Global Fencing Market Size, Share, And Industry Analysis Report By Product (Welded Fences, Hinge-joint Fences, Electric Fences, Others), By Distribution Channel (Offline, Online), By Application (Agricultural, Residential, Industrial), By Material (Metal, Wood, Plastic and Composite, Concrete), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 34108

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

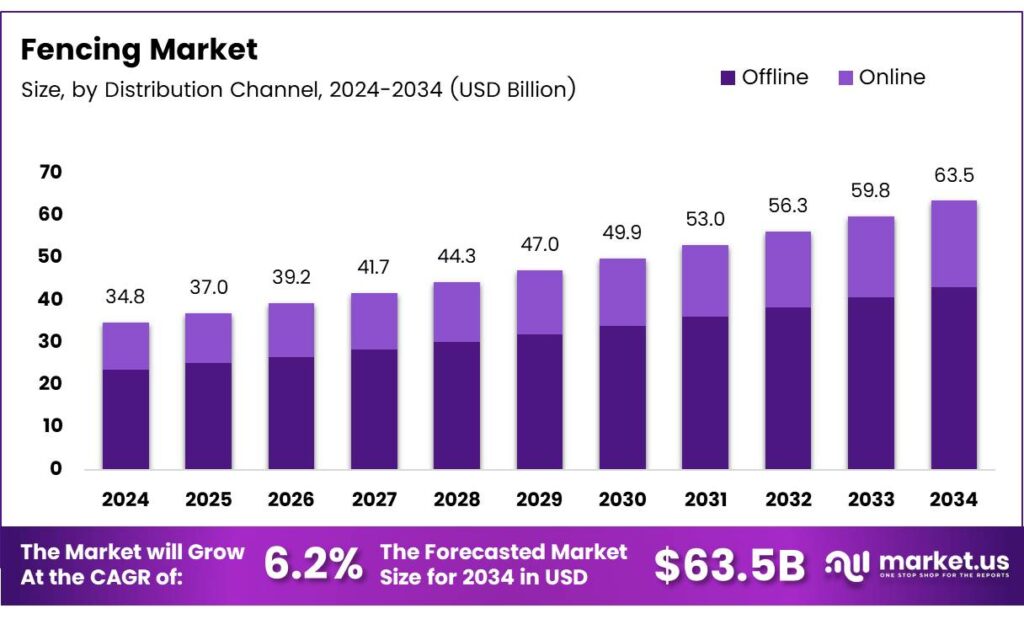

The Global Fencing Market size is expected to be worth around USD 63.5 billion by 2034, from USD 34.8 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The fencing market represents a foundational segment within construction, agriculture, and property improvement ecosystems worldwide. It includes perimeter security fencing, agricultural fencing, decorative fencing, and access control barriers. Consequently, fencing supports safety, land management, asset protection, and visual order across residential, commercial, and rural environments.

Fencing functions as both a protective solution and a value-enhancing improvement. Property owners increasingly view fencing as a long-term investment rather than a discretionary expense. As a result, demand steadily aligns with housing turnover, renovation cycles, infrastructure upgrades, and expanding agricultural operations across developed and emerging economies.

- The U.S. remodeling and repair market exceeded USD 600 billion, with fencing representing about 8–15% of owner-occupied yard and property improvement spending. Meanwhile, farm improvements reached USD 21.2 billion, or 4.4% of total farm production expenses, highlighting fencing’s importance in agricultural infrastructure and livestock management.

The fencing market is strongly connected to urban expansion and lifestyle-driven home improvement activity. As cities densify, homeowners prioritize boundary definition, privacy, and safety. Meanwhile, suburban development encourages decorative and functional fencing adoption. Consequently, manufacturers benefit from repeat demand driven by replacements, upgrades, and compliance-related retrofits.

Opportunities are expanding through material innovation and sustainability-focused design. Transitioning from traditional wood toward metal, composite, and recycled materials improves durability and lifecycle value. Additionally, modular fencing systems reduce installation time and labor costs. These advancements support contractors, distributors, and property owners seeking faster project completion and predictable long-term maintenance outcomes.

