Global Fertility and Pregnancy Rapid Test Kits Market By Product Type (Pregnancy Rapid Tests and Fertility Rapid Tests), By Test Type (hCG Urine, LH Urine, hCG Blood, and FSH Urine), By Distribution Channel (Pharmacy, Hypermarkets & Supermarkets, Gynecology/Fertility Clinics, E-commerce, and Drugstore), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166583

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

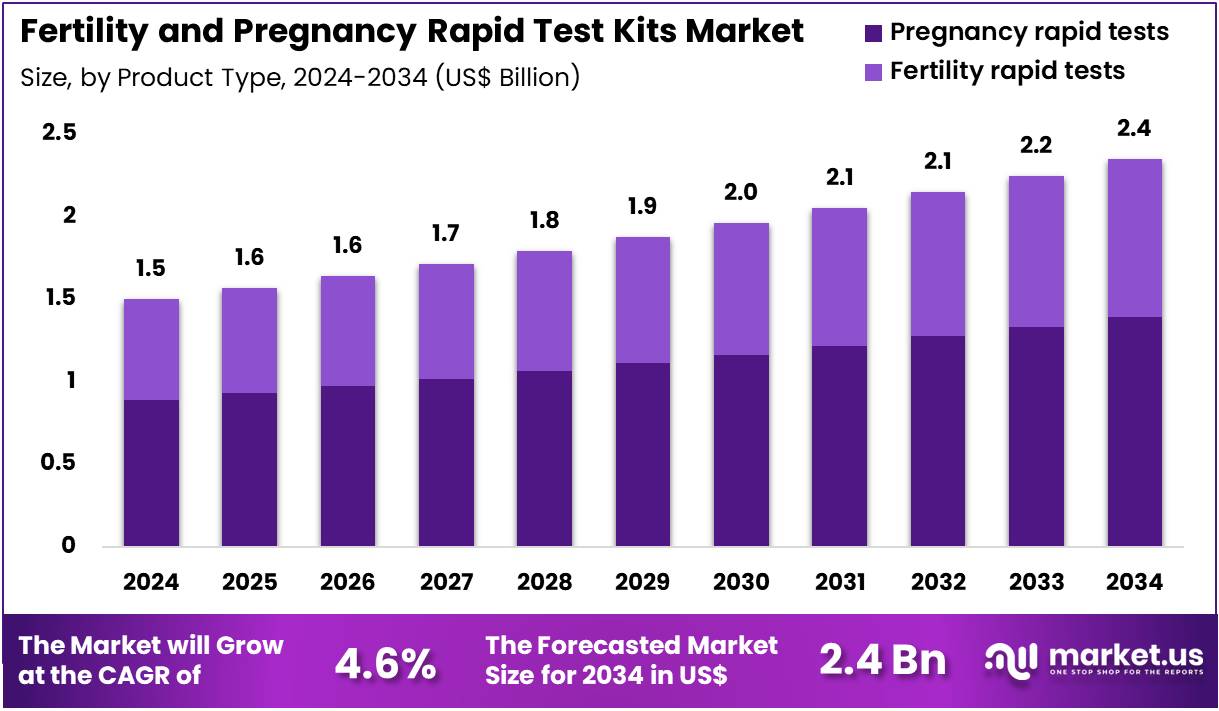

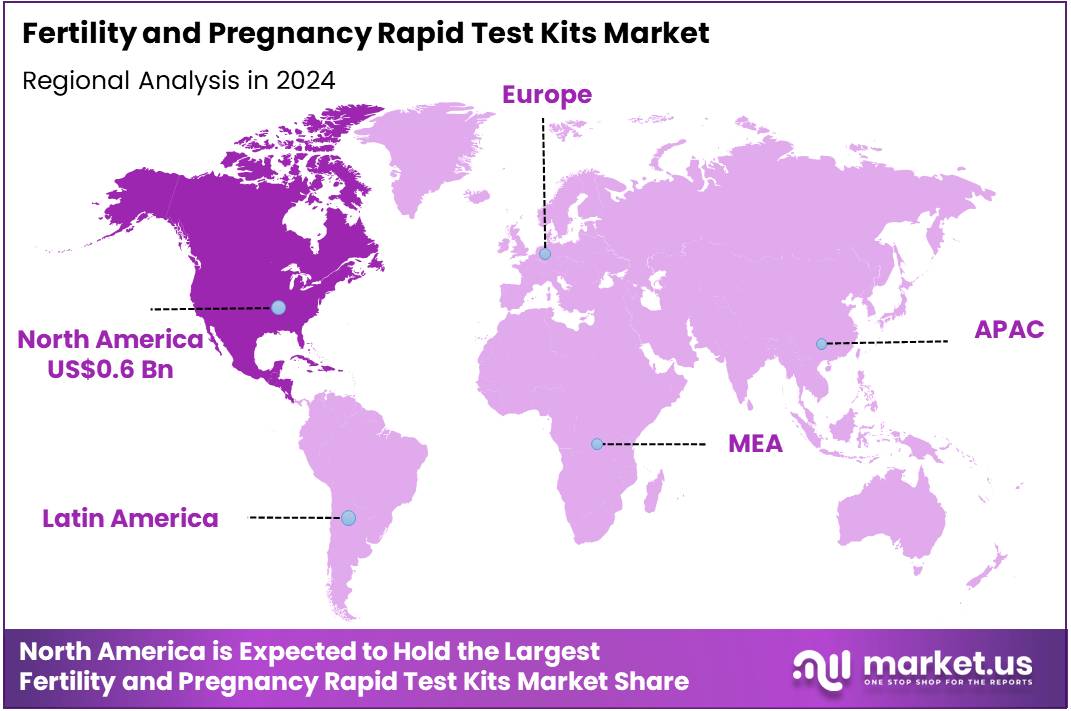

The Global Fertility and Pregnancy Rapid Test Kits Market size is expected to be worth around US$ 2.4 Billion by 2034 from US$ 1.5 Billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.7% share with a revenue of US$ 0.6 Billion.

Increasing awareness among consumers about reproductive health propels the demand for fertility and pregnancy rapid test kits, as individuals actively seek reliable tools for family planning and early detection. Manufacturers innovate to meet this surge by enhancing product accuracy and user-friendliness, which drives market growth through expanded accessibility in home settings. These kits find applications in ovulation prediction for couples trying to conceive, hormone level monitoring during fertility treatments, and quick pregnancy confirmation to alleviate anxiety.

Opportunities arise from integrating digital features that allow result tracking via apps, opening avenues for personalized health insights. A notable trend involves collaborations that advance biosensor technology, such as iXensor’s technology licensing agreement with Rohto Pharmaceutical in November 2022, which fosters smartphone-based testing for seamless fertility and pregnancy monitoring. This evolution toward app-connected solutions enhances user engagement and positions the market for sustained expansion through technological synergy.

Growing adoption of at-home diagnostic tools accelerates the fertility and pregnancy rapid test kits market, as people prioritize convenience and privacy in managing their reproductive journeys. Companies respond by developing kits that offer rapid results with minimal invasiveness, fueling drivers like consumer empowerment and reduced healthcare visits. Applications extend to fertility clinics for preliminary assessments, pharmacies for over-the-counter sales, and online platforms for discreet purchases, broadening market reach.

Emerging opportunities include customizing kits for diverse user needs, such as those with irregular cycles or undergoing assisted reproduction. Recent trends highlight launches of advanced detection methods, exemplified by Proov’s introduction of early-detection hCG tests in June 2022, which cater to demands for quicker, more dependable outcomes. Such innovations bolster the segment focused on early pregnancy verification, driving overall market progression and competitive differentiation.

