Global External Defibrillators Market Analysis By Product (Automated External Defibrillators (Semi-Automated, Fully Automated), Manual External Defibrillators, Wearable Cardioverter Defibrillators), By Patient Type (Adult, Pediatric, Geriatric), By End-User (Hospitals & Cardiac Centers, Pre-Hospital & Emergency Medical Services (EMS), Public Access Market (Public Spaces, Corporate Offices & Workplaces), Home Healthcare, Nursing Homes & Assisted Living Facilities, Rehabilitation & Long-Term Care Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159670

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

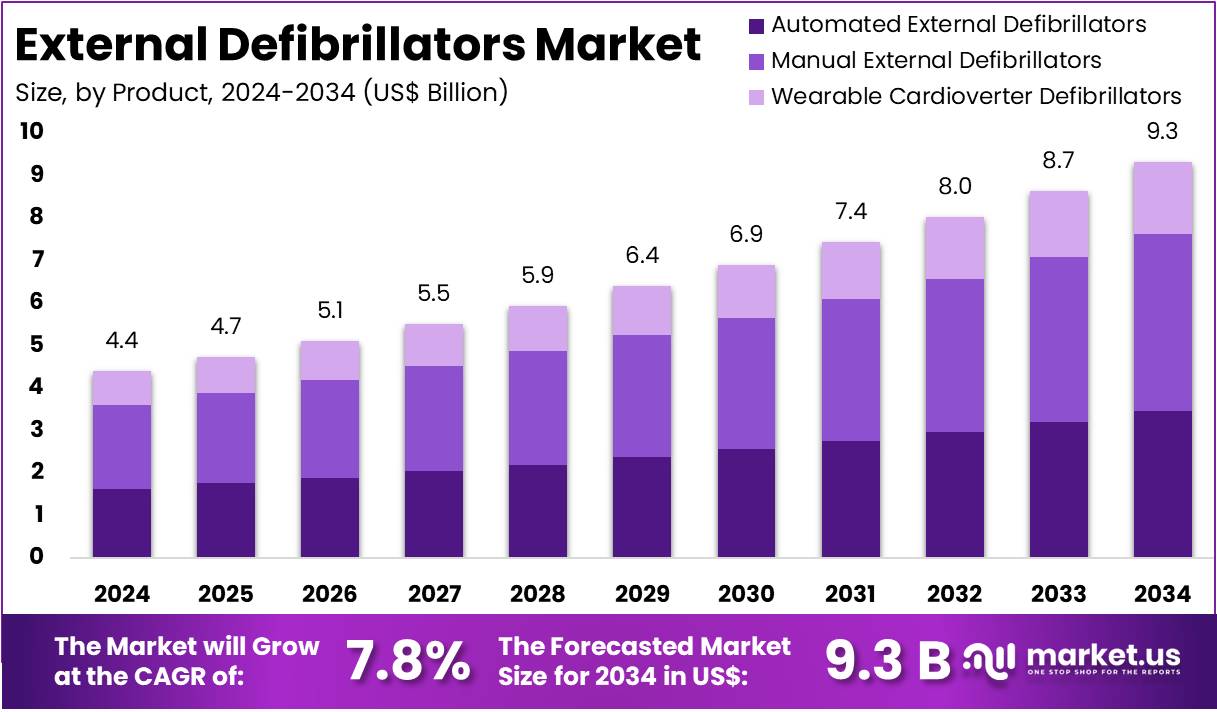

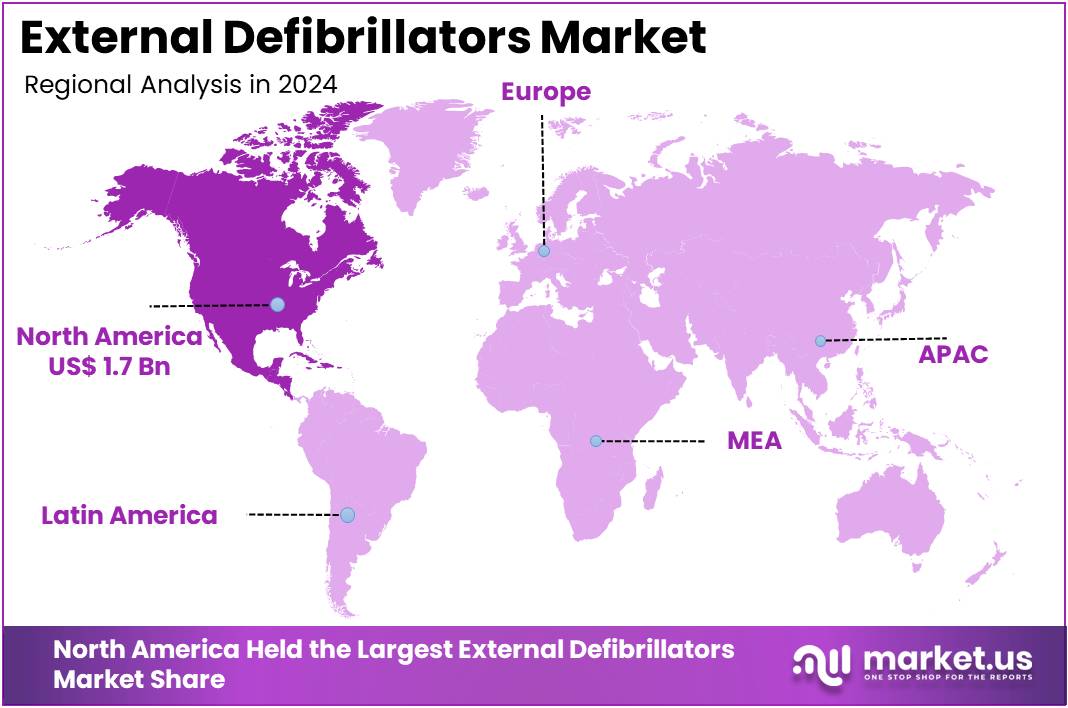

The Global External Defibrillators Market size is expected to be worth around US$ 9.3 Billion by 2034, from US$ 4.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.6% share and holding a market value of US$ 1.7 billion.

External defibrillators are designed to deliver controlled shocks that restore normal rhythm in ventricular fibrillation or pulseless ventricular tachycardia. Two types dominate. Automated external defibrillators (AEDs) enable layperson use in public access programs, while professional defibrillators are used by clinicians and EMS. According to clinical guidance, portability, intuitive prompts, and robust safety features have enabled deployment across hospitals, workplaces, transport hubs, schools, and community sites, supporting broader emergency response coverage.

The market is underpinned by the cardiovascular disease (CVD) burden. According to the World Health Organization, 19.8 million people died from CVD in 2022, representing 32% of all deaths. Historically, CVD deaths were about 17.9 million annually, indicating a rising trajectory. Approximately 85% of these deaths are due to heart attack and stroke. This persistent epidemiology sustains demand for rapid defibrillation and strengthens the case for continuous AED deployment and maintenance in high-footfall locations.

