Global Filter Bag Market Size, Share, And Industry Analysis Report By Bag Type (Liquid Filter Bags, Air Filter Bags, Fruits and Vegetables), By Material (Polyamide, Polyethylene Terephthalate, Polypropylene), By End Use (Automobile, Oil and Gas, Mining, Water Treatment, Aerospace, Defense, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175678

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

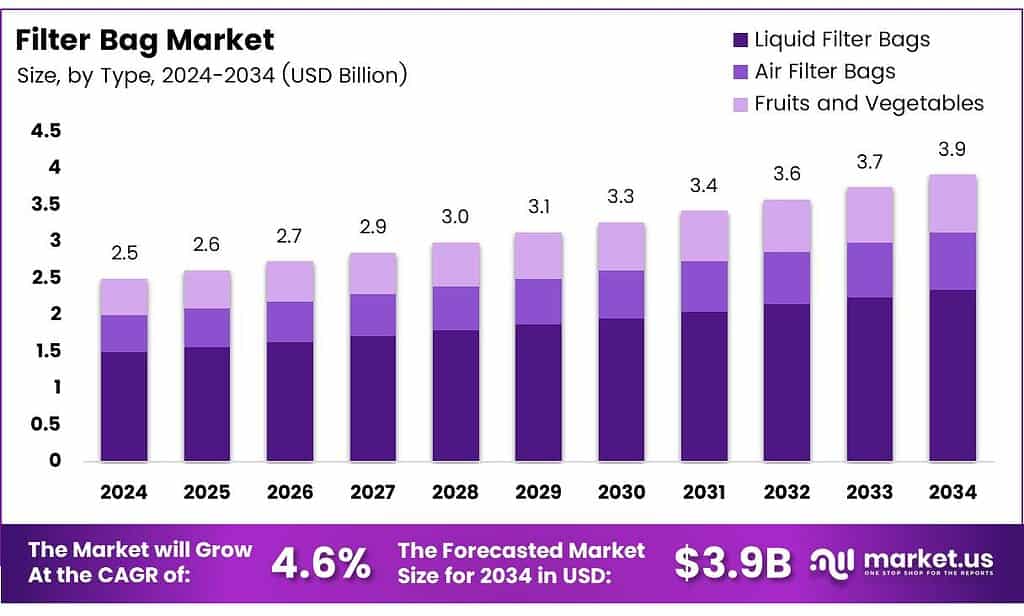

The Global Filter Bag Market size is expected to be worth around USD 3.9 billion by 2034, from USD 2.5 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Filter Bag Market represents a crucial part of industrial filtration, supporting cleaner production, regulatory compliance, and operational efficiency across sectors like chemicals, automotive, food processing, mining, and water treatment. It is designed to remove solid contaminants from air and liquid streams, enabling companies to maintain higher productivity while reducing environmental impact sustainably.

As demand grows, the market continues shifting toward advanced filter media and higher-efficiency solutions. Industries increasingly adopt filtration systems due to tightening emission norms and the need to manage particulate pollution effectively. Additionally, ongoing infrastructure development across emerging economies strengthens the long-term relevance of filter bags within dust control and liquid filtration applications.

- Standard Mesh Liquid Filter Bags offer versatile micron ratings from 1 to 1500, supporting precise liquid filtration across industries and meeting FDA food-contact standards that expand their use in beverages, edible oils, and industrial liquids. Advanced materials such as P-84 polyimide, with heat resistance up to 260°C, and Polyphenylene Sulfide, stable up to 190°C, provide strong chemical durability and fine-particle filtration, reinforcing the market’s shift toward high-performance, application-specific filtration media.

The market benefits from rising government spending on clean manufacturing and stricter global regulatory frameworks. Several countries are enforcing limits on industrial discharges, pushing manufacturers toward high-performance filtration systems. As a result, companies are prioritizing durability, operational reliability, and lower maintenance, contributing to steady market expansion and greater end-use diversification.

