Global Federated AI Learning Market Size, US Tariff Impact Analysis Report By Application (Industrial Internet of Things, Drug Discovery, Risk Management, Augmented & Virtual Reality, Data Privacy Management, Others), By Technology (Machine Learning (ML) & Deep Learning, Natural Language Processing (NLP), Computer Vision, Big Data & Analytics, Cloud Computing, Others), By Organization Size (Large Enterprises, SMEs), By Industry Vertical (IT & Telecommunications, Healthcare & Life Sciences, BFSI, Retail & E-commerce, Automotive, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146369

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analyst’s Viewpoint

- Key Growth Factors

- U.S. Federated AI Learning Market

- Application Analysis

- Technology Analysis

- Organization Size Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

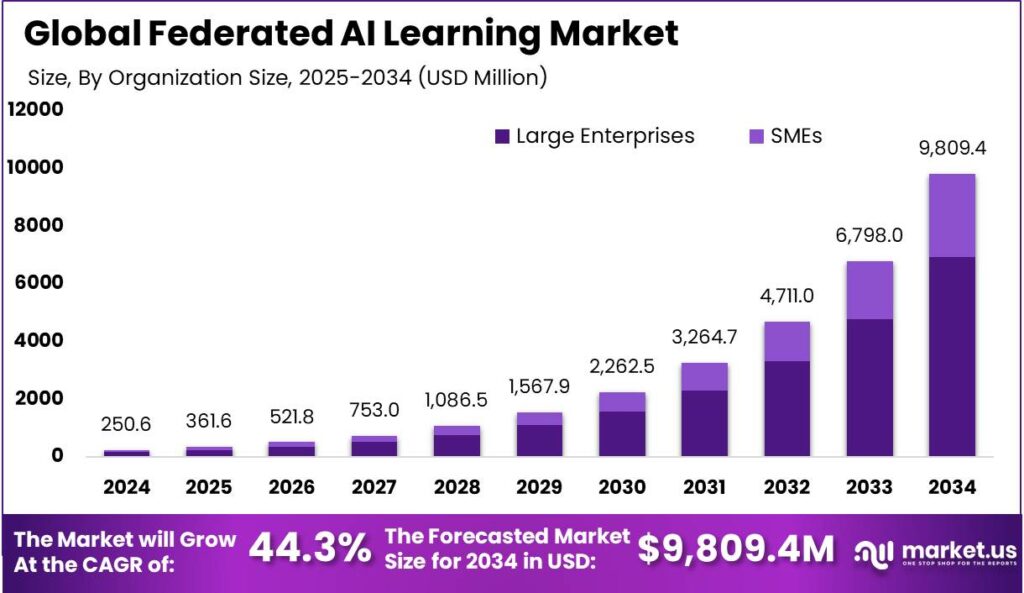

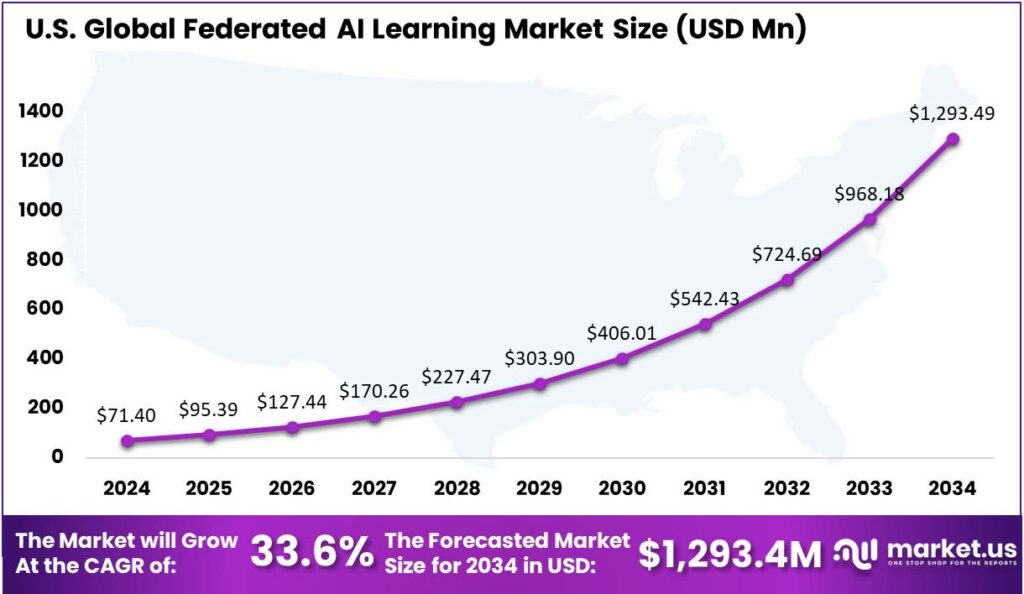

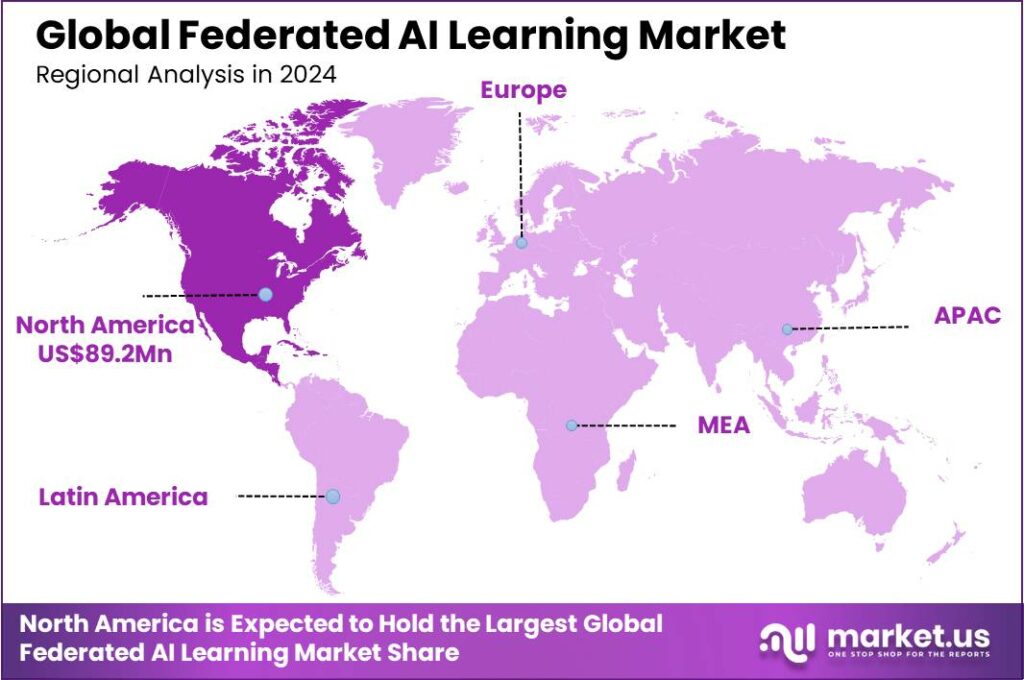

The Global Federated AI Learning Market size is expected to be worth around USD 9,809.4 Million By 2034, from USD 250.6 Million in 2024, growing at a CAGR of 44.30% during the forecast period from 2025 to 2034. In 2024, North America led the Federated AI Learning market with a 35.6% share and USD 89.2 million in revenue. The U.S. alone contributed USD 71.4 million, driven by a 33.6% CAGR, highlighting its leadership in this space.

Federated AI Learning (FL) is a machine learning technique that allows algorithms to be trained across multiple decentralized devices or servers without exchanging the data itself. This approach ensures that data remains on local devices, enhancing privacy and security. It’s particularly effective in scenarios where data cannot be centralized due to privacy concerns, regulatory requirements, or logistical challenges

The demand for Federated AI Learning is rapidly growing, especially in industries that handle sensitive data, such as healthcare, finance, and telecommunications. With these sectors facing stringent regulatory oversight on data usage, Federated AI Learning is becoming vital for ensuring compliance and achieving competitive differentiation.