Out-of-hospital cardiac arrest (OHCA) incidence reinforces demand. The U.S. records more than 356,000 OHCA events each year, and most patients die before hospital arrival. Study by PMC pooling ~140,000 patients reported 7.6% survival to discharge and ~23.8% survival to hospital admission. According to the U.S. CARES registry, survival to discharge was 9.6%, while 26.3% survived to hospital admission. These ranges indicate that incremental gains in early defibrillation can meaningfully improve outcomes.

Early defibrillation provides the largest survival lift. According to CDC evidence, survival can reach up to 70% when an AED is applied within two minutes of collapse. By contrast, baseline community survival is often less than 8% without robust public-access defibrillation programs. For example, faster recognition, dispatcher-assisted CPR, and rapid AED access shorten time to first shock. These dynamics translate directly into adoption, installed base expansion, and consistent replacement of devices and pads.

Regulation, Policy, and System Readiness

Regulation has been supportive and stringent. In the United States, AEDs and key accessories follow the FDA premarket approval pathway, which requires evidence of safety and effectiveness and ongoing reporting. These requirements improve product reliability and drive fleet refresh cycles.

Public policy aims to lift performance above current baselines. According to CDC state law summaries, programs emphasize visible placement, maintenance, training, and EMS notification. The operational need is clear: only 3.7% of OHCA patients received an AED shock before EMS arrival, while bystander CPR occurred in ~43.8% of cases. For example, England’s co-funding for community defibrillators and linkage to responder apps seeks to raise pre-EMS defibrillation above the 3.7% baseline and improve bystander engagement.

