Global Film Capacitor Market Size, Share, Industry Analysis Report By Material (Paper, Plastic), By Application (AC Application, DC Application), By End-Use (Automotive, Consumer Electronics, Manufacturing, Communication & Technology, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157393

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

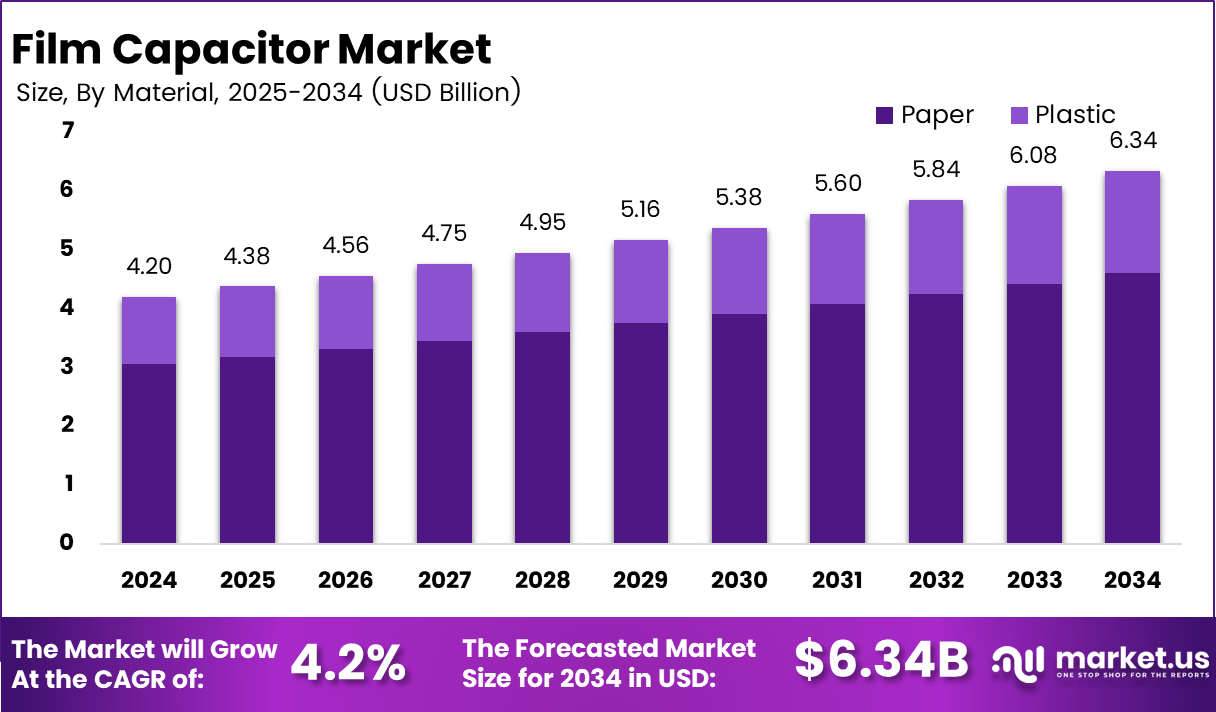

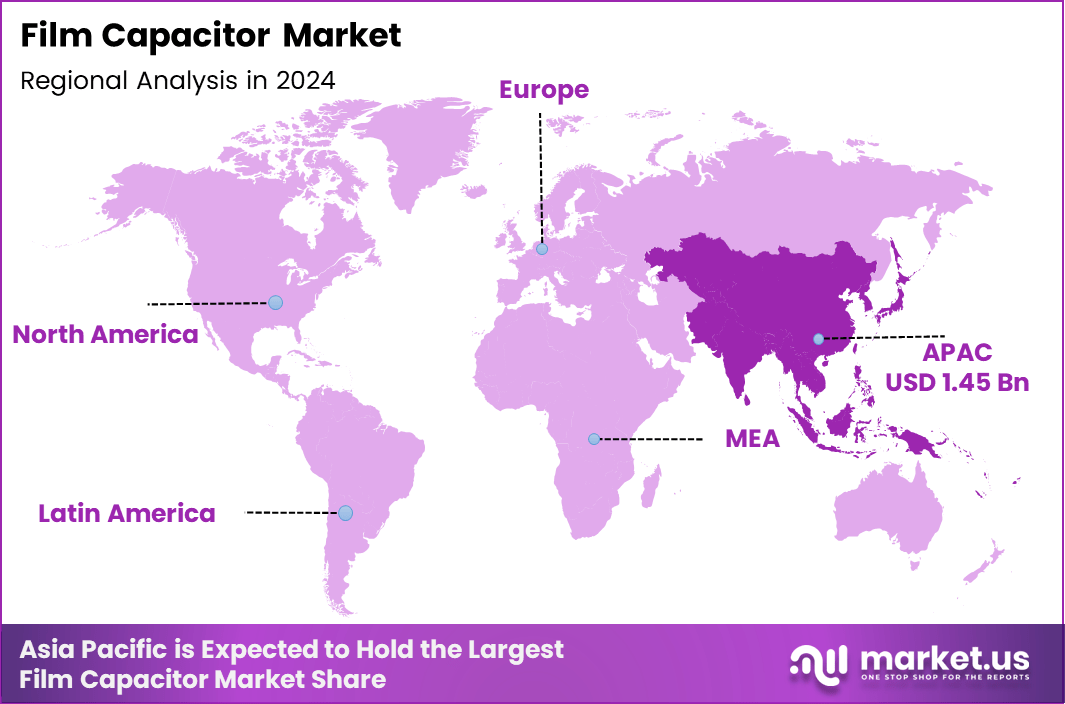

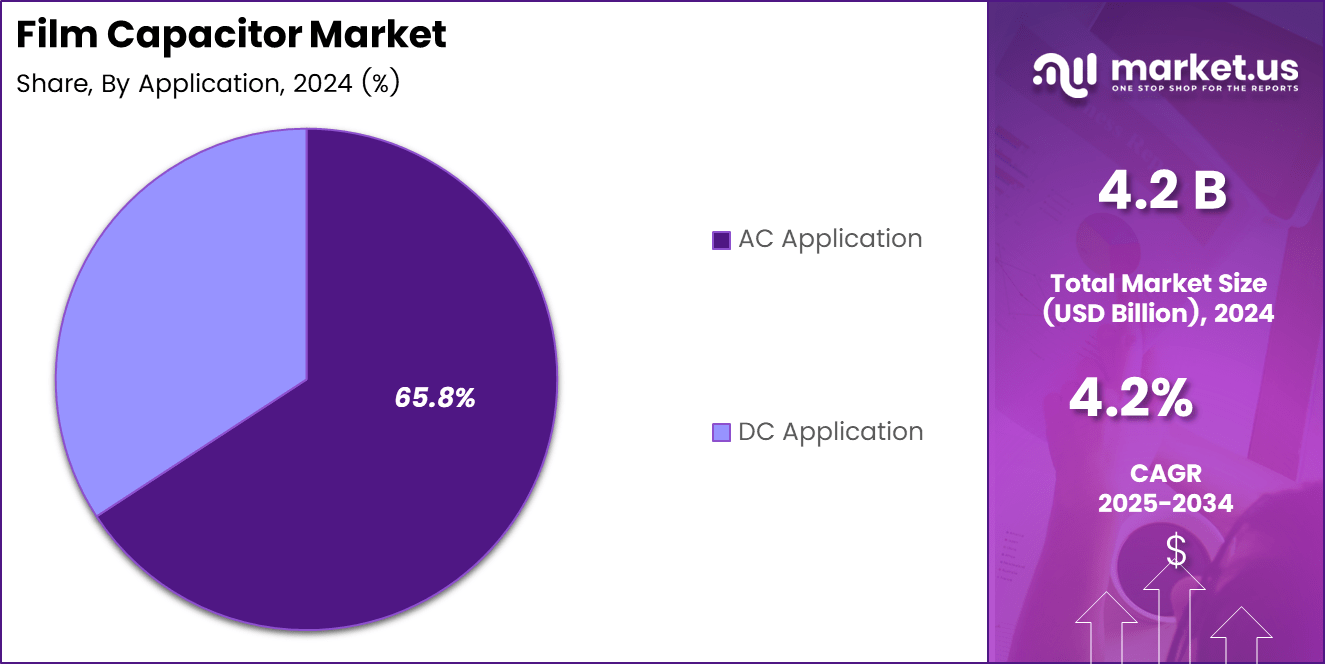

The Global Film Capacitor Market size is expected to be worth around USD 6.34 Billion By 2034, from USD 4.2 billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 34.6% share, holding USD 1.45 Billion revenue.

The Film Capacitor Market refers to the industry focused on the production and application of capacitors that use plastic film as the dielectric. These capacitors are widely used in electronic