Europe Luxury Packaging Market Size, Share, Growth Analysis By Material (Paper & Paperboard, Plastic, Wood, Glass, Metal, Fabric), By Packaging Format (Boxes & Cartons, Bags, Pouches, Bottles, Composite Cans, Others), By End-Use (Food & Beverages, Fashion Accessories & Apparels, Consumer Goods, Consumer Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157767

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

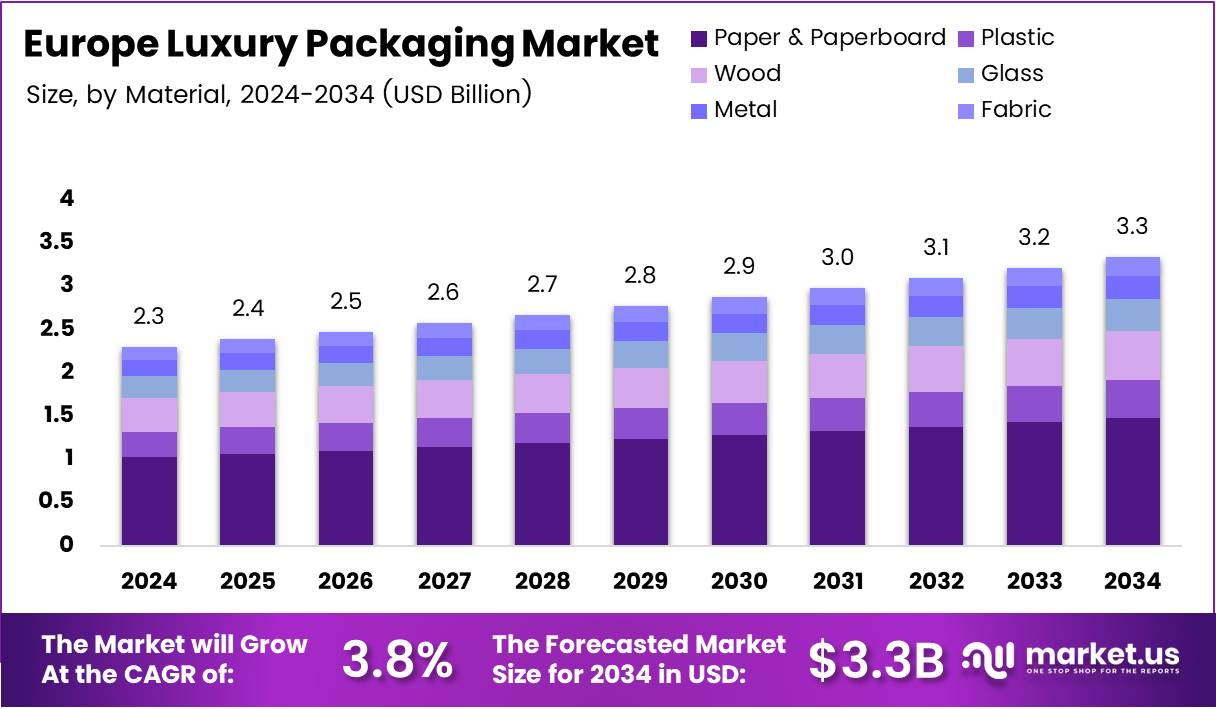

The Europe Luxury Packaging Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Europe Luxury Packaging Market is experiencing significant growth as consumer preferences increasingly align with sustainability, premium experiences, and innovative packaging solutions. Luxury brands are focusing on packaging that not only represents high quality but also reflects their commitment to environmental responsibility. As consumers demand more from the brands they support, packaging has become a vital element of the luxury experience.

One key factor driving the market is the growing preference for eco-friendly packaging. Many European consumers are willing to pay a premium for products with sustainable packaging. This shift is driven by increasing environmental consciousness among consumers, who are seeking brands that align with their values. The emphasis on sustainable materials and packaging designs has elevated the luxury packaging sector.