Key Takeaways

- The Global Fencing Market is projected to grow from USD 34.8 billion in 2024 to USD 63.5 billion by 2034, expanding at a 6.2% CAGR.

- Welded fences lead the product segment with a dominant share of 38.1%, supported by durability and broad residential and agricultural usage.

- The offline distribution channel dominates the market, accounting for a strong 79.4% share due to established dealer and contractor networks.

- Agricultural applications represent the largest end-use segment, holding a market share of 44.8% driven by livestock and farm boundary needs.

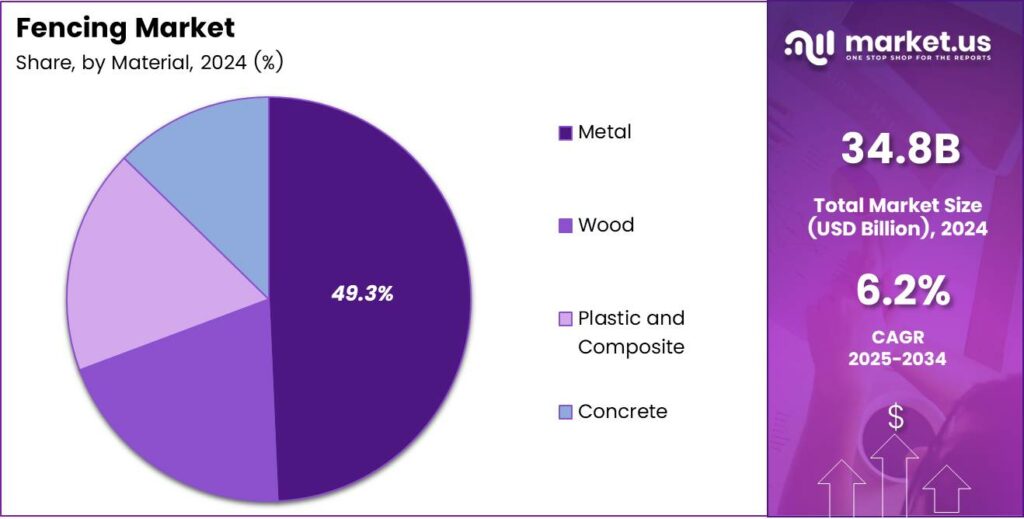

- Metal fencing remains the most preferred material, capturing 49.3% of total market demand due to its strength and low maintenance.

