Global Farm Automation Market By Agriculture Type (Driverless Tractors, Material Management, Analytical and Monitoring Farming Tools, Automated Harvesting Systems, Other Types), By Application (Harvest Management, Dairy and Livestock Management, Soil Management, Irrigation Management, Field Farming, Pruning Management, Inventory Management, Other Applications), By Farm Produce (Fruit and Vegetable, Field Crops, Diary & Livestock, Other Products), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 103616

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

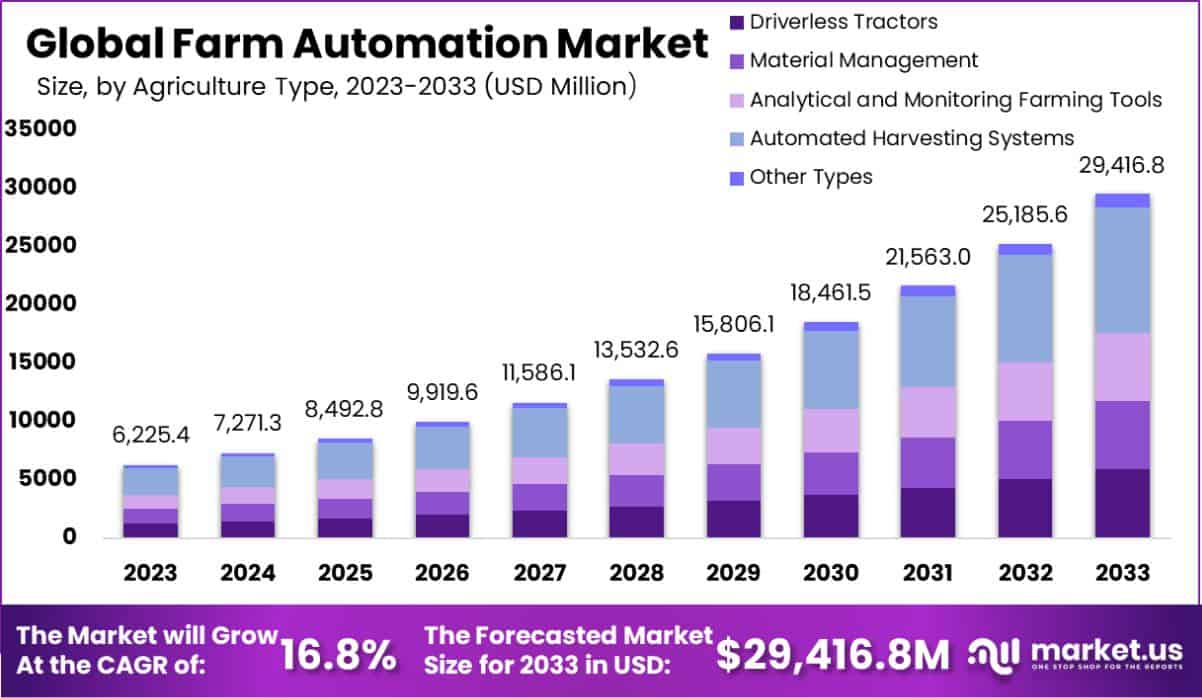

The Global Farm Automation Market is expected to be worth around USD 29,416.8 million by 2033, up from USD 6,225.4 million in 2023, growing at a CAGR of 16.8% during the forecast period from 2024 to 2033.

Farm automation involves the implementation of advanced technologies and systems to increase the efficiency and effectiveness of agricultural operations. This encompasses various mechanized solutions, such as robotics, AI, GPS, and IoT devices, which facilitate processes from planting to harvesting, aiming to optimize labor usage, increase crop yields, and enhance overall farm management.

The farm automation market refers to the economic sector focused on the development, production, and distribution of these technologies. Driven by growing global food demands and labor shortages in agriculture, this market is expanding as farms seek sustainable, innovative solutions to enhance productivity and profitability.

The expansion of the farm automation market can be attributed to technological advancements in robotics and AI, which enable precise agriculture and optimal resource management, leading to increased yields and efficiency.