Moreover, packaging that is easy to recycle is becoming more important to European consumers. According to Procarton, approximately 65% of consumers consider recyclability when evaluating packaging, underlining the growing demand for environmentally responsible packaging solutions. This trend is pushing luxury brands to adopt innovative designs and eco-friendly materials to meet customer expectations.

In addition to sustainability, the luxury packaging market is also being shaped by the growing importance of customer experience. According to Talium, 55% of consumers believe luxury brands provide a better customer experience compared to mass-market retailers. This reinforces the idea that packaging is not just about protecting the product; it plays a crucial role in delivering a premium experience that delights customers and strengthens brand loyalty.

Government investments and regulations are also contributing to the growth of the European luxury packaging market. European Union policies are increasingly pushing brands to comply with sustainability targets, such as reducing plastic waste and using recyclable materials. These regulations are expected to shape the packaging landscape, encouraging innovation and adoption of sustainable practices.

According to PackagingTechToday, 82% of European consumers are inclined to pay more for products with sustainable packaging. This statistic demonstrates the significant market potential for luxury packaging solutions that prioritize environmental responsibility. With growing demand for sustainable options, brands are expected to innovate further, focusing on materials and designs that align with eco-conscious values.

Key Takeaways

- The Europe Luxury Packaging Market is expected to reach USD 3.3 Billion by 2034, growing at a CAGR of 3.8% from 2025 to 2034.

- Paper & Paperboard leads the By Material Analysis segment with a 44.4% share in 2024, driven by eco-friendly packaging demand.

- Boxes & Cartons dominate the By Packaging Format Analysis segment with a 37.5% share in 2024, emphasizing customer engagement.

