Global EV Battery Testing Market Size, Share, Growth Analysis By Chemistry (Lithium-Ion, Solid-State, Others), By Form (Prismatic, Pouch, Cylindrical), By Propulsion (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Battery Technology (Cell-To-Pack, Cell-To-Module, Cell-To-Chassis/Cell-To-Body), By EV Type (Light-Duty Vehicle, Heavy Commercial Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166755

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global EV Battery Testing Market size is expected to be worth around USD 20.2 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034.

The EV Battery Testing Market refers to specialized testing solutions that validate durability, lifecycle, performance, safety, and compliance of electric vehicle batteries. This market supports OEMs, cell manufacturers, and testing labs by ensuring battery reliability. As electrification accelerates, demand for advanced testing equipment, validation frameworks, and automated diagnostic systems continues rising.

Transitioning toward broader industry insights, analysts view EV battery testing as a critical enabler of large-scale EV adoption. The market grows steadily as manufacturers invest in thermal, mechanical, and environmental validation tools. Increasing charging-infrastructure expansion and rising energy-storage integration further strengthen testing requirements across global automotive and battery supply chains.

Furthermore, ongoing government investments and evolving regulations create significant opportunities for testing innovation. New safety mandates push companies to upgrade test benches, simulation systems, and certification processes. Incentive-driven EV manufacturing programs also stimulate procurement of high-precision test platforms, encouraging consistent quality across global production lines and accelerating technological maturity.

Additionally, emerging opportunities arise from fast-charging development, lightweight battery designs, and next-generation chemistries. These advancements require rigorous validation cycles, which drive demand for automated testing software, performance-tracking analytics, and high-voltage system testing. As companies pursue extended range and efficiency, testing services remain essential for reducing product recalls and ensuring regulatory compliance.

From a growth perspective, rising EV penetration reinforces the market’s long-term trajectory. According to research, electric car sales reached 17 million in 2024, representing over 20% of global new-car sales and expanding the fleet to almost 58 million vehicles, more than 3× the 2021 level. This surge increases the need for comprehensive battery testing frameworks.

Moreover, expanding battery production amplifies validation requirements. According to research, global lithium-ion battery demand rose 65% in 2022, climbing from 330 GWh in 2021 to 550 GWh in 2022, driven mainly by a 55% year-on-year increase in electric passenger-vehicle sales. Consequently, battery testing solutions gain strong momentum across manufacturing ecosystems.