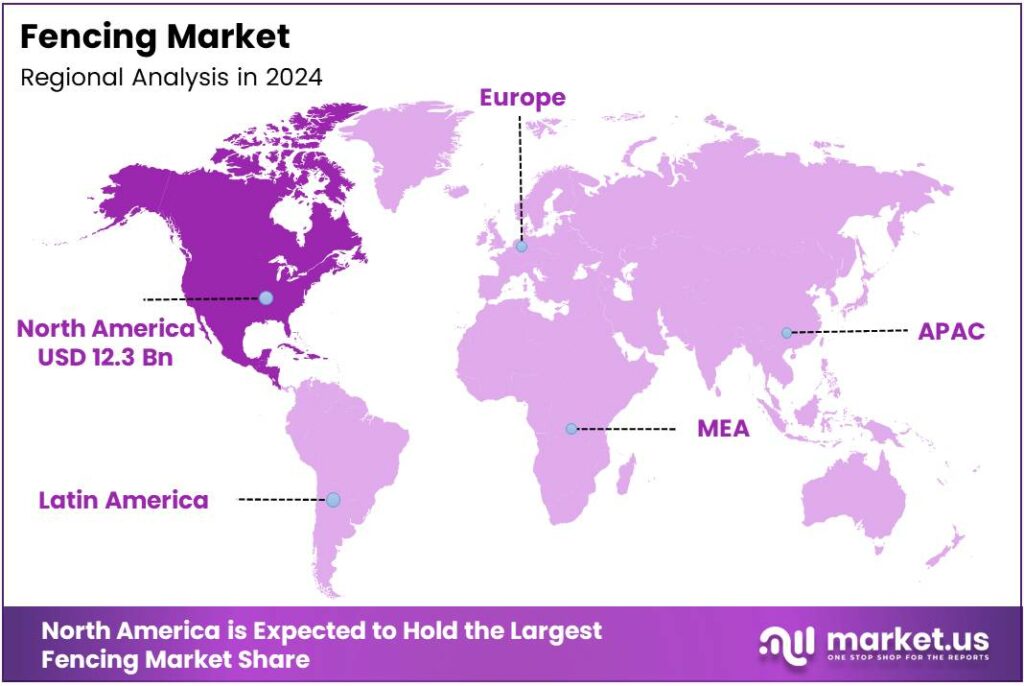

- North America leads the global fencing market with a 35.4% share, generating approximately USD 12.3 billion in revenue.

By Product Analysis

Welded Fences dominate with 38.1% due to their durability and wide usage across residential and agricultural applications.

In 2024, Welded Fences held a dominant market position in the By Product Analysis segment of the Fencing Market, with a 38.1% share. This dominance is driven by strong structural strength, uniform appearance, and ease of installation. As a result, welded fences are widely preferred for boundary protection and long-term installations.

Hinge-joint Fences continue to play an important role, especially in rural and livestock applications. These fences offer flexibility and adaptability across uneven terrain. Consequently, farmers prefer hinge-joint designs for cost efficiency and ease of repair in large land parcels.

Electric Fences are steadily gaining relevance due to rising awareness of animal control and security needs. They are commonly adopted in modern farms and high-security zones. Moreover, electric fencing benefits from lower material usage and effective perimeter management.

Other fencing products, including decorative and temporary solutions, address niche requirements. These options are often selected for short-term use, landscaping, or aesthetic enhancement. Thus, they support customization and diversified demand within the fencing market.

By Distribution Channel Analysis

Offline dominates with 79.4% owing to strong dealer networks and hands-on product evaluation.

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Fencing Market, with a 79.4% share. Buyers prefer physical stores for bulk purchases, professional guidance, and immediate availability. This channel remains vital for contractors and agricultural buyers.

Online distribution is gradually expanding as digital platforms improve product visibility. Customers increasingly explore online channels for price comparison and convenience. However, complex installation needs still limit full-scale online adoption.

By Application Analysis

Agricultural fencing leads with 44.8% driven by livestock protection and farm boundary requirements.

In 2024, Agricultural held a dominant market position in the By Application Analysis segment of the Fencing Market, with a 44.8% share. Strong demand comes from crop protection and livestock containment. Additionally, fencing supports efficient land management and long-term farm productivity.

Residential fencing continues to grow as homeowners prioritize safety and privacy. These fences are widely used for gardens, yards, and property demarcation. Moreover, design-focused fencing enhances visual appeal and home value. Industrial fencing addresses security and compliance needs across factories and infrastructure sites. These fences help restrict access and protect assets.

By Material Analysis

Metal fencing dominates with 49.3% due to strength, longevity, and low maintenance needs.

In 2024, Metal held a dominant market position in the By Material Analysis segment of the Fencing Market, with a 49.3% share. Metal fences are favored for their high durability and resistance to environmental stress. Consequently, they are widely adopted across agricultural and industrial applications.

Wood fencing remains popular for residential and decorative uses. It offers natural aesthetics and design flexibility. However, maintenance requirements influence buyer decisions over long-term usage. Plastic and Composite fencing is gaining attention for corrosion resistance and lightweight properties.

These materials suit modern residential needs and low-maintenance environments. As sustainability awareness grows, its adoption continues to grow gradually. Concrete fencing is suitable for heavy-duty and permanent installations. It provides strong structural integrity and noise reduction benefits.