Rising investments in manufacturing capabilities invigorate the fertility and pregnancy rapid test kits sector, as firms scale production to satisfy escalating global needs efficiently. Stakeholders optimize supply chains to ensure timely availability, which acts as a key driver by lowering costs and improving product distribution. These kits serve various applications, including routine fertility tracking in wellness apps, professional use in obstetric practices for initial screenings, and educational purposes in health programs.

Opportunities emerge from localizing production to enhance affordability and reduce import reliance, paving the way for deeper market penetration. A prominent trend features strategic expansions, like Quidel Corporation’s US$5 million investment in August 2025 to boost manufacturing operations, which streamlines delivery and elevates accessibility. This focus on operational efficiency strengthens the market’s foundation, enabling sustained growth amid increasing consumer reliance on rapid testing solutions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.5 Billion, with a CAGR of 4.6%, and is expected to reach US$ 2.4 Billion by the year 2034.

- The product type segment is divided into pregnancy rapid tests and fertility rapid tests, with pregnancy rapid tests taking the lead in 2023 with a market share of 59.3%.

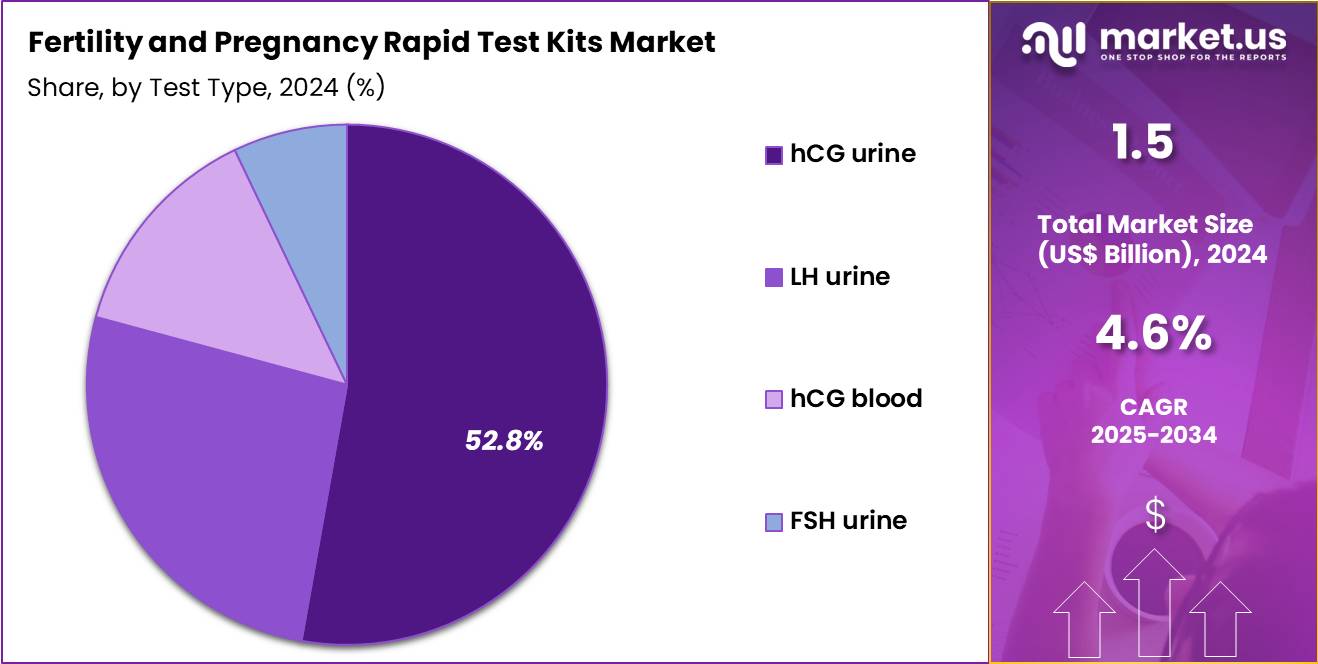

- Considering test type, the market is divided into hCG urine, LH urine, hCG blood, and FSH urine. Among these, hCG urine held a significant share of 52.8%.