Demand for farm automation technologies is rising due to the pressing need for high-efficiency farming systems that can provide sustainable food production with minimal human labor.

Significant opportunities lie in integrating IoT and data analytics into farm operations, allowing for real-time field data usage, which can significantly improve decision-making processes and operational transparency, thus opening new avenues for market growth.

The farm automation market is poised for significant expansion, driven by a confluence of technological innovations and pressing agricultural demands.

This sector is increasingly characterized by the integration of advanced robotics, artificial intelligence, and Internet of Things (IoT) technologies, which are pivotal in enhancing the efficiency and productivity of farming operations.

Recent funding announcements underscore the vibrant investment landscape and the potential for substantial market growth. For instance, Farmblox, a leading innovator in farm automation, has successfully secured $2.5 million in seed funding to advance its system that integrates farm equipment with in-field sensors for enhanced connectivity and operational intelligence.

Similarly, the UK government’s commitment to advancing agricultural technology is evident from its allocation of £12.5 million to support 19 projects focused on automation and robotics, aiming to bolster productivity and sustainability in farming practices.

Further illustrating the sector’s dynamism, AquaExchange, an aquaculture technology firm, has raised $6 million in Series A funding. This investment will further its development of automation technologies that not only streamline operations but also improve the financial and operational visibility of aquaculture farms, leading to better pricing and reduced operational costs.

Additionally, Farm-ng has recently completed a $10 million Series A funding round, which will facilitate the expansion of its AI and robotics solutions, emphasizing the market’s movement towards more technologically integrated and efficient farming solutions.

These developments reflect a market that is not only ripe with opportunities for technological advancement but also for financial investment, as stakeholders capitalize on the drive towards more sustainable and productive agricultural practices. The farm automation market, therefore, stands as a beacon of innovation and economic promise in the realm of modern agriculture.

Key Takeaways

- The Global Farm Automation Market is expected to be worth around USD 29,416.8 million by 2033, up from USD 6,225.4 million in 2023, growing at a CAGR of 16.8% during the forecast period from 2024 to 2033.

- In 2023, Automated Harvesting Systems held a dominant market position in the By Agriculture Type segment of the Farm Automation Market, with a 36.5% share.

- In 2023, Harvest Management held a dominant market position in the By Application segment of the Farm Automation Market.