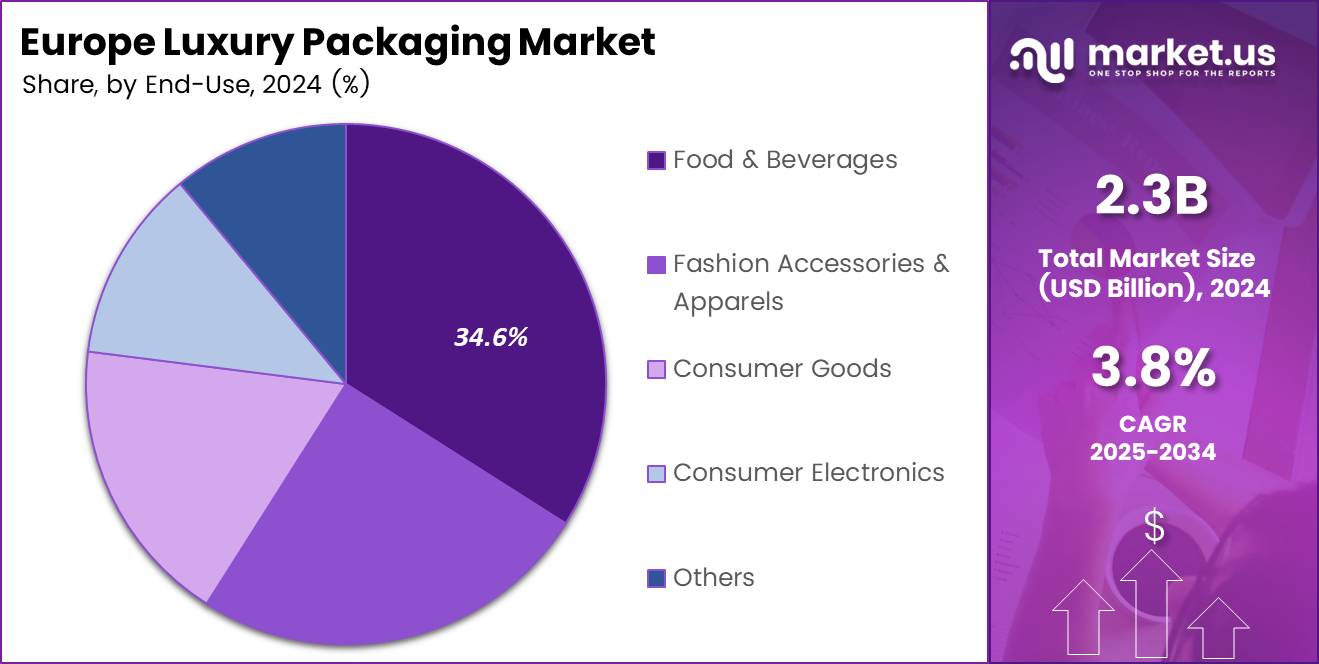

- Food & Beverages hold the largest share of the By End-Use Analysis segment with a 34.6% share in 2024, fueled by premium culinary and beverage trends.

Material Analysis

Paper & Paperboard dominates with 44.4% due to its sustainable appeal and premium aesthetic qualities.

In 2024, Paper & Paperboard held a dominant market position in By Material Analysis segment of Europe Luxury Packaging Market, with a 44.4% share. This leadership position stems from the material’s exceptional versatility and growing consumer preference for eco-friendly packaging solutions. The segment’s dominance reflects the luxury industry’s shift toward sustainable practices while maintaining premium presentation standards.

Plastic emerged as the second-largest material segment, capturing significant market attention due to its durability and design flexibility. Wood materials have carved a niche in ultra-premium segments, particularly for high-end spirits and cosmetics, where natural aesthetics command premium pricing.

Glass continues to maintain its traditional stronghold in luxury beverages and perfumes, offering unmatched product protection and brand prestige. Metal packaging, while smaller in volume, remains crucial for luxury electronics and premium consumer goods. Fabric materials represent a specialized segment, primarily serving luxury fashion and jewelry brands seeking distinctive packaging experiences.

The material landscape reflects Europe’s commitment to sustainability, with Paper & Paperboard leading the transformation toward environmentally responsible luxury packaging solutions without compromising aesthetic appeal.

Packaging Format Analysis

Boxes & Cartons dominate with 37.5% due to their versatility and superior brand presentation capabilities.

In 2024, Boxes & Cartons held a dominant market position in By Packaging Format Analysis segment of Europe Luxury Packaging Market, with a 37.5% share. This format’s supremacy reflects its unparalleled ability to create memorable unboxing experiences that luxury brands prioritize for customer engagement and brand differentiation.

Bags represent the second-largest format segment, particularly popular in luxury retail and fashion industries where portability and brand visibility are paramount. Pouches have gained momentum in premium food and cosmetic segments, offering innovative design possibilities and enhanced product protection.

Bottles maintain their essential role in luxury beverages, perfumes, and premium personal care products, where product integrity and brand prestige intersect. Composite Cans serve specialized applications, particularly in premium food and beverage segments requiring superior barrier properties.

The Others category encompasses innovative formats including tubes, wraps, and custom-designed containers that cater to specific luxury product requirements. The format diversity demonstrates the market’s evolution toward personalized packaging solutions that align with distinct brand positioning strategies and consumer expectations in the luxury segment.

End-Use Analysis

Food & Beverages dominates with 34.6% due to premium product proliferation and gifting culture.

In 2024, Food & Beverages held a dominant market position in By End-Use Analysis segment of Europe Luxury Packaging Market, with a 34.6% share. This segment’s leadership reflects the robust demand for premium culinary experiences and luxury beverage consumption across European markets, particularly driven by gifting traditions and special occasion purchases.

Fashion Accessories & Apparels represents a significant end-use segment, leveraging packaging as a crucial brand differentiation tool where unboxing experiences directly impact customer perception and brand loyalty. This sector emphasizes packaging as an extension of product design philosophy.

Consumer Goods encompasses a diverse range of luxury products including home décor, premium personal care items, and lifestyle products where packaging sophistication matches product quality expectations. Consumer Electronics has emerged as a growing segment, with premium device manufacturers investing heavily in packaging experiences.

The Others category includes jewelry, watches, luxury stationery, and specialized premium products requiring bespoke packaging solutions. The segment distribution highlights Europe’s mature luxury market where packaging transcends functional requirements to become integral components of brand storytelling and customer experience design.

