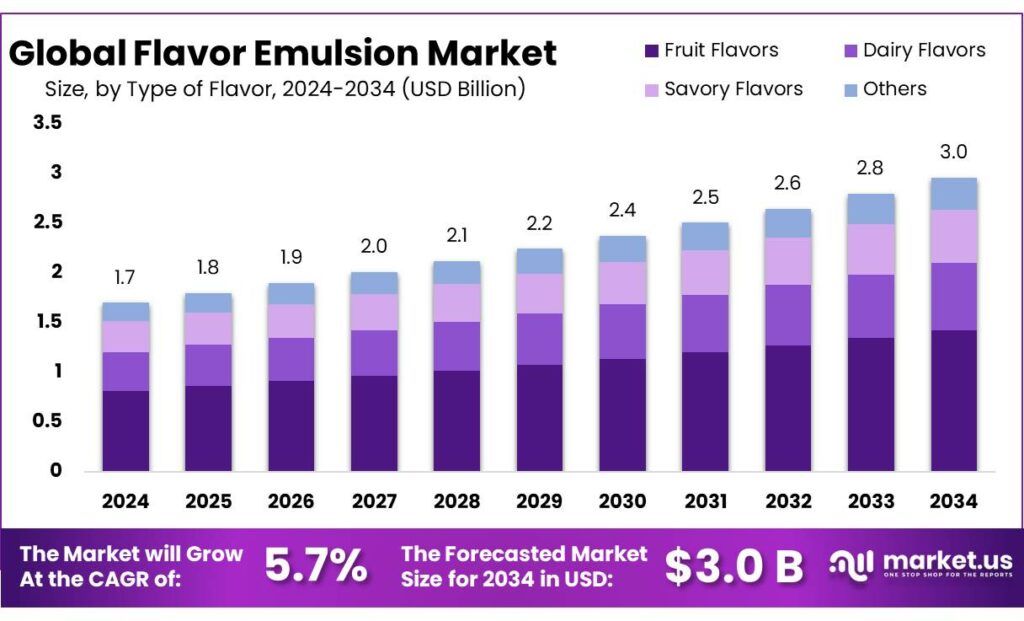

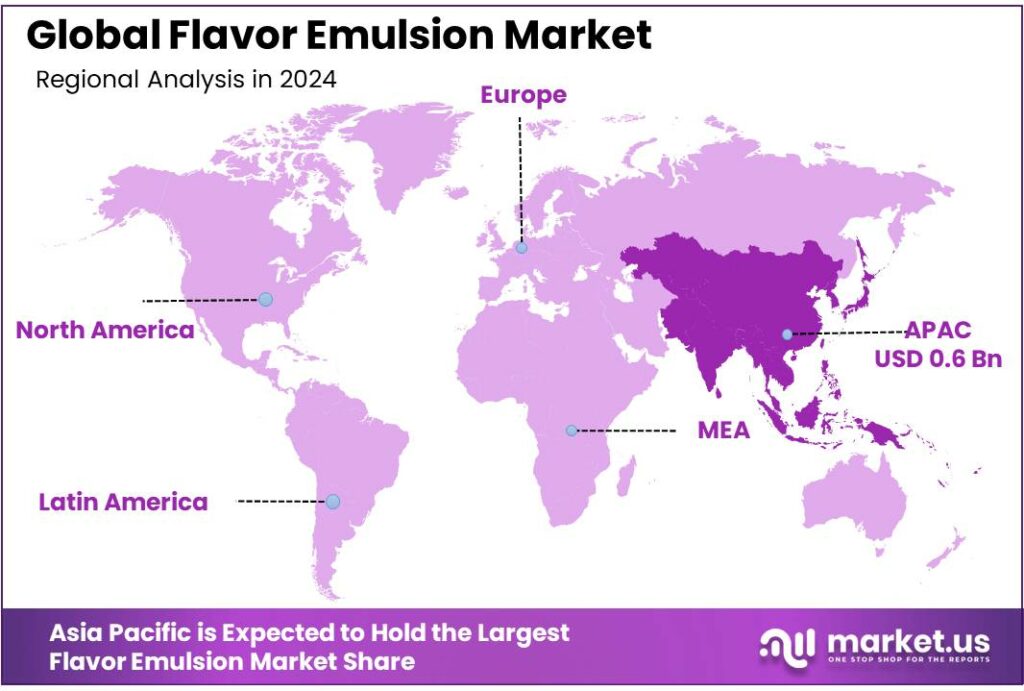

Global Flavor Emulsion Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.9% share, holding USD 0.6 Billion in revenue.