Key drivers of the Federated AI Learning market include the rise of edge computing for local data processing, the use of diverse data sources for accurate models, and growing data privacy concerns. This trend is especially important in healthcare, finance, autonomous driving, and personalized medicine, as it supports secure and efficient AI model development.

The adoption of Federated AI Learning is being facilitated by advancements in secure multi-party computation, edge computing, and blockchain. These technologies enhance the security and efficiency of Federated AI Learning systems, making it feasible for more organizations to implement this approach at scale.

Federated AI Learning offers several business benefits, including enhanced security, access to a broader range of data insights, and improved model accuracy without compromising data integrity. These advantages make it an attractive option for businesses looking to leverage AI while maintaining stringent data privacy standards.

The market is set for significant growth, driven by rising privacy concerns, the growing volume of edge-generated data, and the continuous need for enhanced AI model performance across various applications. As the technology matures and more industries recognize its potential, widespread adoption is expected to accelerate, fueling further market expansion.

Key Takeaways

- The Global Federated AI Learning Market is projected to grow from USD 250.6 million in 2024 to around USD 9,809.4 million by 2034, expanding at a CAGR of 44.30% during the forecast period from 2025 to 2034.

- In 2024, the Industrial Internet of Things (IIoT) segment held a leading position, accounting for more than 28.7% of the overall Federated AI Learning market share.

- The Machine Learning (ML) & Deep Learning segment also dominated in 2024, capturing over 30.6% of the market share.

- Large Enterprises were the key adopters of Federated AI Learning solutions in 2024, commanding more than a 70.6% market share.

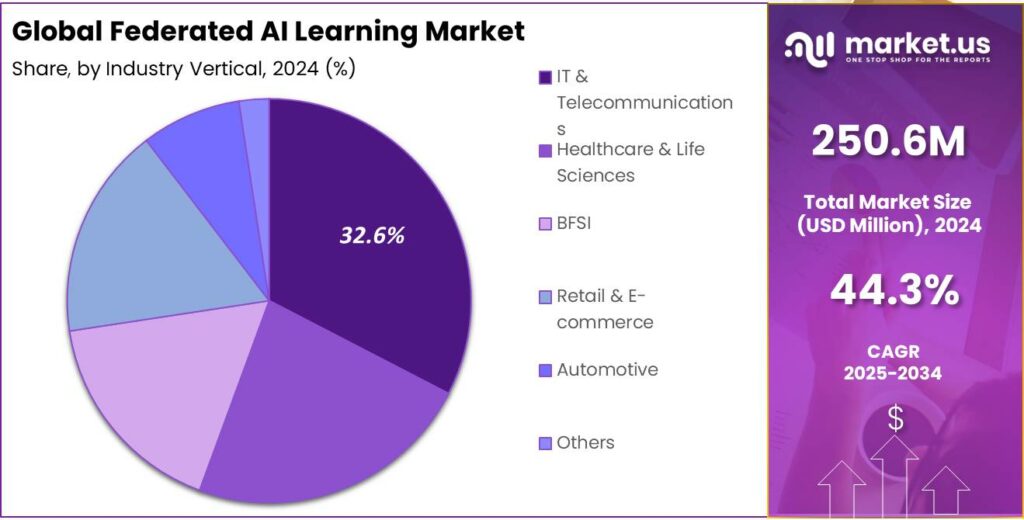

- The IT & Telecommunications sector led the market by industry vertical in 2024, contributing more than 32.6% of the total market share.

- Geographically, North America held a dominant position in the Federated AI Learning market in 2024, with a 35.6% share and revenues reaching USD 89.2 million.

- Within North America, the U.S. market alone was valued at USD 71.4 million in 2024, driven by a strong growth rate of 33.6% CAGR, underscoring its leadership in this emerging technology space.

Analyst’s Viewpoint

Healthcare, finance, and manufacturing sectors are leading the adoption of Federated AI Learning (FL). In healthcare, FL enables collaborative research and diagnostics while protecting patient privacy. Financial institutions use FL for fraud detection and risk assessment, ensuring client confidentiality. Manufacturing industries apply FL for predictive maintenance and quality control across distributed facilities.

