Global Exosomes Market, By Product (Kits & Reagents, Instruments, and Services), By Workflow (Isolation Methods and Downstream Analysis), By Application (Cancer, Neurodegenerative Diseases, Cardiovascular Diseases, Infectious Diseases, and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 100981

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

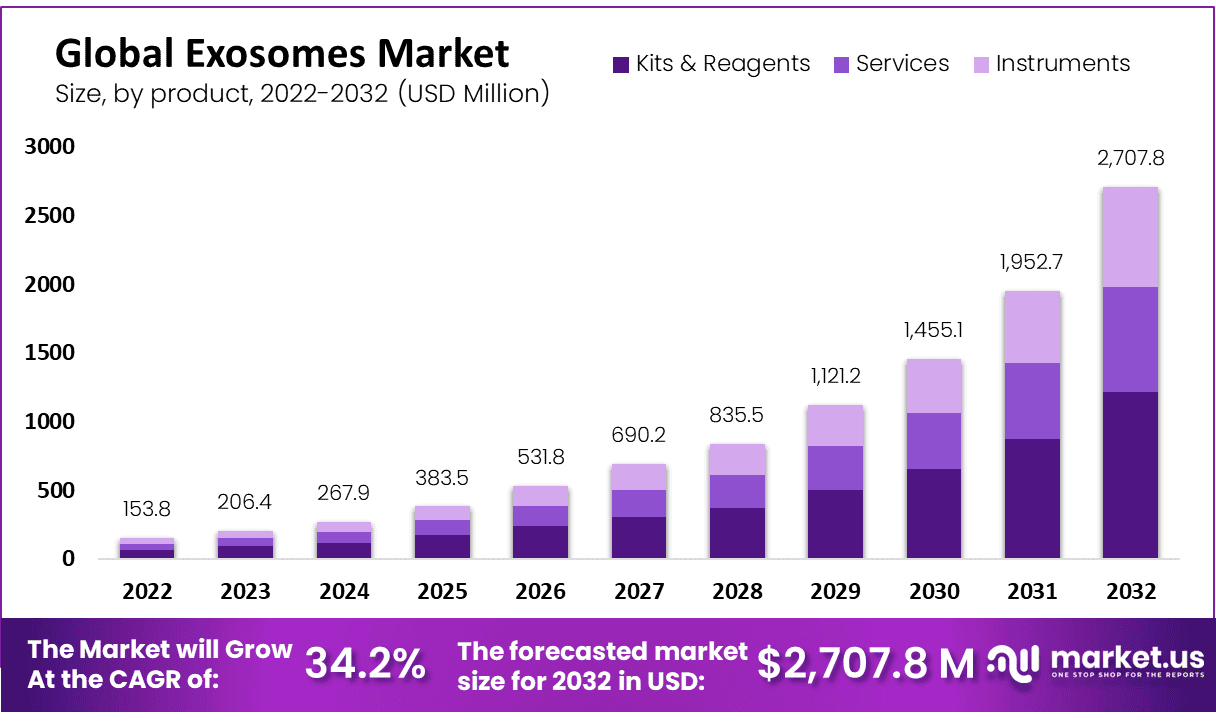

The Global Exosomes Market size is expected to be worth around USD 2707.8 Million by 2032 from USD 153.8 Million in 2022, growing at a CAGR of 34.20% during the forecast period from 2023 to 2032.

A eukaryotic cell’s extracellular compartment generates the membrane-bound vesicle called an exosome. Cancer, heart disease, infections caused by viruses & other various issues are handled by exosomes. Exosomes deliver biomolecules including proteins, nucleic acid, and metabolites into target cells to change their biological response. Chemotherapeutics, immune-mediated modulators, antisense oligonucleotides (antisense RNAs), and short-interfering RNAs (RNAs) are among only a few of the therapeutic payloads which exosomes can transport. For patients with cancer or other illnesses, the liquid biopsy based on exosome vesicles can be utilized to make an evaluation and forecast their prognosis.

Exosomes are a valuable diagnostic & therapeutic tool. The market share of exosomes is driven primarily by the increase in cancer, chronic illness, autoimmune diseases, and infectious diseases. Furthermore, continuous advancement in exosome technologies in drug development and discovery provides important insights into biological heterogeneity and function and improves our capacity to harness the therapeutic and diagnostic potential for infectious illness and cancer. So, the expansion of the exosome market is driven by advancements in technology in the healthcare sector.

