Global Ethyl Acetate Market By Manufacturing Process (Esterification Process, Alternate Processe, Bio-Based Production), By Application (Paint and Coatings, Inks, Process Solvents, Pigments, Others), By End-use (Artificial Leather, Automotive, Food and Beverage, Packaging, Pharmaceutical, Others), By Distribution Channel (Offline, Online), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133361

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

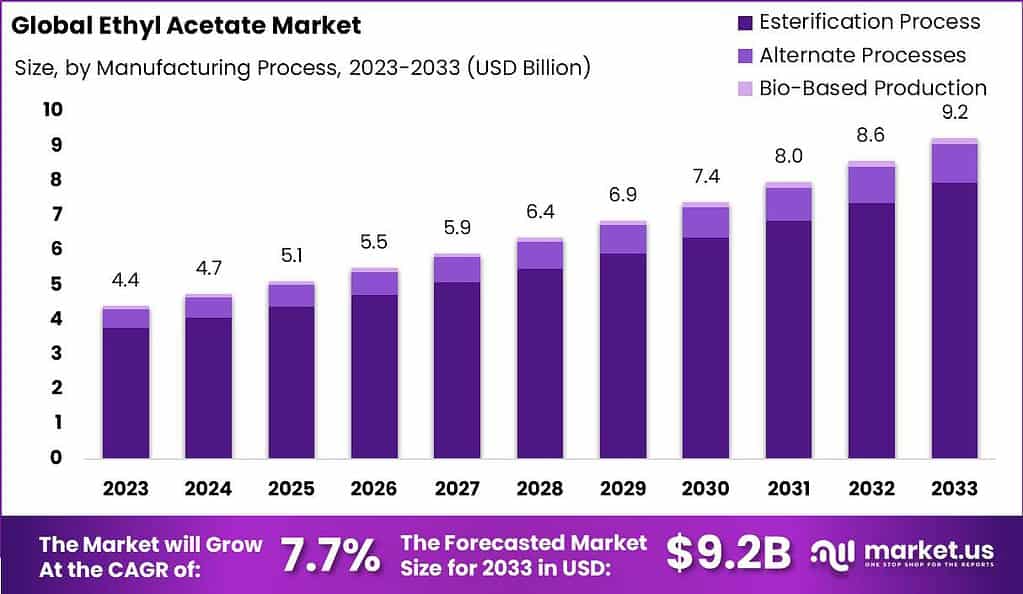

The Global Ethyl Acetate Market size is expected to be worth around USD 9.2 Billion by 2033, from USD 4.4 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

The term “Ethyl Acetate Market” refers to the global industry and commerce surrounding ethyl acetate, a chemical compound used as a solvent in various products. This market deals with the production, buying, and selling of ethyl acetate across different countries and industries.

The market demand for ethyl acetate is experiencing growth, primarily driven by its extensive use in various industries such as pharmaceuticals, automotive, food and beverages, and paints and coatings. The compound is favored due to its low toxicity, cost-effectiveness, and effective solvent properties, making it suitable for a wide range of applications.

The market popularity of ethyl acetate has been steadily increasing due to its versatile use in various industries and its environmentally friendly properties. Ethyl acetate is a popular solvent in sectors like paints and coatings, adhesives, pharmaceuticals, and the printing industry because of its effective solvent qualities, pleasant smell, and low toxicity.

The Ethyl Acetate market is a dynamic field influenced by various industrial demands and economic activities. In 2022, the market for Ethyl Acetate was prominently driven by its use in paints and coatings, which held approximately 54% of the market share. This segment benefits from the solvent’s properties, such as low toxicity and the ability to efficiently dissolve resins and control viscosity, making it essential in the printing and packaging industries as well.