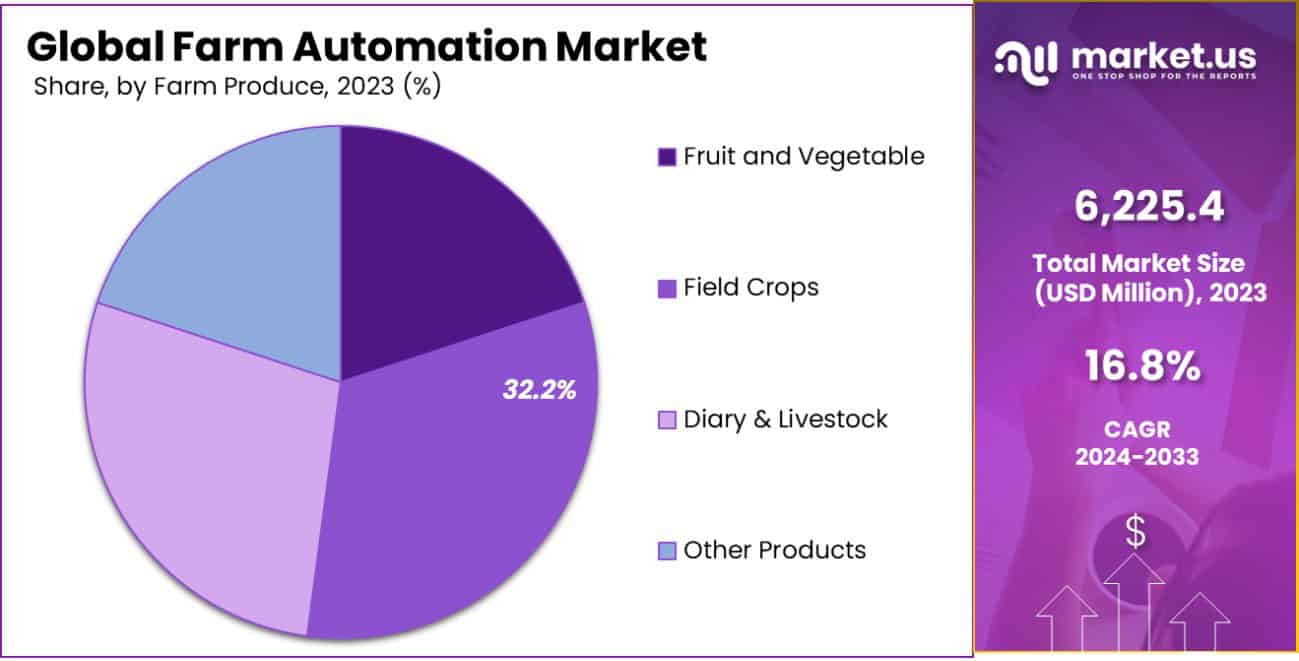

- In 2023, Field Crops held a dominant market position in the By Farm Produce segment of the Farm Automation Market, with a 32.2% share.

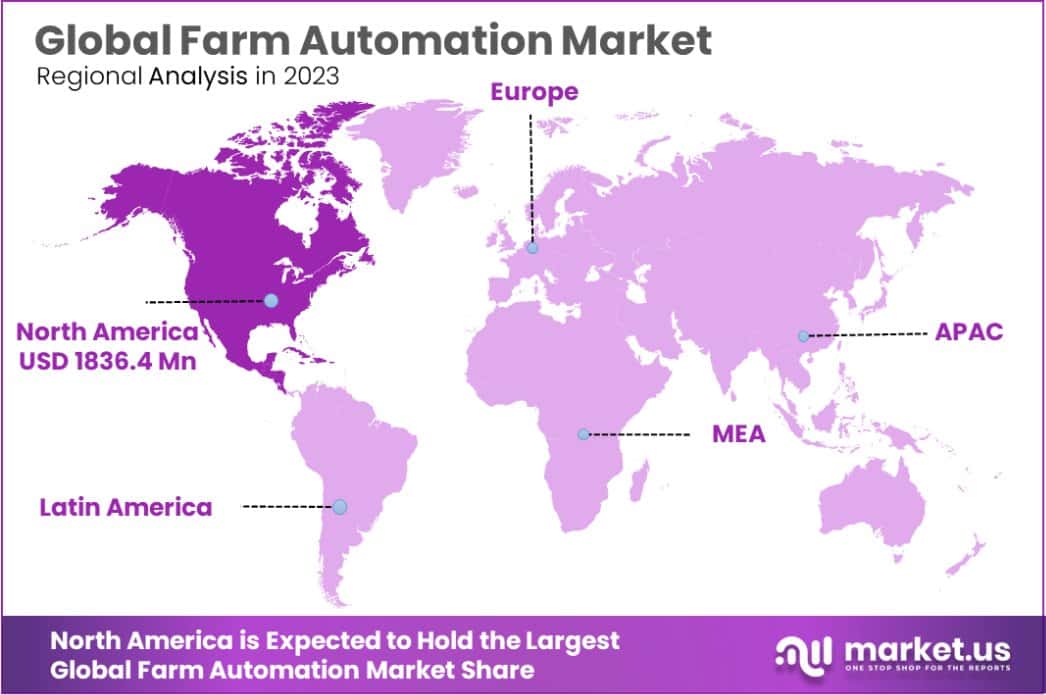

- North America dominated a 29.5% market share in 2023 and held USD 1836.4 Million in revenue from the Farm Automation Market.

By Agriculture Type Analysis

In 2023, Automated Harvesting Systems held a dominant market position in the “By Agriculture Type” segment of the Farm Automation Market, capturing a 36.5% share. This segment outperformed others such as Driverless Tractors, Material Management, Analytical and Monitoring Farming Tools, and Other Types, underscoring its pivotal role in modern agriculture.