Key Market Segments

By Material

- Paper & Paperboard

- Plastic

- Wood

- Glass

- Metal

- Fabric

By Packaging Format

- Boxes & Cartons

- Bags

- Pouches

- Bottles

- Composite Cans

- Others

By End-Use

- Food & Beverages

- Fashion Accessories & Apparels

- Consumer Goods

- Consumer Electronics

- Others

Drivers

Rising Consumer Demand for Premium Goods Drives Market Growth

European consumers are showing stronger interest in luxury products, which directly boosts demand for high-quality packaging. People want products that look and feel premium from the moment they receive them. This trend pushes brands to invest more in sophisticated packaging solutions.

Smart packaging technologies are changing how luxury brands connect with customers. These advanced systems include features like QR codes, NFC chips, and temperature sensors that provide interactive experiences. Brands use these tools to share product stories, verify authenticity, and create memorable unboxing moments.

The growth of online shopping and direct-to-consumer sales creates new packaging challenges. Luxury brands need packaging that protects products during shipping while maintaining the premium experience customers expect. This shift requires innovative designs that work well for both retail displays and home deliveries.

Packaging has become a key way for luxury brands to stand out from competitors. Companies invest heavily in unique designs, premium materials, and distinctive finishes to create memorable brand experiences. This focus on differentiation drives continuous innovation in the packaging industry, as brands seek new ways to impress customers and justify premium pricing through exceptional presentation.

Restraints

Complex Regulatory Compliance and Sustainability Mandates Limit Market Flexibility

European regulations around packaging materials and waste management create significant challenges for luxury packaging companies. New environmental laws require brands to use specific recyclable materials and meet strict sustainability targets. These rules often conflict with traditional luxury packaging approaches that prioritize appearance over environmental impact.

Compliance costs add substantial expenses to packaging development. Companies must invest in new materials research, testing procedures, and certification processes. Small and medium-sized packaging firms struggle most with these requirements, as they lack resources for extensive compliance programs.

Supply chain disruptions severely impact material availability for luxury packaging. Recent global events have made it harder to source premium materials like specialty papers, metals, and high-quality plastics. These shortages force companies to find alternative materials or face production delays.

The luxury packaging industry depends on consistent access to specific materials that meet quality standards. When disruptions occur, companies face difficult choices between maintaining quality and meeting delivery deadlines. Material price volatility also makes it challenging to maintain profit margins while delivering the premium experience customers expect from luxury brands.

Growth Factors

Adoption of Biodegradable and Recyclable Materials Creates New Market Opportunities

The shift toward eco-friendly packaging materials opens significant growth opportunities in the luxury market. Consumers increasingly prefer brands that use biodegradable and recyclable materials without compromising quality. This trend drives innovation in sustainable luxury packaging solutions that maintain premium aesthetics while meeting environmental standards.

Augmented reality technology offers exciting possibilities for luxury packaging. Brands can embed AR features that allow customers to access exclusive content, virtual try-ons, or interactive product demonstrations through their smartphones. This technology creates unique engagement opportunities that justify premium pricing.

Customization and personalization services represent a major growth area. Luxury consumers want packaging that reflects their individual preferences or commemorates special occasions. Companies that offer personalized engraving, custom colors, or limited-edition designs can command higher prices and build stronger customer loyalty.

Strategic partnerships between packaging companies and luxury brands create mutual benefits. Co-branding initiatives allow packaging firms to associate with prestigious brands while helping luxury companies access specialized packaging expertise. These collaborations often lead to innovative solutions that push industry boundaries and create new market segments.

Emerging Trends

Shift Towards Minimalist and Sustainable Packaging Designs Shapes Market Trends

Modern luxury packaging increasingly embraces minimalist designs that emphasize clean lines and simple elegance. This trend reflects changing consumer preferences for sophisticated simplicity over elaborate decoration. Brands find that minimalist approaches often create stronger impact while reducing material costs and environmental impact.