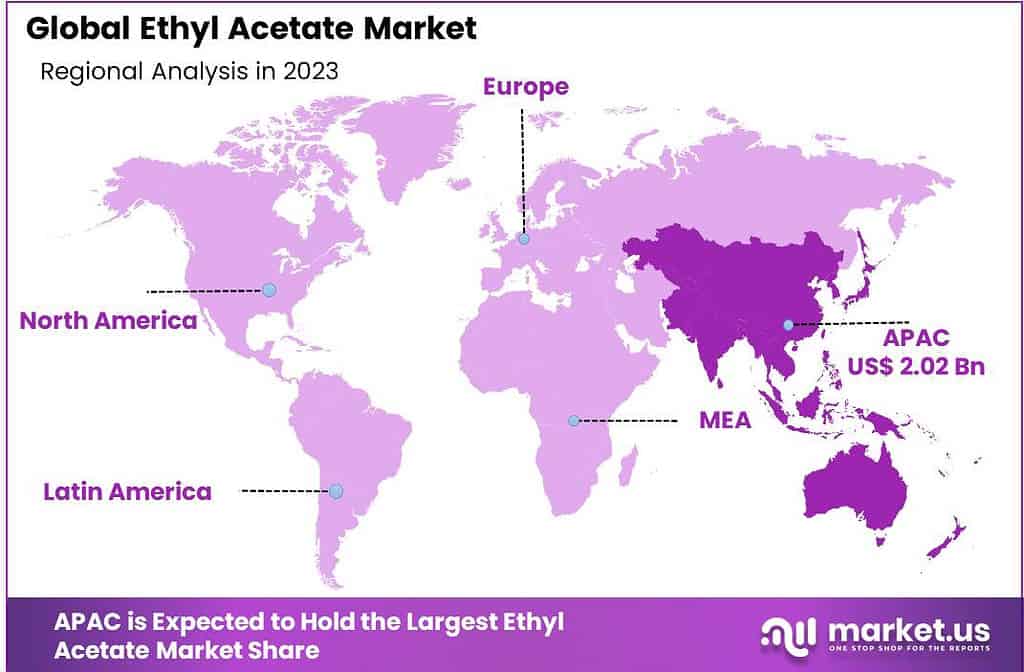

From a regional perspective, Asia Pacific is the largest and fastest-growing market for Ethyl Acetate, driven by rapid industrialization and expanding manufacturing sectors in countries like China, India, and Japan. This region accounted for a dominant revenue share of 48% in 2022, with expectations of continued growth due to its critical role in various applications ranging from pharmaceuticals to food flavoring.

Government regulations also play a significant role in shaping the market, especially with increasing environmental concerns leading to stricter control over solvent-based products, pushing the market towards more sustainable and less volatile options.

Key Takeaways

- The Global Ethyl Acetate Market size is expected to be worth around USD 9.2 Billion by 2033, from USD 4.4 Billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2024 to 2033.

- The Esterification Process dominated the Ethyl Acetate Market with an 86.3% share.

- Paint & Coatings dominated the Ethyl Acetate Market with a 42.3% share.

- Artificial Leather dominant market position in the By End-Use segment of the Ethyl Acetate Market with a 29.2% share.

- Offline dominated the Ethyl Acetate Market with a 76.3% distribution share.

- APAC dominates the Ethyl Acetate Market with a 39.2% share, valued at $2.02 billion.

By Manufacturing Process Analysis

The Esterification Process dominated the Ethyl Acetate Market with an 86.3% share.

In 2023, The Ethyl Acetate Market saw the Esterification Process dominating the By Manufacturing Process segment, holding a commanding 86.3% market share. This traditional method of ethyl acetate production, which involves the reaction between ethanol and acetic acid, continues to be favored due to its cost-effectiveness and well-established industrial application.

Alternate Processes, which include methods such as the Tishchenko reaction, held a smaller portion of the market. These processes are generally less preferred due to their higher complexity and cost, limiting their adoption primarily to regions where specific industrial configurations or raw material availability favors such methods.

Meanwhile, Bio-Based Production of ethyl acetate is gradually gaining traction, reflecting the broader industry shift towards sustainable manufacturing practices. Although this segment currently captures a modest market share, it is poised for growth.

Driven by increasing regulatory pressures and growing consumer demand for environmentally friendly products, bio-based production methods are expected to expand their presence in the market, offering a renewable and less environmentally impactful alternative to traditional ethyl acetate manufacturing processes.