The ascendancy of Automated Harvesting Systems can be attributed to significant advancements in automation technology, which have enhanced efficiency and reduced labor costs on farms.

These systems are increasingly adopted due to their ability to streamline the harvesting process, thereby improving yield and operational speed while minimizing human error and labor dependency.

The broader Farm Automation Market has seen varied contributions from other segments: Driverless Tractors and Material Management are integral to farm operations, offering precision and control in field activities.

Analytical and Monitoring Farming Tools have grown in application, driven by the need for data-driven farming decisions; and Other Types continue to develop, encompassing emerging technologies that promise further automation.

Together, these segments reflect a diverse and technologically advancing industry, with Automated Harvesting Systems leading the charge in transforming agricultural practices through automation.

By Application Analysis

In 2023, Harvest Management held a dominant market position in the “By Application” segment of the Farm Automation Market, underscoring its critical role in modern agricultural practices.

This segment’s prominence reflects the increasing reliance on technology to optimize harvest timing, yield quality, and resource management, which are key to maximizing productivity and profitability in farming operations.

The Farm Automation Market features various application areas, each contributing uniquely to the agricultural sector’s modernization. Dairy and Livestock Management, Soil Management, and Irrigation Management are pivotal in enhancing the efficiency and sustainability of farm operations.

Field Farming and Pruning Management integrate advanced technologies to support precise and controlled cultivation practices. Furthermore, Inventory Management systems are increasingly adopted to streamline farm logistics and supply chain efficiency.

Harvest Management’s leading position is bolstered by innovations in automation technology that ensure accurate crop handling and processing, thereby reducing waste and improving economic outcomes.

The integration of real-time data analysis tools further elevates its effectiveness, allowing for better decision-making and operational adjustments. This segment, along with others in the Farm Automation Market, illustrates a trend toward an increasingly automated and data-driven agricultural industry.

By Farm Produce Analysis

In 2023, Field Crops held a dominant market position in the “By Farm Produce” segment of the Farm Automation Market, commanding a 32.2% share. This segment outperformed others such as Fruit and Vegetable, Dairy & Livestock, and Other Products, highlighting its pivotal role in leveraging automation for enhanced agricultural output.

The prominence of Field Crops in farm automation is largely driven by the extensive adoption of technologies that optimize planting, cultivation, and harvesting processes. Innovations in machinery, such as autonomous tractors and sensor-based monitoring systems, have significantly increased efficiency and yield, particularly crucial for staple crops like wheat, corn, and rice.

Comparatively, the Fruit and Vegetable segment also integrates advanced technologies, focusing on precision agriculture to manage and improve the quality and quantity of produce. Meanwhile, Dairy & Livestock management has seen increased use of automation for feeding, milking, and health monitoring, reflecting broader trends towards efficiency and sustainability in animal husbandry.

The Other Products category continues to explore new areas for automation applications, indicating potential growth areas within the market.

Together, these segments showcase the evolving landscape of farm automation, where Field Crops lead with significant contributions to global food supply and agricultural productivity enhancements.

Key Market Segments

By Agriculture Type

- Driverless Tractors

- Material Management

- Analytical and Monitoring Farming Tools

- Automated Harvesting Systems

- Other Types

By Application

- Harvest Management

- Dairy and Livestock Management

- Soil Management

- Irrigation Management

- Field Farming

- Pruning Management

- Inventory Management

- Other Applications

By Farm Produce

- Fruit and Vegetable

- Field Crops

- Diary & Livestock

- Other Products

Drivers

Key Drivers in Farm Automation

The Farm Automation Market is witnessing significant growth due to several compelling factors. Primarily, the increasing demand for food due to the global population rise necessitates higher agricultural productivity, which farm automation facilitates through advanced technologies like robotics and AI.

Moreover, a notable decline in the rural workforce prompts farms to adopt automation to maintain crop yields and operational efficiency. Technological advancements are making these solutions more accessible and cost-effective, further driving adoption.

Environmental concerns also play a critical role, as automated systems optimize resource use and reduce waste, aligning with sustainable farming practices. This convergence of efficiency, necessity, and sustainability underpins the expanding reach of farm automation.