Key Takeaways

- The Global Filter Bag Market is valued at USD 2.5 billion in 2024 and is expected to reach USD 3.9 billion by 2034, at a CAGR of 4.6% from 2025 to 2034.

- Liquid Filter Bags dominate the Bag Type segment with a 62.3% market share.

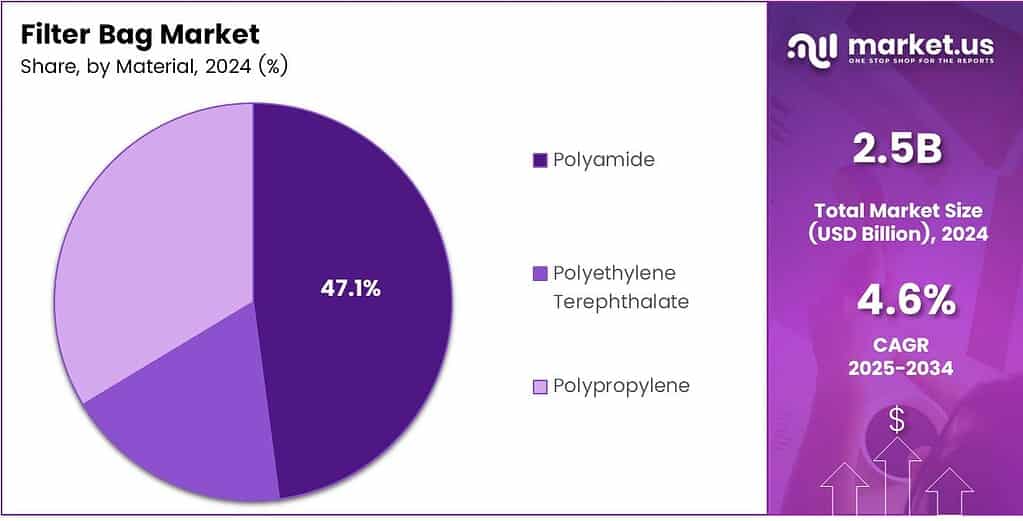

- Polyamide leads the Material segment with a 47.1% contribution.

- The Automobile segment is the largest end-use category, holding 78.4% of the market.

