Europe Direct Selling Market Size, Share, Growth Analysis By Product (Health & Wellness, Cosmetics and Personal Care, Household Goods & Durables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152474

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

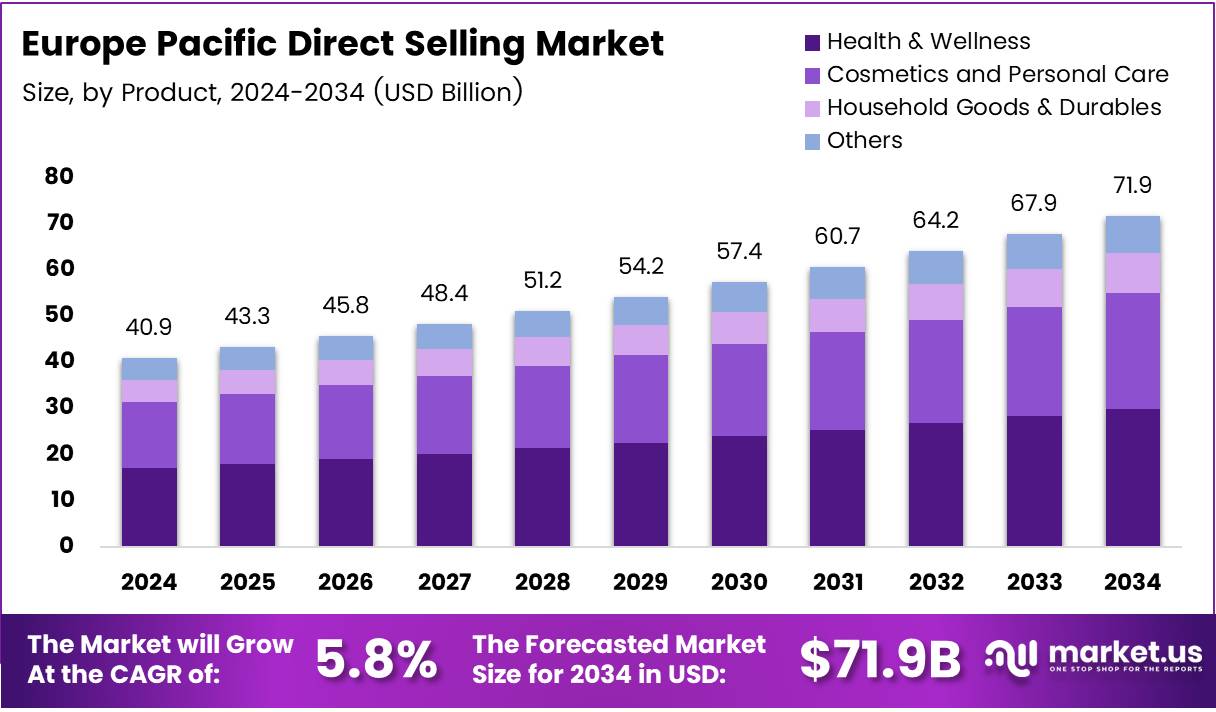

The Europe Direct Selling Market size is expected to be worth around USD 71.9 Billion by 2034, from USD 40.9 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Europe Direct Selling market is experiencing steady growth, fueled by the demand for personalized sales and unique product offerings. Direct selling allows businesses to sell products directly to consumers, avoiding traditional retail outlets. This approach strengthens customer relationships and drives expansion across Europe, as more people are drawn to the convenience of shopping from home.

A key factor behind this growth is changing consumer behavior. Consumers are increasingly looking for flexible and personalized shopping experiences. The shift towards direct sales channels that offer exclusive products and more interaction with sellers is boosting the market. As a result, Europe’s direct selling sector has gained momentum, particularly as more individuals explore alternative income opportunities.

Opportunities for growth are also rising in emerging sectors like wellness, beauty, and health. These industries show strong potential for direct selling, as consumers seek more tailored solutions to their needs. Additionally, the use of digital tools and social media is expanding the reach of direct selling businesses in Europe, creating new paths to connect with a wider audience and grow brand presence. The opportunities in Europe’s direct selling market are broad, especially in these high-demand sectors.

Government support has also contributed to the market’s growth. European governments recognize the economic value of direct selling and its potential to create jobs. Policies that encourage entrepreneurship, offer flexible working hours, and reduce barriers to entry have made it easier for individuals to start businesses. Additionally, government investments in digital infrastructure help direct selling companies expand their reach and operate more efficiently.

Regulations play an important role in shaping the direct selling industry in Europe. Strict consumer protection laws ensure that businesses operate transparently and fairly. These laws help prevent deceptive practices and ensure that product claims and compensation structures are clearly outlined. By maintaining strong regulatory standards, the European market supports the long-term success of direct selling businesses, helping them build trust with consumers.

