Global Faucet Market By Product Type (Electronic, Manual), By End-user (Residential, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 37769

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

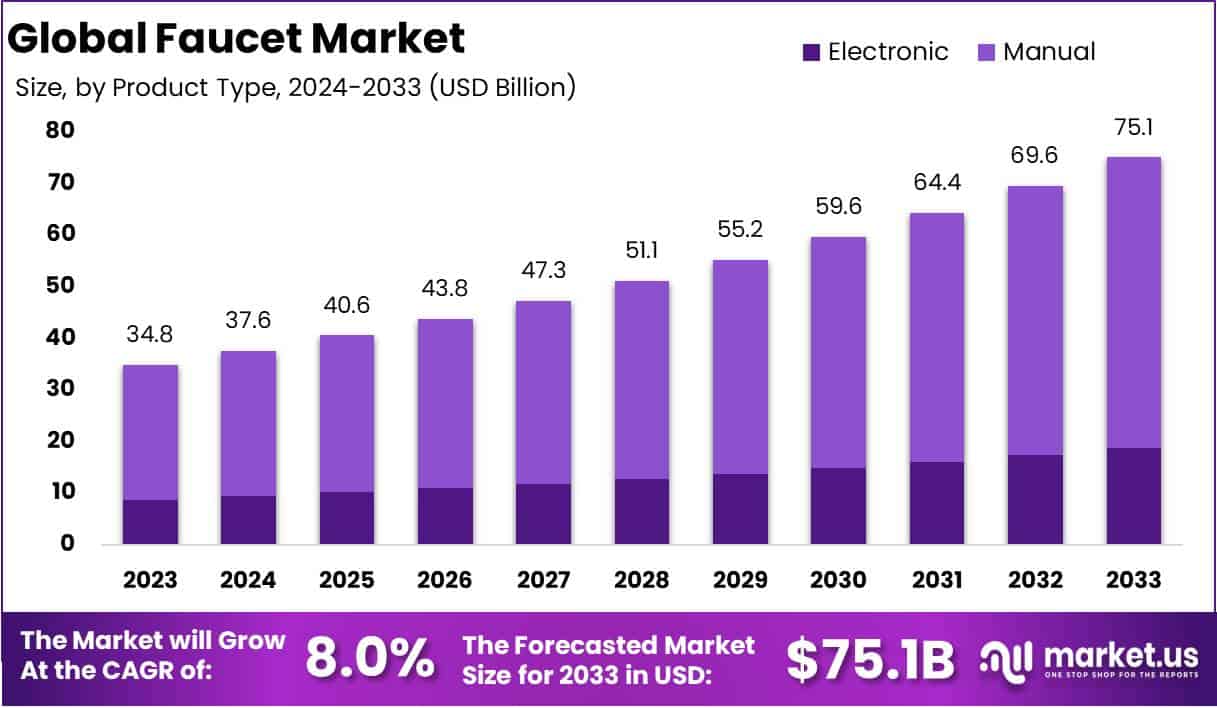

The Global Faucet Market size is expected to be worth around USD 75.1 Billion by 2033, from USD 34.8 Billion in 2023, growing at a CAGR of 8.0% during the forecast period from 2024 to 2033.

A faucet is a device that regulates the flow of water from a plumbing system, designed to control the release of water for tasks like washing, drinking, or cleaning. It is typically installed in bathrooms, kitchens, and other utility spaces, and comes in various designs, mechanisms, and materials to match both functional and aesthetic requirements.

Modern faucets often incorporate features such as touchless operation, temperature control, and water-saving capabilities, aiming to enhance user experience and resource efficiency. The faucet market encompasses the production, distribution, and sale of different types of faucets for residential, commercial, and industrial applications.

It includes a wide variety of products, such as manual, sensor-operated, and thermostatic faucets, each tailored to meet specific user demands and usage environments. The market is highly influenced by trends in construction, infrastructure development, and consumer preferences for smart, sustainable, and aesthetically pleasing bathroom and kitchen fixtures.

The faucet market is experiencing robust growth due to several key factors. Urbanization and the rising trend of modern infrastructure development, particularly in emerging economies, are driving demand for both residential and commercial plumbing products. Additionally, increasing awareness of water conservation has led to the adoption of innovative, water-saving faucets, boosting market expansion.