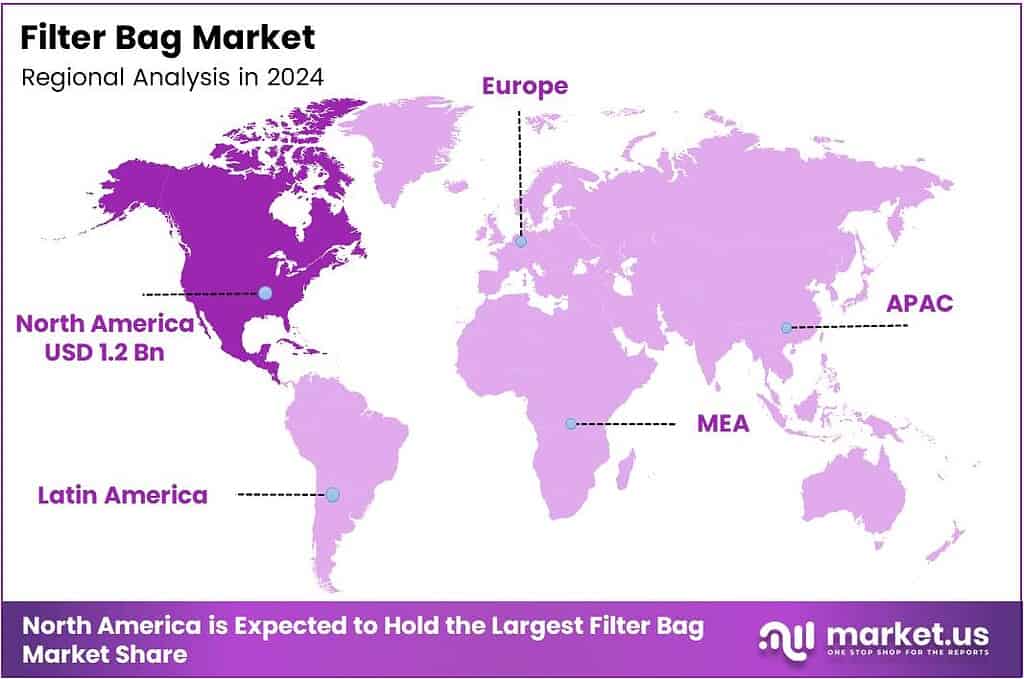

- North America dominates regionally with a 49.9% share valued at USD 1.2 billion

By Bag Type Analysis

Liquid Filter Bags dominate the Bag Type segment with 62.3% due to their high efficiency and strong industrial acceptance.

In 2025, Liquid Filter Bags held a dominant market position in the By Bag Type Analysis segment of the Filter Bag Market, with a 62.3% share. These bags remain essential for industries handling liquids requiring stable filtration and consistent purity. Their adaptability across chemical, food, and pharmaceutical plants continues to strengthen demand.

Air Filter Bags gained traction as industries move toward improved air quality systems. These bags support dust control, pollution reduction, and workplace safety. Industries such as cement, power generation, and metals use them widely due to rising emission standards and stricter operational hygiene requirements worldwide.

The Fruits and Vegetables segment uses filter bags mainly for washing, sorting, and processing applications. These bags help remove debris and ensure product cleanliness. Growing awareness of food safety and increasing packaged produce demand support the gradual adoption of filtration bags within modern food-handling environments.

By Material Analysis

Polyamide dominates the Material segment with 47.1% due to its excellent strength and chemical resistance.

In 2025, Polyamide held a dominant market position in the By Material Analysis segment of the Filter Bag Market, with a 47.1% share. This material remains popular for its durability, heat resistance, and long operational life. Industries prefer polyamide for demanding filtration environments requiring strong mechanical stability.

Polyethylene Terephthalate (PET) is steadily used for applications requiring moisture resistance and fine particle retention. PET bags offer consistent performance in food processing, water filtration, and chemical industries. Their light weight and affordability make them a balanced choice for medium-duty industrial filtration activities.

Polypropylene continues to expand in usage for highly corrosive or chemical-intensive environments. Its compatibility with acids and solvents makes it suitable for wastewater, chemicals, and industrial cleaning processes. Polypropylene bags offer cost-effective performance with reliable filtration efficiency and broad chemical resistance.

By End Use Analysis

Automobiles dominate the end-use segment with 78.4% due to high filtration usage in manufacturing and maintenance cycles.

In 2025, Automobile held a dominant market position in the By End Use Analysis segment of the Filter Bag Market, with a strong 78.4% share. Automakers rely heavily on filter bags for paint processes, metal finishing, lubricant purification, and dust control, supporting efficient production and environmental compliance.

The Oil and Gas sector uses filter bags to manage impurities in drilling fluids, produced water, and refinery operations. Filtration supports better equipment protection, smoother fluid handling, and reduced operational disruptions in upstream, midstream, and downstream sites.

Mining applications use filter bags to control dust, manage slurry processing, and ensure clean air for workers. As environmental and safety requirements evolve, mining companies increasingly depend on filtration bags for improved workplace conditions and reduced emissions.

The Water Treatment sector benefits from filter bags during sediment removal, pre-filtration, and sludge management. Their use enhances system efficiency by capturing fine particles. Meanwhile, Aerospace, Defense, Marine, and Other industries employ filter bags for precision cleaning, fluid processing, and contamination control essential for operational reliability.