As consumer preferences continue to evolve, the Europe direct selling market will need to remain flexible and innovative. Companies that focus on improving customer experience and leveraging new trends will be well-positioned for future growth. With the right strategies in place, direct selling businesses can continue to thrive in Europe’s expanding market.

Key Takeaways

- The Europe Direct Selling Market is expected to reach USD 71.9 Billion by 2034, growing at a CAGR of 5.8% from 2025 to 2034.

- In 2024, Health & Wellness holds a dominant position in the By Product Analysis segment of the Europe Direct Selling Market.

- Rising consumer awareness around healthy living and the increasing demand for wellness products drive the growth of the Health & Wellness segment.

- Consumers increasingly seek personalized shopping experiences, contributing to the growth of the direct selling market.

- The integration of AI and machine learning in direct selling platforms presents significant growth opportunities.

- Mobile apps are becoming a key trend in the Europe Direct Selling Market, offering convenience and accessibility to consumers.

Statistics

- Europe Direct Sales Volume: The direct sales volume in Europe is approximately US$20 billion, with Germany leading at US$3.76 billion, followed by Italy at US$3.36 billion, Russia at US$3.06 billion, and France at US$2.41 billion.

- EU Enterprises Using Websites for Direct Sales: Over 22.2% of EU enterprises use their websites as a direct sales channel, offering online ordering functionality.

- Direct Selling Association: The Direct Selling Association has 50 members, generating a combined turnover of about £1 billion annually, with around 500,000 independent sales representatives or affiliates.

- Internet Usage in the EU (2024): 94% of individuals aged 16-74 in the EU used the internet in the past year, and 77% of them bought or ordered goods/services online.

- Wellness Products in Direct Sales (2023): Wellness products accounted for 30% of direct sales in Europe in 2023, up from 15% in 2022.

- Flexibility of Direct Selling in Europe: 68% of European direct sellers engage in direct selling as a secondary occupation, showcasing the model’s flexibility.

- Online Shopping Growth in Europe: Online shopping in Europe is expected to grow by 8% in 2024, increasing competition for direct sellers.

Product Analysis

Health & Wellness dominates with a strong share in the Europe Direct Selling Market, driven by increasing consumer focus on personal well-being and fitness.

In 2024, Health & Wellness held a dominant market position in the By Product Analysis segment of the Europe Direct Selling Market, with a significant share. This growth is driven by the rising consumer awareness around healthy living and the increasing demand for wellness products. These include nutritional supplements, fitness equipment, and self-care items, all contributing to the sector’s leading position.

The Cosmetics and Personal Care segment follows as another key player in the market, benefiting from the continued emphasis on personal grooming and skincare. The sector is projected to maintain steady growth, as consumers invest more in premium personal care products for skin health, beauty, and grooming.

Household Goods & Durables, while showing steady demand, is less dominant in comparison. This segment’s performance is primarily fueled by the increasing need for durable home essentials, but it has not seen the same rapid growth as Health & Wellness or Cosmetics.

Others make up the remaining portion of the market, encompassing various miscellaneous product categories that don’t fall under the major segments, but still contribute to the overall market diversity.

Key Market Segments

By Product

- Health & Wellness

- Cosmetics and Personal Care

- Household Goods & Durables

- Others

Drivers

Increasing Demand for Direct Selling Drives Market Growth in Europe

The Europe Direct Selling market is being significantly driven by the increasing preference for personalized shopping experiences. Consumers are seeking tailored products and services that meet their unique needs, and direct selling provides this flexibility. With direct interaction between the seller and buyer, customers receive a more customized and personal approach, which enhances the overall shopping experience.

Expanding internet penetration and the growth of online shopping platforms have also been pivotal in the market’s growth. As more people gain access to the internet, the convenience of online shopping continues to propel the direct selling sector. These platforms enable sellers to reach wider audiences, enhancing market visibility and boosting sales.

Another key driver is the rising adoption of digital payment solutions. As payment technologies evolve, consumers find it easier and more secure to make purchases online. Digital wallets, contactless payments, and other innovative payment methods increase consumer confidence in purchasing through direct selling channels.

The wellness and health-focused product segments are also fueling growth. The growing emphasis on healthier lifestyles has led to a surge in demand for health and wellness products, which are often marketed through direct selling. These products cater to health-conscious consumers, contributing to the overall expansion of the direct selling market.

Restraints

Challenges Facing the Europe Direct Selling Market

Despite the market’s growth, challenges exist, including a lack of trust among consumers toward direct selling. Many consumers remain cautious about the legitimacy and authenticity of direct selling offers, which may hinder wider adoption. Building trust and overcoming skepticism remains a key hurdle for direct sellers.

Economic instability and reduced discretionary spending also pose challenges. During economic downturns, consumers often cut back on non-essential purchases, which affects demand for direct selling products. This reduced spending power can lead to slower market growth, particularly for higher-priced products.