Health-system guidance aligns with measurable outcomes. The European Resuscitation Council stresses early defibrillation, while UK NHS audits document instances where non-ambulance defibrillators restored circulation before EMS arrival. According to the CARES registry, 26.3% of OHCA patients survive to hospital admission but only 9.6% are discharged alive, indicating room for improvement. For instance, expanding AED density and training can close the gap toward scenarios where survival reaches up to 70% with a shock delivered within two minutes.

Sector rules extend coverage in regulated environments. Aviation regulators in Europe classify AEDs as approved onboard equipment, normalizing access in aircraft cabins. For example, education and sports policies require placement and maintenance protocols, ensuring readiness during high-risk activities. According to WHO, 85% of CVD deaths arise from heart attack and stroke, so targeted AED deployment at transport nodes and workplaces is rational. These measures, combined with <8% baseline survival, support steady market growth and recurrent accessory demand.

Key Takeaways

- The global external defibrillators market is projected to grow from US$ 4.4 billion in 2024 to US$ 9.3 billion by 2034.

- This growth reflects a compound annual growth rate (CAGR) of 7.8% between 2025 and 2034, highlighting steady expansion in cardiac care technologies.

- In 2024, manual external defibrillators dominated the product segment, securing over 44.8% market share, supported by strong adoption in hospital and emergency care.

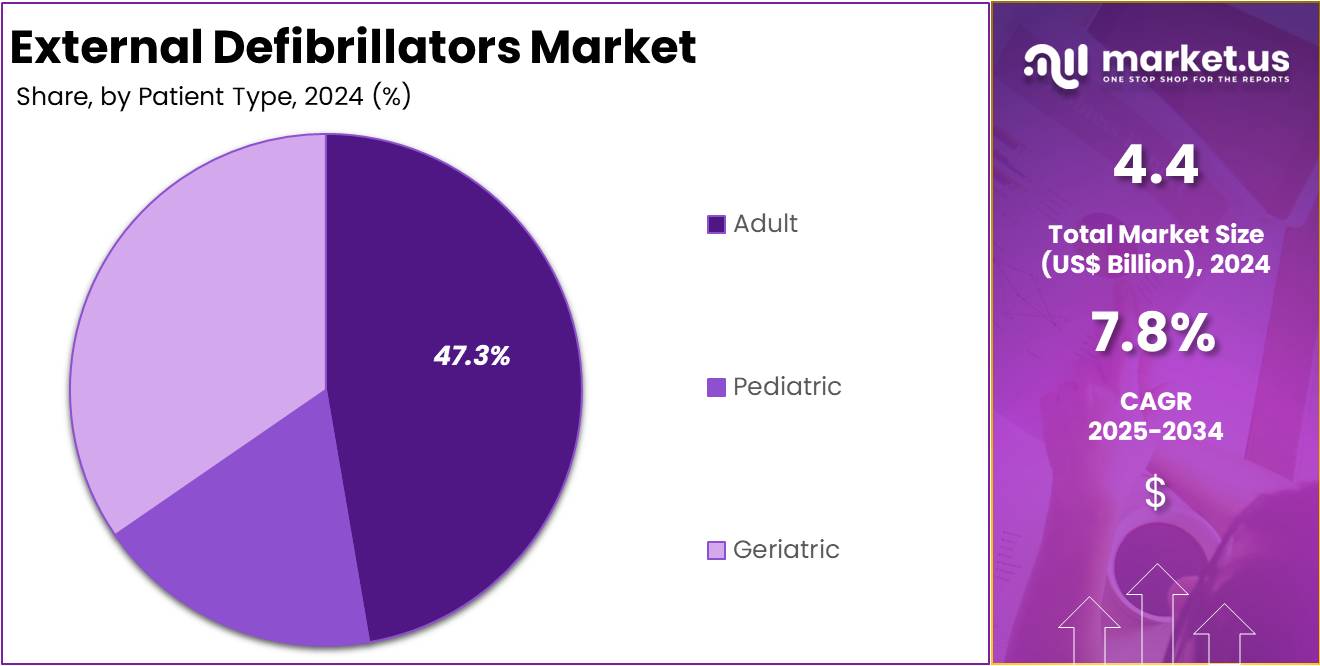

- The adult patient category held the leading position in 2024, capturing more than 47.3% share, indicating higher incidence of cardiac emergencies in adults.

- Hospitals and cardiac centers emerged as the primary end users in 2024, commanding over 26.5% market share due to advanced treatment capabilities.