Key Takeaways

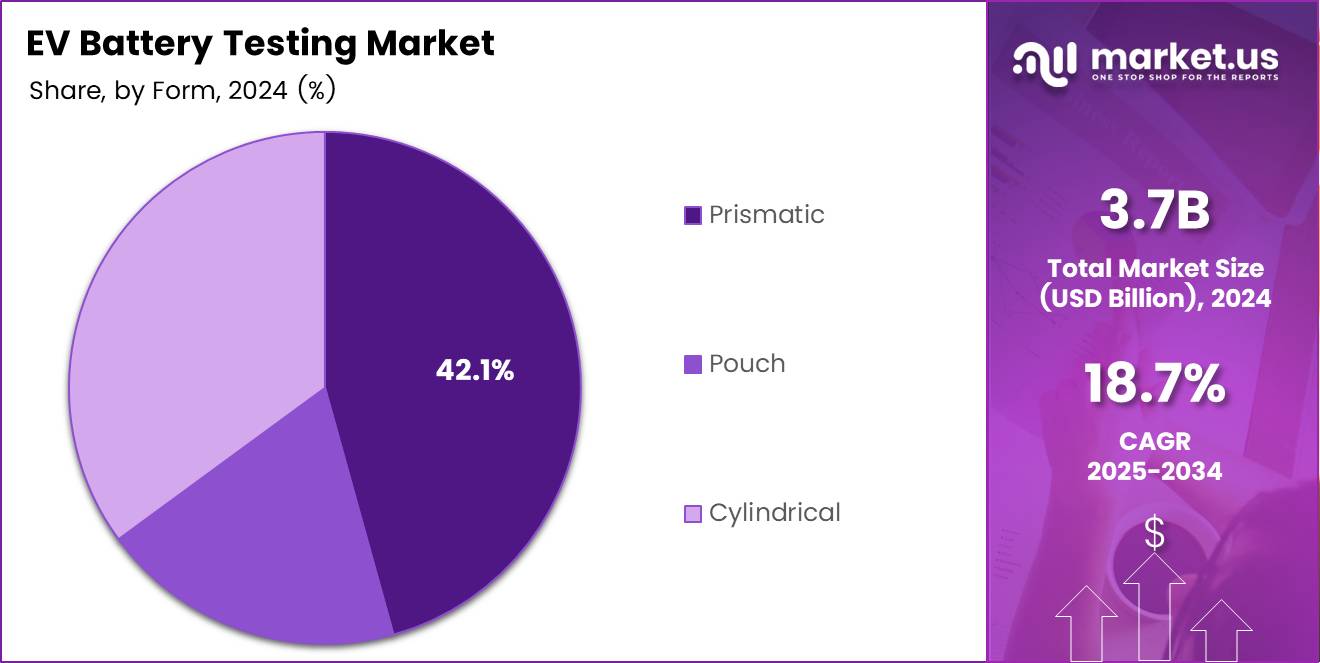

- The Global EV Battery Testing Market is projected to reach USD 20.2 Billion by 2034, up from USD 3.7 Billion in 2024, growing at a CAGR of 18.7%.

- Lithium-Ion chemistry dominates the market with a 72.5% share.

- Prismatic battery form leads the segment with a 42.1% share.

- Battery Electric Vehicles (BEVs) account for the largest propulsion share at 56.6%.

- Cell-To-Pack battery technology holds the highest share at 44.8%.

- Light-Duty Vehicles dominate the EV type segment with an 82.3% share.

