Global Examination Gloves Market By Material (Natural Rubber, Synthetic Materials), By Usage (Disposable, Reusable), By Sterility (Sterile Gloves, Non-Sterile Gloves), By Application (Hospitals & Clinics, Diagnostic Centers, Other Applications), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170485

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

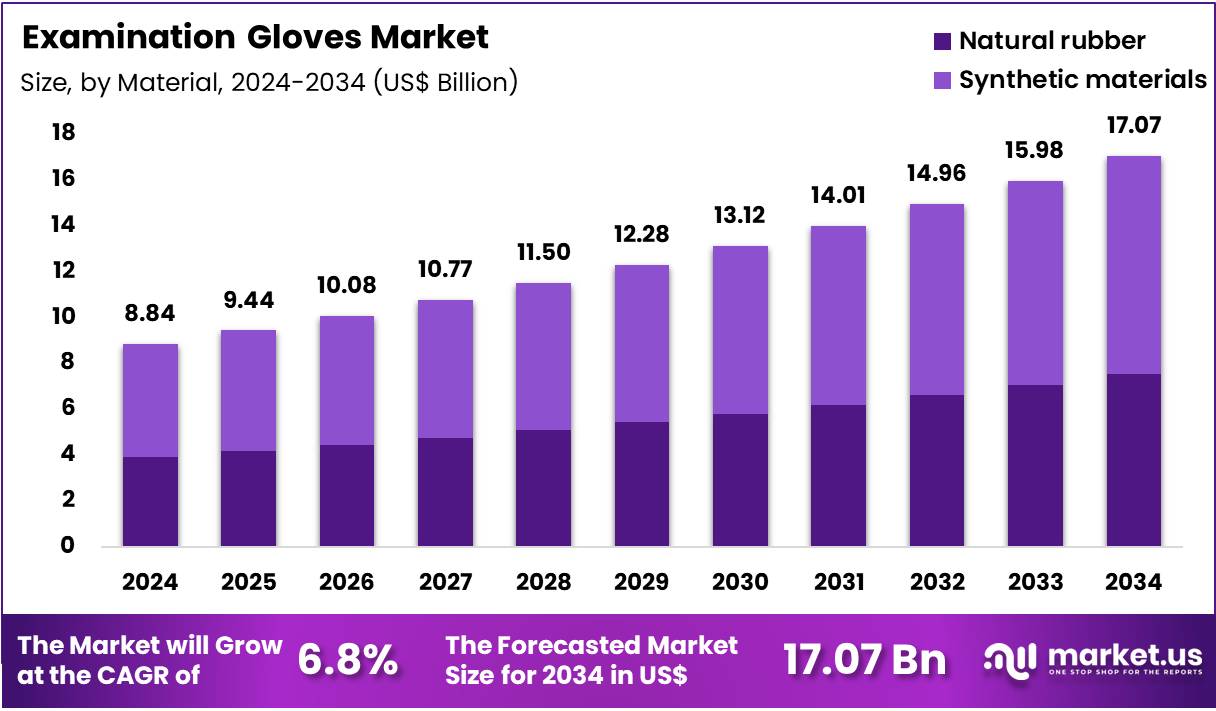

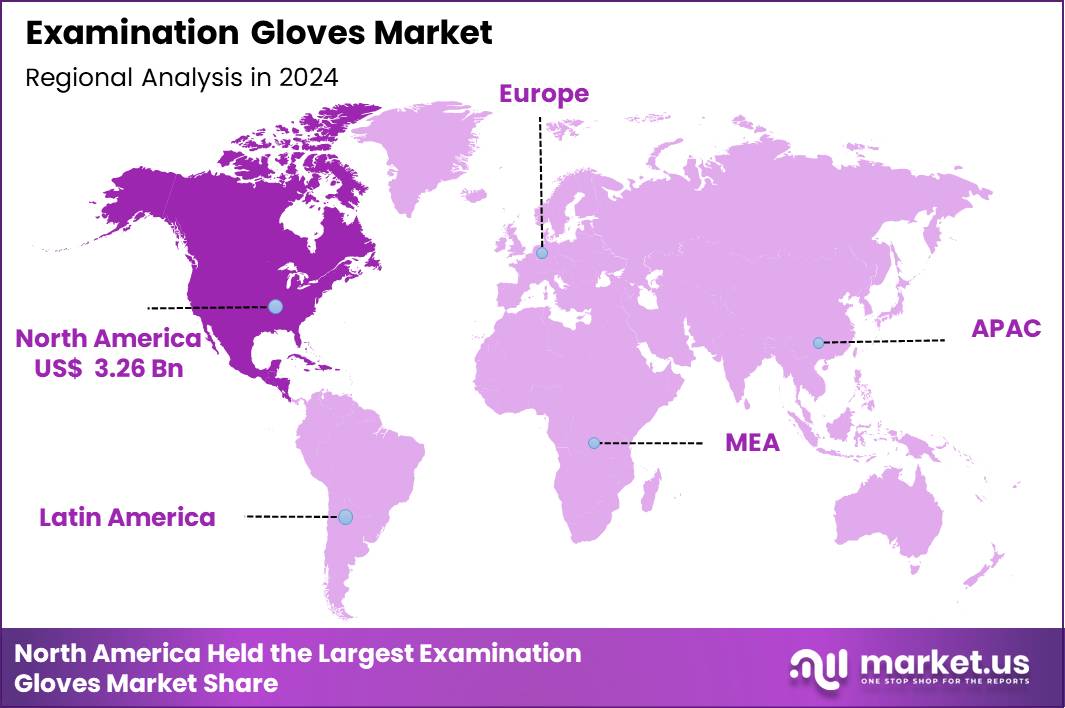

The Global Examination Gloves Market size is expected to be worth around US$ 17.07 Billion by 2034 from US$ 8.84 Billion in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.9% share with a revenue of US$ 3.26 Billion.

The Examination Gloves Market represents a critical segment within medical consumables, driven by rising infection-prevention protocols, growing outpatient volumes, and increasing procedure frequency across hospitals and diagnostic settings. Examination gloves are fundamental to routine patient handling, invasive and non-invasive assessments, laboratory work, and contamination control.

Healthcare systems increasingly depend on examination gloves due to rising incidences of HAIs, stricter hygiene audits, and global emphasis on occupational safety standards. Public health events have further accelerated glove usage across triage rooms, drive-through sample-collection units, emergency departments, and ambulance services.

Natural rubber and synthetic materials both remain core components in glove production. Synthetic variants, such as nitrile and vinyl, have expanded their presence due to enhanced durability and reduced allergy risks. Manufacturers globally have introduced more puncture-resistant, textured, antimicrobial, and accelerator-free formulations to support broader clinical utility. Several governments have also updated healthcare-worker protection norms, reinforcing reliance on examination gloves for direct patient care, specimen collection, and point-of-care diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 8.84 billion, with a CAGR of 6.8%, and is expected to reach US$ 17.07 billion by the year 2034.

- The Material segment is divided into Natural rubber, and Synthetic materials, with Synthetic materials taking the lead in 2024 with a market share of 55.8%