- Furthermore, concerning the distribution channel segment, the market is segregated into pharmacy, hypermarkets & supermarkets, gynecology/fertility clinics, e-commerce, and drugstore. The pharmacy sector stands out as the dominant player, holding the largest revenue share of 44.6% in the market.

- North America led the market by securing a market share of 38.7% in 2023.

Product Type Analysis

Pregnancy rapid tests hold 59.3% of the Fertility and Pregnancy Rapid Test Kits market and are projected to dominate due to increasing awareness regarding early pregnancy detection and the rising preference for home-based testing. The growing female workforce and evolving lifestyle patterns have accelerated the need for quick, private, and affordable testing solutions. These kits deliver fast and accurate results without the need for laboratory assistance, driving convenience for users worldwide.

Manufacturers are investing in digital pregnancy test devices with Bluetooth and smartphone connectivity for enhanced result tracking. Expanding access to over-the-counter pregnancy test kits across both urban and rural areas supports wider market penetration. Government initiatives aimed at improving reproductive health and fertility awareness are also boosting demand.

Moreover, advancements in test sensitivity and the inclusion of dual-hormone detection technologies are enhancing diagnostic accuracy. As healthcare systems emphasize early prenatal care and awareness, pregnancy rapid tests are expected to remain the preferred choice for at-home pregnancy detection.

Test Type Analysis

hCG urine tests account for 52.8% of the market and are anticipated to retain their lead due to their cost-effectiveness, simplicity, and widespread use for early pregnancy diagnosis. These tests detect the presence of human chorionic gonadotropin hormone in urine, a reliable indicator of pregnancy. Growing consumer preference for quick, non-invasive, and private testing has strengthened this segment’s adoption globally. Technological advancements in test sensitivity have allowed detection of low hCG levels even in the earliest stages of pregnancy, improving accuracy rates.

The availability of midstream, strip-based, and digital formats has diversified user options. Pharmacies and online retail platforms have enhanced accessibility, particularly in developing regions. Public health campaigns promoting reproductive awareness and early detection of pregnancy are further stimulating demand. The trend toward self-testing for reproductive health, coupled with greater acceptance of home diagnostic devices, is anticipated to sustain the strong growth of hCG urine-based pregnancy testing kits in the coming years.

Distribution Channel Analysis

Pharmacies dominate the distribution channel with a 44.6% market share, driven by their accessibility, product reliability, and trust among consumers for sensitive healthcare purchases. Pharmacies serve as the primary retail point for pregnancy and fertility test kits due to their convenience and immediate availability. Consumers rely on pharmacists for guidance on test selection and usage, reinforcing in-store purchases. The increasing expansion of organized pharmacy chains in both developed and emerging economies strengthens this segment’s growth.

Urbanization and women’s growing health awareness are leading to frequent over-the-counter purchases of pregnancy and fertility kits. Pharmacies also benefit from collaborations with diagnostic manufacturers for direct product distribution, ensuring steady inventory. Regulatory approvals for over-the-counter sales of fertility and pregnancy kits have further widened reach. Additionally, the growing integration of digital pharmacy platforms offering doorstep delivery enhances user convenience. As pharmacies continue evolving into multi-service health outlets, their share in the fertility and pregnancy test kit market is projected to remain dominant.

Key Market Segments

By Product Type

- Pregnancy Rapid Tests

- Fertility Rapid Tests

By Test Type

- hCG Urine

- LH Urine

- hCG Blood

- FSH Urine

By Distribution Channel

- Pharmacy

- Hypermarkets & Supermarkets

- Gynecology/Fertility Clinics

- E‑commerce

- Drugstore

Drivers

Increasing Awareness of Reproductive Health is Driving the Market

The surge in public awareness regarding reproductive health has significantly propelled the demand for fertility and pregnancy rapid test kits, enabling individuals to monitor their reproductive status conveniently at home. This heightened consciousness stems from broader educational campaigns and accessible information through digital platforms, encouraging proactive family planning decisions. As more people recognize the importance of early detection in fertility challenges, the adoption of rapid test kits has accelerated, particularly among urban professionals delaying parenthood.