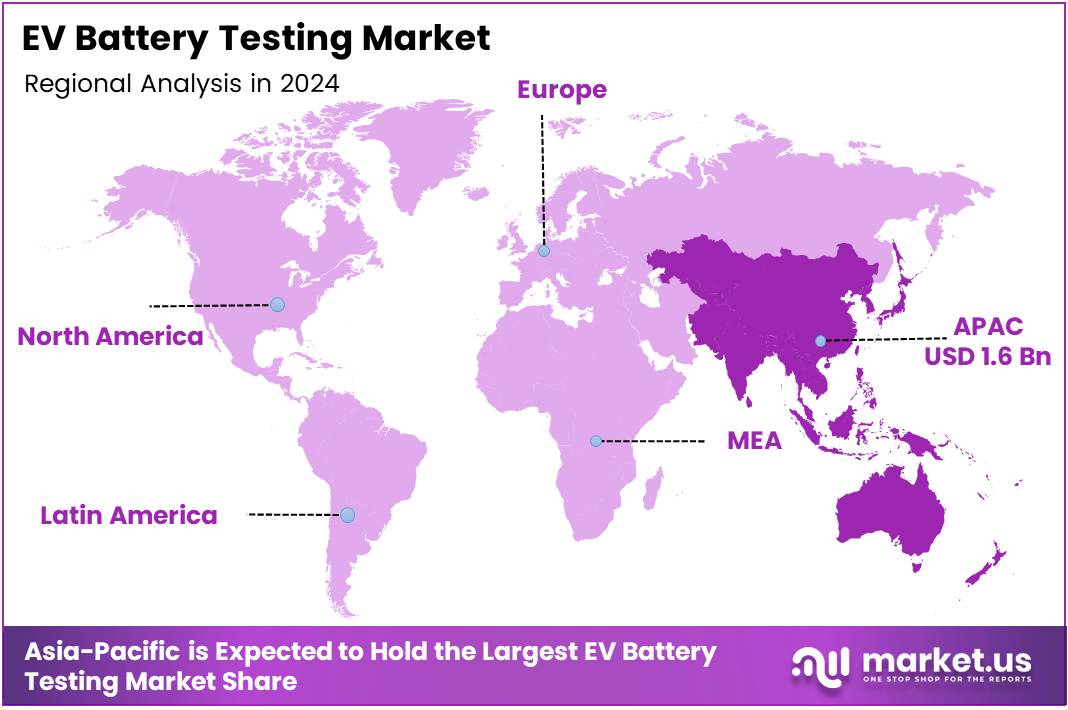

- Asia Pacific leads the regional market with a 45.9% share, valued at USD 1.6 Billion.

By Chemistry Analysis

Lithium-Ion dominates with 72.5% due to its stability, maturity, and strong commercial adoption.

In 2024, Lithium-Ion held a dominant market position in the By Chemistry Analysis segment of the EV Battery Testing Market, with a 72.5% share. This chemistry continued to lead as manufacturers increased testing volumes for advanced lithium-ion cells, improving safety, cycle life, and thermal stability. Moreover, growing EV sales and ongoing innovations further strengthened the need for comprehensive testing procedures.

In 2024, Solid-State technology witnessed accelerated testing as companies worked to validate its safety advantages and energy density improvements. Although still emerging, solid-state batteries required rigorous evaluation to ensure stability under various environmental conditions, pushing manufacturers to invest in specialized testing equipment and processes supporting long-term commercialization goals.

In 2024, Others chemistry types, including emerging next-generation formulations, also underwent systematic testing to validate performance characteristics. These chemistries, though less adopted, contributed to broadening the testing demand as automakers explored alternatives to conventional lithium-based systems, aiming to optimize cost efficiency, sustainability, and operational safety in diverse electric vehicle applications.

By Form Analysis

Prismatic batteries dominate with 42.1% backed by structural rigidity and higher packaging efficiency.

In 2024, Prismatic cells held a dominant market position in the By Form Analysis segment of the EV Battery Testing Market, with a 42.1% share. Their widespread adoption in EV platforms increased testing needs, focusing on thermal behavior, durability, and safety under high mechanical stress, ensuring that these structured cells perform optimally under demanding vehicle conditions.

In 2024, Pouch cells experienced growing testing requirements due to their flexible architecture and high energy density. Testing emphasized mechanical stability, swelling behavior, and thermal performance to ensure safe vehicle integration. As automakers sought lightweight battery solutions, pouch formats continued to draw attention across multiple testing protocols.

In 2024, Cylindrical cells remained relevant, requiring extensive testing to validate consistency and safety across large production volumes. These cells demanded repetitive testing cycles to ensure uniform thermal management and structural robustness. Their ongoing use in performance-oriented EVs further increased the need for standardized testing procedures.

By Propulsion Analysis

Battery Electric Vehicles dominate with 56.6% supported by rising global electrification.

In 2024, Battery Electric Vehicles held a dominant market position in the By Propulsion Analysis segment of the EV Battery Testing Market, with a 56.6% share. BEVs required extensive testing to validate high-capacity battery packs, fast-charging compatibility, and long-cycle durability, reflecting rising consumer demand and accelerating global transitions toward fully electric mobility.

In 2024, Hybrid Electric Vehicles continued to generate steady testing demand as manufacturers validated battery efficiency across varied driving conditions. Hybrid systems needed precise testing for charge-discharge cycles, thermal control, and long-term reliability, particularly as they remained a transitional solution in many global markets.

In 2024, Plug-In Hybrid Electric Vehicles also contributed notably to testing volumes. Their dual-operational nature required specific evaluations for EV-mode performance, battery endurance, and charging stability. As many regions positioned PHEVs as bridge technologies, testing intensity remained consistent.