The integration of smart technologies, such as sensor-based and IoT-enabled faucets, is also gaining traction, fueled by consumer demand for enhanced convenience and hygiene. Moreover, government regulations promoting water conservation and sustainable building practices are fostering growth in this sector.

The faucet market is largely shaped by the residential construction sector, which remains the primary consumer of faucet products. With growing disposable incomes, consumers are investing more in bathroom and kitchen upgrades, emphasizing style, functionality, and sustainability.

In commercial settings like hotels, offices, and hospitals, the adoption of sensor-operated and touchless faucets has surged, driven by the need to maintain high hygiene standards. The demand is further propelled by the rise in renovation projects and retrofitting activities, as consumers seek to replace old, inefficient models with newer, more efficient alternatives.

The faucet market presents significant opportunities, particularly in smart faucets and eco-friendly products. Smart faucets, equipped with features like voice control, automated temperature adjustment, and leak detection, are rapidly gaining popularity, especially in developed markets where the focus is on smart home integration.

According to the U.S. Environmental Protection Agency, faucets contribute to over 15% of indoor household water use, amounting to more than 1 trillion gallons annually across the United States. WaterSense-labeled faucets and accessories can reduce water flow by over 30% without compromising performance, underscoring significant potential for market growth in eco-friendly fixtures.

The market opportunity is evident: retrofitting the country’s 222 million bathroom sink faucets with WaterSense models could save billions of gallons annually, driving demand for water-efficient solutions. Additionally, household leaks account for over 10,000 gallons of wasted water per home each year, equivalent to 270 loads of laundry.

Approximately 10% of homes experience leaks exceeding 90 gallons daily. Fixing such leaks could reduce homeowners’ water bills by 10%, reinforcing the economic and environmental appeal of investing in efficient faucet solutions. The faucet market stands to benefit from increased consumer awareness and regulatory support.

Key Takeaways

- The global faucet market is projected to grow from USD 34.8 billion in 2023 to approximately USD 75.1 billion by 2033, reflecting a robust CAGR of 8.0% over the forecast period (2024-2033),

- Manual faucets lead the market with a 75% share in 2023, favored for their cost-effectiveness and broad adoption.

