Global Fermented Ingredients Market Size, Share Report By Product Type (Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, Others), By Form (Liquid, Dry), By Application (Food and Beverages, Pharmaceuticals, Paper, Feed, Personal Care, Biofuel, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154324

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

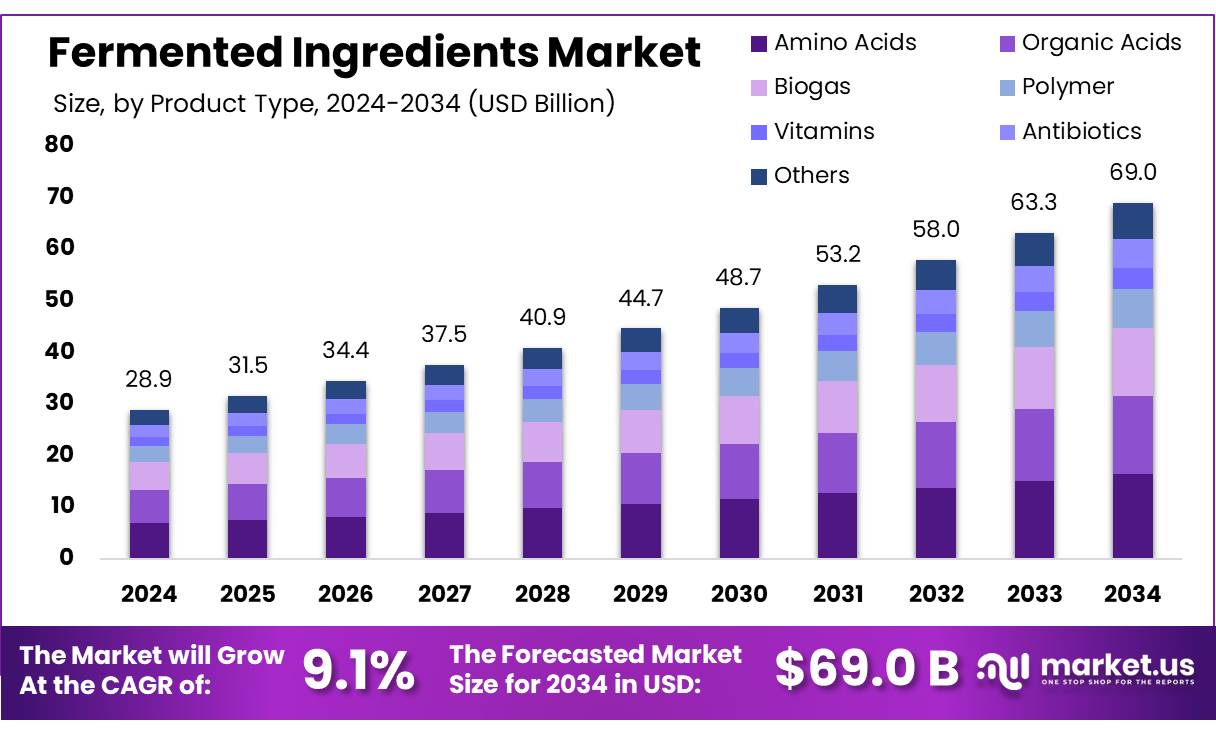

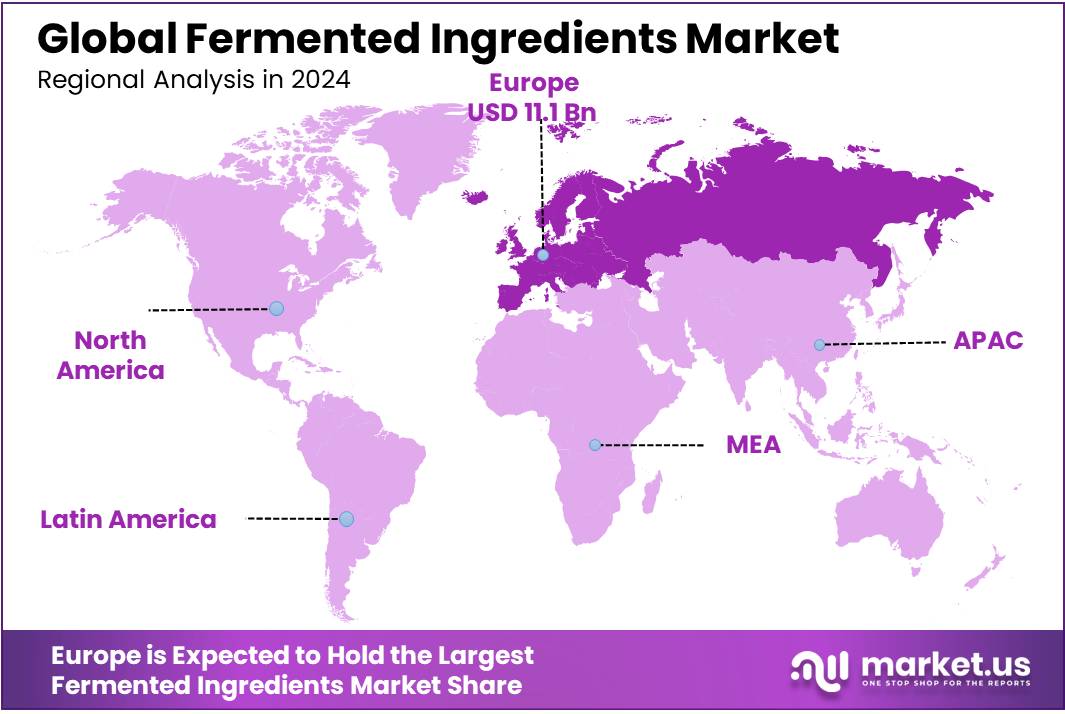

The Global Fermented Ingredients Market size is expected to be worth around USD 69.0 Billion by 2034, from USD 28.9 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 38.50% share, holding USD 11.1 Billion in revenue.

Fermented ingredient concentrates constitute biomass‑derived products concentrated from microbial fermentation processes. Predominant types include amino acids (e.g., glutamic and lactic), organic acids (lactic, acetic, citric), enzymes, vitamins, and protein concentrates. These ingredients function as nutritional enhancers, preservatives, flavor agents and functional components used across food & beverage, pharmaceuticals, nutraceuticals, feed and industrial applications

Government initiatives are playing a pivotal role in supporting the fermentation sector. For instance, the U.S. Department of Agriculture (USDA) has invested in research and development projects exploring innovative food production technologies, including precision fermentation, to bolster food security and reduce the environmental impact of agriculture. Similarly, the U.S. Economic Development Administration (EDA) has allocated a $51 million federal grant to the Illinois Fermentation and Agriculture Biomanufacturing (iFAB) Hub to develop new uses for Illinois corn and other crops through precision fermentation.

The future growth prospects for fermented ingredients concentrates are promising, with projections indicating a potential market size of USD 100 billion to USD 150 billion by 2050, depending on factors such as climate policies and technological advancements. To achieve this, it is estimated that over USD 250 billion in cumulative investment will be required to scale fermentation technologies and reduce production costs. Key drivers of this growth include the increasing demand for alternative proteins, innovations in fermentation processes, and a shift towards sustainable and efficient food production methods.

Key Takeaways

- The global Fermented Ingredients Market is projected to reach USD 69.0 billion by 2034, up from USD 28.9 billion in 2024, registering a CAGR of 9.1% during the forecast period.

- In 2024, Amino Acids emerged as the leading product type, accounting for 23.8% share of the global market.

- By form, the Liquid segment dominated in 2024, capturing over 58.6% of the market share.