The adoption of Federated Learning (FL) is driven by the growing focus on data privacy, security, and regulations like the EU’s Artificial Intelligence Act, which demand solutions that comply with legal frameworks. The rise of edge devices and the demand for real-time data processing are driving FL’s integration into applications like autonomous vehicles and personalized healthcare.

The regulatory landscape is increasingly supporting FL adoption, with laws like the EU’s AI Act prioritizing data sovereignty and privacy, aligning with FL’s core principles. Technological innovations, such as secure multi-party computation and differential privacy, are enhancing FL’s security. Additionally, integrating FL with edge computing allows efficient data processing at the source, reducing latency and bandwidth usage.

Key Growth Factors

- Privacy Preservation: Federated AI Learning provides significant privacy benefits by enabling data to be processed locally at the device level, thus preventing sensitive data from being centralized. This aspect is particularly important in industries like healthcare and finance, where data sensitivity is paramount.

- Improved Data Security: Secure aggregation methods within Federated AI Learning frameworks ensure that individual model updates are protected during the learning process, adding an additional layer of security against potential data breaches.

- Enhanced Model Accuracy and Efficiency: Advanced techniques like quantum optimization improve the efficiency of global model convergence, especially when dealing with non-IID (non-independent and identically distributed) federated datasets. This leads to better model accuracy and faster convergence times.

- Regulatory Compliance: Federated AI Learning aligns well with global data protection regulations such as GDPR, as it inherently supports data localization by processing data in situ. This compliance is particularly critical for businesses operating across different geographical boundaries.

- Broad Applicability in Diverse Industries: The technology finds applications across various sectors including healthcare, for predictive diagnostics and patient monitoring, in finance for fraud detection, and in smart devices like mobile phones for enhancing user experience without compromising privacy.

U.S. Federated AI Learning Market

In 2024, the U.S. market for Federated AI Learning was valued at USD 71.4 million. This niche yet rapidly expanding sector is characterized by a robust compound annual growth rate (CAGR) of 33.6%. This growth highlights the rising interest and investment in Federated AI Learning in the U.S., recognizing its potential to transform industries through collaborative machine learning while preserving data privacy.

Federated AI Learning represents a paradigm shift in data usage for AI. Unlike traditional methods that require data centralization, it allows the algorithm to move instead of the data. As industries recognize the value of insights from shared models, demand for Federated AI Learning solutions is expected to grow, driving further market expansion.

This method not only addresses significant concerns about data privacy and security but also opens up new avenues for data utilization across sectors that are sensitive about sharing data, such as healthcare, finance, and defense. The ability to train algorithms on diverse datasets without actual data transfer aligns with stringent regulatory frameworks like GDPR in Europe and various U.S. privacy laws.

Anticipated to continue its trajectory, the market for Federated AI Learning in the U.S. is expected to keep growing rapidly. This growth is fueled by factors such as advancements in AI and machine learning, growing concerns over data privacy, and the increasing demand for collaborative learning tools that prioritize data security.

In 2024, North America held a dominant market position in the Federated AI Learning landscape, capturing more than a 35.6% share with revenues amounting to USD 89.2 million. The region’s strong market share stems from its advanced tech infrastructure and the presence of leading AI and machine learning innovators.

Strict data privacy laws in North America, especially in sectors like healthcare and finance, are accelerating the adoption of Federated AI Learning. This approach allows organizations to comply with privacy standards by enabling AI model participation without exposing sensitive data, thereby enhancing both privacy and security.

Increased investments in AI research and development, along with growing collaborations between academia and industry in North America, strengthen the region’s leadership in the Federated AI Learning market. These partnerships focus on addressing the challenges of traditional AI models and advancing Federated AI Learning frameworks, driving ongoing growth and innovation.

North America’s dedication to innovation and early adoption of advanced technologies fosters a strong foundation for Federated AI Learning. This proactive stance on overcoming traditional data challenges through secure and efficient methods places the region at the forefront of the global market.

Application Analysis

In 2024, the Industrial Internet of Things (IIoT) segment held a dominant market position, capturing more than a 28.7% share of the Federated AI Learning Market. This dominance is largely driven by the growing demand for decentralized machine learning across large-scale industrial environments where sensitive operational data cannot be easily transferred to centralized servers.

