Global Factoring Market By Type (Domestic Factoring and International Factoring), By End-User (Manufacturing, Healthcare, Retail, Construction, Transportation, Other End-Users), By Service Provider (Banks, Non-Bank Financial Institutions, Fintech Companies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 62920

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

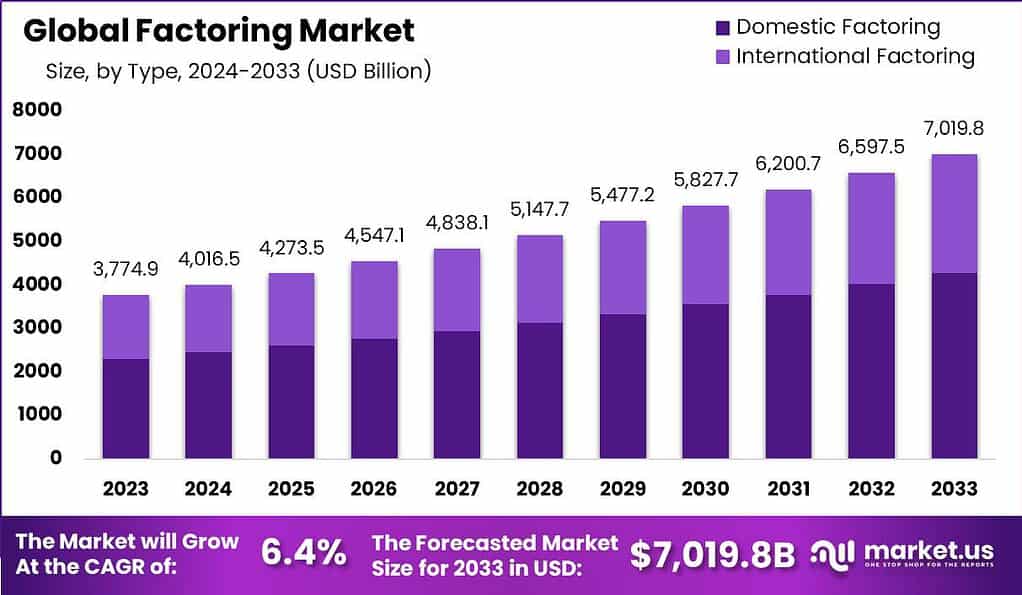

The Global Factoring Market is anticipated to be USD 7,019.8 billion by 2033. It is estimated to record a steady CAGR of 6.4% in the Forecast period 2024 to 2033. It is likely to total USD 4,016.5 billion in 2024.

Factoring, also known as accounts receivable financing or invoice factoring, is a financial service where a company sells its accounts receivable (unpaid invoices) to a third-party financial institution called a factor. The factor provides an immediate cash advance to the company, typically a percentage of the invoice value, and takes over the responsibility of collecting payments from the customers. Once the customers pay the invoices, the factor deducts its fees and returns the remaining balance to the company.

The factoring market has experienced significant growth over the years, driven by the need for working capital and cash flow management among businesses. Factors serve a wide range of industries, including manufacturing, retail, construction, and services. The market size varies across regions, with factors operating globally, nationally, or regionally.

Note: Actual Numbers Might Vary In Final Report

The factoring market refers to the industry and ecosystem surrounding the provision of factoring services. It involves various participants, including factors, businesses seeking financing, and the customers of those businesses.

Key Takeaways

- Market Size and Growth: The Factoring Market is projected to reach a valuation of USD 7,019.8 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.4% from 2024 to 2033. In 2024, it is estimated to be worth USD 4,016.5 billion.

- Definition of Factoring: Factoring, also known as accounts receivable financing or invoice factoring, involves a company selling its unpaid invoices to a third-party financial institution called a factor. The factor provides immediate cash advance, typically a percentage of the invoice value, and handles the collection of payments from customers.

- Market Growth Drivers: The growth of the factoring market is driven by the need for working capital and cash flow management among businesses. Factors serve various industries, including manufacturing, retail, construction, and services.