Key Takeaways

- In 2022, the Kits & Reagents segment emerged as the frontrunner in terms of revenue generation, securing a substantial market share of 44.82%.

- Among different workflow categories, the downstream segment stood out as the dominant force, contributing to an impressive 58.46% of the global revenue in 2022.

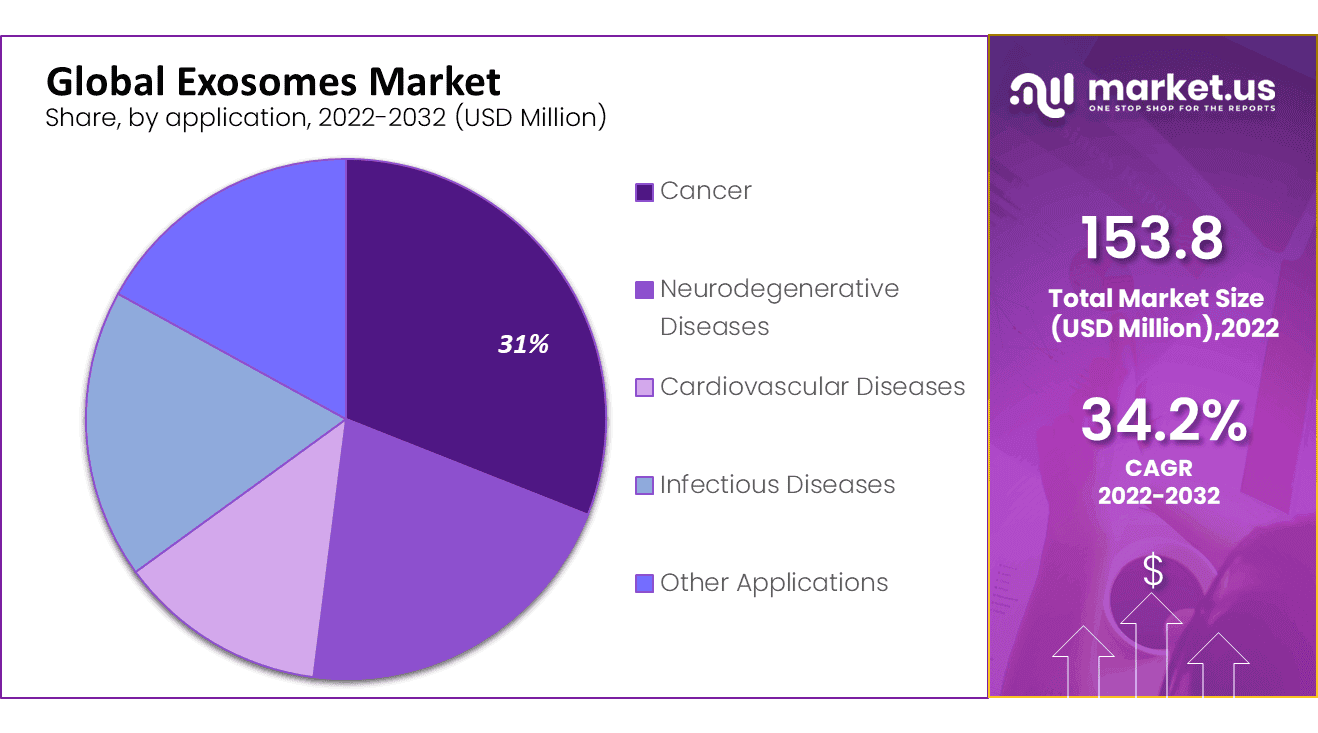

- The market’s landscape in 2022 was heavily influenced by the cancer segment, which claimed the largest market revenue share at 31.88%.

- The pharmaceutical & biotechnology companies segment emerged as the powerhouse in the market, commanding a substantial market revenue share of 49.42% in 2022.