circuits where stability, low loss, and long operational life are required. Film capacitors are typically found in applications such as power conversion, electromagnetic interference suppression, lighting ballasts, and automotive electronics.

One of the key drivers of this market is the growing demand for durable and high-efficiency electronic components across automotive, energy, and industrial sectors. As the need for energy-efficient systems rises, film capacitors are being used more frequently in power electronics, particularly in electric vehicles and renewable energy systems. Their long service life and high insulation resistance make them suitable for critical and high-voltage applications. The demand for film capacitors is expected to grow at a CAGR of approximately 6.8% from 2024 to 2030, as energy-efficient technologies continue to gain momentum.

There is strong demand for film capacitors in regions with advanced manufacturing capabilities and widespread adoption of renewable energy infrastructure. Applications in solar inverters, wind turbines, and smart grid systems are creating new requirements for stable and heat-resistant capacitors. These sectors are projected to contribute around 40% of the total film capacitor market growth by 2030. Additionally, the growing electronics and appliance industry is contributing to market expansion, with film capacitors expected to capture a 20% share of the market by 2027.

Key Takeaways

- By material, Plastic film capacitors dominated with a 72.7% share.

- By application, AC applications led the market, securing 65.8% share.

- By end-use, the Automotive sector was the largest contributor, holding 34.8% share.

- Regionally, Asia Pacific captured 34.6% share of the global market.