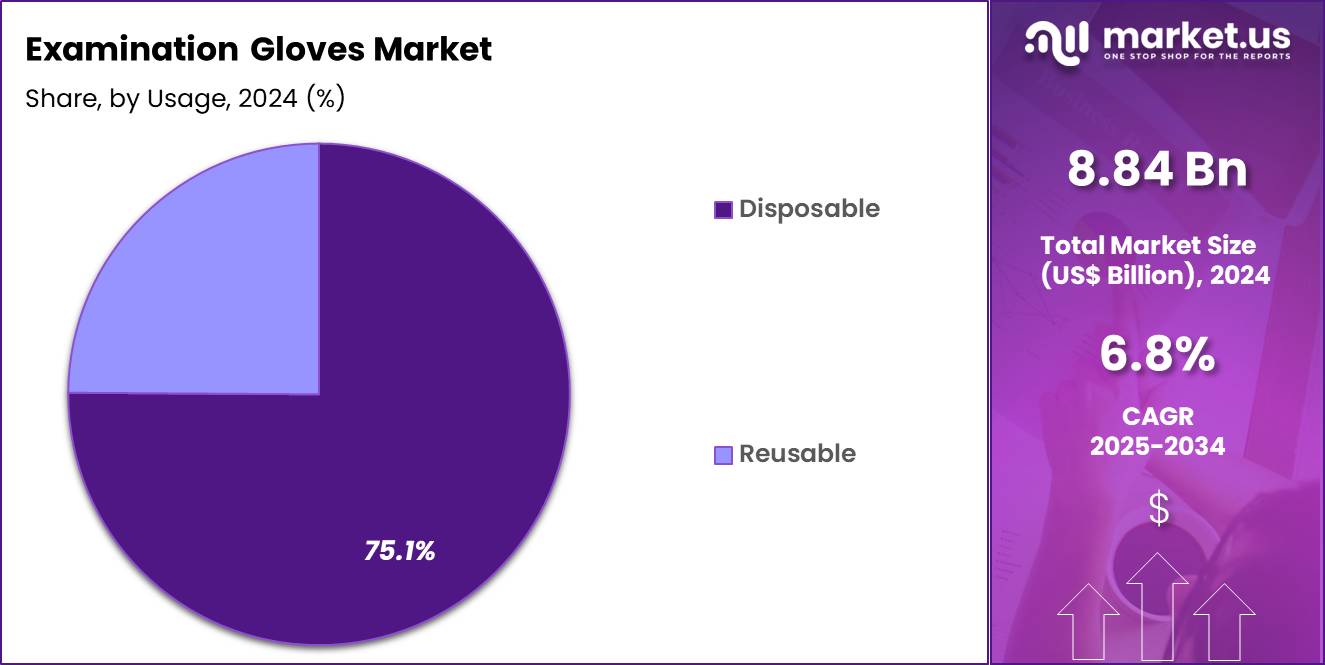

- The Usage segment is divided into Disposable, and Reusable, with Disposable taking the lead in 2024 with a market share of 75.1%

- Considering Sterility, the market is bifurcated into Sterile glove and Non-sterile gloves, with Sterile gloves accounting for majority share of 71.3% in 2024

- The Application segment is divided into Hospitals & Clinics, Diagnostic Centers, and Other applications, with Hospitals & Clinics taking the lead in 2024 with a market share of 61.2%

- North America led the market by securing a market share of 36.9% in 2024.

Material Analysis

Synthetic materials account for the dominant share of 55.8% due to their superior durability, chemical resistance, and ability to withstand extended examination sessions without tearing. Nitrile gloves, for instance, are widely used in emergency care, oncology infusion rooms, infectious-disease wards, and diagnostic laboratories because they offer strong puncture resistance and perform well during specimen collection involving bodily fluids.

Vinyl gloves remain common in non-critical tasks such as basic examinations, patient bathing, and room-cleaning protocols where tactile sensitivity is less critical. In August 2024, Shield Scientific launched accelerator-free nitrile gloves targeting laboratories and diagnostic centers seeking reduced skin-sensitivity risks during repeated glove use.

Natural rubber gloves maintain strong relevance because of their elasticity and comfort. They are frequently preferred in high-touch routine examinations, physiotherapy preparations, dental checkups, gynecology assessments, and pediatric patient handling. In several regions, natural-rubber infrastructure is well established, enabling broader availability for public hospitals. However, latex-allergy concerns have pushed many facilities to gradually transition toward nitrile-based options. Manufacturers have introduced low-protein and powder-free latex gloves to address allergy-related clinical constraints.