In 2024, Fuel Cell Electric Vehicles saw specialized battery testing focused on auxiliary energy storage systems. Although smaller in share, FC EVs required testing for cold-start performance, power buffering, and hybridized battery–fuel cell integration.

By Battery Technology Analysis

Cell-To-Pack dominates with 44.8% owing to simplified structure and enhanced energy density.

In 2024, Cell-To-Pack held a dominant market position in the By Battery Technology Analysis segment of the EV Battery Testing Market, with a 44.8% share. This architecture required advanced testing to validate thermal uniformity and structural integrity, supporting improved range and efficiency across modern EV platforms while reducing overall system complexity.

In 2024, Cell-To-Module technologies continued to undergo comprehensive testing for optimized performance, structural safety, and thermal control. Automakers relied on this configuration for modular flexibility, maintaining consistent testing needs across durability, vibration, and long-term reliability assessments.

In 2024, Cell-To-Chassis/Cell-To-Body designs attracted heightened testing due to their structural integration into vehicle platforms. Testing focused on crash resistance, load distribution, and thermal propagation risks, ensuring that these innovative architectures met advanced safety standards before broader adoption.

By EV Type Analysis

Light-Duty Vehicles dominate with 82.3% reflecting large-scale consumer EV adoption.

In 2024, Light-Duty Vehicles held a dominant market position in the By EV Type Analysis segment of the EV Battery Testing Market, with a remarkable 82.3% share. The mass adoption of passenger EVs significantly increased testing volumes, emphasizing fast-charging reliability, battery lifespan, and enhanced performance validation for daily commuting patterns.

In 2024, Heavy Commercial Vehicles generated growing testing needs as electrification expanded into logistics fleets. Larger batteries required assessment of thermal stress, high-load cycling, and extended operational endurance, supporting fleet reliability and regulatory compliance.

Key Market Segments

By Chemistry

- Lithium-Ion

- Solid-State

- Others

By Form

- Prismatic

- Pouch

- Cylindrical

By Propulsion

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

By Battery Technology

- Cell-To-Pack

- Cell-To-Module

- Cell-To-Chassis/Cell-To-Body

By EV Type

- Light-Duty Vehicle

- Heavy Commercial Vehicle

Drivers

Accelerating Global Adoption of Electric Vehicles Across Consumer and Commercial Segments

The rapid rise in electric vehicle adoption worldwide is a major driver for the EV battery testing market. As more consumers and businesses shift to EVs, manufacturers must ensure every battery meets strict reliability and safety standards before vehicles reach the road. This expands the demand for thorough performance and durability testing.

Increasingly strict global regulations surrounding high-capacity battery systems also push companies to invest in advanced testing solutions. Governments now require detailed validation of thermal stability, charging safety, and long-term performance, making reliable testing equipment essential for market compliance.

Continuous advancements in battery chemistries—such as high-energy-density cells and new anode materials—further strengthen the need for rigorous testing. Each new chemistry must go through comprehensive validation cycles to verify safety and performance under real-world conditions.

Moreover, large-scale investments in gigafactories and EV manufacturing infrastructure are boosting testing requirements. As production capacity grows, so does the need for automated, high-volume battery test systems to maintain quality at scale.

Restraints

High Cost of Advanced Battery Testing Equipment and Facility Setup

The high cost of advanced battery testing systems remains a significant restraint for the EV battery testing market. Setting up specialized facilities requires heavy investment in high-precision tools, safety chambers, and environmental control systems, which can limit adoption among smaller manufacturers.

Another major challenge is the lack of consistent global testing standards. Different countries follow varied compliance frameworks, making it difficult for manufacturers to streamline processes. This inconsistency increases testing complexity and raises operational costs.

The absence of unified protocols also slows innovation, as companies must run multiple certification cycles for different regions. This creates delays in product launches and adds administrative burdens for EV developers.

Overall, the combination of high setup costs and limited international standardization continues to restrict market expansion, especially for emerging market players and new EV entrants.