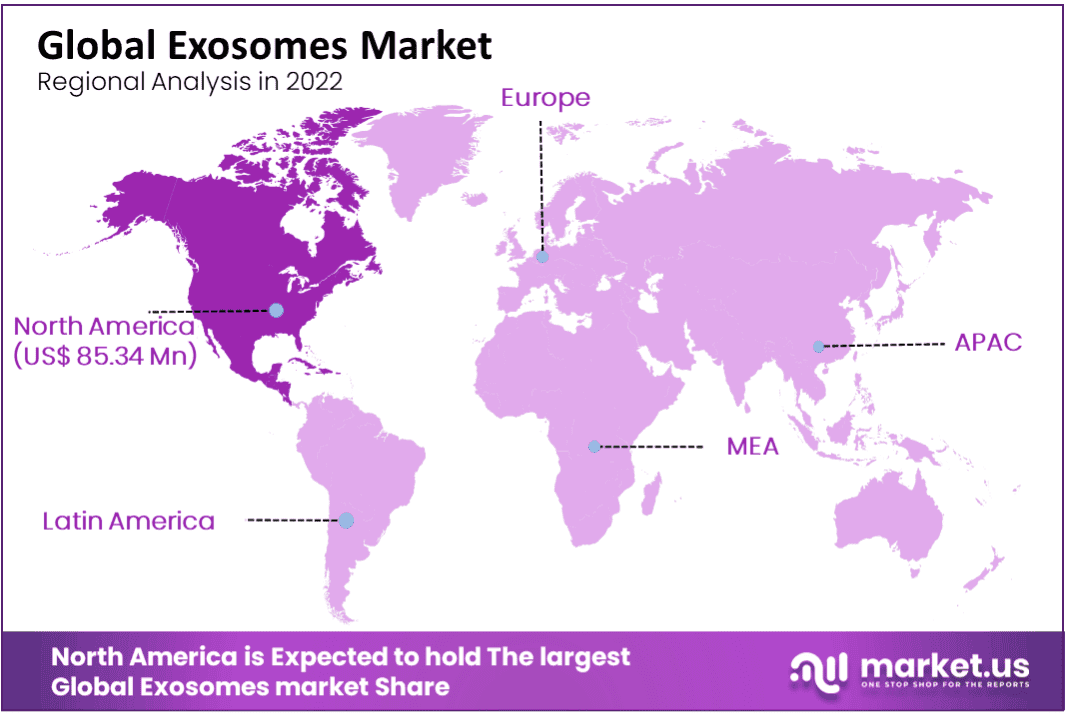

- Geographically, North America asserted its dominance in the market during 2022, accounting for the highest revenue share at 55.49%.

- Looking ahead, the European region is poised for significant growth, with a projected robust Compound Annual Growth Rate (CAGR) from 2023 to 2032.

Driving Factors

Increasing prevalence of cancer

The increasing prevalence of cancer is one of the primary variables boosting the global exosome market. Exosomes are essential to the biology of cancer due to their influence on the formation and growth of the tumor. As a result, there is a growing demand for exosome-based treatments and diagnostics given that they may provide crucial details about the recognition, progression, and treatment of cancer.

Growing knowledge about exosomes

Over the past few years, awareness of exosomes’ role in biological processes has improved. Exosome isolation and purification kits, exosome quantification assays, and exosome character development tools are some of the exosome research tools and reagents. This increased demand has driven the growth of the global exosomes market.

Technological advancements

Exosomes and their roles in disease are now more understood as a consequence of the development of new technologies for exosome isolation, quantification, and characterization. For instance, advances in flow cytometry, electron microscopy, and nanoparticle tracking evaluations have helped make it feasible to identify and measure exosomes more accurately. The emergence of new exosome-based diagnostics and treatments as an outcome has encouraged the rapid growth of the around-the-world exosome market.

Restraining Factors

High cost of exosome-based products

Exosome-based goods are expensive to develop and are thus prohibitively expensive for many potential customers. Exosome-based products are still relatively new. This may restrict their market acceptance, especially in low- and middle-income nations.

Competition from alternative technologies

Apoptotic bodies and microvesicles are two additional extracellular vesicles that are crucial to this process. In addition, potential alternatives to exosome-based diagnostics and therapies are developing, including liquid biopsy & single-cell sequencing.

Limited understanding of exosome biology

Despite advancements in exosome research, the biology of exosomes and their methods of action remains limited understanding. This may hinder the development of new exosome-based products and prevent their use in therapeutic settings.

Product Analysis

The Kits and Reagents Segment Accounted for the Largest Revenue Share in Exosomes Market in 2022.