Government initiatives promoting reproductive health education have further amplified this trend, fostering a culture of self-reliant health management. Consequently, key manufacturers have reported robust sales growth, reflecting sustained consumer engagement with these products. Church & Dwight Co., Inc. achieved a 9.2% increase in full-year net sales to $5,867.9 million in 2023, compared to 2022. This expansion underscores the market’s responsiveness to evolving societal norms around delayed childbearing and infertility concerns.

Moreover, the convenience of over-the-counter availability has democratized access, reducing reliance on clinical visits and empowering users with timely insights. In parallel, declining overall fertility rates have intensified the need for such tools, as evidenced by the U.S. general fertility rate dropping 3% to 54.5 births per 1,000 females aged 15-44 in 2023 from 56.0 in 2022. These dynamics not only drive immediate purchases but also cultivate long-term loyalty to reliable brands. Ultimately, this driver positions the market for continued expansion as awareness permeates diverse demographics globally.

Restraints

Persistent High Unmet Need for Family Planning is Restraining the Market

The elevated unmet need for family planning services in various regions continues to hinder widespread adoption of fertility and pregnancy rapid test kits, particularly where socioeconomic barriers limit product availability. In many low-income settings, inadequate distribution networks and cultural stigmas surrounding reproductive discussions exacerbate this challenge, leaving potential users without viable options. High costs relative to average incomes further deter purchases, confining the market to affluent segments and stalling broader penetration.

Regulatory inconsistencies across borders also complicate supply chains, delaying product launches and inflating prices for imported kits. As a result, millions remain underserved, perpetuating cycles of unplanned pregnancies and undiagnosed fertility issues. In sub-Saharan Africa, the proportion of women with an unmet need for family planning who seek to avoid pregnancy stood at 24% in 2021, reflecting persistent regional disparities. Such statistics reveal how infrastructural deficits restrain market growth, as test kits fail to reach those most in need.

Additionally, fluctuating currency values in emerging economies amplify affordability issues, eroding consumer confidence in investing in non-essential health tools. This restraint not only caps revenue potential but also underscores the ethical imperative for inclusive pricing strategies. Addressing these barriers requires collaborative efforts between manufacturers and international health bodies to enhance accessibility without compromising quality.

Opportunities

Improvements in Family Planning Satisfaction in Emerging Markets are Creating Growth Opportunities

Advancements in family planning satisfaction rates within emerging markets present substantial avenues for expanding the fertility and pregnancy rapid test kits sector, as enhanced healthcare integration boosts product relevance. Rising investments in reproductive health infrastructure by governments in Asia and Africa are facilitating better distribution channels, opening doors for innovative test solutions.

As urbanization accelerates, a growing middle class in these regions seeks discreet, reliable at-home diagnostics to align with modern lifestyles. This shift creates fertile ground for market entry, where localized manufacturing could mitigate import duties and tailor products to cultural preferences. Furthermore, partnerships with non-governmental organizations can leverage community outreach to embed test kits into routine health services.

In sub-Saharan Africa, the percentage of demand for family planning satisfied by modern methods increased by 3.6 percentage points between 2017 and 2022, reaching 56% by 2021. Similarly, Central and Southern Asia achieved a satisfaction rate of 74% in 2021, up from lower levels in prior years, indicating untapped potential for scaled adoption. These improvements correlate with demographic expansions, where younger populations demand tools for informed reproductive choices.

Educational programs emphasizing early fertility assessment further amplify opportunities, potentially driving volume sales through subsidized programs. By capitalizing on these trends, manufacturers can achieve economies of scale, fostering sustainable growth in previously underserved territories. Overall, this opportunity heralds a transformative phase for the market, blending profitability with public health advancements.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures, such as rising inflation and fluctuating disposable incomes, challenge consumers’ ability to afford fertility and pregnancy rapid test kits, potentially slowing market penetration in emerging economies. Economic expansions, however, empower healthcare providers to invest in accessible diagnostics, boosting demand among urban professionals seeking family planning solutions.