Restraint

Challenges Facing Farm Automation

While the Farm Automation Market offers considerable benefits, it faces significant restraints that hinder widespread adoption. The primary challenge is the high initial costs associated with purchasing and implementing advanced machinery and technologies.

This financial barrier is particularly steep for small to medium-sized farms, which may not have the capital to invest in such innovations. Additionally, there is a notable skill gap in the agricultural sector, as many farmers lack the technical expertise required to operate and maintain automated systems. This skill shortage can lead to the underutilization of advanced technologies, reducing their potential impact.

Furthermore, concerns about data security and privacy in digital farming solutions also discourage some farmers from transitioning to automated systems. These factors collectively create substantial obstacles to the growth of the farm automation sector.

Opportunities

Expanding Opportunities in Farm Automation

The Farm Automation Market presents vast opportunities for growth and innovation. As technology evolves, the integration of Internet of Things (IoT) devices and artificial intelligence in farming operations allows for more precise and efficient agricultural practices.

This includes everything from soil and crop monitoring to automated harvesting systems, which can significantly boost productivity and reduce labor costs. Additionally, the growing emphasis on sustainable agriculture is driving demand for technologies that minimize waste and improve resource management, such as water and fertilizers.

Emerging markets are also showing increased interest in farm automation as they seek to modernize their agricultural sectors and increase food production. Furthermore, government incentives and subsidies to adopt green technologies provide a financial boost, making it easier for farmers to invest in automation. These factors combine to create a fertile environment for the expansion of the farm automation industry.

Challenges

Key Challenges in Farm Automation

The Farm Automation Market faces several challenges that could slow its progress. High costs are a major barrier, as advanced equipment like autonomous tractors and drones come with significant price tags, making them inaccessible for smaller farms.

Compatibility issues also arise, as integrating new technology with existing farm systems can be complex and costly. There’s a significant learning curve associated with adopting new technologies, requiring training and skill development that many agricultural workers may not initially possess.

Additionally, concerns about the reliability of automated systems and their ability to adapt to different environmental conditions can deter farmers from making the switch. Finally, regulatory hurdles and privacy concerns related to data collection in agriculture further complicate the adoption of farm automation technologies, posing ongoing challenges to the industry’s growth.

Growth Factors

Growth Drivers in Farm Automation

The growth of the Farm Automation Market is propelled by several key factors. The need to increase agricultural productivity to feed a growing global population is a major driver, as automation allows for more efficient farming practices.

Technological advancements, particularly in robotics and artificial intelligence, are making these systems more accessible and effective, enabling precise operations like planting, watering, and harvesting. Additionally, labor shortages in rural areas push farmers towards adopting automation to maintain productivity without a large workforce.

Environmental sustainability concerns also promote the use of automation, as it helps optimize resource usage, reducing waste and the environmental footprint of farming practices.

Furthermore, governmental support through subsidies and incentives for adopting modern agricultural technologies provides a financial boost, encouraging more farms to transition to automated solutions. These factors collectively fuel the expansion of the farm automation industry.

Emerging Trends

Emerging Trends in Farm Automation

Emerging trends in the Farm Automation Market are shaping the future of agriculture. There is a growing shift towards the use of artificial intelligence (AI) and machine learning to predict crop yields, detect plant diseases early, and optimize field management decisions.

The integration of the Internet of Things (IoT) is also prevalent, with sensors and connected devices providing real-time data on soil conditions, crop health, and weather patterns. This allows for precision farming, where resources like water and fertilizers are applied optimally, enhancing productivity and sustainability.

Additionally, the adoption of drone technology for aerial surveillance and field mapping is becoming more common, offering detailed insights that were previously unattainable.

Moreover, robotics continues to advance, with autonomous tractors and harvesters becoming more sophisticated, reducing the need for human labor and increasing efficiency. These trends collectively drive innovation and efficiency in farm automation, offering promising prospects for the industry’s growth.

Regional Analysis

The global Farm Automation Market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America dominates the market with a 29.5% share, valued at USD 1836.4 million, driven by advanced agricultural technologies and substantial investments in farm automation.