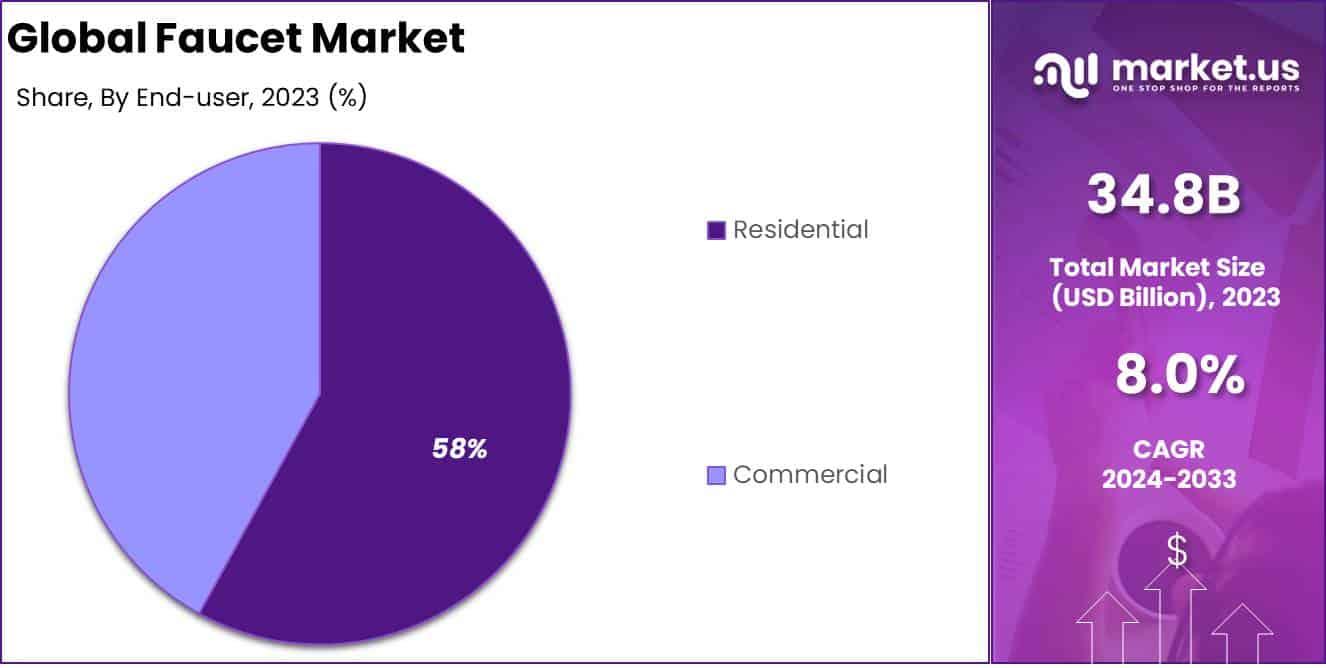

- The residential sector dominates, holding a 58% share in 2023, driven by home renovations and rising disposable incomes.

- Offline channels account for 70% of the market in 2023, reflecting consumer preference for physical product inspection.

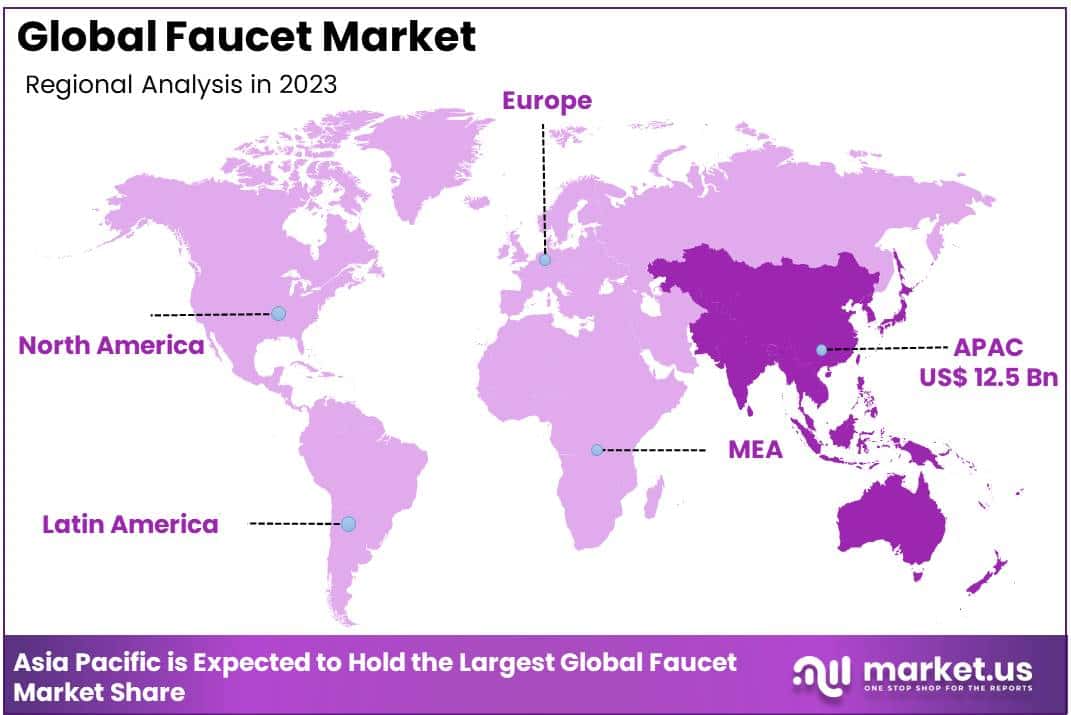

- Asia Pacific holds 36% of the global market share, driven by rapid urbanization and residential construction growth.

By Product Analysis

Manual Segment Dominating Faucet Market with 75% Market Share in 2023

In 2023, the Manual segment held a dominant market position by product type in the global faucet market, capturing more than a 75% share. The high preference for manual faucets can be attributed to their cost-effectiveness, ease of installation, and minimal maintenance requirements, making them a favored choice across residential and commercial settings.