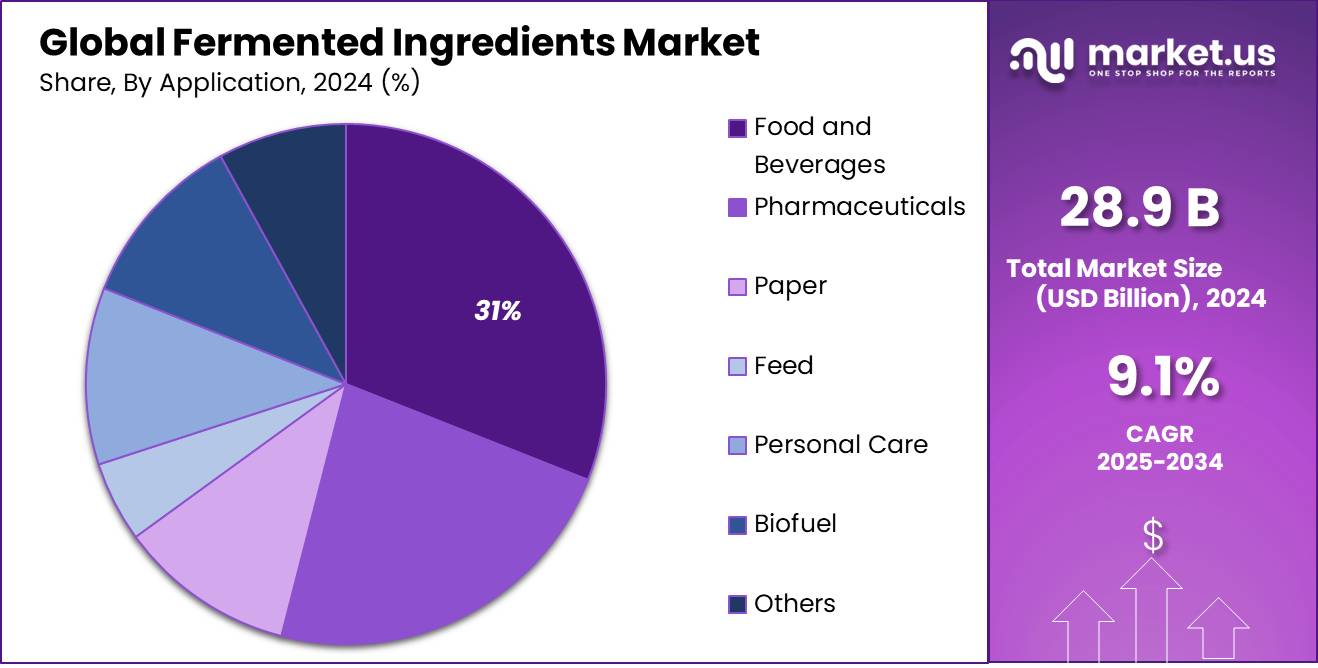

- The Food and Beverages segment led by application in 2024, with a market share of more than 31.2%.

- Europe held the largest regional share in 2024, contributing to over 38.50% of the global market, valued at approximately USD 11.1 billion.

By Product Type Analysis

Amino Acids lead Fermented Ingredients Market with 23.8% share in 2024

In 2024, Amino Acids held a dominant market position, capturing more than a 23.8% share in the global fermented ingredients market. This strong market presence is driven by the rising demand for amino acid-based formulations in dietary supplements, sports nutrition, pharmaceuticals, and functional foods. The increased focus on health, muscle development, and recovery has encouraged manufacturers to adopt fermentation processes to produce amino acids at scale, ensuring better purity and sustainability. With growing consumer preference for natural and bio-based components, fermented amino acids have emerged as a reliable ingredient category.

By Form Analysis

Liquid Form dominates with 58.6% due to its easy use and better absorption

In 2024, Liquid held a dominant market position, capturing more than a 58.6% share in the global fermented ingredients market. This strong performance is mainly due to its ease of application, faster absorption, and better mixability in various food and beverage formulations. Liquid fermented ingredients are widely used in dairy products, beverages, sauces, and nutritional supplements because they blend smoothly and deliver consistent flavor and nutritional value. Their popularity has grown among manufacturers looking for processing efficiency and improved shelf-life.

By Application Analysis

Food and Beverages dominate with 31.2% share due to growing demand for natural nutrition

In 2024, Food and Beverages held a dominant market position, capturing more than a 31.2% share in the global fermented ingredients market. This leadership is mainly supported by the rising consumer shift toward natural, clean-label, and gut-friendly products. Fermented ingredients are widely used in yogurts, pickles, bread, sauces, and plant-based drinks, adding both flavor and health benefits. As awareness about probiotics, digestive health, and immunity grows, food and beverage manufacturers are increasingly using fermented inputs to meet this demand.

Key Market Segments

By Product Type

- Amino Acids

- Organic Acids

- Biogas

- Polymer

- Vitamins

- Antibiotics

- Others

By Form

- Liquid

- Dry

By Application

- Food and Beverages

- Pharmaceuticals

- Paper

- Feed

- Personal Care

- Biofuel

- Others

Emerging Trends

Rise of Precision Fermentation in Food Innovation

Precision fermentation is transforming the food industry by enabling the production of complex ingredients with high efficiency and sustainability. This advanced biotechnological process involves engineering microorganisms to produce specific compounds, such as proteins, fats, and vitamins, which are traditionally derived from animals or plants. The growing interest in precision fermentation is driven by its potential to create animal-free, allergen-friendly, and environmentally sustainable food ingredients.