Geopolitical tensions, including ongoing trade disputes, disrupt global supply chains for raw materials, delaying production and elevating costs for manufacturers reliant on international sourcing. These same conflicts encourage domestic innovation, as companies diversify suppliers to mitigate risks and enhance product reliability. Current U.S. tariffs on imported medical devices from key Asian producers increase retail prices by up to 10-15%, straining affordability for American buyers and complicating export strategies for global firms.

Latest Trends

Integration of Digital Technologies in Test Kits is a Recent Trend

The incorporation of digital technologies into fertility and pregnancy rapid test kits marks a pivotal 2024 development, enhancing user experience through smartphone connectivity and result tracking features. This evolution allows for precise hormone level monitoring and personalized fertility insights, appealing to tech-oriented consumers seeking data-driven decisions. Manufacturers are prioritizing intuitive apps that provide conception probability estimates, revolutionizing traditional analog methods. Such innovations reduce interpretation errors and offer multilingual support, broadening global appeal.

In 2024, this trend gained momentum with product updates emphasizing user-friendly interfaces and AI-assisted analytics for cycle predictions. Procter & Gamble Co. reported 4% organic sales growth for its fiscal year 2024, encompassing the baby, feminine, and family care segment that includes Clearblue digital kits. This growth aligns with broader consumer shifts toward connected health devices, as evidenced by the segment’s contribution to overall corporate performance.

Digital kits now dominate premium sales channels, with features like weeks estimators providing emotional reassurance during early pregnancy detection. Regulatory approvals for these tech-enhanced products have accelerated, ensuring safety while spurring competitive differentiation. Looking ahead, this trend promises interoperability with wearables, further embedding test kits into holistic wellness ecosystems. By 2024, adoption rates surged among millennials, underscoring the trend’s role in modernizing reproductive health management.

Regional Analysis

North America is leading the Fertility and Pregnancy Rapid Test Kits Market

In 2024, North America captured a 38.7% share of the global fertility and pregnancy rapid test kits market, driven by clinical endorsements and shifting reproductive behavior. The American College of Obstetricians and Gynecologists’ support for at-home ovulation tracking encouraged widespread adoption of luteinizing hormone detection strips, particularly among couples delaying conception. Declines in fertility rates—down 1% to 53.8 births per 1,000 women aged 15–44—further spurred consumers to adopt predictive kits as part of fertility planning.

Retail pharmacies expanded distribution of hCG-based urine tests with 99% detection accuracy within 10 days post-conception, aligning with CDC priorities to improve early prenatal care access. With first-trimester initiation rates slipping from 77.0% in 2022 to 76.1% in 2023, these home-use kits filled diagnostic gaps, especially in underserved and rural populations. Federal data showing infertility prevalence at 13.1% among women aged 15–44 prompted grant-backed distribution of low-cost kits through family planning programs.

The FDA’s fast-track approvals under its OTC framework facilitated entry of digital ovulation predictors and combo kits, appealing to millennial parents delaying childbirth to an average maternal age of 30. These shifts reinforced North America’s leadership in consumer-directed reproductive diagnostics and digital health integration.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific market is expected to expand steadily as governments integrate ovulation and hCG test kits into public health programs addressing declining fertility, averaging 1.3 births per woman. Family planning departments in East Asia and the Pacific are promoting diagnostic accessibility by equipping rural health posts and urban community centers with rapid test supplies. Partnerships between domestic diagnostics firms and national health authorities have improved the sensitivity of LH predictors, supporting fertility awareness among working women postponing motherhood.