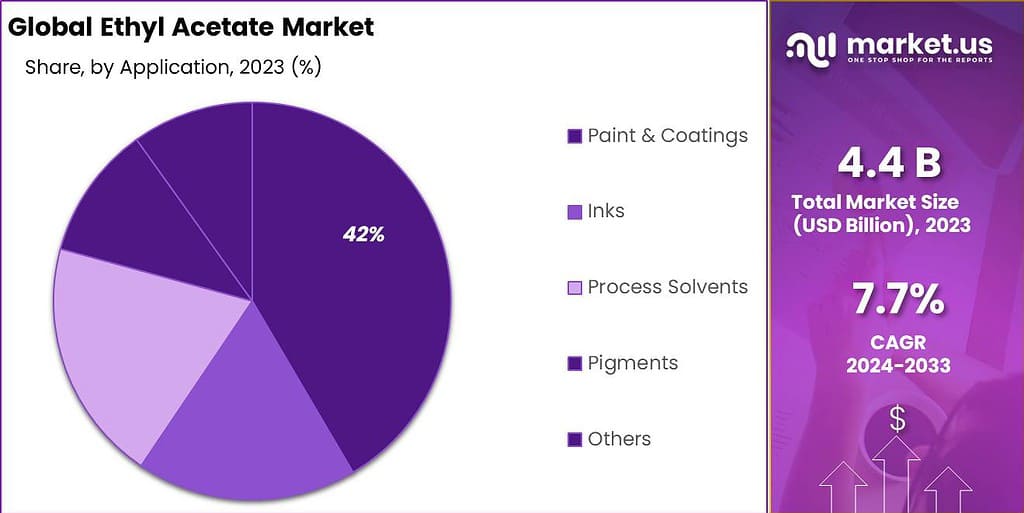

By Application Analysis

Paint & Coatings dominated the Ethyl Acetate Market with a 42.3% share.

In 2023, The Paint & Coatings segment held a dominant market position in the By Application segment of the Ethyl Acetate Market, capturing more than a 42.3% share. This significant market share is attributed to the widespread use of ethyl acetate as a key solvent in the production of paints and coatings, where its rapid evaporation rate and low toxicity are highly valued.

The segment benefits from global construction growth and rising automotive production, which fuel demand for both decorative and industrial coatings.

The ink segment also represents a substantial application area for ethyl acetate, given its excellent solvency properties for high-performance printing inks. This segment leverages ethyl acetate for flexographic and gravure printing processes, commonly used in packaging and publications.

As a Process Solvent, ethyl acetate is utilized in various industrial processes, including pharmaceuticals, where it is used in extraction and purification processes. Its effectiveness in these applications supports a steady demand within this segment.

By End-use Analysis

Artificial Leather dominant market position in the By End-Use segment of the Ethyl Acetate Market with a 29.2% share.

In 2023, The Artificial Leather segment held a dominant market position in the By End-Use segment of the Ethyl Acetate Market, capturing more than a 29.2% share. This prominence is driven by the rising demand for artificial leather in the fashion and automotive industries, where ethyl acetate is utilized as a solvent in the production process, enhancing texture and finish quality. The versatility and cost-effectiveness of artificial leather continue to make it a popular choice over natural leather, boosting the consumption of ethyl acetate.

The Automotive segment also forms a significant part of the ethyl acetate market, leveraging the solvent in paints, coatings, and adhesives. This use is supported by the ongoing growth in automotive production globally, where ethyl acetate helps meet the standards for high-performance coatings.

In the Food & Beverage sector, ethyl acetate is primarily used as an extraction solvent for flavors and as a carrier solvent for food colorings, benefiting from its FDA-approved status for certain uses. This segment’s growth is influenced by the expanding processed foods industry and a rising preference for convenience food products.

The Packaging sector utilizes ethyl acetate in adhesives and coatings, necessary for ensuring the durability and integrity of packaging materials. This application is critical in food safety and extends to consumer goods, driven by e-commerce and retail expansions.

Pharmaceutical applications of ethyl acetate include its use as a solvent in drug formulation and manufacturing, particularly in the extraction and purification of active pharmaceutical ingredients (APIs), supporting steady growth in this segment.

By Distribution Channel Analysis

Offline dominated the Ethyl Acetate Market with a 76.3% distribution share.

In 2023, The Offline segment held a dominant market position in the By Distribution Channel segment of the Ethyl Acetate Market, capturing more than a 76.3% share. This significant majority is primarily attributed to the established networks of chemical distributors and suppliers that facilitate bulk industrial transactions, which are more commonly conducted through traditional channels. The offline distribution channel benefits from the trust and reliability perceived in direct supplier relationships and the ability of buyers to negotiate contracts and secure supply chain logistics, which are crucial in handling chemicals like ethyl acetate.