Governments worldwide are recognizing the potential of precision fermentation and are investing in its development. In 2024, the United States Department of Commerce’s Economic Development Administration awarded a $51 million grant to the University of Illinois Urbana-Champaign to establish the iFAB Tech Hub, the nation’s first lab-to-product innovation center for precision fermentation.

This initiative aims to advance fermentation technology for applications in agriculture, nutrition, and manufacturing . Similarly, in Finland, Business Finland provided a $10 million grant to Onego Bio for the development of animal-free egg proteins using precision fermentation .

The adoption of precision fermentation is also influencing consumer preferences. A growing number of consumers are seeking products that are not only sustainable but also health-conscious. Precision fermentation enables the production of ingredients that are cleaner, more consistent, and tailored to specific nutritional needs, aligning with the increasing demand for functional foods and beverages.

Drivers

Health and Wellness Trends Driving the Fermented Ingredients Market

The growing consumer focus on health and wellness is significantly influencing the demand for fermented ingredients. As individuals become more health-conscious, there’s an increasing preference for foods and beverages that offer functional benefits, such as improved digestion, enhanced immunity, and better gut health. Fermented ingredients, known for their probiotic properties and nutritional enhancements, are at the forefront of this shift.

The popularity of probiotics is a key factor in this trend. Probiotics, which are beneficial bacteria found in fermented foods, are recognized for their role in maintaining a healthy gut microbiome. This has led to a surge in the consumption of probiotic-rich products such as yogurt, kefir, and kombucha. For instance, sales of kefir, a fermented milk drink, have risen by 30% year-on-year, reflecting its growing acceptance among health-conscious consumers .

Government initiatives are also supporting this trend. In 2024, the United States government funded nearly 25 research projects or business grants advancing fermentation technology for defense, economic development, agricultural benefits, or nutrition enhancement, including a $51 million investment in precision fermentation capacity in Illinois. Such investments underscore the commitment to exploring and expanding the benefits of fermentation in food production.

The emphasis on health and wellness is not limited to traditional fermented foods. There’s a growing interest in functional beverages and plant-based products that incorporate fermented ingredients. For example, Generation Z consumers are increasingly replacing traditional beverages like alcohol and coffee with health-focused alternatives such as mushroom shots and kombucha . This shift indicates a broader movement towards functional foods that support various aspects of health, including mental well-being and energy levels.

Restraints

Regulatory Challenges Hindering the Growth of Fermented Ingredients

A significant barrier to the expansion of the fermented ingredients market is the complex and often stringent regulatory environment surrounding novel food technologies. While fermentation has been utilized for centuries in traditional food production, the advent of modern techniques, such as precision fermentation, has introduced new challenges in regulatory approval processes.

In the United States, the Food and Drug Administration (FDA) has issued Generally Recognized as Safe (GRAS) status for several fermentation-derived products. However, the approval process can be lengthy and costly, deterring many companies from pursuing innovation in this area.

For instance, the approval process for Impossible Foods’ soy leghemoglobin, a key ingredient in their plant-based burger, was delayed in the European Union due to concerns over its classification as a genetically modified organism (GMO). This classification required a more extensive and time-consuming approval process, highlighting the regulatory hurdles faced by companies in the fermentation sector.

In the European Union, the regulatory framework for novel foods, including those derived from fermentation, is governed by the European Food Safety Authority (EFSA). The approval process involves rigorous safety assessments and can be influenced by political factors, as seen in the case of Impossible Foods. The presence of host proteins in the final product led to its classification as a GMO, necessitating a more complex approval pathway and causing delays in market entry.

Opportunity

Government Support for Fermented Ingredients

Government initiatives are playing a pivotal role in propelling the growth of the fermented ingredients sector, particularly through funding, policy support, and strategic investments. These efforts are fostering innovation, enhancing production capabilities, and expanding market access for fermented products.

In the United States, the federal government has demonstrated a strong commitment to advancing fermentation technologies. A notable example is the $51 million federal grant awarded to the Illinois Fermentation and Agricultural Biotechnology (iFAB) center. This funding aims to explore new applications for corn and other crops through precision fermentation, such as producing hemoglobin for plant-based meats and developing biodegradable materials from renewable resources. Such investments underscore the government’s recognition of fermentation as a key component of sustainable food production and biomanufacturing.

Similarly, in Finland, Business Finland, a government agency, provided a $10 million grant to Onego Bio, a company focused on producing animal-free egg proteins using fermentation. This support highlights the government’s role in facilitating the commercialization of innovative fermentation-based solutions in the food industry.