- Type Analysis: In 2023, Domestic Factoring held a dominant market position, capturing over 61.0% share due to increasing small and medium-sized enterprises (SMEs) seeking immediate liquidity solutions in their own countries. International Factoring is experiencing robust growth due to globalization and international trade.

- End-User Analysis: In 2023, Manufacturing held a dominant market position, accounting for more than 25% share, as manufacturers require working capital for production. Healthcare, Retail, Construction, and Transportation industries also heavily rely on factoring services.

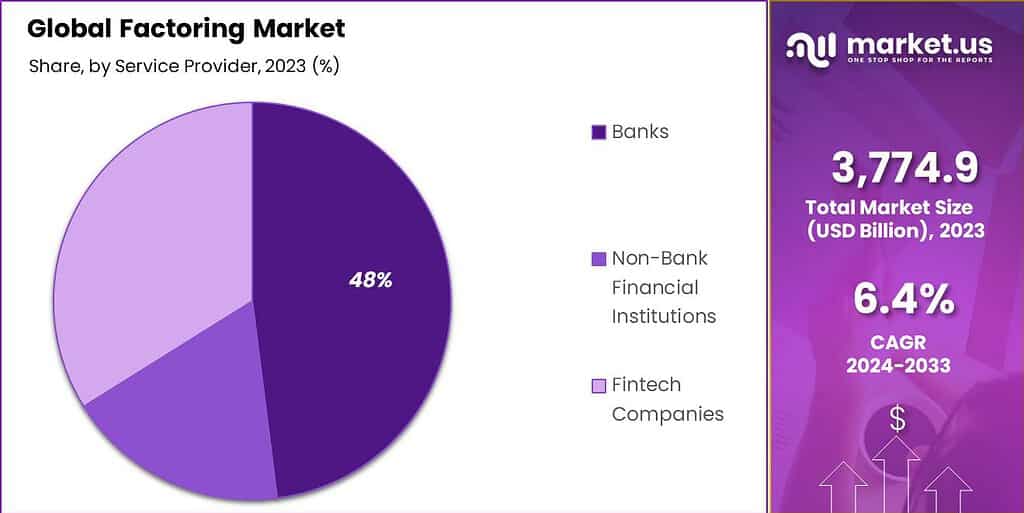

- Service Provider Analysis: Banks dominated the factoring market in 2023, with over 48% market share due to trust, reliability, and comprehensive services. Non-Bank Financial Institutions (NBFIs) offer more flexibility and cater to SMEs, while Fintech Companies are rapidly gaining ground with digital-first solutions.

- Growth Factors: Key factors driving growth include the expansion into emerging markets, technological advancements in digitizing factoring processes, collaboration with financial institutions, and integration with supply chain finance.

- Challenges: Challenges in the factoring market include regulatory compliance, economic conditions affecting default risks, competition from alternative financing options, and the complexity of international factoring.

- Key Market Trend: The digital transformation of processes and services is a significant trend, with factoring companies adopting digital platforms, automation, and data analytics to streamline operations, enhance risk assessment, and improve customer experience.