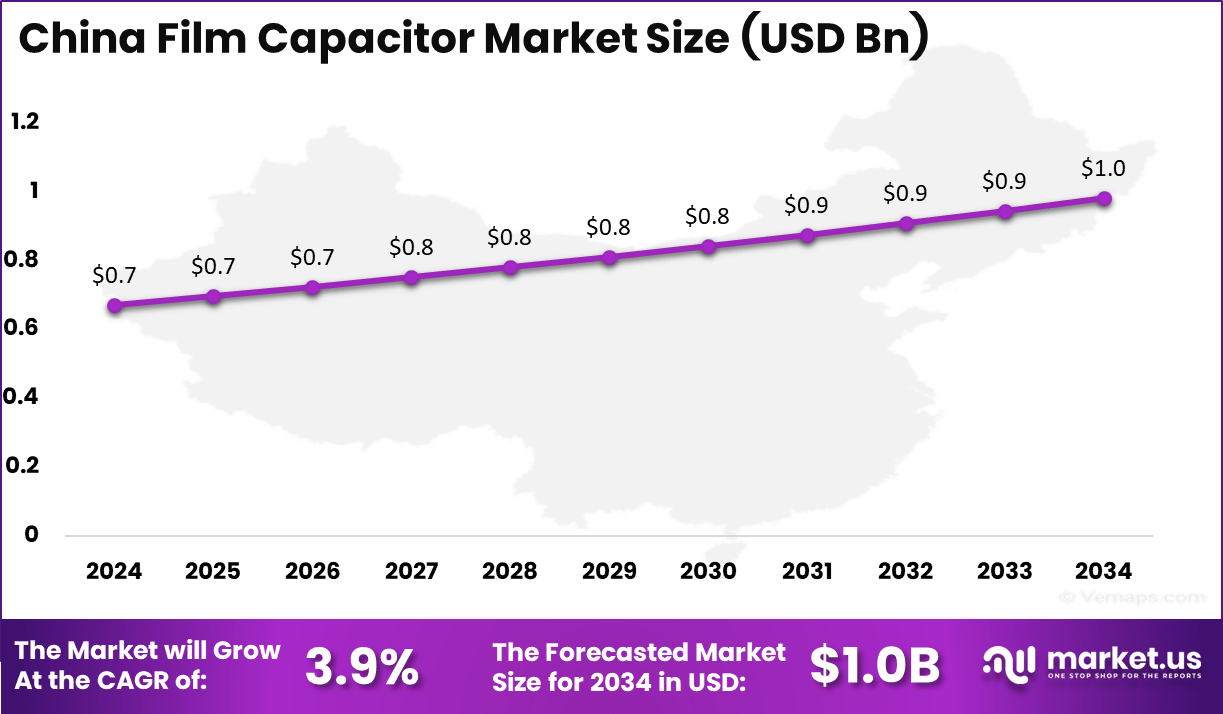

- Within Asia Pacific, China accounted for USD 0.67 Billion, growing at a 3.9% CAGR.

Emerging Trends

- Miniaturization and High-Energy Density: The demand for compact, high-capacity film capacitors is growing, particularly in consumer electronics and electric vehicles, projected to account for 25% of the global market by 2030.

- High-Temperature and High-Voltage Capacitors: Capacitors capable of withstanding extreme conditions are expected to capture 35% of the market by 2030, driven by automotive and renewable energy applications.

- Self-Healing Capacitors: The self-healing capacitor segment is expected to grow by 8% annually, contributing 15% to the overall market by 2030.

- Integration into Electric Mobility and Renewable Energy: This segment is projected to capture 30% of the market share by 2030, driven by increased adoption in electric vehicles and renewable energy systems.

- Localized Production and Supply Chain Resilience: Localized production is expected to account for 18% of market growth by 2030, as manufacturers aim to reduce supply chain risks.

- Research and Development Investments: R&D investments are projected to boost innovation, contributing 10% to the growth of the film capacitor market by 2030.

Role of Generative AI

- Design Optimization: Generative AI can be used to design advanced capacitor structures by simulating various material combinations and configurations, optimizing performance and efficiency in real time.

- Predictive Maintenance: AI models can analyze historical performance data to predict potential failures or degradation in film capacitors, enabling proactive maintenance and enhancing product reliability.

- Material Discovery: Generative AI aids in discovering new materials for film capacitors, optimizing properties like heat resistance and energy storage capabilities, contributing to improved capacitor performance.

- Supply Chain Management: AI-driven solutions can streamline supply chain processes, predicting material shortages, optimizing inventory levels, and improving the resilience of the global capacitor market.

- Product Customization: AI enables manufacturers to quickly develop customized film capacitors for specific industries, improving adaptability to customer needs.

- Automation in Testing: Generative AI can automate the testing and quality control process, ensuring that film capacitors meet stringent industry standards and reduce human error in manufacturing.

Investment & Business Benefits

There are several investment opportunities in regions developing electric mobility and renewable energy sectors, with companies offering specialized film capacitors for high-voltage and temperature-sensitive applications expected to see increasing demand, capturing 30% of market growth by 2030. Investments in research to develop thinner dielectric films and more efficient manufacturing processes are anticipated to deliver cost benefits and performance improvements, contributing an estimated 12% to market growth by 2030.