Key Market Segments

By Product

- Welded Fences

- Hinge-joint Fences

- Electric Fences

- Others

By Distribution Channel

- Offline

- Online

By Application

- Agricultural

- Residential

- Industrial

By Material

- Metal

- Wood

- Plastic and Composite

- Concrete

Emerging Trends

Shift Toward Smart, Durable, and Low-Maintenance Fencing Solutions Shapes Trends

The shift toward durable and low-maintenance materials. Buyers increasingly prefer fencing that lasts longer and requires minimal upkeep, reducing long-term ownership costs. Sustainability awareness influences material choices as well. Eco-friendly and recyclable fencing options are gaining interest among environmentally conscious buyers.

- In the U.S., total construction spending in August 2025 was estimated at a seasonally adjusted annual rate of $2,169.5 billion. That scale matters because it signals ongoing site starts, active projects, and contractor movement that routinely requires jobsite fencing, gates, and controlled entry points.

The integration of technology. Smart fencing systems with sensors or monitoring features are gaining attention in high-security and commercial applications. These solutions improve safety and control. Design-focused fencing is also trending, especially in residential areas. Consumers want fences that balance security with modern appearance, leading to higher demand for customized styles and finishes.

Drivers

Rising Need for Property Security and Boundary Protection Drives Fencing Demand

The fencing market is strongly driven by the growing need for safety and clear boundary definition across residential, agricultural, and industrial spaces. Homeowners increasingly install fences to protect families, pets, and assets while also enhancing property appearance. This basic need keeps demand steady across urban and suburban areas.

In agriculture, fencing remains essential for livestock control, crop protection, and land demarcation. Farmers rely on durable fencing to reduce animal loss and improve farm management efficiency. Expansion of organized farming and livestock operations further supports this demand.

Industrial and infrastructure projects also contribute to growth. Warehouses, factories, transport hubs, and utilities require fencing to meet safety standards and prevent unauthorized access. Public infrastructure development, therefore, directly increases fencing consumption.

Restraints

High Material and Installation Costs Limit Wider Fencing Adoption

One major restraint in the fencing market is the rising cost of raw materials such as steel, aluminum, and treated wood. Price fluctuations make fencing projects more expensive and sometimes delay purchasing decisions, especially for cost-sensitive users.

- The U.S. Customs and Border Protection announced a smart wall package where one project alone was awarded at $372,832,130 to build about 22 miles of primary wall system, alongside supporting infrastructure that strengthens monitoring and control. This can discourage small homeowners and farmers from investing in high-quality fencing.

Maintenance concerns further limit adoption. Certain fence types need regular painting, coating, or repairs to prevent corrosion or damage. Over time, these recurring costs reduce long-term affordability. In rural and remote areas, limited access to skilled installers and quality materials can slow market penetration.

Growth Factors

Urban Expansion and Modern Farming Practices Create New Growth Opportunities

Rapid urban expansion presents strong growth opportunities for the fencing market. New housing developments, gated communities, and commercial complexes require fencing as a basic component of construction planning. This creates consistent demand during project development stages.

Modern farming practices also open new opportunities. As farms become more organized and technology-driven, demand grows for reliable fencing solutions that support better livestock and crop management. Farmers increasingly view fencing as a productivity tool rather than a simple barrier.

Rising awareness of property value improvement supports market growth as well. Well-designed fencing improves visual appeal and resale value, encouraging adoption among homeowners. Additionally, replacement of temporary or damaged fencing with more durable solutions offers recurring sales potential.

Regional Analysis

North America Dominates the Fencing Market with a Market Share of 35.4%, Valued at USD 12.3 Billion

North America holds the leading position in the fencing market, accounting for a dominant 35.4% share and generating approximately USD 12.3 billion in value. This strong performance is supported by steady investments in residential remodeling, agricultural infrastructure, and commercial property development. Demand remains high for perimeter security, farm fencing, and boundary solutions across both urban and rural landscapes.

The European fencing market shows stable growth, driven by renovation of aging infrastructure and rising focus on property demarcation and safety. Residential housing upgrades, public infrastructure maintenance, and agricultural land management contribute to steady demand. Environmental regulations and land-use planning policies also encourage the replacement of old fencing systems with durable and compliant alternatives.