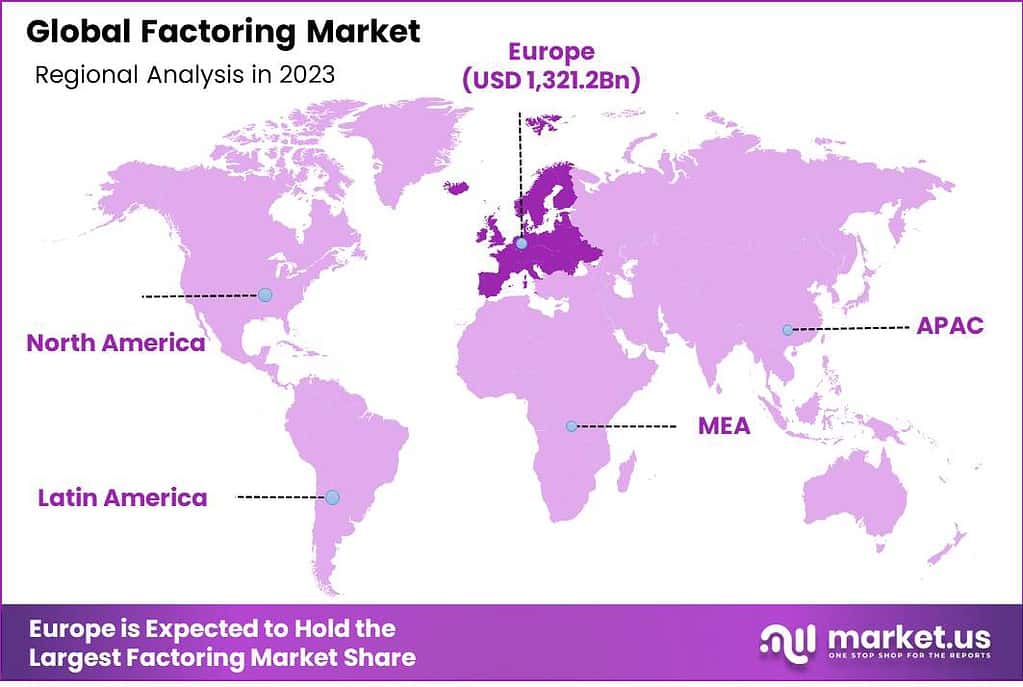

- Regional Analysis: Europe held a dominant market position in 2023, driven by well-established financial infrastructure.

Type Analysis

In 2023, the Domestic Factoring Segment held a dominant market position in the Factoring Market, capturing more than a 61.0% share. This segment’s strength is primarily due to the increasing number of small and medium-sized enterprises (SMEs) seeking immediate liquidity solutions within their own countries.

Domestic factoring has become a popular choice for these businesses due to its simpler and quicker process compared to international factoring, and the lesser risks involved when dealing with familiar local markets and regulations. Additionally, the growing awareness and acceptance of alternative financing methods have significantly contributed to the segment’s expansion.

On the other hand, the International Factoring segment, while smaller, is experiencing robust growth, driven by globalization and the increasing volume of international trade. Companies venturing into new markets seek international factoring services to mitigate the risks associated with cross-border transactions, including currency fluctuations and differences in legal systems.

This segment is particularly prevalent in regions with significant export activities, such as Asia-Pacific and Europe. Despite the complexities and higher costs associated with international factoring, the demand for such services is expected to rise as businesses continue to expand globally and seek secure financing solutions to support their international trade activities.

End-User Analysis

In 2023, the Manufacturing Segment held a dominant market position in the Factoring Market, capturing more than a 25% share. This sector’s substantial share is attributed to the manufacturing industry’s constant need for working capital to manage inventory, handle operational costs, and sustain production cycles. Factoring provides a quick and effective cash flow solution, enabling manufacturers to continue their operations without interruption. This is particularly vital for small to medium-sized manufacturers who may not have access to traditional lending sources.

The Healthcare sector is also a significant user of factoring services. With the long payment cycles often associated with insurance companies and other payers, healthcare providers turn to factoring to maintain a steady cash flow. This ensures they can continue to invest in essential medical equipment and supplies and meet their day-to-day operational costs.

Retail is another area where factoring is increasingly popular. Retailers often need to pay upfront for stock and may not see a return on that investment until much later. By using factoring services, they can keep shelves stocked and businesses running smoothly, even during slower sales periods.

In the Construction industry, the long duration of projects and delayed payment terms can lead to substantial cash flow challenges. Factoring allows construction companies to maintain liquidity and manage the costs associated with materials, labor, and equipment, ensuring projects stay on track.

Transportation companies, dealing with high fuel costs, fleet maintenance, and irregular payment schedules, also rely heavily on factoring. It provides them the necessary funds to cover these expenses and keep their vehicles on the road.