Conversely, the Online segment, though smaller, is growing as digital platforms become increasingly prevalent in the chemical distribution market. Online channels offer convenience, competitive pricing, and access to a global marketplace. However, the complexities of shipping and handling hazardous materials like ethyl acetate still pose challenges that restrain the growth of this segment.

Key Market Segments

By Manufacturing Process

- Esterification Process

- Alternate Processes

- Bio-Based Production

By Application

- Paint & Coatings

- Inks

- Process Solvents

- Pigments

- Others

By End-use

- Artificial Leather

- Automotive

- Food & Beverage

- Packaging

- Pharmaceutical

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Increasing Demand in Paints and Coatings

The Ethyl Acetate Market is experiencing robust growth primarily driven by the expanding paints and coatings industry. As a key solvent in the formulation of paints and coatings, ethyl acetate is valued for its quick-drying properties and low-cost profile. The global paint and coatings market, which is projected to grow at a CAGR of approximately 4% to 5% over the next five years, significantly influences the demand for ethyl acetate.

This growth is attributed to increasing urbanization and the resultant rise in construction activities, both residential and commercial, which predominantly use these products for decorative and protective purposes.

Growth in Pharmaceutical Applications

Ethyl acetate is increasingly being utilized in pharmaceutical applications, where it serves as an important solvent in the production of medicines, particularly in the purification and extraction processes. The pharmaceutical sector’s expansion, driven by rising healthcare expenditure and the growing prevalence of chronic diseases, directly impacts the demand for ethyl acetate.

The pharmaceutical industry’s growth rate, which is expected to be around 6% annually over the next decade, mirrors this trend. The compatibility of ethyl acetate with a wide range of pharmaceutical ingredients and its approval by regulatory bodies like the FDA for use in certain drug formulations enhance its market penetration and usage scope.

Bio-Based Ethyl Acetate Production

The shift towards sustainable and eco-friendly production methods has catalyzed the development of bio-based ethyl acetate, marking a pivotal advancement in the market. This green alternative is derived from ethanol, which can be produced from renewable resources, offering a reduced carbon footprint compared to conventional petroleum-based solvents.

The increasing environmental regulations and a strong market push towards sustainability are prompting both producers and consumers to prefer bio-based variants. The adoption of bio-based ethyl acetate is expected to grow, particularly in regions with stringent environmental policies, supporting the overall market growth by aligning with global sustainability trends.

Restraining Factors

Volatile Raw Material Prices

The fluctuating costs of raw materials, primarily acetic acid, and ethanol, which are crucial for the production of ethyl acetate, represent a significant restraining factor for the market. Volatility in these prices can lead to inconsistent production costs and impact profitability for manufacturers.

This instability often stems from changes in global oil prices, agricultural output (for ethanol), and international trade dynamics, which can disrupt supply chains and pricing structures. Such economic unpredictability can deter investment in ethyl acetate production capacities, as manufacturers may seek more stable and predictable markets to minimize financial risk.

Health Hazards Associated with Exposure

Ethyl acetate, while useful in various industrial applications, poses several health hazards upon exposure, which can restrain its market growth. Inhalation of its vapors can cause respiratory irritation, headaches, and dizziness, while prolonged skin contact can lead to irritation and drying.

These health risks necessitate stringent handling and safety regulations in workplaces using ethyl acetate, increasing operational costs and potentially limiting its use in sensitive applications, such as in consumer products and environments with inadequate ventilation or occupational health measures.

Shift Towards Water-Based Alternatives

The market for ethyl acetate is also being restrained by a growing shift towards water-based alternatives, particularly in the paints and coatings industry. These alternatives are perceived as more environmentally friendly and sustainable, offering lower VOC emissions and easier compliance with increasingly strict environmental regulations.

This shift is supported by advances in water-based technology that increasingly meet the performance standards traditionally achieved only by solvent-based formulations. As a result, sectors that have historically relied on ethyl acetate are transitioning towards these alternatives, reducing the overall demand for ethyl acetate in certain applications.

Growth Opportunity

Innovations in Bio-Based Products

The Ethyl Acetate Market is poised for significant growth, particularly through innovations in bio-based products. As industries increasingly seek sustainable alternatives to conventional solvents, bio-based ethyl acetate presents a promising opportunity. These products not only align with global sustainability trends but also meet stringent environmental regulations.