Usage Analysis

Disposable gloves represent the largest usage category with holding 75.1% market share in 2024 due to strict global protocols that require single-use products for every patient interaction. High patient footfall in outpatient clinics, maternity care, dermatology units, dialysis centers, and emergency departments drives massive daily glove turnover.

Disposable gloves help reduce cross-contamination risks and align with infection-control policies set by public health authorities. They are used intensively in procedures ranging from sample collection and wound dressing to catheter insertion and point-of-care diagnostics.

Reusable gloves hold a smaller but essential niche, primarily used in environmental cleaning, certain laboratory processes, and non-invasive care tasks requiring longer duration contact. These gloves are thicker, often made from rubber blends, and designed to withstand multiple disinfection cycles. Their demand is supported by sustainability initiatives in some regions where hospitals are prioritizing reduced medical waste. However, compliance with reprocessing standards and the need for validated sterilization procedures limit widespread adoption.

Sterility Analysis

Non-sterile gloves account for the highest usage volume with accounting market share of 71.3% because they are required for routine examinations, triage operations, blood-draw stations, specimen-handling benches, rehabilitation therapy, and patient transport. These settings demand high throughput and continuous glove changes, making non-sterile variants essential for operational efficiency. Their rapid use in outpatient units, emergency departments, and diagnostic laboratories reflects their role in day-to-day patient care workflows.

In September 2023, Supermax Corporation introduced a new line of textured nitrile examination gloves optimized for improved grip in high-precision tasks such as catheterization and dental procedures. Moreover, In November 2023, Kimberly-Clark Professional enhanced its Purple Nitrile exam glove series with improved tear resistance for high-risk medical procedures.

Sterile gloves are reserved for more invasive or medically sensitive contexts such as minor surgical procedures, wound debridement, catheterization, certain obstetric tasks, and sterile-field maintenance. Their individually packaged, sterilized format ensures safety in applications that require higher microbial-barrier protection.

Manufacturers have introduced sterile gloves with enhanced grip patterns and low-residue coatings to support precision tasks. Though consumed in lower volume compared to non-sterile gloves, sterile gloves remain indispensable in clinical procedures that demand strict aseptic technique.

Application Analysis

Hospitals & Clinics form the largest application segment with 61.2% market share in 2024, driven by high patient inflow, extensive diagnostic activity, and frequent medical examinations conducted across emergency units, ICUs, general medicine, neurology, cardiology, and maternity departments. Everyday procedures such as suturing assistance, IV line preparation, physical examinations, respiratory assessments, and medication administration require constant glove usage. Multi-specialty hospitals also maintain significant stock levels due to 24/7 operations.

Diagnostic Centers rely heavily on examination gloves during sample collection, specimen processing, microscopy, centrifuge handling, and assay preparation. The rise in imaging-guided biopsy procedures, pathology workflows, and molecular-diagnostic assessments has expanded glove usage within laboratory settings.

Other applications include dental clinics, veterinary care, home-care providers, long-term-care facilities, and first responders. For example, ambulance teams use gloves for emergency airway management, trauma stabilization, and infectious-disease transport protocols. Assisted-living centers employ gloves extensively during hygiene care, mobility assistance, and medication handling.

By Material

- Natural rubber

- Synthetic materials

By Usage

- Disposable

- Reusable

By Sterility

- Sterile glove

- Non-sterile gloves

By Application

- Hospitals & Clinics

- Diagnostic Centers

- Other applications

Drivers

Growing emphasis on infection prevention and occupational safety

Growing emphasis on infection prevention and occupational safety continues to fuel demand for examination gloves across hospitals, clinics, and diagnostic units. Healthcare-associated infections affect 7% of patients in high-income countries and up to 15% in low- and middle-income regions, according to WHO, prompting strict hygiene protocols requiring glove changes for every patient interaction. In emergency departments alone, staff perform dozens of procedures per shift including triage assessments, blood draws, catheter insertions, and respiratory evaluations each requiring new gloves to prevent cross-contamination.