Digital printing techniques are revolutionizing packaging customization capabilities. These technologies allow brands to produce small batches of highly customized packaging designs cost-effectively. Digital printing enables variable data printing, seasonal variations, and limited-edition packages that create exclusivity and drive customer engagement.

Metallic finishes and embossed textures continue growing in popularity across luxury packaging applications. These premium finishes create tactile experiences that reinforce product quality perceptions. Advances in finishing techniques make these options more accessible while maintaining the premium feel that luxury consumers expect.

Subscription-based luxury packaging services are emerging as a significant trend. These services provide regular deliveries of curated luxury products in specially designed packaging. The recurring nature of these services creates steady demand for innovative packaging solutions while building stronger relationships between brands and consumers through consistent premium experiences.

Key Europe Luxury Packaging Company Insights

In 2024, DS Smith plc continues to be a significant player in the Europe Luxury Packaging Market, focusing on sustainable packaging solutions that meet growing consumer demand for eco-friendly products. Their innovative approach to corrugated packaging has positioned them as a leader in the luxury packaging segment.

Crown Holdings, Inc. remains a dominant force, leveraging its extensive expertise in metal packaging. The company’s commitment to high-quality, aesthetically pleasing cans and bottles is integral to the growing demand for premium packaging, especially in beverages and cosmetics.

Stoelzle Glass Group is highly recognized for its luxurious glass packaging, which remains a top choice for high-end perfumes, cosmetics, and premium beverages. Their use of advanced glassmaking techniques and a strong focus on design-driven packaging ensures they retain a significant share in the luxury packaging sector.

Aptar Group, Inc. has made remarkable strides in the luxury packaging market, particularly with their high-performance dispensing systems. Their products, especially in the beauty and personal care sectors, cater to consumers’ desire for both convenience and luxury, positioning Aptar as an essential player in the industry.

Top Key Players in the Market

- DS Smith plc

- Crown Holdings, Inc.

- Stoelzle Glass Group

- Aptar Group, Inc.

- International Paper Company

- WestRock Company

- Ardagh Group S.A.

- Robinson plc

- Swiss Packaging LLC

- Npack Ltd.

Recent Developments

- In August 2024, Mainetti acquired Morresi Cartotecnica, a move aimed at expanding its luxury packaging operations in Southern Europe. This acquisition is expected to bolster Mainetti’s market presence in the region, enhancing its ability to cater to high-end brands.

- In January 2025, Virospack’s owner acquired Eurovetrocap, a leading packaging firm, strengthening Virospack’s position in the luxury packaging market. This acquisition is set to enhance its portfolio, particularly in glass packaging for premium products.

- In May 2024, Mosaiq Group, a new holding company focused on sustainable fashion and luxury packaging, was founded. The company aims to combine eco-conscious packaging solutions with high-end fashion brands to meet the growing demand for sustainable luxury.

- In March 2024, Cardbox Packaging announced a €6.5 million investment in the Czech Republic, aimed at expanding its manufacturing capabilities for luxury packaging solutions. This move is expected to boost production capacity and strengthen its foothold in the European market.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.3 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Paper & Paperboard, Plastic, Wood, Glass, Metal, Fabric), By Packaging Format (Boxes & Cartons, Bags, Pouches, Bottles, Composite Cans, Others), By End-Use (Food & Beverages, Fashion Accessories & Apparels, Consumer Goods, Consumer Electronics, Others) Competitive Landscape DS Smith plc, Crown Holdings, Inc., Stoelzle Glass Group, Aptar Group, Inc., International Paper Company, WestRock Company, Ardagh Group S.A., Robinson plc, Swiss Packaging LLC, Npack Ltd. Customization Scope Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Luxury Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Luxury Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DS Smith plc

- Crown Holdings, Inc.

- Stoelzle Glass Group

- Aptar Group, Inc.

- International Paper Company

- WestRock Company

- Ardagh Group S.A.

- Robinson plc

- Swiss Packaging LLC

- Npack Ltd.