- North America led the global market in 2024, holding a 39.6% share valued at US$ 1.7 billion, supported by advanced healthcare infrastructure.

Product Analysis

In 2024, the Manual External Defibrillators Section held a dominant market position in the Product Segment of External Defibrillators Market, and captured more than a 44.8% share. The preference for manual systems was influenced by their advanced control features. Hospitals and emergency rooms favored these devices because trained professionals could adjust energy levels and rhythms. Their strong presence in intensive care units, cath labs, and surgical environments also reinforced this leadership. Long replacement cycles and integration with monitoring systems further supported adoption.

Automated External Defibrillators (AEDs) represented the next significant category. Their use was supported by community initiatives and workplace installations. Public access programs in airports, malls, and transportation hubs improved visibility. Semi-automated AEDs led within this group as emergency medical staff preferred having manual shock control. Fully automated AEDs, however, gained traction in schools, offices, and other public areas. Growth was supported by easy usability, voice prompts, and improved self-testing features.

Wearable Cardioverter Defibrillators (WCDs) served a more specific group. They were prescribed for patients at temporary risk of sudden cardiac arrest. Post-heart attack monitoring and bridge-to-implantable defibrillator use cases were the main applications. Physicians valued remote monitoring and adherence data. However, the patient pool remained small compared to manual or AED devices. Short therapy durations and rental-based models influenced revenue contribution. Their adoption remained steady but limited within the overall external defibrillator market.

Overall, the product mix was shaped by clinical requirements, user training, and budget considerations. Hospitals continued to rely on manual units, while AEDs gained momentum across public and private facilities. Semi-automated AEDs were widely used by emergency responders, while fully automated models expanded community-based availability. WCDs, although niche, offered critical short-term protection. Future growth is expected to depend on connectivity features, asset management systems, and lifecycle costs that drive purchasing decisions across all product categories.

Patient Type Analysis

In 2024, the Adult Section held a dominant market position in the Patient Segment of the External Defibrillators Market, and captured more than a 47.3% share. This dominance was attributed to a higher incidence of sudden cardiac arrest among adults. Cardiovascular diseases have become common in the working population, creating significant demand for external defibrillators. Their use in hospitals, ambulances, and emergency care settings has grown. Rising awareness campaigns and training initiatives have also supported adoption in this segment.

The geriatric segment recorded a notable share of the market. Older adults are more prone to arrhythmias and cardiac arrests due to age-related conditions. Growth in this category was supported by increasing installations of automated external defibrillators in elderly care centers and residential settings. Supportive health programs and initiatives promoting defibrillator use for older populations strengthened adoption. Demographic changes, such as rising global aging populations, continue to contribute to demand for defibrillators among the geriatric segment.

The pediatric segment remained smaller but showed measurable growth. Increased awareness of cardiac conditions in children has played a role in expanding its demand. Availability of devices with pediatric-specific features, such as lower energy pads, supported market growth. Many schools and community institutions have adopted these devices to address emergency needs. Health authorities have encouraged training and awareness programs, which further strengthened this trend. Although smaller compared to adults and geriatrics, the pediatric segment is steadily advancing.

End-User Analysis

In 2024, the Hospitals & Cardiac Centers Section held a dominant market position in the End-User Segment of External Defibrillators Market, and captured more than a 26.5% share. Hospitals continued to invest in advanced defibrillator systems due to strict clinical protocols and rising cardiac emergencies. Integration with patient monitoring systems and compliance with uptime standards supported higher adoption. Frequent staff training and strict replacement cycles also contributed. This group remained the primary revenue generator among all end-user categories.

Pre-hospital and EMS providers registered consistent demand. Devices with rugged designs, lightweight structure, and real-time data transfer features were most preferred. Emergency fleets valued fast charging systems and extended battery performance. Government funding programs and local protocols influenced purchases. Public access installations also increased. Airports, corporate offices, and transit hubs adopted automated external defibrillators to improve survival rates. Simple interfaces and remote monitoring solutions enhanced bystander confidence and lowered inspection costs.

Home healthcare and elderly care facilities showed steady growth. Patients with chronic heart conditions supported rising demand. Compact units with voice-guided instructions improved safe usage. Telehealth connectivity allowed clinicians to oversee device data remotely. Nursing homes and assisted living centers valued semi-automatic systems due to staff turnover and limited budgets. Rehabilitation and long-term care centers deployed units based on risk profiles. Schools, gyms, and sports facilities added defibrillators to comply with safety policies, expanding coverage beyond traditional healthcare.