Lastly, Other End-Users, encompassing a wide range of industries from IT services to agriculture, also utilize factoring services to manage their unique cash flow challenges. The flexibility and accessibility of factoring make it an attractive option across various sectors.

Service Provider

In 2023, the Banks Segment held a dominant market position in the Factoring Market, capturing more than a 48% share. This dominance is primarily due to the trust and reliability traditionally associated with banks. Businesses often prefer banks for their established reputations, comprehensive services, and perceived security.

Banks also offer a wide range of financial products, allowing clients to integrate their factoring services with other financial needs. Despite stricter regulations and sometimes longer processing times, the scale and network of banks make them a preferred choice for many large corporations and established businesses seeking factoring services.

Non-Bank Financial Institutions (NBFIs) also play a critical role in the Factoring Market, offering more flexible and specialized services than traditional banks. These institutions often cater to small and medium-sized enterprises (SMEs) that may not meet the stringent requirements of banks. NBFIs typically provide quicker approvals and more personalized service, making them a popular choice for businesses looking for more agile and responsive factoring solutions. Their focus on customer-centric products and services allows them to adapt quickly to market changes and client needs.

Fintech Companies are the newest players in the Factoring Market and are rapidly gaining ground. In 2023, they brought innovation and disruption to the sector, offering digital-first solutions that streamline the factoring process. With advanced technologies like AI and blockchain, Fintech companies are making factoring more accessible, efficient, and secure.

They often cater to niche markets and provide highly customized services. The convenience, speed, and user-friendly platforms of Fintech factoring solutions particularly appeal to the younger, tech-savvy generation of entrepreneurs and small businesses looking for modern financing solutions.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Type

- Domestic Factoring

- International Factoring

End-User

- Manufacturing

- Healthcare

- Retail

- Construction

- Transportation

- Other End-Users

Service Provider

- Banks

- Non-Bank Financial Institutions

- Fintech Companies

Driving Factors

- Small and Medium Enterprises (SME) Growth: The growth of small and medium enterprises is a major driving factor in the factoring market. SMEs often face challenges in accessing traditional financing options, and factoring provides them with an alternative source of working capital to support their business operations and growth.

- Cash Flow Management: Effective cash flow management is crucial for businesses of all sizes. Factoring allows companies to convert their accounts receivable into immediate cash, helping them bridge the gap between invoicing and receiving payment. The need for improved cash flow management drives the demand for factoring services.

- Access to Quick Financing: Factoring offers businesses a quick and relatively hassle-free financing solution. Instead of waiting for customers to pay their invoices, companies can sell their receivables to a factoring company and receive immediate funds. This quick access to financing is particularly beneficial for businesses with urgent capital needs.

- Risk Mitigation: Factoring provides businesses with a way to mitigate the risk of customer non-payment or delayed payment. By transferring the credit risk to the factoring company, businesses can protect themselves from potential losses and maintain a more stable cash flow.

Restraining Factors

- Lack of Awareness: One of the primary restraining factors in the factoring market is the lack of awareness among businesses about factoring as a financing option. Many companies, especially smaller ones, may not be familiar with factoring or its benefits, which limits the market’s potential growth.

- Perception and Stigma: Factoring has historically been associated with businesses facing financial difficulties. Some companies may perceive factoring as a sign of financial distress or view it negatively. Overcoming these perceptions and addressing the stigma associated with factoring is a challenge for market growth.

- Cost Considerations: Factoring services come at a cost, typically in the form of a discount or fee charged by the factoring company. The cost of factoring may be higher compared to traditional financing options such as bank loans. Companies need to carefully evaluate the cost implications and determine the affordability of factoring for their business.

- Risk Assessment and Eligibility: Factoring companies assess the creditworthiness of a business’s customers before approving factoring arrangements. Companies with customers who have a high credit risk may face difficulties in qualifying for factoring services. The risk assessment process and eligibility criteria can pose challenges for businesses seeking factoring solutions.