Outpatient departments handle massive footfall; for example, the US records over 860 million physician office visits annually, driving significant glove consumption. Rising prevalence of infectious diseases such as influenza, RSV, tuberculosis, and emerging viral outbreaks further pushes routine glove use. During specimen collection, gloves protect healthcare workers from exposure to bloodborne pathogens like HIV and hepatitis B, which collectively infect millions of individuals globally each year.

Regulatory agencies such as OSHA mandate protective handwear for tasks involving bodily fluids, chemical disinfectants, or potential microbial exposure. This regulatory reinforcement, combined with rising chronic-disease management (dialysis, oncology infusions, wound care), results in continuously increasing glove turnover across all care settings.

Restraints

Latex allergies and environmental disposal challenges

Latex allergy concerns and environmental waste generation remain major restraints to examination gloves adoption. Latex hypersensitivity affects up to 6% of healthcare workers, according to CDC estimates, leading to skin irritation, respiratory symptoms, and in some cases, severe anaphylaxis. Hospitals must therefore maintain dual inventory latex and non-latex alternatives which increases procurement complexity and operational cost.

Additionally, powder-free regulations in many countries have phased out low-cost powdered latex gloves, shifting institutions toward more expensive nitrile formulations. Environmental disposal is another constraint: hospitals produce millions of tons of medical waste annually, and disposable gloves form a significant portion due to single-use mandates. Nitrile and vinyl gloves degrade slowly, adding pressure on waste-management systems, especially in densely populated regions where incineration capacity is limited.

Reusable gloves could reduce waste, but strict sterilization guidelines hinder widespread adoption, as improper reprocessing risks microbial contamination. Supply-chain volatility also acts as a restraint. During global health emergencies, border closures and raw-material shortages (such as fluctuations in natural rubber supply from Thailand and Malaysia) disrupt glove availability.

Opportunities

Innovation in eco-friendly, antimicrobial, and accelerator-free gloves

Emerging innovation in glove materials presents significant opportunities for manufacturers and healthcare providers. Biodegradable nitrile technology, for example, offers the potential to reduce glove disposal time from decades to a few years, helping hospitals address sustainability targets. Several companies are piloting plant-based polymers and cornstarch-derived additives to enhance eco-friendly performance.

Antimicrobial gloves represent another key opportunity; these contain surface agents capable of reducing bacterial load by up to 99.9%, assisting in high-risk environments such as intensive care and oncology units. Accelerator-free gloves also reduce Type IV chemical allergies, making them suitable for dermatology clinics and long-term glove users like laboratory technicians. Growth of decentralized and mobile healthcare is further expanding glove demand home-care visits, mobile dialysis units, and community sample-collection drives all require high volumes of disposable gloves.

In emerging markets, expanding primary-healthcare infrastructure is rapidly increasing procedural volumes. India, for example, performs over 50 million diagnostic tests per month in urban and rural labs combined, each necessitating multiple glove changes. Government initiatives promoting infection prevention, vaccination drives, and maternal-child healthcare also increase glove utilization. In July 2024, Hartalega announced upgrades to its next-generation glove manufacturing facilities incorporating energy-efficient systems and improved quality-inspection automation.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic volatility and geopolitical disruptions significantly influence the Examination Gloves Market by affecting raw-material availability, pricing, logistics, and procurement strategies across healthcare systems. Natural rubber production, concentrated in Thailand, Indonesia, and Malaysia, is highly sensitive to climate fluctuations and labor shortages; periods of heavy rainfall or disease outbreaks in rubber plantations can reduce yield by 10–20%, causing immediate price surges.