Key Market Segments

By Product

- Automated External Defibrillators

- Semi-Automated

- Fully Automated

- Manual External Defibrillators

- Wearable Cardioverter Defibrillators

By Patient Type

- Adult

- Pediatric

- Geriatric

By End-User

- Hospitals & Cardiac Centers

- Pre-Hospital & Emergency Medical Services (EMS)

- Public Access Market

- Public Spaces

- Corporate Offices & Workplaces

- Home Healthcare

- Nursing Homes & Assisted Living Facilities

- Rehabilitation & Long-Term Care Centers

- Others

Drivers

Rising Burden Of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases has become a significant factor driving the demand for external defibrillators. According to the World Health Organization, these diseases remain the leading cause of mortality worldwide. This high burden of heart-related illnesses increases the need for reliable emergency treatment options. As sudden cardiac arrests continue to occur in large numbers, healthcare providers, governments, and communities are prioritizing immediate response solutions. External defibrillators are emerging as essential life-saving devices in this scenario.

The growing incidence of sudden cardiac arrests has accelerated the adoption of external defibrillators across different settings. Hospitals are increasingly equipped with these devices to provide rapid emergency care. Public spaces such as airports, gyms, and schools are also witnessing higher installations to ensure timely intervention. The availability of external defibrillators in accessible locations is considered critical in saving lives. This rising deployment reflects the strong demand for quick-response technologies capable of reducing mortality risks.

In addition, the shift toward homecare and personalized healthcare solutions is expanding the market for external defibrillators. Patients with a high risk of cardiac events, or those already diagnosed with heart conditions, are increasingly adopting these devices for use at home. This trend highlights the growing awareness about prevention and preparedness. The combination of rising cardiovascular disease prevalence, higher sudden cardiac arrest rates, and the emphasis on immediate response is driving steady growth in external defibrillator adoption across healthcare, public, and homecare environments.

Restraints

High Cost and Limited Accessibility

The adoption of external defibrillators is restricted by their high device costs, particularly in low- and middle-income countries. The initial purchase, along with maintenance and replacement parts, requires significant financial investment. This expenditure creates challenges for hospitals, clinics, and emergency response services in resource-limited markets. As a result, despite the proven clinical value of external defibrillators in saving lives during cardiac emergencies, affordability remains a major barrier to penetration in price-sensitive healthcare systems.

Budget limitations within public healthcare systems also contribute to slow adoption. Many governments allocate limited funds to advanced medical devices due to competing priorities, such as infectious disease control, maternal health, and infrastructure development. External defibrillators, while lifesaving, often receive lower priority compared to basic healthcare needs. This leads to fewer installations across hospitals and emergency medical services in underfunded regions. Consequently, the broader availability of these devices is hindered by financial restrictions at the institutional level.

In addition to cost-related barriers, lack of awareness significantly limits accessibility. In many resource-limited regions, healthcare workers and the general population have low awareness of the importance of external defibrillators. Training gaps and inadequate knowledge about device use reduce demand, even where devices are available. Limited educational programs and insufficient government-led awareness initiatives further constrain adoption. As a result, the potential benefits of these devices in reducing sudden cardiac deaths remain underutilized in emerging markets, where accessibility is most needed.

Opportunities

Smart and Connected External Defibrillators

The integration of external defibrillators with advanced digital technologies presents a significant growth opportunity. Smart defibrillators enabled with Internet of Things (IoT) connectivity can transmit critical patient data to emergency teams in real time. This capability allows faster decision-making and improves the coordination of care. The ability to link devices with connected healthcare systems is expected to increase adoption, particularly in hospitals, emergency response networks, and community health programs, where rapid action is crucial for survival rates.

Artificial intelligence (AI) integration further strengthens the market potential. AI-enabled defibrillators can analyze patient conditions quickly, guide responders with precise instructions, and predict outcomes. These features reduce the dependence on highly trained operators, making defibrillators accessible for wider community use. By offering accurate and user-friendly operation, AI-powered devices enhance confidence in emergency situations. This is anticipated to drive demand among non-medical users, schools, airports, and public spaces where immediate intervention is critical.