The integration of Federated AI Learning with IIoT systems allows industries such as manufacturing, energy, and logistics to derive insights from distributed data sources without the risk of data exposure. As smart factories and connected industrial networks become more prevalent, the need to safeguard proprietary operational data while still optimizing machine learning performance has increased.

The large volume of data from IIoT devices drives Federated AI’s leadership, as traditional cloud-based models struggle with bandwidth and centralized processing limits. Federated AI enables devices to learn locally and contribute to a global model without sharing raw data, making it ideal for bandwidth-sensitive industrial environments.

Advancements in edge computing and 5G are boosting the adoption of Federated AI in industrial sectors. Enhanced connectivity and edge processing enable better implementation, making the Industrial Internet of Things a key revenue driver in the Federated AI market, particularly in smart manufacturing and predictive maintenance.

Technology Analysis

In the Federated AI Learning Market, the Machine Learning (ML) & Deep Learning segment held a dominant position in 2024, capturing over 30.6% of the market share. This prominence can be attributed to several key factors.

The continuous enhancements in ML and Deep Learning algorithms have significantly boosted their adoption. These advancements have enabled more effective model training with less data, a crucial advantage in federated learning environments where data remains distributed across devices.

ML and Deep Learning excel in providing personalized insights and predictions, tailored to the specific needs of users. In sectors such as healthcare and finance, where personalized data is sensitive, federated learning ensures data privacy while still leveraging advanced ML models to derive meaningful outcomes.

The flexibility of ML and Deep Learning to adapt to various scenarios and data types makes them indispensable across multiple industries. This versatility is a driving force behind their dominance, as they provide essential tools for businesses seeking to implement AI without compromising on data security and regulatory compliance.

ML and Deep Learning often integrate seamlessly with other technologies like IoT and cloud computing, enhancing their functionality within the federated learning framework. This integration capability ensures that these technologies remain at the forefront, driving both innovation and market share in the federated AI learning landscape.

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position within the Federated AI Learning market, capturing more than a 70.6% share. These enterprises partner with tech giants, academic institutions, and research organizations to boost their federated AI capabilities, gaining technological support and innovative insights to refine and scale federated learning models across industries.

Large enterprises typically possess significant financial and technical resources, allowing them to invest in cutting-edge technologies such as federated AI learning. This investment capability enables them to pioneer in adopting new technologies that require substantial upfront capital, such as advanced AI computational tools and data security systems, which are integral to implementing federated learning.

Federated AI learning relies heavily on the availability of vast datasets to improve learning accuracy without compromising data privacy. Large enterprises benefit from vast data pools across business units, providing a strong foundation for deploying federated learning algorithms. This extensive data access enables the training of more comprehensive AI models, improving predictive accuracy and operational efficiency.

Large organizations are more likely to have sophisticated IT infrastructures, which are essential for supporting the complex network and computational requirements of federated AI systems. The ability to handle extensive computations distributed across various nodes geographically enables large enterprises to leverage federated learning more efficiently than smaller entities.

Industry Vertical Analysis

In 2024, the IT & Telecommunications segment held a dominant market position in the Federated AI Learning market, capturing more than a 32.6% share. This leadership can be explained through several influential factors.

IT & Telecommunications industries face stringent regulatory requirements regarding data security and privacy. Federated AI learning, which allows for the decentralized processing of data, aligns perfectly with these needs. By enabling data to be processed locally at the data source and only sharing model updates, federated AI learning helps these industries comply with data protection laws while still benefiting from collective insights.

This segment is at the forefront of technological innovations, including the deployment of 5G, IoT, and smart infrastructure, which are reliant on sophisticated data analysis tools. Federated AI learning supports these technologies by providing a platform for enhancing machine learning models across vast networks without compromising the latency and integrity of data, which is crucial for real-time decision making in telecommunications.

The nature of IT and telecommunications necessitates technology that can scale across extensive networks and manage vast amounts of data generated from multiple sources. Federated AI learning offers a scalable solution where insights are garnered from diverse network nodes, enhancing the overall efficiency of data systems and supporting continuous improvement in services and customer experience.