The development and commercialization of bio-based ethyl acetate are expected to attract new investments and partnerships, driven by consumer demand for eco-friendly products and corporate sustainability goals.

Increase in Consumer Spending on Cosmetics

Another substantial growth opportunity lies in the cosmetics sector, where consumer spending is on the rise. Ethyl acetate is utilized extensively as a solvent in nail polish formulations and other cosmetic products.

The increasing consumer interest in beauty and personal care, coupled with rising disposable incomes, particularly in emerging markets, is likely to boost the demand for ethyl acetate in this segment. Manufacturers can capitalize on this trend by expanding their production capabilities and exploring formulations that cater to the evolving preferences of beauty consumers.

Expansion into New Application Areas

The expansion into new application areas offers a fertile ground for growth in the Ethyl Acetate Market. As technological advancements continue to evolve, new uses for ethyl acetate are being discovered in fields such as electronics, where it can be used as a cleaning solvent for circuit boards, and in specialty coatings, where its fast-drying properties are advantageous. Diversifying into these new applications can open up additional revenue streams and strengthen market presence.

Latest Trends

Integration with Blockchain for Supply Chain Management

A significant trend set to influence the Ethyl Acetate Market is the integration of blockchain technology in supply chain management. This innovation promises enhanced transparency, traceability, and efficiency in the tracking of ethyl acetate from production to delivery.

By adopting blockchain, manufacturers and distributors can mitigate risks associated with counterfeit products, manage recalls more effectively, and streamline compliance with safety regulations. This digital transformation within the supply chain is expected to foster trust and security among stakeholders, contributing to smoother operations and potentially boosting market growth.

Rising DIY Culture

The rising DIY culture represents another key trend, particularly within the home improvement and personal care sectors. As consumers increasingly undertake home projects and craft their own cosmetic products, the demand for solvents like ethyl acetate, known for its versatility and effectiveness, is likely to surge. This trend is driven by the growing consumer preference for customization, self-sufficiency, and cost-saving measures, presenting opportunities for ethyl acetate suppliers to cater to this burgeoning market segment.

Innovations in Formulations for Health and Safety

Lastly, innovations in formulations for health and safety are trending in the ethyl acetate market. With heightened regulatory scrutiny and consumer awareness regarding chemical exposure, manufacturers are developing safer, less toxic formulations of ethyl acetate.

These advancements not only enhance the product’s appeal by mitigating health risks but also align with global mandates for safer industrial and consumer products. As these innovative formulations gain traction, they are set to open new applications in sensitive environments, further propelling market expansion.

Regional Analysis

APAC dominates the Ethyl Acetate Market with a 39.2% share, valued at $2.02 billion.

Asia Pacific (APAC) dominates the global Ethyl Acetate Market with a 39.2% share, valued at approximately $2.02 billion. This region’s leadership is driven by rapid industrialization and urbanization, especially in countries like China, India, and Southeast Asia. The significant manufacturing bases for paints, coatings, and pharmaceuticals in these areas fuel the demand for ethyl acetate. Moreover, APAC benefits from favorable government policies promoting chemical manufacturing, making it a pivotal region for market growth.

North America follows, with substantial consumption driven by its advanced pharmaceutical and automotive industries. The region’s stringent environmental regulations have also spurred the adoption of bio-based ethyl acetate, reflecting a shift towards more sustainable solvents. This transition is supported by a well-established technological infrastructure that enables innovations in solvent applications, particularly in the U.S. and Canada.

Europe holds a significant position in the market, where ethyl acetate is extensively used in the food & beverage and cosmetic industries. European demand is influenced by stringent regulatory standards requiring low-VOC solvents, which has led to increased use of ethyl acetate in environmentally sensitive applications. Germany, France, and the UK are key contributors to the regional market, with their large industrial bases and focus on sustainable chemical practices.

Latin America and the Middle East & Africa (MEA) are emerging regions in the ethyl acetate market. Growth in Latin America is catalyzed by expanding industrial activities in Brazil and Mexico, while in MEA, the market is gradually developing, with increased investments in industrial sectors and a rising demand for consumer goods that require ethyl acetate.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Eastman Chemical is anticipated to maintain its prominence in the global Ethyl Acetate Market in 2024, driven by its robust production capabilities and extensive distribution network. As a leader in chemical innovation, Eastman’s focus on sustainable practices and the development of bio-based ethyl acetate variants is expected to meet the growing demand for eco-friendly solvents, thereby strengthening its market position.