Flavor emulsions sit at the intersection of food science and branded sensory experience, enabling oil-based flavor to disperse evenly in water-based systems like soft drinks, sports beverages, dairy alternatives, sauces, and confectionery. In industrial terms, they function as “delivery systems” that protect volatile aroma notes, stabilize cloud and color, and keep taste consistent across shelf life, temperature swings, and high-speed filling lines.

The industrial scenario is shaped by scale, trade complexity, and input-cost volatility. Global food and agricultural trade reached USD 1.9 trillion in 2023, and the average diversity of foods available for consumption has expanded to around 225 food items, increasing the need for standardized flavor systems that can travel well across markets and formulations. In parallel, the global food import bill was forecast to rise by 2.5% in 2024 to exceed USD 2 trillion, reinforcing why manufacturers value emulsified flavors that can help manage variability in raw materials while maintaining consistent sensory outcomes.

Demand-side drivers are especially visible in non-alcoholic beverages, where flavors must stay uniform across high-volume production runs and varied packaging formats. In Europe, industry-reported data estimate non-alcoholic beverage production at around 132 billion litres in 2023, with per-capita consumption of 246.4 litres—a scale that favors emulsified flavor systems for throughput, repeatability, and cost control. Reformulation pressure also matters: UNESDA notes that no- and low-calorie drinks account for up to 40% of sales at EU level, which tends to increase reliance on efficient flavor delivery.

Regulatory and compliance pressures are another key driver, pushing manufacturers toward tighter documentation, standardized additive use, and auditable formulation decisions. In the United States, the FDA’s GRAS Notice database shows 1,290 records found (as displayed in the inventory interface), illustrating the scale of documented ingredient safety pathways used by developers working on food-and-beverage ingredients.

Key Takeaways

- Flavor Emulsion Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 5.7%.

- Fruit Flavors held a dominant market position, capturing more than a 48.3% share.

- Conventional held a dominant market position, capturing more than a 69.2% share.

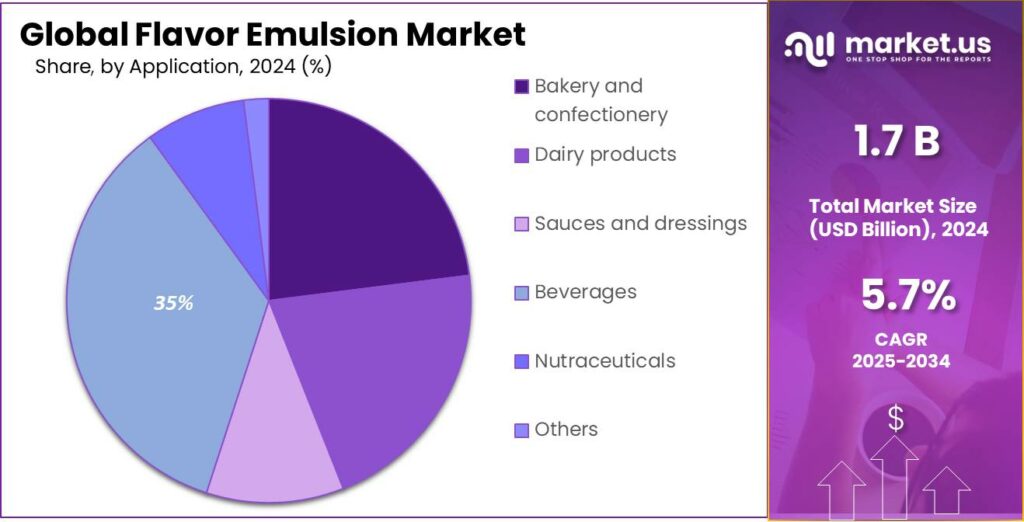

- Beverages held a dominant market position, capturing more than a 35.1% share.