The region benefits from a strong presence of leading technology providers and robust governmental support through grants and subsidies, which encourage the adoption of automation.

In Europe, farm automation is rapidly growing due to the increasing need for operational efficiency and high labor costs. Europe’s strong focus on sustainable farming practices further accelerates the integration of smart agricultural tools.

Asia Pacific shows significant growth potential, spurred by rising technological adoption in countries like Japan, China, and India, aiming to enhance yield and combat labor shortages.

The Middle East & Africa, and Latin America are gradually adopting farm automation technologies, driven by the need to improve productivity and reduce dependency on manual labor.

These regions are witnessing early stages of adoption but show promise due to increasing government initiatives supporting modern agricultural practices. Collectively, these regional dynamics highlight diverse growth trends and potential in the global farm automation landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of the global Farm Automation Market, three key players—AGCO, Autonomous Solutions Inc., and Autonomous Tractor Corporation—stand out for their significant contributions and strategic advancements in 2023.

AGCO has solidified its position as a leader in the farm automation sector through continuous innovation and the development of integrated solutions. The company’s focus on precision agriculture and smart farming technologies, including data-driven insights and IoT-enabled machinery, allows for more efficient farm management and higher yields.

AGCO’s equipment is renowned for its reliability and technological sophistication, making it a preferred choice for large-scale farming operations seeking to maximize productivity.

Autonomous Solutions Inc. specializes in the customization of autonomous technology for various vehicles and equipment in smart agriculture. Their solutions are tailored to enhance the capabilities of existing farm machinery through retrofit kits, which transform standard vehicles into autonomous systems.

This not only extends the life of agricultural equipment but also reduces the need for immediate large-scale capital investments in new technologies, presenting a cost-effective option for farmers transitioning towards automation.

Autonomous Tractor Corporation offers a distinctive approach with their electric and hybrid-electric autonomous tractors. These tractors are designed to reduce emissions and operating costs, addressing environmental concerns and the rising costs of fuel.

The company’s focus on sustainability and innovation positions it well within the niche market of eco-conscious agricultural practices, attracting farmers who are prioritizing green technologies.

Together, these companies are driving the adoption of farm automation technologies by addressing key industry challenges such as labor shortages, sustainability, and operational efficiency. Their diverse approaches and solutions provide valuable insights into the market’s direction and the evolving needs of the agricultural sector.

Top Key Players in the Market

- AGCO

- Autonomous Solutions Inc.

- Autonomous Tractor Corporation

- Clearpath Robotics

- Deepfield Robotics

- DeLaval

- GEA Group

- Harvest Automation

- John Deere

- Lely

- Other key players

Recent Developments

- In August 2024, Zhang co-leads a $1 million USDA and NSF-funded initiative under NRI-3.0, focusing on multi-institutional agricultural robotics research.

- In July 2024, Monarch Tractor secured $133 million, the largest-ever funding for an agricultural robotics firm, to enhance AI-driven sustainable farming with their electric, driver-optional smart tractors

Report Scope

Report Features Description Market Value (2023) USD 6,225.4 Million Forecast Revenue (2033) USD 29,416.8 Million CAGR (2024-2033) 16.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Agriculture Type(Driverless Tractors, Material Management, Analytical and Monitoring Farming Tools, Automated Harvesting Systems, Other Types), By Application(Harvest Management, Dairy and Livestock Management, Soil Management, Irrigation Management, Field Farming, Pruning Management, Inventory Management, Other Applications), By Farm Produce(Fruit and Vegetable, Field Crops, Diary & Livestock, Other Products) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGCO, Autonomous Solutions Inc., Autonomous Tractor Corporation, Clearpath Robotics, Deepfield Robotics, DeLaval, GEA Group, Harvest Automation, John Deere, Lely, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGCO

- Autonomous Solutions Inc.

- Autonomous Tractor Corporation

- Clearpath Robotics

- Deepfield Robotics

- DeLaval

- GEA Group

- Harvest Automation

- John Deere

- Lely

- Other key players