Growth Factors

Rising Demand for Testing Solutions for Solid-State and Next-Generation Battery Technologies

The increasing shift toward solid-state and other advanced battery technologies is creating strong growth opportunities in the EV battery testing market. These next-generation batteries require new testing methods to assess performance, safety, and lifecycle characteristics.

Emerging EV startups are also driving demand for outsourced testing services. Many lack internal testing infrastructure and rely on specialized third-party labs, creating opportunities for service providers to expand their offerings.

AI-driven predictive analytics is another major opportunity, allowing companies to simulate battery behavior, detect early failure patterns, and shorten development timelines. Integrating AI tools into testing frameworks makes processes faster and more accurate.

Additionally, the market is benefiting from growing interest in battery lifecycle assessment, recycling evaluation, and second-life repurposing. As sustainability becomes a priority, more companies seek testing solutions that support circular battery ecosystems.

Emerging Trends

Adoption of Real-Time Battery Monitoring and Digital Twin Testing Models

One of the strongest trends in the EV battery testing market is the shift toward real-time monitoring and digital twin models. These technologies allow manufacturers to simulate battery performance under various conditions without physical prototypes, speeding up development cycles.

There is also rising emphasis on testing for fast-charging compatibility. As EV users demand quicker charging times, manufacturers must evaluate how batteries handle high thermal and electrical stress.

Another key trend is the development of modular and automated test platforms. These systems increase efficiency, reduce manual intervention, and improve scalability for mass production environments.

Finally, the market is seeing a significant increase in high-voltage, high-energy testing capabilities. As EV platforms become more powerful, testing systems must adapt to handle higher energy loads safely and accurately.

Regional Analysis

Asia Pacific Dominates the EV Battery Testing Market with a Market Share of 45.9%, Valued at USD 1.6 Billion

The Asia Pacific region leads the global EV battery testing market, holding a dominant 45.9% share and reaching an estimated value of USD 1.6 Billion. Rapid growth in electric vehicle manufacturing, strong government policies promoting clean mobility, and accelerated investments in battery innovation underpin this leadership. Additionally, the region’s expanding testing infrastructure and rising adoption of high-performance battery technologies further reinforce APAC’s commanding position in the market.

North America EV Battery Testing Market Trends

North America demonstrates strong market traction driven by increased EV adoption, regulatory emphasis on battery safety, and the expansion of domestic battery manufacturing. The region benefits from advanced R&D capabilities and a growing network of testing facilities focused on enhancing efficiency, durability, and compliance. Federal incentives supporting clean energy transition continue to strengthen the region’s long-term growth prospects.

Europe EV Battery Testing Market Trends

Europe remains a key market with robust demand supported by stringent emission regulations and ambitious electrification targets set by regional governments. The presence of highly developed automotive industries and major battery research clusters contributes to steady market growth. Investments in sustainable battery production and circular economy frameworks also drive the expansion of testing services across the region.

Middle East and Africa EV Battery Testing Market Trends

The Middle East and Africa region is gradually emerging in the EV battery testing landscape as governments introduce clean mobility strategies and infrastructure development accelerates. Growing interest in renewable energy integration and early-stage EV adoption is fostering demand for reliable battery performance evaluation. While still developing, the region shows long-term potential as testing facilities and partnerships continue to expand.

Latin America EV Battery Testing Market Trends

Latin America exhibits steady growth driven by increasing awareness of electric mobility benefits and rising investments in sustainable transportation. Countries in the region are gradually strengthening regulatory frameworks that support EV deployment and battery standardization. Ongoing improvements in automotive manufacturing capabilities and technology adoption are expected to enhance the demand for battery testing solutions across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key EV Battery Testing Company Insights

The global EV Battery Testing Market in 2024 is shaped by a concentrated group of specialized testing, certification, and inspection companies that continue to expand capabilities to meet rising electric vehicle demand.