Real-time monitoring and remote data sharing provide additional advantages that increase device attractiveness. Healthcare providers can review usage data, track performance, and ensure devices remain operational. Emergency systems benefit from improved preparedness and faster deployment of resources. Such connectivity-driven value propositions align with the global emphasis on digital health transformation. As governments and organizations invest in smart healthcare infrastructure, demand for advanced external defibrillators is expected to grow steadily, creating strong market opportunities across developed and emerging regions.

Trends

Expansion of Public Access Defibrillation Programs

The external defibrillators market is experiencing strong momentum due to the rapid adoption of public access defibrillation programs. Governments, healthcare authorities, and NGOs are prioritizing the placement of automated external defibrillators (AEDs) in airports, schools, offices, and sports facilities. These initiatives are supported by strategic funding and regulatory encouragement, which is enhancing the availability of devices in both developed and emerging economies. As a result, the market is witnessing broader accessibility and stronger awareness about the importance of immediate cardiac emergency response.

Another major driver of this trend is the increasing training initiatives for non-medical personnel. Programs that equip laypersons with AED handling skills are expanding globally. These initiatives are aimed at improving community response to sudden cardiac arrest events outside hospital environments. The emphasis on skill development is fostering higher usage readiness among the general population. This is creating a supportive ecosystem for AED adoption, which in turn is expected to accelerate market growth during the forecast period.

The success of public access defibrillation programs is reflected in improved survival outcomes for cardiac arrest cases. Studies have shown that timely access to AEDs significantly raises survival rates in out-of-hospital emergencies. This outcome has encouraged more private organizations and public institutions to invest in AED installations. The integration of these devices into daily environments demonstrates a preventive healthcare approach. Consequently, the external defibrillators market is positioned to benefit from rising installations, growing awareness, and enhanced emergency preparedness worldwide.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.6% share and holding a market value of US$ 1.7 billion. The region’s leadership is driven by a large cardiac arrest burden and structured public-health initiatives. According to the American Heart Association, over 356,000 people in the United States suffer from out-of-hospital cardiac arrests each year. Alarmingly, 60%–80% die before reaching hospitals, creating an urgent demand for automated external defibrillators (AEDs) across public places and workplaces.

Regulatory frameworks further strengthen adoption across the region. The U.S. Food and Drug Administration mandates premarket approvals for AEDs and accessories. Study by FDA shows that compliance deadlines and Unique Device Identification rules improve product safety, reliability, and lifecycle management. These regulations also sustain replacement cycles for older devices. For example, established suppliers with approved portfolios benefit from consistent procurement as organizations transition to updated systems that meet stringent safety standards.

Emergency medical infrastructure and registries enhance market growth. For instance, the Cardiac Arrest Registry to Enhance Survival (CARES) covers more than half of the U.S. population. It provides outcome data that supports placement, funding, and quality improvement in AED programs. Research indicates that survival rates double or triple when CPR and AED use occur before EMS arrival. Such evidence encourages adoption in airports, schools, large employers, and public spaces, further reinforcing the steady rise in deployments and training.

Canada demonstrates parallel growth drivers. Health Canada regulates AEDs as medical devices and ensures monitoring of quality and safety. Government sources highlight nearly 45,000 sudden cardiac arrests annually, with survival improving significantly if defibrillation occurs within 1–3 minutes. For example, workplace readiness initiatives and community defibrillator programs promote accessibility. Canadian studies also report ongoing efforts to register, map, and maintain AEDs, generating recurring demand for devices, services, and replacement accessories.

Training and awareness remain vital growth factors. National guidelines updated by the American Heart Association and Canadian authorities emphasize CPR and AED use. Many U.S. states and Canadian provinces now integrate CPR/AED training in schools and workplaces. This broader awareness leads to higher bystander intervention rates compared to other regions. As a result, consistent training, strong regulations, robust registries, and a large cardiac arrest burden collectively establish North America as the leading market for external defibrillators.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The external defibrillator market is shaped by regulatory oversight, brand lock-in from installed bases, and rising demand for connected solutions. Connectivity, CPR feedback, and post-event analytics differentiate offerings, while procurement has shifted toward value-based criteria. Vendors are judged on device reliability, training ecosystems, and total cost of ownership (TCO). This shift benefits companies able to integrate hardware with services and consumables. Key players compete on global reach, ecosystem integration, and post-sales service while balancing cost pressures in increasingly competitive tenders.