Regulatory bodies in Southeast Asia are subsidizing digital combo kits to reduce clinic dependency, while telehealth-linked pregnancy apps enhance early counseling and tracking. Ongoing collaborations between regional manufacturers and UN agencies have ensured affordability of urine-based tests across low-fertility zones. These coordinated initiatives are building a sustainable ecosystem for reproductive self-monitoring and early pregnancy confirmation, positioning Asia Pacific as a fast-evolving hub for fertility and maternal health innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading executives in the reproductive health diagnostics sector drive expansion through targeted innovations, such as integrating AI for precise hormone detection and launching digital kits that deliver instant, app-connected results to enhance user engagement. Major firms forge strategic partnerships with e-commerce platforms and healthcare influencers to broaden distribution channels and elevate consumer awareness, particularly in emerging Asian markets where demand surges due to rising fertility concerns.

Companies aggressively pursue acquisitions of niche startups specializing in ovulation tracking to consolidate market share and accelerate product pipelines. They invest heavily in R&D collaborations with biotech entities to refine sensitivity levels in early-detection tools, ensuring compliance with evolving regulatory standards while capturing premium pricing. Furthermore, proactive sustainability initiatives, like eco-friendly packaging, appeal to environmentally conscious demographics and differentiate brands in competitive retail landscapes.

Church & Dwight Co., Inc., established in 1846 as a pioneer in sodium bicarbonate production, has evolved into a diversified consumer goods powerhouse with annual revenues exceeding $6 billion, commanding leadership in household essentials through iconic brands like Arm & Hammer and OxiClean. The firm dominates the personal care arena via its Specialty Products Division, which propelled a 5.1% sales increase in Q3 2025, fueled by robust performance from First Response, the top-selling pregnancy confirmation brand in North America.

Church & Dwight sustains growth by channeling resources into category expansion and operational efficiencies, positioning itself as a resilient player amid shifting demographic trends toward delayed family planning.

Top Key Players

- Swiss Precision Diagnostic GmbH

- Sugentech, Inc

- Quidel Corporation

- Proov

- Piramal Pharma Ltd.

- Mankind Pharma Ltd.

- Gregory Pharmaceutical Holdings, Inc

- Church & Dwight Co, Inc.

- bioMérieux SA

- Abbott

Recent Developments

- In October 2025, Procter & Gamble’s collaboration with an Indian healthcare provider strengthened the Fertility and Pregnancy Rapid Test Kits Market by localizing product offerings for one of the fastest-growing consumer bases. By tailoring its kits to regional preferences and improving distribution reach, P&G is addressing affordability and accessibility gaps in emerging markets. This localization strategy enhances consumer trust and increases overall market adoption of home-based pregnancy testing solutions.

- In September 2025, Roche Diagnostics’ introduction of a digital platform integrating pregnancy test kits with a mobile application advanced the market through digital transformation. By merging physical diagnostics with digital tracking and personalized health insights, Roche is driving consumer engagement and positioning pregnancy testing within a broader ecosystem of women’s health monitoring. This innovation strengthens the premium segment of connected fertility solutions, appealing to urban, tech-driven users.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 2.4 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pregnancy Rapid Tests and Fertility Rapid Tests), By Test Type (hCG Urine, LH Urine, hCG Blood, and FSH Urine), By Distribution Channel (Pharmacy, Hypermarkets & Supermarkets, Gynecology/Fertility Clinics, E-commerce, and Drugstore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swiss Precision Diagnostic GmbH, Sugentech, Inc, Quidel Corporation, Proov, Piramal Pharma Ltd., Mankind Pharma Ltd., Gregory Pharmaceutical Holdings, Inc, Church & Dwight Co, Inc., bioMérieux SA, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fertility and Pregnancy Rapid Test Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Fertility and Pregnancy Rapid Test Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Swiss Precision Diagnostic GmbH

- Sugentech, Inc

- Quidel Corporation

- Proov

- Piramal Pharma Ltd.

- Mankind Pharma Ltd.

- Gregory Pharmaceutical Holdings, Inc

- Church & Dwight Co, Inc.

- bioMérieux SA

- Abbott