Applus+ remains a prominent player with its strong network of labs supporting durability, performance, and safety validation for lithium-ion batteries. Its expansion into high-voltage testing facilities positions it well as OEMs scale next-generation battery platforms.

AVL continues to strengthen its role through advanced battery simulation tools and automated test systems. Its integrated testing solutions—spanning cell to pack levels—help manufacturers reduce development cycles while ensuring regulatory compliance across global markets.

Bureau Veritas leverages its extensive certification expertise to support EV battery safety, transportation, and reliability assessments. Its global presence enables harmonized testing for automakers and suppliers navigating diverse regulatory environments, especially in Europe and Asia.

DEKRA remains influential with its growing portfolio of e-mobility testing services, including thermal runaway evaluation and environmental stress assessments. The company’s continued investments in EV-focused laboratories enhance its competitiveness in supporting automotive R&D and homologation.

Beyond these leaders, companies such as DNV AS, Element Materials Technology, Eurofins Scientific, Infinita Lab Inc., Intertek Group Plc, and Nemko play pivotal roles in niche testing domains. DNV AS is known for system-level risk assessment expertise, while Element and Eurofins expand battery material and failure analysis capabilities.

Intertek and Nemko continue to support international safety certifications, and Infinita Lab focuses on precision cell-level analytics. Collectively, these players contribute to a fast-evolving testing ecosystem driven by safety standards, rapid EV innovation, and growing global sustainability commitments.

Top Key Players in the Market

- Applus+

- Avl

- Bureau Veritas

- Dekra

- Dnv As

- Element Materials Technology

- Eurofins Scientific

- Infinita Lab Inc.

- Intertek Group Plc

- Nemko

Recent Developments

- In May 2025, UL Solutions launched its Europe Advanced Battery Laboratory in Aachen, Germany, establishing a cutting-edge facility for advanced testing, simulation, and certification of automotive and stationary batteries. This new center replaces and significantly expands the former BatterieIngenieure site, strengthening UL’s European battery testing presence and technical capabilities.

- In January 2024, Unico LLC broadened its battery testing and EV charging portfolio by acquiring Present Power Systems, integrating a full suite of cell, module, and pack-level testing solutions. The acquisition also brought advanced EV charging technologies into Unico’s offering, enhancing its position across the electrification value chain.

- In May 2024, UL Solutions acquired Germany-based BatterieIngenieure GmbH to deepen its expertise in EV and stationary battery performance testing and simulation. The move expanded UL’s European laboratory footprint and provided additional technical capabilities ahead of the launch of its new Aachen battery lab.

- In November 2024, TÜV SÜD strengthened its role in battery technology by acquiring the remaining 30% of TÜV SÜD Battery Testing GmbH, making it a wholly owned subsidiary. This consolidation enables TÜV SÜD to fully control its battery testing operations and accelerate strategic development within the sector.

- In November 2024, AVL was commissioned by PowerCo SE, the Volkswagen Group’s battery company, to design and equip a new battery-cell testing laboratory in Salzgitter, Germany. The state-of-the-art testing facility is scheduled for completion in 2025 and will support PowerCo’s growing battery-cell development and quality assurance needs.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 20.2 Billion CAGR (2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Chemistry (Lithium-Ion, Solid-State, Others), By Form (Prismatic, Pouch, Cylindrical), By Propulsion (Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Battery Technology (Cell-To-Pack, Cell-To-Module, Cell-To-Chassis/Cell-To-Body), By EV Type (Light-Duty Vehicle, Heavy Commercial Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Applus+, Avl, Bureau Veritas, Dekra, Dnv As, Element Materials Technology, Eurofins Scientific, Infinita Lab Inc., Intertek Group Plc, Nemko Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Applus+

- Avl

- Bureau Veritas

- Dekra

- Dnv As

- Element Materials Technology

- Eurofins Scientific

- Infinita Lab Inc.

- Intertek Group Plc

- Nemko