Additionally, the manual faucet segment’s strong presence in developing regions, where affordability is a key purchasing factor, further reinforced its leading position.

Although the Electronic segment held a comparatively smaller share of the faucet market in 2023, it is experiencing notable growth, driven by increasing consumer demand for advanced, touchless, and sensor-based solutions.

Enhanced hygiene features, water-saving capabilities, and rising adoption in public infrastructure are key factors accelerating the segment’s growth trajectory. The electronic faucet market is expected to grow rapidly in coming years, aligning with broader trends of smart home integration and sustainability.

By End-user Analysis

Residential Segment Dominating Faucet Market with 58% Market Share in 2023

In 2023, the Residential segment secured a dominant position by end-user in the global faucet market, capturing more than a 58% share. This dominance is fueled by several factors, including the surge in home renovation and remodeling projects, increasing urbanization, and rising disposable incomes across emerging and developed economies.

The growing consumer interest in interior design has further boosted demand for faucets with modern aesthetics, innovative designs, and advanced water-saving features. Additionally, the rise of e-commerce and retail expansion has made residential faucets more accessible, particularly in emerging markets, contributing to its strong market presence.

The Commercial segment in the faucet market, while smaller compared to the residential segment, is experiencing steady growth. The demand is driven by rapid expansion in commercial construction projects such as hotels, office buildings, educational institutions, healthcare facilities, and public restrooms.

Increasing adoption of touchless and sensor-based faucets, which enhance hygiene and water efficiency, is a key growth driver in commercial spaces. Compliance with sustainability standards and building regulations is further pushing the adoption of advanced faucet technologies. As the commercial sector continues to invest in infrastructural development, this segment is expected to maintain a stable growth rate in the coming years.

By Distribution Channel Analysis

Offline Segment Dominating The Faucet Market with 70% Market Share in 2023

In 2023, the Offline segment held a dominant position by distribution channel in the global faucet market, capturing more than a 70% share. The strong preference for offline retail channels can be attributed to the traditional consumer behavior of physically inspecting products before purchase, especially for home improvement goods like faucets.

Specialized stores, home improvement centers, and hardware retailers offer personalized service, immediate availability, and professional guidance, making them the preferred choice for a majority of consumers. Additionally, the established presence of brick-and-mortar stores in both urban and rural areas has contributed to the offline segment’s leading market share.

While the Online segment accounted for a smaller share in 2023, it is experiencing rapid growth driven by the rising penetration of e-commerce platforms, increasing internet accessibility, and a shift towards digital shopping behavior. Consumers are increasingly drawn to the convenience of online channels, which offer wider product varieties, competitive pricing, and home delivery services.

The availability of easy return policies, customer reviews, and detailed product descriptions also supports the growth of online faucet sales. As digital infrastructure continues to improve globally, the online segment is expected to gain significant traction in the coming years.

Key Market Segments

By Product Type

- Electronic

- Manual

By End-user

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Driver

Rising Demand for Smart Faucets

The increasing adoption of smart home technology is driving the global faucet market, particularly in developed regions. Smart faucets offer innovative features such as touchless operation, voice-activated commands, and water-saving mechanisms, aligning with consumer preferences for convenience and sustainability.

The integration of Internet of Things (IoT ) in faucets allows users to control water flow, temperature, and consumption through smartphones or voice assistants. This demand is further fueled by the ongoing shift towards connected living spaces, where appliances, including faucets, are seamlessly integrated into smart home ecosystems.

Moreover, government regulations promoting water conservation have further bolstered the adoption of smart faucets. Many smart models incorporate eco-friendly features, such as flow restrictors and sensors, which contribute to reducing water wastage.

These features are gaining traction among environmentally conscious consumers and commercial establishments alike, especially in hotels and public restrooms where hygiene and water efficiency are critical. This focus on water conservation not only aligns with regulatory standards but also appeals to consumers seeking sustainable lifestyle choices, making smart faucets a significant driver in the overall faucet market’s growth trajectory.