Key Market Segments

By Bag Type

- Liquid Filter Bags

- Air Filter Bags

- Fruits and Vegetables

By Material

- Polyamide

- Polyethylene Terephthalate

- Polypropylene

By End Use

- Automobile

- Oil and Gas

- Mining

- Water Treatment

- Aerospace

- Defense

- Marine

- Others

Emerging Trends

Shift Toward High-Efficiency and Eco-Friendly Filter Bags Shapes Market Trends

A key trend influencing the filter bag market is the rising preference for eco-friendly and energy-efficient filtration solutions. Industries want bags that consume less energy, last longer, and require fewer replacements. This shift is encouraging manufacturers to use innovative fibers, surface treatments, and coatings.

- Automation inside filtration systems is becoming more common. Advanced baghouse designs equipped with smart sensors and automated cleaning systems improve efficiency and reduce manual work. The U.S. EPA’s February 2024 update set the primary annual PM2.5 standard at 9.0 µg/m³ (down from 12.0 µg/m³). The WHO’s air quality guideline recommends an annual PM2.5 level of 5 µg/m³.

The adoption of high-temperature filter bags is also rising. Industries such as cement, steel, and power generation need durable solutions that can withstand extreme heat and harsh chemicals. This requirement is pushing manufacturers to develop more robust materials.

Drivers

Rising Industrial Air Pollution Regulations Drive Market Expansion

Stricter air pollution rules across industries are becoming one of the biggest reasons for the growing demand for filter bags. Governments are enforcing cleaner production standards, and companies must install efficient filtration systems to stay compliant. This is pushing industries like cement, mining, chemicals, and power plants to upgrade or replace their existing filtration solutions.

The rise in global industrial activity is also increasing the need for dust-control equipment. As factories expand and new manufacturing plants come online, the requirement for high-performance filter bags naturally grows. These products help maintain a safe working environment, reduce emissions, and ensure smooth operations.

The growing focus on energy efficiency. Modern filter bags are designed to reduce pressure drop and lower energy consumption. Companies now prefer advanced filter media that offer longer life and better dust-holding capacity, helping them save on operational costs over time.

Restraints

High Maintenance and Replacement Costs Restrict Market Growth

One of the major restraints holding back the filter bag market is the high ongoing cost of maintenance and replacement. Filter bags must be cleaned, inspected, and replaced regularly, depending on the process and dust load. This creates a continuous expense for industries, especially for large plants with hundreds of filter units.

- It references limits for NOx (down to 100 mg/Nm³ for newer units) and mercury at 0.03 mg/Nm³ for larger units. Even when plants move to very high-temperature options, trade-offs appear. filter bag specifications show common offerings rated to 260°C (500°F), and also list media weights like 830 g/m² for certain ePTFE felt constructions.

Fluctuations in raw material prices, especially synthetic fibers like polyamide or polypropylene, affect manufacturing costs. This makes pricing unstable and reduces affordability for smaller businesses. Complex installation processes and the need for skilled technicians further add to the restraint.

Growth Factors

Adoption of Advanced Filtration Materials Creates New Market Opportunities

A major growth opportunity in the filter bag market comes from the rising adoption of advanced filter media. New materials such as PTFE, aramid, and nano-fiber coatings provide higher filtration efficiency and longer service life. Companies are increasingly shifting toward these premium solutions to meet strict emission norms and reduce maintenance costs.

Emerging industries, including waste-to-energy, biomass power plants, and recycling plants, are creating fresh demand. These sectors require reliable dust-collection systems, and filter bags are a cost-effective choice for them. Their expansion presents strong long-term opportunities for manufacturers.

Growing investments in environmental sustainability also support the market. Countries in Asia, the Middle East, and Africa are modernizing industrial infrastructure, which includes upgrading filtration systems. This opens doors for global suppliers to expand into these regions.

Regional Analysis

North America Dominates the Filter Bag Market with a Market Share of 49.9%, Valued at USD 1.2 Billion

North America stands as the leading region in the global Filter Bag Market, supported by stringent environmental regulations and strong industrial activity across power generation, chemicals, and waste management. The region’s dominance, reflected in its 49.9% share and valuation of USD 1.2 billion, is further strengthened by its rapid adoption of advanced emission-control technologies.