In India, the government’s Bio-RIDE scheme, approved in September 2024, is set to invest ₹9,197 crore (approximately $1.1 billion) to advance biotechnology research and development, entrepreneurship, and biomanufacturing. This initiative aims to grow India’s bioeconomy to $300 billion by 2030, with a significant focus on fermentation technologies. Such large-scale investments are expected to bolster the development and commercialization of fermented ingredients in the country.

Regional Insights

In 2024, Europe held a dominant position in the global fermented ingredients market, accounting for more than 38.50% of the overall market share, with a total value of approximately USD 11.1 billion. This regional leadership can be attributed to Europe’s strong food and beverage processing infrastructure, deep-rooted tradition of fermented products, and increasing consumer inclination toward clean-label and functional foods.

Countries such as Germany, France, the Netherlands, and Denmark are major contributors to this market, with advanced capabilities in microbial fermentation technologies and sustainable ingredient production. The rising demand for plant-based dairy alternatives, sourdough products, kombucha, and fortified beverages has further driven the adoption of fermented ingredients across the European food and beverage sector.

Moreover, the European Union’s active support for biotechnology and food innovation has played a significant role in expanding fermentation-based applications. The EU’s Horizon Europe programme allocated nearly €1.6 billion in 2024 for food, bioeconomy, natural resources, agriculture, and environment-related research, a portion of which directly supports microbial fermentation and precision fermentation initiatives across food and nutrition sectors. Additionally, the European Food Safety Authority (EFSA) continues to provide regulatory clarity and safety assessments for novel fermented ingredients, encouraging industry innovation and compliance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ajinomoto Corporation Inc. is a major player in the fermented ingredients market, known for its large-scale production of amino acids, seasonings, and specialty ingredients through microbial fermentation. The company focuses on health-oriented and functional food solutions, supporting clean-label trends. In 2024, it continued to invest in biotechnology-driven fermentation processes and expanded its footprint in Asia and North America. Ajinomoto’s emphasis on innovation and sustainability strengthens its position in the global fermented ingredients industry.

AngelYeast Co., Ltd. is a leading Chinese manufacturer specializing in yeast and yeast extract products derived through fermentation. The company serves food, beverage, baking, and biotechnology sectors globally. In 2024, AngelYeast enhanced its R&D efforts to develop customized functional fermented ingredients, focusing on nutrition and taste. Its growing presence in Europe and Southeast Asia reflects its strategy to cater to global food security and sustainable production demands through efficient biofermentation platforms.

BASF SE is a major chemical and life sciences company involved in producing fermented vitamins, enzymes, and organic acids. In 2024, BASF focused on biotechnological innovations to improve production efficiency and reduce carbon footprint in fermentation processes. The company’s integrated approach to fermentation supports the development of sustainable food, animal nutrition, and agricultural applications. Its extensive R&D capabilities and strategic global presence position BASF as a critical player in the industrial-scale fermented ingredients market.

Top Key Players Outlook

- Ajinomoto Corporation Inc.

- AngelYeast Co., Ltd.

- Associated British Food (ABF)

- Bakels

- BASF SE

- Cargill, Incorporated

- Novonesis Group

- Citizen Cider LLC

- Dawn Food Products

- Döhler Group

- DuPont

Recent Industry Developments

BASF SE reported sales revenue of €21.79 billion for the year, a slight decrease from €22.83 billion in 2023, with a net income of €1.3 billion, up from €0.2 billion in the previous year.

In October 2024, Ajinomoto Foods Europe announced a collaboration with AMSilk GmbH to biomanufacture silk proteins using industrial fermentation at its Nesle facility in France.

Report Scope

Report Features Description Market Value (2024) USD 28.9 Bn Forecast Revenue (2034) USD 69.0 Bn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, Others), By Form (Liquid, Dry), By Application (Food and Beverages, Pharmaceuticals, Paper, Feed, Personal Care, Biofuel, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ajinomoto Corporation Inc., AngelYeast Co., Ltd., Associated British Food (ABF), Bakels, BASF SE, Cargill, Incorporated, Novonesis Group, Citizen Cider LLC, Dawn Food Products, Döhler Group, DuPont Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fermented Ingredients MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Fermented Ingredients MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Corporation Inc.

- AngelYeast Co., Ltd.

- Associated British Food (ABF)

- Bakels

- BASF SE

- Cargill, Incorporated

- Novonesis Group

- Citizen Cider LLC

- Dawn Food Products

- Döhler Group

- DuPont