Based on product, the market is segmented into kits & reagents, instruments, and services. Among these products, the kits & reagents are expected to be the most lucrative in the global exosomes market, with the largest revenue share of 44.82% during the forecast period. To broaden the application of exosomes, key players are introducing innovative reagents and kits. Clara Biotech, for example, launched in May 2022 an ExoRelease Starter Kit for exosome purification and isolation. These technologically advanced products allow researchers to discover novel biomarkers and explore exosome-based diagnostics and therapeutics. Such developments will drive the segment’s growth in the coming year.

The services Segment is Fastest Growing Type Segment in Exosomes Market.

It is expected that the services segment will grow rapidly during the forecasted years. The isolation of exosomes is a tedious, difficult, and non-specific process. Exosome services are offered by several industry players. AMSBIO is a U.S.-based company that offers exosome quantification and isolation, exosome miRNA sequencing and analysis, and exosome surface markers and proteomics services. The segment is expected to be driven by a wide range of services offered by different companies.

Workflow Analysis

The downstream analysis Segment Accounted for the Largest Revenue Share in Exosomes Market in 2022.

In 2022, based on workflow, the market is segmented into Isolation methods and downstream Analysis. Among these products, the downstream analysis is expected to be the most lucrative in the global exosomes market, with the largest revenue share of 58.46% during the forecast period. The downstream analysis involves the detection, quantification, and labeling of exosomes. These procedures can require complex sample preparation and downstream data analysis. They may also use analytical methods including mass spectrometry and RNA sequencing for proteomic analyses.

Major players offer a variety of technologically advanced downstream analysis products. Exosomes can be quantified in four hours using the System Biosciences Exo-ELISA Ultra Method. The increasing utility and efficiency of developed downstream analysis techniques are contributing to segment growth. Over the forecast period, the segment of isolation methods is expected to raise at an attractive CAGR.

Application Analysis

Based on application, the market is segmented into cancer, neurodegenerative diseases, cardiovascular diseases, Infectious diseases, and other applications. Among these applications, cancer is expected to be the most lucrative in the global exosomes market, with the largest revenue share of 31.88% during the forecast period. This is due to the wide range of applications for exosomes, including cancer diagnosis, treatment, and prognosis.

Exosomes could be used to deliver RNAs and small molecules as well as proteins with high efficacy. Exosomes also carry lipids and proteins that are being investigated as potential targets for cancer treatments and as promising biomarkers to detect and predict cancer. In the future, the rising cancer incidence and the need for early diagnosis of the disease will boost this segment.

End-User Analysis

Based on end-user, the market is segmented into pharmaceutical & biotechnology companies, hospitals & diagnostics centers, academic & research institutes, and other end-users. Among this end-user, the pharmaceutical & biotechnology companies are expected to be the most lucrative in the global exosomes market, with the largest revenue share of 49.42% during the forecast period. This segment is driven by the increasing demand for therapeutics and vaccines based on extracellular vesicles. In order to increase manufacturing on a broad scale, numerous pharmaceutical and biotechnology businesses have also formed collaborations and partnerships.

Key Market Segments

Based on Product

- Kits & Reagents

- Instruments

- Services

Based on Workflow

Isolation Methods

- Ultracentrifugation

- Immunocapture on Beads

- Precipitation

- Filtration

- Other Isolation Methods

Downstream Analysis

- Cell Surface Marker Analysis Using Flow Cytometry

- Protein Analysis Using Blotting & ELISA

- RNA Analysis with NGS & PCR

- Proteomic Analysis Using Mass Spectroscopy

- Other Downstream Analysis

Based on Application

- Cancer

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Other Applications

Based on End-User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostics Centers

- Academic & Research institutes

- Other End-Users

Growth Opportunities

Increasing research on exosomes

Rising interest in understanding the role of exosomes in numerous diseases and biological processes is a result of the area of exosome research rapidly expanding. Companies are currently given a chance to generate fresh exosome-based products for use throughout both research and therapeutic areas.

Development of exosome-based therapeutics

Exosomes are showing promise as a drug’s way of delivery due to the way they can deliver therapeutic cargo to certain cells and tissues. Development of exosome-based therapy. This provides organizations the possibility to develop innovative exosome-based treatments for a number of conditions, including cancer, infectious diseases, and disorders of the brain.

Exosome isolation and purification advancements

Exosomes are challenging to identify and purify, which might restrict their utility in research and clinical settings. However, there have been considerable improvements in exosome extraction and purification methods, which gives businesses a chance to create brand-new goods in this field.