Europe remains a mature and highly regulated market, influenced by strict EU emission directives and sustainable industrial policies. Growth is driven by the rising need for dust and particulate control in cement, metal processing, and waste-to-energy facilities. With ongoing decarbonization and circular economy initiatives, the region continues to adopt high-efficiency filtration solutions that support long-term environmental compliance.

Asia Pacific shows strong growth momentum, propelled by rapid industrialization, expanding manufacturing bases, and increasing construction activity. Countries such as China, India, and Southeast Asia are investing heavily in pollution-control infrastructure to address rising air-quality concerns. As industrial output scales up, demand for durable and cost-effective filter bags is expected to grow significantly across power plants, mining, and chemical sectors.

The Middle East & Africa region is witnessing gradual growth, supported by the expansion of oil & gas, mining, and industrial processing sectors. Environmental reforms and investments in air-quality monitoring systems are encouraging industries to adopt reliable filtration technologies. Infrastructure development and rising energy-sector projects continue to create new opportunities for filter bag deployment.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Filter Bag Market continues to evolve as industrial pollution control norms become more stringent and end-use sectors such as cement, chemicals, and power generation increase their environmental compliance efforts. Within this landscape, leading manufacturers play a decisive role in shaping performance benchmarks, technology adoption, and pricing behavior.

Donaldson Company, Inc. maintains strong momentum due to its continuous emphasis on high-efficiency filtration media and expanding aftermarket service capabilities. The company’s global footprint and ability to supply durable filter bag solutions keep it firmly positioned as a preferred vendor for heavy-duty industries upgrading their emission control systems.

Parker Hannifin Corporation demonstrates steady competitive strength driven by its advanced engineered filtration systems and its ability to serve diversified industrial clients. Its sustained investment in performance-enhanced filtration fabrics supports demand for long-life, low-maintenance filter bags across dust-intensive applications.

3M Company continues to benefit from its material science innovations, especially in filtration media engineered for high-temperature and chemically aggressive environments. Its strong brand trust and consistent rollout of enhanced industrial filtration solutions contribute to its stable market influence in 2025.

Filtration Group remains a prominent growth contributor backed by its broad portfolio and customer-centric filtration technologies. The company’s strategic focus on improving industrial air quality, combined with its scalable manufacturing approach, reinforces its rising share across global manufacturing and processing sectors.

Top Key Players in the Market

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- 3M Company

- Filtration Group

- Mann+Hummel

- Gore and Associates

- Eaton Corporation

- BWF Group

- Camfil Group

- Sefar AG

Recent Developments

- In 2025, Donaldson has focused on advancing its baghouse dust collector technologies, including the introduction of the Dalamatic G2 Smart dust collector, which is designed for handling sticky or agglomerative dust materials in filtration applications. The company also launched the Downflo Evolution Pre-assembled Small Dust Collector.

- In 2025, Parker Hannifin, through its Industrial Gas Filtration and Generation Division, continues to emphasize BHA cartridge and pleated filters for dust collection, offering one-piece designs that eliminate the need for traditional filter bags and cages, reducing installation time and improving efficiency with 99.99+% filtration.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Bag Type (Liquid Filter Bags, Air Filter Bags, Fruits and Vegetables), By Material (Polyamide, Polyethylene Terephthalate, Polypropylene), By End Use (Automobile, Oil and Gas, Mining, Water Treatment, Aerospace, Defense, Marine, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Donaldson Company, Inc., Parker Hannifin Corporation, 3M Company, Filtration Group, Mann+Hummel, Gore and Associates, Eaton Corporation, BWF Group, Camfil Group, Sefar AG Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- 3M Company

- Filtration Group

- Mann+Hummel

- Gore and Associates

- Eaton Corporation

- BWF Group

- Camfil Group

- Sefar AG