On the business side, market expansion is supported by demand from original equipment manufacturers in the automotive, industrial, and consumer electronics sectors, with these industries projected to account for 40% of the film capacitor market by 2030. Using film capacitors provides businesses with benefits such as improved product reliability, lower maintenance needs, and enhanced energy efficiency, with the automotive sector expected to see a 25% reduction in maintenance costs by 2027 due to their usage. Additionally, the regulatory environment supports the use of film capacitors due to their environmentally safer materials and compliance with global electrical standards. Manufacturers are expected to meet certification requirements such as RoHS and REACH, which will likely contribute to 18% of market growth by 2030.

China Market Size Analysis

The China Film Capacitor Market is projected to experience steady growth from USD 0.7 billion in 2024 to USD 1.0 billion by 2034, representing a compound annual growth rate of 3.9%. This growth is driven by the increasing adoption of energy-efficient electronic components across various industries, including consumer electronics, automotive, and industrial applications.

The demand for film capacitors, known for their reliability, low cost, and superior performance, is expected to rise as technological advancements and energy-saving trends continue to shape the market, contributing to an estimated 35% increase in market value over the next decade.

Asia Pacific was a leading region for the film capacitor market, representing 34.6% of the total market share in 2024. China alone accounted for approximately USD 0.67 billion of the market, reflecting the country’s strong role as a major hub of electronics manufacturing and assembly.

The region’s dominance is supported by rapid industrialization, rising demand for consumer electronics, and the accelerating electric vehicle (EV) market. Key economies like China, India, Japan, and South Korea contribute heavily, driven by well-established electronics industries and government initiatives supporting renewable energy and electric mobility.

The Asia Pacific market is projected to grow at a CAGR of 3.9% through the forecast period, fueled by ongoing investments in renewable energy infrastructure, expanding smart grid projects, and accelerating adoption of EVs, with the region expected to account for 40% of global film capacitor market growth by 2034. The region’s competitive manufacturing landscape and increasing R&D efforts in advanced dielectric materials further enhance its leadership position in the film capacitor market globally.

By Material

Plastic film capacitors dominated the market in 2024 with a significant share of 72.7%. This category includes widely used materials like polypropylene and polyester films, favored for their high electrical insulation, low dielectric loss, and excellent self-healing properties. These attributes make plastic film capacitors highly reliable and suitable for high-frequency and high-voltage applications, especially in power electronics, motor drives, and inverter circuits. The increasing demand for plastic film capacitors is also driven by their versatility across diverse electronic applications, including consumer electronics and automotive electronics, contributing to an expected 30% market growth by 2034.

Furthermore, the shift toward miniaturized, energy-efficient electronic components amplifies the demand for plastic-based capacitors. Growing investments in renewable energy systems, particularly solar and wind power installations, and the expanding electric vehicle market underpin their adoption for power conditioning and energy storage applications. This is projected to account for 25% of the overall market growth in the coming decade, as demand for energy-efficient solutions in these sectors rises rapidly.

By Application

The AC application segment held a dominant 65.8% share of the film capacitor market in 2024. AC film capacitors are vital for power transmission and distribution systems, industrial motor drives, and motor-run capacitors in household appliances. The robust demand from electric power infrastructure development and industrial automation supports continuous growth in AC film capacitor applications, contributing to a projected 28% growth in the segment by 2034.

Additionally, advances in dielectric film materials enable higher temperature tolerance and higher capacitance density, pushing innovations and performance in AC film capacitors. With many industries undergoing electrification and modernization, the use of AC film capacitors extends across emerging technologies such as smart grids and renewable energy conversion systems. Their essential role in filtering, power factor correction, and noise reduction in alternating current circuits ensures ongoing traction within this application segment, which is expected to account for 35% of the total market growth by 2034.