Key Market Segments

By Application

- Industrial Internet of Things

- Drug Discovery

- Risk Management

- Augmented & Virtual Reality

- Data Privacy Management

- Others

By Technology

- Machine Learning (ML) & Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

- Big Data & Analytics

- Cloud Computing

- Others

By Organization Size

- Large Enterprises

- SMEs

By Industry Vertical

- IT & Telecommunications

- Healthcare & Life Sciences

- BFSI

- Retail & E-commerce

- Automotive

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Regulatory Compliance and Data Privacy

The increasing emphasis on data privacy and stringent regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) have necessitated the adoption of privacy-preserving technologies.

Federated Learning (FL) addresses these concerns by enabling model training across decentralized data sources without transferring raw data to a central server. This approach aligns with legal requirements by keeping sensitive information localized, thereby reducing the risk of data breaches and ensuring compliance with data protection laws.

For instance, in sectors like healthcare and finance, where data sensitivity is paramount, FL allows institutions to collaborate on model training without compromising individual privacy . By facilitating such collaborations, FL not only ensures regulatory compliance but also enhances the robustness of AI models through diverse data inputs.

Restraint

Data Heterogeneity

A significant challenge in Federated Learning is the heterogeneity of data across different clients. In real-world scenarios, data distributions are often non-identical and non-independent (non-IID), leading to inconsistencies in model training. This heterogeneity can result in models that perform well on certain client data but poorly on others, undermining the generalizability of the global model.

Moreover, variations in data quality, quantity, and feature representation across clients can exacerbate this issue. Researchers have been exploring methods to mitigate the impact of data heterogeneity, such as personalized models and advanced aggregation techniques . However, achieving a balance between personalization and generalization remains a complex task, limiting the scalability and effectiveness of FL in diverse environments.

Opportunity

Cross-Silo Collaboration

Federated Learning presents a unique opportunity for cross-silo collaboration, enabling multiple organizations to jointly train AI models without sharing proprietary data. This collaborative approach is particularly beneficial in industries where data is siloed due to privacy concerns or competitive interests.

In industries like automotive and healthcare, companies can work together to enhance AI models such as autonomous driving systems or diagnostic tools by training on diverse datasets while preserving data privacy. These collaborations result in more robust, generalizable models and foster innovation through the sharing of resources and expertise across organizations.

Challenge

Communication Overhead

Implementing Federated Learning (FL) introduces substantial communication overhead due to frequent model update exchanges between clients and the central server. This becomes a challenge in environments with limited bandwidth or unreliable network connections, leading to increased latency and energy consumption. The issue is exacerbated when there are many clients or large model sizes, further straining resources.

Researchers have proposed strategies like model compression, update sparsification, and asynchronous communication to tackle communication challenges in Federated Learning (FL). However, these methods often come with trade-offs, impacting model accuracy and convergence speed. Thus, optimizing communication efficiency without sacrificing performance remains a key challenge for FL’s broader adoption.

Emerging Trends

A significant trend is the integration of federated learning with other machine learning paradigms, such as multitask learning, meta-learning, and transfer learning. This combination enhances the adaptability and performance of models across diverse tasks and datasets .

Another development is the application of federated learning in edge computing environments. By training models directly on edge devices like smartphones and IoT gadgets, data remains localized, reducing latency and preserving user privacy .

Additionally, the fusion of federated learning with generative AI techniques, such as Generative Adversarial Networks (GANs), is being explored. This integration aims to generate synthetic data that mirrors real datasets, enhancing model training without compromising sensitive information .

Business Benefits

Implementing federated AI learning offers key advantages, especially in sectors where data privacy and security are critical. A primary benefit is enhanced data privacy, as raw data stays on local devices, reducing the risk of breaches and ensuring compliance with data protection regulations.

Federated learning also reduces the need for extensive data transfer, leading to cost savings in bandwidth and storage. This efficiency is especially beneficial for organizations operating in bandwidth-constrained environments .

Federated AI learning allows businesses to collaborate with partners, such as a bank and a telecommunications company, to improve AI models like predicting loan defaults without sharing proprietary data. This approach enhances model accuracy, upholds data privacy, reduces operational costs, and fosters collaborative innovation by harnessing collective insights.