Additionally, the high competition from traditional retail and e-commerce giants is a restraint. The convenience, variety, and established infrastructure of traditional retail and e-commerce platforms make it difficult for direct selling to maintain a competitive edge. Consumers often prefer shopping from well-known retailers with established reputations, which limits the growth potential of direct selling businesses.

Growth Factors

Growth Opportunities in the Europe Direct Selling Market

There are significant growth opportunities for the Europe Direct Selling market, particularly with the integration of AI and machine learning in direct selling platforms. These technologies can help optimize sales strategies, enhance personalized recommendations, and improve customer engagement, driving further market expansion.

Emerging markets in Eastern Europe are also offering untapped potential. As these regions experience economic growth and increasing internet penetration, they provide new opportunities for direct sellers to expand their reach and cater to new consumer bases that have previously been underserved.

Collaboration with social media influencers presents another growth opportunity. By leveraging influencers’ large and engaged followings, direct sellers can reach broader audiences and build trust among potential customers. Influencers can promote products effectively, especially in the wellness and beauty segments, thus boosting the direct selling industry’s growth.

Emerging Trends

Trending Factors Shaping the Europe Direct Selling Market

Several factors are currently trending in the Europe Direct Selling market. One notable trend is the increased use of mobile apps for direct selling transactions. With the growing use of smartphones, consumers are increasingly opting to shop and make purchases through mobile apps, which offer convenience and accessibility.

The growing focus on health and beauty products is another trend. These segments are becoming increasingly popular among consumers, particularly in the direct selling space, as they seek products that align with personal health and wellness goals. Direct selling companies are capitalizing on this trend by offering specialized products that cater to this demand.

The surge in home-based direct selling businesses is also contributing to market growth. Many entrepreneurs are turning to direct selling as a low-cost, flexible business model, which has been particularly attractive in the post-pandemic era. The home-based model offers individuals the opportunity to start businesses with minimal investment, contributing to the sector’s expansion.

Finally, the rise in multi-level marketing (MLM) strategies within the direct selling space is gaining momentum. MLM provides an opportunity for sellers to grow their network and earn commissions through team-building, which is encouraging more people to enter the direct selling market. This model has shown to be particularly successful in driving sales and building strong customer loyalty.

Key Europe Direct Selling Company Insights

In 2024, Natura &Co Holding SA ADR is expected to continue its growth in the European direct selling market, driven by its sustainable beauty and wellness products. The company’s commitment to eco-friendly practices and diverse portfolio is anticipated to strengthen its position in the region.

The Friedrich Vorwerk Group SE ADR, with a strong focus on health, wellness, and energy-saving products, is likely to benefit from increasing consumer interest in sustainable living and health-conscious lifestyles. Their innovative product lines and direct-to-consumer business model are projected to drive further market penetration.

Oriflame, a leading brand in the European direct selling market, is expected to leverage its well-established reputation in beauty and personal care. Their focus on empowering entrepreneurs and offering personalized customer experiences will likely support sustained growth in the region.

Amway Corporation, one of the largest players in direct selling, is expected to continue expanding its strong presence in Europe, with a focus on health and wellness products. Their robust distribution network and commitment to innovation are projected to drive their continued success in the competitive market landscape.

Top Key Players in the Market

- Natura &Co Holding SA ADR

- Friedrich Vorwerk Group SE ADR

- Oriflame

- Amway Corporation

- Herbalife Ltd

- Tupperware Brands Corp

- Nu Skin Enterprises Inc Class A

Recent Developments

- In April 2025, Zinzino acquired Valentus Global to strengthen its presence and enhance distribution capabilities across Europe, boosting its market penetration in the region.

- In January 2025, KARL STORZ expanded its direct sales network by acquiring a company in Switzerland, aiming to enhance its operational footprint and customer reach in the European market.

- In September 2024, ICG successfully raised a record €15.2 billion for its European direct-lending fund, positioning itself as a leader in private lending and enhancing its investment capacity in Europe.

- In April 2024, KARL STORZ made a strategic acquisition in Belgium, Luxembourg, and the Netherlands to further solidify its direct sales operations, expanding its market influence in the Benelux region.

Report Scope

Report Features Description Market Value (2024) USD 40.9 Billion Forecast Revenue (2034) USD 71.9 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Health & Wellness, Cosmetics and Personal Care, Household Goods & Durables, Others) Competitive Landscape Natura &Co Holding SA ADR, Friedrich Vorwerk Group SE ADR, Oriflame, Amway Corporation, Herbalife Ltd, Tupperware Brands Corp, Nu Skin Enterprises Inc Class A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Direct Selling MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Direct Selling MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Natura &Co Holding SA ADR

- Friedrich Vorwerk Group SE ADR

- Oriflame

- Amway Corporation

- Herbalife Ltd

- Tupperware Brands Corp

- Nu Skin Enterprises Inc Class A