INEOS Group Holdings SA is another key player, known for its strategic expansions and strong operational excellence. INEOS’s investment in new production facilities and technology upgrades is likely to enhance its efficiency and scalability, catering to the increasing global demand, particularly in Europe, where stringent environmental regulations favor the use of low-VOC solvents such as ethyl acetate.

Celanese Corporation continues to excel in the market due to its technological leadership and comprehensive product portfolio. Celanese’s commitment to customer-centric innovation and its global presence enables it to capitalize on emerging market trends, particularly in high-growth regions like Asia Pacific.

Sipchem, based in Saudi Arabia, is poised to leverage the Middle Eastern market’s growth potential. With its strategic initiatives to expand its product line and enhance production capacities, Sipchem is well-positioned to serve the rising demand in both local and international markets, particularly leveraging the industrial growth in the Gulf Cooperation Council (GCC) countries.

Market Key Players

- Eastman Chemical

- INEOS Group Holdings SA

- Solventis Limited

- Sasol Ltd.

- Celanese

- Showa Denko K.K.

- Jubilant Life Sciences Limited

- Wacker Chemie AG

- Ashok Alco-Chem Ltd.

- LCY Chemical Corp.

- Sipchem

- Jiangsu Sopo (Group) Co., Ltd.

- Shanghai Wujing Chemical Co., Ltd.

- Daicel Corporation

- Rhodia Acetow GmbH

- Nippon Synthetic Chemical Industry Co., Ltd.

- Saudi International Petrochemical Co.

- Carbohim d.o.o.

- Avantium N.V.

- Tokuyama Corporation

Recent Development

- In June 2024, Celanese declared force majeure on its acetic acid and vinyl acetate monomer products in the Western Hemisphere due to operational disruptions from multiple raw material suppliers. This situation adversely affected their U.S. Gulf Coast acetyl chain operations, leading to production impacts estimated between 15% to 20% for the second quarter.

- In April 2024, INEOS completed the acquisition of a major ethyl acetate production facility in Belgium. This acquisition is expected to bolster INEOS’s production capacity and distribution network across Europe, aligning with its strategy to meet increasing regional demand.

- In March 2024, Avantium commenced the construction of a pilot plant dedicated to producing bio-based ethyl acetate, aligning with the industry’s shift towards sustainable and renewable chemical production methods.

Report Scope

Report Features Description Market Value (2023) USD 4.4 Billion Forecast Revenue (2033) USD 9.2 Billion CAGR (2024-2032) 7.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Process (Esterification Process, Alternate Process, Bio-Based Production), By Application (Paint & Coatings, Inks, Process Solvents, Pigments, Others), By End-use (Artificial Leather, Automotive, Food & Beverage, Packaging, Pharmaceutical, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Eastman Chemical, INEOS Group Holdings SA, Solventis Limited, Sasol Ltd., Celanese, Showa Denko K.K., Jubilant Life Sciences Limited, Wacker Chemie AG, Ashok Alco-Chem Ltd., LCY Chemical Corp., Sipchem, Jiangsu Sopo (Group) Co., Ltd., Shanghai Wujing Chemical Co., Ltd., Daicel Corporation, Rhodia Acetow GmbH, Nippon Synthetic Chemical Industry Co., Ltd., Saudi International Petrochemical Co., Carbohim d.o.o., Avantium N.V., Tokuyama Corporation Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eastman Chemical

- INEOS Group Holdings SA

- Solventis Limited

- Sasol Ltd.

- Celanese

- Showa Denko K.K.

- Jubilant Life Sciences Limited

- Wacker Chemie AG

- Ashok Alco-Chem Ltd.

- LCY Chemical Corp.

- Sipchem

- Jiangsu Sopo (Group) Co., Ltd.

- Shanghai Wujing Chemical Co., Ltd.

- Daicel Corporation

- Rhodia Acetow GmbH

- Nippon Synthetic Chemical Industry Co., Ltd.

- Saudi International Petrochemical Co.

- Carbohim d.o.o.

- Avantium N.V.

- Tokuyama Corporation