Growth Opportunities

- Expansion into Emerging Markets: The factoring market presents opportunities for expansion into emerging markets. As economies in various regions continue to develop, SMEs are emerging and seeking financing solutions. Factoring companies can tap into these markets and provide much-needed working capital to support the growth of SMEs.

- Technological Advancements: Embracing technology can unlock growth opportunities in the factoring market. Digital platforms and fintech solutions can streamline factoring processes, improve efficiency, and enhance the customer experience. Factoring companies that invest in technology and offer user-friendly digital interfaces are likely to attract more businesses.

- Collaboration with Financial Institutions: Collaborating with banks and other financial institutions can create growth opportunities for factoring companies. Banks may refer clients to factoring companies for financing solutions that fall outside their scope. Factoring companies can also partner with financial institutions to leverage their networks and expand their customer base.

- Supply Chain Finance: Factoring can be integrated with supply chain finance to provide comprehensive working capital solutions. By extending financing options beyond accounts receivable, factoring companies can offer a broader range of services, including inventory financing and purchase order financing. Diversifying their product offerings through supply chain finance can drive growth in the factoring market.

Challenges

- Regulatory Compliance: Factoring is subject to regulatory frameworks that vary across different jurisdictions. Compliance with these regulations, such as anti-money laundering (AML) and know your customer (KYC) requirements, can be a complex and costly challenge for factoring companies operating in multiple markets.

- Economic Conditions and Default Risks: The factoring market is sensitive to economic conditions and the financial health of businesses. During economic downturns, the risk of customer defaults increases, impacting the profitability and stability of factoring companies. Managing default risks and navigating through challenging economic environments can be a significant challenge.

- Competition from Alternative Financing Options: Factoring faces competition from alternative financing options such as bank loans, crowdfunding, and peer-to-peer lending. Companies have a range of financing choices, and factoring companies need to differentiate themselves and demonstrate the unique value they provide to attract clients.

- Complexity of International Factoring: International factoring involves cross-border transactions, currency conversions, and compliance with international trade regulations. The complexity of international factoring adds challenges related to documentation, legal frameworks, and coordination with different stakeholders across borders.

Key Market Trend

The key market trend in the factoring market is the digital transformation of processes and services. Factoring companies are adopting digital platforms, automation and advanced data analytics to streamline operations, improve risk assessment, and enhance the overall customer experience. The shift towards digitalization enables faster onboarding, real-time tracking of receivables, and seamless communication between the factoring company and its clients. This trend is driven by the need for efficiency, convenience, and enhanced transparency in the factoring process.

Regional Analysis

In 2023, Europe held a dominant market position in the Factoring Market, capturing more than a 35% share. This robust position is largely due to the region’s well-established financial infrastructure and the strong presence of both traditional banks and specialized factoring companies. The demand for Factoring in North America reached US$ 1,321.2 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

European businesses, particularly SMEs, have a long history of using factoring to optimize their cash flow and manage the longer payment terms often seen in this market. Additionally, stringent regulations and a focus on transparency have made factoring a reliable and secure option for businesses across the continent.

North America, particularly the United States, represents a significant portion of the global factoring market. The region’s advanced financial services sector, combined with a culture of entrepreneurialism and innovation, creates a fertile environment for factoring services. The U.S. market is characterized by its competitive landscape, with a mix of large banks and niche factoring companies catering to the diverse needs of businesses across various industries.

The Asia-Pacific (APAC) region is experiencing rapid growth in factoring services, driven by the expanding economies of countries like China and India. The region’s burgeoning SME sector, along with increasing international trade activities, is propelling the demand for factoring solutions. Additionally, the growing adoption of digital technologies in the financial sector is making factoring services more accessible and efficient, further accelerating market growth.

Latin America’s factoring market is on an upward trajectory, supported by the growing need for alternative financing solutions among local businesses. Economic volatility in the region has led businesses to seek more flexible and immediate sources of funding. Countries like Brazil and Mexico are leading this growth, with an increasing number of factoring providers entering the market to meet the rising demand.