Restraint

High Cost of Smart Faucets

Despite the growing interest in smart faucets, their high initial cost is a major barrier to widespread adoption. Compared to traditional faucets, smart versions require advanced technology, sensors, and software, making them significantly more expensive. This price difference poses challenges, particularly in cost-sensitive regions like parts of Asia, Latin America, and Africa, where consumers prioritize affordability over advanced features.

Additionally, the need for professional installation and occasional maintenance further adds to the total cost of ownership, which can deter potential buyers. These factors limit the penetration of smart faucets in low- to middle-income households, thereby restraining market growth.

Another aspect that exacerbates the cost-related barrier is the limited availability of low-cost smart faucet options. The high costs can be attributed to the incorporation of IoT technology, wireless communication modules, and high-quality materials to ensure durability and performance.

While manufacturers are striving to reduce production costs and offer more affordable smart faucets, the current price disparity remains a significant obstacle. As a result, the adoption rate of smart faucets is slower in regions where disposable incomes are lower, ultimately restricting the market’s growth potential.

Opportunity

The commercial sector presents significant growth opportunities for the faucet market. Increasing investments in infrastructure projects, including hotels, offices, hospitals, and retail outlets, are driving the demand for advanced faucet solutions. In particular, the rising trend of smart bathrooms in commercial settings, aimed at enhancing user experience and reducing water consumption, is propelling the adoption of innovative faucet technologies.

For instance, touchless faucets, which offer hands-free operation and improved hygiene, are becoming a preferred choice in high-traffic areas such as airports, malls, and restaurants. This trend is expected to contribute significantly to the market’s expansion in the near future.

Additionally, government initiatives focused on water conservation are prompting commercial establishments to replace traditional faucets with more efficient models. Many commercial projects are now incorporating sensor-equipped and water-efficient faucets to comply with regulatory requirements and achieve sustainability targets.

This shift not only aligns with environmental goals but also meets consumer expectations for modern, convenient, and safe facilities. As a result, the commercial sector is anticipated to play a pivotal role in driving demand for faucets, with projected growth rates exceeding 7% over the next few years.

Trends

Technological Advancements in Faucet Design

Technological advancements continue to shape the global faucet market, with manufacturers introducing new designs and features to cater to evolving consumer preferences. One prominent trend is the incorporation of smart sensors, AI capabilities, and IoT integration, enabling greater user convenience and customization.

Consumers are increasingly favoring faucets with touchless technology, programmable water flow, and temperature control settings, enhancing both functionality and hygiene. Additionally, the introduction of faucets with LED displays, voice commands, and real-time water usage monitoring exemplifies how technology is transforming user interaction with these products.

Another trend that aligns with consumer demand is the focus on eco-friendly faucet designs. Innovations such as aerators, low-flow systems, and water filtration features are gaining traction among consumers who prioritize sustainability. Faucets with self-cleaning mechanisms and anti-bacterial coatings are also emerging as popular choices, especially in the wake of increased health awareness post-pandemic.

This trend is expected to not only boost sales of technologically advanced faucets but also encourage product differentiation in an increasingly competitive market. As technological advancements in faucet design continue to evolve, the market is poised for sustained growth, driven by a blend of innovation, functionality, and sustainability.

Regional Analysis

Asia Pacific Dominates the Faucet Market with 36% Share in 2023

The global faucet market is experiencing diverse growth trajectories across regions, with Asia Pacific leading the market, representing a significant share of 36% and valued at USD 12.5 billion in 2023. The region’s dominance is fueled by rapid urbanization, infrastructure expansion, and increased residential construction in key markets like China, India, and Japan.

Government initiatives in smart city projects and enhanced sanitation infrastructure further amplify demand. Additionally, a rising middle-class population driving home renovation trends contributes to market expansion in Asia Pacific.

In North America, the faucet market is buoyed by increasing remodeling activities and a growing preference for advanced technologies, such as touchless and voice-activated faucets.

The U.S. plays a central role, with a high uptake of premium products in both residential and commercial spaces. The region is anticipated to sustain steady growth, driven by consumer demand for water-efficient solutions and adherence to strict water conservation regulations.