By End-Use

The automotive sector accounted for 34.8% of the film capacitor market in 2024, reflecting the rising integration of capacitors in electric vehicles (EVs), hybrid vehicles, and advanced driver-assistance systems. Capacitors play a critical role in automotive electronics, specifically in EV powertrains, battery management systems, and regenerative braking units, owing to their reliability under high-temperature and high-voltage conditions. The automotive sector is expected to see a 25% market growth by 2034, driven by increased adoption of these components in electric and hybrid vehicles.

Government regulations promoting fuel efficiency and emission reduction further stimulate the demand for advanced capacitors in automotive applications. Increasing investments in electrification and smart vehicle technologies, particularly in North America, Europe, and the Asia Pacific, are expected to contribute to 30% of the sector’s market growth by 2034.

The automotive industry’s need for compact, high-capacitance, and durable components aligns with ongoing capacitor material innovations and miniaturization trends. The automotive segment is projected to continue its expansion, supported by the accelerating transition toward electric and hybrid vehicles, contributing to a projected 22% share of the global film capacitor market by 2034.

Key Market Segments

By Material

- Paper

- Dominating Plastic

By Application

- AC Application

- DC Application

By End-Use

- Automotive

- Consumer Electronics

- Manufacturing

- Communication Technology

- Others

Top 5 Use Cases

- Power Supply Systems: Film capacitors improve energy efficiency and voltage regulation in AC power applications, contributing to 22% of market growth by 2034.

- Automotive Electronics: In electric vehicles, film capacitors support power management and regenerative braking, projected to contribute 25% to market growth by 2034.

- Consumer Electronics: Film capacitors enhance power efficiency and reduce EMI in devices like TVs and audio systems, expected to account for 18% of market growth by 2034.

- Communication Systems: Film capacitors are essential for signal coupling and noise reduction in communication devices, contributing 15% to market growth by 2034.

- Industrial Machinery: Film capacitors support power conditioning and motor control in industrial machinery, projected to account for 20% of market growth by 2034.

nery and heavy equipment.

Drivers

The growth of the Film Capacitor market is primarily driven by the increasing demand for energy-efficient power management solutions across various sectors. Industries such as automotive, consumer electronics, and industrial machinery require capacitors for efficient energy storage, power conditioning, and voltage regulation.

The automotive sector, particularly with the rise of electric vehicles (EVs), is a significant contributor to this demand. Additionally, the expansion of renewable energy systems, including solar and wind, relies on efficient energy storage and management, further driving the adoption of film capacitors in these systems.

Opportunities

The Film Capacitor market presents several opportunities driven by technological advancements and industry trends. The rise of smart grid technologies and the growing focus on renewable energy sources offer significant growth potential.

As electric vehicles continue to gain traction, the need for capacitors in power systems, motor drives, and energy storage solutions will grow. Furthermore, the increasing demand for energy-efficient solutions across industries such as manufacturing, communication, and consumer electronics provides a strong foundation for the continued growth of the market, particularly in energy-hungry applications.

Trends

Several key trends are shaping the Film Capacitor market, notably the growing adoption of advanced materials, particularly plastic film, due to their superior dielectric properties and long-term reliability. These capacitors are increasingly being used in applications that require stable energy delivery, such as in AC power systems and automotive electronics.

Additionally, the trend toward sustainable and green technologies is influencing the market, with more industries seeking eco-friendly and energy-efficient components. Manufacturers are focusing on innovation to meet the evolving requirements of electric vehicles, industrial automation, and renewable energy systems.

Challenges

The Film Capacitor market faces several challenges, including high production costs and intense competition from alternative capacitor technologies. While film capacitors are known for their durability and performance, they often come at a higher price point compared to other capacitor types, which may limit their adoption in price-sensitive applications.

Additionally, rapid technological advancements in the electronics and automotive industries present a constant challenge for manufacturers, who must continuously innovate to meet the changing demands for more efficient, smaller, and higher-performance capacitors across various sectors.

SWOT Analysis

Strengths

Film capacitors offer high reliability, efficiency, and durability, making them ideal for power management applications. Their versatility across industries like automotive, consumer electronics, and industrial machinery strengthens their market position.