Geopolitical tensions affecting trade routes such as port congestion, restricted maritime channels, or sanctions can delay international shipments of nitrile butadiene rubber (NBR), accelerating supply shortages for glove manufacturers. Inflation also impacts glove production: rising costs of chemicals, accelerators, energy, and transportation elevate per-unit glove prices, placing financial pressure on hospitals already grappling with increasing patient loads.

During pandemics or health emergencies, governments often implement export bans on PPE, leading to sudden global supply imbalance. For example, several countries restricted outbound shipments of medical gloves during major outbreaks, causing procurement delays of weeks to months in regions reliant on imports. Geopolitical instability also drives demand surges for emergency stockpiling by public-health agencies, military hospitals, and disaster-response units. Additionally, workforce disruptions including high turnover among healthcare providers increase glove turnover per shift, further amplifying consumption during periods of global uncertainty.

Latest Trends

Shift toward synthetic, powder-free, and textured high-precision gloves

A strong trend shaping the Examination Gloves Market is the shift toward synthetic, powder-free, textured, and specialty gloves designed for precision tasks. Nitrile gloves now dominate usage due to superior puncture resistance and reliable performance during high-dexterity procedures such as IV insertion, dental scaling, suturing, and ultrasound-guided injections. Studies show nitrile gloves resist perforation three times better than latex in certain clinical tasks, improving worker safety.

Powder-free variants are now standard worldwide due to regulatory restrictions linked to airway irritation and postoperative granulomas. Textured fingertips and micro-roughened surfaces improve grip while handling instruments like syringes, catheters, endoscopes, and biopsy tools. Color-coding is also becoming common: for instance, double-gloving in dental and surgical-adjacent procedures uses contrasting colors to highlight tears instantly.

Another trend is the integration of chemo-rated gloves that withstand cytotoxic drug exposure, supporting oncology infusion centers where chemotherapeutic handling volumes rise annually. Digital health and home diagnostics have also contributed to glove adoption, as remote-care teams require sterile and non-sterile gloves during home visits. Additionally, manufacturing automation including AI-monitored dipping lines and robotic packaging is improving glove consistency and reducing contamination risk, aligning the industry with global quality-assurance standards.

Regional Analysis

North America is leading the Examination Gloves Market

North America remains the leading region in the Examination Gloves Market due to its extensive healthcare infrastructure, high procedure volumes, and strict regulatory emphasis on infection prevention. Hospitals, outpatient clinics, urgent care centers, and ambulatory surgery units collectively conduct hundreds of millions of examinations each year, resulting in continuous glove consumption across all departments.

The region reports substantial annual volumes of blood draws, triage assessments, chronic disease check-ups, and emergency interventions, each requiring multiple glove changes. The Centers for Disease Control and Prevention and OSHA guidelines reinforce routine glove use for any clinical activity involving bodily fluids, contaminated surfaces, or potential pathogen exposure.

Rising prevalence of diabetes, cardiovascular conditions, respiratory infections, and oncology treatments further increases patient visits and procedural intensity. North America also benefits from strong local manufacturing, stable supply chains, and rapid adoption of improved synthetic glove materials, positioning the region as the dominant consumer in the global landscape.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest growing region in the Examination Gloves Market, driven by expanding healthcare capacity, rising infectious disease incidence, and increasing diagnostic testing volumes. Countries such as China, India, Indonesia, and Vietnam continue to scale hospital networks and public health programs, resulting in higher demand for gloves in outpatient care, maternal health services, emergency medicine, and community-level disease screening.

The region performs exceptionally high volumes of laboratory tests each month, including routine hematology, microbiology, and virology analyses, all requiring strict glove usage. Government initiatives aimed at improving hygiene standards in both public and private facilities further accelerate adoption. Local glove production has expanded rapidly, especially in synthetic materials, improving affordability and supply stability.