Key Player Analysis

As the demand for privacy-first AI grows, several key players have emerged, driving innovation and adoption of this technology.

Acuratio is one of the most focused players in the federated AI space. What makes it unique is its strong dedication to privacy-preserving machine learning for industries like healthcare and finance, where data security is a top priority. Acuratio develops highly customizable federated learning solutions that help organizations train AI models directly on user devices or local servers.

Cloudera, Inc. brings the power of big data analytics into the world of federated AI. Known for its enterprise-grade data platforms, Cloudera is helping organizations move towards distributed AI models without losing performance. The company’s strength lies in combining machine learning with data engineering in a secure environment.

Edge Delta takes a slightly different route by focusing on edge observability and analytics. They specialize in processing data at the edge of the network, which perfectly aligns with federated AI’s goal of decentralized learning. Edge Delta’s platform analyzes data where it is generated whether it’s from servers, devices, or IoT endpoints reducing the need for data to be transferred.

Top Key Players in the Market

- Acuratio, Inc.

- Cloudera, Inc.

- Edge Delta

- Enveil

- FedML

- Google LLC

- IBM Corporation

- Intel Corporation

- Lifebit

- NVIDIA Corporation

- Others

Top Opportunities for Players

- Expansion in Healthcare Applications: Federated learning is poised to transform healthcare by enhancing drug discovery and enabling personalized treatment plans without compromising patient data privacy. This technology allows for collaborative machine learning across different institutions, maintaining data confidentiality and compliance with stringent healthcare regulations.

- Automotive Innovations: The automotive industry stands to benefit significantly from federated learning, particularly in developing autonomous driving technologies. By utilizing decentralized data, federated learning improves the accuracy and efficiency of machine learning models underpinning autonomous vehicles, driving advancements in this sector.

- Growth in Smart Cities and IoT: Federated learning is critical in smart city and IoT applications where data privacy and efficient handling of vast data streams are crucial. This technology supports the development of smart infrastructure by enabling localized data processing, which is essential for real-time decision-making and maintaining privacy.

- Advancements in Telecommunications: Telecom companies can harness federated learning to optimize network operations, improve customer service through personalized offerings, and enhance privacy and security measures. This opportunity is driven by the need to process large volumes of data efficiently while adhering to strict privacy regulations.

- Integration with Edge Computing: The combination of federated learning with edge computing holds significant potential for industries requiring real-time data processing capabilities. This integration is particularly advantageous for sectors like manufacturing and retail, where immediate data analysis is critical for operational efficiency and customer satisfaction.

Recent Developments

- In July 2024, Enveil secured a contract with the U.S. Army’s Project Linchpin to provide secure AI capabilities. The company’s solutions will support the operationalization of machine learning in multi-domain environments.

- In April 2025, NVIDIA collaborated with Meta to integrate NVIDIA FLARE with Meta’s ExecuTorch, enabling federated learning on mobile devices. This integration facilitates privacy-preserving AI model training across distributed mobile platforms.

Report Scope

Report Features Description Market Value (2024) USD 250.6 Mn Forecast Revenue (2034) USD 9,809.4 Mn CAGR (2025-2034) 44.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Industrial Internet of Things, Drug Discovery, Risk Management, Augmented & Virtual Reality, Data Privacy Management, Others), By Technology (Machine Learning (ML) & Deep Learning, Natural Language Processing (NLP), Computer Vision, Big Data & Analytics, Cloud Computing, Others), By Organization Size (Large Enterprises, SMEs), By Industry Vertical (IT & Telecommunications, Healthcare & Life Sciences, BFSI, Retail & E-commerce, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acuratio, Inc., Cloudera, Inc., Edge Delta, Enveil, FedML, Google LLC, IBM Corporation, Intel Corporation, Lifebit, NVIDIA Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Federated AI Learning MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Federated AI Learning MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acuratio, Inc.

- Cloudera, Inc.

- Edge Delta

- Enveil

- FedML

- Google LLC

- IBM Corporation

- Intel Corporation

- Lifebit

- NVIDIA Corporation

- Others