Koninklijke Philips and Nihon Kohden hold strong hospital and EMS positions. Philips benefits from its HeartStart portfolio, wide distribution, and trusted brand in public access. However, compliance costs from recalls and tender-driven pricing pressures limit margins. Its focus is on connected AED fleets, training partnerships, and consumables growth. Nihon Kohden is leveraging its monitoring systems to cross-sell defibrillators, particularly in Asia. While it is respected for quality and reliability in hospitals, it faces visibility challenges in Western public-access markets.

Regional and specialist competitors add diversity to the landscape. Bexen Cardio focuses on customization, rugged AEDs, and distributor-driven growth in Europe and Latin America, though brand scale limits global impact. Silverline Meditech competes in India with low-cost tenders and local market access, but struggles with global brand strength and premium connectivity. Stryker dominates EMS and hospital segments with the LIFEPAK range and a robust ecosystem but faces pricing risks. Boston Scientific, though not a direct AED player, influences protocols through CRM expertise and ecosystem partnerships.

Market Key Players

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Bexen Cardio

- Silverline Meditech Pvt. Ltd.

- Stryker

- Boston Scientific Corporation

- Progetti Srl

- AMI Italia

- Shenzhen Mindray Bio-Medical Electronics

- ZOLL Medical Corporation

- CU Medical

- Corpuls

- Mediana Co., Ltd.

- BPL Medical Technologies

- MS Westfalia GmbH

- LivaNova PLC

- Schiller AG

Recent Developments

- In October 2024: Reanibex introduced the Reanibex 100 Trainer, a dedicated AED/CPR training device. Equipped with Bluetooth app control, real-time scenario management, and reusable training pads, the device was developed to improve proficiency in both defibrillator usage and cardiopulmonary resuscitation (CPR).

- In March 2024: Stryker launched the next-generation LIFEPAK CR2 automated external defibrillator (AED). The product was designed with QUIK-STEP™ electrodes for faster placement and an improved Shock Advisory ECG analysis system. These advancements aimed to support both lay rescuers and healthcare professionals in responding effectively to sudden cardiac arrest emergencies.

- In February 2024: ZOLL announced that its AED 3® defibrillator received approval under the European Union Medical Device Regulation (EU MDR). The CE marking under MDR represented one of the earliest certifications for AEDs within the company’s portfolio. This achievement enhanced ZOLL’s regulatory compliance and positioned the device more strongly in the European medical device market.

- In March 2023: Philips introduced Philips Virtual Care Management, a telehealth and remote patient management platform. The solution incorporates condition-specific protocols, including those for heart disease. While not a direct defibrillator launch, this initiative expanded Philips’ role in remote cardiac monitoring and management, thereby strengthening its presence in the broader cardiac care ecosystem, which is closely linked to defibrillator and arrhythmia care pathways.

Report Scope

Report Features Description Market Value (2024) US$ 4.4 Billion Forecast Revenue (2034) US$ 9.3 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Automated External Defibrillators (Semi-Automated, Fully Automated), Manual External Defibrillators, Wearable Cardioverter Defibrillators), By Patient Type (Adult, Pediatric, Geriatric), By End-User (Hospitals & Cardiac Centers, Pre-Hospital & Emergency Medical Services (EMS), Public Access Market (Public Spaces, Corporate Offices & Workplaces), Home Healthcare, Nursing Homes & Assisted Living Facilities, Rehabilitation & Long-Term Care Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Koninklijke Philips N.V., Nihon Kohden Corporation, Bexen Cardio, Silverline Meditech Pvt. Ltd., Stryker, Boston Scientific Corporation, Progetti Srl, AMI Italia, Shenzhen Mindray Bio-Medical Electronics, ZOLL Medical Corporation, CU Medical, Corpuls, Mediana Co., Ltd., BPL Medical Technologies, MS Westfalia GmbH, LivaNova PLC, Schiller AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  External Defibrillators MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

External Defibrillators MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Koninklijke Philips N.V.

- Nihon Kohden Corporation

- Bexen Cardio

- Silverline Meditech Pvt. Ltd.

- Stryker

- Boston Scientific Corporation

- Progetti Srl

- AMI Italia

- Shenzhen Mindray Bio-Medical Electronics

- ZOLL Medical Corporation

- CU Medical

- Corpuls

- Mediana Co., Ltd.

- BPL Medical Technologies

- MS Westfalia GmbH

- LivaNova PLC

- Schiller AG