- Asia Pacific dominates with 38.9%, supported by large-scale beverage manufacturing and urban consumption growth, valued at USD 0.6 Bn.

By Type of Flavor Analysis

Fruit Flavors dominate with a 48.3% share, supported by rising demand for natural taste profiles.

In 2024, Fruit Flavors held a dominant market position, capturing more than a 48.3% share, driven by the strong preference for refreshing, natural, and versatile taste profiles across beverages, dairy products, confectionery, and nutraceuticals. Fruit-based emulsions—especially citrus, tropical, and berry formats—remain the most widely used because they offer bright aromas, good stability, and broad global acceptance. Their dominance also reflects the continued expansion of ready-to-drink beverages, where fruit-forward formulations still account for a major share of new launches.

By Nature Analysis

Conventional flavors lead the market with a strong 69.2% share, driven by wide industrial use and cost efficiency.

In 2024, Conventional held a dominant market position, capturing more than a 69.2% share, reflecting the long-standing reliance of beverage and food manufacturers on traditional formulation methods. Conventional flavor emulsions continue to be preferred because they offer predictable performance, stable shelf life, and compatibility with a wide range of product matrices—from carbonated drinks and dairy beverages to confectionery and processed foods. Their broad availability and lower production cost compared to specialty or natural-only variants also reinforce their strong market presence.

By Application Analysis

Beverages dominate the market with a 35.1% share, supported by rising demand for refreshing and flavored drink formulations.

In 2024, Beverages held a dominant market position, capturing more than a 35.1% share, driven by the rapid growth of flavored drinks, functional beverages, and ready-to-consume refreshment products. Flavor emulsions are widely used in beverages because they help achieve uniform taste, improved aroma release, and stable appearance in both clear and cloudy drinks. Their role is especially important in citrus, tropical, and mixed-fruit profiles, which require consistent dispersion of oils and volatile compounds to maintain flavor integrity.

Key Market Segments

By Type of Flavor

- Fruit Flavors

- Dairy Flavors

- Savory Flavors

- Others

By Nature

- Organic

- Conventional

By Application

- Bakery and confectionery

- Dairy products

- Sauces and dressings

- Beverages

- Nutraceuticals.

- Others

Emerging Trends

Health-first beverages are rising, so brands are using cleaner, more stable flavor emulsions to keep taste strong with less sugar

A major latest trend in flavor emulsions is the shift toward health-first beverages—especially low-sugar and no-sugar drinks—where companies need smarter flavor delivery to keep products enjoyable. When sugar is reduced, fruit and citrus profiles can taste weaker, and aroma can fade faster during storage. In response, beverage formulators are leaning more on well-designed emulsions that hold volatile flavor oils in a stable system, improve flavor release, and keep the drink looking consistent over its shelf life.

The same WHO-linked discussion is also moving toward stronger “health tax” pressure. A Reuters report summarizing WHO findings said sugary drinks became more affordable in 62 countries between 2022 and 2024, and highlighted WHO’s “3 by 35” initiative that calls for raising prices of sugary drinks, alcohol, and tobacco by 50% over a decade through taxation, aiming to generate $1 trillion by 2035. Even when a country does not raise taxes immediately, this direction increases boardroom attention on reformulation.

A second layer behind this trend is the expansion of packaged beverage consumption driven by urban lifestyles. The UN notes that 55% of the world’s population lives in urban areas today and this is projected to reach 68% by 2050. More urban living usually means more on-the-go beverage buying, wider cold-chain and ambient distribution, and longer shelf-life requirements. That environment rewards emulsions that can maintain uniformity (no ring formation, no separation) and keep aroma consistent from factory to retail shelf.