Rising medical tourism in Thailand, India, and Malaysia also contributes to increased glove turnover across surgical and non-surgical specialties. Together, these factors position Asia Pacific as the fastest advancing region with sustained long-term growth momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Ansell Limited, Cardinal Health Inc., Semperit AG Holding, Medline Industries Inc., B. Braun Melsungen AG, Intco Medical Technology Co. Ltd., Kanam Latex Industries Pvt. Ltd., RFB Latex Limited, Sri Trang Gloves, and Others.

Top Glove Corporation Bhd is one of the largest global suppliers of examination gloves, operating an expansive production network that supports high-volume demand across hospitals, diagnostic centers, and clinical service providers. The company manufactures a wide portfolio of natural rubber and synthetic examination gloves, including latex, nitrile, vinyl, and specialty powder-free variants tailored for infection-control requirements.

Hartalega Holdings Berhad is a leading Malaysian glove manufacturer recognized for its technological innovation in nitrile examination gloves. The company pioneered high-capacity automated production lines designed to deliver consistently high glove quality while reducing contamination and defect rates. Hartalega’s nitrile gloves are widely used in hospitals, outpatient clinics, and laboratory environments due to their superior puncture resistance, low allergy risk, and enhanced comfort for prolonged use.

Kossan Rubber Industries Bhd is a major producer of examination gloves, supplying natural rubber and synthetic materials to hospitals, diagnostic laboratories, and healthcare distributors worldwide. The company is known for its stable manufacturing output, diverse glove portfolio, and strong focus on product consistency. Kossan’s examination gloves are designed to support routine clinical activities including physical examinations, specimen handling, triage procedures, and non-invasive diagnostic workflows

Top Key Players

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Ansell Limited

- Cardinal Health Inc.

- Semperit AG Holding

- Medline Industries Inc.

- Braun Melsungen AG

- Intco Medical Technology Co. Ltd.

- Kanam Latex Industries Pvt. Ltd.

- RFB Latex Limited

- Sri Trang Gloves

- Others

Recent Developments

- In March 2025, Top Glove unveiled new examination glove innovations including LiteGuard and ElastiCore as part of its upcoming MEDICA showcase, highlighting enhanced comfort, durability, and improved allergy protection.

- In February 2025, Sri Trang Gloves (STGT) announced the introduction of traceable natural-rubber medical gloves at global trade fairs in Germany, reinforcing sustainability and end-to-end supply chain visibility.

- In April 2025, INTCO Medical launched its Syntex synthetic disposable latex gloves, designed for stronger puncture resistance and improved elasticity for clinical applications.

- In January 2024, Ansell introduced a nitrile-free and powder-free examination glove engineered specifically for latex-sensitive healthcare workers, expanding its allergy-safe portfolio.

- In May 2023, Cranberry International released its Bio Nitrile Biodegradable gloves featuring an eco-additive that accelerates biodegradation in landfill environments, supporting greener PPE adoption across healthcare systems.

Report Scope

Report Features Description Market Value (2024) US$ 8.84 Billion Forecast Revenue (2034) US$ 17.07 Billion CAGR (2025-2034) 17.07 billion Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Natural rubber and Synthetic materials), By Usage (Disposable and Reusable), By Sterility (Sterile glove and Non-sterile gloves), By Application (Hospitals & Clinics, Diagnostic Centers, and Other applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Top Glove Corporation Bhd, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Supermax Corporation Berhad, Ansell Limited, Cardinal Health Inc., Semperit AG Holding, Medline Industries Inc., B. Braun Melsungen AG, Intco Medical Technology Co. Ltd., Kanam Latex Industries Pvt. Ltd., RFB Latex Limited, Sri Trang Gloves, and Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Ansell Limited

- Cardinal Health Inc.

- Semperit AG Holding

- Medline Industries Inc.

- Braun Melsungen AG

- Intco Medical Technology Co. Ltd.

- Kanam Latex Industries Pvt. Ltd.

- RFB Latex Limited

- Sri Trang Gloves

- Others