Asia Pacific represents a fast-expanding fencing market due to rapid urbanization, industrial expansion, and large-scale agricultural activity. Growing investments in residential communities, industrial parks, and transportation infrastructure support consistent fencing demand. Population growth and land fragmentation further increase the need for boundary marking and security solutions.

The U.S. fencing market remains a key contributor within North America, driven by strong demand from residential renovations and agricultural operations. Fencing is widely used for yard improvements, livestock containment, and property boundary definition. Continuous spending on home upgrades and farm infrastructure supports consistent market activity. The focus on safety, privacy, and land optimization keeps fencing demand stable across states.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Allied Tube & Conduit continues to stand out for its scale in steel tubing and roll-formed profiles that fit well with modern fencing needs, especially when buyers want consistent quality and reliable lead times. Its strength is in manufacturing discipline and broad distribution reach, which helps contractors source posts, rails, and structural components without frequent supply disruptions.

Ameristar Fence Products Incorporated remains closely tied to higher-security perimeter solutions, where durability and performance expectations are stricter than in purely residential projects. The company’s positioning benefits from steady demand in commercial, industrial, and infrastructure sites, where buyers prioritize long service life, tested specifications, and professional installation support over the lowest upfront price.

The American Fence Company is often viewed through a service-and-execution lens, with value created in project management, installation capability, and the ability to handle customized requirements across mixed applications. In a market shaped by labor availability and schedule pressure, strong field delivery and maintenance support can be as important as product selection, especially for large properties and multi-site customers.

Associated Materials LLC keeps a practical advantage in exterior building products that complement fencing purchases, supporting bundled demand in repair, remodel, and curb-appeal upgrades. Its brand presence and channel access help it compete where homeowners and builders prefer coordinated exterior solutions, balancing aesthetics, weatherability, and cost in a single purchase decision.

Top Key Players in the Market

- Allied Tube & Conduit

- Ameristar Fence Products Incorporated

- The American Fence Company

- Associated Materials LLC

- Bekaert

- Betafence NV

- CertainTeed Corporation

- Gregory Industries, Inc.

- Jerith Manufacturing Company Inc.

- Long Fence Company Inc.

- Ply Gem Holdings Inc.

- Poly Vinyl Creations Inc.

Recent Developments

- In 2025, Allied Tube & Conduit, a subsidiary of Atkore Inc., specializes in manufacturing steel, PVC, and aluminum conduits for electrical and mechanical applications, with some involvement in fencing-related products like steel fence frameworks. Atkore announced the sale of its Tectron mechanical tube product line and associated manufacturing facility to Lock Joint Tube.

- In 2025, Ameristar Fence Products, headquartered in Tulsa, Oklahoma, is a leading manufacturer of ornamental steel and aluminum fences, gates, and perimeter security solutions. ASSA ABLOY (Ameristar’s parent company) acquired Wallace & Wallace and Wallace Perimeter Security, a Canadian manufacturer, distributor, and installer of perimeter fencing, doors, and gates for commercial and residential markets.

Report Scope

Report Features Description Market Value (2024) USD 34.8 Billion Forecast Revenue (2034) USD 63.5 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Welded Fences, Hinge-joint Fences, Electric Fences, Others), By Distribution Channel (Offline, Online), By Application (Agricultural, Residential, Industrial), By Material (Metal, Wood, Plastic and Composite, Concrete) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Allied Tube & Conduit, Ameristar Fence Products Incorporated, The American Fence Company, Associated Materials LLC, Bekaert, Betafence NV, CertainTeed Corporation, Gregory Industries, Inc., Jerith Manufacturing Company Inc., Long Fence Company Inc., Ply Gem Holdings Inc., Poly Vinyl Creations Inc. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Allied Tube & Conduit

- Ameristar Fence Products Incorporated

- The American Fence Company

- Associated Materials LLC

- Bekaert

- Betafence NV

- CertainTeed Corporation

- Gregory Industries, Inc.

- Jerith Manufacturing Company Inc.

- Long Fence Company Inc.

- Ply Gem Holdings Inc.

- Poly Vinyl Creations Inc.