Drivers

Sugar-cut and reformulation pressure is pushing beverage brands to rely more on stable flavor emulsions

One major driving factor for flavor emulsions is the global push to reduce sugar in drinks without losing taste. When sugar is lowered, beverages can taste flat, thin, or “less fruity.” In practical formulation work, flavor emulsions help solve that gap: they carry aroma oils, improve flavor release, and keep drinks stable and uniform across shelf life. This matters most in citrus and mixed-fruit profiles, where the aroma impact comes from oil-based compounds that do not blend naturally with water. As a result, reformulation programs often increase the value of emulsified flavor systems, because they support taste recovery while meeting nutrition targets.

- Public-health guidance is a clear signal behind this shift. The World Health Organization (WHO) recommends keeping free sugars below 10% of total energy intake and suggests a further reduction to below 5% for added health benefits. Public-health guidance is a clear signal behind this shift. The World Health Organization (WHO) recommends keeping free sugars below 10% of total energy intake and suggests a further reduction to below 5% for added health benefits. Source: WHO guidance on free sugars.

Tax and policy actions are making the pressure more direct. WHO’s Global report on the use of sugar-sweetened beverage taxes (2025) states that, as of July 2024, excise taxes were applied at national level to at least one type of sugar-sweetened beverage in at least 116 countries. This policy trend encourages manufacturers to reformulate to lower sugar bands and protect price competitiveness. Separately, an evaluation summary of the UK’s Soft Drinks Industry Levy (SDIL) reports a 46% decrease in the sales-weighted average sugar content of drinks from 2015 to 2020, pointing to how quickly recipes can change when incentives are strong.

Restraints

Volatile input supply and tougher compliance rules can slow down flavor emulsion growth

One major restraint for the flavor emulsion industry is raw-material volatility, especially for citrus-led flavor systems that depend on consistent availability of fruit oils and aroma compounds. When orange and other citrus supply shifts due to weather, disease pressure, or regional crop swings, it can tighten availability of upstream inputs used in emulsions and push up procurement risk for beverage and food formulators. For example, USDA’s world citrus outlook forecasts global orange production for 2024/25 at 45.2 million tons, down 662,000 tons year-on-year.

Cost pressure from global trade and logistics is another part of the same restraint. Flavor emulsion supply chains are international: oils, emulsifiers, stabilizers, packaging, and processing aids may come from different regions. FAO estimated the global food import bill would reach USD 1.98 trillion in 2023, highlighting how expensive and complex global sourcing has become. When freight, insurance, or working-capital costs rise, emulsion producers and users often face a squeeze: either absorb higher costs or pass them through, which can reduce adoption in price-sensitive beverage categories.

Regulatory compliance adds a second layer of friction because flavor emulsions sit inside “additive-adjacent” decision making. Companies selling across markets must track changing standards and re-check whether a formulation aligns with local rules and labeling expectations. Codex’s General Standard for Food Additives (GSFA) is updated through the 48th Session (2025), showing that the global reference framework is actively evolving.

Opportunity

Scaling ready-to-drink beverage production in emerging markets creates steady demand for reliable flavor emulsions

A major growth opportunity for flavor emulsions is the fast build-out of processed beverage capacity in emerging markets, where brands need stable, repeatable flavors that perform well in large-scale plants. As more consumers live in cities, packaged drinks and convenient refreshment formats become part of daily routines. The UN reports that 55% of the world’s population lives in urban areas today, and this share is projected to rise to 68% by 2050—a long, structural shift that supports sustained demand for industrial food and beverage production.

This opportunity is especially clear in India and similar manufacturing-led economies where government programs are actively encouraging food and beverage processing investments. India’s Ministry of Food Processing Industries (MoFPI) describes the Production Linked Incentive (PLI) scheme for food processing as a central sector program with an outlay of ₹10,900 crore.