With advanced materials like plastic film, they provide superior performance in energy storage and power conversion applications.

Weaknesses

Film capacitors are relatively expensive compared to other capacitor types, limiting their use in cost-sensitive markets. Additionally, while durable, they can suffer wear in high-stress environments. Continuous innovation is necessary to meet evolving technological demands, which requires significant R&D investments and could strain manufacturers’ financial resources.

Opportunities

The growing demand for electric vehicles, renewable energy systems, and smart grids presents significant opportunities. As these industries expand, the need for efficient power storage and energy management solutions will increase.

Advancements in material science also promise cost-effective manufacturing, broadening the potential for film capacitors in various sectors.

Threats

Competition from alternative energy storage technologies, such as supercapacitors, poses a threat. Rising raw material costs can impact production costs and market pricing.

Additionally, rapid technological changes and economic disruptions, such as supply chain issues or geopolitical tensions, can create instability in the Film Capacitor market.

Key Player Analysis

The Film Capacitor Market is driven by established players such as AVX Corporation, Cornell Dubilier Electronics, and KEMET Corporation. These companies are known for reliable products that meet the needs of industrial, automotive, and consumer electronics. AVX Corporation holds a significant market share, accounting for approximately 18% of the global film capacitor market, thanks to its focus on quality, broad product lines, and global distribution, which has helped it remain competitive in diverse markets.

Asian companies like Nichicon Corporation, Panasonic Corporation, and TDK Corporation hold strong positions due to innovation and large-scale production. Their strengths lie in miniaturization, thermal performance, and energy efficiency. Panasonic Corporation, for instance, captures around 15% of the market share, particularly in high-growth areas such as automotive electronics and renewable energy systems, thanks to its advanced capacitor technologies.

European and U.S. firms, including Vicor Corporation, Vishay Intertechnology, WIMA GmbH & Co. KG, and Wurth Elektronik GmbH & Co. KG, specialize in niche markets. They cater to aerospace, defense, and industrial automation with customized solutions. Their role in advancing high-reliability designs positions them as key contributors to future technological progress in the film capacitor sector.

Top Key Players

- AVX Corporation

- Cornell Dubilier Electronics, Inc.

- KEMET Corporation

- Nichicon Corporation

- Panasonic Corporation

- TDK Corporation

- Vicor Corporation

- Vishay Intertechnology, Inc.

- WIMA GmbH & Co. KG

- Wurth Elektronik GmbH & Co. KG

- Others.

Recent Developments

- In April 2025, TDK expanded its CGA series of automotive multilayer ceramic capacitors with a new 100-V product offering 10 µF capacitance in a compact 3225 case size. This product addresses the increasing demand for capacitors in high-current automotive power lines and supports vehicle electrification trends

- In April 2024, Kyocera AVX (a key AVX division) launched two new snap-in aluminum electrolytic capacitor series (SNA and SNL) designed for commercial and industrial applications such as power inverters and solar inverters. These capacitors offer high reliability, lead-free compliance, and extended temperature operation from -25°C to +105°C.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 6.34 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material(Paper, plastic) By Application (AC Application, DC Application) By End-Use (Automotive, Consumer Electronics, Manufacturing, Communication Technology, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AVX Corporation, Cornell Dubilier Electronics, Inc., KEMET Corporation, Nichicon Corporation, Panasonic Corporation, TDK Corporation, Vicor Corporation, Vishay Intertechnology, Inc., WIMA GmbH & Co. KG, Wurth Elektronik GmbH & Co. KG, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- AVX Corporation

- Cornell Dubilier Electronics, Inc.

- KEMET Corporation

- Nichicon Corporation

- Panasonic Corporation

- TDK Corporation

- Vicor Corporation

- Vishay Intertechnology, Inc.

- WIMA GmbH & Co. KG

- Wurth Elektronik GmbH & Co. KG

- Others.