Europe showcases a mature but evolving faucet market, with substantial demand in countries like Germany, the UK, and France. This growth is underpinned by a strong commitment to sustainability and green building practices, promoting the adoption of energy-efficient and eco-friendly products. Additionally, the increasing demand for aesthetically designed, high-end faucets among homeowners further supports market growth.

In the Middle East & Africa, market expansion is driven by rapid urban development, rising disposable incomes, and substantial investments in the hospitality sector. Key contributors like the UAE and Saudi Arabia benefit from large-scale infrastructure projects and luxury housing developments.

Latin America exhibits moderate growth, supported by improving economic conditions and increasing rates of homeownership. Brazil and Mexico emerge as pivotal markets, spurred by ongoing residential construction and renovation activities, along with demand for cost-effective faucet solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global faucet market continues to demonstrate robust growth driven by increasing demand for residential and commercial renovations, along with rising awareness of water conservation technologies. Key players in the market are focusing on innovation, sustainability, and expanding their global presence.

Kohler Co., a leader in the premium faucet segment, continues to differentiate itself through cutting-edge designs and smart technologies, emphasizing touchless and water-efficient solutions. Kraus, USA, known for its modern, high-quality faucets, leverages strong online sales channels and collaborations with home improvement stores to enhance its market reach.

American Standard Brands and Pfister focus on offering mid-range products with a blend of aesthetics and functionality, targeting the growing demand for affordable luxury in residential projects. Grohe America Inc. maintains its competitive advantage by prioritizing sustainable manufacturing and energy-efficient products, aligning with global green building standards.

Delta Faucet Company and Moen Incorporated maintain their positions as dominant players by capitalizing on their broad product lines, technological innovations like voice-activated faucets, and strong distribution networks. Aqua Source Faucet and Lota Group are positioned in the value segment, benefiting from the growing DIY culture and demand for budget-friendly renovation solutions.

Toto is recognized for its high-quality, durable, and eco-friendly products, gaining traction among environmentally conscious consumers. Other emerging and local players are intensifying competition, particularly in Asia-Pacific and Latin America, by offering cost-effective solutions tailored to regional preferences.

Top Key Players in the Market

- Kohler Co.

- Kraus, USA

- American Standard Brands

- Grohe America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- Aqua Source Faucet

- Lota Group

- Toto

- Other Key Players

Recent Developments

- In 2024, Moen, a global leader in water delivery solutions with annual sales exceeding $4 billion, made a significant impact at KBIS 2024. Moen unveiled a range of groundbreaking kitchen and bathroom products, emphasizing water efficiency, smart technology, and stylish design. At its new booth (#N2645), Moen provided attendees with an immersive experience, highlighting its commitment to innovation, sustainability, and enhanced user convenience.

- In 2023, American Standard, a prominent name in the kitchen and bath industry, introduced a series of new products at the Kitchen and Bath Industry Show (KBIS) in Las Vegas. American Standard showcased advanced solutions that blend functionality, design, and eco-conscious features. Located at Booth #N1927, the company offered attendees a glimpse into the future of residential and commercial bathroom solutions.

- In 2023, Grohe, a leading global provider of sanitary fittings, made waves at KBIS with the launch of its newest collection centered on modern design, sustainable materials, and intelligent water solutions. The products introduced at Booth #N2045 aimed to redefine the kitchen and bathroom experience with a focus on luxury, performance, and environmental responsibility.

- In 2023, Hansgrohe Group reported strong progress on its sustainability goals in its annual report. Hansgrohe outlined advancements in reducing water consumption, increasing recyclable materials in products, and promoting diversity, equity, and inclusion (DEI) across its global operations, reinforcing its commitment to social responsibility and environmental leadership.

Report Scope

Report Features Description Market Value (2023) USD 34.8 Billion Forecast Revenue (2033) USD 75.1 Billion CAGR (2024-2033) 8.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electronic, Manual), By End-user (Residential, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kohler Co., Kraus, USA, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, Moen Incorporated, Aqua Source Faucet, Lota Group, Toto, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kohler Co.

- Kraus, USA

- American Standard Brands

- Grohe America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- Aqua Source Faucet

- Lota Group

- Toto

- Other Key Players