Increasing adoption of exosomes in regenerative medicine

Exosomes are becoming more widely used in regenerative medicine. Because exosomes have demonstrated potential in supporting tissue repair and regeneration, businesses now have a chance to create new exosome-based products for use in regenerative medicine.

Latest Trends

Increasing use of exosome-based therapeutics

Exosome-based treatments for a range of illnesses, such as cancer, neurological disorders, and infectious diseases, are gaining more attention. The development of exosome-based medicines is anticipated to propel the growth of the exosome market in the coming years. Exosomes have shown potential in encouraging tissue repair and regeneration, and there is growing interest in using them in regenerative medicine applications. Over the next few years, this is anticipated to fuel the market for exosomes. Microfluidic devices, for example, enable the quicker and more effective isolation of exosomes. Exosome isolation and characterization techniques have seen major developments.

Regional Analysis

North America Accounted for the Largest Revenue Share in Exosomes Market in 2022.

North America is estimated to be the most lucrative market in the global exosomes market, with the largest market share of 55.49% during the forecast period. This rise is owing to government financing for the recognition of new biomarkers and the prevalence of chronic illnesses like cancer and cardiovascular disease. The category is also expected to rise as a result of expanding research and development efforts for the creation of innovative medications, diagnostic techniques, and treatment choices.

Europe is expected as the Fastest Growing Region in the Projected Period in exosome market.

Europe is anticipated to expand faster. The region’s expanding governmental and private joint activities have led to ongoing market expansion. For instance, a network of experts in the field of exosomes is the German Society for Extracellular Vesicles. The organization strives to advance interdisciplinary study and help rising academic stars in the exosomes sector in the region. Such activities are anticipated to encourage the market’s long-term growth potential.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The industry is growing rapidly due to many strategic initiatives taken by key players. For instance, to allow GMP-compliant manufacture of exosome and cell treatments, FUJIFILM Diosynth Biotechnologies and RoosterBio agreed to a strategic partnership in October 2022.

Market Key Players

- Danaher Corp.

- Hologic Inc.

- Fujifilm Holdings Corp.

- Lonza

- Miltenyi Biotec

- Bio-Techne Corp.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Abcam plc

- RoosterBio, Inc.

- Other Market Players

Recent Developments

- In February 2022, Bio-techne and Thermo Fisher Scientific signed an exclusive agreement for the development, commercialization, and distribution of the ExoTRU rejection test developed by Bio-Techne. This biopsy test provides allograft health data suitable for clinical and research purposes.

- In November 2020, Lonza acquired an exosome production facility from Codiak BioSciences. This development allowed Codiak BioSciences to retain its therapeutic pipeline and exosome technology while still receiving manufacturing services from Lonza.

- In September 2020, QIAGEN and Biotechne will extend their non-exclusive partnership to co-market exosome technologies. QIAGEN was granted a non-exclusive development license by Bio-Techne to develop companion in vitro diagnosis products using an exosome.

Report Scope:

Report Features Description Market Value (2022) USD 153.8 Mn Forecast Revenue (2032) USD 2,707.8 Mn CAGR (2023-2032) 34.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Kits & Reagents, Instruments, Services), By Workflow (Isolation Methods and Downstream Analysis), By Application (Cancer, Neurodegenerative Diseases, Cardiovascular Diseases, Infectious Diseases, and Other Applications) By End-User (Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostics Centers, Academic & Research institutes and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Danaher Corp., Hologic Inc., Fujifilm Holdings Corp., Lonza, Miltenyi Biotec, Bio-Techne Corp., QIAGEN, Thermo Fisher Scientific, Inc., Abcam plc, RoosterBio, Inc., Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What was the Exosomes Market Size in the Year 2022?The Global Exosomes Market size was USD 153.8 Billion in 2022, growing at a CAGR of 34.20% during the forecast period from 2023 to 2032.

What is the Exosomes Market CAGR During the Forecast Period 2023 – 2032?The Global Exosomes Market is growing at a CAGR of 34.20% during the forecast period from 2023 to 2032.

What is the Exosomes Market Size During the Forecast Period?The Global Exosomes Market size is expected to be worth around USD 2707 Billion by 2032 growing at a CAGR of 34.20% during the forecast period from 2023 to 2032.

-

-

- Danaher Corp.

- Hologic Inc.

- Fujifilm Holdings Corp.

- Lonza

- Miltenyi Biotec

- Bio-Techne Corp.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Abcam plc

- RoosterBio, Inc.

- Other Market Players