Lastly, the Middle East and Africa are emerging as potential growth areas for the factoring market. While these regions currently hold a smaller share of the global market, the increasing focus on diversifying economies and the rise in entrepreneurial activities are creating new opportunities for factoring services. The development of more sophisticated financial sectors and regulatory environments in these regions is expected to further support the growth of factoring.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Factoring Market, key players typically include a mix of traditional banks, non-bank financial institutions, and fintech companies. These entities are crucial in shaping the market dynamics through their services, innovations, and customer engagement strategies. These companies specialize in purchasing accounts receivable from businesses at a discounted rate, providing immediate cash flow and reducing the risk of non-payment

Top Company Profiles

- Citigroup Inc. (Citibank)

- JPMorgan Chase & Co.

- Wells Fargo & Co.

- BNP Paribas

- HSBC Holdings plc

- Deutsche Bank AG

- CIT Group Inc.

- Santander Group

- PNC Financial Services Group

- DBS Bank Ltd

- BNY Mellon

- Standard Chartered PLC

- Other Key Players

Recent Developments

- In March 2023, BNP Paribas S.A. and Hokodo introduced a B2B Buy Now, Pay Later (BNPL) platform, aiming to deliver optimal cash management and factoring services to multinational corporations.

- In January 2022, Bluevine Capital Inc. completed the sale of its invoice factoring business to FundThrough, a Canadian invoice funding platform.

Report Scope

Report Features Description Market Value (2023) US$ 3,774.9 Bn Forecast Revenue (2033) US$ 7,019.8 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Domestic Factoring and International Factoring), By End-User (Manufacturing, Healthcare, Retail, Construction, Transportation, Other End-Users), By Service Provider (Banks, Non-Bank Financial Institutions, Fintech Companies) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Citigroup Inc. (Citibank), JPMorgan Chase & Co., Wells Fargo & Co., BNP Paribas, HSBC Holdings plc, Deutsche Bank AG, CIT Group Inc., Santander Group, PNC Financial Services Group, DBS Bank Ltd, BNY Mellon, Standard Chartered PLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is factoring, and how does it work in financial terms?Factoring is a financial arrangement where a business sells its accounts receivable (invoices) to a third party, known as a factor, at a discount. This provides immediate cash flow for the business.

Why do businesses opt for factoring services?Businesses choose factoring to improve their cash flow, accelerate receivable collections, and access immediate funds for operational needs without waiting for customers to pay.

How big is Factoring Market?The Global Factoring Market is anticipated to be USD 7,019.8 billion by 2033. It is estimated to record a steady CAGR of 6.4% in the Forecast period 2024 to 2033. It is likely to total USD 4,016.5 billion in 2024.

How does the factoring process benefit small businesses?Factoring is advantageous for small businesses as it provides quick access to working capital, helps manage cash flow gaps, and allows them to focus on core operations rather than chasing overdue payments.

Are there industries where factoring is more commonly used?Factoring is prevalent in industries with extended payment terms, such as textiles, trucking, staffing, and manufacturing. However, businesses across various sectors can benefit from factoring services.

What is factoring in the stock market?Factoring in the stock market refers to the process of calculating the present value of future cash flows using a discount rate. It helps investors evaluate the attractiveness of an investment by considering the time value of money.

What is the #1 rule of factoring?The number one rule of factoring is to thoroughly assess the creditworthiness of the customers whose invoices are being factored. This helps minimize the risk of non-payment and ensures a healthy financial arrangement.

-

-

- Citigroup Inc. (Citibank)

- JPMorgan Chase & Co.

- Wells Fargo & Co.

- BNP Paribas

- HSBC Holdings plc

- Deutsche Bank AG

- CIT Group Inc.

- Santander Group

- PNC Financial Services Group

- DBS Bank Ltd

- BNY Mellon

- Standard Chartered PLC

- Other Key Players