On-the-ground progress signals the same direction. A Government of India press release (PIB) states that, based on data reported by beneficiaries, investment of ₹8,910 crore has been made across 213 locations under the food processing PLI scheme, and the scheme has reportedly generated employment of over 2.89 lakh as of 31 October 2024. Another practical opportunity is the rise of small and mid-sized manufacturers moving into branded packaged foods and drinks. The Government of India’s PMFME scheme has a total outlay of ₹10,000 crore for FY 2020–2025, has been extended up to FY 2025–26, and is targeted to benefit 2 lakh enterprises.

Regional Insights

Asia Pacific dominates with 38.9%, supported by large-scale beverage manufacturing and urban consumption growth, valued at USD 0.6 Bn

In 2024, Asia Pacific held the dominant position in the Flavor Emulsion Market, supported by its large beverage and processed-food base and rapid retail expansion. The region accounted for a leading share of 38.9%, with the market valued at USD 0.6 Bn. This leadership is strongly linked to high-volume production of flavored beverages, dairy drinks, and fruit-based refreshment formats where emulsions are essential for dispersing oil-based flavor compounds, maintaining uniform appearance, and protecting aroma during long-distance distribution.

A key structural advantage is the region’s scale of urban consumers and modern trade channels. UN-Habitat highlights that more than 2.2 billion urban residents live in Asia and the Pacific, and the region’s urban population in Asia is projected to grow by 50% by 2050—a long-term demand engine for packaged beverages and convenience foods that depend on stable flavor systems. In addition, the World Bank shows East Asia & Pacific urban population at 64% (2024), reflecting how urban purchasing patterns are becoming the norm across many of the largest consumer markets.

Policy-led capacity building also supports emulsion demand by expanding food and beverage processing infrastructure. In India, a Government of India press release on the food processing PLI program reports investment of ₹8,910 crore across 213 locations and employment generation of over 2.89 lakh as of 31 October 2024.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill remains one of the strongest players, operating in 70+ countries with over 160,000 employees. Its flavor emulsion capabilities integrate into its broader food-ingredient business, which serves thousands of global manufacturers. With annual revenue exceeding USD 165 billion, the company leverages robust R&D and technical centers to scale natural, clean-label, and beverage-focused emulsified flavor systems across global markets.

Firmenich, now part of dsm-firmenich, operates across 40+ countries with more than 10,000 employees and serves clients in over 100 markets. The company delivers thousands of flavor solutions annually, including advanced emulsions used in beverages and dairy applications. With sales surpassing EUR 12 billion, it leads in sensory science, clean-label formats, and sustainable flavor-delivery technologies.

Cape Food Ingredients continues to strengthen its position with a portfolio serving more than 20+ countries and supplying close to 150–180 customized flavor systems annually. The company benefits from South Africa’s growing processed-food sector, supporting beverage, dairy, and confectionery manufacturers. Its expanding production capabilities and consistent delivery standards help it maintain competitive relevance in emerging African markets.

Top Key Players Outlook

- Cape Food Ingredients

- Cargill Incorporated

- Firmenich

- Gold Coast Ingredients

- Jamsons Industries

- Keva Flavours

- LorAnn Oils

Recent Industry Developments

In 2025, Gold Coast Ingredients actively participated in industry events such as IBIE 2025 and continued to share innovations on functional and flavored beverage systems via social media channels with over 2,300 followers on LinkedIn, showing strong engagement with the F&B community.

In late 2024, Firmenich also highlighted cultural taste trends by naming “Milky Maple” as its Flavor of the Year for 2025, reflecting its focus on market-driven innovation that resonates through flavored beverage development.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Flavor (Fruit Flavors, Dairy Flavors, Savory Flavors, Others), By Nature (Organic, Conventional), By Application (Bakery and confectionery, Dairy products, Sauces and dressings, Beverages, Nutraceuticals., Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cape Food Ingredients, Cargill Incorporated, Firmenich, Gold Coast Ingredients, Jamsons Industries, Keva Flavours, LorAnn Oils Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cape Food Ingredients

- Cargill Incorporated

- Firmenich

- Gold Coast Ingredients

- Jamsons Industries

- Keva Flavours

- LorAnn Oils